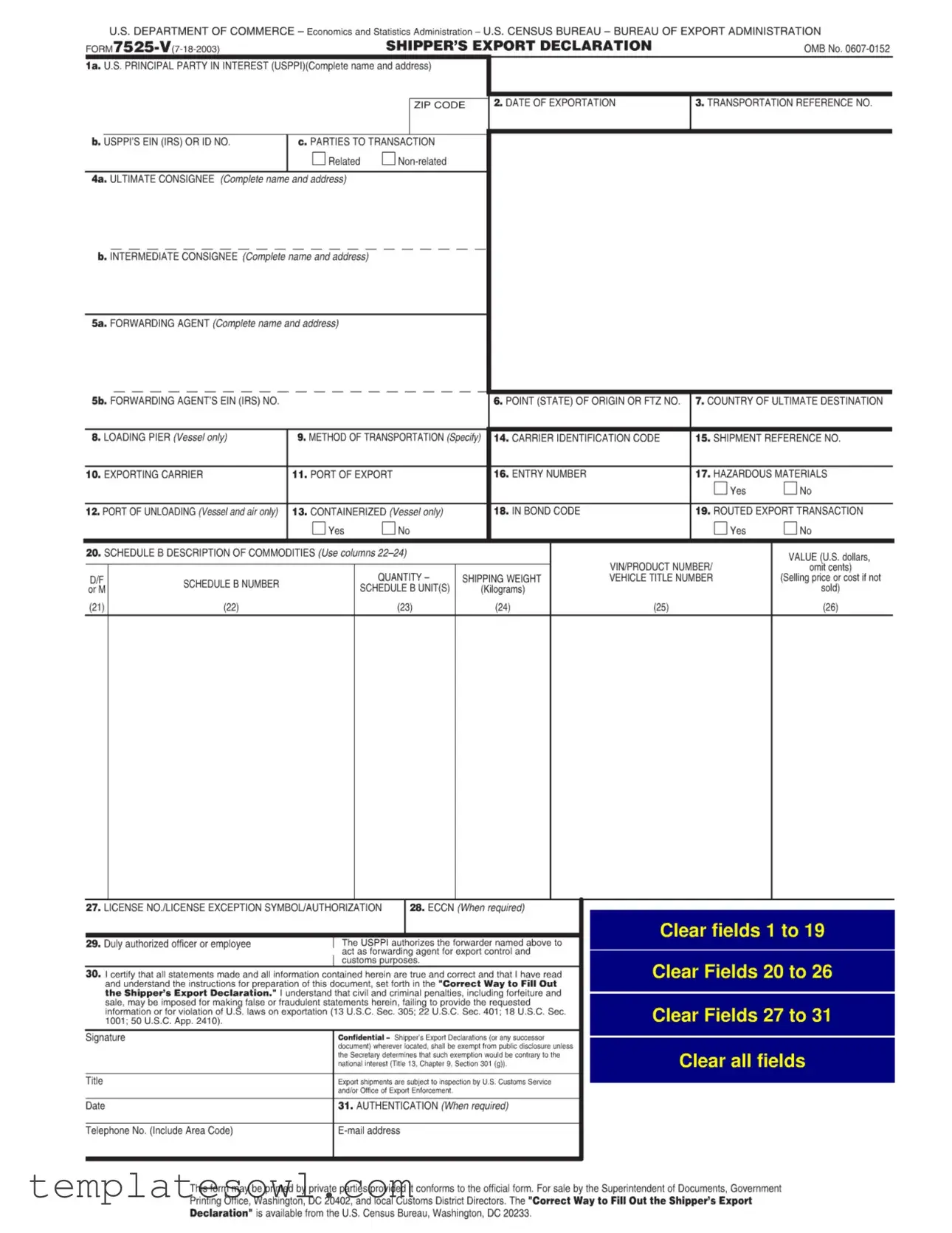

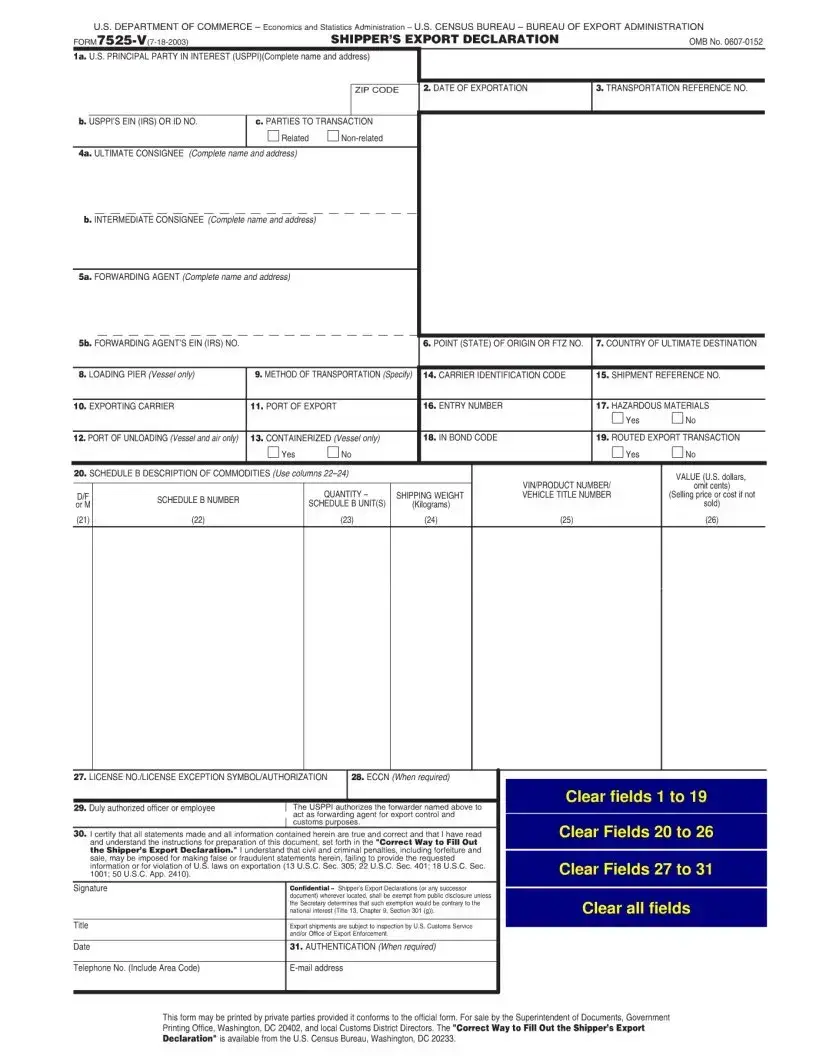

Fill Out Your 7525 V Form

The 7525 V form, also known as the Shipper's Export Declaration, plays a critical role in international trade by providing essential information required by U.S. authorities regarding exported goods. This form captures a variety of key details, including the identity of the U.S. Principal Party in Interest (USPPI), the ultimate consignee, and any forwarding agents involved in the transaction. It serves not just as a declaration of export but also ensures compliance with U.S. laws, including export control regulations. Specific fields on the form request information about the export date, transportation details, port of export, method of transportation, and even whether the shipment includes hazardous materials. Additionally, the form requires a description of the commodities being exported, along with their value and quantity. It is crucial for businesses engaged in exporting to understand these requirements and ensure that the form is completed accurately, as any inaccuracies could lead to significant penalties. For companies navigating the complexities of international shipping, understanding the nuances of the 7525 V form will facilitate a smoother export process while adhering to legal standards.

7525 V Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The 7525 V form serves as the Shipper's Export Declaration, necessary for documenting the exportation of goods from the United States. |

| Governing Laws | This form is governed by Title 13 U.S.C. Sec. 305, 22 U.S.C. Sec. 401, and 18 U.S.C. Sec. 1001, which establish requirements for export declarations and related penalties for inaccuracies. |

| Confidentiality | Information provided on the form is considered confidential and exempt from public disclosure unless deemed contrary to national interest by the Secretary (Title 13, Chapter 9, Section 301(g)). |

| Filing Requirements | Exporters must ensure all information is accurate and complete. Incorrect or incomplete filings can result in civil and criminal penalties, including forfeiture. |

Guidelines on Utilizing 7525 V

Completing the 7525 V form is an essential step in ensuring that your export transactions are properly documented. This form collects vital information about the shipment and its parties involved. Below are the detailed steps to successfully fill out the form.

- Section 1a: Enter the name and complete address of the U.S. Principal Party in Interest (USPPI), including ZIP code.

- Section 1b: Provide the USPPI's Employer Identification Number (EIN) or another identification number.

- Section 1c: Indicate if the parties to the transaction are related or non-related.

- Section 2: Fill in the date of exportation.

- Section 3: Include the transportation reference number.

- Section 4a: Enter the complete name and address of the ultimate consignee.

- Section 4b: Provide the name and address of the intermediate consignee, if applicable.

- Section 5a: Fill in the name and address of the forwarding agent.

- Section 5b: Enter the forwarding agent’s EIN.

- Section 6: Specify the point of origin (state) or Foreign Trade Zone (FTZ) number.

- Section 7: Describe the country of ultimate destination.

- Section 8: If applicable, indicate the loading pier (for vessel shipments only).

- Section 9: Specify the method of transportation.

- Section 10: Enter the exporting carrier's name.

- Section 11: Provide the port of export information.

- Section 12: Include the port of unloading for vessel and air transport, if applicable.

- Section 13: Indicate whether the shipment is containerized (for vessels only).

- Section 14: Enter the carrier identification code.

- Section 15: Provide a reference number for the shipment.

- Section 16: Fill out any entry number if applicable.

- Section 17: State whether hazardous materials are being shipped (Yes or No).

- Section 18: Include the in-bond code if applicable.

- Section 19: If applicable, answer whether this is a routed export transaction (Yes or No).

- Section 20: Describe the commodities using the Schedule B format and include the following:

- Value in U.S. dollars (omit cents)

- Schedule B number

- Quantity

- Schedule B units

- Shipping weight in kilograms

- Vehicle title number (if applicable)

- Section 27: Provide any license number, license exception symbol, or authorization as required.

- Section 28: Include the Export Control Classification Number (ECCN) if required.

- Section 29: Have a duly authorized officer or employee sign and date the form, certifying the information is accurate.

- Section 30: Include the signature of the certifying individual along with their contact information (phone number and email address).

After completing these steps, review all the information to ensure accuracy. If any corrections are necessary, make them before finalizing the form. Submitting the document is key to complying with export regulations, ensuring a smooth and legal export process.

What You Should Know About This Form

What is the purpose of the 7525 V form?

The 7525 V form, also known as the Shipper’s Export Declaration, is utilized primarily to facilitate the exportation of goods from the United States. It provides essential information about the shipment, including details about the parties involved, the nature of the goods, and their final destination. This form supports compliance with U.S. export laws and regulations while assisting in the management of export control and statistical data collection.

Who is required to submit the 7525 V form?

Any U.S. principal party in interest (USPPI)—typically the party that receives the proceeds from the sale of the goods—is required to file this form when exporting goods valued at more than $2,500. Additionally, exporters may need to file it in specific situations involving export licenses or restricted goods, regardless of value. This includes shipments of hazardous materials and those categorized as routed export transactions.

What information is needed to complete the 7525 V form?

The form requires a variety of information, including the names and addresses of the USPPI, ultimate consignee, and any forwarding agents. You will need to indicate the date of exportation, transportation reference number, and the method of transportation. Additionally, details about the shipment, such as the country of ultimate destination, commodity descriptions, and any applicable license numbers, must be provided. Accurate representation of this data is vital to ensure compliance with regulations.

Is there a specific format for filling out the form?

Yes, adherence to the official format is important. The 7525 V form can be printed by private parties, but it must conform to the specifications established by the U.S. Census Bureau. This includes using the correct dimensions, font sizes, and layout as required by regulations. The "Correct Way to Fill Out the Shipper’s Export Declaration" guide can be consulted for additional details on the proper formatting and required information.

What are the consequences of failing to file the 7525 V form accurately?

Failure to provide accurate information or to file the 7525 V form when required can result in serious penalties. These may include civil and criminal charges such as forfeitures and fines. Furthermore, the export shipment may be subjected to delays or holds until compliance is achieved, potentially impacting business relations and logistics. It’s essential to ensure accuracy to avoid these complications.

Can I authorize a forwarding agent to submit the 7525 V form on my behalf?

Yes, as the USPPI, you may authorize a forwarding agent to act on your behalf for exportational purposes. This authorization must be indicated on the 7525 V form. By doing so, you enable the agent to handle the necessary filings and manage compliance with applicable export laws, streamlining the process for all parties involved.

What should I do if my shipment includes hazardous materials?

When shipping hazardous materials, it is crucial to accurately indicate this on the 7525 V form. You must select "Yes" for the hazardous materials question on the form to comply with additional regulatory requirements. This may include providing further documentation relating to the nature of the materials, ensuring that proper safety measures and regulations governing the transport of such goods are followed.

How is the information on the 7525 V form used after submission?

Once submitted, the information collected through the 7525 V form serves multiple purposes. Primarily, it supports U.S. Customs and border security in monitoring and enforcing export laws. Additionally, the data aids the U.S. Census Bureau in compiling trade statistics, which are essential for economic analysis and policy-making. The thorough documentation also assists in the identification of compliance issues or trends within export activities.

Where can I obtain the official 7525 V form?

The official 7525 V form can be obtained from the U.S. Census Bureau or through authorized government agencies. It is also available for purchase from the Superintendent of Documents, Government Printing Office, located in Washington, DC. Ensure that you are using the most current version of the form to comply with any updates in export regulations.

Common mistakes

When filling out the 7525 V form, attention to detail is crucial. One common mistake is providing incomplete or incorrect information for the U.S. Principal Party in Interest (USPPI). This section must include the complete name and address, but often individuals forget essential elements such as the ZIP code or the Employer Identification Number (EIN). Neglecting any part of this information can lead to unnecessary delays.

Another frequent error occurs in the section regarding the date of export. Some people either forget to enter a date or enter a date that is not consistent with the actual export activity. Inaccurate dating can raise red flags with customs officials and complicate the export process.

Similarly, the Ultimate Consignee and Intermediate Consignee sections must be filled out with complete addresses. Failing to provide comprehensive details, like the city or country, creates problems later on. Clarity and precision in these entries help ensure smooth transitions through customs.

One more issue arises with the Schedule B Description of Commodities. This section often gets overlooked or filled out improperly. It’s vital to include accurate descriptions along with the respective Schedule B numbers. A mismatch or vagueness can lead to questions from customs, which could slow down the processing of the shipment.

People also make mistakes when entering the Value of the goods. Omitting cents or miscalculating the total can result in financial discrepancies and potential regulatory scrutiny. It is essential to provide an exact amount to avoid these complications.

Another point of confusion is regarding the Exporting Carrier. This is often left blank or incorrectly filled out. If the exporting carrier is not accurately represented, shipment tracking and other logistics can become problematic.

The Method of Transportation is another area where errors frequently occur. It's important to specify the transport method clearly, whether it’s air, land, or sea. Confusion here can lead to misclassification of the shipment, which might cause further delays.

In sections dealing with Hazardous Materials, some individuals either misidentify materials or fail to answer the question entirely. Properly marking hazardous goods is not just a requirement but also a critical safety measure.

Another mistake often made is related to not having the required signatures in the designated section. A missing signature from an authorized officer can render the form invalid, delaying the export process and causing frustration.

Lastly, individuals sometimes forget to double-check their entries against the original shipping documents. Failing to ensure that all information matches can lead to discrepancies. Therefore, reviewing the entire form before submission is a vital step that shouldn't be skipped.

Documents used along the form

When dealing with international shipping and exports, several forms and documents may be required alongside the 7525 V form, also known as the Shipper's Export Declaration (SED). This list includes essential documents used in the export process, ensuring compliance with regulations and smooth transactions.

- Commercial Invoice: This document provides a detailed description of the goods being exported, their value, and the terms of sale. It is often required by customs to assess duties and taxes.

- Bill of Lading: A legal document issued by a carrier, confirming receipt of goods for shipment. It serves as a contract and can be used to transfer ownership of the goods during transit.

- Export License: Required for certain restricted items, this government-issued authorization ensures that the export complies with U.S. laws and international agreements.

- Certificate of Origin: This document certifies the country in which the goods were manufactured. It may be necessary for determining tariff rates and ensuring compliance with trade agreements.

- Insurance Certificate: Proof of insurance coverage for the exported goods, this document protects the shipper against loss or damage during transit.

- Packing List: A detailed inventory of the shipments, including dimensions and weight of packages. This document aids customs officials in verifying the shipment contents.

- Trademark Registration: If applicable, this document proves that the product bears a trademark owned by the exporter, which might be necessary for intellectual property protection in foreign markets.

Understanding and preparing these documents can help streamline the export process. Each document has a specific purpose and contributes to legal compliance, ensuring that goods reach their intended destination without unnecessary delays. Careful attention to these details can support successful international trade practices.

Similar forms

- Shipper’s Export Declaration (SED): The SED, like the 7525 V form, is used to provide the government with crucial information about exports. Both documents include details such as the shipper's information and the ultimate consignee, facilitating the monitoring of exports for compliance with U.S. trade laws.

- Commercial Invoice: A commercial invoice serves as a bill for the goods being sold, detailing the transaction between the seller and buyer. Similar to the 7525 V form, it outlines essential information such as the value of the goods and shipping details. Both documents work together to ensure accurate customs processing and valuation of goods for export.

- Bill of Lading: This document acts as a contract between a shipper and carrier, outlining the agreed-upon shipping terms. Like the 7525 V form, it contains information on the parties involved, the goods being transported, and the destination. This ensures that all parties are aware of their responsibilities and the goods' routing.

- Export License: An export license is a government-issued authorization to export specific items. While the 7525 V form primarily reports exports, the export license regulates the items that can be exported. Both documents ensure compliance with international trade laws, helping to prevent the export of restricted or controlled goods.

Dos and Don'ts

When filling out the 7525 V form, following certain guidelines can help ensure accuracy and compliance. Here are seven important do's and don'ts:

- Do provide complete and accurate information for the U.S. Principal Party in Interest (USPPI), including name, address, and ZIP code.

- Don't leave any mandatory fields blank. Missing information can delay processing.

- Do check that all names and addresses are spelled correctly to avoid confusion later.

- Don't misrepresent the value or quantity of goods; ensure that figures are truthful and precise.

- Do include the correct ECCN (Export Control Classification Number) when required, as this is crucial for compliance.

- Don't forget to sign the form. An unsigned document may be considered invalid.

- Do read the "Correct Way to Fill Out the Shipper’s Export Declaration" instructions thoroughly before submission.

Misconceptions

Misconceptions can lead to confusion when dealing with the 7525 V form. Here are eight common misunderstandings about this important document.

- Misconception 1: The 7525 V form is only for large companies.

- Misconception 2: The form is optional.

- Misconception 3: Only the shipper needs to fill out the form.

- Misconception 4: You don't need to report hazardous materials if they're under a certain weight.

- Misconception 5: The form can be filled out after the shipment leaves.

- Misconception 6: The form is the same as a customs declaration.

- Misconception 7: Completing the form is straightforward, with no potential for errors.

- Misconception 8: You can submit the form electronically without verification.

This is incorrect. Any exporter, regardless of size, must complete this form for certain shipments.

It is mandatory for specific exports. Failing to file it can result in penalties.

Multiple parties, including the ultimate consignee and forwarding agents, may be involved in completing the details.

All hazardous materials must be declared, regardless of weight. This is crucial for safety regulations.

You must complete the 7525 V form before exportation occurs.

While both are important, they serve different purposes and require different information.

Even minor mistakes can lead to major complications, including fines.

Always review the information carefully before submission to avoid issues.

Understanding these misconceptions about the 7525 V form can help ensure compliance and facilitate smoother export processes.

Key takeaways

Here are important points to consider when filling out and using the 7525 V form:

- Complete Information: Ensure all required fields, such as the name and address of the U.S. Principal Party in Interest (USPPI), are filled in accurately.

- Export Date: Clearly indicate the date of exportation to avoid processing delays.

- Method of Transportation: Specify the method of transportation used for the shipment, as this information is crucial for customs procedures.

- Hazardous Materials: Check the appropriate box for hazardous materials if applicable, as different rules apply to such shipments.

- Certification: The signer must certify the accuracy of the information provided, which reinforces accountability.

- Filing Requirements: Be aware that the completed form is often required before shipping to comply with U.S. export laws.

- Keep Records: Retain a copy of the form for your records, as it may be needed for future reference or audits.

Understanding these key takeaways will help ensure proper compliance when using the 7525 V form for export transactions.

Browse Other Templates

Irs 1099 C - The IRS prioritizes taxpayer education through concise descriptions and practical examples in this document.

Arkansas W2 Form - Employers can indicate if the report covers more than one FEIN and list them.