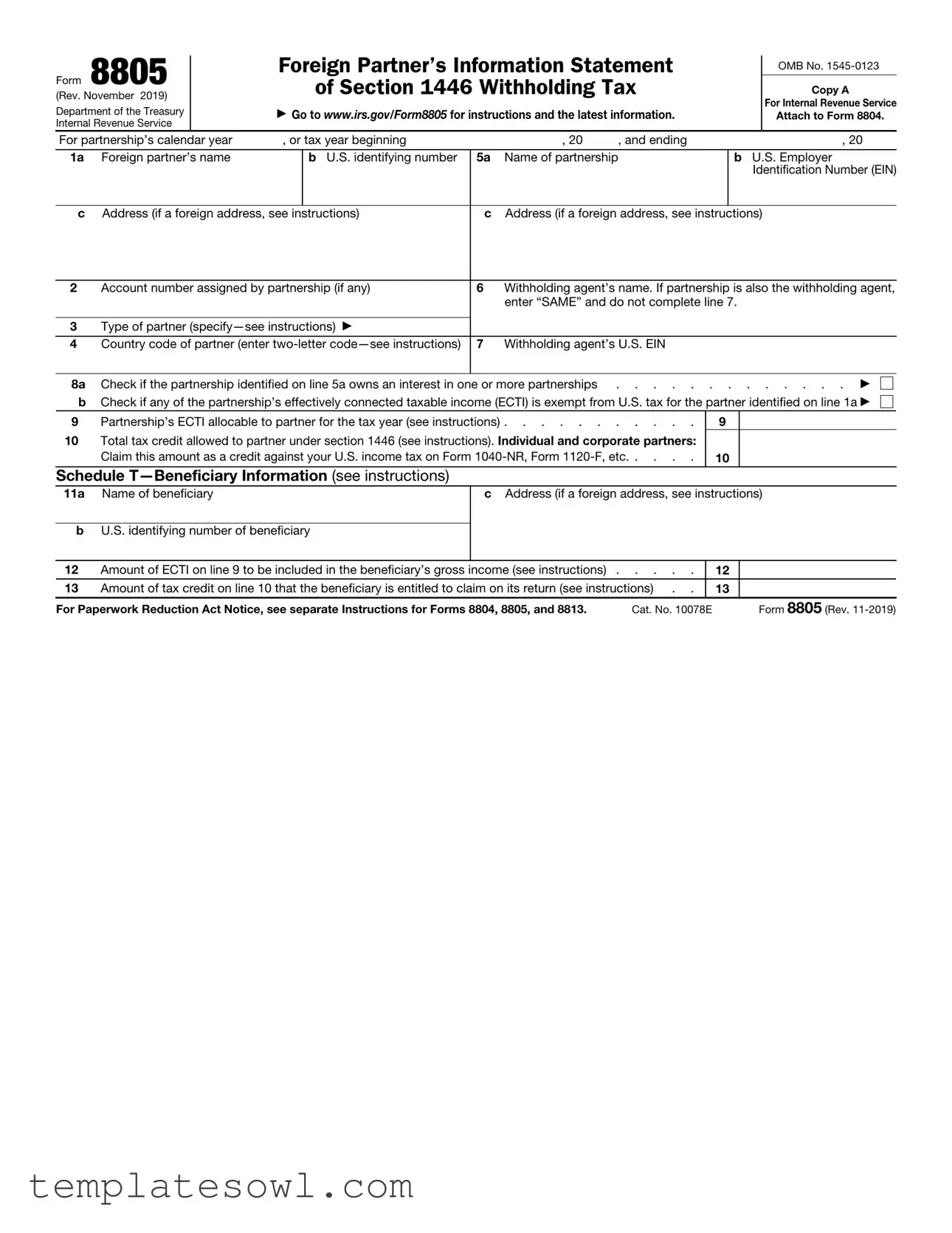

Fill Out Your 8805 Form

Form 8805, known as the Foreign Partner’s Information Statement, plays a crucial role in the taxation of foreign partners involved in U.S. partnerships. This form is required under Section 1446 of the Internal Revenue Code and must be filed by partnerships that have foreign partners receiving effectively connected taxable income (ECTI). Every partnership must accurately report information about its foreign partners, which includes their names, U.S. identifying numbers, and details about the partnership itself, such as its Employer Identification Number (EIN). The form also addresses tax credits that foreign partners may be entitled to, allowing them to claim these credits against their U.S. income tax when filing Forms 1040-NR or 1120-F. In addition to key information about the partnership and the foreign partner, Form 8805 requires disclosure regarding whether the partnership owns interests in other partnerships and if any of its ECTI is exempt from U.S. tax. Thus, this form is not just a requirement; it is essential for ensuring compliance with U.S. tax laws for foreign stakeholders.

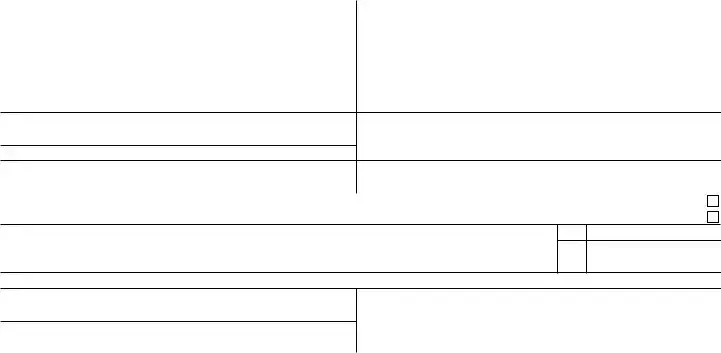

8805 Example

Form |

8805 |

|

Foreign Partner’s Information Statement |

|

OMB No. |

|||

|

|

of Section 1446 Withholding Tax |

|

Copy A |

||||

(Rev. November 2019) |

|

|

|

|||||

|

|

|

|

|

|

For Internal Revenue Service |

||

Department of the Treasury |

|

|

|

|

|

|

||

|

▶ Go to WWW.IRS.GOV/FORM8805 for instructions and the latest information. |

|

Attach to Form 8804. |

|||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

For partnership’s calendar year |

, or tax year beginning |

, 20 |

, and ending |

, 20 |

||||

|

|

|

|

|

|

|||

1a |

Foreign partner’s name |

|

b U.S. identifying number |

5a Name of partnership |

b U.S. Employer |

|||

|

|

|

|

|

|

|

Identification Number (EIN) |

|

|

|

|

|

|||||

c Address (if a foreign address, see instructions) |

c Address (if a foreign address, see instructions) |

|||||||

2 |

Account number assigned by partnership (if any) |

6 Withholding agent’s name. If partnership is also the withholding agent, |

|

|

enter “SAME” and do not complete line 7. |

3Type of partner

4 |

Country code of partner (enter |

|

|

8a |

Check if the partnership identified on line 5a owns an interest in one or more partnerships . . . . . . . . . . . . . ▶ |

b Check if any of the partnership’s effectively connected taxable income (ECTI) is exempt from U.S. tax for the partner identified on line 1a ▶

9 |

Partnership’s ECTI allocable to partner for the tax year (see instructions) |

9 |

10Total tax credit allowed to partner under section 1446 (see instructions). Individual and corporate partners:

Claim this amount as a credit against your U.S. income tax on Form |

10 |

Schedule

11a Name of beneficiary |

c Address (if a foreign address, see instructions) |

bU.S. identifying number of beneficiary

12 |

Amount of ECTI on line 9 to be included in the beneficiary’s gross income (see instructions) |

|

12 |

|

|

13 |

Amount of tax credit on line 10 that the beneficiary is entitled to claim on its return (see instructions) . . |

|

13 |

|

|

For Paperwork Reduction Act Notice, see separate Instructions for Forms 8804, 8805, and 8813. |

Cat. No. 10078E |

|

Form 8805 (Rev. |

||

Form |

8805 |

|

Foreign Partner’s Information Statement |

|

OMB No. |

|||

|

|

of Section 1446 Withholding Tax |

|

Copy B |

||||

(Rev. November 2019) |

|

|

|

|||||

|

|

|

|

|

|

For Partner |

||

Department of the Treasury |

|

|

|

|

|

|

||

|

▶ Go to WWW.IRS.GOV/FORM8805 for instructions and the latest information. |

|

Keep for your records. |

|||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

For partnership’s calendar year |

, or tax year beginning |

, 20 |

, and ending |

, 20 |

||||

|

|

|

|

|

|

|||

1a |

Foreign partner’s name |

|

b U.S. identifying number |

5a Name of partnership |

b U.S. Employer |

|||

|

|

|

|

|

|

|

Identification Number (EIN) |

|

|

|

|

|

|||||

c Address (if a foreign address, see instructions) |

c Address (if a foreign address, see instructions) |

|||||||

2 |

Account number assigned by partnership (if any) |

6 Withholding agent’s name. If partnership is also the withholding agent, |

|

|

enter “SAME” and do not complete line 7. |

3Type of partner

4 |

Country code of partner (enter |

|

|

8a |

Check if the partnership identified on line 5a owns an interest in one or more partnerships . . . . . . . . . . . . . ▶ |

b Check if any of the partnership’s effectively connected taxable income (ECTI) is exempt from U.S. tax for the partner identified on line 1a ▶

9 |

Partnership’s ECTI allocable to partner for the tax year (see instructions) |

9 |

10Total tax credit allowed to partner under section 1446 (see instructions). Individual and corporate partners:

Claim this amount as a credit against your U.S. income tax on Form |

10 |

Schedule

11a Name of beneficiary |

c Address (if a foreign address, see instructions) |

bU.S. identifying number of beneficiary

12 |

Amount of ECTI on line 9 to be included in the beneficiary’s gross income (see instructions) |

12 |

|

13 |

Amount of tax credit on line 10 that the beneficiary is entitled to claim on its return (see instructions) . . |

13 |

|

Form 8805 (Rev.

Form |

8805 |

|

Foreign Partner’s Information Statement |

|

OMB No. |

|||

|

|

of Section 1446 Withholding Tax |

|

Copy C |

||||

|

|

|

|

|

||||

(Rev. November 2019) |

|

|

|

|

|

|

For Partner |

|

Department of the Treasury |

|

▶ Go to WWW.IRS.GOV/FORM8805 for instructions and the latest information. |

|

Attach to your federal |

||||

Internal Revenue Service |

|

|

|

|

|

|

tax return. |

|

For partnership’s calendar year |

, or tax year beginning |

, 20 |

, and ending |

, 20 |

||||

|

|

|

|

|

|

|||

1a |

Foreign partner’s name |

|

b U.S. identifying number |

5a Name of partnership |

b U.S. Employer |

|||

|

|

|

|

|

|

|

Identification Number (EIN) |

|

|

|

|

|

|||||

c Address (if a foreign address, see instructions) |

c Address (if a foreign address, see instructions) |

|||||||

2 |

Account number assigned by partnership (if any) |

6 Withholding agent’s name. If partnership is also the withholding agent, |

|

|

enter “SAME” and do not complete line 7. |

3Type of partner

4 |

Country code of partner (enter |

|

|

8a |

Check if the partnership identified on line 5a owns an interest in one or more partnerships . . . . . . . . . . . . . ▶ |

b Check if any of the partnership’s effectively connected taxable income (ECTI) is exempt from U.S. tax for the partner identified on line 1a ▶

9 |

Partnership’s ECTI allocable to partner for the tax year (see instructions) |

9 |

10Total tax credit allowed to partner under section 1446 (see instructions). Individual and corporate partners:

Claim this amount as a credit against your U.S. income tax on Form |

10 |

Schedule

11a Name of beneficiary |

c Address (if a foreign address, see instructions) |

bU.S. identifying number of beneficiary

12 |

Amount of ECTI on line 9 to be included in the beneficiary’s gross income (see instructions) |

12 |

|

13 |

Amount of tax credit on line 10 that the beneficiary is entitled to claim on its return (see instructions) . . |

13 |

|

Form 8805 (Rev.

Form |

8805 |

|

Foreign Partner’s Information Statement |

|

OMB No. |

|||

|

|

of Section 1446 Withholding Tax |

|

|

||||

(Rev. November 2019) |

|

|

|

Copy D |

||||

|

|

|

|

|

|

|||

Department of the Treasury |

|

▶ Go to WWW.IRS.GOV/FORM8805 for instructions and the latest information. |

|

For Withholding Agent |

||||

|

|

|

||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

For partnership’s calendar year |

, or tax year beginning |

, 20 |

, and ending |

, 20 |

||||

|

|

|

|

|

|

|||

1a |

Foreign partner’s name |

|

b U.S. identifying number |

5a Name of partnership |

b U.S. Employer |

|||

|

|

|

|

|

|

|

Identification Number (EIN) |

|

|

|

|

|

|||||

c Address (if a foreign address, see instructions) |

c Address (if a foreign address, see instructions) |

|||||||

2 |

Account number assigned by partnership (if any) |

6 Withholding agent’s name. If partnership is also the withholding agent, |

|

|

enter “SAME” and do not complete line 7. |

3Type of partner

4 |

Country code of partner (enter |

|

|

8a |

Check if the partnership identified on line 5a owns an interest in one or more partnerships . . . . . . . . . . . . . ▶ |

b Check if any of the partnership’s effectively connected taxable income (ECTI) is exempt from U.S. tax for the partner identified on line 1a ▶

9 |

Partnership’s ECTI allocable to partner for the tax year (see instructions) |

9 |

10Total tax credit allowed to partner under section 1446 (see instructions). Individual and corporate partners:

Claim this amount as a credit against your U.S. income tax on Form |

10 |

Schedule

11a Name of beneficiary |

c Address (if a foreign address, see instructions) |

bU.S. identifying number of beneficiary

12 |

Amount of ECTI on line 9 to be included in the beneficiary’s gross income (see instructions) |

12 |

|

13 |

Amount of tax credit on line 10 that the beneficiary is entitled to claim on its return (see instructions) . . |

13 |

|

Form 8805 (Rev.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | Form 8805 is used to report information for foreign partners regarding withholding tax for effectively connected taxable income (ECTI) under section 1446. |

| Filing Requirements | This form must be attached to Form 8804. It is essential for partnerships that have foreign partners to report their allocable share of ECTI and related tax credits. |

| Copies of the Form | Form 8805 has multiple copies, including Copy A for the IRS, and additional copies for partners, allowing them to keep their records. |

| Governing Law | The form is governed by IRS regulations applicable to U.S. income tax for foreign partnerships under section 1446. |

Guidelines on Utilizing 8805

Filling out Form 8805 requires careful attention to detail. Each section needs to be completed accurately to ensure compliance with tax regulations. Here’s a straightforward guide to help navigate the form efficiently.

- Start by entering the partnership's tax year at the top of the form, including the beginning and ending dates.

- For the foreign partner, fill in their name and U.S. identifying number in the appropriate boxes.

- Write down the name of the partnership, and its U.S. Employer Identification Number (EIN).

- If the partnership has a foreign address, reference the instructions for the correct format. Include the address (if applicable).

- Provide the account number assigned by the partnership, if one exists.

- Specify the type of partner. Check the appropriate box as per the instructions.

- Enter the two-letter country code of the partner.

- Complete the withholding agent's name. If the partnership is the withholding agent itself, write "SAME" and skip line 7.

- Input the withholding agent’s U.S. EIN.

- Check the boxes to indicate if the partnership owns an interest in other partnerships and if any of its effectively connected taxable income (ECTI) is exempt from U.S. tax.

- Provide the partnership's ECTI that is allocable to the partner for the tax year.

- Calculate and enter the total tax credit allowed to the partner under Section 1446.

- Proceed to Schedule T for Beneficiary Information, filling in the name and U.S. identifying number of the beneficiary along with their address.

- Lastly, report the amount of ECTI to be included in the beneficiary’s gross income and the amount of tax credit they are entitled to claim.

Once you've completed all the sections of Form 8805, review the information for accuracy before submitting. Each partner listed should receive their own copy for their records.

What You Should Know About This Form

What is Form 8805?

Form 8805, known as the Foreign Partner’s Information Statement, is an IRS document used primarily to report the income and withholding tax related to foreign partners in a U.S. partnership. The form provides critical information that helps ensure compliance with U.S. tax obligations for foreign entities and individuals who have invested in U.S. partnerships.

Who needs to file Form 8805?

Partnerships with foreign partners are required to file Form 8805. The purpose of the form is to report any effectively connected taxable income (ECTI) that the foreign partner has earned through the partnership. Additionally, it serves to detail the withholding tax that the partnership must remit to the IRS on behalf of the foreign partner.

When is Form 8805 due?

The deadline to file Form 8805 typically coincides with the partnership's tax return due date, including extensions. Partnerships need to attach this form to Form 8804, which is the Annual Return for Partnership Withholding Tax (Form 8804). It’s crucial to adhere to these deadlines to avoid penalties.

What information is required on Form 8805?

Form 8805 requires several key pieces of information, including the names and U.S. identifying numbers of the foreign partner and the partnership, the amount of ECTI allocable to the partner, and the total tax credit allowed under Section 1446. Additionally, the form asks for beneficiary information if applicable.

How does a foreign partner report income from Form 8805?

Foreign partners use the information reported on Form 8805 to prepare their tax returns. The amount listed as ECTI should be included in the gross income calculations on forms like 1040-NR for individuals or 1120-F for corporations. They can also claim credits for any taxes withheld as noted on the form.

What is meant by effectively connected taxable income (ECTI)?

Effectively Connected Taxable Income refers to income that is connected with a U.S. trade or business. For tax purposes, this is crucial because foreign partners are taxed differently based on the source of their income. ECTI establishes a tax obligation for foreign partners under U.S. tax law.

Can a partnership electronically file Form 8805?

Yes, partnerships can electronically file Form 8805 along with their other tax returns. It is advisable to check for the most current electronic filing options on the IRS website to ensure compliance. Electronic filing may expedite the process and reduce errors in submission.

What happens if Form 8805 is not filed?

If a partnership fails to file Form 8805, it may face penalties. The IRS imposes fines for inadequate or late filings, which can significantly impact the partnership's financial standing. Additionally, the foreign partner may also encounter complications with their U.S. tax obligations.

Where can one find instructions for completing Form 8805?

Instructions for completing Form 8805 can be found on the IRS website. It is essential to refer to the most current guidelines to ensure accurate reporting and compliance with all relevant tax laws. The site offers detailed information along with examples to assist filers.

Common mistakes

Completing Form 8805 can be complex, and mistakes often lead to delays or issues with the IRS. Here are nine common errors made when filling out this form.

First, many individuals fail to input the correct U.S. identifying number for the foreign partner. This number is crucial for identification and tax purposes. Without it, processing may be stalled.

Second, neglecting to provide a complete and accurate partnership name and its Employer Identification Number (EIN) is common. If these details do not match IRS records, it may cause complications.

Third, many overlook the requirement to specify the type of partner on line three. This information influences how the IRS processes the partnership's returns and the partner’s tax obligations.

Fourth, the two-letter country code for the foreign partner is critical. Incorrect or missing entries can lead to further inquiries from the IRS, extending the processing time.

Another frequent mistake is in the allocation of effectively connected taxable income (ECTI). Partners should ensure that the amount reported on line nine aligns with actual earnings. Discrepancies can trigger audits or requests for more documentation.

Additionally, many people skip checking boxes that apply to their situation, particularly regarding ownership interests in other partnerships or tax exemptions. This oversight can lead to missed benefits or improper filings.

Another mistake happens at the end of the form: partners often forget to include the tax credit amount allowed under Section 1446. This credit can significantly impact the partner's tax return, so it should not be overlooked.

Finally, not retaining copies of the submitted form is a common pitfall. Maintaining records ensures that partners have reference points for future filings or in case of IRS queries.

Understanding these errors and taking careful measures can help ensure smoother processing of Form 8805 and compliance with IRS regulations.

Documents used along the form

When dealing with the intricacies of U.S. tax law, particularly regarding foreign partners, it's essential to be aware of several key forms and documents that often accompany Form 8805. These documents serve various roles in ensuring compliance with tax obligations and provide necessary information to all parties involved in the partnership. Understanding these forms is critical for effective tax management and for preventing potential issues with the IRS.

- Form 8804: This form outlines the annual partnership withholding tax return for foreign partners. It is essential for reporting the total tax withheld on the effectively connected income that the partnership allocates to its foreign partners.

- Form 1040-NR: A U.S. Nonresident Alien Income Tax Return, this form is used by foreign partners to report their U.S. source income, including any effectively connected taxable income from the partnership.

- Form 1120-F: Foreign Corporation U.S. Income Tax Return must be filed by foreign corporations. This form is used to report income effectively connected with a U.S. trade or business.

- Schedule K-1: This schedule provides each partner with their share of income, deductions, and credits from the partnership. It’s crucial for partners to accurately report their tax obligations.

- Form 8805-C: The Notice of Partnership’s Effectively Connected Taxable Income Allocable to a Foreign Partner is typically provided to foreign partners to inform them about their share of the partnership's taxable income.

- Form 8833: Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b) may be filed by foreign partners to claim a tax benefit under a tax treaty between the U.S. and their home country.

- Form W-8BEN: This certificate is provided by foreign persons to establish their foreign status and claim a tax treaty benefit. It is critical for partnerships when facilitating withholding obligations.

- Form W-8IMY: This form is used by intermediaries to certify their foreign status and claim tax treaty benefits on behalf of their foreign partners.

- Form 1099: Information returns reporting various types of income that the partnership may distribute to its foreign partners, which can include interest, dividends, or rents.

In summary, navigating the complex landscape of taxation for foreign partners involves understanding and utilizing various vital forms along with Form 8805. By familiarizing oneself with these documents, partnerships can better manage their tax responsibilities and ensure that all partners comply with U.S. tax laws. Maintaining proper records and submitting these forms accurately is not just a best practice—it is essential for preventing audits and ensuring a smooth partnership experience.

Similar forms

The Form 8805 is a crucial document for reporting income and taxes related to foreign partners in a partnership. Several other forms serve similar purposes, either reporting income, tax withholding, or providing information to foreign partners or shareholders. Here are seven documents that are similar to Form 8805:

- Form 1040-NR: This is the U.S. Nonresident Alien Income Tax Return. It is used by nonresident aliens to report income sourced in the United States, including effectively connected income. Like Form 8805, it provides a way for foreign partners to report their U.S. income and claim credits.

- Form 1120-F: The U.S. Income Tax Return of a Foreign Corporation serves a similar role for foreign corporations earning income in the U.S. Similar to Form 8805, it outlines where these entities need to report their U.S. effectively connected income.

- Form 8804: This form is the Annual Return for Partnership Withholding Tax. It works closely with Form 8805, as it's used to report the total amount of tax withheld by a partnership on behalf of foreign partners. It helps ensure that the tax is properly accounted for.

- Form 1099-DIV: This form reports dividends and distributions to shareholders, including foreign entities. Like Form 8805, it’s focused on ensuring that information is accurately reported for income taxation purposes.

- Form 1065: This is the U.S. Return of Partnership Income. It reports the partnership's income, deductions, and credits. It complements Form 8805, as it provides the overall context for income distribution among partners, including foreign partners.

- Form 5471: Used by certain U.S. persons who are officers, directors, or shareholders in certain foreign corporations. This form is similar in that it helps report foreign income allocations and holdings, reflecting the international business interests similar to what a foreign partner might have.

- Form 8832: The Entity Classification Election form allows partnerships to elect how they are treated for tax purposes. This impacts how income and taxes are reported, aligning with the objectives of Form 8805 in terms of taxation and reporting for foreign partners.

Dos and Don'ts

When filling out Form 8805, consider these do's and don'ts to ensure accuracy and compliance.

- Do: Verify the foreign partner's name and U.S. identifying number before submission.

- Do: Ensure the partnership's Employer Identification Number (EIN) is correct.

- Do: Check the boxes regarding the ownership of interests in other partnerships.

- Do: Understand and report the effectively connected taxable income (ECTI) properly.

- Don't: Leave any fields blank if they are required; incomplete forms may delay processing.

- Don't: Use a foreign address in the wrong format; refer to instructions for proper handling.

- Don't: Misreport tax credits; make sure to follow the guidelines on claiming credits.

- Don't: Ignore the instructions on changes from previous years; they can affect your submission.

Misconceptions

- Form 8805 is only for foreign partners. This form is specifically designed for partnerships that have foreign partners, but U.S. partners may need to reference this form for reporting purposes, especially if they are part of the tax structure that includes foreign partners.

- Only the partnership needs to fill out Form 8805. While the partnership is primarily responsible for completing the form, individual foreign partners also have obligations, such as reporting income and tax credits on their returns.

- Filing Form 8805 is optional. This form is required for partnerships with foreign partners under U.S. tax law. Failing to file can result in penalties, so it is essential to understand the requirements.

- Form 8805 is only for reporting income. In addition to income reporting, Form 8805 involves calculating taxes withheld and tax credits allocated to foreign partners. It plays a role in ensuring compliance with tax withholding regulations.

- There are no penalties for errors. Mistakes on Form 8805 can lead to penalties for both the partnership and the foreign partners. It is crucial to review the form carefully before submission to avoid issues.

Key takeaways

Here are some important points regarding the 8805 form, which is used for reporting information about foreign partners in a partnership:

- Purpose: Form 8805 is designed for partnerships to report information related to foreign partners and their effectively connected taxable income (ECTI).

- Attachments: Attach Form 8805 to Form 8804 when filing. This is essential for proper processing by the IRS.

- Identification: Each foreign partner must provide their name, U.S. identifying number, and country code. This ensures accurate tracking of necessary tax payments.

- Tax Credit: Partners can claim their total tax credit on their individual tax returns, specifically on Form 1040-NR or Form 1120-F, depending on their status.

- Beneficiary Information: If applicable, provide details about beneficiaries receiving income from the partnership. Their information must also be accurately reported.

- Keep Copies: It’s important for the partnership and the partners to keep copies of the filed form for their records, ensuring all parties have the necessary documentation.

Browse Other Templates

Uc Login Portal - The admissions office can assist with any questions during the application process.

End of Day Security Checks - The SF 701 aids in the verification that security equipment is operational and effective.

Medical Lien Personal Injury Settlement - Settlement or judgment amounts are subject to the stipulations laid out in this document.