Fill Out Your 668 D Form

The 668 D form is an essential document utilized by the Internal Revenue Service (IRS) to formally release levies on property, rights to property, and income related to taxpayers. This form is particularly relevant after a notice of levy has been served, which demands the surrender of specific assets belonging to the taxpayer. Upon fulfilling certain criteria under the Internal Revenue Code, specifically section 6343, the IRS can initiate a release of the levy. This process relieves creditors, banks, employers, or other entities from the obligation to withhold company funds, wages, or any other income that had previously been targeted by the IRS for collection. The document outlines the taxpayer's identifying information, including their business name and applicable tax identification numbers, and clarifies the specific nature of the release, whether it pertains to tangible assets or income streams. Crucially, the form also includes detailed instructions for the recipient on managing any remaining obligations. Understanding the implications of the 668 D form is vital for both creditors and debtors alike, as it plays a pivotal role in resolving tax-related collections and restoring financial independence for affected taxpayers.

668 D Example

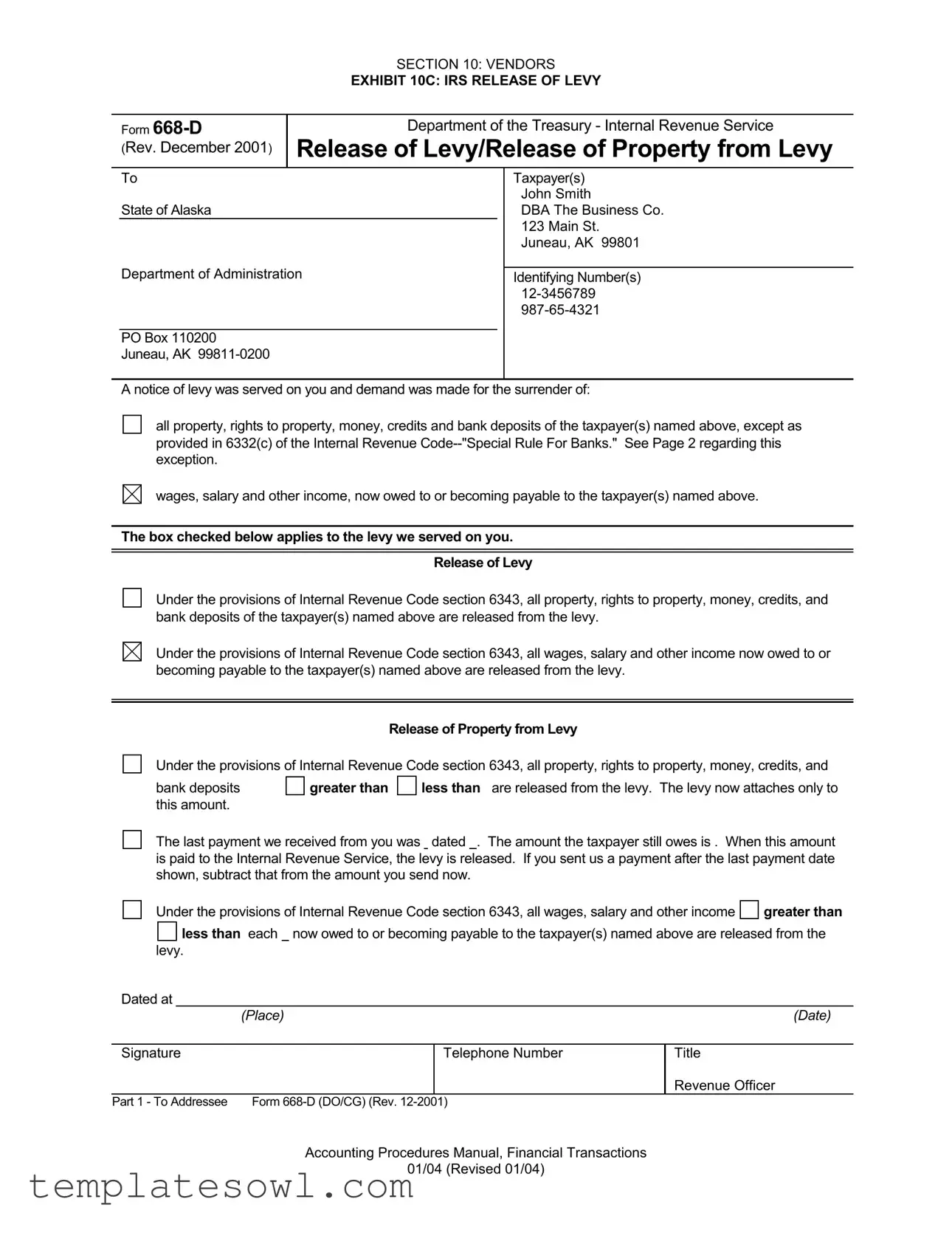

SECTION 10: VENDORS

EXHIBIT 10C: IRS RELEASE OF LEVY

Form

(Rev. December 2001)

Department of the Treasury - Internal Revenue Service

Release of Levy/Release of Property from Levy

To

State of Alaska

Department of Administration

PO Box 110200 Juneau, AK

Taxpayer(s)

John Smith

DBA The Business Co.

123 Main St.

Juneau, AK 99801

Identifying Number(s)

A notice of levy was served on you and demand was made for the surrender of:

all property, rights to property, money, credits and bank deposits of the taxpayer(s) named above, except as provided in 6332(c) of the Internal Revenue

wages, salary and other income, now owed to or becoming payable to the taxpayer(s) named above.

The box checked below applies to the levy we served on you.

Release of Levy

Under the provisions of Internal Revenue Code section 6343, all property, rights to property, money, credits, and bank deposits of the taxpayer(s) named above are released from the levy.

Under the provisions of Internal Revenue Code section 6343, all wages, salary and other income now owed to or becoming payable to the taxpayer(s) named above are released from the levy.

Release of Property from Levy

Under the provisions of Internal Revenue Code section 6343, all property, rights to property, money, credits, and

bank deposits this amount.

greater than |

|

less than are released from the levy. The levy now attaches only to |

The last payment we received from you was dated . The amount the taxpayer still owes is . When this amount is paid to the Internal Revenue Service, the levy is released. If you sent us a payment after the last payment date shown, subtract that from the amount you send now.

Under the provisions of Internal Revenue Code section 6343, all wages, salary and other income

greater than

less than each now owed to or becoming payable to the taxpayer(s) named above are released from the levy.

less than each now owed to or becoming payable to the taxpayer(s) named above are released from the levy.

Dated at

(Place) |

(Date) |

Signature

Telephone Number

Title

Revenue Officer

Part 1 - To Addressee |

Form |

Accounting Procedures Manual, Financial Transactions

01/04 (Revised 01/04)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Release of Levy/Release of Property from Levy |

| Form Version | Rev. December 2001 |

| Governing Agency | Department of the Treasury - Internal Revenue Service |

| Applicable Law | Internal Revenue Code Section 6343 |

| Purpose | To notify the release of property, wages, salary, and other income from levy. |

| Taxpayer Identification | Identifying numbers are provided for taxpayers (e.g., 12-3456789, 987-65-4321). |

| Restrictions | Does not apply to certain bank levies according to IRC section 6332(c). |

| Notification Requirements | A notice of levy must have been served prior to this form being issued. |

| State Specific | Form has specific instructions for use in Alaska. |

Guidelines on Utilizing 668 D

Completing the IRS Form 668-D is a straightforward process that requires careful attention to detail. This form should be filled out completely and accurately to ensure all necessary information is documented. The following steps will guide you through filling out the form efficiently.

- Gather all necessary information, including taxpayer names, addresses, and identifying numbers.

- Locate the section of the form that pertains to the release of levy. You will find checkboxes indicating the specific release applicable.

- Check the box that specifies the type of levy being released for the taxpayer(s): either property rights or wages.

- Fill in the relevant amounts where prompted. If there are amounts owed, state them clearly.

- Indicate the date of the last payment received and enter the amount the taxpayer still owes.

- If applicable, subtract any subsequent payments from the total owed and note this adjustment on the form.

- Provide the place and date of signing at the designated area on the form.

- Have the revenue officer sign the form and include their telephone number and title.

Once these steps are completed, ensure the form is reviewed for accuracy before submission. Properly filling out this form will facilitate the release process as required by the IRS regulations.

What You Should Know About This Form

What is Form 668-D?

Form 668-D is an IRS document used to formally release a levy placed on a taxpayer's property. This form notifies relevant parties that specific property, rights, or income have been released from the levy under the provisions of the Internal Revenue Code.

Who needs to use Form 668-D?

This form should be used by the IRS when a levy on a taxpayer's property needs to be released. Taxpayers, banks, and other parties involved in holding the taxpayer's assets may receive this form if it applies to their situation.

What does a levy involve?

A levy is a legal seizure of a taxpayer's property to satisfy a tax debt. It can include a range of assets, such as bank accounts, wages, and other rights to property. Form 668-D signals the release of the IRS's claim to those assets specified in the form.

What is the process for releasing a levy?

The IRS prepares and sends Form 668-D once the conditions for the release of the levy are met. This may be after full payment has been made, or if the IRS deems the levy no longer necessary. The form must be completed and sent to all relevant parties to ensure that they are aware of the release.

What should I do if I receive Form 668-D?

If you receive Form 668-D, it is crucial to acknowledge it as a formal notice that the levy on the taxpayer's assets has been released. Review the details on the form carefully, and ensure that any necessary actions, such as updating records, are taken promptly.

What happens if there is still an amount owed after the levy is released?

If there is still an outstanding balance after the release, the taxpayer will remain liable for the remaining debt. Form 668-D simply indicates that the claimed property is no longer under levy, but it does not absolve the taxpayer of their tax obligations.

What if I believe the levy was released improperly?

If you think that the levy was released in error, contact the IRS directly. It is important to address any discrepancies promptly to avoid potential issues in the future.

Common mistakes

Completing the IRS Form 668-D can be a straightforward process, yet several common mistakes often occur. Awareness of these errors can lead to a smoother submission experience and quicker resolution of any outstanding tax issues.

One significant mistake involves incomplete identification of the taxpayer. It is essential to ensure that the taxpayer's name, business name (if applicable), and identifying numbers are filled out accurately. Omitting or misspelling any of these details can result in delays, as the IRS may struggle to match the form to the correct taxpayer account. Always double-check this information for accuracy before submission.

Another mistake pertains to misinterpretations of the levy details. Taxpayers frequently misunderstand which assets are subject to levy. For instance, a misunderstanding about the types of property that can be released or the conditions under which this occurs may lead to improper requests. It's vital to read the sections carefully to determine what specific assets you need to address on the form.

Additionally, many individuals fail to include the required payment amounts when notifying the IRS about any existing liabilities. Not providing a clear and accurate account of the last payment date and the amount still owed can cause confusion. Always ensure that you provide all relevant financial information, stating clearly what has been paid and what remains outstanding.

Furthermore, people often neglect to verify their contact information. The telephone number and address listed on the form must be current and accurate. Failing to provide this information can hinder communication between the taxpayer and the IRS, complicating the resolution process further. Before submitting the form, reviewing this vital information can prevent unnecessary complications.

Lastly, not signing the form is a frequent error that can render the whole submission invalid. Without a signature, the IRS has no proof that the information provided is legitimate, which can lead to denial of your request. Be sure to sign and date the form appropriately before sending it to avoid this oversight.

Documents used along the form

The Form 668-D is commonly used for the release of levies by the IRS. Several other forms and documents are often associated with it to manage tax-related matters effectively. Here is a list of those documents along with brief descriptions.

- Form 668-A: This form is used to notify individuals about the levy on their property. It details the property subject to the levy and the amount owed to the IRS.

- Form 843: A request for the abatement of interest and penalties can be made using this form. Taxpayers may file it if they believe their tax penalties should be forgiven under certain circumstances.

- Form 9465: This form allows taxpayers to request a monthly installment plan. If individuals cannot pay their tax bill in full, they may use this form to set up a payment plan to ease the financial burden.

- Form 2848: A Power of Attorney form is used by taxpayers to authorize someone else to represent them before the IRS. This can be helpful if they need assistance with tax issues or negotiations.

- Form 1040: The standard individual income tax return form. Taxpayers must file this form annually to report their income and determine their tax liability.

- Form 1099: These forms report various types of income other than wages. They are used to inform the IRS about income earned through freelance work, interest, dividends, and other sources.

- Form 4562: Depreciation and Amortization form used by businesses to claim deductions for the depreciation of assets. This form is crucial for accurately reporting business expenses and tax calculations.

- Form 2553: This form is used by small business corporations to elect S corporation status for tax purposes. It must be submitted within a specific period to receive S corporation tax benefits.

Understanding these forms can simplify dealings with the IRS and help navigate tax-related situations more efficiently. Each document serves a specific purpose and can aid in addressing various financial and tax responsibilities.

Similar forms

The Form 668-D is a document related to the release of a tax levy by the Internal Revenue Service (IRS). It is comparable to several other documents. Below is a list of six documents that share similarities with Form 668-D, along with explanations of those similarities.

- Form 668-C: This document is another IRS release form specifically indicating a full release of levy. Like the 668-D, it serves to notify the taxpayer and third parties that a previously imposed levy has ended. Both forms are used to ensure that the taxpayer's property rights are restored following compliance or resolution of tax debts.

- Form 668-W: This form, known as the Notice of Levy on Wages, Salary, and Other Income, also deals with wage levies. It indicates that a portion of a taxpayer's income is being withheld for debt repayment. Similar to the 668-D, it protects certain rights of the taxpayer while outlining the IRS's claims against income.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. While it primarily addresses unemployment taxes, it can also lead to levies. The form shares the essential function of tax compliance and may result in similar release procedures when obligations are met, much like the release described in the 668-D.

- Form 941: The Employer's Quarterly Federal Tax Return serves a similar purpose as Form 940, focusing on employment taxes. If taxes from this form lead to a levy, the process for releasing those levies follows similar guidelines as outlined in the 668-D, maintaining transparency for tax payments.

- Form 1058: The Notice of Intent to Levy and Notice of Your Right to a Hearing is sent prior to the implementation of a levy. It informs taxpayers about their rights. Like the 668-D, it is crucial for due process in tax collection, highlighting the procedural steps required before any property is seized.

- Form 433-A (OIC): This document is a Collection Information Statement for Wage Earners and Self-Employed Individuals. It aids in evaluating an offer in compromise. Its purpose ties back to tax liability similar to the 668-D, as both forms may ultimately affect the course of debt resolution and the release of levies.

Dos and Don'ts

When filling out the 668 D form, it is important to follow certain guidelines to ensure that your submission is correct and clear. Below are some key dos and don'ts to keep in mind.

- Do: Provide complete and accurate taxpayer information, including names and identifying numbers.

- Do: Double-check the amounts mentioned to avoid discrepancies with the Internal Revenue Service.

- Do: Sign and date the form in the appropriate sections to validate your submission.

- Do: Keep a copy of the completed form for your records for future reference.

- Don't: Leave any sections blank. Incomplete forms can lead to processing delays.

- Don't: Use incorrect or misleading terms; clarity is essential for all parties involved.

- Don't: Ignore the deadlines for submission, as late forms may not be processed in time.

- Don't: Forget to review the IRS guidelines to ensure compliance with the latest regulations.

Misconceptions

Understanding the Form 668-D can be confusing, and there are several misconceptions that deserve clarification. Here are five common misunderstandings people have about this form:

- Misconception 1: Form 668-D automatically eliminates all debts owed to the IRS.

- Misconception 2: Receiving Form 668-D means a tax issue has been fully resolved.

- Misconception 3: The form only applies to individuals.

- Misconception 4: There is no time limit associated with Form 668-D.

- Misconception 5: Completing the form eliminates the need for professional assistance.

This is not accurate. While Form 668-D releases specific property or wages from a levy, it does not erase the total debt owed. Taxpayers must still address their outstanding liabilities with the IRS.

Receiving this form indicates that a levy on certain assets has been released, but it does not mean the taxpayer's tax obligations have been resolved. Ongoing communication with the IRS may still be necessary.

Form 668-D is applicable to both individuals and businesses. Any entity that has debts to the IRS and is facing a levy can be involved with this form.

While the form releases specific assets, it’s important for taxpayers to act quickly in addressing any remaining debts. Delays can lead to additional penalties or interest accruing on unpaid amounts.

Although the form may seem straightforward, navigating tax obligations and levies can be complex. Consulting with a tax professional can provide valuable guidance and help ensure compliance with IRS requirements.

Key takeaways

Here are some key points to keep in mind when filling out and using Form 668-D:

- Purpose: Form 668-D is used to release a levy imposed by the IRS on a taxpayer's property or income.

- Basic Information: Ensure all details are accurate, including the taxpayer's name, address, and identifying numbers.

- Understanding Levies: A levy allows the IRS to take assets or income to satisfy unpaid tax debts. This form is how you can formally release that action.

- Sections of the Form: Pay attention to the sections that specify what property is being released from the levy and under what conditions.

- Date and Signature: Remember to include the correct date and signature of the Revenue Officer. This validates the release.

- Notification: Notify all involved parties, such as banks or employers, about the release to prevent further illegal levy actions.

- Follow-Up: Always keep a copy of the completed form for your records and follow up to ensure the levy has been lifted.

Browse Other Templates

Supply Request Form Army - The DA 3953 includes space for the estimated cost of items requested.

Hhs690 - Data accuracy on this form is critical for maintaining integrity in federal assistance applications.