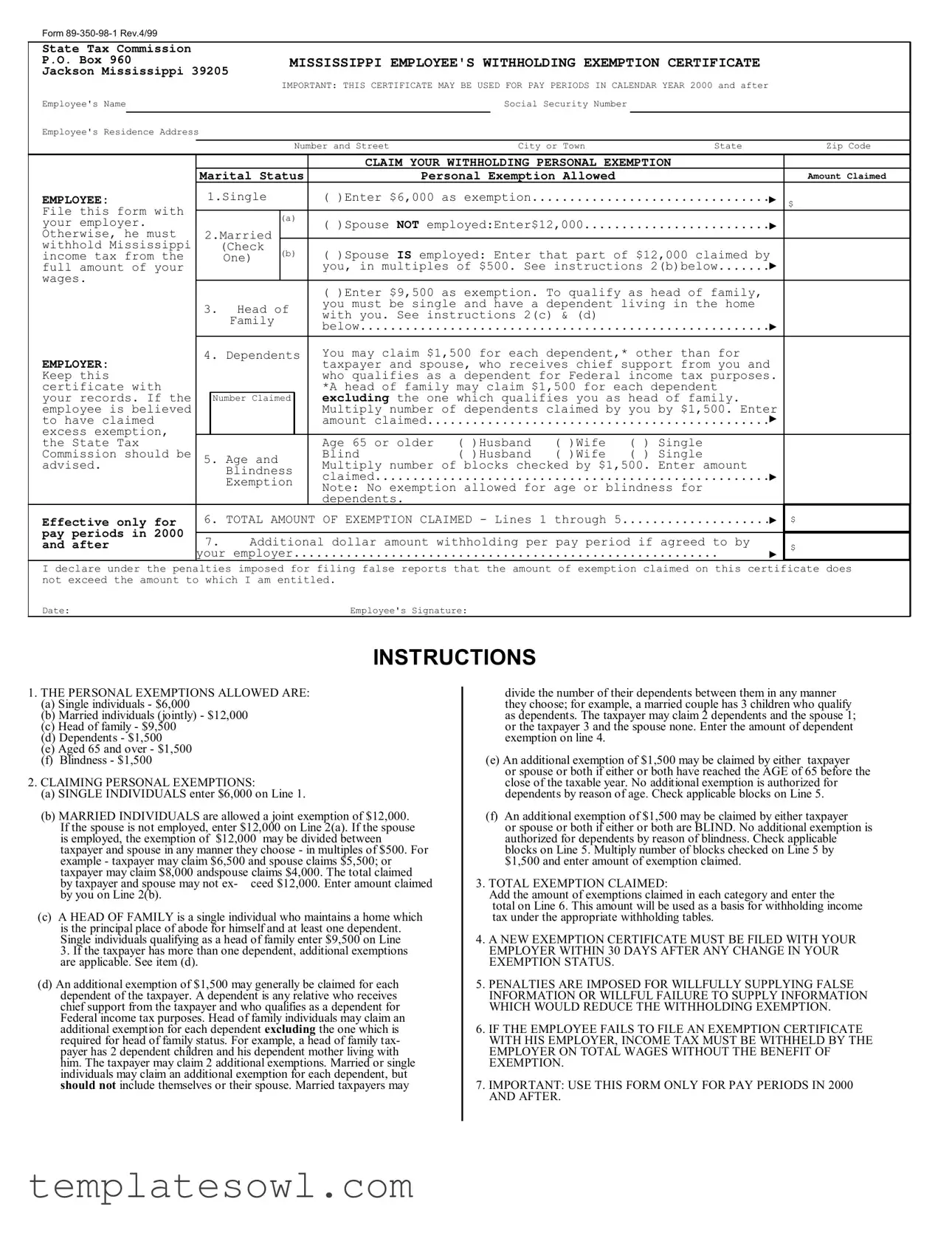

Fill Out Your 89 350 98 1 Form

The FORM 89-350-98-1 is crucial for employees working in Mississippi as it serves as the Employee's Withholding Exemption Certificate. It allows individuals to claim personal exemptions that are essential for determining how much state income tax should be withheld from their wages. The form outlines various categories of exemptions based on marital status, dependency status, age, and blindness. For example, single individuals can claim a $6,000 exemption, while married people can jointly claim $12,000. Heads of families have the opportunity to claim $9,500, with additional exemptions available for each dependent at $1,500. Accurate completion of this form is vital, as incorrect claims can result in penalties. Employees must file the form with their employer and are required to update it within 30 days if their exemption status changes. It is important to remember that failure to file this certificate will result in the withholding of taxes without any exemptions. Commitments to accuracy and timeliness can alleviate unnecessary tax burdens and promote financial well-being for employees in the state.

89 350 98 1 Example

FORM

State Tax Commission |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 960 |

|

|

|

MISSISSIPPI EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE |

|

|

||||||||

Jackson Mississippi 39205 |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

IMPORTANT: THIS CERTIFICATE MAY BE USED FOR PAY PERIODS IN CALENDAR YEAR 2000 and after |

|

|

|||||||

Employee's Name |

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee's Residence Address |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and Street |

|

City or Town |

|

State |

|

Zip Code |

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

CLAIM YOUR WITHHOLDING PERSONAL EXEMPTION |

|

|

|||||

|

|

Marital Status |

Personal Exemption Allowed |

|

|

|

Amount Claimed |

|||||||

EMPLOYEE: |

1.Single |

|

|

( )Enter $6,000 as exemption |

................................ |

|

▲ |

$ |

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

File this form with |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

(a) |

|

|

|

|

|

|

|

|

|||

your employer. |

|

|

|

( )Spouse NOT employed:Enter$12,000 |

|

|

▲ |

|

||||||

|

|

|

|

|

|

|

||||||||

Otherwise, he must |

2.Married |

|

|

|

|

|

|

|

|

|

|

|||

withhold Mississippi |

|

(Check |

(b) |

( )Spouse IS employed: Enter that part of $12,000 claimed by |

|

|

||||||||

income tax from the |

|

|

One) |

|

|

|||||||||

|

|

|

|

▲ |

|

|||||||||

full amount of your |

|

|

|

|

|

you, in multiples of $500. See instructions 2(b)below |

|

|||||||

wages. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( )Enter $9,500 as exemption. To qualify as head of family, |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

3. |

Head of |

you must be single and have a dependent living in the home |

|

|

||||||||

|

|

with you. See instructions 2(c) & (d) |

|

|

|

|

||||||||

|

|

|

|

Family |

|

|

|

|

|

|

||||

|

|

|

|

|

|

below |

|

|

|

|

▲ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||

|

|

4. Dependents |

You may claim $1,500 for each dependent,* other than for |

|

|

|||||||||

EMPLOYER: |

|

|

|

|

|

taxpayer and spouse, who receives chief support from you and |

|

|

||||||

Keep this |

|

|

|

|

|

who qualifies as a dependent for Federal income tax purposes. |

|

|||||||

certificate with |

|

|

|

|

|

*A head of family may claim $1,500 for each dependent |

|

|

||||||

your records. If the |

|

Number Claimed |

|

excluding the one which qualifies you as head of family. |

|

|

||||||||

employee is believed |

|

|

|

|

|

Multiply number of dependents claimed by you by $1,500. Enter |

|

|||||||

to have claimed |

|

|

|

|

|

amount claimed |

|

|

|

|

▲ |

|

||

excess exemption, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the State Tax |

|

|

|

|

|

Age 65 or older |

( )Husband |

( )Wife |

( ) Single |

|

|

|||

Commission should be |

5. Age and |

|

|

Blind |

( )Husband |

( )Wife |

( ) Single |

|

|

|||||

advised. |

|

|

Blindness |

Multiply number of blocks checked by $1,500. Enter amount |

|

|

||||||||

|

|

|

|

claimed |

|

|

|

|

▲ |

|

||||

|

|

|

|

Exemption |

|

|

|

|

|

|||||

|

|

|

|

Note: No exemption allowed for age or blindness for |

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

dependents. |

|

|

|

|

|

|

|

Effective only for |

6. TOTAL AMOUNT OF EXEMPTION CLAIMED - Lines 1 through 5 |

|

▲ |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

pay periods in 2000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Additional dollar amount withholding per pay period if agreed to by |

|

|

|||||||||||

and after |

|

$ |

||||||||||||

your employer |

|

|

|

|

|

|

▲ |

|||||||

|

|

|

|

|

|

|

|

|

||||||

I declare under the penalties imposed for filing false reports that the amount of exemption claimed on this certificate does not exceed the amount to which I am entitled.

Date: |

Employee's Signature: |

INSTRUCTIONS

1.THE PERSONAL EXEMPTIONS ALLOWED ARE:

(a)Single individuals - $6,000

(b)Married individuals (jointly) - $12,000

(c)Head of family - $9,500

(d)Dependents - $1,500

(e)Aged 65 and over - $1,500

(f)Blindness - $1,500

2.CLAIMING PERSONAL EXEMPTIONS:

(a)SINGLE INDIVIDUALS enter $6,000 on Line 1.

(b)MARRIED INDIVIDUALS are allowed a joint exemption of $12,000.

If the spouse is not employed, enter $12,000 on Line 2(a). If the spouse is employed, the exemption of $12,000 may be divided between taxpayer and spouse in any manner they choose - in multiples of $500. For example - taxpayer may claim $6,500 and spouse claims $5,500; or taxpayer may claim $8,000 andspouse claims $4,000. The total claimed by taxpayer and spouse may not ex- ceed $12,000. Enter amount claimed by you on Line 2(b).

(c)A HEAD OF FAMILY is a single individual who maintains a home which is the principal place of abode for himself and at least one dependent. Single individuals qualifying as a head of family enter $9,500 on Line

3. If the taxpayer has more than one dependent, additional exemptions are applicable. See item (d).

(d)An additional exemption of $1,500 may generally be claimed for each dependent of the taxpayer. A dependent is any relative who receives chief support from the taxpayer and who qualifies as a dependent for Federal income tax purposes. Head of family individuals may claim an additional exemption for each dependent excluding the one which is required for head of family status. For example, a head of family tax- payer has 2 dependent children and his dependent mother living with him. The taxpayer may claim 2 additional exemptions. Married or single individuals may claim an additional exemption for each dependent, but should not include themselves or their spouse. Married taxpayers may

divide the number of their dependents between them in any manner they choose; for example, a married couple has 3 children who qualify as dependents. The taxpayer may claim 2 dependents and the spouse 1; or the taxpayer 3 and the spouse none. Enter the amount of dependent exemption on line 4.

(e) An additional exemption of $1,500 may be claimed by either taxpayer or spouse or both if either or both have reached the AGE of 65 before the close of the taxable year. No additional exemption is authorized for dependents by reason of age. Check applicable blocks on Line 5.

(f)An additional exemption of $1,500 may be claimed by either taxpayer

or spouse or both if either or both are BLIND. No additional exemption is authorized for dependents by reason of blindness. Check applicable blocks on Line 5. Multiply number of blocks checked on Line 5 by $1,500 and enter amount of exemption claimed.

3.TOTAL EXEMPTION CLAIMED:

Add the amount of exemptions claimed in each category and enter the total on Line 6. This amount will be used as a basis for withholding income tax under the appropriate withholding tables.

4.A NEW EXEMPTION CERTIFICATE MUST BE FILED WITH YOUR EMPLOYER WITHIN 30 DAYS AFTER ANY CHANGE IN YOUR EXEMPTION STATUS.

5.PENALTIES ARE IMPOSED FOR WILLFULLY SUPPLYING FALSE INFORMATION OR WILLFUL FAILURE TO SUPPLY INFORMATION WHICH WOULD REDUCE THE WITHHOLDING EXEMPTION.

6.IF THE EMPLOYEE FAILS TO FILE AN EXEMPTION CERTIFICATE WITH HIS EMPLOYER, INCOME TAX MUST BE WITHHELD BY THE EMPLOYER ON TOTAL WAGES WITHOUT THE BENEFIT OF EXEMPTION.

7.IMPORTANT: USE THIS FORM ONLY FOR PAY PERIODS IN 2000 AND AFTER.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used by Mississippi employees to claim exemptions from withholding state income tax. |

| Governing Law | The form is governed by Mississippi income tax laws. |

| Eligibility Period | The form can only be used for pay periods beginning in the year 2000 and continuing thereafter. |

| Filing Requirement | Employees must file this form with their employer to claim exemptions. |

| Personal Exemption Amounts | Single individuals can claim $6,000, married individuals can claim $12,000, and heads of families can claim $9,500. |

| Additional Exemptions | Employees may claim $1,500 for each dependent and for age or blindness if eligible. |

| Penalties for False Claims | Penalties apply for providing false information or failing to submit required information regarding exemptions. |

Guidelines on Utilizing 89 350 98 1

Filling out the 89-350-98-1 form is a straightforward process that allows employees in Mississippi to claim their withholding exemptions for income tax purposes. Follow these steps carefully to ensure all necessary information is correctly provided.

- Begin by writing your Name on the line labeled "Employee's Name."

- Next, enter your Social Security Number in the designated space provided.

- Fill in your Residence Address, including number and street, city or town, state, and zip code.

- Indicate your Marital Status by checking the appropriate box: Single, Married (with or without an employed spouse), or Head of Family.

- Claim your Personal Exemption Amount as follows:

- If Single, enter $6,000 on Line 1.

- If Married with a non-employed spouse, enter $12,000 on Line 2(a).

- If Married with an employed spouse, enter the portion of $12,000 claimed by you on Line 2(b).

- If Head of Family, enter $9,500 on Line 3.

- For Dependents, enter the total number of dependents you are claiming on Line 4. Multiply this number by $1,500 for each dependent and enter the amount.

- If you are 65 or older or blind, indicate this by checking the appropriate boxes on Line 5. Multiply the number of boxes checked by $1,500 and enter the amount on Line 5.

- Add all amounts claimed from Lines 1 through 5 and write the total on Line 6 as your TOTAL AMOUNT OF EXEMPTION CLAIMED.

- If you and your employer agree on an additional amount to withhold, enter that figure on the last line for additional dollar amount withholding per pay period.

- Date the form and sign your name to confirm that the information is accurate.

Once you have completed the form, submit it to your employer. They will use this information to determine how much income tax to withhold from your paychecks. Make sure to file a new certificate if your exemption status changes in the future.

What You Should Know About This Form

What is the purpose of the 89 350 98 1 form?

The 89 350 98 1 form, also known as the Employee's Withholding Exemption Certificate, is used by employees in Mississippi to claim personal exemptions for state income tax withholding purposes. This form helps employees inform their employers about how much state tax to withhold from their paychecks based on their marital status and the number of dependents they have.

Who should complete the 89 350 98 1 form?

Any employee working in Mississippi who wishes to claim a personal withholding exemption should complete this form. This includes single individuals, married individuals, heads of households, and those with dependents. It must be submitted to the employer for processing.

What information is required to complete the form?

The form requires the employee's name, Social Security number, residence address, and marital status. Additionally, employees must declare the amount of personal exemptions they are claiming, such as those for themselves, their spouse, dependents, and any additional exemptions for age or blindness.

What are the personal exemption amounts allowed on the form?

Employees may claim the following personal exemptions: $6,000 for single individuals, $12,000 for married couples, and $9,500 for heads of household. Each dependent qualifies for an additional $1,500 exemption. Employees aged 65 or older or those who are blind may also claim an additional $1,500 exemption.

How does a married couple claim their exemptions?

Married couples are allowed a joint exemption of $12,000. If both spouses work, they may divide this amount between themselves in multiples of $500. For instance, one spouse may claim $7,000 while the other claims $5,000, as long as the total does not exceed $12,000.

What happens if an employee does not file this form?

If an employee fails to submit the 89 350 98 1 form to their employer, income tax must be withheld from their total wages without considering any exemptions. This could result in a higher tax withholding than the employee might be entitled to claim.

When should an employee update their exemption certificate?

Employees must file a new exemption certificate with their employer within 30 days of any change in their exemption status. Changes could include a change in marital status, the birth of a child, or any other circumstance affecting the number of claimed exemptions.

What should an employee do if they believe they have claimed too many exemptions?

If an employee suspects they have claimed an excessive number of exemptions, they should consult their employer or a tax professional. It may be necessary to file a revised form to avoid penalties for incorrect reporting.

What are the penalties for providing false information on the form?

Penalties may be imposed for willfully providing false information or failing to report information that would reduce the withholding exemption. Such actions can lead to fines or other legal consequences, so accuracy is crucial when completing the form.

Is the 89 350 98 1 form valid for any tax year?

No, the 89 350 98 1 form is only valid for pay periods in the calendar year 2000 and onwards. Employees must ensure they are using the correct version of the form for the applicable tax year to ensure compliance with state laws.

Common mistakes

Filling out the FORM 89-350-98-1 can be straightforward, yet many individuals encounter pitfalls that may affect their tax withholding status. One common mistake involves selecting the wrong marital status. This form requires individuals to correctly identify if they are single, married, or head of household. If a taxpayer claims the wrong status, it could result in an inaccurate exemption amount. For example, a single individual may unintentionally file as married, which ultimately leads to claiming a higher exemption than permitted.

Another frequent error occurs when individuals fail to account for their dependents accurately. Taxpayers must remember to include only those dependents who receive chief support and qualify under federal guidelines. Miscounting dependents or incorrectly assuming that a relative qualifies can lead to a lower refund or higher tax liability later. It’s essential to double-check that the number of dependents claimed accurately reflects the taxpayer's household situation.

Miscalculating the total exemption claimed is also a prevalent issue. Taxpayers should ensure the amounts from all applicable exemption categories, including personal exemptions and additional exemptions for age, blindness, or dependents, are correctly added together. A simple arithmetic mistake can change the total exemption amount, resulting in incorrect tax withholding. Taxpayers should carefully review their calculations before submitting the form to avoid complications with their employer.

Lastly, many fail to submit a new exemption certificate within the required 30 days after a change in their status. This oversight can cause significant issues. If someone experiences a change in marital status or the number of dependents, but does not update their employer, withholding exemptions may not align with their current situation. As a result, it can lead to excessive withholding and a smaller paycheck. Regular reviews of personal situations help ensure that the most accurate information remains on file.

Documents used along the form

The Form 89-350-98-1 serves as the Employee's Withholding Exemption Certificate for Mississippi employees. When filling out this form, individuals frequently utilize additional documents. The following list outlines five such forms and documents that may be relevant during the withholding exemption process.

- Form W-4: This is the federal withholding allowance certificate used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from paychecks.

- Form W-2: This document reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must provide this form to their employees by January 31 of each year.

- Form 1099: Often used for independent contractors, this form reports various types of income other than wages. It provides information necessary for personal income tax filings.

- State Tax Forms: Each state may have its own tax liability forms which employees must file. These forms often require details similar to those requested on the federal W-4 and are crucial for complying with state tax laws.

- Proof of Dependent Status: While not always a formal document, any supporting documentation that verifies the status of dependents may be necessary. This could include birth certificates or other relevant paperwork to claim additional exemptions on applicable forms.

Understanding these additional forms and documents can facilitate a smoother experience when filing for withholding exemptions. Ensuring that all required documentation is accurate and complete can provide clarity and help avoid potential issues with tax withholding.

Similar forms

-

W-4 Form: This form is used by employees to indicate their tax situation to their employer. Similar to the 89-350-98-1 form, it allows employees to claim exemptions and specify withholding amounts for federal income tax. Both forms require personal information about the employee, including the number of dependents and marital status.

-

1040 Form: The 1040 is an individual income tax return form used to report income and calculate tax obligations. Like the 89-350-98-1, it incorporates exemptions and deductions that affect the total tax liability. Both forms are critical in determining how much tax an individual may owe or be refunded.

-

State Tax Exemption Form: Many states require a form similar to the 89-350-98-1 to report personal income tax exemptions. These forms often ask for similar information, such as marital status and dependent claims, to calculate state withholding accurately.

-

I-9 Form: While primarily for employment verification, the I-9 is similar in that it collects personal information to determine eligibility for tax purposes. It establishes how taxes will be withheld based on employment records, much like the employee withholding exemption certificate.

-

State Employee Tax Withholding Certificate: This document, similar to the 89-350-98-1 form, allows employees to claim exemptions based on state-specific tax laws. It also requires detailed personal and tax information, aligning closely with the exemption claims made on the Mississippi form.

Dos and Don'ts

When filling out the 89 350 98 1 form, careful attention to detail is vital. Here’s a list to guide you on the right practices and common pitfalls.

- Do verify your personal information. Ensure that your name, address, and Social Security number are correct.

- Do carefully review your marital status. This affects your exemption amount, so make sure you select the appropriate option.

- Do correctly calculate your exemptions. Double-check the amount you claim based on your dependents and personal circumstances.

- Do file the form with your employer promptly. It’s essential to submit your exemption certificate on time to avoid unnecessary tax withholding.

- Do keep a copy of the completed form for your records. This ensures you have a reference for future changes or questions.

- Don't leave any sections blank. Incomplete information can lead to processing delays or incorrect withholding amounts.

- Don't misrepresent your status. Providing false information about your exemptions can lead to penalties.

- Don't forget to update the form if your situation changes. File a new certificate within 30 days of any change in your exemption status.

- Don't assume your employer knows your exemption status. Always submit your form directly to ensure compliance.

- Don't use outdated forms. Ensure you are using the most recent version for the calendar year specified.

Misconceptions

Here are seven common misconceptions about the Mississippi Employee's Withholding Exemption Certificate, Form 89-350-98-1:

- Only Married Individuals Qualify for Exemptions: Both single individuals and married couples are eligible for personal exemptions. Single individuals can claim $6,000, while married couples can claim up to $12,000.

- Dependents Should Include Spouses: When claiming dependents, you cannot include yourself or your spouse. Dependents must be other qualifying relatives who receive your support.

- There’s No Age Limit for Exemptions: Taxpayers aged 65 and older can claim an additional exemption of $1,500. However, dependents do not earn this additional benefit.

- Form Needs to Be Filed Annually: A new exemption certificate must be submitted within 30 days of any change in exemption status, not just once per year.

- All Employees Automatically Receive Withholding Exemptions: If an employee fails to submit the exemption certificate, income tax will be withheld on total wages without exemptions.

- Eligibility is Based Only on Income: A qualifying head of family must be single and maintain a home for at least one dependent, regardless of income.

- All Exemptions are Fixed Amounts: Married taxpayers can divide their $12,000 exemption between themselves in multiples of $500, allowing flexibility in claiming exemptions.

Understanding these points can help ensure accurate tax withholding and prevent unnecessary penalties or over-withholding.

Key takeaways

Here are key takeaways about filling out and using the 89-350-98-1 form:

- Personal Exemptions: Understand the exemptions available based on your marital status and dependents. Single individuals can claim $6,000, married couples can claim $12,000, and heads of family can claim $9,500.

- Dependents: You may claim an additional $1,500 for each dependent you support. For heads of families, this applies to all dependents except for the one that qualifies you as head of family.

- Timely Filing: File this form with your employer within 30 days after any change in your exemption status. If not filed, taxes will be withheld at the maximum rates without exemptions.

- Accurate Claims: Ensure all claimed exemptions are accurate. Penalties may be imposed for providing false information or failing to disclose information that would affect your exemption status.

- What Happens If Not Filed: If the exemption certificate isn’t provided to the employer, income tax must be withheld on total wages, negating any exemption benefits.

- Usage Period: This form is valid only for pay periods in the calendar year 2000 and later. Be sure to use the correct form for the applicable years.

Browse Other Templates

Massachusetts Death Certificate - The form includes a section for the deceased’s social security number for identification purposes.

Usa Draft - The individual expresses a willingness to comply if they had known.

Brenau Acceptance Rate - Verification of sources like bank letters reinforces your financial claims.