Fill Out Your 8 Re Form

The Form 8-K, utilized by publicly traded companies, serves as a crucial tool for disclosing significant events affecting the registrant. This form is primarily required under the Securities Exchange Act of 1934 and ensures timely communication of material information to investors and the public. A key aspect of the Form 8-K is its broad scope; it mandates reporting on various events, including changes in a company's business operations, financial condition, and other relevant operational changes. Companies must file this form within four business days of the occurrence of such events, thereby facilitating transparency and accountability within the financial markets. The form also allows registrants to satisfy certain filing obligations under other regulations, such as written communications related to business combination transactions. Notably, the Form 8-K does not require the filing of all events; specific exceptions apply based on particular circumstances or regulatory requirements. The structure of the form mandates detailed disclosures, often necessitating information about material agreements, the status of financial statements, and updates regarding company leadership changes—ensuring stakeholders remain informed about significant developments.

8 Re Example

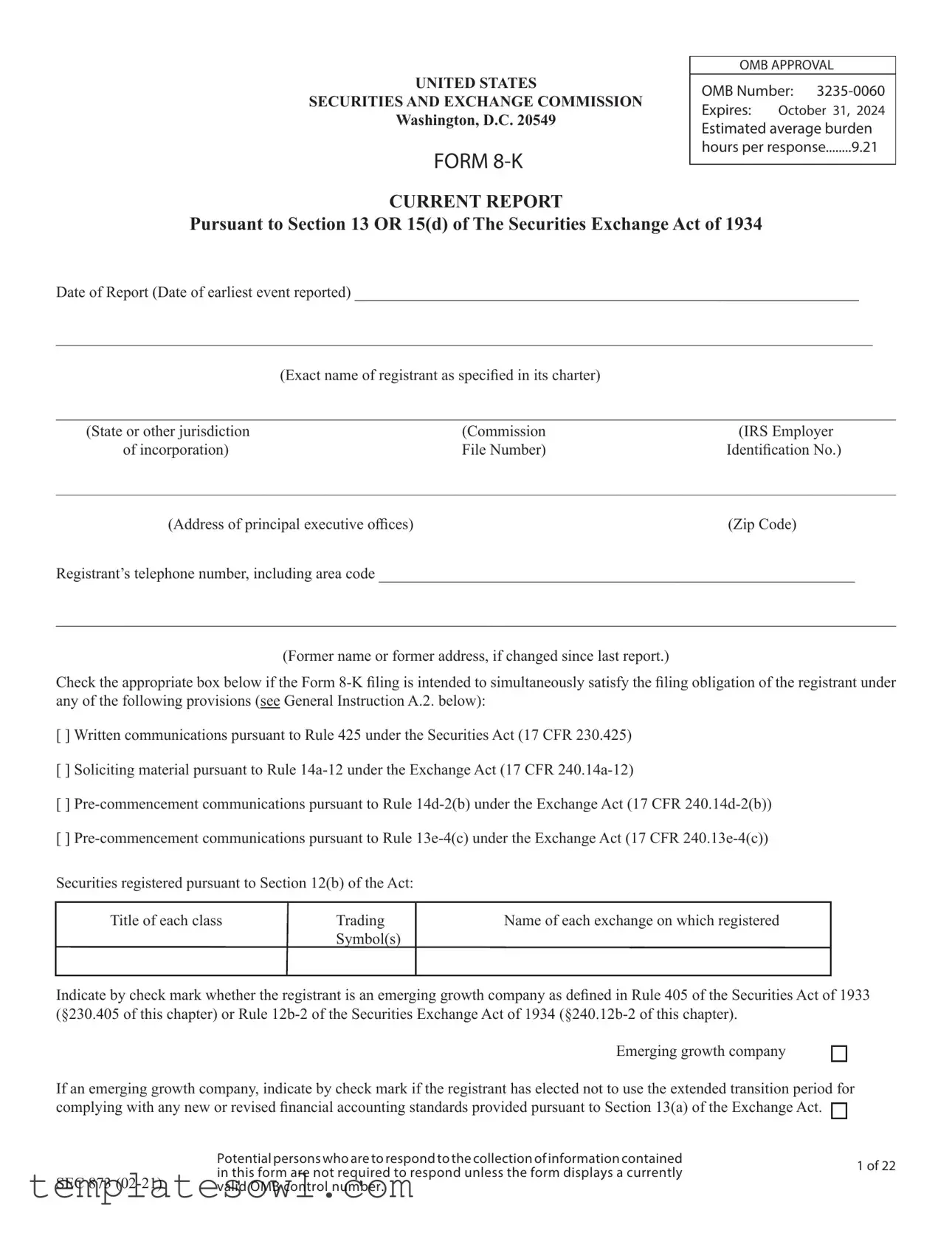

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OMB APPROVAL

OMB Number:

Expires: October 31, 2024 Estimated average burden hours per response........9.21

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) ______________________________________________________

_________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

______________________________________________________________________________________________________________

(State or other jurisdiction |

(Commission |

(IRS Employer |

of incorporation) |

File Number) |

Identification No.) |

_____________________________________________________________________________________________________________

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code ___________________________________________________

______________________________________________________________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule

[ ]

[ ]

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading |

|

Symbol(s) |

Name of each exchange on which registered

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Potential persons who are to respond to the collection of information contained |

1 of 22 |

|

SEC 873 |

in this form are not required to respond unless the form displays a currently |

||

|

|||

valid OMB control number. |

|

GENERAL INSTRUCTIONS

A. Rule as to Use of Form

1.Form

2.Form

B.Events to be Reported and Time for Filing of Reports.

1.A report on this form is required to be filed or furnished, as applicable, upon the occurrence of any one or more of the events specified in the items in Sections 1 - 6 and 9 of this form. Unless otherwise specified, a report is to be filed or furnished within four business days after occurrence of the event. If the event occurs on a Saturday, Sunday or holiday on which the Commission is not open for business, then the four business day period shall begin to run on, and include, the first business day thereafter. A registrant either furnishing a report on this form under Item 7.01 (Regulation FD Disclosure) or electing to file a report on this form under Item 8.01 (Other Events) solely to satisfy its obligations under Regulation FD (17 CFR 243.100 and 243.101) must furnish such report or make such filing, as applicable, in accordance with the requirements of Rule 100(a) of Regulation FD (17 CFR 243.100(a)), including the deadline for furnishing or filing such report. A report pursuant to Item 5.08 is to be filed within four business days after the registrant determines the anticipated meeting date.

2.The information in a report furnished pursuant to Item 2.02 (Results of Operations and Financial Condition) or Item 7.01 (Regulation FD Disclosure) shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, unless the registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act or the Exchange Act. If a report on Form

3.If the registrant previously has reported substantially the same information as required by this form, the registrant need not make an additional report of the information on this form. To the extent that an item calls for disclosure of developments concerning a previously reported event or transaction, any information required in the new report or amendment about the previously reported event or transaction may be provided by incorporation by reference to the previously filed report. The term previously reported is defined in Rule

4.Copies of agreements, amendments or other documents or instruments required to be filed pursuant to Form

5.When considering current reporting on this form, particularly of other events of material importance pursuant to Item 7.01 (Regulation FD Disclosure) and Item 8.01(Other Events), registrants should have due regard for the accuracy, completeness and currency of the information in registration statements filed under the Securities Act which incorporate by reference information in reports filed pursuant to the Exchange Act, including reports on this form.

6.A registrant’s report under Item 7.01 (Regulation FD Disclosure) or Item 8.01 (Other Events) will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

2

C. Application of General Rules and Regulations.

1.The General Rules and Regulations under the Act (17 CFR Part 240) contain certain general requirements which are applicable to reports on any form. These general requirements should be carefully read and observed in the preparation and filing of reports on this form.

2.Particular attention is directed to Regulation 12B (17 CFR

D.Preparation of Report.

This form is not to be used as a blank form to be filled in, but only as a guide in the preparation of the report on paper meeting the requirements of Rule

E. Signature and Filing of Report.

Three complete copies of the report, including any financial statements, exhibits or other papers or documents filed as a part thereof, and five additional copies which need not include exhibits, shall be filed with the Commission. At least one complete copy of the report, including any financial statements, exhibits or other papers or documents filed as a part thereof, shall be filed, with each exchange on which any class of securities of the registrant is registered. At least one complete copy of the report filed with the Commission and one such copy filed with each exchange shall be manually signed. Copies not manually signed shall bear typed or printed signatures.

F. Incorporation by Reference.

If the registrant makes available to its stockholders or otherwise publishes, within the period prescribed for filing the report, a press release or other document or statement containing information meeting some or all of the requirements of this form, the information called for may be incorporated by reference to such published document or statement, in answer or partial answer to any item or items of this form, provided copies thereof are filed as an exhibit to the report on this form.

G. Use of this Form by

The following applies to registrants that are

1.Reportable Events That May Be Omitted.

The registrant need not file a report on this Form upon the occurrence of any one or more of the events specified in the following:

(a)Item 2.01, Completion of Acquisition or Disposition of Assets;

(b)Item 2.02, Results of Operations and Financial Condition;

(c)Item 2.03, Creation of a Direct Financial Obligation or an Obligation under an

(d)Item 2.05, Costs Associated with Exit or Disposal Activities;

3

(e)Item 2.06, Material Impairments;

(f)Item 3.01, Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing;

(g)Item 3.02, Unregistered Sales of Equity Securities;

(h)Item 4.01, Changes in Registrant’s Certifying Accountant;

(i)Item 4.02,

(j)Item 5.01, Changes in Control of Registrant;

(k)Item 5.02, Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers;

(l) Item 5.04, Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans; and

(m)Item 5.05, Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. 2. Additional Disclosure for the Form

Immediately after the name of the issuing entity on the cover page of the Form

3.Signatures.

The Form

INFORMATION TO BE INCLUDED IN THE REPORT

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

(a)If the registrant has entered into a material definitive agreement not made in the ordinary course of business of the registrant, or into any amendment of such agreement that is material to the registrant, disclose the following information:

(1)the date on which the agreement was entered into or amended, the identity of the parties to the agreement or amendment and a brief description of any material relationship between the registrant or its affiliates and any of the parties, other than in respect of the material definitive agreement or amendment; and

(2)a brief description of the terms and conditions of the agreement or amendment that are material to the registrant.

(b)For purposes of this Item 1.01, a material definitive agreement means an agreement that provides for obligations that are material to and enforceable against the registrant, or rights that are material to the registrant and enforceable by the registrant against one or more other parties to the agreement, in each case whether or not subject to conditions.

Instructions.

1.Any material definitive agreement of the registrant not made in the ordinary course of the registrant’s business must be disclosed under this Item 1.01. An agreement is deemed to be not made in the ordinary course of a registrant’s business even if the agreement is such as ordinarily accompanies the kind of business conducted by the registrant if it involves the subject matter identified in Item 601(b)(10)(ii)

(A) - (D) of Regulation

2.A registrant must provide disclosure under this Item 1.01 if the registrant succeeds as a party to the agreement or amendment to the

4

agreement by assumption or assignment (other than in connection with a merger or acquisition or similar transaction).

3.With respect to

4.To the extent a material definitive agreement is filed as an exhibit under this Item 1.01, schedules (or similar attachments) to the exhibits are not required to be filed unless they contain information material to an investment or voting decision and that information is not otherwise disclosed in the exhibit or the disclosure document. Each exhibit filed must contain a list briefly identifying the contents of all omitted schedules. Registrants need not prepare a separate list of omitted information if such information is already included within the exhibit in a manner that conveys the subject matter of the omitted schedules and attachments. In addition, the registrant must provide a copy of any omitted schedule to the Commission or its staff upon request.

5.To the extent a material definitive agreement is filed as an exhibit under this Item 1.01, the registrant may redact information from the exhibit if disclosure of such information would constitute a clearly unwarranted invasion of personal privacy (e.g., disclosure of bank account numbers, social security numbers, home addresses and similar information).

6.To the extent a material definitive agreement is filed as an exhibit under this Item 1.01, the registrant may redact provisions or

terms of the exhibit if those provisions or terms are both (i) not material and (ii) would likely cause competitive harm to the registrant if publicly disclosed, provided that the registrant intends to incorporate by reference this filing into its future periodic reports or registration statements, as applicable, in satisfaction of Item 601(b)(10) of Regulation

If requested by the Commission or its staff, the registrant must promptly provide an unredacted copy of the exhibit on a supplemental basis. The Commission or its staff also may request the registrant to provide its materiality and competitive harm analyses on a supplemental basis. Upon evaluation of the registrant’s supplemental materials, the Commission or its staff may request the registrant to amend its filing to include in the exhibit any previously redacted information that is not adequately supported by the registrant’s materiality and competitive harm analyses.

The registrant may request confidential treatment of the supplemental material submitted under Instruction 6 of this Item pursuant to Rule 83 (§ 200.83 of this chapter) while it is in the possession of the Commission or its staff. After completing its review of the supplemental information, the Commission or its staff will return or destroy it at the request of the registrant, if the registrant complies with the procedures outlined in Rules 418 or

Item 1.02 Termination of a Material Definitive Agreement.

(a)If a material definitive agreement which was not made in the ordinary course of business of the registrant and to which the registrant is a party is terminated otherwise than by expiration of the agreement on its stated termination date, or as a result of all parties completing their obligations under such agreement, and such termination of the agreement is material to the registrant, disclose the following information:

(1)the date of the termination of the material definitive agreement, the identity of the parties to the agreement and a brief description of any material relationship between the registrant or its affiliates and any of the parties other than in respect of the material definitive agreement;

(2)a brief description of the terms and conditions of the agreement that are material to the registrant;

(3)a brief description of the material circumstances surrounding the termination; and

(4)any material early termination penalties incurred by the registrant.

(b)For purposes of this Item 1.02, the term material definitive agreement shall have the same meaning as set forth in Item 1.01(b). Instructions.

1.No disclosure is required solely by reason of this Item 1.02 during negotiations or discussions regarding termination of a material definitive agreement unless and until the agreement has been terminated.

2.No disclosure is required solely by reason of this Item 1.02 if the registrant believes in good faith that the material definitive agreement has not been terminated, unless the registrant has received a notice of termination pursuant to the terms of agreement.

5

3.With respect to

Item 1.03 Bankruptcy or Receivership.

(a)If a receiver, fiscal agent or similar officer has been appointed for a registrant or its parent, in a proceeding under the U.S. Bankruptcy Code or in any other proceeding under state or federal law in which a court or governmental authority has assumed jurisdiction over substantially all of the assets or business of the registrant or its parent, or if such jurisdiction has been assumed by leaving the existing directors and officers in possession but subject to the supervision and orders of a court or governmental authority, disclose the following information:

(1)the name or other identification of the proceeding;

(2)the identity of the court or governmental authority;

(3)the date that jurisdiction was assumed; and

(4)the identity of the receiver, fiscal agent or similar officer and the date of his or her appointment.

(b)If an order confirming a plan of reorganization, arrangement or liquidation has been entered by a court or governmental authority having supervision or jurisdiction over substantially all of the assets or business of the registrant or its parent, disclose the following;

(1)the identity of the court or governmental authority;

(2)the date that the order confirming the plan was entered by the court or governmental authority;

(3)a summary of the material features of the plan and, pursuant to Item 9.01 (Financial Statements and Exhibits), a copy of the plan as confirmed;

(4)the number of shares or other units of the registrant or its parent issued and outstanding, the number reserved for future issuance in respect of claims and interests filed and allowed under the plan, and the aggregate total of such numbers; and

(5)information as to the assets and liabilities of the registrant or its parent as of the date that the order confirming the plan was entered, or a date as close thereto as practicable.

Instructions.

1.The information called for in paragraph (b)(5) of this Item 1.03 may be presented in the form in which it was furnished to the court or governmental authority.

2.With respect to

(b) of this Item with respect to the sponsor, depositor, servicer contemplated by Item 1108(a)(3) of Regulation AB (17 CFR 229.1108(a) (3)), trustee, significant obligor, enhancement or support provider contemplated by Items 1114(b) or 1115 of Regulation AB (17 CFR 229.1114(b) or 229.1115) or other material party contemplated by Item 1101(d)(1) of Regulation AB (17 CFR 1101(d)(1)). Terms used in this Instruction 2 have the same meaning as in Item 1101 of Regulation AB (17 CFR 229.1101).

Item 1.04 Mine Safety – Reporting of Shutdowns and Patterns of Violations.

(a)If the registrant or a subsidiary of the registrant has received, with respect to a coal or other mine of which the registrant or a subsidiary of the registrant is an operator

•an imminent danger order issued under section 107(a) of the Federal Mine Safety and Health Act of 1977 (30

U.S.C. 817(a));

•a written notice from the Mine Safety and Health Administration that the coal or other mine has a pattern of violations of mandatory health or safety standards that are of such nature as could have significantly and substantially contributed to the cause and effect of coal or other mine health or safety hazards under section 104(e) of such Act (30 U.S.C. 814(e)); or

•a written notice from the Mine Safety and Health Administration that the coal or other mine has the potential to have such a pattern, disclose the following information:

6

(1)The date of receipt by the issuer or a subsidiary of such order or notice.

(2)The category of the order or notice.

(3)The name and location of the mine involved.

Instructions to Item 1.04.

1.The term “coal or other mine” means a coal or other mine, as defined in section 3 of the Federal Mine Safety and Health Act of 1977 (30 U.S.C. 802), that is subject to the provisions of such Act (30 U.S.C. 801 et seq).

2.The term “operator” has the meaning given the term in section 3 of the Federal Mine Safety and Health Act of 1977 (30 U.S.C. 802).

Section 2 - Financial Information

Item 2.01 Completion of Acquisition or Disposition of Assets.

If the registrant or any of its subsidiaries consolidated has completed the acquisition or disposition of a significant amount of assets, otherwise than in the ordinary course of business, or the acquisition or disposition of a significant amount of assets that constitute a real estate operation as defined in §

(a)the date of completion of the transaction;

(b)a brief description of the assets involved;

(c)the identity of the person(s) from whom the assets were acquired or to whom they were sold and the nature of any material relationship, other than in respect of the transaction, between such person(s) and the registrant or any of its affiliates, or any director or officer of the registrant, or any associate of any such director or officer;

(d)the nature and amount of consideration given or received for the assets and, if any material relationship is disclosed pursuant to paragraph (c) of this Item 2.01, the formula or principle followed in determining the amount of such consideration;

(e)if the transaction being reported is an acquisition and if a material relationship exists between the registrant or any of its affiliates and the source(s) of the funds used in the acquisition, the identity of the source(s) of the funds unless all or any part of the consideration used is a loan made in the ordinary course of business by a bank as defined by Section 3(a)(6) of the Act, in which case the identity of such bank may be omitted provided the registrant:

(1)has made a request for confidentiality pursuant to Section 13(d)(1)(B) of the Act; and

(2)states in the report that the identity of the bank has been so omitted and filed separately with the Commission; and

(f)if the registrant was a shell company, other than a business combination related shell company, as those terms are defined in Rule

Instructions.

1.No information need be given as to:

(i)any transaction between any person and any

(ii)any transaction between two or more

(iii)the redemption or other acquisition of securities from the public, or the sale or other disposition of securities to the public, by the issuer of such securities or by a

2.The term acquisition includes every purchase, acquisition by lease, exchange, merger, consolidation, succession or other acquisition, except that the term does not include the construction or development of property by or for the registrant or its subsidiaries or the acquisition

7

of materials for such purpose. The term disposition includes every sale, disposition by lease, exchange, merger, consolidation, mortgage, assignment or hypothecation of assets, whether for the benefit of creditors or otherwise, abandonment, destruction, or other disposition.

3.The information called for by this Item 2.01 is to be given as to each transaction or series of related transactions of the size indicated. The acquisition or disposition of securities is deemed the indirect acquisition or disposition of the assets represented by such securities if it results in the acquisition or disposition of control of such assets.

4.An acquisition or disposition will be deemed to involve a significant amount of assets:

(i)if the registrant’s and its other subsidiaries’ equity in the net book value of such assets or the amount paid or received for the assets upon such acquisition or disposition exceeded 10 percent of the total assets of the registrant and its consolidated subsidiaries;

(ii)if it involved a business (see 17 CFR

(iii)in the case of a business development company, if the amount paid for such assets exceeded 10 percent of the value of the total investments of the registrant and its consolidated subsidiaries.

The aggregate impact of acquired businesses are not required to be reported pursuant to this Item 2.01 unless they are related businesses (see 17 CFR

5.Attention is directed to the requirements in Item 9.01 (Financial Statements and Exhibits) with respect to the filing of:

(i)financial statements of businesses or funds acquired;

(ii)pro forma financial information; and

(iii)copies of the plans of acquisition or disposition as exhibits to the report.

Item 2.02 Results of Operations and Financial Condition.

(a)If a registrant, or any person acting on its behalf, makes any public announcement or release (including any update of an earlier announcement or release) disclosing material

(b)A Form

(1)the information is provided as part of a presentation that is complementary to, and initially occurs within 48 hours after, a related, written announcement or release that has been furnished on Form

(2)the presentation is broadly accessible to the public by

(3)the financial and other statistical information contained in the presentation is provided on the registrant’s website, together with any information that would be required under 17 CFR 244.100; and

(4)the presentation was announced by a widely disseminated press release, that included instructions as to when and how to access the presentation and the location on the registrant’s website where the information would be available.

Instructions.

1.The requirements of this Item 2.02 are triggered by the disclosure of material

2.The requirements of paragraph (e)(1)(i) of Item 10 of Regulation

8

3.Issuers that make earnings announcements or other disclosures of material

4.This Item 2.02 does not apply in the case of a disclosure that is made in a quarterly report filed with the Commission on Form

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an

(a)If the registrant becomes obligated on a direct financial obligation that is material to the registrant, disclose the following information:

(1)the date on which the registrant becomes obligated on the direct financial obligation and a brief description of the transaction or agreement creating the obligation;

(2)the amount of the obligation, including the terms of its payment and, if applicable, a brief description of the material terms under which it may be accelerated or increased and the nature of any recourse provisions that would enable the registrant to recover from third parties; and

(3)a brief description of the other terms and conditions of the transaction or agreement that are material to the registrant.

(b)If the registrant becomes directly or contingently liable for an obligation that is material to the registrant arising out of an

(1)the date on which the registrant becomes directly or contingently liable on the obligation and a brief description of the transaction or agreement creating the arrangement and obligation;

(2)a brief description of the nature and amount of the obligation of the registrant under the arrangement, including the material terms whereby it may become a direct obligation, if applicable, or may be accelerated or increased and the nature of any recourse provisions that would enable the registrant to recover from third parties;

(3)the maximum potential amount of future payments (undiscounted) that the registrant may be required to make, if different; and

(4)a brief description of the other terms and conditions of the obligation or arrangement that are material to the registrant.

(c)For purposes of this Item 2.03, direct financial obligation means any of the following:

(1)a

(2)a finance lease obligation means a payment obligation under a lease that would be classified as a finance lease pursuant to FASB ASC Topic 842, Leases, as may be modified or supplemented;

(3)an operating lease obligation means a payment obligation under a lease that would be classified as an operating lease pursuant to FASB ASC Topic 840, as may be modified or supplemented; or

(4)a

(d)For purposes of this Item 2.03,

(1)Any obligation under a guarantee contract that has any of the characteristics identified in FASB ASC paragraph

(2)A retained or contingent interest in assets transferred to an unconsolidated entity or similar arrangement that serves as credit, liquidity or market risk support to such entity for such assets;

(3)Any obligation, including a contingent obligation, under a contract that would be accounted for as a derivative instrument, except that it is both indexed to the registrant’s own stock and classified in stockholders’ equity in the registrant’s statement of financial position, and therefore excluded from the scope of FASB ASC Topic 815, Derivatives and Hedging, pursuant to FASB ASC subparagraph

9

(4)Any obligation, including a contingent obligation, arising out of a variable interest (as defined in the FASB ASC Master Glossary), as may be modified or supplemented) in an unconsolidated entity that is held by, and material to, the registrant, where such entity provides financing, liquidity, market risk or credit risk support to, or engages in leasing, hedging or research and development services with, the registrant.

(e)For purposes of this Item 2.03,

Instructions.

1.A registrant has no obligation to disclose information under this Item 2.03 until the registrant enters into an agreement enforceable against the registrant, whether or not subject to conditions, under which the direct financial obligation will arise or be created or issued. If there is no such agreement, the registrant must provide the disclosure within four business days after the occurrence of the closing or settlement of the transaction or arrangement under which the direct financial obligation arises or is created.

2.A registrant must provide the disclosure required by paragraph (b) of this Item 2.03 whether or not the registrant is also a party to the transaction or agreement creating the contingent obligation arising under the

3.In the event that an agreement, transaction or arrangement requiring disclosure under this Item 2.03 comprises a facility, program or similar arrangement that creates or may give rise to direct financial obligations of the registrant in connection with multiple transactions, the registrant shall:

(i)disclose the entering into of the facility, program or similar arrangement if the entering into of the facility is material to the registrant; and

(ii)as direct financial obligations arise or are created under the facility or program, disclose the required information under this Item 2.03 to the extent that the obligations are material to the registrant (including when a series of previously undisclosed individually immaterial obligations become material in the aggregate).

4.For purposes of Item 2.03(b)(3), the maximum amount of future payments shall not be reduced by the effect of any amounts that may possibly be recovered by the registrant under recourse or collateralization provisions in any guarantee agreement, transaction or arrangement.

5.If the obligation required to be disclosed under this Item 2.03 is a security, or a term of a security, that has been or will be sold pursuant to an effective registration statement of the registrant, the registrant is not required to file a Form

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an

(a)If a triggering event causing the increase or acceleration of a direct financial obligation of the registrant occurs and the consequences of the event, taking into account those described in paragraph (a)(4) of this Item 2.04, are material to the registrant, disclose the following information:

(1)the date of the triggering event and a brief description of the agreement or transaction under which the direct financial obligation was created and is increased or accelerated;

(2)a brief description of the triggering event;

(3)the amount of the direct financial obligation, as increased if applicable, and the terms of payment or acceleration that apply; and

(4)any other material obligations of the registrant that may arise, increase, be accelerated or become direct financial obligations as a result of the triggering event or the increase or acceleration of the direct financial obligation.

(b)If a triggering event occurs causing an obligation of the registrant under an

10

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form 8-K is used to report significant events that may be important to investors, ensuring timely disclosure of material information. |

| Governing Law | Form 8-K is governed by the Securities Exchange Act of 1934, specifically Sections 13 and 15(d). |

| Filing Timeline | Reports must be filed within four business days of the triggering event, offering a prompt update to stakeholders. |

| Emerging Growth Companies | Companies defined as emerging growth under Rule 405 of the Securities Act have specific filing options and reduced reporting requirements. |

Guidelines on Utilizing 8 Re

To properly complete the 8-K form, gather all essential information regarding the event being reported. Ensure the accuracy and completeness of all entries before submission, as this report must be filed with the Securities and Exchange Commission within a specific timeframe once the event occurs.

- Begin by entering the date of the report, which is the date of the earliest event reported.

- Fill in the exact name of the registrant as specified in its charter.

- Provide the state or other jurisdiction of incorporation, along with the Commission file number and the IRS Employer Identification Number.

- Complete the address of the principal executive offices and the associated zip code.

- Include the registrant's telephone number, ensuring to include the area code.

- If applicable, note any former name or address used since the last report.

- Check the appropriate box to indicate if the filing is intended to satisfy any other obligations under specific provisions of the Securities Act or Exchange Act.

- List any securities registered under Section 12(b) of the Act, including the title of each class, trading symbols, and the name of each exchange where registered.

- Indicate if the registrant is an emerging growth company by checking the relevant box.

- Complete the applicable items related to the events being reported, ensuring detailed disclosure as required.

- Sign the report manually, and ensure to have additional copies as specified for filing with the Commission and each exchange.

- If relevant, prepare copies of any press releases or documents that can be incorporated by reference and include them as exhibits.

What You Should Know About This Form

What is the primary purpose of Form 8-K?

Form 8-K serves as a current report that companies must file with the Securities and Exchange Commission (SEC) when certain significant events occur. This form allows companies to disclose important information that shareholders and the public need to know. Events that trigger the filing of Form 8-K include material contracts, changes in control, appointment or departure of directors, and other significant developments that may impact a company's financial condition or operations.

When must a company file Form 8-K after a triggering event occurs?

A company must file Form 8-K within four business days of the occurrence of a reportable event. This timeline ensures that relevant information reaches the public promptly. However, if the event takes place on a weekend or holiday, the filing period begins on the next business day. Adhering to this timeline is essential for maintaining transparency and compliance with SEC regulations.

What types of events require a Form 8-K filing?

Various events require the submission of a Form 8-K. These include but are not limited to: entering into or terminating a significant agreement, completion of an acquisition or disposition of assets, changes in the executive team or board of directors, and material impairments. Additionally, companies must report any amendments to their articles of incorporation or bylaws that are significant to the registrant. Being aware of these events can help shareholders stay informed about the company's status and outlook.

Can information from previous reports be included in a new Form 8-K submission?

If a company has previously reported information that is still relevant, it may incorporate that information by reference in the current Form 8-K. This means that instead of repeating previously disclosed information, the company can reference its earlier filings. This approach streamlines the reporting process, making it easier for both the company and its stakeholders to track important developments without redundancy.

Is there a distinct process for asset-backed issuers when filing Form 8-K?

Yes, asset-backed issuers have specific provisions that apply when filing Form 8-K. For instance, certain reportable events may be omitted for these registrants, such as entry into a definitive agreement regarding financing. Additionally, when filing Form 8-K, asset-backed issuers must include specific details about the depositor and sponsor, enhancing transparency for investors in asset-backed securities.

Common mistakes

Filling out the Form 8-K can be a challenging task, and many people stumble in the process. One common mistake is failing to provide the correct exact name of the registrant as specified in its charter. It's crucial to use the official name without any alterations. An incorrect name could lead to complications and might even delay the filing process.

Another frequent error involves missing deadlines. Form 8-K reports must be filed within four business days after the occurrence of a significant event. Forgetting this timeline can result in penalties or even increased scrutiny from the SEC. Make a diary note or set reminders to ensure you're not late.

Many people confuse sections and inadvertently disclose the wrong information. It's essential to review the items carefully before filling them out. For instance, if you’re reporting on an acquisition, ensure you’re using the correct Item number. Mistakes here can lead to misleading information being conveyed.

Another common oversight is neglecting the item-specific instructions. Each item has detailed requirements regarding what needs to be disclosed. Failure to follow these specifics can result in incomplete reports or missing essential information, leading to a rejection of the filing.

Many filers overlook the need for manual signatures. While electronic signatures are often accepted in various contexts, Form 8-K requires at least one manual signature. Omitting this detail can halt the filing process and delay important updates.

Inadequate description of material agreements can cause issues as well. If an agreement is crucial to the registrant, ensure you provide a comprehensive yet concise description of its terms. Avoid vague language, as it can confuse the reviewers.

Another pitfall is neglecting to file exhibits when necessary. Some items specifically require related documents to be filed with the Form 8-K. Ignoring this can lead to regulatory concerns and may require you to amend your report later.

Many filers also forget to indicate whether they qualify as emerging growth companies. This distinction carries significant implications for the filing requirements and can impact investor perception. Always check the applicable box to avoid misunderstandings.

Additionally, the use of outdated templates can be problematic. Forms can change over time, so always ensure that you're working with the most recent version. Using an old template may mean missing new items or requirements that have been added.

Finally, many people don’t keep a copy of their filed Form 8-K. It’s vital to retain a record for future reference and compliance checks. Keeping copies can save time and effort when future filings may lead to questions about past disclosures.

Documents used along the form

The Form 8-K is a crucial document for publicly traded companies, as it allows them to report significant events in a timely manner. Along with this form, several other documents often complement its purpose, enhancing transparency and compliance in financial reporting.

- Regulation FD Disclosure: This document ensures that all investors have equal access to material information. It may be included in conjunction with Form 8-K to fulfill disclosure obligations.

- Proxy Statement (Form DEF 14A): This form is used when shareholders vote on important matters. It includes information about management, board members, and proposals requiring shareholder approval.

- Annual Report (Form 10-K): This comprehensive report gives investors insights into a company's financial performance over the past year. It includes audited financial statements and information about the company’s operations.

- Quarterly Report (Form 10-Q): Similar to the 10-K, but filed quarterly, this report provides updated financial information and operational insights, keeping investors informed about the company's progress throughout the year.

- Current Report (Form 8-K/A): An amendment to a previously filed Form 8-K, which provides updated or additional information that was not included in the initial filing.

- Material Definitive Agreements: These are contracts that a company enters into, which can have a significant impact on its operations or obligations. Such agreements may need to be disclosed formally with the 8-K.

- Financial Statements: These documents provide a snapshot of the company’s financial status, including income statements, balance sheets, and cash flow statements. They accompany other forms to offer a complete picture of financial health.

Understanding the forms and documents that work alongside the Form 8-K enhances your grasp of corporate financial reporting. This knowledge is vital not only for compliance but also for making informed investment decisions.

Similar forms

- Form 10-Q: Similar to Form 8-K, Form 10-Q is a quarterly report that provides an overview of a company's financial performance. Both forms are filed with the SEC and help keep stakeholders informed about a company's operational status.

- Form 10-K: This is an annual report detailing a company's financial performance. Like Form 8-K, it is filed with the SEC and informs the public about significant events that have occurred over the year.

- Form S-1: Used for registering securities, Form S-1 is similar in that it must disclose material information. Like Form 8-K, it requires the registrant to provide detailed information that could impact investor decisions.

- Form 14A: This proxy statement is filed when a company solicits shareholder votes. It shares similarities with Form 8-K in that both require timely disclosures about significant corporate events to keep investors informed.

- Form 13D: This form must be filed by anyone who acquires more than 5% of a company's stock. Similar to Form 8-K, it aims to disclose crucial information that may affect stockholder interests.

- Form 3: This document is utilized by insiders of a publicly traded company to report their ownership. It shares the essence of Form 8-K, as both forms focus on timely reporting of material information to protect investors.

- Form 4: This form is used primarily for reporting changes in insider ownership. Like Form 8-K, it ensures transparency and timely reporting of notable events affecting stakeholders.

- Form 5: Similar to Form 4, but filed annually, Form 5 allows insiders to report transactions not previously reported. Both forms are essential for maintaining transparency in corporate governance, akin to the disclosures required in Form 8-K.

Dos and Don'ts

When filling out the Form 8-K, there are several important considerations to keep in mind. Adhering to these guidelines can ensure a smoother filing process and greater compliance with regulatory expectations.

- Do: Clearly indicate the date of the event being reported. This helps establish a clear timeline for your disclosures.

- Do: Use the exact legal name of the registrant in the appropriate section. This is crucial for accuracy and identification.

- Do: Ensure that all necessary items are addressed as per the guidelines. Omitting required information could lead to complications.

- Do: Review and double-check all information before submission. Accuracy is paramount in regulatory filings.

- Don't: Use vague descriptions when reporting. Clear and concise language is essential to avoid confusion.

- Don't: Forget to check the appropriate boxes for compliance with various rules. This ensures that your filing meets the necessary regulatory requirements.

- Don't: Submit incomplete reports. All required fields must be filled out appropriately to be considered valid.

- Don't: Ignore the filing deadlines. Disclosures must be made within the specified timeframe to avoid penalties.

Misconceptions

Here are five common misconceptions about Form 8-K, along with clarifications for each:

- Form 8-K is only for bad news. Many believe that Form 8-K is solely for reporting negative events. However, this form is also used to disclose positive developments, such as significant agreements or achievements. The focus is on material events that could influence investors' decisions.

- Any company can file a Form 8-K at any time. Some think that any business can submit a Form 8-K whenever they please. In reality, only publicly traded companies must use this form to report specific events as detailed by the Securities Exchange Commission (SEC). This includes events that have happened within a set timeframe.

- There are no time limits for filing. It's a common misconception that companies can take their time when filing a Form 8-K. In fact, firms must file this report within four business days of the event occurring. Timeliness is crucial to ensure that investors receive relevant information quickly.

- All events must be reported individually. Some individuals believe that every single event must be documented separately. However, if a company has reported similar information previously, they may incorporate that information by reference instead of submitting a new report.

- Filing Form 8-K means the information is automatically public. It is often assumed that filing this form guarantees public access to the information disclosed. While Form 8-K filings are required, the information is only considered filed and available to the public if the registrant explicitly states so in their report.

Key takeaways

Key Takeaways for Completing and Using the Form 8-K:

- The Form 8-K is used for current reports under specific sections of the Securities Exchange Act of 1934. Make sure to follow the applicable rules when filing.

- Reports must be filed within four business days of the event occurring. If the event falls on a weekend or holiday, count from the next business day.

- Only include relevant sections of the form that pertain to the specific event. Items not applicable do not need to be referenced in the report.

- Be clear about the details of material definitive agreements. Provide the date, parties involved, and any material terms related to the agreement.

- Ensure all reports are signed, and include multiple copies as required. For electronic submissions, maintain accurate documentation for compliance.

Browse Other Templates

Form Wh-58 - It is an essential tool for ethical business practices regarding employee compensation.

Pennsylvania Corporate Estimated Tax Payments - The form reinforces the importance of maintaining clear records for sole proprietorships.

Scout Personal Profile,Scout Member Information,Individual Scout Registration,Scout Participant Record,Scout Membership Document,Troop Youth Record,Scout Achievement Log,Scout Status Report,Scout Activity Summary,Troop Member Profile - Record board of review dates for formal evaluation criteria.