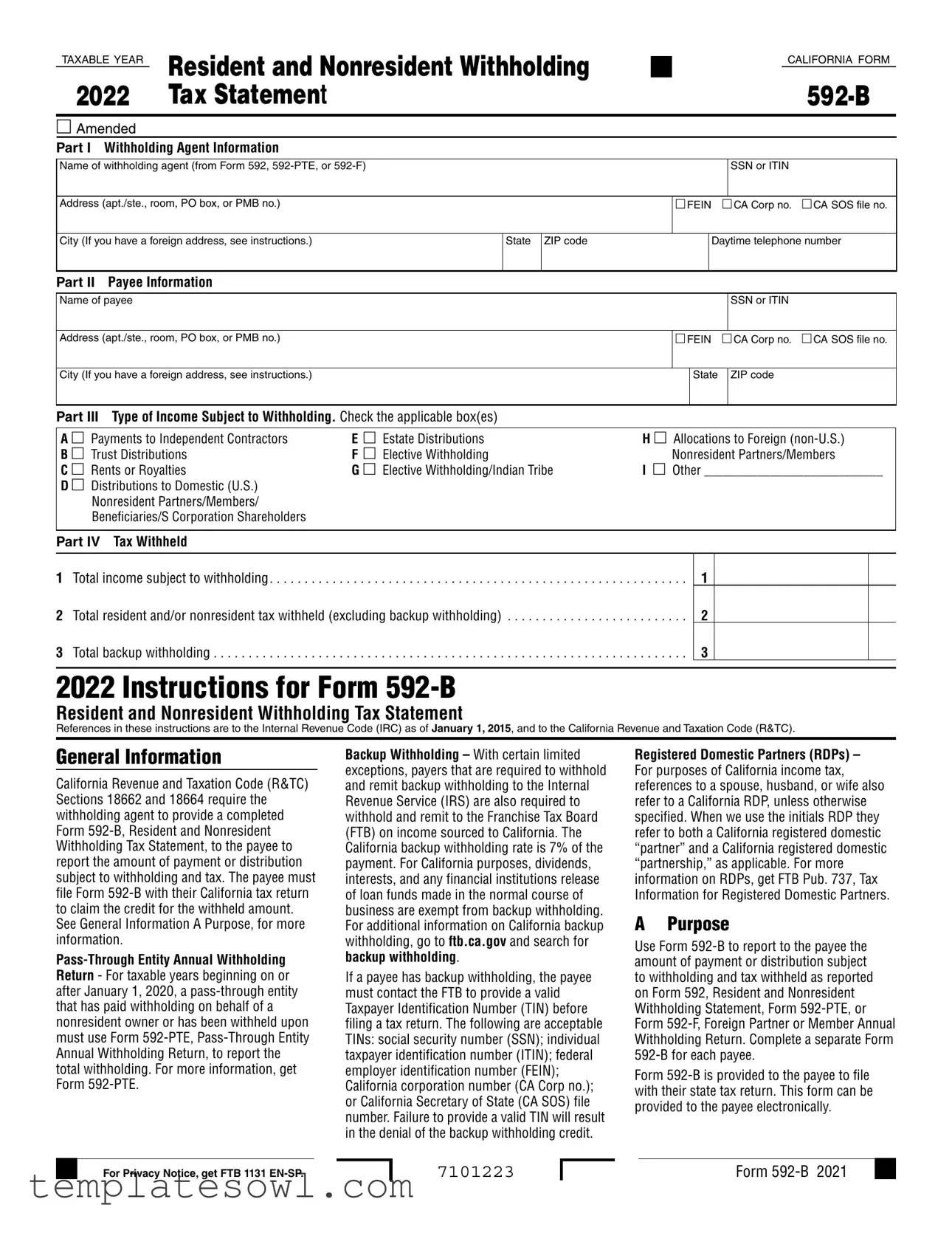

Fill Out Your 592 B Form

Form 592-B is an essential tax document that plays a crucial role in California's withholding tax system, serving both residents and nonresidents. This form helps report the amounts subject to withholding, including payments made to independent contractors, estate distributions, and trust distributions, among others. Withholding agents must complete Form 592-B to inform payees of the income that has been withheld for tax purposes. By doing so, payees will be able to include the withheld amounts when filing their California tax returns, claiming the credits for the taxes already remitted. Notably, the form includes sections for important information such as the withholding agent's details, payee identification, and the type of income subject to withholding, along with the total amount withheld. Timeliness is critical, as withholding agents must provide completed forms to payees by specific deadlines at the beginning of the year. Moreover, clear guidelines exist for amending Form 592-B in the event of errors, ensuring accurate reporting remains a priority. Understanding this form is key for anyone involved in the withholding process in California, as it can significantly impact tax liabilities and compliance.

592 B Example

TAXABLE YEAR |

Resident and Nonresident Withholding |

|

CALIFORNIA FORM |

|

|||

2022 |

Tax Statement |

|

□Amended

Part I Withholding Agent Information

Name of withholding agent (from Form 592,

SSN or ITIN

Address (apt./ste., room, PO box, or PMB no.)

□FEIN □CA Corp no. □CA SOS file no.

City (If you have a foreign address, see instructions.)

State ZIP code

Daytime telephone number

Part II Payee Information

Name of payee |

|

|

|

SSN or ITIN |

|

|

|

|

|

Address (apt./ste., room, PO box, or PMB no.) |

□FEIN |

□CA Corp no. □CA SOS file no. |

||

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

State |

|

ZIP code |

|

|

|

|

|

Part III Type of Income Subject to Withholding. Check the applicable box(es)

A □ Payments to Independent Contractors |

E □ Estate Distributions |

H □ Allocations to Foreign |

|

B □ Trust Distributions |

F □ Elective Withholding |

Nonresident Partners/Members |

|

C □ Rents or Royalties |

G □ Elective Withholding/Indian Tribe |

I □ Other ___________________________ |

|

D □ Distributions to Domestic (U.S.) |

|

|

|

|

Nonresident Partners/Members/ |

|

|

|

Beneficiaries/S Corporation Shareholders |

|

|

Part IV Tax Withheld |

|

|

|

1 |

Total income subject to withholding |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . 1 |

2 |

Total resident and/or nonresident tax withheld (excluding backup withholding) |

. . . . . . . 2 |

|

3 |

Total backup withholding |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . 3 |

2022 Instructions for Form

Resident and Nonresident Withholding Tax Statement

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

General Information

California Revenue and Taxation Code (R&TC) Sections 18662 and 18664 require the withholding agent to provide a completed Form

Backup Withholding – With certain limited exceptions, payers that are required to withhold and remit backup withholding to the Internal Revenue Service (IRS) are also required to withhold and remit to the Franchise Tax Board (FTB) on income sourced to California. The California backup withholding rate is 7% of the payment. For California purposes, dividends, interests, and any financial institutions release of loan funds made in the normal course of business are exempt from backup withholding. For additional information on California backup withholding, go to ftb.ca.gov and search for backup withholding.

If a payee has backup withholding, the payee must contact the FTB to provide a valid Taxpayer Identification Number (TIN) before filing a tax return. The following are acceptable TINs: social security number (SSN); individual taxpayer identification number (ITIN); federal employer identification number (FEIN); California corporation number (CA Corp no.); or California Secretary of State (CA SOS) file number. Failure to provide a valid TIN will result in the denial of the backup withholding credit.

Registered Domestic Partners (RDPs) – For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

A Purpose

Use Form

Form

For Privacy Notice, get FTB 1131

7101223

Form

For more information, go to ftb.ca.gov and search for electronic

Do not use Form

•Form

•Form

B Helpful Hints

•Get taxpayer identification numbers (TINs) from all payees.

•Complete all applicable fields.

•Complete all forms timely to avoid penalties.

C Who Must Complete

Form

•Has withheld on payments to residents or nonresidents.

•Has withheld backup withholding on payments to residents or nonresidents.

•Was withheld upon and must pass through the withholding credit to their

Record Keeping

The withholding agent retains the proof of withholding for a minimum of five years and must provide it to the FTB upon request.

D When To Complete

Form

•January 31st following the close of the calendar year for residents or nonresidents.

•February 15th following the close of the calendar year for brokers as stated in Internal Revenue Code (IRC) Section 6045.

Form

•The 15th day of the 3rd month following the close of the partnership's or LLC's taxable year.

•The 15th day of the 6th month following the close of the partnership's or LLC's taxable year, if all the partners in the partnership or members in the LLC are foreign.

by the partnership. The partners use this information to adjust the amount of estimated tax that they must otherwise pay to the IRS. The notification to the foreign partners must be provided within 10 days of the payment due date, or, if paid later, the date the withholding payment is made. See Treas. Reg. Section

E Amending Form

If an error is discovered after the withholding agent provides Form

the amending instructions for Form 592, Form

•Complete a new Form

•Check the Amended box at the top left corner of the form.

•Provide the amended copy of Form

F Penalties

The withholding agent must furnish complete and correct copies of Form(s)

If the withholding agent fails to provide complete, correct, and timely Form(s)

•Up to $270 for each payee statement not provided by the due date.

•$550 or 10% of the amount required to be reported (whichever is greater), if the failure is due to intentional disregard of the requirement.

Specific Instructions

Instructions for Withholding Agent

Year – The year at the top left corner of Form

For foreign partners or foreign members, match the year at the top left corner of Form

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Follow the country's practice for entering the city, county, province, state, country, and postal code, as applicable, in the appropriate boxes. Do not abbreviate the country name.

Part I – Withholding Agent Information

Enter the withholding agent’s name, TIN, address, and telephone number.

Part II – Payee Information

Enter the payee's name, TIN, and address.

If the payee is a grantor trust, enter the individual name and SSN or ITIN of the grantor that is required to file a tax return and report the income. Do not enter the name of the trust or trustee information. (For tax purposes, grantor trusts are transparent. The individual grantor must report the income and claim the withholding on the individual’s California tax return.)

If the payee is a nongrantor trust, enter the name of the trust and the trust’s FEIN. Do not enter trustee information.

If the trust has applied for a FEIN, but it has not been received, enter "applied for" in the space for the trust’s FEIN and attach a copy of the federal application to the back of Form

If the payees are married/RDP, enter only the name and SSN or ITIN of the primary spouse/RDP. However, if the payees intend to file separate California tax returns, the withholding agent should split the withholding and complete a separate Form

Part III – Type of Income Subject to Withholding

Check the box(es) for the type of income subject to withholding.

Part IV – Tax Withheld

Line 1

Enter the total income subject to withholding.

Line 2

Enter the total resident and/or nonresident tax withheld (excluding backup withholding). The amount of tax to be withheld is computed by applying a rate of 7% on items of income subject to withholding. For foreign partners, the rate is 8.84% for corporations, 10.84% for banks and financial institutions, and 12.3% for all others.

For

Line 3

Enter the total backup withholding, if applicable.

Page 2 Form

Instructions for Payee

This withholding of tax does not relieve you of the requirement to file a California tax return.

You may be assessed a penalty if:

•You do not file a California tax return.

•You file your tax return late.

•The amount of withholding does not satisfy your tax liability.

For more information on California filing requirements, go to ftb.ca.gov/file.

How To Correct An Error

If a payee notices an error, the payee should contact the withholding agent. Only withholding agents can complete an amended Form

How to Claim the Withholding

Claim your withholding credit on one of the following:

•Form 540, California Resident Income Tax Return

•Form 540NR, California Nonresident or

•Form 541, California Fiduciary Income Tax Return

•Form 100, California Corporation Franchise or Income Tax Return

•Form 100S, California S Corporation Franchise or Income Tax Return

•Form 100W, California Corporation Franchise or Income Tax Return – Water’s- Edge Filers

•Form 109, California Exempt Organization Business Income Tax Return

•Form 565, Partnership Return of Income

•Form 568, Limited Liability Company Return of Income

If you have backup withholding, you must contact the FTB to provide a valid TIN before filing a tax return. The following are acceptable TINs: SSN, ITIN, FEIN, CA Corp no., or CA SOS file number. Failure to provide a valid TIN will result in the denial of the backup withholding credit. Using the information provided on this page, contact the FTB as soon as you receive this form.

Report the income as required and enter the amount from Form

If you are an S corporation, partnership, or LLC, you may either pass through the entire amount to your shareholders, partners, or members or claim the withholding, to the extent of your outstanding tax liability, on your tax return.

If the withholding exceeds the amount of tax you owe on your tax return, you must pass through the excess to your shareholders, partners, or members.

If you do not have an outstanding balance on your tax return, you must pass through the entire amount to your shareholders, partners, or members. Use Form

If you are an estate or trust, you must pass through the withholding to your beneficiaries if the related income was distributed. Use Form

The amount shown as “Total income subject to withholding” may be an estimate or may only reflect how withholding was calculated. Be sure to report your actual taxable California source income. If you are an independent contractor or receive rent, endorsement income, royalties, see your contract and/or federal Form 1099

to determine your California source income. If you are a shareholder of an

Additional Information

Website: |

For more information go to |

|

ftb.ca.gov and search for |

|

nonwage. |

|

MyFTB offers secure online tax |

|

account information and services. |

|

For more information, go to |

|

ftb.ca.gov and login or register |

|

for MyFTB. |

Telephone: |

888.792.4900 or 916.845.4900, |

|

Withholding Services and |

|

Compliance phone service |

Fax: |

916.845.9512 |

Mail: |

WITHHOLDING SERVICES AND |

|

COMPLIANCE MS F182 |

|

FRANCHISE TAX BOARD |

|

PO BOX 942867 |

|

SACRAMENTO CA |

Franchise Tax Board Privacy Notice on Collection

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

For questions unrelated to withholding, or to download, view, and print California tax forms and publications, or to access the California Relay Service, see the information below.

Internet and Telephone Assistance

Website: ftb.ca.gov

Telephone: |

800.852.5711 from within the |

|

United States |

|

916.845.6500 from outside the |

|

United States |

California |

|

Relay |

|

Service: |

711 or 800.735.2929 for |

|

persons with hearing or |

|

speaking limitations. |

Asistencia Por Internet y Teléfono ftb.ca.gov

800.852.5711 dentro de los Estados Unidos

916.845.6500 fuera de los Estados Unidos

711 o 800.735.2929 para personas con limitaciones auditivas o del habla.

Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Form 592-B reports the amount of payment or distribution subject to withholding and the tax withheld to payees in California. |

| Filing Deadline | Withholding agents must provide Form 592-B to each payee by January 31 for residents or nonresidents each year. |

| Governing Laws | California Revenue and Taxation Code (R&TC) Sections 18662 and 18664 govern the requirements for Form 592-B. |

| Who Completes the Form? | Any person or entity that has withheld on payments to residents or nonresidents must complete Form 592-B. |

Guidelines on Utilizing 592 B

Completing Form 592-B is essential for reporting income subject to withholding in California. This form must be filled out carefully to ensure accurate reporting. Following these steps will help guide you through the process.

- Gather the Necessary Information: Collect taxpayer identification numbers (TINs) for both the withholding agent and the payee, as well as their addresses and contact details.

- Complete Part I - Withholding Agent Information: Write the name, TIN, address, and daytime telephone number of the withholding agent.

- Fill Out Part II - Payee Information: Enter the payee's name and TIN. If applicable, provide the necessary trust or partnership details.

- Indicate Income Type in Part III: Check the appropriate box or boxes for the type of income that is being reported.

- Report Tax Withheld in Part IV:

- Line 1: Total income subject to withholding goes here.

- Line 2: Enter the total tax withheld, excluding backup withholding.

- Line 3: Include any backup withholding amount, if applicable.

- Review and Verify: Ensure all provided information is accurate and complete, checking for errors or missing details.

- Distribute the Form: Make sure to give the completed Form 592-B to the payee by the required deadline.

Once submitted, the payee must attach this form to their California tax return to claim the withholding credit. Keeping a copy for your records is crucial, as it may be needed for future reference or verification.

What You Should Know About This Form

What is the purpose of Form 592-B?

Form 592-B serves to report the amount of payment or distribution subject to tax withholding in California. Withholding agents use this form to inform payees about the tax withheld from their payments. Payees must then file Form 592-B with their California tax return to claim credit for the tax that was withheld. This ensures that taxpayers can accurately report income and any taxes paid when filing their returns.

Who needs to complete Form 592-B?

The withholding agent must complete Form 592-B. This includes individuals or entities that have withheld taxes on payments made to both residents and nonresidents. If there is backup withholding involved, this form must also be completed. It’s crucial for withholding agents to gather taxpayer identification numbers from payees and ensure all information is accurately recorded on the form.

When should Form 592-B be provided to payees?

Form 592-B must be provided to each payee by January 31st of the year following the calendar year for most payees. Brokers have a slightly different deadline, which is February 15th. For partners or members that are foreign, the form has to be delivered by the 15th day of the third month following the close of the partnership's or LLC's taxable year. Adhering to these deadlines helps avoid potential penalties for late submission.

What should a payee do if they notice an error on Form 592-B?

If a payee detects an error on their copy of Form 592-B, they should reach out directly to the withholding agent. Only the withholding agent is authorized to complete an amended Form 592-B. Once the withholding agent has updated the form, they are responsible for providing the corrected copy back to the payee. It’s important to correct any discrepancies as soon as possible to avoid any issues when filing tax returns.

Common mistakes

Filling out Form 592-B can be a daunting task, and many individuals make errors that could lead to complications down the line. One common mistake arises from the incorrect entry of taxpayer identification numbers (TINs). Payees must provide valid TINs, whether it’s a Social Security Number, Employer Identification Number, or individual taxpayer identification number. Omitting or incorrectly entering this information can lead to delays or even the denial of tax credits.

Another frequent oversight involves the failure to complete all applicable fields. Each section of the form requires specific details, and leaving something blank can have serious repercussions. For instance, both withholding agents and payees must ensure that all names, addresses, and identification numbers are accurately filled out to prevent issues with tax reporting.

People often overlook the importance of checking the appropriate income types in Part III of the form. Incorrectly marking the type of income can lead to miscalculations of tax liabilities, potentially resulting in extra fees or penalties. Therefore, it is essential to carefully review the income categories and select the correct option(s) to reflect the situation accurately.

Timeliness is crucial when managing taxes. Submitting Form 592-B after the required deadlines can incur penalties that strain resources further. The withholding agent needs to furnish the completed form by January 31st or February 15th, depending on the circumstances. Failing to adhere to these deadlines can lead to added financial burdens that could otherwise be avoided.

Additionally, not providing the recipient with a copy of the form can create significant barriers for payees when they file their state tax returns. Form 592-B must be given to the payee so they can claim the appropriate withholding credit. Without a copy, they may struggle to accurately report their income and tax withheld, causing potential issues with the Franchise Tax Board.

Finally, neglecting to amend the form when errors are discovered can escalate problems. If mistakes are noticed after the initial filing, it is essential to complete a new Form 592-B marked “Amended.” By providing this updated document promptly, withholding agents can help prevent complications and ease the filing process for everyone involved.

Documents used along the form

The Form 592-B is a critical document in California’s tax system for reporting resident and nonresident withholding. However, it is often accompanied by other forms that play an equally important role in tax reporting and compliance. Below are five commonly used forms and documents associated with Form 592-B.

- Form 592: This form is used by the withholding agent to report the total withholding payments made on behalf of the payee. It is essential for transmitting the withholding credit to the payee, ensuring accurate tax credit claims.

- Form 592-PTE: Specifically designed for pass-through entities, this form reports the total withholding that these entities have paid on behalf of nonresident partners or members. It effectively communicates the withholding amounts to those entitled to receive it.

- Form 592-F: This form serves a similar purpose as Form 592-PTE but is directed at foreign (non-U.S.) partners or members. It allows the withholding agent to distribute withheld tax credits accurately among non-resident foreign entities.

- Form 540: California residents use this form to file their personal income tax return. It is crucial for claiming the credit reported on Form 592-B, linking the withholding and the individual’s tax obligation.

- Form 540NR: This is the nonresident or part-year resident income tax return for California. Like Form 540, it is used to claim credits from Form 592-B, catering specifically to individuals who do not reside in California for the entire year.

Each of these forms complements Form 592-B, creating a comprehensive framework for tax reporting in California. Proper completion and timely submission of all related documents ensure compliance and can help avoid potential penalties.

Similar forms

- Form 592: This form is used for withholding agents to report the total amounts withheld from payments made to residents and nonresidents. Like Form 592-B, it provides important details about tax withheld.

- Form 592-PTE: This form is intended for pass-through entities to report their withholding tax obligations on behalf of nonresident owners. It complements Form 592-B, which is specifically for reporting amounts to payees.

- Form 592-F: It is designed for foreign (non-U.S.) partners or members, passing through the withholding credits similar to Form 592-B but for a different payee category.

- California Form 540: This is the California Resident Income Tax Return. Taxpayers use it to report income, including withholding reported on Form 592-B.

- California Form 540NR: The California Nonresident or Part-Year Resident Income Tax Return incorporates withholding reported from Form 592-B, similar to other income tax forms.

- Form 541: This form is used for California Fiduciary Income Tax Return, also reporting income that includes amounts withheld as indicated on Form 592-B.

- Form 565: The Partnership Return of Income allows partnerships to report income and withholding credits like those reported on Form 592-B for their partners.

- Form 568: This is the Limited Liability Company Return of Income. LLCs report their income and any withholding through this form, similarly to Form 592-B.

- Form 109: The California Exempt Organization Business Income Tax Return reports earnings for non-profit groups that might also include withholding from payments made to them, akin to what Form 592-B outlines.

Dos and Don'ts

When filling out Form 592-B, it is essential to ensure accuracy and compliance with California's tax regulations. Here are five things to do and avoid:

- Do ensure accurate information: Verify that all names, taxpayer identification numbers (TINs), and addresses are correct before submitting.

- Don't ignore deadlines: Submit the form by January 31st to residents or nonresidents and February 15th if sent by brokers to avoid penalties.

- Do check applicable income types: Clearly mark all the relevant boxes that apply to the type of income subject to withholding in Part III.

- Don't overlook backup withholding: If applicable, accurately report the total backup withholding on Line 3.

- Do keep a copy for your records: Retain a copy of the completed Form 592-B for at least five years for record-keeping purposes.

Misconceptions

- Misconception 1: The 592-B form is only for California residents.

- Misconception 2: Once tax is withheld, the recipient does not need to file a tax return.

- Misconception 3: The 592-B form can be submitted after the tax due date without penalties.

- Misconception 4: The 592-B form is not necessary if backup withholding is applied.

- Misconception 5: Only the withholding agent needs to worry about the 592-B form.

This misconception is incorrect. The 592-B form is required for both California residents and nonresidents. It reports tax withheld on payments made to individuals or entities from California sources.

This is not true. Even if tax has been withheld and reported on Form 592-B, recipients must still file their California tax return. The withheld amount is a credit against their overall tax liability.

This is misleading. If the withholding agent fails to provide the correct and timely 592-B form by the due date, penalties may apply. It is crucial to meet deadlines to avoid fines.

This misconception is false. Even when backup withholding occurs, the 592-B form must still be completed. It serves as a record of the tax withheld, ensuring proper reporting to both the payee and the tax authorities.

This is a narrow view. Recipients of the 592-B form need to maintain it for their records. They must also accurately report the withheld amounts when filing their own tax returns.

Key takeaways

Key Takeaways for Filling Out and Using Form 592-B

- Understand the Purpose: Form 592-B is essential for reporting payments or distributions subject to withholding. It notifies payees of the tax withheld and is crucial for their California tax returns.

- Timeliness is Key: Ensure that the form is completed and provided to each payee by the specified deadlines—January 31 for most payees and February 15 for brokers. Missing these deadlines can lead to penalties.

- Complete Information is Necessary: Fill in all applicable fields accurately. This includes taxpayer identification numbers (TINs) for both the withholding agent and payees, as well as accurate addresses.

- Record Keeping: Retain copies of the completed forms for at least five years. This documentation provides proof of withholding and may be requested by the California Franchise Tax Board (FTB).

- Reacting to Changes: If errors are found after issuing Form 592-B, prepare an amended copy and provide it to the payee. Check the Amended box at the top of the form to ensure clarity.

Browse Other Templates

Va Form 28-1900 - This form includes sections for both the veteran's application and certification from authorized officials.

California Dealers License - A total amount due section helps track payment for plates and fees.

1099 Agreement - Approval from TVC is required for marketing TVC's products beyond provided materials.