Fill Out Your 8882 Form

Form 8882 is an essential tool for employers looking to claim tax credits related to childcare services provided to their employees. This tax form specifically addresses two key components: qualifying expenditures for childcare facilities and resource referral services. Employers can receive a credit equal to 25% of their qualified childcare facility expenditures and 10% for childcare resource and referral expenditures, both limited to a maximum of $150,000 per tax year. To qualify, childcare facilities must adhere to local regulations and can't discriminate based on employee compensation levels. The form also lays out specific criteria for calculating the credit, including limiting the credit for capital expenditures and for various deductions. Additionally, the credit must be reported correctly depending on the business structure—whether the employer is a partnership, corporation, or an estate. Understanding the nuances of Form 8882 can significantly benefit employers by reducing their taxable income while supporting the childcare needs of their workforce, making it a valuable asset in any business's tax planning strategy.

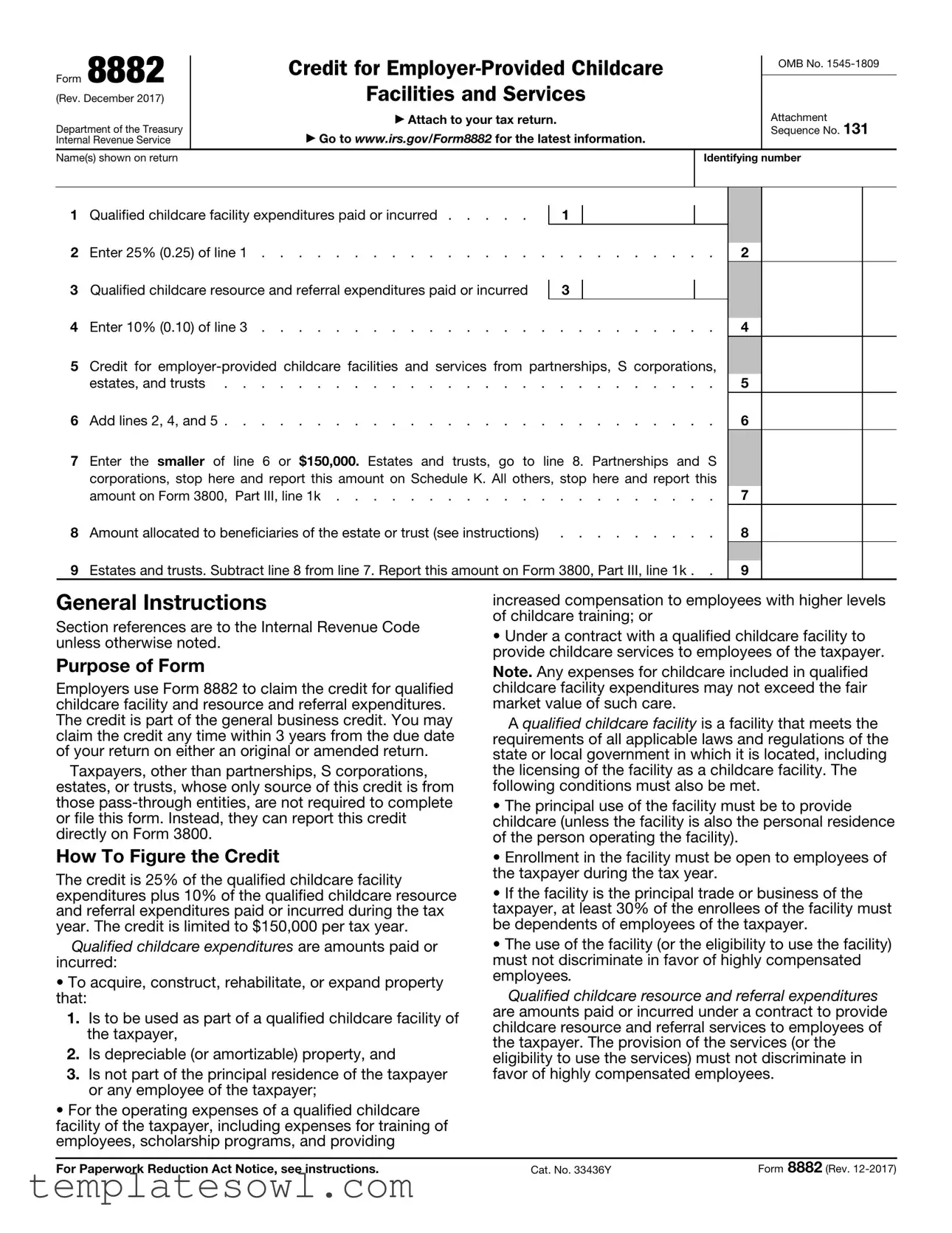

8882 Example

Form 8882 |

|

Credit for |

|

OMB No. |

|

|

|||

|

|

|

|

|

(Rev. December 2017) |

|

Facilities and Services |

|

|

|

|

|

||

Department of the Treasury |

|

▶ Attach to your tax return. |

|

Attachment |

|

▶ Go to www.irs.gov/Form8882 for the latest information. |

|

Sequence No. 131 |

|

Internal Revenue Service |

|

|

|

|

Name(s) shown on return |

|

|

Identifying number |

|

|

|

|

|

|

1 |

Qualified childcare facility expenditures paid or incurred |

1 |

|

|

||

2 |

Enter 25% |

(0.25) |

of line 1 |

|||

3 |

Qualified childcare resource and referral expenditures paid or incurred |

|

|

|

||

3 |

|

|

||||

4 |

Enter 10% |

(0.10) |

of line 3 |

|||

5Credit for

estates, and trusts |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

6 Add lines 2, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . .

7Enter the smaller of line 6 or $150,000. Estates and trusts, go to line 8. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this

|

amount on Form 3800, Part III, line 1k |

8 |

Amount allocated to beneficiaries of the estate or trust (see instructions) |

9 |

Estates and trusts. Subtract line 8 from line 7. Report this amount on Form 3800, Part III, line 1k . . |

2

4

5

6

7

8

9

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Employers use Form 8882 to claim the credit for qualified childcare facility and resource and referral expenditures. The credit is part of the general business credit. You may claim the credit any time within 3 years from the due date of your return on either an original or amended return.

Taxpayers, other than partnerships, S corporations, estates, or trusts, whose only source of this credit is from those

How To Figure the Credit

The credit is 25% of the qualified childcare facility expenditures plus 10% of the qualified childcare resource and referral expenditures paid or incurred during the tax year. The credit is limited to $150,000 per tax year.

Qualified childcare expenditures are amounts paid or incurred:

•To acquire, construct, rehabilitate, or expand property that:

1.Is to be used as part of a qualified childcare facility of the taxpayer,

2.Is depreciable (or amortizable) property, and

3.Is not part of the principal residence of the taxpayer or any employee of the taxpayer;

•For the operating expenses of a qualified childcare facility of the taxpayer, including expenses for training of employees, scholarship programs, and providing

increased compensation to employees with higher levels of childcare training; or

•Under a contract with a qualified childcare facility to provide childcare services to employees of the taxpayer.

Note. Any expenses for childcare included in qualified childcare facility expenditures may not exceed the fair market value of such care.

A qualified childcare facility is a facility that meets the requirements of all applicable laws and regulations of the state or local government in which it is located, including the licensing of the facility as a childcare facility. The following conditions must also be met.

•The principal use of the facility must be to provide childcare (unless the facility is also the personal residence of the person operating the facility).

•Enrollment in the facility must be open to employees of the taxpayer during the tax year.

•If the facility is the principal trade or business of the taxpayer, at least 30% of the enrollees of the facility must be dependents of employees of the taxpayer.

•The use of the facility (or the eligibility to use the facility) must not discriminate in favor of highly compensated employees.

Qualified childcare resource and referral expenditures are amounts paid or incurred under a contract to provide childcare resource and referral services to employees of the taxpayer. The provision of the services (or the eligibility to use the services) must not discriminate in favor of highly compensated employees.

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 33436Y |

Form 8882 (Rev. |

Form 8882 (Rev. |

Page 2 |

No Double Benefit Allowed

You must reduce:

•The basis of any qualified childcare facility by the amount of the credit on line 7 allocable to capital expenditures related to the facility,

•Any otherwise allowable deductions used to figure the credit by the amount of the credit on line 7 allocable to those deductions, and

•Any expenditures used to figure any other credit by the amount of the credit on line 7 allocable to those expenditures (for purposes of figuring the other credit).

Note. For credits entered on line 5, only the

Recapture of Credit

You may have to recapture part or all of the credit if, before the 10th tax year after the tax year in which your qualified childcare facility is placed in service, the facility ceases to operate as a qualified childcare facility or there is a change in ownership of the facility. However, a change in ownership will not require recapture if the person acquiring the interest in the facility agrees, in writing, to assume the recapture liability. See section 45F

(d) for details.

Any recapture tax is reported on the line of your tax return where other recapture taxes are reported (or, if no such line, on the “total tax” line). The recapture tax may not be used in figuring the amount of any credit or in figuring the alternative minimum tax.

Member of Controlled Group or Business Under Common Control

For purposes of figuring the credit, all members of a controlled group of corporations (as defined in section 52 (a)) and all members of a group of businesses under common control (as defined in section 52(b)), are treated as a single taxpayer. As a member, figure your credit for lines 2 and 4 as follows:

•Figure your credit for line 2 based on your proportionate share of qualified childcare facility expenditures giving rise to the group’s credit for line 2. Enter your share of the credit on line 2. Attach a statement showing how your share of the credit was figured, and write “See Attached” next to the entry space for line 2.

•Figure your credit for line 4 based on your proportionate share of qualified resource and referral expenditures giving rise to the group’s credit for line 4. Enter your share of the credit on line 4. Attach a statement showing how your share of the credit was figured, and write “See Attached” next to the entry space for line 4.

Specific Instructions

Line 8

Estates and trusts. Allocate the credit for employer- provided childcare facilities and services on line 7 between the estate or trust and the beneficiaries in the same proportion as income was allocated, and enter the beneficiaries’ share on line 8.

If the estate or trust is subject to the passive activity rules, include on line 5 any credit for

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual and business taxpayers filing this form is approved under OMB control number

Recordkeeping |

2 hr., 37 min. |

|

Learning about the law or the form . . |

. . |

30 min. |

Preparing and sending |

|

|

the form to the IRS |

. . |

.34 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | Employers use Form 8882 to claim a credit for childcare facility and resource expenditures. |

| Credit Rate | The credit equals 25% of qualified childcare facility expenditures and 10% for resource and referral expenditures. |

| Maximum Credit | The credit is capped at $150,000 per tax year. |

| Filing Timeframe | Employers may claim the credit within three years of the return's due date, whether on an original or amended return. |

| Eligibility | A qualified childcare facility must comply with local laws and primarily provide childcare services. |

| No Double Benefit | Taxpayers must reduce deductions and facilities’ basis by the credit amount to prevent double benefits. |

| Recapture of Credit | If the childcare facility ceases to operate as qualified within ten years, the credit may need to be recaptured. |

Guidelines on Utilizing 8882

After gathering all necessary financial information, you are ready to fill out Form 8882. This form allows you to claim credits for employer-provided childcare facilities and services. Follow these steps closely to complete the form accurately.

- At the top of the form, enter the name(s) shown on your tax return.

- Fill in your identifying number, such as your Social Security Number or Employer Identification Number.

- On line 1, enter the total amount of qualified childcare facility expenditures that you paid or incurred.

- On line 2, calculate 25% of the amount on line 1 and enter that number.

- On line 3, enter any qualified childcare resource and referral expenditures that you paid or incurred.

- On line 4, calculate 10% of the amount on line 3 and write that total down.

- If applicable, fill in line 5 with the credit for employer-provided childcare facilities and services from partnerships, S corporations, estates, and trusts.

- Add together the amounts from lines 2, 4, and 5, and put the total on line 6.

- For line 7, enter the smaller of the amount on line 6 or $150,000.

- On line 8, if you are managing an estate or trust, enter the amount that has been allocated to the beneficiaries.

- Lastly, if applicable, subtract line 8 from line 7 and write this amount on line 9 if you are an estate or trust.

Once finished, double-check your entries for accuracy. Attach this form to your tax return and submit it according to IRS guidelines.

What You Should Know About This Form

What is Form 8882?

Form 8882 is a document used by employers to claim a tax credit for expenses related to qualified childcare facilities and resource and referral services. This form is part of the general business credit and helps businesses reduce their tax liability by promoting childcare services for employees.

Who is eligible to use Form 8882?

Employers who incur expenses for providing childcare facilities or related services to their employees can use this form. This includes businesses, as well as partnerships and S corporations, provided they are reporting these credits appropriately. However, if a taxpayer’s only source of credit is through pass-through entities like partnerships or S corporations, they do not need to file this form but may report the credit directly on Form 3800.

What types of expenses qualify for the credit?

Qualified childcare facility expenditures include amounts spent to acquire, construct, rehabilitate, or expand facilities designated for childcare. Operating expenses of these facilities, salaries for trained staff, and expenses related to scholarships for employees can also count. Additionally, if there is a contract with a childcare facility to provide services to employees, those costs are eligible as well. However, all expenses must not exceed the fair market value for such services.

How is the credit calculated?

The credit amount is based on a percentage of expenditures incurred. Specifically, you calculate 25% of your qualified childcare facility expenditures and 10% of your qualified childcare resource and referral expenditures. The total credit is capped at $150,000 for each tax year, meaning this is the maximum amount you can claim regardless of your actual expenditures.

What should I do if my childcare facility no longer qualifies?

If your childcare facility stops operating as a qualified facility or there is a change in ownership before ten years after you placed it in service, you may have to recapture some or all of the credit claimed. However, if a new owner agrees in writing to take on this recapture liability, you may not need to recapture the credit. It's crucial to follow the rules outlined in section 45F(d) regarding recapture taxes.

Are there any limitations on claiming this credit?

Yes, while Form 8882 allows you to claim a significant credit, it’s essential to understand that double benefits are not allowed. If you claim this credit, you must reduce the basis of any qualified childcare facility by the amount of the credit and adjust any associated deductions. This ensures that you do not benefit more than once from the same expenditures.

How do I report the credit on my tax return?

After completing Form 8882, you report the credit directly on your tax return based on your business structure. If your business is a partnership or an S corporation, you report the credit on Schedule K. For other taxpayers, you report the credit on Form 3800, Part III, line 1k. Be sure to follow the specific instructions on the form to ensure accurate reporting.

Common mistakes

Filling out Form 8882 can lead to mistakes that may affect your credit for employer-provided childcare. One common error is miscalculating the credit amounts. The credit is based on specific percentages of qualified expenditures. For instance, you must enter **25%** of childcare facility expenditures and **10%** of childcare resource and referral expenditures. If these calculations are incorrect, the total credit may be underreported, affecting the overall tax liability.

Another typical mistake occurs when people do not provide the appropriate documentation. It is essential to gather and attach any necessary records related to childcare expenditures. This includes invoices, contracts, and proof of payments. Failing to attach these documents may result in processing delays or even denial of the credit.

Further, applicants often overlook eligibility requirements for qualified childcare facilities. These facilities must comply with local laws and regulations, and their primary function must be to provide childcare. If a facility does not meet these criteria, the associated expenditures may not qualify for the credit. Therefore, it's crucial to verify that all facilities used align with these specifications.

Finally, another frequent mistake is not considering the impact of ownership changes or operational status. If a facility ceases to operate as a qualified childcare provider before the 10th tax year following the placement of the facility in service, there may be a need to recapture part or all of the credit. This obligation should be evaluated carefully, as it can significantly alter how tax returns are filed in the future.

Documents used along the form

When preparing to file Form 8882 for claiming the credit for employer-provided childcare, there are several other key forms and documents that may be required. Each of these documents plays a vital role in ensuring a comprehensive and accurate tax filing. Below is a list of important forms and documents to consider.

- Form 3800: This form is known as the General Business Credit. Taxpayers use it to report various business credits, including the credit claimed from Form 8882. It summarizes all credit amounts along with other relevant details.

- Schedule K: This schedule is used by partnerships and S corporations to report the business’s income, deductions, and credits. It provides a means for partners and shareholders to receive their share of credits, including those from Form 8882.

- Form 8582-CR: If the taxpayer is part of an estate or trust, this form is necessary to determine the allowed credit limitations for passive activities, especially when there are credits carried forward from previous years.

- Qualified Childcare Facility Documentation: Any expenditures claimed must be substantiated with evidence detailing the costs associated with establishing or maintaining qualified childcare facilities. This may include invoices, contracts, or receipts.

- Employee Enrollment Documentation: Proof that at least 30% of the enrolled children are dependents of employees is essential. Records should include enrollment lists and employee status verification.

- Taxpayer Identification Numbers (TINs): All taxpayer documentation should include the appropriate TINs for entities claiming the credit. This ensures that all parties are correctly identified in the tax system.

- State or Local Licensing Documents: Proof that the childcare facility is licensed in accordance with applicable state or local regulations. This documentation verifies that the facility meets the requirements necessary to qualify for the credit.

Gathering these forms and documents ahead of your tax filing can streamline the process and reduce the likelihood of errors or delays. Always ensure that all required information is complete and accurate to facilitate a smooth submission.

Similar forms

-

Form 3800: This form is used to claim general business credits, including the credit from Form 8882. If you're not a partnership, S corporation, estate, or trust, you report your credit directly on Form 3800.

-

Form 8582-CR: This form helps determine limitations on passive activity credits, which may apply if you're part of an estate or trust. It ensures credits are properly allocated among beneficiaries.

-

Form 941: This is the employer's quarterly tax return. It reports taxes withheld for employee wages, similar to how Form 8882 reports credits for employee-related expenditures.

-

Form W-2: Employers use this form to report annual wages and taxes withheld for each employee. This connects to Form 8882 since credits claimed can affect employee benefits and compensation.

-

Form 1065: Partnerships use this form to report income, deductions, and credits. If you’re part of a partnership that qualifies for credits, you'll also have to address them on Form 1065.

-

Form 1040: This is the individual income tax return. Taxpayers may incorporate credits from Form 8882 into their main tax return, reflecting how business credits impact personal taxes.

-

Form 1120: Corporations use this form to report income, gains, losses, and deductions. Similar to Form 8882, it accounts for business activities and credits when filing taxes.

-

Form 8862: This form allows taxpayers to claim the Earned Income Tax Credit after it has been denied. Like Form 8882, it centers around claiming credits to reduce tax liabilities.

-

Form 8832: Businesses use this form to elect how they want to be taxed. It is similar in that tax treatment can affect how credits, like those from Form 8882, are calculated and claimed.

-

Form 1099: This is used to report various types of income other than wages. It relates to Form 8882 in illustrating that different forms and reports track financial activities that may affect credit eligibility.

Dos and Don'ts

When filling out Form 8882 for the Credit for Employer-Provided Childcare, following certain guidelines can streamline the process. Here are nine things to do and avoid.

- Do: Ensure that your name and identifying number are correctly entered at the top of the form.

- Don't: Forget to include all qualified childcare facility expenditures on line 1.

- Do: Calculate the percentage credits accurately by referring to the correct lines – 25% for qualified childcare facility expenditures and 10% for childcare resource and referral expenditures.

- Don't: Misreport or omit any credit amounts if you are part of a partnership or S corporation; stop at the appropriate line and report correctly.

- Do: Attach any required statements if you are a member of a controlled group or business under common control.

- Don't: Overlook the limitations on the credit, which caps at $150,000 each tax year.

- Do: Include deductions for any amounts that you claimed for the credit directly on the relevant lines of your tax return.

- Don't: Assume all expenditures qualify. Ensure your childcare expenditures meet the fair market value requirements.

- Do: Keep records of all expenditures related to the credits for your records and future reference.

Misconceptions

Form 8882, known as the Credit for Employer-Provided Childcare, has several misconceptions associated with it. Here are nine common misunderstandings explained.

- Misconception 1: Only large businesses can claim the credit.

- Misconception 2: The credit can be claimed without any documentation.

- Misconception 3: The credit amount is automatically granted at $150,000.

- Misconception 4: Only direct expenditures on childcare facilities are eligible.

- Misconception 5: The credit cannot be claimed on amended tax returns.

- Misconception 6: This credit applies to any childcare service.

- Misconception 7: The credit is only for childcare facilities owned by the taxpayer.

- Misconception 8: The credit is available to anyone, without any restrictions.

- Misconception 9: Once claimed, the credit cannot be taken back.

In reality, businesses of all sizes can qualify for this credit, as long as they meet the necessary criteria for qualified childcare expenditures.

Taxpayers must keep records of all expenses to support their claim. This includes documentation proving that the expenditures were indeed for qualified childcare services.

The maximum credit is $150,000, but it must be calculated based on eligible expenditures. The actual credit amount may be less depending on these calculated costs.

Both expenditures on childcare facilities and childcare resource and referral expenditures qualify for the credit, broadening the range of eligible costs.

Taxpayers can claim the credit on amended tax returns within three years from the due date of the original return.

Services must be provided by a qualified childcare facility. Simply having childcare services available is not sufficient to claim the credit.

Even if the facility is not owned by the taxpayer, as long as they incur qualified expenditures under a contract, they can still claim the credit.

The credit has specific conditions, including that it must be open to employees and not discriminate against any group of employees, including high-income earners.

There is a recapture provision. If a facility ceases to operate as a qualified childcare facility within ten years, part or all of the credit may need to be repaid.

Key takeaways

Here are some key takeaways about filling out and using Form 8882:

- The form is used to claim a credit for employer-provided childcare facilities and services.

- Employers need to attach Form 8882 to their tax return.

- The credit is calculated as 25% of qualified childcare facility expenditures and 10% of childcare resource and referral expenditures.

- The total credit is capped at $150,000 per tax year.

- Qualified childcare expenditures include costs for acquiring, constructing, rehabilitating, or operating childcare facilities.

- Taxpayers can claim the credit any time within three years from the due date of their return.

- Partnerships and S corporations typically do not need to fill out this form; they should report their credits directly on Form 3800.

- If a facility stops operating as a childcare provider or changes ownership, a recapture of credit may be necessary.

- When part of a controlled group of businesses, credits must be shared and reported proportionately based on expenditures.

Browse Other Templates

Science Project Report - Fire hazards should be considered and addressed in any project involving heat sources.

Cosmetology Questions - Understanding the scope of their licensing profession is key for applicants.