Fill Out Your 710A Form

The 710A form plays a critical role in the Home Affordable Modification Program, specifically designed for government monitoring purposes. It collects essential information related to ethnicity, race, and sex to ensure compliance with federal laws that prohibit discrimination in housing practices. While you are not required to provide this information, it is encouraged to promote transparency and accountability within the lending process. Should you choose to participate, you will have the option to specify your ethnicity and race, with the flexibility to select multiple designations if applicable. If you prefer not to disclose this information, a simple checkbox allows you to express your choice. Additionally, lenders or servicers may document this data based on visual observation or surname, particularly when modifications are requested in person. The form also includes sections to be completed by the servicer, capturing vital details such as their name, contact information, and the method through which the request was taken. Understanding the 710A form and its implications can empower you to navigate your loan modification options with confidence and ensure your rights are protected.

710A Example

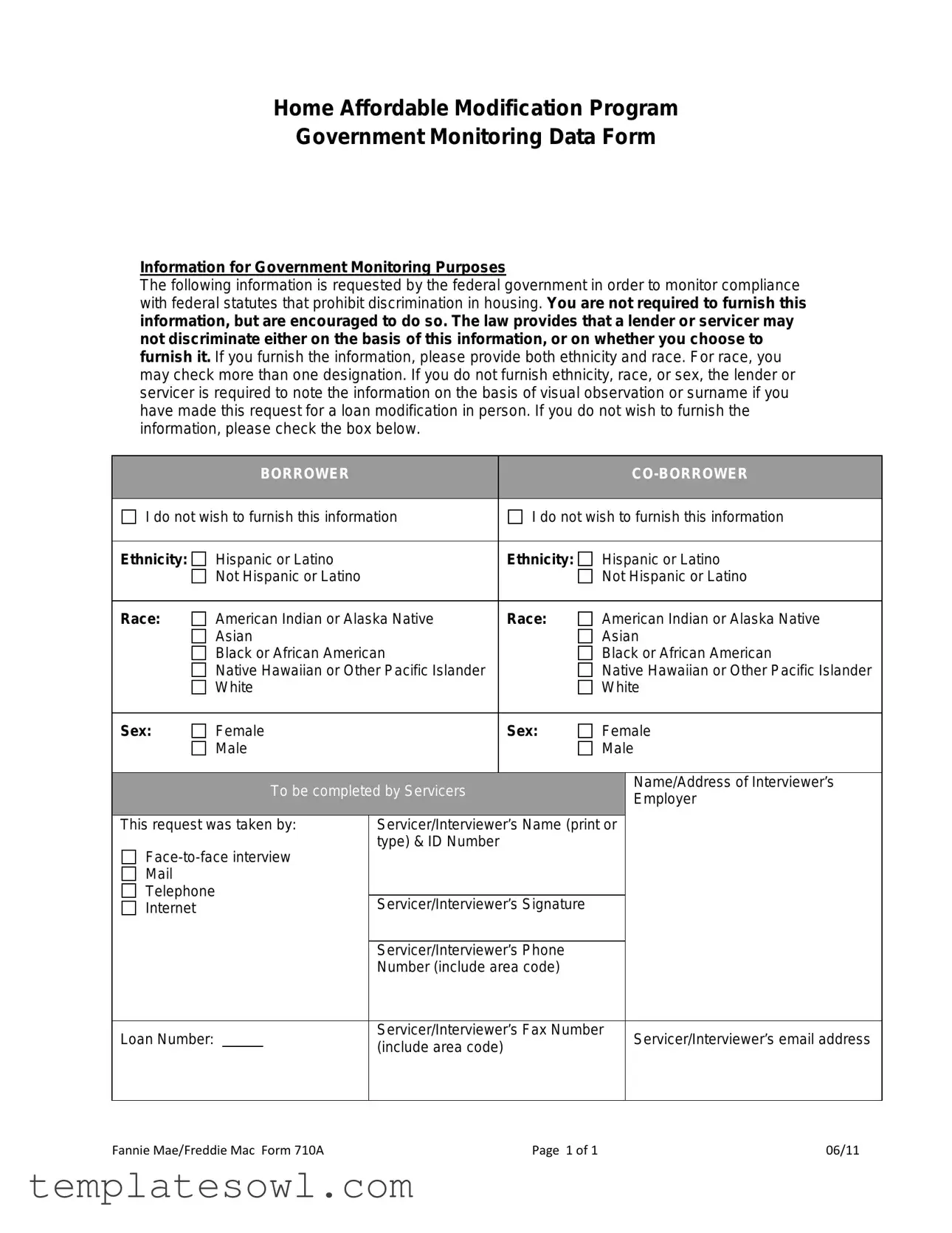

Home Affordable Modification Program

Government Monitoring Data Form

Information for Government Monitoring Purposes

The following information is requested by the federal government in order to monitor compliance with federal statutes that prohibit discrimination in housing. You are not required to furnish this information, but are encouraged to do so. The law provides that a lender or servicer may not discriminate either on the basis of this information, or on whether you choose to furnish it. If you furnish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race, or sex, the lender or servicer is required to note the information on the basis of visual observation or surname if you have made this request for a loan modification in person. If you do not wish to furnish the information, please check the box below.

|

|

BORROWER |

|

|

|

|

||

|

|

|

|

|

|

|

||

I do not wish to furnish this information |

|

I do not wish to furnish this information |

||||||

|

|

|

|

|

|

|

|

|

Ethnicity: |

Hispanic or Latino |

|

|

Ethnicity: |

Hispanic or Latino |

|||

|

Not Hispanic or Latino |

|

|

|

Not Hispanic or Latino |

|||

|

|

|

|

|

|

|

|

|

Race: |

American Indian or Alaska Native |

|

Race: |

American Indian or Alaska Native |

||||

|

Asian |

|

|

|

Asian |

|||

|

Black or African American |

|

|

Black or African American |

||||

|

Native Hawaiian or Other Pacific Islander |

|

|

Native Hawaiian or Other Pacific Islander |

||||

|

White |

|

|

|

White |

|||

|

|

|

|

|

|

|

|

|

Sex: |

Female |

|

|

Sex: |

Female |

|||

|

Male |

|

|

|

Male |

|||

|

|

|

|

|

|

|

|

|

|

|

|

To be completed by Servicers |

|

|

Name/Address of Interviewer’s |

||

|

|

|

|

|

Employer |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

This request was taken by: |

Servicer/Interviewer’s Name (print or |

|

||||||

type) & ID Number |

|

|

|

|||||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|||

Internet |

|

|

|

Servicer/Interviewer’s Signature |

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

Servicer/Interviewer’s Phone |

|

|

||

|

|

|

|

Number (include area code) |

|

|

||

|

|

|

|

|

|

|||

Loan Number: |

|

|

|

Servicer/Interviewer’s Fax Number |

Servicer/Interviewer’s email address |

|||

|

|

|

(include area code) |

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Fannie Mae/Freddie Mac Form 710A |

|

|

Page 1 of 1 |

|

06/11 |

|||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | The 710A form is used for collecting government monitoring data, primarily for compliance with federal housing discrimination laws. |

| Participation | Providing the requested information is encouraged but not mandatory. Individuals can choose not to furnish this information. |

| Discrimination Prohibition | Federal law prohibits lenders and servicers from discriminating based on the information provided on this form. |

| Race and Ethnicity Options | Borrowers can select multiple racial designations and are also requested to specify their ethnicity. |

| Visual Observation | If ethnicity or race is not provided, lenders must note this information based on visual observation or surname. |

| Interview Types | Data can be collected through different methods: face-to-face interviews, mail, telephone, or internet. |

| Servicer Responsibilities | Servicers must complete their section of the form, including their name, signature, and contact information. |

| Submission Requirements | The form should be filled out completely and submitted to the appropriate lender or servicer for processing. |

| Governing Laws | This form is governed by federal statutes related to fair housing and anti-discrimination laws. |

| Use of Data | The collected data is used for monitoring compliance with federal laws, ensuring fair treatment in lending practices. |

Guidelines on Utilizing 710A

Completing the 710A form is an important step for those seeking assistance through the Home Affordable Modification Program. Accurate and thorough completion helps ensure that your information is properly recorded. Follow these steps carefully to fill it out.

- Start by indicating whether you, as Borrower 1, wish to provide your information. If you choose not to share it, check the box next to "do not wish to furnish this information."

- In the section for Ethnicity, choose your ethnicity by selecting either "Hispanic or Latino" or "Not Hispanic or Latino."

- Next, move to the Race section. You may select one or more designations, including: American Indian or Alaska Native, Asian, Black or African American, Native Hawaiian or Other Pacific Islander, and White. Indicate all that apply.

- Proceed to the Sex section. Choose either "Female" or "Male" to identify your sex.

- Now, turn to the Co-Borrower 1 section. Repeat steps 1 through 4 for the co-borrower’s information.

- In the section titled "To be completed by Servicers", enter the name and address of the interviewer’s employer.

- Identify how the request was taken by selecting one of the following: Face-to-face interview, Mail, Telephone, or Internet.

- Fill in the Loan Number, and provide the name, ID number, phone number, and fax number of the servicer/interviewer.

- Lastly, ensure that the servicer/interviewer signs the form and includes their email address for further communication.

What You Should Know About This Form

What is the purpose of the 710A form?

The 710A form is designed to collect government monitoring data as part of the Home Affordable Modification Program. The information gathered is used to ensure compliance with federal laws that prohibit discrimination in housing. By completing this form, borrowers help in monitoring these important compliance efforts.

Do I have to fill out the 710A form?

You are not required to complete the 710A form. However, providing the requested information can assist in efforts to prevent discrimination and promote equal treatment in housing processes. If you choose not to disclose your ethnicity, race, or sex, simply check the specified box indicating your preference.

What happens if I choose not to provide my personal information?

If you decide not to furnish information regarding your ethnicity, race, or sex, the lender or servicer is required to make a note based on visual observation or your surname. Your choice to withhold information will not affect your application for a loan modification.

Can I select more than one race on the form?

Yes, the form allows you to check more than one racial designation. This acknowledges that individuals may identify with multiple racial backgrounds.

What if I don't identify with the provided ethnic or racial categories?

If you do not identify with any of the provided categories, you can still choose not to provide that information. You're encouraged to disclose what you are comfortable with, but remember that any omission is completely acceptable. Select the option for "do not wish to furnish this information."

Who completes the "To be completed by Servicers" section?

This section is completed by the servicer or interviewer who takes your request for a loan modification. They will include their name, contact information, and other relevant details to ensure proper record keeping.

Is this information used for any other purpose?

The information collected on the 710A form is strictly for monitoring purposes. It is essential for ensuring that lenders and servicers comply with anti-discrimination laws. It will not be used to evaluate your creditworthiness or impact your loan modification application.

How do I submit this form?

You will submit the 710A form according to the instructions provided by your lender or servicer. This might involve submitting it via mail, fax, or online, depending on their preferred method of communication.

Are there any consequences for not filling out the form?

There are no penalties or drawbacks for choosing not to fill out the 710A form. Your loan modification application will still be considered, regardless of your participation in this specific data collection effort. It is entirely your choice.

Who can I contact if I have questions about the form?

If you have questions regarding the 710A form or the Home Affordable Modification Program, reach out to your lender or servicer directly. They can provide you with specific guidance and assistance tailored to your situation.

Common mistakes

Filling out the 710A form can be straightforward, but many make common mistakes that can lead to delays or complications. One frequent error is failing to provide complete information. Each section of the form must be filled out accurately, including ethnicity, race, and sex. Omitting these details can result in a processing snag.

Another mistake is misunderstanding the optional nature of the data requested. Some individuals believe that all sections are mandatory, which is not the case. While you're encouraged to furnish your information, the law protects you from discrimination, whether you choose to provide this data or not. It’s important to check the box if you do not wish to furnish certain information to avoid confusion.

Many people also mistakenly choose only one race option when they may identify with multiple ethnicities. The form allows checking more than one designation. This misstep can misrepresent your identity and affect the lender’s compliance data.

Confusion arises around the meaning of ethnicity. Some users simply overlook this distinction, opting for options without fully understanding what they imply. Take the time to read the choices carefully to ensure you select the correct categories that represent your background.

In addition, failing to double-check for typos can lead to processing issues. Typos in names or other personal information can cause delays, especially in matching your request to existing records. Make sure everything is spelled correctly before submission.

Another common oversight involves selecting the wrong method of submission. The form allows for various methods such as mail or phone. If you submit it through the wrong channel, it may not reach the intended recipient promptly, leading to unnecessary delays.

Lastly, not providing required signatures can entirely halt the process. The sections on interviewer details, including name and signature, must be filled out correctly. Without these, lenders may regard the form as incomplete, leading to further complications.

Documents used along the form

The 710A form is an important document used in the Home Affordable Modification Program (HAMP). In addition to this form, there are several other documents that may be required to support a loan modification request. Each document plays a crucial role in providing information and ensuring that the application process runs smoothly.

- Loan Modification Application: This document contains detailed information about the borrower's financial situation and the reasons for requesting a modification. It helps the lender assess eligibility for HAMP.

- Proof of Income: Borrowers need to submit recent pay stubs, tax returns, or bank statements to verify their current income. This information is essential for evaluating the borrower's ability to make modified payments.

- Hardship Letter: A personal letter explaining the circumstances that led to financial difficulties. This letter provides context and helps the lender understand the need for assistance.

- Property Information: Details about the property, including appraisal values or property tax statements, help establish the current value of the home and assist in modification decisions.

- Monthly Expenses Statement: A breakdown of monthly expenses, including bills and living costs. This statement allows the lender to get a comprehensive view of the borrower’s financial situation.

- Authorization to Release Information: Signed by the borrower, this form allows the lender to obtain necessary information from third parties, such as employers or financial institutions.

- Credit Report: A copy of the borrower's credit report may be required to assess creditworthiness and provide a complete picture of financial behavior.

- IRS Form 4506-T: This form authorizes the lender to obtain the borrower's tax return information directly from the IRS, ensuring accurate income verification.

- Servicer's Response: After reviewing all submitted documents, the servicer provides a response outlining any decisions, agreements, or next steps related to the modification request.

Gathering and submitting these documents can greatly enhance the chances of achieving a successful loan modification. Each piece of information supports the borrower’s case and demonstrates the need for assistance during challenging times.

Similar forms

- HMDA (Home Mortgage Disclosure Act) Report - This document collects data about home loans to ensure lenders are following fair lending laws. Like the 710A form, it requires demographic information on borrowers to identify any discrimination patterns in lending practices.

- Loan Estimate Form - Similar to the 710A, this form outlines important loan details and costs for borrowers. It is meant to help individuals understand their loan and compare offers but does not focus on demographic information.

- Uniform Residential Loan Application (URLA) - This is the standard application for residential mortgages. It gathers essential personal, financial, and demographic information to process a mortgage, much like the 710A form.

- Closing Disclosure - This document provides details about the finalized terms of the loan and costs involved. While it differs in purpose from the 710A, both forms are essential in keeping borrowers informed and ensuring compliance with regulations.

- Fair Housing Act Disclosure - Similar in intent to the 710A, this document promotes awareness of housing discrimination laws. It informs potential borrowers about their rights and encourages the reporting of discriminatory practices.

Dos and Don'ts

When filling out the 710A form for the Home Affordable Modification Program, it's crucial to approach the task with care. Here’s a list of things to consider:

- Do provide information requested by the federal government to improve compliance monitoring.

- Do indicate your ethnicity and race if you choose to provide this information.

- Do remember that you may check more than one race designation if applicable.

- Do ensure all personal details are accurately completed to avoid processing delays.

- Don't feel pressured to furnish this information; you have the right to choose.

- Don't modify the form or use correction fluid on mistakes; neatness is important.

- Don't forget to sign and date the form appropriately before submission.

Misconceptions

Many individuals have misconceptions about the 710A form associated with the Home Affordable Modification Program (HAMP). Understanding the truths behind these misconceptions can help borrowers navigate the process more efficiently. Here is a list of ten common misunderstandings:

- It’s mandatory to provide personal information. Many believe they must furnish their ethnicity, race, and sex. However, providing this information is voluntary.

- Refusing to provide this information affects my loan application. Some worry that not providing personal data could jeopardize their application. In reality, lenders cannot discriminate based on these details.

- Only loan applicants from certain backgrounds must fill out the form. This misconception suggests that only specific ethnic groups are affected. In fact, the form is applicable to all applicants.

- Information is shared with unauthorized third parties. There is a fear that personal data will be misused. However, the law protects this information to ensure it is only used for monitoring compliance with fair housing laws.

- Checking the “do not wish to furnish” box causes delays. Some believe this selection will slow down processing. Actually, it should not affect the timeline of the application.

- Poverty status determines whether I need to provide this information. There is a misconception that low-income individuals have fewer obligations. In truth, everyone is entitled to the same rights regarding the form.

- The lender will make assumptions based on visual observation. While lenders may note observations for individuals who choose not to disclose information, this does not establish a basis for discrimination.

- All lenders use the data for promotional purposes. This belief implies that lenders may use personal information for marketing. In fact, the data collected is strictly for government monitoring purposes.

- I can only indicate one racial category. Many think they must select just one race on the form. However, it is permissible to identify with multiple racial categories.

- The form is only relevant in certain states. Some assume the form is specific to particular regions. Yet, this form is utilized nationwide for compliance with federal regulations.

Having accurate information can empower individuals as they navigate the loan modification process, ensuring that they understand their rights and obligations regarding the 710A form.

Key takeaways

When filling out the 710A form for the Home Affordable Modification Program (HAMP), it is essential to understand its purpose and the implications of the information provided.

- Compliance Oversight: The form collects data to help federal entities monitor compliance with laws that prevent housing discrimination. It supports efforts to ensure fair treatment in lending practices.

- Voluntary Information: You are encouraged, but not required, to provide information regarding your ethnicity, race, and sex. Its collection is optional, and your choice will not affect your loan modification eligibility.

- Multiple Responses Allowed: For race identification, you can select more than one category. This flexibility acknowledges the complexity of racial identity and ensures accurate representation.

- Observation Method: If you choose not to provide certain demographic information, the lender or servicer must note it based on visual observation or your surname if you request an in-person modification.

It is vital to approach the form with care, ensuring that your responses reflect your preferences and understanding of the program's requirements.

Browse Other Templates

Uhc Predetermination Form - The form serves as a legal declaration between the purchaser and seller regarding tax-exempt transactions.

Ched-unifast Online Scholarship Application Portal - Key focus areas in the evaluation include academic background and family income.