Fill Out Your 90 Form

The Owner Designation Reference Page, commonly referred to as Form 90-1940, serves an essential role in the administration of life insurance policies. This form is specifically tailored for five common scenarios involving the designation of a new owner or a successor owner for an insurance policy. It allows policyholders to select one of several options, ranging from naming the insured as the new owner to appointing individuals, trusts, or corporations as owners. Each option carries unique implications, particularly concerning tax considerations, especially when ownership is transferred to a non-natural person. The form requests vital information, including taxpayer identification numbers and personal details of the new owner, to ensure proper record-keeping and compliance with regulations. Additionally, the completion of accompanying forms, such as the Request for New Owner Address and/or New Payer Information, is necessary to maintain clear communication regarding future billing and policy updates. Instructions for submitting the completed form via mail or fax are outlined, ensuring an efficient transfer process. It is advisable to keep copies of all submitted forms for personal records. Should additional guidance be required, assistance is readily available through designated customer service channels. Understanding the nuances of Form 90-1940 is crucial for policyowners looking to make informed decisions regarding their insurance holdings.

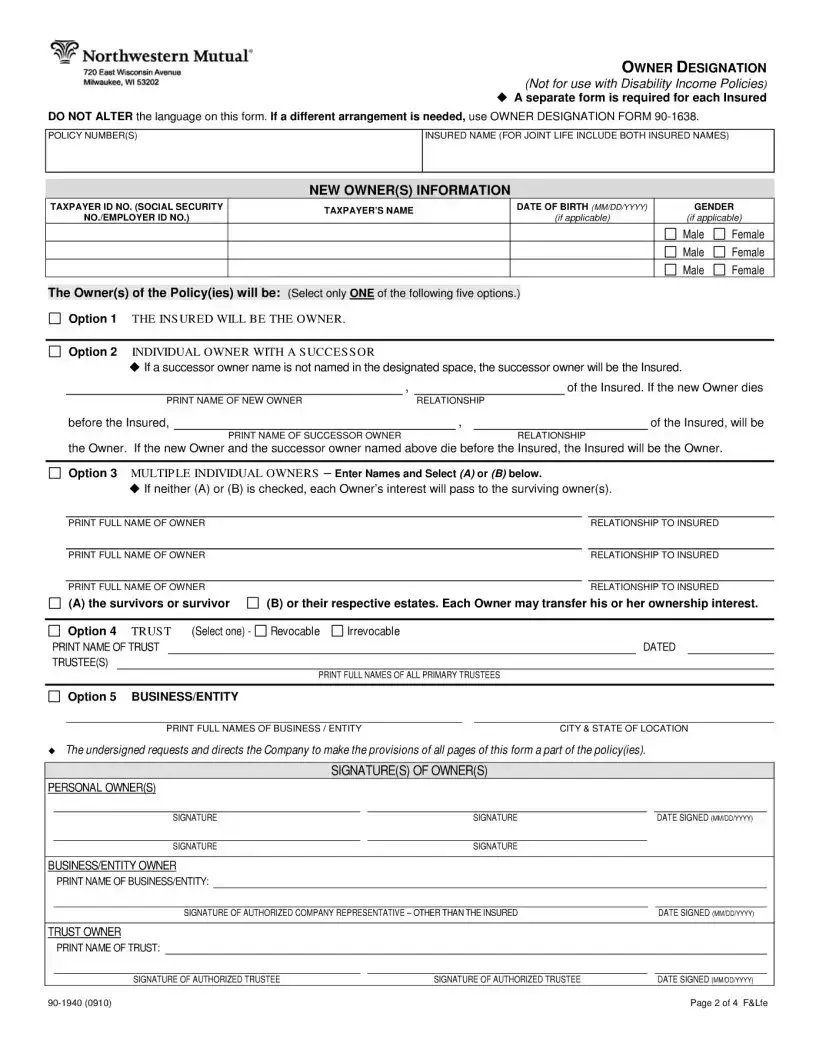

90 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Owner Form 90-1940 is used to designate a new owner for policies and covers common ownership transfers. |

| Ownership Options | Five options exist for selecting a new owner, including individuals, trusts, and corporations. |

| Tax Considerations | Designating a non-natural person as the owner may lead to significant tax consequences. |

| Required Information | New owners must provide their taxpayer ID number, date of birth, and gender when completing the form. |

| Mailing Instructions | After signing, all completed pages should be mailed to the designated address or faxed to the Home Office. |

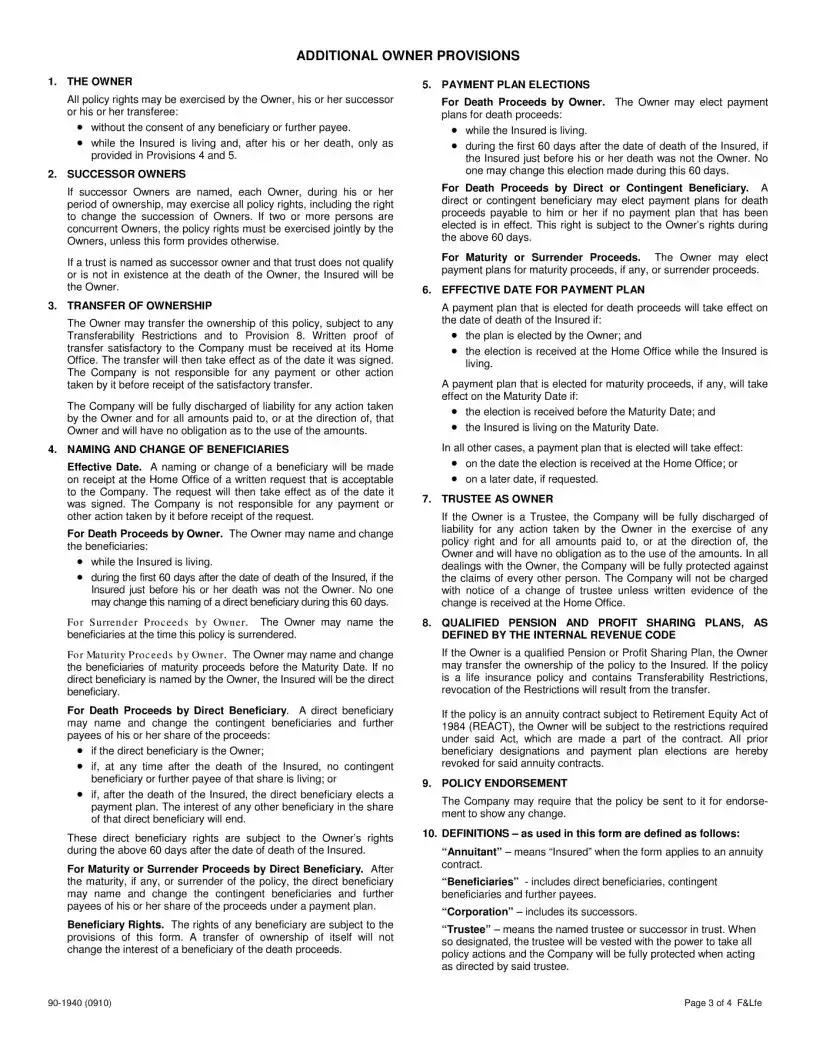

| Successor Owners | If a successor owner is designated, they may exercise rights during the period of ownership. |

| Governing Law | This form is governed by insurance law in the applicable state as well as federal tax laws. |

Guidelines on Utilizing 90

Filling out the Form 90-1940 can seem daunting, but following a clear and straightforward process will make it manageable. This form allows you to designate a new owner for various types of ownership situations regarding your insurance policies. After completing the form, you will submit it for processing to ensure that your ownership designation is updated appropriately.

- Gather the Necessary Information: Collect details such as the policy number, the name of the insured, and the new owner's taxpayer identification number (Social Security Number for individuals or Employer Identification Number for entities).

- Identify the New Owner: Decide who the new owner will be. Choose only one option among the five available options for ownership transfer.

- Fill Out New Owner’s Information: Complete the new owner's name, taxpayer ID number, date of birth, and gender in the designated fields.

- Indicate Ownership Type: Based on your previous choice, fill in the appropriate section for the ownership type. Be thorough when listing multiple owners or specifying a trust or corporation.

- Signatures: Ensure that all required signatures are provided, including the date signed. This step is crucial for confirming the authenticity of the request.

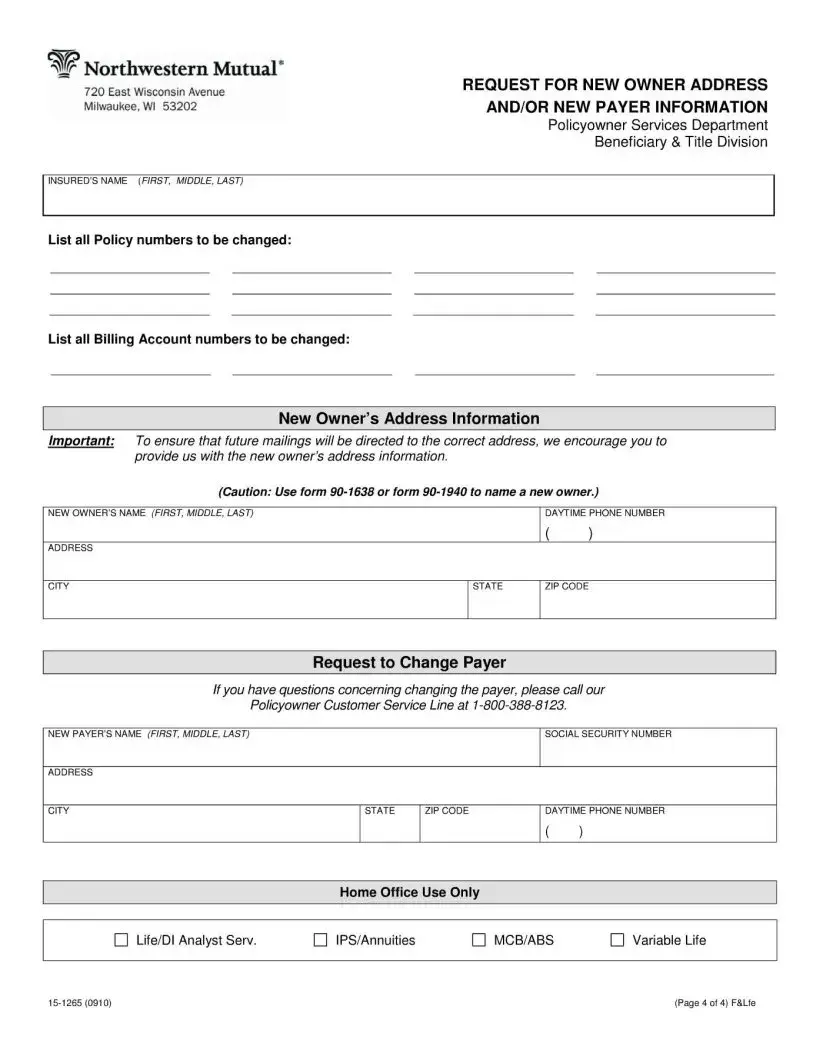

- Prepare the Mailing Package: Include the completed owner designation form along with Form 15-1265 (for address and billing information) if necessary.

- Submit the Forms: Mail all pages of the completed forms to Northwestern Mutual at the provided address or fax them to the Home Office.

- Keep Copies: Retain copies of the completed forms and any correspondence for your records.

After submission, if any questions arise or additional assistance is needed, the Beneficiary & Title Division is available to help clarify ownership designations. Keeping communication open ensures that everything is handled efficiently.

What You Should Know About This Form

What is the purpose of Form 90-1940?

Form 90-1940 is used to designate a new owner for a policy, covering different types of ownership transfers and succession ownership arrangements. Only one ownership option can be selected on this form, making it straightforward for policyholders to specify their preference. The form outlines various options, including naming the insured as the new owner, appointing individual owners, establishing trusts, or selecting corporations as owners.

What information is required when filling out Form 90-1940?

When completing Form 90-1940, you'll need to provide the new owner’s taxpayer identification number and, for individual owners, their date of birth and gender. This data ensures that the new owner's identity is verified and correctly documented. Additionally, you must select one of the available ownership options and provide details regarding the relationship between the new owner and the insured.

How should I submit Form 90-1940 once it is completed?

Once you have filled out and signed Form 90-1940, you have a couple of options for submission. You can mail it along with Form 15-1265 to Northwestern Mutual at their designated P.O. Box. Alternatively, you can fax both forms to their Home Office. Regardless of the method you choose, be sure to keep copies of all completed documents for your records.

Can I request a custom owner arrangement if none of the options fit my needs?

If the standard options on Form 90-1940 do not meet your requirements, you can request a custom owner arrangement. To do this, simply contact the Beneficiary & Title Division of the Policyowner Services Department at the provided phone number. They can help draft a suitable arrangement that aligns with your specific situation.

Are there any tax implications when naming a non-natural person as the new owner?

Yes, naming a non-natural person, such as a corporation or trust, as the new owner of a personal deferred annuity contract can have significant tax consequences. It’s essential to consult with an attorney or tax advisor before making such changes. This step will help ensure you fully understand any potential tax implications that may arise from transferring ownership to a non-natural entity.

Common mistakes

Filling out the Owner Designation Form 90-1940 can be a straightforward process, but there are several common mistakes that can lead to complications. One significant error is not selecting only one ownership option from the available choices. This form offers five distinct options for naming a new owner, such as individual owners or trusts. It is crucial to select only one option. If multiple options are checked, it can lead to confusion and processing delays.

Another frequent mistake involves omitting essential information. Each new owner must provide a taxpayer identification number, which is typically a Social Security Number for individuals or an Employer Identification Number for entities. Additionally, date of birth and gender for individual owners are required. Missing this information can cause the form to be returned or delayed as the company may not be able to process the request without complete information.

People also often forget to include the necessary accompanying forms. Along with the Owner Designation Form, Form 15-1265 should be completed to confirm the new owner's address and billing information. Failing to submit this additional form can result in future correspondence being sent to an incorrect address or the wrong payer being billed, leading to further complications in managing the policy.

Lastly, there is a tendency to overlook the importance of signing and dating the form correctly. The new owner must sign the document using the appropriate signature block. If this step is neglected or performed incorrectly, the form may not be accepted, causing further delays in processing the ownership designation. Ensuring all signatures and dates are present will help facilitate a smoother transition of ownership.

Documents used along the form

When designating a new owner for a policy, several other forms and documents are often necessary to ensure a smooth transition and proper record-keeping. Below, you will find an overview of these commonly used documents. Each plays a crucial role in the owner designation process and helps maintain clear communication with the insurance provider.

- Form 15-1265: This form is used to request a new owner address and/or new payer information. It is important to fill this out in conjunction with the owner designation form to ensure that all future correspondence reaches the appropriate party.

- Form 90-1638: If the standard ownership options do not accommodate the specific needs of the policyholder, this form allows for a custom-drafted owner arrangement. It's useful when more complex ownership structures are required.

- Change of Beneficiary Form: This document is essential for updating or naming new beneficiaries after the new owner is designated. It ensures that the right individuals receive the benefits when the policy matures or in the event of the owner's death.

- Transfer of Ownership Form: When transferring ownership from one individual or entity to another, this form formally documents the change. It provides legal evidence of the transfer and is vital for the maintenance of rights associated with the policy.

- Trust Agreement: If the new owner is a trust, a copy of the trust agreement may be required. This document provides details on the trust's purpose, trustees, and their powers, ensuring that the insurance company recognizes the trust's validity.

- Payment Plan Election Form: If the new owner intends to set up payment plans for premiums or death benefits, this form outlines those choices. It is crucial for specifying how benefits are paid out and under what conditions.

Understanding these documents and forms is key to successfully managing the ownership and benefits of any policy. Always consult with a knowledgeable professional if you have any questions or need guidance on completing these forms accurately.

Similar forms

- Form 15-1265 - This form complements the Owner Designation Form by allowing for a request for new owner address and/or new payer information. Like Form 90-1940, it ensures that communications are sent to the correct parties.

- Form 90-1638 - This is an alternative owner designation form for situations not covered by Form 90-1940. Both forms facilitate the designation of ownership but differ in the ownership arrangements they accommodate.

- Beneficiary Designation Form - This form allows the owner to specify beneficiaries for a policy. Like the 90-1940 form, it requires the detailed identification of involved parties and their relationships to the insured.

- Transfer of Ownership Form - This document is used to formally transfer the ownership of a policy from one person or entity to another. Similar to Form 90-1940, it deals with changes in policy ownership, albeit typically under different circumstances.

- Trust Setup Form - This form is utilized to establish a trust that may serve as the owner of a policy. Both the trust setup and Form 90-1940 address ownership designations but focus on different structures for managing ownership.

- Change of Address Form - Like Form 15-1265, this document ensures that the correct contact information is on file. Both forms aim to maintain accurate records for effective communication regarding the policy.

- Power of Attorney Form - This form grants authority to another individual to act on behalf of the owner. While Form 90-1940 concerns owner designations, both involve the delegation of rights and responsibilities concerning policy management.

- Change of Payer Form - This form is used to update the payer information for a policy. Similar to the Owner Designation Form, it necessitates relevant details about the payer and their relationship to the policy owner or insured.

Dos and Don'ts

- Do read the entire form carefully before filling it out.

- Don't alter any language on the form; use it as provided.

- Do ensure only one ownership option is selected.

- Don't forget to include the new owner’s taxpayer identification number.

- Do provide the new owner’s date of birth and gender where applicable.

- Don't leave sections blank; fill out all required fields accurately.

- Do sign and date the form using the appropriate signature block.

- Don't send the form without making a copy for your records.

- Do call customer service if you have any questions during the process.

- Don't mail or fax the form without checking that all necessary documents are included.

Misconceptions

- Misconception 1: The Form 90-1940 can be used for any type of policy.

- Misconception 2: You can select multiple ownership options on Form 90-1940.

- Misconception 3: There are no significant tax implications when naming a non-natural person as an owner.

- Misconception 4: Mailing or faxing the completed form is optional.

Many people believe that the Form 90-1940 is applicable for all insurance types. In reality, this form is specifically designed for ownership changes, excluding Disability Income Policies. Users must refer to a different form, the Owner Designation Form 90-1638, if they wish to make ownership changes regarding Disability Income Policies.

Some individuals think they can choose several options at once to designate ownership. However, the form strictly allows only one ownership option to be selected at a time, ensuring clarity and preventing confusion about the ownership structure.

It’s easy to assume that all ownership transfers are straightforward. Nonetheless, naming a non-natural person, such as a corporation or trust, as the new owner of a personal deferred annuity contract can lead to substantial tax consequences. Consulting with an attorney or tax advisor is essential to avoid unexpected liabilities.

People often overlook the importance of submitting the completed Form 90-1940 properly. Sending all pages of the form, including any necessary additional forms, to the specified address or fax number is crucial. This ensures that the ownership change is processed without delays or complications.

Key takeaways

Understanding the 90 form is crucial when it comes to transferring or designating ownership. Here are some key takeaways about utilizing the Owner Designation Form 90-1940:

- Choose Wisely: Only one ownership option can be selected on the form. Options range from naming the Insured as the new Owner to identifying a trust or corporation.

- Tax Considerations: Be cautious when naming a non-natural person as the new Owner on personal deferred annuity contracts due to possible significant tax implications. Consulting with an attorney or tax advisor first is recommended.

- Accurate Information is Essential: Ensure to provide the new Owner’s taxpayer identification number, date of birth, and gender. Any inaccuracies may cause delays in processing.

- Follow Mailing Instructions: After completing the form, remember to date and sign it. It can be mailed or faxed to the specified address to ensure it is processed promptly.

Browse Other Templates

Donation Form Template for Nonprofit - Make your donation using a check or by charging directly to your credit card.

How to Obtain a Background Check on Myself - Please print all information clearly to avoid errors in your background check.