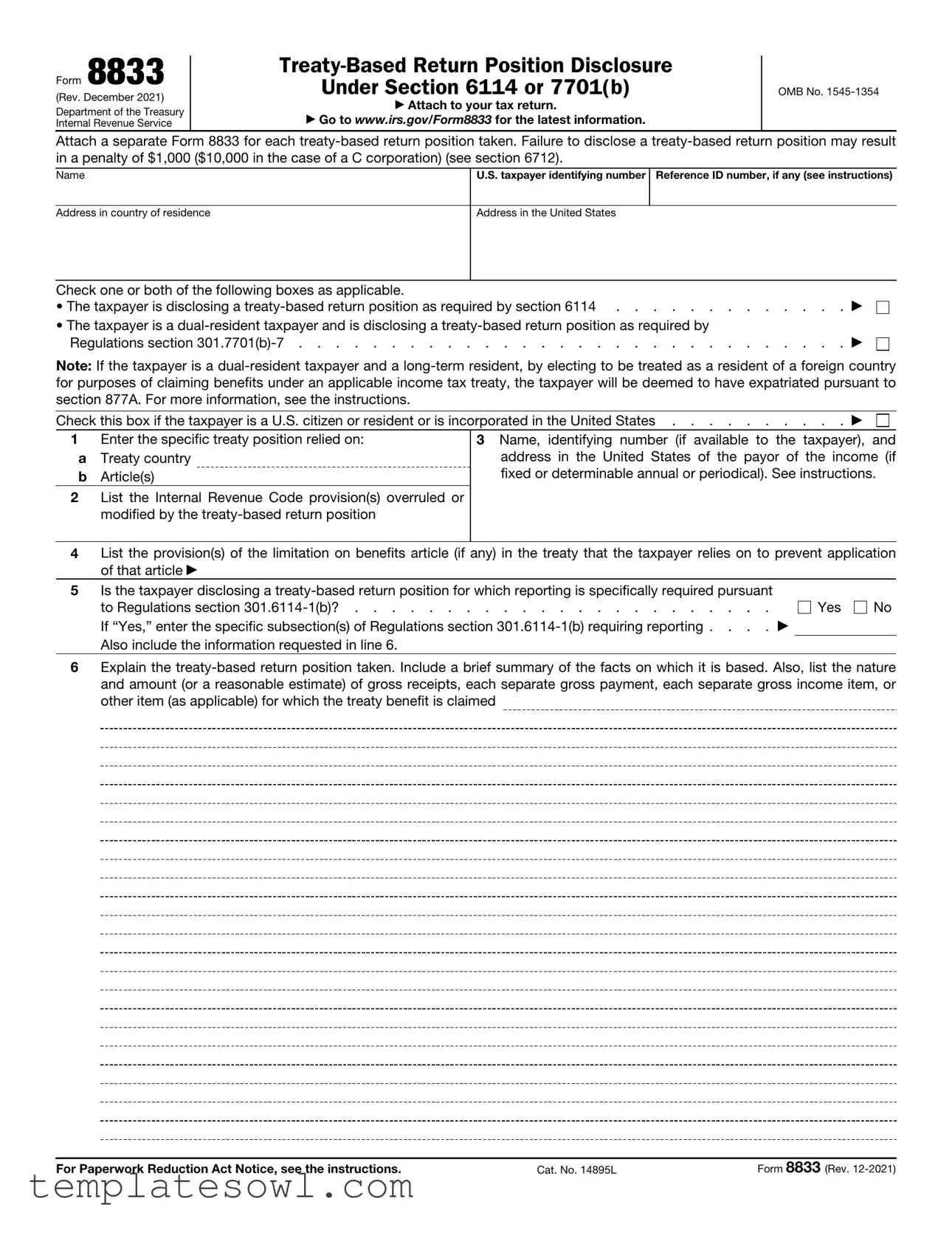

Fill Out Your 8833 Form

Form 8833 is an important document used by taxpayers to disclose treaty-based return positions as required under U.S. tax law. It serves a dual purpose: taxpayers must use it to report positions that modify or overrule Internal Revenue Code provisions through international tax treaties under section 6114, and it also aids dual-resident taxpayers in disclosing necessary information under regulations pertaining to residency. Each taxpayer needs to complete a separate Form 8833 for each treaty-based position, providing critical details such as treaty country, relevant IRS code sections impacted, and the specific treaty articles invoked. The form demands thorough documentation, requiring taxpayers to summarize the relevant facts and financial details supporting their claims for treaty benefits. Failure to adequately disclose a treaty-based return position can lead to significant penalties. Therefore, understanding the requirements for filing Form 8833 is essential for compliance and to avoid potential fines. This article will explore the form's structure, the specific reporting obligations, and the implications for both U.S. residents and dual-resident taxpayers.

8833 Example

Form 8833

(Rev. December 2021)

Department of the Treasury

Internal Revenue Service

Under Section 6114 or 7701(b)

▶Attach to your tax return.

▶Go to www.irs.gov/Form8833 for the latest information.

OMB No.

Attach a separate Form 8833 for each

Name

U.S. taxpayer identifying number

Reference ID number, if any (see instructions)

Address in country of residence

Address in the United States

Check one or both of the following boxes as applicable. |

|

|

• The taxpayer is disclosing a |

. . . . . |

. ▶ |

• The taxpayer is a |

|

|

Regulations section |

. . . . . |

. ▶ |

Note: If the taxpayer is a

Check this box if the taxpayer is a U.S. citizen or resident or is incorporated in the United States . . . . . . . . . . ▶

1Enter the specific treaty position relied on: a Treaty country

b Article(s)

2List the Internal Revenue Code provision(s) overruled or modified by the

3Name, identifying number (if available to the taxpayer), and address in the United States of the payor of the income (if fixed or determinable annual or periodical). See instructions.

4List the provision(s) of the limitation on benefits article (if any) in the treaty that the taxpayer relies on to prevent application of that article ▶

5Is the taxpayer disclosing a

to Regulations section |

Yes |

No |

If “Yes,” enter the specific subsection(s) of Regulations section |

|

|

Also include the information requested in line 6. |

|

|

6Explain the

For Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 14895L |

Form 8833 (Rev. |

[This page left blank intentionally]

Form 8833 (Rev. |

Page 3 |

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8833 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8833.

General Instructions

Purpose of Form

Form 8833 must be used by taxpayers to make the

Who Must File

Generally, a taxpayer who takes a

A taxpayer takes a

Reporting specifically required. Regulations section

•That a nondiscrimination provision of the treaty prevents the application of an otherwise applicable Code provision, other than with respect to making an election under section 897(i);

•That a treaty reduces or modifies the taxation of gain or loss from the disposition of a U.S. real property interest;

•That a treaty reduces or modifies the branch profits tax (section 884(a)) or the tax on excess interest (section 884(f)(1) (B));

•That a treaty exempts from tax or reduces the rate of tax on dividends or interest paid by a foreign corporation that are

•That a treaty exempts from tax or reduces the rate of tax on fixed or determinable annual or periodical (FDAP) income that a foreign person receives from a U.S. person, but only if:

(1)The amount is not properly reported on Form

(2)The foreign person is related to the payor under section 267(b) or section 707(b) and receives income exceeding $500,000, in the aggregate, from the payor and the treaty contains a limitation on benefits article; or

(3)The treaty imposes additional conditions for the entitlement of treaty benefits (for example, the treaty requires the foreign corporation claiming a preferential rate on dividends to meet ownership percentage and ownership period requirements);

•That income effectively connected with a U.S. trade or business of a taxpayer is not attributable to a permanent establishment or a fixed base in the United States;

•That a treaty modifies the amount of business profits of a taxpayer attributable to a permanent establishment or a fixed base in the United States;

•That a treaty alters the source of any item of income or deduction (unless the taxpayer is an individual);

•That a treaty grants a credit for a foreign tax which is not allowed by the Code;

•That the residency of an individual is determined under a treaty and apart from the Code. See

Exceptions from reporting. Regulations section

specifically reportable, and thus careful review of the regulations is advised. In addition, some waivers do not apply to positions that are specifically required to be reported under these form instructions. See Reporting specifically required by Form 8833 instructions, later.

Positions for which reporting is waived include, but are not limited to, the following. See Regulations section

•That a treaty reduces or modifies the taxation of income derived by an individual from dependent personal services, pensions, annuities, social security, and other public pensions, as well as income derived by artists, athletes, students, trainees, or teachers;

•That a Social Security Totalization Agreement or Diplomatic or Consular Agreement reduces or modifies the income of a taxpayer;

•That a treaty exempts a taxpayer from the excise tax imposed by section 4371, but only if certain conditions are met (for example, the taxpayer has entered into an insurance excise tax closing agreement with the IRS);

•That a treaty exempts from tax or reduces the rate of tax on FDAP income, if the beneficial owner is an individual or governmental entity;

•If a partnership, trust, or estate has disclosed a treaty position that the partner or beneficiary would otherwise be required to disclose;

•Unless modified by the instructions

below, that a treaty exempts from tax or reduces the rate of tax on FDAP income that is properly reported on Form

a.Related party (within the meaning of section 6038A(c)(2)) from a reporting corporation within the meaning of section 6038A(a) (a domestic corporation that is 25% foreign owned and required to file Form 5472);

b.Beneficial owner that is a direct account holder of a U.S. financial institution or qualified intermediary, or a direct partner, beneficiary, or owner of a withholding foreign partnership or trust, from that U.S. financial institution, qualified intermediary, or withholding foreign partnership or withholding foreign trust (whether the Form

c.Taxpayer that is not an individual or a State, if the amounts are not received through an account with an intermediary or with respect to an interest in a partnership or a simple or grantor trust, and if the amounts do not total more than $500,000 for the tax year.

Form 8833 (Rev. |

Page 4 |

Reporting specifically required by Form 8833 instructions. The following are amounts for which a

•Amounts described in paragraph a or c, above, that are received by a corporation that is a resident under the domestic law of both the United States and a foreign treaty jurisdiction (a dual- resident corporation).

•Amounts described in paragraph a or c, above, that are received by a corporation that is a resident of both the jurisdiction whose treaty is invoked and another foreign jurisdiction that has an income tax treaty with that treaty jurisdiction. See Revenue Ruling

•Amounts described in paragraph a or c, above, that are received by a foreign collective investment vehicle that is a contractual arrangement and not a person under foreign law. See Example 7 of Regulations section

•Amounts described in paragraph a or c, above, that are received by a foreign “interest holder” in a “domestic reverse hybrid entity,” as those terms are used in Regulations section

If you are an individual who is a

for U.S. competent authority assistance. See Rev. Proc.

If you choose to be treated as a resident of a foreign country under an income tax treaty, you are still treated as a U.S. resident for purposes other than figuring your U.S. income tax liability (see Regulations section

When and Where To File

Attach Form 8833 to your tax return (Form

Specific Instructions

U.S. Taxpayer Identifying Number

The identifying number of an individual is his or her social security number or individual taxpayer identification number. The identifying number of all others is their employer identification number.

For more information about identifying numbers, see the instructions for the tax return with which this form is filed.

Reference ID Number

If the taxpayer is a foreign corporation, enter any reference ID number assigned to the foreign corporation by a U.S. person with respect to which information reporting is required (for example, on Form 5471 or Form 5472).

Address in Country of Residence

Enter the information in the following order: city, province or state, and country. Follow the country’s practice for entering the postal code. Please do not abbreviate the country name.

Termination of U.S. Residency

If you are a

year your status as an LTR ends. For additional information, see the Instructions for Form 8854, Initial and Annual Expatriation Statement, and Pub. 519, U.S. Tax Guide for Aliens.

Line 3

Income that is fixed or determinable annual or periodical includes interest (other than original issue discount), dividends, rents, premiums, annuities, salaries, wages, and other compensation. For more information (including other items of income that are fixed or determinable annual or periodical), nonresident aliens and dual- resident taxpayers filing as nonresident aliens should see section 871(a) and Regulations section

Line 4

Name the specific test in the Limitations on Benefits (LOB) article that is met. See Table 4, Limitation on Benefits, at IRS.gov/Individuals/International-

Line 5

If the taxpayer answers “Yes” to the question on line 5, the taxpayer must enter the subsection of Regulations section

Line 6

All taxpayers taking a

Form 8833 (Rev. |

Page 5 |

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must

be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual and business taxpayers filing this form is approved under OMB control numbers

for all other taxpayers who file this form is shown below.

Recordkeeping . . . . 3 hr., 7 min.

Learning about the

law or the form . . . . 1 hr., 35 min.

Preparing and sending

the form to the IRS . . 1 hr., 43 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form 8833 is used by taxpayers to disclose treaty-based return positions required by U.S. tax laws. |

| Mandatory Filing | Taxpayers must file the form if they are taking a treaty position overruled by U.S. internal revenue code sections. |

| Penalties | Failure to disclose a treaty-based return position can incur a penalty of $1,000, or $10,000 for C corporations. |

| Form Attachments | Each treaty-based position requires a separate Form 8833 to be attached to the relevant tax return. |

| Information Required | Taxpayers need to provide information like treaty country, applicable Internal Revenue Code provisions, and a detailed explanation of the position taken. |

| Dual-Resident Taxpayers | Individuals considered residents in both the U.S. and another country must disclose treaty positions when filing Form 8833. |

| Regulatory Reference | The form is governed by sections 6114 and 7701(b) of the Internal Revenue Code, as well as specific regulations under IRS guidelines. |

| Filing Deadline | Form 8833 must be filed along with other tax returns by the tax return's due date to avoid complications. |

| Exceptions | Some treaty positions may not require reporting under specific regulatory waivers, reducing the burden on taxpayers. |

Guidelines on Utilizing 8833

Filling out Form 8833 can seem complex, but breaking it down into manageable steps makes it simpler. This form is crucial for disclosing treaty-based return positions to the IRS. Make sure to have your tax return information handy, as you will need to attach this form when you file your taxes.

- Begin with your personal information:

- Enter your name.

- Provide your U.S. taxpayer identifying number (such as your Social Security Number).

- If applicable, include a reference ID number.

- List your address in your country of residence.

- Also, include your address in the United States.

- Check the appropriate boxes to indicate whether you are:

- Disclosing a treaty-based return position as required by section 6114.

- A dual-resident taxpayer disclosing a return position under Regulations section 301.7701(b)-7.

- If you wish, check the box confirming you are a U.S. citizen, resident, or incorporated in the United States.

- Fill out the section regarding the specific treaty position you are relying on:

- Identify the treaty country.

- List the article(s) of the treaty relevant to your position.

- Provide the details of any Internal Revenue Code provisions you are modifying or overruling with this treaty-based return position.

- Name the payor of the income, include their identifying number if available, and provide their address in the U.S.

- Identify any relevant provisions of the limitation on benefits article of the treaty you are relying on.

- Answer whether you are disclosing a treaty position for which reporting is specifically required. If yes, include the applicable subsection.

- In the explanation section, summarize your treaty-based return position and include the nature and amount of gross receipts or income items related to the treaty benefit you are claiming.

Once you’ve completed the form, attach it to your tax return and send it to the proper IRS address. Properly filing this form can help ensure that you take advantage of treaty benefits without facing penalties. Keep a copy for your records.

What You Should Know About This Form

What is Form 8833 and when is it used?

Form 8833, also known as the Treaty-Based Return Position Disclosure, is used by taxpayers to disclose a treaty-based position. This form is important when a taxpayer claims that a tax treaty between the United States and another country modifies or overrides a provision of the Internal Revenue Code. Individuals and businesses must file this form alongside their tax returns to avoid potential penalties.

Who needs to file Form 8833?

Generally, any taxpayer who is taking a treaty-based return position must file Form 8833. This includes both individual and corporate taxpayers that are relying on a tax treaty for certain benefits that affect their tax obligations. Dual-resident taxpayers, those considered residents of both the U.S. and another country, must also file this form to disclose their treaty positions.

What happens if I fail to disclose my treaty-based return position?

Failing to disclose a treaty-based return position can result in significant penalties. The Internal Revenue Service (IRS) can impose a penalty of $1,000 for individuals and up to $10,000 for corporations. It is critical to submit Form 8833 to ensure compliance with tax laws and avoid these penalties.

How many times must I file Form 8833?

A separate Form 8833 must be filed for each treaty-based position taken in a tax year. However, if multiple payments or income items come from the same source and relate to the same treaty position, they can be reported together as a single item for simplicity.

Where do I submit Form 8833?

Form 8833 should be attached to your main tax return, whether it is Form 1040-NR for non-residents or another form like 1120-F for corporations. If you are not otherwise required to file a tax return, you must still submit Form 8833 to the IRS Service Center that corresponds to your normal filing location to properly disclose your treaty position.

What information do I need to provide on Form 8833?

When completing Form 8833, taxpayers must provide detailed information about the treaty-based position they are taking. This includes naming the specific treaty, identifying the articles being relied upon, as well as describing the facts of the situation and the income impacted. Providing accurate and thorough information is essential to ensure that the IRS understands your position clearly.

What is a dual-resident taxpayer and how does it relate to Form 8833?

A dual-resident taxpayer is an individual who is considered a tax resident in both the United States and another country under each country's tax laws. If such an individual determines they are a resident of the foreign country under a relevant tax treaty, they can claim benefits as a foreign resident. They must then file Form 8833 alongside Form 1040-NR to disclose this position to the IRS.

Common mistakes

Filling out Form 8833 is a crucial step for taxpayers claiming treaty benefits. Unfortunately, common mistakes can lead to issues or delays. One frequent mistake is failing to attach a separate Form 8833 for each treaty-based return position taken. It is vital to understand that each position must be reported on an individual form. Skipping this could lead to misunderstandings with the IRS and potentially incur penalties.

Another mistake often made is overlooking the proper marking of the applicable boxes on the form. Taxpayers must clearly identify if they are disclosing a general treaty-based return position or if they are dual-resident taxpayers. Neglecting to check the correct box may confuse the IRS regarding the taxpayer's intentions, resulting in further complications.

In addition, some individuals do not accurately specify the treaty country and relevant articles when detailing their treaty position. This part of the form is essential as it establishes the basis for the claimed benefits. If the information provided is vague or incorrect, it may lead to a rejection of the treaty claim.

A common error might also include failing to provide sufficient details in the explanation of the treaty-based return position. Simply stating that a treaty applies is insufficient. Taxpayers should include the specific facts and the nature of income involved. A comprehensive explanation demonstrates a clear understanding of how the treaty applies to their situation.

On Line 5, taxpayers are required to indicate if specific reporting is mandated under regulations. A misunderstanding or incorrect response here can create issues down the line. It is crucial to read the instructions carefully and answer each question to the best of one’s ability.

Finally, many taxpayers do not take the time to review the instructions thoroughly before submitting the form. Misinterpreting or overlooking important details in the instructions can lead to inaccuracies. Therefore, double-checking each section ensures that the form is completed correctly and reduces the likelihood of complications with tax filings.

Documents used along the form

Form 8833 is utilized by taxpayers to disclose treaty-based return positions related to changes in tax liability due to international tax treaties. Below is a list of additional documents and forms that may be commonly associated with Form 8833. Each serves a specific purpose in the taxation process.

- Form 1040-NR: This is the U.S. Nonresident Alien Income Tax Return. It is required for individuals who must file a return but are considered nonresident aliens for tax purposes. It provides the framework to report income and claim deductions under the rules applicable to nonresidents.

- Form 8854: Used for the Initial and Annual Expatriation Statement, this form is necessary when a taxpayer relinquishes U.S. citizenship or terminates long-term residency. It reports any potential tax implications of expatriation.

- Form 5472: This form is filed by foreign corporations with U.S. owners. It helps to report transactions with related parties, ensuring compliance with U.S. tax laws regarding foreign ownership and operation of domestic corporations.

- Form W-8BEN: This form certifies that the beneficial owner is a foreign person and claims benefits under an income tax treaty. It helps to establish eligibility for reduced withholding tax rates on certain types of U.S.-sourced income.

- Form W-8BEN-E: Similar to Form W-8BEN but for entities, this form is used by foreign entities to claim tax treaty benefits and reduce withholding rates on U.S.-sourced income. It provides necessary certifications regarding the entity's status and eligibility.

These forms and documents enhance the reporting and compliance process for international taxpayers by ensuring that treaty-based positions and associated implications are properly disclosed and managed according to U.S. tax regulations.

Similar forms

- Form 1040-NR: This form is utilized by nonresident aliens to report their U.S. income. Similar to Form 8833, it requires specific disclosures about income and deductions, but focuses on reporting overall income tax liability instead of treaty positions.

- Form 5471: Used by U.S. citizens and residents to report their ownership in foreign corporations. Like Form 8833, it necessitates detailed reporting to the IRS concerning income and tax treaties affecting taxation.

- Form 8840: Also known as the Closer Connection Exception Statement for Aliens, this form is used by certain individuals living abroad. It shares similarities in that it details residency status and tax obligations under U.S. law, paralleling the residency disclosures of Form 8833.

- Form 8834: This form claims the electric vehicle credit. While its focus is on individuals or businesses claiming tax credits rather than treaty positions, both forms require detailed disclosure of tax-related facts for eligibility determinations.

- Form W-8BEN: Foreign individuals use this form to establish their foreign status and claim treaty benefits. Like Form 8833, it helps facilitate the claiming of treaty benefits by providing the IRS with necessary data related to income and residency.

Dos and Don'ts

When completing Form 8833, it is important to follow specific guidelines to ensure accurate submission. Below are seven recommendations and cautionary notes to consider.

- Attach the form to your tax return. Ensure that you include Form 8833 with the appropriate tax form, such as Form 1040-NR or Form 1120-F.

- Fill out only one form per treaty position. If you are taking multiple treaty-based return positions, submit a separate Form 8833 for each one.

- Provide detailed explanations. Clearly explain the treaty-based return position you are claiming, including necessary background and income details.

- Check for accuracy. Double-check all entries, especially your identification numbers, to avoid delays or penalties.

Conversely, certain actions should be avoided:

- Do not leave blank sections. Ensure all applicable sections are completed, even if reporting is waived for some items.

- Avoid submitting the form late. Timeliness is crucial; submit Form 8833 with your tax return by the deadline.

- Do not ignore treaty requirements. Familiarize yourself with the specific treaty articles you are claiming benefits under, as misinterpretations can lead to complications.

Misconceptions

When it comes to Form 8833, there are several prevalent misconceptions that can lead to confusion for taxpayers. Here are six of the most common misunderstandings:

- Form 8833 is only for foreign taxpayers. Many believe this form is exclusively for those residing outside the U.S. In fact, it’s designed for U.S. taxpayers who take advantage of tax treaties that can reduce their tax liability.

- Filing Form 8833 guarantees tax benefits. While Form 8833 is a necessary step to disclose treaty benefits, simply filing the form does not guarantee that the IRS will approve the benefits claimed. Eligibility under the treaty must still be established.

- Only those with dual residency need to file it. Some taxpayers think that only individuals who are dual residents need to worry about this form. However, any taxpayer claiming a treaty benefit must disclose their treaty position, regardless of residency status.

- One Form 8833 file is sufficient for multiple claims. Another misconception is that a single Form 8833 can cover multiple treaty positions in one year. In reality, a separate form must be submitted for each treaty claim made in a given tax year.

- There are no penalties for not filing. Many believe failing to file Form 8833 will go unchecked. However, not disclosing a treaty-based position can result in penalties, including fines of up to $1,000, or $10,000 for C corporations.

- Once filed, the form does not require updates. Another common error is the belief that once Form 8833 is filed, it doesn't need to be revisited. It is essential to update the form whenever there are changes to the treaty position or related information.

Understanding these misconceptions can help taxpayers navigate their obligations regarding Form 8833 more effectively, ensuring they remain compliant and minimize potential issues with the IRS.

Key takeaways

Filling out and using Form 8833 is essential for taxpayers who want to disclose their treaty-based return positions. Below are some key takeaways to keep in mind:

- Separate Forms for Each Position: A separate Form 8833 must be attached to your tax return for each treaty-based return position you take. If multiple items stem from the same source, they can be combined for reporting.

- Importance of Accurate Disclosure: Disclosing your treaty position is crucial. Failure to do so can result in penalties. For individuals, this can total up to $1,000, while it escalates to $10,000 for C corporations.

- Criteria for Reporting: Not all treaty-based positions require the same level of reporting. Numerous positions that benefit from treaty agreements may need to be disclosed, while others might be exempt.

- Residency Implications: For dual-resident taxpayers opting for treaty benefits in a foreign country, note that this decision may terminate U.S. residency for tax purposes. Certain forms, like Form 8854, may need to be filed to comply with this change.

- Specific Lines for Information: When completing the form, specific sections require details regarding the treaty relied upon, the relevant provisions of the Internal Revenue Code, and any exceptions that apply. This ensures that your position is clear and that you meet federal requirements.

- Filing the Form: Always attach Form 8833 to your main tax return (such as Form 1040-NR or Form 1120-F). If you aren’t otherwise obligated to submit a tax return, you still need to file Form 8833 at the appropriate IRS Service Center.

Browse Other Templates

Meaning Behind Howl's Moving Castle - Throughout the narrative, tension rises as the conflict between good and evil unfolds, leading to critical confrontations.

Who Is Exempt From Workers' Compensation Insurance California - Only active contractors are eligible to submit the 13L 50 form; inactive licenses disqualify you.