Fill Out Your 96 Alabama Form

The 96 Alabama form serves as a vital tool for individuals and businesses in Alabama to report certain financial transactions to the Alabama Department of Revenue. This summary form must be submitted by any payer—whether an individual, corporation, or association—who makes payments of $1,500 or more in a calendar year to anyone liable for Alabama income tax. It includes essential details such as the payer's Social Security number or Federal Employer Identification Number (FEIN), their address, and the total number of Form 99s attached. The form clearly outlines that even if Alabama income tax has been withheld from these payments, the corresponding Form 99 still needs to be filed except where employers are submitting Form A-2 for salaries. Importantly, payers can opt to submit copies of federal Form 1099 in place of Form 99 if that avenue is more suitable. Timeliness is critical; the form must be finalized and sent to the Department of Revenue by March 15 of the following year to ensure compliance. This duty underscores the importance of maintaining accurate records and adhering to state regulations regarding income reporting.

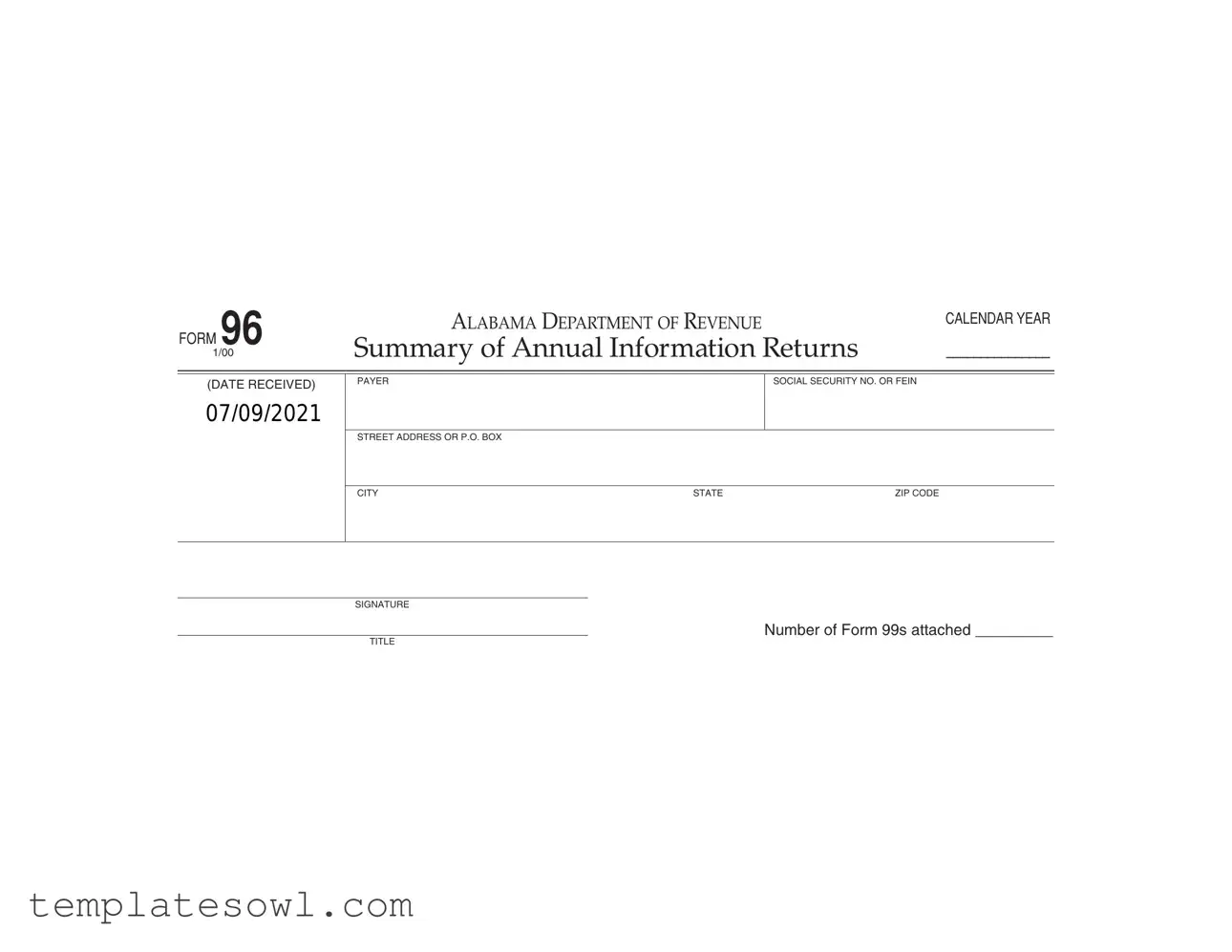

96 Alabama Example

FORM 96 |

ALABAMA DEPARTMENT OF REVENUE |

CALENDAR YEAR |

|

|

|

1/00 |

Summary of Annual Information Returns |

_______________ |

(DATE RECEIVED)

07/09/2021

PAYER |

SOCIAL SECURITY NO. OR FEIN |

STREET ADDRESS OR P.O. BOX

CITY |

STATE |

ZIP CODE |

SIGNATURE

NUMBER OF FORM 99S ATTACHED _________

TITLE

Instructions

Information returns on Form 99 must be filed by every resident individual, corporation, association or agent making payment of gains, profits or income (other than interest coupons payable to bearer) of $1,500.00 or more in any calendar year to any taxpayer subject to Alabama income tax. If you have voluntarily withheld Alabama income tax from such payments, you must file Form 99 or approved substitute regardless of the amount of the payment. Employers filing Form

Returns must be filed with the Alabama Department of Revenue for each calendar year on or before March 15 of the following year.

Mail to: Alabama Department of Revenue |

NOTE: IF ALABAMA INCOME TAX HAS BEEN WITHHELD ON FORM 99 |

Individual & Corporate Tax Division |

DO NOT USE THIS FORM; USE FORM |

P.O. Box 327489 |

OF ALABAMA INCOME TAX WITHHELD. |

Montgomery, AL |

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The 96 Alabama form is a summary of annual information returns for payments made to taxpayers subject to Alabama income tax. |

| Governing Law | This form is governed by the Alabama Code Title 40, Chapter 18, which deals with income tax regulations. |

| Filing Requirement | Every resident individual, corporation, association, or agent must file Form 99 if they make payments of $1,500 or more within the calendar year. |

| Payment Exemption | Employers filing Form A-2 for salaries and wages do not need to report the same payments on Form 99. |

| Due Date | Form 96 must be filed with the Alabama Department of Revenue on or before March 15 of the following year. |

| Address for Filing | Mailed forms should be sent to the Alabama Department of Revenue, P.O. Box 327489, Montgomery, AL 36132-7489. |

| Form 99 Filing | If Alabama income tax has been withheld, individuals should not use this form; instead, they must use Form A-3. |

| Voluntary Withholding | Voluntary withholding of Alabama income tax requires filing Form 99 or an approved substitute, no matter the payment amount. |

| Submission Format | In place of Form 99, filers can submit copies of federal Form 1099 to the Alabama Department of Revenue. |

| Signature Requirement | A signature is required on the form to certify the accuracy of the information provided. |

Guidelines on Utilizing 96 Alabama

After gathering the necessary information, it's time to fill out Form 96 for the Alabama Department of Revenue. This form helps summarize annual information returns. Below are the step-by-step instructions to complete it accurately.

- Start by entering the date received in the designated space.

- Fill in the Payer's Social Security Number or FEIN. Ensure that this number is correct, as it identifies your tax records.

- Next, provide the street address or P.O. Box of the payer. Be thorough; missing details can lead to delays.

- Add the city, state, and ZIP code of the payer's address. Correct information here is essential for proper filing.

- Sign the form in the signature section. This confirms that the information is accurate and complete.

- Indicate the number of Form 99s attached by filling in the appropriate number. This shows how many returns accompany your submission.

- Double-check all entries for accuracy to avoid any issues with the filing.

- Mail the completed form to the provided address: Alabama Department of Revenue, Individual & Corporate Tax Division, P.O. Box 327489, Montgomery, AL 36132-7489.

What You Should Know About This Form

What is Form 96 and what is its purpose?

Form 96 is a document required by the Alabama Department of Revenue. It summarizes the annual information returns associated with Form 99. This form is used by individuals and entities that have made payments of gains, profits, or income of $1,500 or more to any taxpayer liable for Alabama income tax within a calendar year.

Who needs to file Form 96?

The form must be completed and filed by every resident individual, corporation, association, or agent that has made qualifying payments during the calendar year. This includes those who have voluntarily withheld state income tax from these payments. Employers filing Form A-2 for wages paid do not need to submit identical information on Form 99 or Form 96.

What types of payments are reported on Form 99?

Form 99 covers all payments of $1,500 or more made during the calendar year to taxpayers subject to Alabama income tax. This includes payments related to earnings, profits, or other income, excluding interest coupons payable to bearer. If Alabama income tax has been forcibly withheld, this must also be reported.

Can I use federal Form 1099 instead of Form 99?

Yes, you can substitute Form 99 with copies of federal Form 1099 when reporting payments to the Alabama Department of Revenue. This option simplifies the process, as federal 1099 forms provide similar information required for local compliance.

What is the deadline for filing Form 96?

Form 96, along with attached Form 99s, must be filed by March 15 of the year immediately following the calendar year in which the payments were made. It is essential to meet this deadline to ensure compliance and avoid potential penalties.

What should I do if Alabama income tax has been withheld on Form 99?

If Alabama income tax has been withheld, Form 96 should not be used. Instead, you must fill out Form A-3, which is specifically designed for the annual reconciliation of withheld Alabama income tax. This will ensure accurate reporting of withheld income tax amounts.

Where should I submit Form 96?

You should mail Form 96, along with any required attachments, to the Alabama Department of Revenue, Individual & Corporate Tax Division, P.O. Box 327489, Montgomery, AL 36132-7489. Ensure that it is properly addressed and submitted before the filing deadline to prevent any issues.

Common mistakes

Completing the 96 Alabama form can be confusing, and people often make mistakes that can lead to issues down the line. One common error is failing to provide accurate taxpayer information. The Payer Social Security Number or Federal Employer Identification Number (FEIN) is critical for identification. Inaccurate or incomplete entries can delay processing and may trigger further inquiries.

Another mistake occurs when individuals overlook the requirement for filing Form 99. Many do not realize that any resident individual or entity making payments of $1,500.00 or more must file this form. Neglecting this duty can lead to penalties, particularly if payments were made to individuals subject to Alabama income tax.

People often misinterpret the attachment process as well. When submitting the 96 Alabama form, it's essential to indicate the number of Form 99s that are attached. Failing to do so can result in processing delays. Additionally, some filers mistakenly assume that reporting payments on Form A-2 negates the need to file Form 99, which is incorrect.

Moreover, many individuals are unaware of the March 15 deadline for submission. Missing this date can result in late fees or penalties. Setting reminders can help ensure compliance and avoid last-minute stress.

Lastly, some people do not pay attention to the specific mailing address for the Alabama Department of Revenue. Sending forms to the wrong location can cause further complications. Always double-check the address to ensure proper delivery of documents.

Documents used along the form

The 96 Alabama form is part of the process for reporting income and tax withholdings to the Alabama Department of Revenue. Several other documents commonly accompany this form to ensure compliance with state regulations. Below is a list of related forms and documents.

- Form 99: This form is used to report payments made to individuals or entities that are subject to Alabama income tax. It captures various income payments, including gains and profits of $1,500 or more made within a calendar year.

- Form A-2: Employers file this form to report salaries and wages paid to employees. This form is separate from Form 99, as it specifically pertains to wages, ensuring that employers do not double-report those figures.

- Form 1099: Federal Form 1099 is similar to Form 99 but is used for reporting various types of income other than wages. In lieu of Form 99, taxpayers may submit copies of this form to the Alabama Department of Revenue.

- Form A-3: This Annual Reconciliation form is required if Alabama income tax has been withheld. It reconciles the amount of tax withheld from employee payments throughout the year, ensuring that the amounts reported are consistent.

- Schedule D: Used for reporting capital gains and losses, this schedule includes details on the sale of assets. For taxpayers in Alabama, it is crucial for accurately reporting taxable income.

- Form R-1: This form is utilized for reporting estate or inheritance tax information. Taxpayers use it when dealing with significant assets or estates that may require additional tax considerations.

- Form IL-1040: For non-resident aliens, this form serves to report income earned in Alabama. It ensures that all income tax liabilities are appropriately calculated and reported to the state.

- Form 40: This is the Alabama individual income tax return. Residents complete this form annually to report their income, deductions, and tax liabilities to the state.

- Form CR: Completed to claim tax credits, this Credit form allows taxpayers to report various credits that may reduce their overall tax liability in Alabama.

- Form D-1: Non-residents use this form to file Alabama income tax returns. This document helps non-residents report income and determine any tax due to the state.

Understanding these forms and their purposes is essential for effective tax reporting in Alabama. By ensuring that all necessary documents are filed, taxpayers can remain compliant with state requirements.

Similar forms

The 96 Alabama form, specifically the Summary of Annual Information Returns, is comparable to several other documents used for reporting income and tax information within Alabama. Below are six documents similar to the 96 Alabama form, along with a brief explanation of how they relate to it.

- Form 99: This form is directly related as it must be filed by individuals and entities making payments of $1,500 or more to Alabama taxpayers. The 96 Alabama form summarizes the information reported on Form 99.

- Federal Form 1099: Like the Form 99, this federal document reports various types of income. Taxpayers can submit copies of Federal Form 1099 to the Alabama Department of Revenue in lieu of Form 99, indicating its importance in income reporting.

- Form A-2: Employers utilize this form to report wages and salaries paid to employees. Unlike Form 99, which also deals with other types of payments, Form A-2 is specifically for employee compensation, and its information does not need to be included on Form 99.

- Form A-3: This form is pertinent when Alabama income tax has been withheld from payments reported on Form 99. It's used for the annual reconciliation of income tax withheld, providing a connection to Form 96 for reporting purposes.

- Form W-2: Employers use this form to report wages, tips, and other compensation paid to employees. Similar to Form A-2, Form W-2 serves a different purpose but is part of the broader context of income reporting in Alabama.

- Form 1040: The individual income tax return filed with the federal government shares similarities, as it summarizes an individual's income for the tax year. Revenue reported on forms like Form 99 or 1099 ultimately factors into the information reported on Form 1040.

Dos and Don'ts

When filling out the 96 Alabama form, it’s crucial to handle it correctly to avoid delays and complications. Here’s a straightforward list of what you should and shouldn’t do:

- Do include your correct Payer Social Security Number or FEIN.

- Do provide a complete street address or P.O. Box for your mailing address.

- Do ensure all information is accurate, including the number of Form 99s attached.

- Do file your form by the deadline of March 15 of the following year.

- Don’t forget to sign the form. Your signature is necessary.

- Don’t use this form if Alabama income tax has been withheld on Form 99; use Form A-3 instead.

- Don’t file the form with incomplete information. Double-check all entries before submission.

- Don’t mail the form to the wrong address. Ensure it goes to the Alabama Department of Revenue.

Misconceptions

Understanding the nuances of tax forms can often lead to confusion. The 96 Alabama form, specifically designed for reporting certain income payments, is no exception. Here are eight common misconceptions about this form, debunked to help clarify its purpose and proper use.

- Misconception 1: The 96 Alabama form is the same as Form 99.

- Misconception 2: You only need to file Form 99 if you're withholding taxes.

- Misconception 3: All payments to any taxpayer require Form 99.

- Misconception 4: The filing deadline is flexible.

- Misconception 5: You cannot use federal Form 1099 as a substitute for Form 99.

- Misconception 6: Employers don’t need to worry about this form if they submit Form A-2.

- Misconception 7: There’s no need to track the payments throughout the year.

- Misconception 8: The form can be submitted electronically.

This is incorrect. Form 96 is a summary form, while Form 99 is the actual information return that must be filed for specific payments made during the calendar year.

This is not true. Form 99 must be filed whenever payments of $1,500 or more are made, regardless of whether taxes were withheld.

This is misleading. Form 99 should only be filed for payments of gains, profits, or income to taxpayers subject to Alabama income tax, not for every single payment.

Actually, the deadline is firm. Form 99 must be filed by March 15 of the following year to avoid penalties.

This is misleading. If you file copies of federal Form 1099 with the Alabama Department of Revenue, that can serve as an acceptable alternative to Form 99.

That is partially false. While employers should file Form A-2 for employee wages, they still need to file Form 99 for other applicable payments.

This is a dangerous belief. Keeping accurate records throughout the year is essential to ensure compliance and to facilitate accurate reporting on Form 99.

This misconception is predicated on outdated info. As of the latest guidance, Form 99 must be filed via mail, not electronically.

By dispelling these misconceptions, individuals and organizations can navigate the requirements of the 96 Alabama form more effectively, ensuring compliance and peace of mind during tax season.

Key takeaways

Understanding how to fill out and utilize the 96 Alabama form is crucial for compliance with state tax regulations. Here are some key takeaways to help you navigate this process effectively:

- Ensure you're filing Form 99 if you are a resident individual, corporation, or association that has made payments over $1,500 in a calendar year to a taxpayer subject to Alabama income tax.

- Always report any voluntarily withheld Alabama income tax, regardless of the payment amount. This ensures you stay compliant with state laws.

- Remember that if you're already submitting Form A-2 for employee wages, those payments do not need to be reported again on Form 99.

- You can submit copies of federal Form 1099 instead of Form 99, making it simpler if you already have these federal records.

- File your returns with the Alabama Department of Revenue by March 15 of the following year to avoid penalties. Keep track of your filing dates!

By following these points, you simplify your tax filing process and reduce the risk of errors. Stay organized and proactive to ensure you meet all requirements efficiently.

Browse Other Templates

Student Emergency Contact Form,Broward County Student Info Card,Emergency Contact Information Sheet,Emergency Contact and Medical Info Card,Student Medical and Contact Preferences Form,Broward County Public Schools Emergency Card,Student Emergency Co - The school cannot release a student to anyone not listed on this Emergency Contact Card.

Treatment Plan Examples - Tasks will be assigned to encourage active participation and support treatment goals.