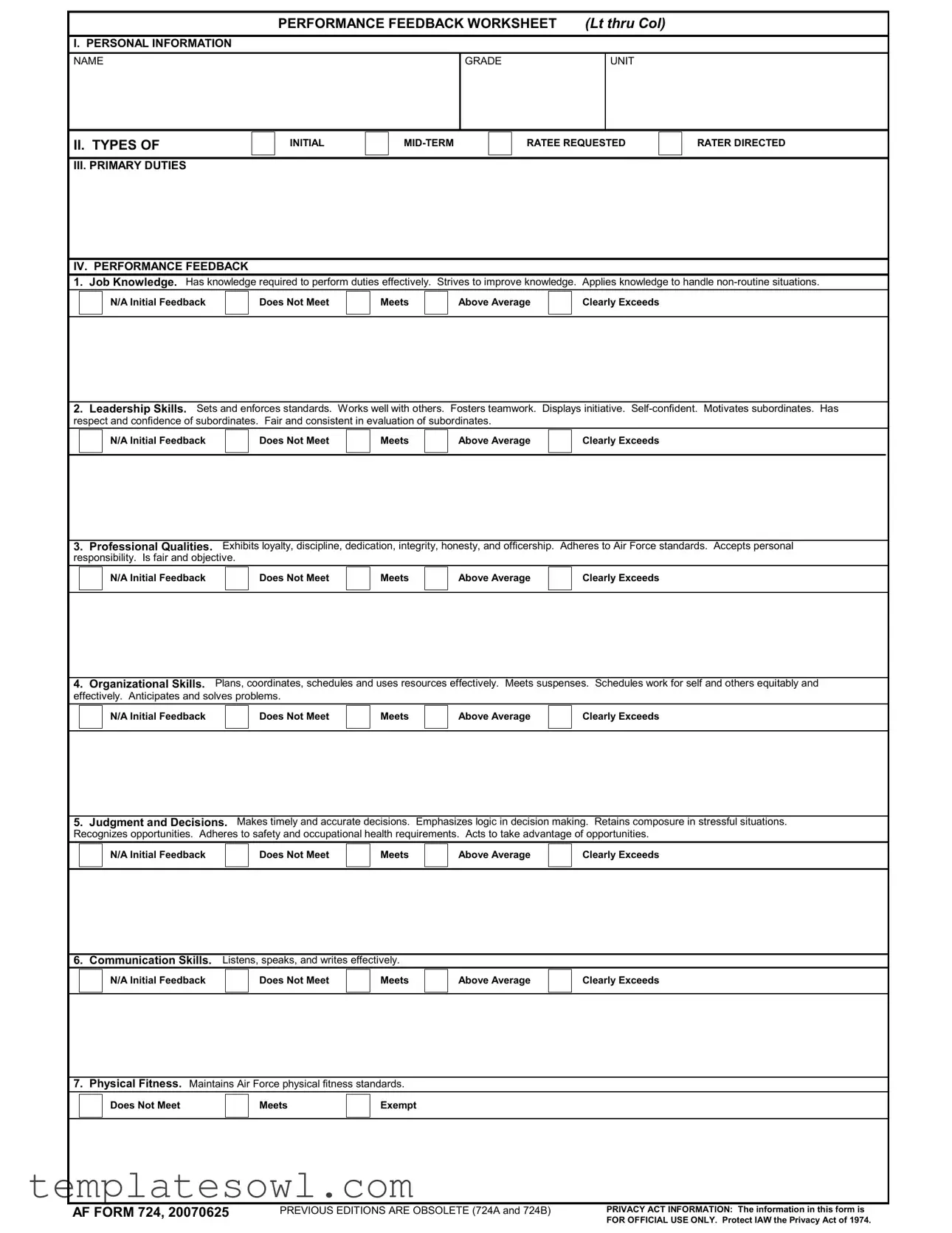

Fill Out Your 724 Form

The 724 form plays a crucial role in various administrative and compliance processes within different sectors. This form is often utilized to gather essential information that supports organizational needs or individual requests. It includes important identification fields, specific data sections, and a structure that ensures clarity and thoroughness. Typically, the 724 form may require an applicant to provide various types of information, such as personal details or specifics about a particular request or circumstance. Ensuring accurate completion of this form is vital, as it can impact the processing time and outcomes for the related request. The layout of the form is designed to facilitate ease of understanding and completion, helping individuals navigate the requirements without unnecessary confusion. Additionally, the submission of the 724 form can trigger important administrative processes, such as approvals or notifications, which are essential for timely resolution. Understanding its importance and how to effectively complete it can empower individuals and organizations alike in achieving their goals.

724 Example

0

' |

|

|

* |

|

() |

|

||

|

|

|

|

|

|

|

|

|

')

9+7.

11

7133,8

,6+

!

9+7.

11

7133,8

,6+

<,101(= 3.444144

..5+

9+7.

11

7133,8

,6+

",8>1.

++.*

9+7.

11

7133,8

,6+

&:=+82+1

9+7.

11

7133,8

,6+

%122=1. !4(4)+

9+7.

11

7133,8

,6+

11

!"#!$$$%!& |

!"#$%#$% & |

'/01,2101,2 |

|

) ',1,31045" |

|||

|

|

0/

000!

778!7

" 4478877&

980" !!44:474&

'

!!"##$%& !'(

..+ %+ ++*/% 0$%& 1$23 *+ %*%+*

4(

$$($)*+ %,&--*(

0

0

!"#!$$$%!& |

!"#$%#$% & |

'/01,2101,2 |

|

) ',1,31045" |

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Number | The form is identified as 724. |

| Purpose | This form is used for specific reporting requirements in various jurisdictions. |

| Governing Law | The applicable governing law varies by state; refer to local regulations for details. |

| Filing Frequency | Submissions of this form may be required on an annual or quarterly basis depending on the state's laws. |

| Signature Requirement | A signature of the authorized person is typically required to validate the submission. |

| Confidentiality | Some information submitted on this form may be protected under state confidentiality laws. |

| Common Errors | Common mistakes include incorrect calculations and missing signatures. |

| Submission Method | This form can often be submitted electronically or through traditional mail, depending on state guidelines. |

| Review Process | Once submitted, the form typically undergoes a review process by the relevant state agency. |

| Record Keeping | It is advisable to keep copies of the submitted form for at least five years for auditing purposes. |

Guidelines on Utilizing 724

Once you've gathered all the necessary information and documents, follow these steps to accurately complete the 724 form. Being thorough will help ensure your application is processed smoothly.

- Begin by downloading the 724 form from the official website. Ensure you are using the most current version of the form.

- Open the form and locate the section labeled "Applicant Information." Fill in your full name, address, and contact details.

- Next, move to the "Purpose of Application" section. Clearly state why you are submitting this form.

- In the "Details of Application" section, provide any further information needed to support your application. Be as detailed as possible.

- Check for any additional required documents that must accompany the form. Ensure you gather and include them with your submission.

- Review the form thoroughly. Look for any missing fields or errors in the information provided.

- Once everything is complete, sign and date the form in the designated area.

- Make a copy of the completed form and all supporting documents for your records before submitting.

- Finally, submit your application according to the instructions provided, making sure to choose a reliable method to ensure timely delivery.

Following these steps carefully will help you fill out the 724 form correctly, improving your chances of a quick and successful application process.

What You Should Know About This Form

What is the 724 form?

The 724 form is a specific type of document used for reporting purposes in various administrative and regulatory settings. It serves to gather essential information efficiently. Understanding the purpose of this form can help individuals or organizations fulfill their reporting obligations accurately.

Who needs to fill out the 724 form?

Typically, entities that are required to provide specific information to government agencies or regulatory bodies will need to fill out the 724 form. This could include businesses, nonprofit organizations, or individuals who engage in activities that necessitate reporting. Ensure that you check the requirements pertinent to your situation.

How do I obtain a 724 form?

You can often find the 724 form on the relevant agency’s website. Many regulatory bodies provide downloadable versions of their forms. Alternatively, it may be possible to request the form directly from the agency if you cannot find it online.

What information is typically required on the 724 form?

The information required on the 724 form can vary based on its intended use. Generally, it may ask for identification details, relevant dates, and descriptions of activities being reported. Always review the instructions carefully to ensure all necessary details are included.

Is there a deadline for submitting the 724 form?

Yes, there is often a deadline for submitting the 724 form. The specific date may depend on the reporting period and the requirements set by the relevant agency. It is crucial to stay informed about these deadlines to avoid any potential penalties or complications.

What should I do if I make a mistake on the 724 form?

If an error is identified after submission, you should check the guidelines provided by the relevant agency. Many agencies allow for corrections or amendments to be made, but the process can vary. It might be necessary to submit a revised form or provide a written explanation of the correction.

Are there any fees associated with submitting the 724 form?

In most cases, there are no fees for completing and submitting the 724 form. However, it is advised to confirm with the relevant agency, as some submissions may carry associated costs in specific circumstances.

Can the 724 form be submitted electronically?

Many agencies have transitioned to accepting forms electronically, including the 724 form. This can facilitate quicker processing and improve efficiency. However, this option may not be available for all agencies or situations, so verifying the submission method is advisable.

What happens after I submit the 724 form?

After submission, the agency will review the 724 form. Depending on the type of report or the agency’s processes, you may receive confirmation of receipt. If further information is needed, someone from the agency will typically reach out to you for clarification.

Where can I find help if I have questions about the 724 form?

If you have questions about the 724 form, the best place to seek help is the agency that requires the form. They often have resources available, such as customer service lines or FAQs. Additionally, professional assistance from qualified individuals may also be beneficial.

Common mistakes

When filling out the 724 form, many individuals encounter common pitfalls that can lead to complications or even delays in processing. Awareness of these mistakes can make the experience smoother and less stressful. Here are nine prevalent missteps made during this process.

First, a frequent issue is the omission of required information. Often, people either skip sections unintentionally or do not realize that certain entries are mandatory. This can result in incomplete applications and necessitate unnecessary follow-ups. Always double-check to ensure every relevant field is filled out accurately.

Another mistake involves incorrect personal details. Simple typos, such as misspellings of names or incorrect addresses, can cause significant issues. These inaccuracies may lead to miscommunications or delays in processing. It's crucial to verify that every detail is entered correctly before submission.

Some individuals also fail to read the instructions thoroughly. Each form typically comes with specific guidelines on how to fill it out. Ignoring these can lead to errors that, while simple, could have easily been avoided. Taking a moment to read these instructions can save a lot of time in the long run.

Using inappropriate signatures is another common error. Forms often require a specific type of signature or may need individuals to sign in a particular area. Not adhering to these requirements can lead to rejected submissions. Ensure that you sign in the correct location and in the correct format.

Additionally, many people underestimate the necessity of double-checking their work. After completion, it’s advisable to review everything once more for any possible mistakes or omissions. This final check can catch errors before the form is sent out.

A lack of attention to deadlines can also cause problems. Individuals sometimes miss critical submission dates, leading to unnecessary delays or complications. Marking deadlines clearly on a calendar and setting reminders can help prevent this oversight.

People frequently forget to keep copies of their submitted forms. It is important to have a record for reference in case any questions arise or if there is a need to verify what was submitted. Keeping a file with a copy of all documents can save headaches later.

Another mistake often observed is incorrect payment methods. Some forms require processing fees or other payments to be made in specific ways. Not adhering to these guidelines can lead to rejected forms due to unpaid fees. Always check the payment instructions ahead of time.

Lastly, many individuals do not contact support services for help when they encounter difficulties. There may be resources available to clarify questions or assist with filling out the form. Utilizing these resources can significantly ease the process.

Avoiding these common mistakes can lead to a more efficient experience when dealing with the 724 form. Taking the time to carefully review and complete each section can make a significant difference.

Documents used along the form

The 724 form serves an essential function in various legal processes, particularly in the context of real estate and contract law. However, it is often accompanied by several other forms and documents that support or complement its purpose. This collection of related documents helps streamline the administrative requirements and ensure that all legalities are adequately addressed. Below is a list of some of these essential forms.

- Warranty Deed: This document transfers ownership of property from one party to another, guaranteeing that the seller has clear title to the property being sold. It provides protection to the buyer against future claims on the property.

- Quitclaim Deed: Unlike a warranty deed, a quitclaim deed transfers whatever interest the seller has in the property, without any guarantees. It is often used in situations like divorce or to clear up title issues.

- Affidavit of Title: This sworn statement by the property owner affirms their ownership and declares that there are no pending claims against the property. It serves as a reassurance for potential buyers or lenders.

- Title Search Report: This document outlines the history of ownership, liens, and encumbrances on a property. It acts as an essential tool in confirming that the title is clear before a transaction.

- Closing Statement: During the closing process, this document details all financial transactions involved in the sale, including costs associated with the property and the adjustments made between the buyer and seller.

- Promissory Note: This written promise outlines the borrower's commitment to repay a loan. In real estate transactions, it typically accompanies a mortgage and specifies the loan amount, interest rate, and repayment terms.

- Mortgage Agreement: This document secures the loan by placing a lien on the property. It specifies the terms under which the lender can take possession of the property if the borrower defaults.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the community rules and regulations, as well as any fees associated with membership. They are critical for ensuring compliance with local standards.

- Disclosure Statements: Sellers are often required to provide disclosures about the property's condition and any known issues. This transparency helps protect buyers and can affect their decision to proceed with a purchase.

These documents collectively enhance the reliability of real estate transactions and ensure compliance with legal requirements. Understanding the role of each form can significantly benefit individuals navigating the complexities of property ownership and conveyancing. Each serves its purpose, fostering clarity and security in property deals.

Similar forms

-

The I-9 Form is used for verifying employment eligibility in the U.S. Similar to the 724 form, it requires specific information about the individual, including personal data and documentation of work authorization.

-

The W-4 Form assists employees in determining their tax withholding. Like the 724 form, it contains fields for personal information and requires accuracy to avoid problems later.

-

The Form 1040 is the individual income tax return. Similar to the 724 form, it collects detailed financial information needed for accurate reporting and processing.

-

The Form SS-4 is used to apply for an Employer Identification Number (EIN). It parallels the 724 form in needing essential details about the business entity, such as ownership structure and reason for applying.

-

The Form 941 reports payroll taxes. Like the 724 form, it requires comprehensive data on employee wages and the taxes withheld.

-

The Form 1099 details various types of income outside of regular employment, similar to the 724 form as they both require reporting of specific financial facts.

-

The Form K-1 is issued for tax purposes, specifically for partnerships and S-corporations. Much like the 724 form, it provides information about income distribution to partners or shareholders.

-

The Form 1065 is the tax return for partnerships. It is similar to the 724 form as it documents financial performance and requires accurate financial disclosures.

-

The Form 990 is filed by tax-exempt organizations. Like the 724 form, it demands detailed information about finances, governance, and activities to ensure compliance with regulations.

Dos and Don'ts

Here are six important tips regarding the completion of the 724 form. Proper attention to these details can help ensure a smooth process.

- Do read the form carefully before starting. Understanding all sections will minimize errors.

- Don't leave any mandatory fields blank. Each required section must be filled out appropriately.

- Do use clear and legible handwriting or type your responses when possible. This prevents misinterpretation of your information.

- Don't provide incomplete or vague answers. Precision is key in avoiding delays.

- Do double-check any calculations or totals. Errors can lead to complications in the processing of the form.

- Don't forget to sign and date the form where indicated. Missing signatures can invalidate your submission.

Misconceptions

Misconception 1: The 724 form is only for tax purposes.

Many believe this form is only used during tax season. In reality, the 724 form serves various purposes, including applications for benefits and reporting certain transactions, not just taxes.

Misconception 2: Filling out the 724 form is unnecessary if I don’t owe anything.

Even if you do not owe taxes, submitting this form can help prevent issues down the line. Proper documentation is important for your records and to satisfy legal requirements.

Misconception 3: I can submit the 724 form anytime.

There are specific deadlines associated with this form. Failing to submit it on time can result in penalties or complications. Be aware of these deadlines to ensure compliance.

Misconception 4: The process of completing the 724 form is straightforward for everyone.

While some might find it simple, others could face challenges. It's not uncommon for individuals to find sections confusing. If you're having trouble, consider seeking assistance.

Misconception 5: Once I submit the 724 form, I can forget about it.

After submission, it’s crucial to keep copies and follow up on the status. Monitoring its acceptance ensures you remain informed about any actions needed on your part.

Misconception 6: I don’t need to keep records related to the 724 form.

It's vital to retain all documentation related to this form. These records can help clarify any discrepancies and serve as proof if questions arise in the future.

Misconception 7: Only financial experts can correctly fill out the 724 form.

While it may help to have financial knowledge, most individuals can complete this form with careful attention to detail. There are resources available to guide you through the process.

Misconception 8: The 724 form does not have any impact on my financial future.

This form can influence various aspects of your financial life. It may affect things like loan applications and government benefits. Therefore, understanding its importance is essential.

Key takeaways

When it comes to filling out and using the 724 form, here are some important points to keep in mind:

- Understand the Purpose: The 724 form serves a specific function. Familiarize yourself with its intended use before diving into the details.

- Complete All Sections: Make sure to fill out every section of the form. Incomplete forms can lead to delays or rejections.

- Double-Check Information: Verify all the information you provide. Simple mistakes can cause big issues later on.

- Gather Required Documentation: Some sections may require supporting documents. Collect everything beforehand to streamline the process.

- Seek Guidance If Needed: If you’re unsure about any part of the form, don’t hesitate to seek help. Whether it’s a friend or a professional, getting advice can make a difference.

- Keep Copies: Always make copies of your completed form. It’s useful for your records and can help if questions arise.

- Follow Submission Instructions: Review the submission guidelines carefully. Different forms may have different protocols.

- Stay Patient: After submitting the form, it could take some time to hear back. Patience is key during this waiting period.

By keeping these takeaways in mind, you can navigate the process of using the 724 form more effectively.

Browse Other Templates

Michigan Tax Return Form - The form must not replace monthly or quarterly returns.

Can You Collect Unemployment With Severance - Employers must list the number of workers included in the report as a part of compliance.