Fill Out Your 5510 Form

The Standard Form 5510 is an important document that allows individuals and organizations to set up automatic payments through electronic fund transfers. This form plays a key role in ensuring that payments to the U.S. Department of the Treasury are made efficiently and accurately. By completing the form, you authorize your bank or financial institution to withdraw designated amounts directly from your account, making it a convenient option for managing recurring payments. The form includes crucial information, such as your name, address, and the financial institution's details, along with the type of payment you wish to initiate. Additionally, it outlines your rights regarding adjustments to payment amounts and the process for stopping automatic payments. With the increasing reliance on electronic transactions, understanding the purpose and requirements of the 5510 form is essential for anyone looking to streamline their payment processes while remaining compliant with federal regulations.

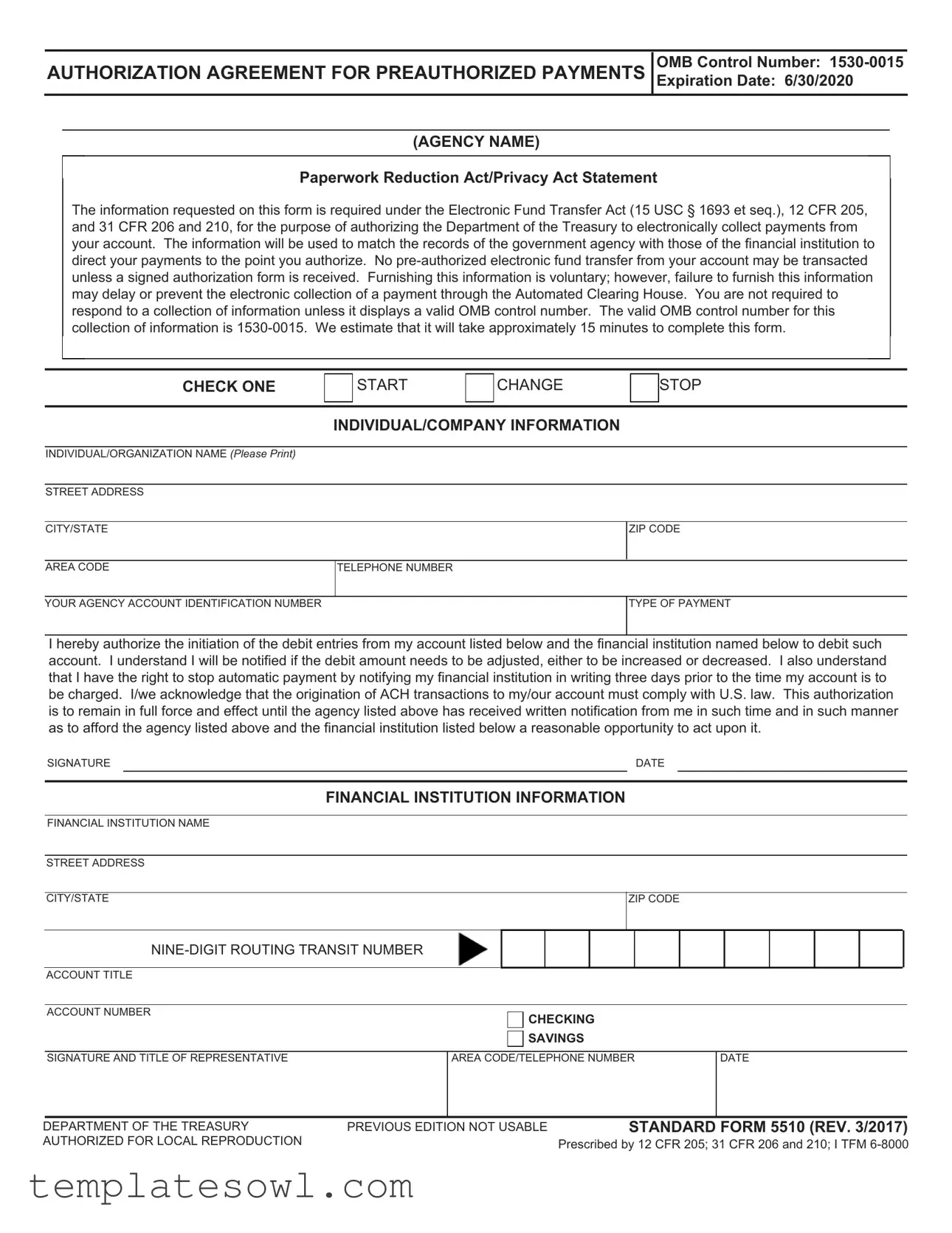

5510 Example

AUTHORIZATION AGREEMENT FOR PREAUTHORIZED PAYMENTS

OMB Control Number:

Expiration Date: 6/30/2020

(AGENCY NAME)

Paperwork Reduction Act/Privacy Act Statement

The information requested on this form is required under the Electronic Fund Transfer Act (15 USC § 1693 et seq.), 12 CFR 205, and 31 CFR 206 and 210, for the purpose of authorizing the Department of the Treasury to electronically collect payments from your account. The information will be used to match the records of the government agency with those of the financial institution to direct your payments to the point you authorize. No

CHECK ONE

START

CHANGE

STOP

INDIVIDUAL/COMPANY INFORMATION

INDIVIDUAL/ORGANIZATION NAME (PLEASE PRINT)

STREET ADDRESS

CITY/STATE

ZIP CODE

AREA CODE

TELEPHONE NUMBER

YOUR AGENCY ACCOUNT IDENTIFICATION NUMBER

TYPE OF PAYMENT

I hereby authorize the initiation of the debit entries from my account listed below and the financial institution named below to debit such account. I understand I will be notified if the debit amount needs to be adjusted, either to be increased or decreased. I also understand that I have the right to stop automatic payment by notifying my financial institution in writing three days prior to the time my account is to be charged. I/we acknowledge that the origination of ACH transactions to my/our account must comply with U.S. law. This authorization is to remain in full force and effect until the agency listed above has received written notification from me in such time and in such manner as to afford the agency listed above and the financial institution listed below a reasonable opportunity to act upon it.

SIGNATURE |

|

DATE |

|

|

|

|

|

FINANCIAL INSTITUTION INFORMATION

FINANCIAL INSTITUTION NAME

STREET ADDRESS

CITY/STATE

ZIP CODE

ACCOUNT TITLE

ACCOUNT NUMBER

CHECKING

SAVINGS

SIGNATURE AND TITLE OF REPRESENTATIVE

AREA CODE/TELEPHONE NUMBER

DATE

DEPARTMENT OF THE TREASURY |

PREVIOUS EDITION NOT USABLE |

STANDARD FORM 5510 (REV. 3/2017) |

AUTHORIZED FOR LOCAL REPRODUCTION |

|

Prescribed by 12 CFR 205; 31 CFR 206 and 210; I TFM |

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The 5510 form is used to authorize the Department of the Treasury to electronically collect payments from a specified bank account. |

| Governing Laws | The form operates under the Electronic Fund Transfer Act (15 USC § 1693 et seq.), along with regulations found in 12 CFR 205 and 31 CFR 206 and 210. |

| Voluntary Information | Providing information on the 5510 form is voluntary, but omitting it may delay or prevent the electronic payment process. |

| Completion Time | It is estimated that filling out this form takes approximately 15 minutes. |

| Withdrawal Rights | Individuals can stop automatic payments by giving written notification to their financial institution at least three days before the scheduled charge. |

| OMB Control Number | The valid OMB control number for this form is 1530-0015, which must be displayed for compliance with federal regulations. |

Guidelines on Utilizing 5510

Completing the 5510 form is a straightforward process that allows for the authorization of electronic payments from your bank account. It’s essential to ensure that all required information is accurate to prevent any delays in your payment processing. Below are the steps to fill out the form correctly.

- Start by identifying whether you are beginning a new payment, changing an existing payment, or stopping a payment. Check the appropriate box for your selection at the top of the form.

- In the section labeled “Individual/Company Information,” print your name or the name of the organization clearly. Ensure all fields are filled, including your street address, city, state, and ZIP code.

- Provide your area code and telephone number for any correspondence regarding the payment.

- Include your agency account identification number in the designated space.

- Select the type of payment you are authorizing. Make sure this aligns with the purpose of the form.

- Next, authorize the payment by signing your name in the specified area and entering the current date. This signature signifies your agreement to the payment terms outlined in the form.

- Proceed to the “Financial Institution Information” section. Fill in the name of your financial institution and its street address, city, state, and ZIP code.

- Provide the nine-digit routing transit number for your financial institution. This ensures that the payments are directed to the correct bank.

- Indicate the account title as it appears on your bank account. Specify whether the account is checking or savings by marking the appropriate box.

- Lastly, if you are completing this form as a representative of an organization, include your signature and title in the designated area, along with your area code and telephone number, and the current date again.

After filling out the form, review it for any errors or missing information. Having all the details accurate and complete will help facilitate a smooth payment process. Once everything is verified, submit the form as directed by your financial institution or the agency requiring it.

What You Should Know About This Form

What is the purpose of the 5510 form?

The 5510 form, officially known as the Authorization Agreement for Preauthorized Payments, is a crucial document designed to authorize the automatic electronic collection of payments from your bank account by the Department of the Treasury. This form aligns with the Electronic Fund Transfer Act, ensuring secure and efficient management of your financial responsibilities. Without this signed authorization, transactions cannot proceed, which may lead to delays in processing payments. It serves as a safeguard for both the payer and the financial institution involved.

Who needs to complete the 5510 form?

Individuals or organizations intending to authorize the Treasury to collect payments via electronic funds transfer must fill out the 5510 form. If you have recurring payments, such as taxes or fees, directly associated with government entities, completing this form ensures that the funds are debited from your account as agreed. Whether you are an individual taxpayer or a representative of a business, understanding your responsibilities regarding this form can help maintain your account in good standing.

What information is required on the 5510 form?

Filling out the 5510 form necessitates providing personal or organizational information. Key details include your name, address, and contact information, as well as your financial institution's name and routing number. You will also specify the type of payment you are authorizing. This structured information is crucial for ensuring that your payments are processed accurately and directed to the correct points as per your authorization.

What happens if I change my mind about the authorization?

If you decide to halt or modify the automatic payment arrangement, you have the right to do so. Simply provide written notification to your financial institution at least three days prior to the next scheduled payment. This step is essential because it allows your bank the necessary time to implement your request. Additionally, ensure that your notice reaches both your bank and the agency involved to avoid any potential disruption in payments.

Common mistakes

Filling out the 5510 form can be straightforward, but many people make mistakes that can lead to delays or complications. One common error is failing to check the correct box for starting, changing, or stopping payments. Making an incorrect selection can cause your request to be processed incorrectly. Always ensure that you select the appropriate action for your situation.

Another mistake often occurs in the section for individual or company information. Participants sometimes forget to fill out all the required fields. Skimming over sections like street address, city/state, or zip code can lead officials to misidentify or misroute your request. Double-check that every requested item is complete and accurate before submitting.

It's easy to overlook providing an accurate account number. One miswritten digit can result in funds being debited from the wrong account. Always review your account number, including the nine-digit routing transit number, to ensure it’s correct. This simple step could save you from potential financial headaches.

The signature section can also pose challenges. Some individuals may forget to sign the form, while others might not date it correctly. A missing signature means that the form is invalid, and this can cause unnecessary delays. Make sure to sign and date the form appropriately before sending it off.

Failing to notify your financial institution in writing about changes can also create issues. If you want to stop automatic payments, you must provide notice at least three days in advance. Not adhering to this requirement can result in unexpected debits continuing even after you've requested to stop. Take note of this timeframe so that you can effectively manage your payments.

Another pitfall is misunderstanding the nature of the authorization. Some people incorrectly assume that once they submit the form, their payments are permanent. In reality, this authorization persists only until the agency receives written notice of your intent to terminate it. Stay informed about your rights and the conditions under which you can manage your automatic payments.

Lastly, many individuals may not take the time to read the entire instruction section before filling out the form. This can lead to key information being missed. Always review guidance provided to ensure you’re following the requirements properly. Taking the time to understand the form can simplify the process significantly.

Documents used along the form

The 5510 form, known as the Authorization Agreement for Preauthorized Payments, is essential for allowing the electronic collection of payments. To effectively manage this process, several other documents often accompany the 5510 form. Each of these documents serves to enhance clarity, ensure compliance, and facilitate proper communication between the involved parties.

- Form W-9: This form is used to provide your taxpayer identification number (TIN) and confirm your tax status. It assists the other party in fulfilling their reporting obligations to the IRS.

- Authorization Letter: A formal letter that grants permission for the payments to be deducted from your account. It usually accompanies the 5510 to reinforce your intent.

- Bank Statement: Recent bank statements might be needed to validate your account details, ensuring accuracy and trust between both parties.

- Payment Schedule: A document outlining the timing and amounts of expected payments. It helps all parties maintain awareness of upcoming transactions.

- Direct Deposit Enrollment Form: If payments are moved into your bank account via direct deposit, this form captures necessary information to facilitate those transactions.

- Change Authorization Form: This is used when there are modifications to the existing payment agreement, such as changing the amount or frequency of payments.

- Cancellation Notice: A document that formally notifies the bank and the agency that you wish to cancel the authorization for electronic payments.

- Contact Information Sheet: This document provides updated contact details for all parties involved to minimize communication gaps and ensure swift responses.

In summary, utilizing the 5510 form without the support of these additional documents may create gaps in communication or compliance. These forms facilitate a smooth process, ensuring that all parties have the required information to perform electronic transactions effectively.

Similar forms

The Standard Form 5510 is used for authorizing preauthorized payments from an individual or organization's bank account. Here are six documents that are similar to the 5510 form, each serving a similar purpose in establishing payment authorizations or agreements.

- ACH Authorization Form: This form is crucial for individuals or businesses wishing to authorize a bank to process Automated Clearing House (ACH) transactions. Like the 5510, it requires the account holder's consent for electronic payment deductions.

- Direct Deposit Authorization Form: Used by employers and governmental agencies, this document allows for the automatic deposit of payments into an account. It serves a similar function as the 5510, ensuring that funds can be transferred electronically with the holder’s permission.

- Recurring Payment Authorization Form: This is often used for subscriptions or memberships. Much like the 5510, it lets organizations charge a set amount at designated intervals, simplifying the payment process for ongoing services.

- Bill Payment Authorization Form: This form allows a bank or bill pay service to automatically pay bills on behalf of the account holder. Similar to the 5510, it helps manage regular payments seamlessly and without additional effort from the account holder.

- Loan Payment Authorization Form: When securing a loan, this document grants permission to a lender to withdraw monthly payments directly from the borrower’s account. The essence parallels the 5510 in facilitating scheduled payments through electronic means.

- Credit Card Payment Authorization Form: This document is used to authorize automatic payments to credit card companies. It functions similarly to the 5510 by ensuring that payments are made on time without requiring the account holder to initiate each transaction manually.

Each of these forms plays a vital role in managing payments electronically, ensuring procedures comply with relevant laws while making it easy for both individuals and organizations to handle their financial commitments.

Dos and Don'ts

When filling out the 5510 form, it is essential to follow specific best practices to ensure accuracy and compliance. Below is a list outlining what you should and shouldn't do.

- Do read all instructions carefully to understand the requirements of the form.

- Do provide accurate personal and financial institution information to avoid processing delays.

- Do sign and date the form at the end to validate your authorization.

- Do check your entries for errors before submitting the form.

- Don't leave sections blank; ensure all required fields are filled out completely.

- Don't submit the form without verifying that the information is current and correct.

Completing the form meticulously will foster a smooth process in setting up electronic payments. Any oversight might lead to complications in your transactions.

Misconceptions

Misunderstandings about the 5510 form can lead to confusion regarding its purpose and requirements. Below are nine common misconceptions explained in simple terms:

- The 5510 form is only for individuals. This form can be used by both individuals and organizations, allowing flexibility in who can authorize electronic payments.

- Submitting the 5510 form is mandatory. While filling out the form is necessary for automatic payments, providing the information is voluntary. However, not submitting it may delay payment processing.

- Once an authorization is given, it cannot be stopped. On the contrary, you can stop automatic payments by notifying your bank in writing at least three days before your account is charged.

- The 5510 form has no expiration date. The form is subject to expiration, such as the one noted on the form as of June 30, 2020. Always check for the latest version.

- It takes a long time to complete the form. The estimated time to fill out the 5510 form is about 15 minutes, making it a relatively quick process.

- You do not need to provide a reason for payment. The form does not require an explanation for the payment; it solely authorizes the transaction.

- The 5510 form is only for government payments. While frequently used for government transactions, it can also be applicable to other payment collections through authorized institutions.

- All information on the form is public. The information submitted is generally kept private and is used solely for the purpose of electronic payment processing.

- You can send the form by email. The form typically needs to be submitted in hard copy with a signature, rather than by email, to maintain its validity.

Understanding these misconceptions can help users navigate the 5510 form more effectively, ensuring timely and accurate payment processing through the Automated Clearing House.

Key takeaways

Understanding the 5510 form is essential for anyone looking to authorize preauthorized payments. Below are key takeaways that can help ease the process.

- Purpose of the Form: The 5510 form is used to authorize the Department of the Treasury to electronically collect payments from an individual's or organization's bank account.

- Required Information: Filling out the form requires personal or organizational details, including name, address, and bank information.

- Time Commitment: It usually takes about 15 minutes to complete the 5510 form.

- Payment Options: The form allows individuals to check off whether they are starting, changing, or stopping an automatic payment.

- Adjustments: If there are changes to the debit amount, you will receive a notification prior to the adjustment.

- Stopping Payments: To stop the automatic payment, send a written notification to your financial institution at least three days before the scheduled charge.

- Legal Compliance: All ACH transactions initiated through this form must comply with U.S. law.

- Voluntary Information: While providing information is voluntary, not completing the form may delay or hinder the electronic payment collection process.

Understanding these key aspects will help ensure that the completion and usage of the 5510 form goes smoothly, facilitating efficient payment processing.

Browse Other Templates

Get a Temporary License Plate - Check that your vehicle meets all state regulations before application.

Texas Dmv Bill of Sale - Documentation of the vehicle sale through this form is essential for record-keeping.

What Happened to Forethought Life Insurance Company? - Kentucky residents are informed about the legal repercussions of false statements in claims.