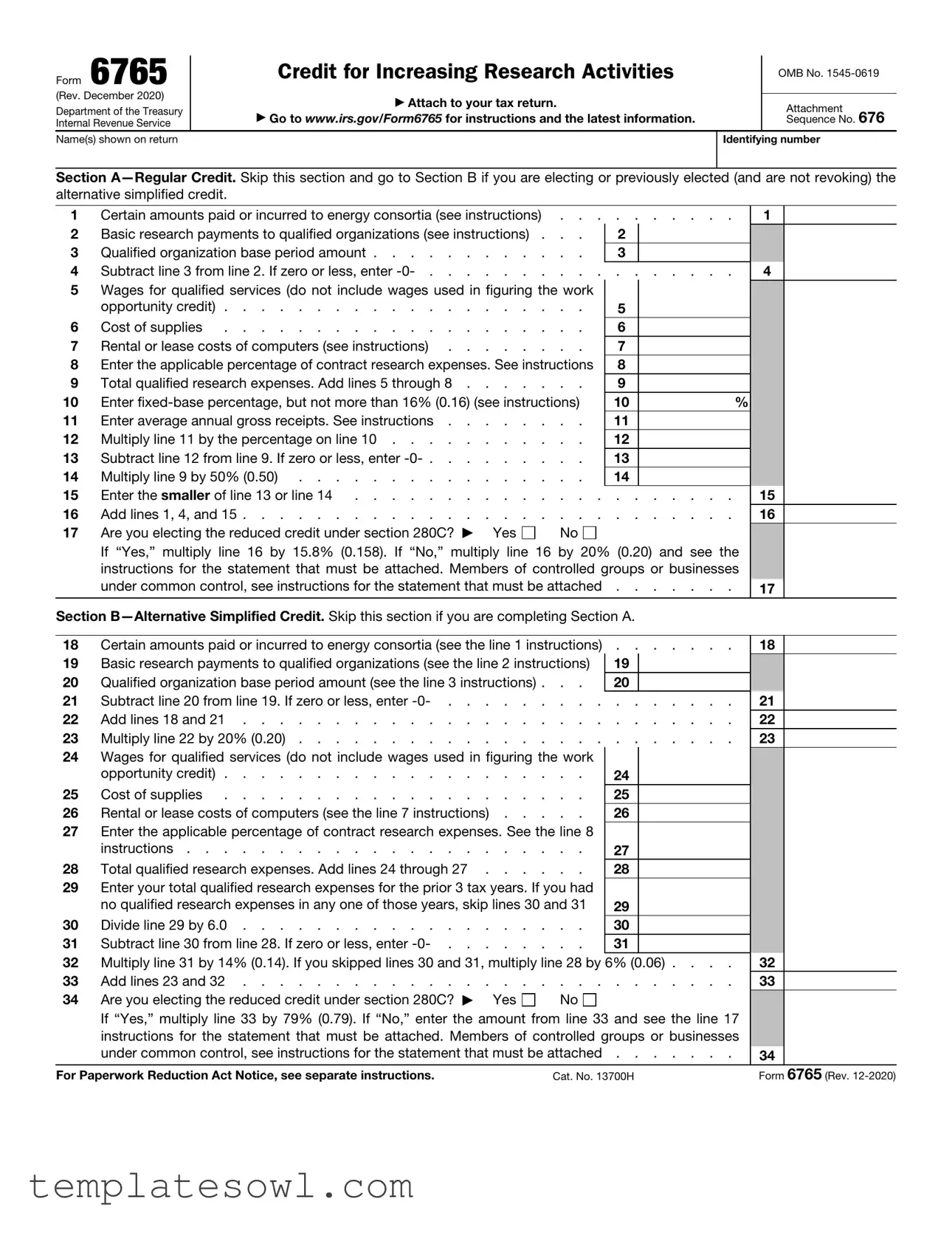

Fill Out Your 6765 Form

Understanding Form 6765, the "Credit for Increasing Research Activities," is essential for businesses engaged in research and development efforts. This form allows eligible companies to claim tax credits for various qualifying research expenses, ultimately reducing their overall tax liability. Businesses can choose between two methods for calculating their credits: the Regular Credit, outlined in Section A, or the Alternative Simplified Credit, provided in Section B. Each section details specific line items that guide taxpayers in reporting costs such as wages for qualified services, supplies, and contract research expenses. Furthermore, Section C covers the Current Year Credit, which takes into account credits from partnerships, S corporations, estates, and trusts. To incentivize small businesses, there is a provision in Section D for those electing a payroll tax credit, allowing for an immediate cash benefit rather than a future tax deduction. With a broad application and streamlined instructions, Form 6765 stands as a vital tool for businesses aiming to enhance their research capabilities while enjoying significant financial relief through tax credits.

6765 Example

Form 6765 |

Credit for Increasing Research Activities |

|

OMB No. |

|

|

|

|

(Rev. December 2020) |

▶ Attach to your tax return. |

|

|

|

Attachment |

||

Department of the Treasury |

|

||

▶ Go to WWW.IRS.GOV/FORM6765 for instructions and the latest information. |

|

Sequence No. 676 |

|

Internal Revenue Service |

|

||

|

|

|

|

Name(s) shown on return |

|

Identifying number |

|

|

|

|

|

Section

1 |

Certain amounts paid or incurred to energy consortia (see instructions) . . |

. . . . . . . . |

1 |

|

||

2 |

Basic research payments to qualified organizations (see instructions) . . . |

|

2 |

|

|

|

3 |

Qualified organization base period amount |

|

3 |

|

|

|

4 |

Subtract line 3 from line 2. If zero or less, enter |

. . . . . . . . |

4 |

|

||

5Wages for qualified services (do not include wages used in figuring the work

|

opportunity credit) |

5 |

|

|

|

|

|

6 |

Cost of supplies |

6 |

|

|

|

|

|

7 |

Rental or lease costs of computers (see instructions) |

7 |

|

|

|

|

|

8 |

Enter the applicable percentage of contract research expenses. See instructions |

8 |

|

|

|

|

|

9 |

Total qualified research expenses. Add lines 5 through 8 |

9 |

|

|

|

|

|

10 |

Enter |

10 |

% |

|

|

|

|

11 |

Enter average annual gross receipts. See instructions |

11 |

|

|

|

|

|

12 |

Multiply line 11 by the percentage on line 10 |

12 |

|

|

|

|

|

13 |

Subtract line 12 from line 9. If zero or less, enter |

13 |

|

|

|

|

|

14 |

Multiply line 9 by 50% (0.50) |

14 |

|

|

|

|

|

15 |

Enter the smaller of line 13 or line 14 |

. . . |

. . . . |

|

15 |

|

|

16 |

Add lines 1, 4, and 15 |

. . . |

. . . . |

|

16 |

|

|

17 |

Are you electing the reduced credit under section 280C? ▶ Yes |

No |

|

|

|

|

|

|

If “Yes,” multiply line 16 by 15.8% (0.158). If “No,” multiply line 16 by 20% (0.20) and see the |

|

|

||||

|

instructions for the statement that must be attached. Members of controlled groups or businesses |

|

|

||||

|

under common control, see instructions for the statement that must be attached |

. . . |

. . . . |

|

17 |

|

|

Section

18 |

Certain amounts paid or incurred to energy consortia (see the line 1 instructions) |

||

19 |

Basic research payments to qualified organizations (see the line 2 instructions) |

19 |

|

20 |

Qualified organization base period amount (see the line 3 instructions) . . . |

20 |

|

21 |

Subtract line 20 from line 19. If zero or less, enter |

||

22 |

Add lines 18 and 21 |

||

23 |

Multiply line 22 by 20% (0.20) |

||

24Wages for qualified services (do not include wages used in figuring the work

|

opportunity credit) |

24 |

25 |

Cost of supplies |

25 |

26 |

Rental or lease costs of computers (see the line 7 instructions) |

26 |

27Enter the applicable percentage of contract research expenses. See the line 8

instructions |

27 |

28 Total qualified research expenses. Add lines 24 through 27 |

28 |

29Enter your total qualified research expenses for the prior 3 tax years. If you had

|

no qualified research expenses in any one of those years, skip lines 30 and 31 |

29 |

30 |

Divide line 29 by 6.0 |

30 |

31 |

Subtract line 30 from line 28. If zero or less, enter |

31 |

32Multiply line 31 by 14% (0.14). If you skipped lines 30 and 31, multiply line 28 by 6% (0.06) . . . .

33 |

Add lines 23 and 32 |

|

34 |

Are you electing the reduced credit under section 280C? ▶ Yes |

No |

If “Yes,” multiply line 33 by 79% (0.79). If “No,” enter the amount from line 33 and see the line 17 instructions for the statement that must be attached. Members of controlled groups or businesses under common control, see instructions for the statement that must be attached . . . . . . .

18

21

22

23

32

33

34

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 13700H |

Form 6765 (Rev. |

Form 6765 (Rev. |

Page 2 |

|

|

Section

35Enter the portion of the credit from Form 8932, line 2, that is attributable to wages that were also

|

used to figure the credit on line 17 or line 34 (whichever applies) |

35 |

|

36 |

Subtract line 35 from line 17 or line 34 (whichever applies). If zero or less, enter |

36 |

|

37 |

Credit for increasing research activities from partnerships, S corporations, estates, and trusts . . . |

37 |

|

38 |

Add lines 36 and 37 |

38 |

|

|

• Estates and trusts, go to line 39. |

|

|

|

• Partnerships and S corporations not electing the payroll tax credit, stop here and report this amount on |

|

|

|

Schedule K. |

|

|

|

• Partnerships and S corporations electing the payroll tax credit, complete Section D and report on |

|

|

|

Schedule K the amount on this line reduced by the amount on line 44. |

|

|

|

• Eligible small businesses, stop here and report the credit on Form 3800, Part III, line 4i. See instructions |

|

|

|

for the definition of eligible small business. |

|

|

|

• Filers other than eligible small businesses, stop here and report the credit on Form 3800, Part III, line 1c. |

|

|

|

Note: Qualified small business filers, other than partnerships and S corporations, electing the payroll tax |

|

|

|

credit must complete Form 3800 before completing Section D. |

|

|

39 |

Amount allocated to beneficiaries of the estate or trust (see instructions) |

39 |

|

40Estates and trusts, subtract line 39 from line 38. For eligible small businesses, report the credit on Form 3800, Part III, line 4i. See instructions. For filers other than eligible small businesses, report the

credit on Form 3800, Part III, line 1c |

40 |

Section

41 Check this box if you are a qualified small business electing the payroll tax credit. See instructions

42Enter the portion of line 36 elected as a payroll tax credit (do not enter more than $250,000). See

instructions |

42 |

43General business credit carryforward from the current year (see instructions). Partnerships and S

corporations, skip this line and go to line 44 |

43 |

44Partnerships and S corporations, enter the smaller of line 36 or line 42. All others, enter the smallest of line 36, line 42, or line 43. Enter here and on the applicable line of Form 8974, Part 1, column (e). Members of controlled groups or businesses under common control, see instructions for the statement

that must be attached |

44 |

|

Form 6765 (Rev. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Credit for Increasing Research Activities |

| OMB Number | 1545-0619 (Rev. December 2020) |

| Attachment Requirement | Must attach to your tax return. |

| Governing Law | Section 41 of the Internal Revenue Code |

| Sections Available | Two sections: Regular Credit and Alternative Simplified Credit. |

| Eligible Expenses | Includes wages, research supplies, and contract research expenses. |

| Percentage Used for Credit | Ranges from 6% to 20%, depending on the section completed. |

| Small Business Provision | Eligible small businesses can elect for a payroll tax credit. |

| Website for Instructions | Visit IRS.gov/Form6765 for updates and instructions. |

Guidelines on Utilizing 6765

After gathering all necessary information, you can now proceed to fill out Form 6765. This form is important for claiming a tax credit related to research activities. The steps below will guide you through the process effectively. Be sure to have your tax return and other relevant documents on hand as you fill out the form.

- Start with Section A if you are claiming the Regular Credit. If not, proceed to Section B for the Alternative Simplified Credit.

- In Section A, fill in your name(s) and identifying number at the top of the form.

- For Line 1, report any amounts paid or incurred to energy consortia.

- On Line 2, include basic research payments made to qualified organizations.

- Enter the qualified organization base period amount on Line 3.

- Subtract Line 3 from Line 2. If the result is zero or less, enter -0- on Line 4.

- Complete Line 5 by entering wages for qualified services. Do not include wages already included in another credit.

- On Line 6, report the cost of supplies used for the research activities.

- For Line 7, list any rental or lease costs for computers, following the line instructions.

- Enter the applicable percentage of contract research expenses on Line 8.

- Add Lines 5 through 8 together to calculate your total qualified research expenses for Line 9.

- Input the fixed-base percentage on Line 10. Ensure it does not exceed 16% (0.16).

- On Line 11, enter your average annual gross receipts as directed by the instructions.

- Multiply the average annual gross receipts from Line 11 by the fixed-base percentage on Line 10 and place the result on Line 12.

- Subtract Line 12 from Line 9. If it’s zero or less, enter -0- on Line 13.

- Fill in Line 14 by multiplying Line 9 by 50% (0.50).

- On Line 15, write the smaller amount from Line 13 or Line 14.

- Sum Lines 1, 4, and 15 to find the total for Line 16.

- Indicate whether you are electing the reduced credit under section 280C on Line 17.

- Follow the instructions to calculate your eligible credit based on your selections for Line 17.

- If completing Section B, repeat similar steps for Lines 18 through 34 as per the instructions provided for the Alternative Simplified Credit.

- Section C outlines how to report the current year credit based on previous entries. Ensure to follow the numbered lines accurately.

- Lastly, if applicable, follow Section D to elect for the qualified small business payroll tax credit, and complete all required lines.

Once you have filled out the form completely, ensure all calculations are correct. Review your entries, and then attach the form to your tax return as required. Maintain copies for your records, as they may be needed for future reference or in case of an audit.

What You Should Know About This Form

What is Form 6765 and why is it important?

Form 6765 is used to claim a tax credit for businesses that increase their research activities. This tax credit, known as the Credit for Increasing Research Activities, offers incentives to companies engaging in research and development. By reducing the tax burden, the form encourages innovation, supports economic growth, and fosters advancement in various industries.

Who should file Form 6765?

Businesses that are involved in qualified research activities may file Form 6765. This includes corporations, partnerships, and sole proprietorships conducting or funding research significant to their field. If a business has spent money on research during the tax year, it likely qualifies. It is essential to evaluate the nature of these expenses to ensure eligibility.

What types of expenses can be claimed on Form 6765?

Eligible expenses include wages for employees engaged in research, costs for supplies used in the research, and payments for contract research services. Additionally, businesses can claim amounts incurred in collaboration with qualified organizations. Expenses relating to energy consortia also qualify for the credit. Each itemized contribution should reflect an investment in research activities to be properly reported.

Are there different sections in Form 6765?

Yes, Form 6765 has three primary sections. Section A is for those seeking the Regular Credit, while Section B is meant for the Alternative Simplified Credit (ASC). Section C deals with the Current Year Credit, where you report the credit derived from various activities. Depending on the type of credit a business chooses, it should skip the section that does not apply.

How do businesses determine which credit to elect?

Businesses may choose between the Regular Credit and the Alternative Simplified Credit based on which option provides a greater benefit. It is wise to calculate the potential credit using both methods to see which one yields a higher amount. A careful review of instructions and possibly consulting a tax professional can aid in making this decision.

What documentation is required to support claims made on Form 6765?

Businesses must maintain adequate records that substantiate their claims for the research credit. This includes receipts for expenses incurred, payroll records demonstrating wages for qualifying activities, and any agreements related to subcontracted research services. Formulaic calculations should be well-documented to support the amounts reported on Form 6765.

Common mistakes

When filling out Form 6765 for the Credit for Increasing Research Activities, individuals often commit errors that may impact their eligibility for the credit. One common mistake is leaving out identifying information. Forms should clearly state the name(s) and identifying number associated with the tax return. This basic but essential information is necessary for processing.

Another frequent error involves incorrectly calculating total qualified research expenses. Applicants may forget to include all relevant items or fail to add the correct lines together, resulting in an inaccurate total. Each category needs careful review to ensure that all applicable expenses are accounted for.

Filing the incorrect section of the form is also a prevalent issue. Section A must be used if choosing the regular credit, while Section B is for those electing the alternative simplified credit. Confusing these sections can lead to significant miscalculations. Users must be clear about which credit they are applying for before beginning the form.

Additionally, misunderstanding the definitions related to qualified services and expenses can result in errors. Individuals should carefully read the instructions regarding wages, supplies, and other costs to ensure they are reporting accurately. Misinterpretations can lead to inflated or reduced claims that may not align with the actual research activities.

Another mistake is failing to report any fixed-base percentage correctly. This percentage should not exceed 16%. If overlooked or miscalculated, the result could substantially alter the final credit amount. Maintaining accuracy in this area is critical.

People sometimes neglect to take advantage of the relevant guidelines provided for electing the reduced credit under Section 280C. There are clear instructions for how to perform this calculation, and failure to follow them can lead to an underclaimed credit.

Documentation is another area where mistakes frequently occur. Applicants often fail to attach required statements or supporting documentation, which may lead to denial of the credit. Each section of the form outlines necessary attachments; adherence to these requirements is essential.

Lastly, individuals may miss the deadline for filing the form. Timely submission is compulsory, as late filings can preclude eligibility for the credit. Keeping track of submission dates helps avoid this crucial mistake.

Documents used along the form

The Form 6765, which is used to claim a credit for increasing research activities, often requires additional documentation to ensure accurate reporting and compliance with tax regulations. Below are some common forms and documents that may accompany Form 6765 when filing your taxes.

- Form 3800: This form is used to report general business credits. Taxpayers must include the total credit calculated on Form 6765 on this form to claim it properly on their tax return. It consolidates various credit claims.

- Form 8932: This form applies specifically to small businesses electing for the payroll tax credit. It helps to determine the portion of the credit attributable to qualified services. Proper completion of Form 8932 is crucial for businesses looking to optimize tax benefits.

- Form 1040: This is the standard individual income tax return form. Taxpayers must attach Form 6765 to their Form 1040 if they are claiming the research credit. It serves as the main document for reporting income and taxes owed.

- Schedule K: This schedule is used by partnerships and S corporations to report income, deductions, and credits. If these entities are involved, the amount calculated on Form 6765 must be reported here as part of their tax return documentation.

Using these additional forms and documents effectively will aid in claiming the credit for increasing research activities, thus maximizing the potential tax benefits available under the law. Careful preparation and conscientious documentation can help avoid unnecessary complications during the filing process.

Similar forms

- Form 1040: This is the standard individual income tax return form. Like Form 6765, it is submitted with a taxpayer's annual tax return and is essential for calculating tax liabilities, including credits and deductions. Both aim to ensure taxpayers accurately report their expenses and qualifications for specific credits.

- Form 1120: The corporate tax return form is used by C corporations to report income and expenses. Similar to Form 6765, it allows corporations to claim credits against their tax liability, including the research credit, thus facilitating detailed financial reporting.

- Form 1065: This is used for partnerships to report income, deductions, gains, and losses. Like Form 6765, it helps allocate tax benefits among partners, particularly concerning credits for research activities.

- Form 8862: If a taxpayer’s eligibility for certain credits is questioned, this form is required to claim the Earned Income Tax Credit (EITC) again. Both forms require documentation to support claims for tax credits, demonstrating the connection to research activities or qualifying criteria.

- Form 8802: This form is necessary to obtain a U.S. residency certification. It parallels Form 6765 in its purpose of certifying eligible entities, specifically for international tax and compliance, underscoring the importance of documentation in claiming credits.

- Form 3800: This general business credit form consolidates various credits, including those reported on Form 6765. Both forms assist taxpayers in reporting and applying for business-related tax benefits effectively.

- Form 8932: This form is for employers claiming a credit for qualified sick and family leave wages. Similar to Form 6765, it enables businesses to take full advantage of available tax credits, boosting overall financial support for active operations.

- Schedule C (Form 1040): Used by sole proprietors to report income and expenses, it contains qualifying deductions that can impact the overall tax situation. Like Form 6765, it helps identify specific financial activities that may lead to beneficial tax outcomes.

Dos and Don'ts

When filling out Form 6765 for the Credit for Increasing Research Activities, it's important to follow certain practices to ensure accuracy and compliance. Here are ten guidelines to consider:

- Do read the instructions provided on the form thoroughly. Understanding the requirements is crucial to proper completion.

- Do keep detailed records of all expenses related to research activities. This documentation is essential for substantiating your claims.

- Do consult a tax professional if you are unsure about any aspect of the form. They can provide valuable insights and assist with complex situations.

- Do ensure that all names and identifying numbers are entered accurately to avoid processing delays.

- Do complete either Section A or Section B, depending on your eligibility. Skipping sections may result in errors.

- Don't use estimates for your qualified research expenses. Accurate figures must be reported to comply with IRS regulations.

- Don't submit the form without double-checking for mistakes or missing information. Errors can lead to delays and potential audits.

- Don't overlook the requirements for attaching any necessary statements or additional documents. These are often critical for processing your credit.

- Don't ignore deadlines for submitting the form. Timeliness is key to receiving your credit.

- Don't hesitate to reach out to the IRS or a qualified tax advisor if you have questions while completing the form. Clarifying uncertainties can save time and reduce errors.

By following these do’s and don'ts, you can improve your chances of successfully claiming the research activities credit. Careful preparation and attention to detail will serve you well in this process.

Misconceptions

Understanding the Form 6765: Credit for Increasing Research Activities is crucial for businesses engaged in research. Despite its benefits, various misconceptions can lead to confusion. Here are some common misunderstandings and clarifications to ensure you're well-informed.

- It’s only for large companies. Many believe that only large corporations can benefit from the research credit. In reality, small and medium-sized businesses can also qualify, provided they meet the necessary criteria.

- Only expenses for new products count. Some think that only costs associated with developing new products are eligible. Eligible activities can include various research and development costs, even those related to improving existing products or processes.

- The credit applies only to wages. While wages are a component, it's a common misconception that they are the only expense. You can also include costs for supplies, contract research, and other qualified expenses.

- You can claim the credit without documentation. Many assume they can claim the credit without comprehensive records. However, proper documentation is essential to substantiate any claims made on Form 6765.

- All R&D efforts are qualified. Not all research activities qualify for the credit. The activities must meet specific IRS requirements related to the purpose and process of the research.

- Only domestic expenses are eligible. There's a belief that expenses must originate from within the U.S. While domestic research qualifies, international expenses may also be eligible if they meet the outlined criteria.

- Once you claim, you're done. Some think that claiming the credit in one year means they can't claim again. The credit can be claimed year after year as long as you continue to invest in qualifying research activities.

- You must file the form with your tax return. Although Form 6765 attaches to the tax return, you might think it’s the only time you can submit it. Amending your return to include the credit is possible if you realize you qualified after the initial filing.

- The amount of the credit is fixed. Many people think the credit amount is set. In reality, the credit can vary year by year based on your research expenses and the method you choose for claiming the credit.

Recognizing these misconceptions can make a significant difference in your ability to utilize the benefits of Form 6765 effectively. Always consult with a qualified professional for personalized guidance tailored to your business needs.

Key takeaways

When filling out Form 6765 for the Credit for Increasing Research Activities, here are some key points to keep in mind:

- Only complete Section A if you are not electing the alternative simplified credit. If you prefer that option, go straight to Section B.

- Make sure to include all qualifying research expenses, such as wages, supplies, rentals, and contract research costs.

- The form requires different calculations based on whether you choose the regular credit or the alternative simplified credit.

- If you’re part of a controlled group, follow the specific instructions for reporting and attaching statements regarding your group's members.

- To claim the reduced credit under section 280C, be careful to calculate the correct percentage based on your election.

- Remember to attach Form 6765 to your tax return. Failure to do so could delay processing or lead to missing out on the credit.

Completing this form accurately can provide significant tax benefits for your research activities.

Browse Other Templates

If There Is No Custody Order in Place Can I Take My Child Ontario - Parties are encouraged to discuss significant issues first before external mediation is involved.

Modelo Canvas - Utilizing the canvas can foster creativity, sparking new ways to address customer needs and market challenges.