Fill Out Your 886 H Dep Form

Form 886-H-DEP serves as a crucial document for taxpayers seeking to claim dependents on their tax returns. This form requires individuals to provide supporting documentation that verifies their relationship and the financial support provided to qualifying dependents. The form addresses various situations, including cases of divorce, legal separation, or custody disputes. Taxpayers must submit a range of documents, which can vary according to their specific circumstances. For example, if parents share custody and provided more than half of a child’s support, both parents must furnish appropriate legal documents, like custody orders or divorce decrees. Intended for use with the Internal Revenue Service, the 886-H-DEP also delineates requirements based on the type of dependent, whether it be a qualifying child or a qualifying relative. The form includes guidelines for establishing residency and support levels, making it essential for anyone aiming to maximize their tax benefits through dependent claims.

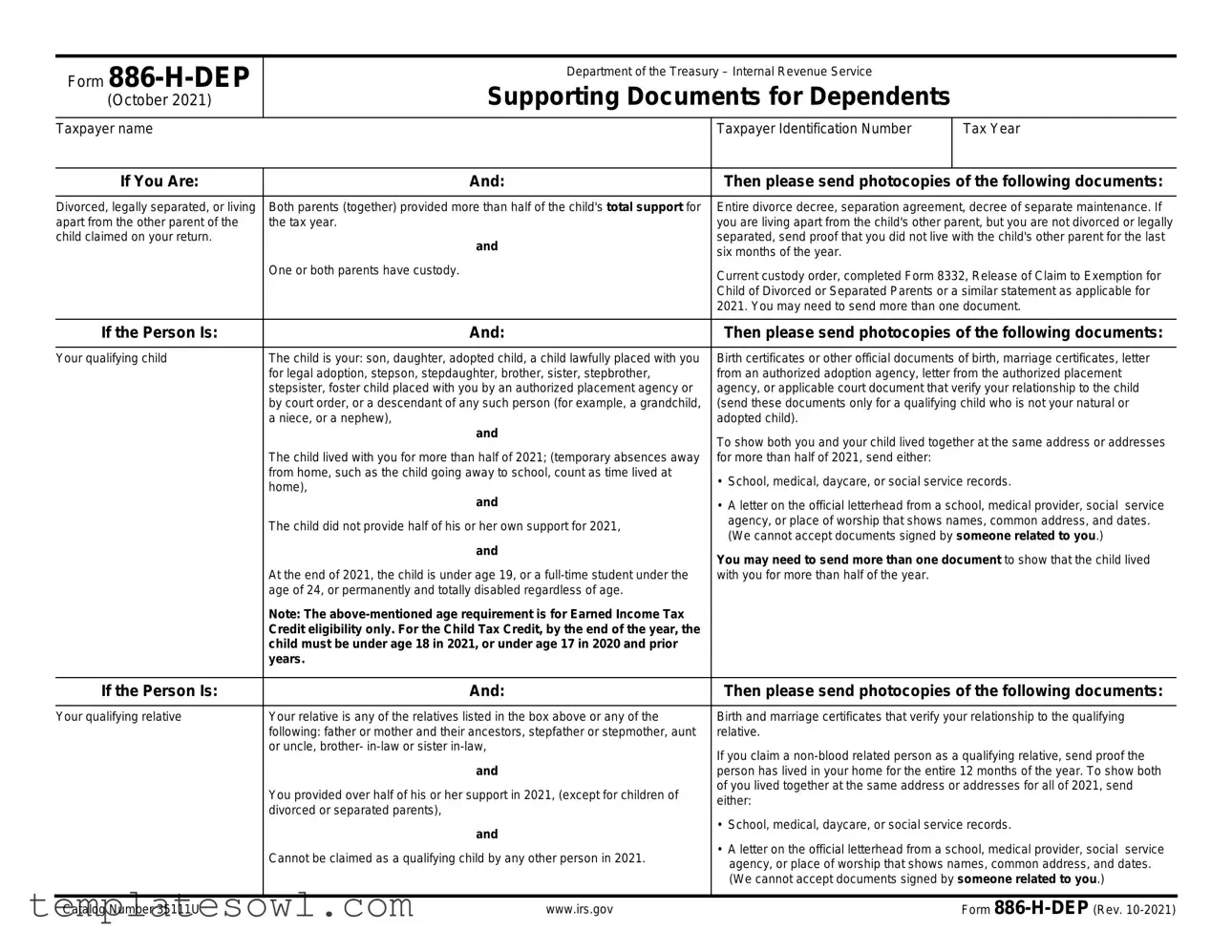

886 H Dep Example

Form

(October 2021)

Department of the Treasury – Internal Revenue Service

Supporting Documents for Dependents

Taxpayer name |

Taxpayer Identification Number |

Tax Year |

|

|

|

If You Are: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Divorced, legally separated, or living |

Both parents (together) provided more than half of the child's total support for |

Entire divorce decree, separation agreement, decree of separate maintenance. If |

|

apart from the other parent of the |

the tax year. |

you are living apart from the child's other parent, but you are not divorced or legally |

|

child claimed on your return. |

and |

separated, send proof that you did not live with the child's other parent for the last |

|

|

six months of the year. |

||

|

|

||

|

One or both parents have custody. |

Current custody order, completed Form 8332, Release of Claim to Exemption for |

|

|

|

||

|

|

Child of Divorced or Separated Parents or a similar statement as applicable for |

|

|

|

2021. You may need to send more than one document. |

|

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Your qualifying child |

The child is your: son, daughter, adopted child, a child lawfully placed with you |

Birth certificates or other official documents of birth, marriage certificates, letter |

|

|

for legal adoption, stepson, stepdaughter, brother, sister, stepbrother, |

from an authorized adoption agency, letter from the authorized placement |

|

|

stepsister, foster child placed with you by an authorized placement agency or |

agency, or applicable court document that verify your relationship to the child |

|

|

by court order, or a descendant of any such person (for example, a grandchild, |

(send these documents only for a qualifying child who is not your natural or |

|

|

a niece, or a nephew), |

adopted child). |

|

|

and |

To show both you and your child lived together at the same address or addresses |

|

|

|

||

|

The child lived with you for more than half of 2021; (temporary absences away |

for more than half of 2021, send either: |

|

|

from home, such as the child going away to school, count as time lived at |

• |

School, medical, daycare, or social service records. |

|

home), |

||

|

|

|

|

|

and |

• |

A letter on the official letterhead from a school, medical provider, social service |

|

The child did not provide half of his or her own support for 2021, |

|

agency, or place of worship that shows names, common address, and dates. |

|

|

(We cannot accept documents signed by someone related to you.) |

|

|

and |

|

|

|

You may need to send more than one document to show that the child lived |

||

|

At the end of 2021, the child is under age 19, or a |

||

|

with you for more than half of the year. |

||

|

age of 24, or permanently and totally disabled regardless of age. |

|

|

|

Note: The |

|

|

|

Credit eligibility only. For the Child Tax Credit, by the end of the year, the |

|

|

|

child must be under age 18 in 2021, or under age 17 in 2020 and prior |

|

|

|

years. |

|

|

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Your qualifying relative |

Your relative is any of the relatives listed in the box above or any of the |

Birth and marriage certificates that verify your relationship to the qualifying |

|

|

following: father or mother and their ancestors, stepfather or stepmother, aunt |

relative. |

|

|

or uncle, brother- |

If you claim a |

|

|

and |

||

|

person has lived in your home for the entire 12 months of the year. To show both |

||

|

You provided over half of his or her support in 2021, (except for children of |

of you lived together at the same address or addresses for all of 2021, send |

|

|

either: |

||

|

divorced or separated parents), |

||

|

• |

School, medical, daycare, or social service records. |

|

|

and |

||

|

• |

A letter on the official letterhead from a school, medical provider, social service |

|

|

Cannot be claimed as a qualifying child by any other person in 2021. |

||

|

|

agency, or place of worship that shows names, common address, and dates. |

|

|

|

|

|

|

|

|

(We cannot accept documents signed by someone related to you.) |

|

|

|

|

Catalog Number 35111U |

www.irs.gov |

|

Form |

*** Note - Send Us Copies of the Following Documents as Proof You Provided More Than Half of Your Dependent's Total Support: ***

•A statement of account from a child support agency.

•A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for the year.

•Rental agreements or a statement showing the fair rental value of your residence (proof of lodging cost).

•Utility and repair bills (proof of household expenses) with canceled checks or receipts.

•Daycare, school, medical records, or bills (proof of child's support) with canceled checks or receipts.

•Clothing bills (proof of child's support) with canceled checks or receipts.

Catalog Number 35111U |

www.irs.gov |

Form |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The Form 886-H-DEP is used to provide support documentation for dependents claimed on a taxpayer's return. It helps the IRS verify eligibility for tax benefits associated with dependents. |

| Applicable Taxpayer Situations | This form applies to various family situations, including divorced, legally separated, or single parents. Each scenario requires specific documentation to validate the claim of a dependent. |

| Required Documentation | Taxpayers must submit photocopies of pertinent documents, such as birth certificates, custody orders, and any other official records that demonstrate the relationship and support provided to the dependent. |

| Support Requirement | To claim a dependent, the taxpayer must have provided more than half of the dependent's total support for the tax year. Documentation may include utility bills, medical expenses, or school fees. |

| Eligibility Age Limits | The eligibility for claiming a child as a dependent varies based on age. For the Earned Income Tax Credit, the child must be under age 19 or a full-time student under age 24, while the Child Tax Credit considers children under age 18. |

Guidelines on Utilizing 886 H Dep

Completing Form 886-H-DEP requires careful attention to detail as you compile the necessary supporting documents for your dependents. Follow these steps to ensure you have everything you need to assist the IRS in verifying your claim.

- Begin by entering your taxpayer name, taxpayer identification number, and tax year at the top of the form.

- Determine your situation (for example, if you are divorced or separated) and identify the applicable requirements for supporting documentation.

- If divorced or legally separated, obtain and photocopy your entire divorce decree or separation agreement. If you live apart but are not divorced, gather proof that you did not live with your child's other parent for the last six months of the year.

- If you share custody of your child, gather the current custody order or completed Form 8332, or a similar statement.

- If claiming a qualifying child, prepare birth certificates or other official documents to verify your relationship, such as marriage certificates or adoption letters.

- Collect any records that prove the child lived with you for more than half of the year—these could be school, medical, or daycare records.

- Gather documentation that shows the child did not provide over half of their support during the year. This could be financial statements or receipts related to their care.

- If your qualifying child is between ages 19 and 24 and a full-time student, prepare documents showing their enrollment.

- If claiming a qualifying relative, gather relevant birth or marriage certificates to verify your relationship.

- Ensure you have documentation, such as school, medical, or social service records, that indicates both you and your qualifying relative lived together for the full year.

- Document your financial support of the dependent with statements like rental agreements, utility bills, and daycare records. Make sure to include canceled checks or receipts where available.

Once you have gathered all the necessary documents, review everything for completeness and accuracy. Then, you can proceed to submit the form along with your tax return to the IRS. Keeping your records organized will make this process smoother in case of any questions or audits in the future.

What You Should Know About This Form

What is Form 886-H-DEP and why do I need it?

Form 886-H-DEP is used by taxpayers in the United States to provide supporting documentation for dependents claimed on their tax returns. This form helps the Internal Revenue Service (IRS) verify that taxpayers qualify for certain tax benefits, such as the Child Tax Credit and the Earned Income Tax Credit. Filing it accurately ensures that you receive the proper credits and deductions, ultimately affecting your tax liability.

What documents do I need to provide for my qualifying child?

If you are claiming a qualifying child, you must provide several specific documents. This includes birth certificates or adoption papers to prove your relationship with the child. Additionally, records showing that the child lived with you for more than half of the tax year should be included. Acceptable documentation might include school or medical records, or letters from relevant agencies verifying the child's address and your relationship. It’s important to ensure that these documents clearly establish your eligibility.

What if my child's other parent also claims them?

If both parents attempt to claim the same child as a dependent, only one may successfully do so in a given year unless there’s a legal agreement in place. You must provide proof of your custody arrangement, such as a custody order or a completed Form 8332, which releases the claim on the exemption from the other parent. This protects your claim and ensures you receive any applicable tax benefits.

How do I prove that I provided more than half of my dependent’s support?

To demonstrate that you provided over half of your dependent's support, you will need to compile and submit various documents. This can include statements from a child support agency, rental agreements, utility bills, and receipts for daycare or medical expenses. Collecting a diverse range of financial records will help assert your claim and validate your support contributions effectively.

Common mistakes

Filling out Form 886-H-DEP can be challenging. Many individuals make mistakes that can lead to delays or complications in claiming dependents. One common error is failing to include all necessary supporting documents. Form 886-H-DEP requires specific papers to prove the relationship and support provided for the child or relative. Without these files, the IRS may question the dependent claim.

Another frequent mistake occurs when parents do not properly document custody arrangements. If parents are divorced or separated, they must provide the entire divorce decree or separation agreement. If they are living apart but not divorced, proof of not living together for the last six months is crucial. People often overlook this detail, which can jeopardize their claims.

Many filers submit documents that are not sufficiently official. For proof of relationship, the IRS looks for birth certificates, marriage certificates, or legal adoption letters. However, not all documents are valid. For instance, documents signed by someone related to the taxpayer are not acceptable. This misunderstanding leads people to present inadequate evidence.

Additionally, another common mistake is assuming that temporary absences do not count toward the time a child lived with them. For tax purposes, if a child was away for school or other reasons, those days still count as time spent living at home. People often miscalculate this, submitting inaccurate dates and affecting their claims.

Claiming a relative can also pose challenges. Taxpayers sometimes fail to correctly demonstrate that they provided more than half of the qualifying relative's support. This requires specific documentation, such as a statement from a child support agency or proof of household expenses. Without these documents, errors in the claim may occur.

The age requirements can cause confusion as well. To qualify for certain credits, the child must either be under age 19, a full-time student under age 24, or permanently disabled. Taxpayers sometimes mistakenly rely on incorrect age information, which can lead to rejected claims. It’s important to be aware of the current guidelines, particularly when they can change yearly.

Moreover, some individuals fail to ensure that the dependent cannot be claimed by another taxpayer. If another person, such as a relative, can legally claim the child, the dependent's claim will ultimately be invalidated. It’s essential to verify this to avoid problems with the IRS.

Lastly, many filers neglect to keep copies of all submitted documents. By not retaining their paperwork, they risk losing critical evidence that could be useful in case of an audit or inquiry. Keeping organized records can save time and stress in the long run, enhancing the filing experience.

Documents used along the form

The Form 886-H-DEP serves as a supporting document for taxpayers claiming dependents on their tax returns. It outlines the necessary proofs that validate the claim of dependency. When submitting this form, other related documents are often required. Below is a list of these additional forms and documents that can aid in meeting IRS requirements.

- Form 8332: This form, known as the Release of Claim to Exemption for Child of Divorced or Separated Parents, allows a custodial parent to release their claim to a child’s tax exemption. It's essential when non-custodial parents are claiming the exemption.

- Divorce Decree or Separation Agreement: This legal document outlines the terms of a divorce or separation. It often specifies the arrangements concerning the custody and financial support of children, making it crucial for understanding dependency claims.

- Custody Order: A custody order, established by a court, defines who has the legal right to make decisions for a child and where the child will live. This document can substantiate claims of custody, impacting who can claim a child as a dependent for tax purposes.

- Proof of Residency: Documents such as utility bills, school records, or letters from service providers showing the child's address are necessary. These documents demonstrate that the child lived with the taxpayer for more than half of the tax year.

When preparing to file taxes, understanding which additional documents accompany Form 886-H-DEP can greatly simplify the process. Providing accurate and comprehensive documentation is essential to support a claim successfully. This foresight can prevent unnecessary delays or complications with tax filings.

Similar forms

- Form 8332: This document is used to release your claim to exemption for a child of divorced or separated parents. Similar to Form 886-H-DEP, it requires proof of custody and shows parental support for a dependent.

- Form 1040: The main tax return form that includes information about dependents. Both forms require documentation to prove the dependent's relationship and support, helping determine tax credit eligibility.

- Form W-2: This employment income report indicates how much you earned, which can be relevant for determining financial support. Both forms focus on income and eligibility for claiming dependents.

- Proof of Relationship Documents: These can include birth certificates or marriage licenses that verify your connection to a dependent. Like Form 886-H-DEP, they establish the basis for claiming someone as a dependent on your taxes.

- Form 8862: This form must be filed to claim the Earned Income Credit after a denial. Similar to Form 886-H-DEP, it proves dependency status and supports eligibility for credits.

- Affidavit of Support: Often used for immigration, it demonstrates financial support for a relative. This is comparable to Form 886-H-DEP in that it provides evidence of your financial responsibility for a dependent.

- Child Support Agreements: Documents detailing the financial support provided for a child. Similar to Form 886-H-DEP, they reflect the obligations of support needed to establish dependency claims.

Dos and Don'ts

Filling out Form 886-H-DEP is an important step in claiming your dependents on your tax return. Here is a comprehensive list of what you should and should not do when completing this form.

- Do make sure all names are spelled correctly.

- Do verify the Taxpayer Identification Number (TIN) for accuracy.

- Do gather all required supporting documents before starting the form.

- Do read the instructions carefully to ensure compliance with IRS regulations.

- Do double-check your calculation of support provided for each dependent.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't submit original documents; always use photocopies.

- Don't forget to include all necessary documentation for divorced or separated parents.

- Don't rely on documents signed by relatives; they are not acceptable.

- Don't hesitate to ask for clarification from a tax professional if needed.

Misconceptions

Many people misunderstand Form 886-H-DEP, leading to confusion and potential errors in filing their taxes. Here are five common misconceptions:

- It’s only for divorced parents. While the form is used often by divorced or separated parents, any taxpayer claiming a dependent must verify support information. This includes single parents and those living apart but not divorced.

- Only birth certificates are acceptable as proof. Some believe that only birth certificates can verify a relationship to a dependent. In reality, there are multiple acceptable documents, including adoption papers and court orders, that serve this purpose.

- You can only claim children under 18. There is a notion that dependents must be below a certain age to be claimed. However, if the dependent is a qualifying child, they can be under 19 or under 24 if they're a full-time student, regardless of household conditions.

- The form can be completed without supporting documents. Many think they can just submit the form without additional proof. To claim a dependent, you must provide supporting documentation that verifies your relationship and financial support.

- Only one parent can claim the child. Some may believe that if one parent claims the child, the other cannot. If both parents provide equal support and fulfill specific conditions, they may share the tax credit, but clear communication and documentation are essential.

Understanding these misconceptions helps taxpayers navigate the complexities of claiming dependents confidently and accurately.

Key takeaways

When it comes to utilizing Form 886-H-DEP, there are several important points to keep in mind:

- Gather all necessary documentation ahead of time. This includes custody agreements, birth certificates, and any statements verifying support. Having everything organized will streamline the process.

- If you are divorced or separated, be prepared to submit copies of your divorce decree or separation agreement. This is essential for verifying custody and support arrangements.

- Demonstrating that the child lived with you for more than half of the year is crucial. Collect school records or letters from medical providers to prove this.

- Ensure that you provide evidence indicating you contributed more than half of the dependent's support. This could include bills, rental agreements, or documentation from child support agencies.

Following these steps can enhance your experience with the form, ensuring you meet the requirements and potentially secure the benefits available to you. Take your time to review and prepare, as submitting incomplete information can delay your tax processing.

Browse Other Templates

Alabama Court Forms - There are specific instructions for the handling of potential over-withholding situations.

Scout Membership Number - To complete the application process, applicants must undergo Youth Protection Training to ensure a safe learning environment.