Fill Out Your 668 Y Form

The 668 Y form plays a crucial role for taxpayers dealing with federal tax liens. This application is specifically designed for individuals or businesses who wish to request the withdrawal of a filed Notice of Federal Tax Lien (NFTL). Filing this form is essential for those who believe that the lien was filed prematurely, or not according to IRS regulations. It allows taxpayers to clarify their current tax status, especially if they have entered into an installment agreement that should not have involved a lien. The form also accommodates situations where the taxpayer, or their representative, feels that withdrawing the lien is advantageous for both the taxpayer and the government. Essential information like taxpayer identification details, the current status of the lien, and a justification for the withdrawal must be provided. Once the IRS reviews the application, they will determine whether to proceed with the withdrawal or not. In essence, the 668 Y form serves as a lifeline for many taxpayers, helping them clear their names and regain financial stability.

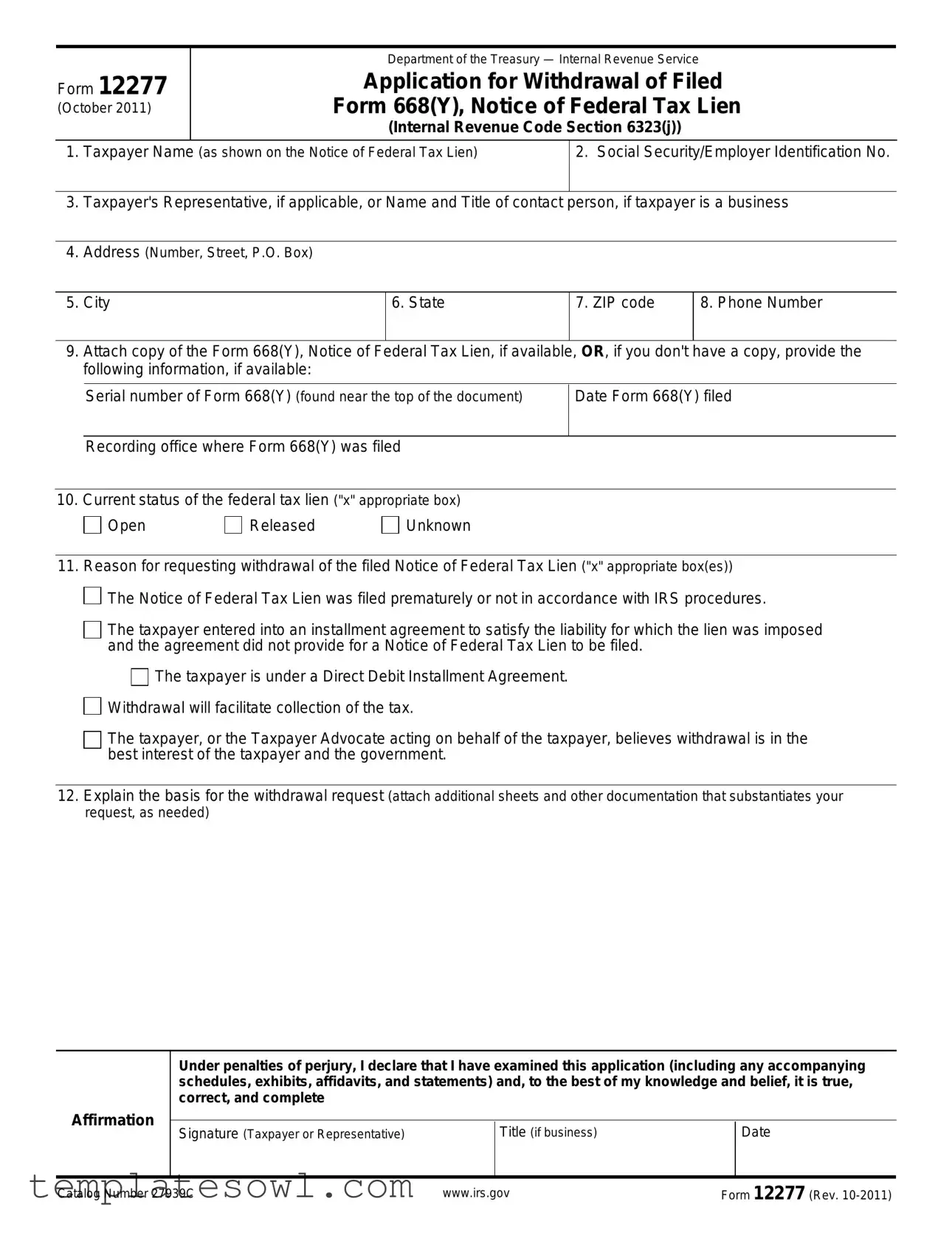

668 Y Example

Form 12277

(October 2011)

Department of the Treasury — Internal Revenue Service

Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien

(Internal Revenue Code Section 6323(j))

1.Taxpayer Name (as shown on the Notice of Federal Tax Lien)

2. Social Security/Employer Identification No.

3.Taxpayer's Representative, if applicable, or Name and Title of contact person, if taxpayer is a business

4.Address (Number, Street, P.O. Box)

5. City

6. State

7. ZIP code

8. Phone Number

9.Attach copy of the Form 668(Y), Notice of Federal Tax Lien, if available, OR, if you don't have a copy, provide the following information, if available:

Serial number of Form 668(Y) (found near the top of the document)

Date Form 668(Y) filed

Recording office where Form 668(Y) was filed

10. Current status of the federal tax lien ("x" appropriate box)

Open

Released

Unknown

11. Reason for requesting withdrawal of the filed Notice of Federal Tax Lien ("x" appropriate box(es))

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The Notice of Federal Tax Lien was filed prematurely or not in accordance with IRS procedures.

The taxpayer entered into an installment agreement to satisfy the liability for which the lien was imposed and the agreement did not provide for a Notice of Federal Tax Lien to be filed.

The taxpayer is under a Direct Debit Installment Agreement.

Withdrawal will facilitate collection of the tax.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

The taxpayer, or the Taxpayer Advocate acting on behalf of the taxpayer, believes withdrawal is in the best interest of the taxpayer and the government.

12.Explain the basis for the withdrawal request (attach additional sheets and other documentation that substantiates your request, as needed)

Affirmation

Under penalties of perjury, I declare that I have examined this application (including any accompanying schedules, exhibits, affidavits, and statements) and, to the best of my knowledge and belief, it is true, correct, and complete

Signature (Taxpayer or Representative) |

Title (if business) |

Date |

|

|

|

Catalog Number 27939C |

www.irs.gov |

Form 12277 (Rev. |

Page 2 of 2

General Instructions

1.Complete the application. If the information you supply is not complete, it may be necessary for the IRS to obtain additional information before making a determination on the application.

Sections 1 and 2: Enter the taxpayer's name and Social Security Number (SSN) or Employer Identification Number (EIN) as shown on the Notice of Federal Tax Lien (NFTL).

Section 3: Enter the name of the person completing the application if it differs from the taxpayer's name in section 1 (for example, taxpayer representative). For business taxpayers, enter the name and title of person making the application. Otherwise, leave blank.

Sections 4 through 8: Enter current contact information of taxpayer or representative.

Section 9: Attach a copy of the NFTL to be withdrawn, if available. If you don't have a copy of the NFTL but have other information about the NFTL, enter that information to assist the IRS in processing your request.

Section 10: Check the box that indicates the current status of the lien.

"Open" means there is still a balance owed with respect to the tax liabilities listed on the NFTL. "Released" means the lien has been satisfied or is no longer enforceable.

"Unknown" means you do not know the current status of the lien.

Section 11: Check the box(es) that best describe the

reason(s) for the withdrawal request. NOTE: If you are requesting a withdrawal of a released NFTL, you generally should check the last box regarding the best interest provision.

Section 12: Provide a detailed explanation of the events or the situation to support your reason(s) for the withdrawal request. Attach additional sheets and supporting documentation, as needed.

Affirmation: Sign and date the application. If you are completing the application for a business taxpayer, enter your title in the business.

2.Mail your application to the IRS office assigned your account. If the account is not assigned or you are uncertain where it is assigned, mail your application to IRS, ATTN: Advisory Group Manager, in the area where you live or is the taxpayer's principal place of business. Use Publication 4235, Advisory Group Addresses, to determine the appropriate office.

3.Your application will be reviewed and, if needed, you may be asked to provide additional information. You will be contacted regarding a determination on your application.

a. If a determination is made to withdraw the NFTL, we will file a Form 10916(c), Withdrawal of Filed Notice of Federal Tax Lien, in the recording office where the original NFTL was filed and provide you a copy of the document for your records.

b. If the determination is made to not withdraw the NFTL, we will notify you and provide information regarding your rights to appeal the decision.

4.At your request, we will notify other interested parties of the withdrawal notice. Your request must be in writing and provide the names and addresses of the credit reporting agencies, financial institutions, and/or creditors that you want notified.

NOTE: Your request serves as our authority to release the notice of withdrawal information to the agencies, financial institutions, or creditors you have identified.

5.If, at a later date, additional copies of the withdrawal notice are needed, you must provide a written request to the Advisory Group Manager. The request must provide:

a.The taxpayer's name, current address, and taxpayer identification number with a brief statement authorizing the additional notifications;.

b.A copy of the notice of withdrawal, if available; and

c.A supplemental list of the names and addresses of any credit reporting agencies, financial institutions, or creditors to notify of the withdrawal of the filed Form 668(Y).

. |

Privacy Act Notice |

We ask for the information on this form to carry out the Internal Revenue laws of the United States. The primary purpose of this form is to apply for withdrawal of a notice of federal tax lien. The information requested on this form is needed to process your application and to determine whether the notice of federal tax lien can be withdrawn. You are not required to apply for a withdrawal; however, if you want the notice of federal tax lien to be withdrawn, you are required to provide the information requested on this form. Sections 6001, 6011, and 6323 of the Internal Revenue Code authorize us to collect this information. Section 6109 requires you to provide the requested identification numbers. Failure to provide this information may delay or prevent processing your application; providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

Catalog Number 27939C |

www.irs.gov |

Form 12277 (Rev. |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of Form | This form is used to apply for the withdrawal of a filed Notice of Federal Tax Lien. |

| Governing Law | Internal Revenue Code Section 6323(j) governs the withdrawal process. |

| Required Information | Applicants need to provide detailed information such as taxpayer name, contact details, and reasons for withdrawal. |

| Supporting Documents | It's important to attach a copy of the original Notice of Federal Tax Lien, if available, or provide relevant details if not. |

| Application Review | The IRS reviews the application and may require additional information before a determination is made. |

Guidelines on Utilizing 668 Y

Filling out the Form 668 Y is a necessary step for those seeking to withdraw a previously filed Notice of Federal Tax Lien. This process requires careful attention to detail to ensure that the application is complete and accurate. Following the steps below will help ensure that your application is filed correctly.

- Begin by providing the taxpayer's name exactly as it appears on the Notice of Federal Tax Lien.

- Enter the Social Security Number (SSN) or Employer Identification Number (EIN) associated with the taxpayer.

- If applicable, fill in the name of the taxpayer's representative or the name and title of a contact person if the taxpayer is a business.

- Provide the current address (including street number, street name, or P.O. Box).

- Enter the city, state, and ZIP code for the taxpayer's address.

- Fill in the phone number where you can be reached.

- Attach a copy of the Form 668(Y) if you have it. If not, include available details like the serial number, date filed, and recording office where it was filed.

- Indicate the current status of the federal tax lien by checking one of the boxes: Open, Released, or Unknown.

- Check the box(es) that best explain the reason for requesting withdrawal of the Notice of Federal Tax Lien.

- In Section 12, provide a detailed explanation supporting your request for withdrawal and attach any necessary documentation.

- Sign and date the form to affirm the accuracy of the information provided. If filing for a business, include your title.

- Finally, mail the completed application to the appropriate IRS office associated with your account. Ensure it goes to the right area using the necessary IRS guides if you're uncertain where your account is assigned.

Once submitted, the IRS will review the application and may request additional information if necessary. They will notify you of the outcome and, if approved, will file the appropriate notifications regarding the withdrawal. Should you need to track its progress or request additional copies later, there will be additional instructions provided by the IRS.

What You Should Know About This Form

What is the purpose of Form 668 Y?

Form 668 Y serves as an application for the withdrawal of a filed Notice of Federal Tax Lien. This tax lien is a public notice that a taxpayer owes the government money. When you submit this form, you’re requesting that the IRS remove this lien from public records, which can improve your credit rating and financial standing.

Who can file Form 668 Y?

Any taxpayer who has had a Notice of Federal Tax Lien filed against them may file Form 668 Y. This form can also be completed by a representative acting on the taxpayer's behalf, such as an attorney or a tax professional. When filing, ensure that the information provided matches what is on the Notice of Federal Tax Lien.

What information do I need to provide on Form 668 Y?

You will need to provide your name, Social Security Number or Employer Identification Number, and contact information. If applicable, include the name of your representative. Additionally, indicate the current status of the federal tax lien. You must also explain the reason for your withdrawal request and may attach supporting documentation to strengthen your application.

What happens after I submit Form 668 Y?

After you submit Form 668 Y, the IRS will review your application. They may reach out for additional information if necessary. If your request is approved, the IRS will file a Withdrawal of Filed Notice of Federal Tax Lien at the original recording office and send you a copy for your records. If the request is denied, you’ll be notified and provided information about how to appeal the decision.

Can I request notifications be sent to other parties if the lien is withdrawn?

Yes, once your request for withdrawal is approved, you can ask the IRS to notify other interested parties such as credit reporting agencies and financial institutions. This request must be in writing, and you need to provide the names and addresses of the entities you want notified.

Common mistakes

Completing the Form 668 Y can be challenging, and several common mistakes often occur that can impede the processing of requests. This form is critical for the withdrawal of a federal tax lien, and errors can lead to delays or outright denial of the application.

One frequent mistake is omitting essential information in the required fields. The first two sections ask for the taxpayer's name and Social Security or Employer Identification Number. If the details provided do not match those on the Notice of Federal Tax Lien, the IRS can reject the application. It is crucial to ensure accuracy when filling these sections. Make no assumption; double-check each entry against the original notice.

Another common error is failing to provide complete or current contact information. Sections 4 through 8 require the taxpayer's or representative's address and phone number. Incomplete or outdated contact details can lead to miscommunication, resulting in the IRS being unable to reach the applicant if further information is needed. Always provide the most accurate current contact details.

Some applicants neglect to check the appropriate boxes in Section 10 regarding the status of the federal tax lien. Misunderstanding or mislabeling the status can confuse the IRS, delaying the processing of the application. It's important to be clear about whether the lien is open, released, or unknown, as this impacts the review process.

Lastly, many individuals overlook the significance of providing a detailed explanation in Section 12. Merely checking boxes without sufficient justification can weaken the application. If the reasons for withdrawal are vague or inadequately explained, the IRS may not find enough grounds to approve the request. A thorough articulation of reasons, backed by documentation, can greatly strengthen the case for withdrawal.

Documents used along the form

The Form 668 Y is used to request the withdrawal of a filed Notice of Federal Tax Lien. Several other forms and documents may accompany this form during this process. Each of these documents serves specific purposes that facilitate communication and resolution with the Internal Revenue Service (IRS). Below is a list of these documents, along with their brief descriptions.

- Form 10916(c): This form is the official Withdrawal of Filed Notice of Federal Tax Lien. When the IRS approves the withdrawal request from Form 668 Y, it files Form 10916(c) in the recording office where the original lien was filed. This document serves as formal confirmation that the lien has been withdrawn.

- Form 843: This is the Claim for Refund and Request for Abatement. It may be submitted to request a refund for overpaid taxes or to abate a tax liability. If the withdrawal of the lien relates to issues of overpayment, this form may be included to clarify the taxpayer's position.

- Power of Attorney (Form 2848): When a taxpayer desires representation, the Power of Attorney document is necessary. This allows someone else (such as a tax advisor or attorney) to act on behalf of the taxpayer in dealings with the IRS. It may accompany the Form 668 Y to indicate that the representative is authorized to manage the withdrawal request.

- Supporting Documentation: Additional documents may provide context or proof for the request. Such documents can include correspondence with the IRS, payment agreements, or any relevant financial records that substantiate the basis for the withdrawal request indicated in Form 668 Y.

Each of these documents plays a crucial role in the process surrounding the withdrawal of a federal tax lien. Submitting complete and accurate paperwork helps streamline the review process and improves the likelihood of a favorable outcome for the taxpayer.

Similar forms

- Form 10916(c): This form is filed by the IRS when a withdrawal of a Notice of Federal Tax Lien is approved. Like the 668 Y form, it is concerned with the status of tax liens and provides formal documentation of their removal.

- Form 12153: This form is used to request a hearing regarding a tax lien or levy. Similar to the 668 Y form, it helps taxpayers address issues surrounding their tax obligations and their impact on financial standing.

- Form 4506-T: This is a request for a transcript of tax returns. Its connection to the 668 Y form lies in its role in verifying taxpayer information and providing clarity on tax matters, especially when a lien is involved.

- Form 8821: This is the Tax Information Authorization form. Much like the 668 Y form, it allows designated representatives to access tax information, important when appealing or dealing with tax liens.

- Form 9465: This form is used to set up an installment agreement for tax payments. Similar to the 668 Y form, it relates to the management of tax liabilities, particularly in cases where a tax lien could be involved, such as when seeking lien withdrawal due to payment arrangements.

Dos and Don'ts

When filling out the Form 668 Y, it is important to pay careful attention to both the instructions and the information provided. Here are five dos and don’ts to consider:

- Do ensure that all sections are completed accurately. Incomplete applications may lead to delays or requests for additional information.

- Do attach a copy of the Form 668(Y) if available. This assists the IRS in processing your request more efficiently.

- Do check the correct box for the current status of the federal tax lien. This information helps the IRS understand your situation better.

- Don't leave out your contact information. Providing up-to-date contact details is crucial for communication regarding your application.

- Don't neglect to explain the reason for your withdrawal request in detail. Supporting information and additional documentation may strengthen your application.

By following these guidelines, you can facilitate the application process and enhance the chances of a favorable outcome.

Misconceptions

- Misconception 1: The Form 668 Y is only for individuals.

- Misconception 2: You need to have a copy of the Form 668 Y to apply for withdrawal.

- Misconception 3: I can submit the Form 668 Y anytime regardless of my tax situation.

- Misconception 4: My request to withdraw the lien will be automatically approved.

- Misconception 5: Once the request is submitted, I’m done. No further action is necessary.

- Misconception 6: The withdrawal of a tax lien removes all tax issues permanently.

- Misconception 7: I do not need to explain why I'm requesting a withdrawal.

- Misconception 8: Submission of Form 668 Y guarantees a favorable credit impact.

- Misconception 9: The IRS will automatically notify my creditors of the withdrawal.

- Misconception 10: I can complete the form quickly without much thought.

This form can be used by both individuals and businesses that have a federal tax lien against them. Entities must ensure they provide the proper representative details in the application.

While attaching a copy of the form is helpful, it's not mandatory. If the copy is unavailable, providing relevant details such as the serial number, filing date, and recording office can suffice.

This form is applicable mainly when specific conditions are met, such as improper filing of the lien or an installment agreement that satisfies the tax liability. It is important to assess your situation before applying.

The IRS reviews all applications carefully. A thorough assessment is conducted based on the information provided, and requests may be denied, depending on the specifics of the lien and collection status.

After submitting the form, you may be required to provide additional information or documentation as requested by the IRS. Staying engaged in the process is crucial.

Withdrawing a lien only addresses that specific notice. Any outstanding tax liabilities remain and must be addressed separately.

A detailed explanation is necessary and should justify the withdrawal. This includes any supporting documents that strengthen your claim.

While withdrawing a tax lien may positively affect your credit, it does not guarantee immediate results. Credit reporting agencies need to be updated, and this process can take some time.

Notification to creditors is not automatic. You must request this in writing and provide a list of the agencies or entities you want notified.

Completing the Form 668 Y requires careful attention to detail. Mistakes or incomplete information may lead to processing delays or denials of the withdrawal request.

Key takeaways

- Complete Accuracy is Crucial: When filling out the Form 668 Y, ensure that all personal information, especially names and identification numbers, matches the Notice of Federal Tax Lien. Inaccuracies can delay processing.

- Clear Communication: Provide a detailed explanation for requesting the withdrawal in Section 12. The more context and supporting documentation you offer, the easier it will be for the IRS to assess your request.

- Stay Informed About the Status: Check the current status of the federal tax lien carefully. Indicate whether it is open, released, or unknown in Section 10. This information impacts the possibility of withdrawal.

- Follow Submission Guidelines: After completing the application, mail it to the correct IRS office. If unsure of the appropriate office, use the IRS publication to find the right address to avoid processing delays.

Browse Other Templates

Dhb 5003 - It details procedures for postponing hearings, ensuring the rights of applicants are maintained.

What Is a Charitable Tax Receipt - List clothing, furniture, and household goods donated.

Osha Basic Plus Training Online - Registration for courses is required by 10:00 a.m. the day before the session.