Fill Out Your 961 Form

The 961 form is a crucial document in the realm of real estate transactions, specifically serving as a Bargain and Sale Deed under Oregon law. This form primarily facilitates the transfer of property ownership from a grantor to a grantee. Its structure includes essential details, such as the names and addresses of both the grantor and the grantee, and it mandates clear identification of the real property being conveyed. A section dedicated to the consideration—the monetary value exchanged—underscores the financial aspect of the transaction, while the form also contains specific legal advisories aimed at protecting the rights of both parties involved. Notably, the document emphasizes the importance of verifying compliance with various land use laws and local planning regulations. Such considerations are pivotal in ensuring that the property is a legally established lot or parcel. For individuals looking to navigate the complexities of property transfers in Oregon, understanding the 961 form serves as a foundational step in making informed decisions.

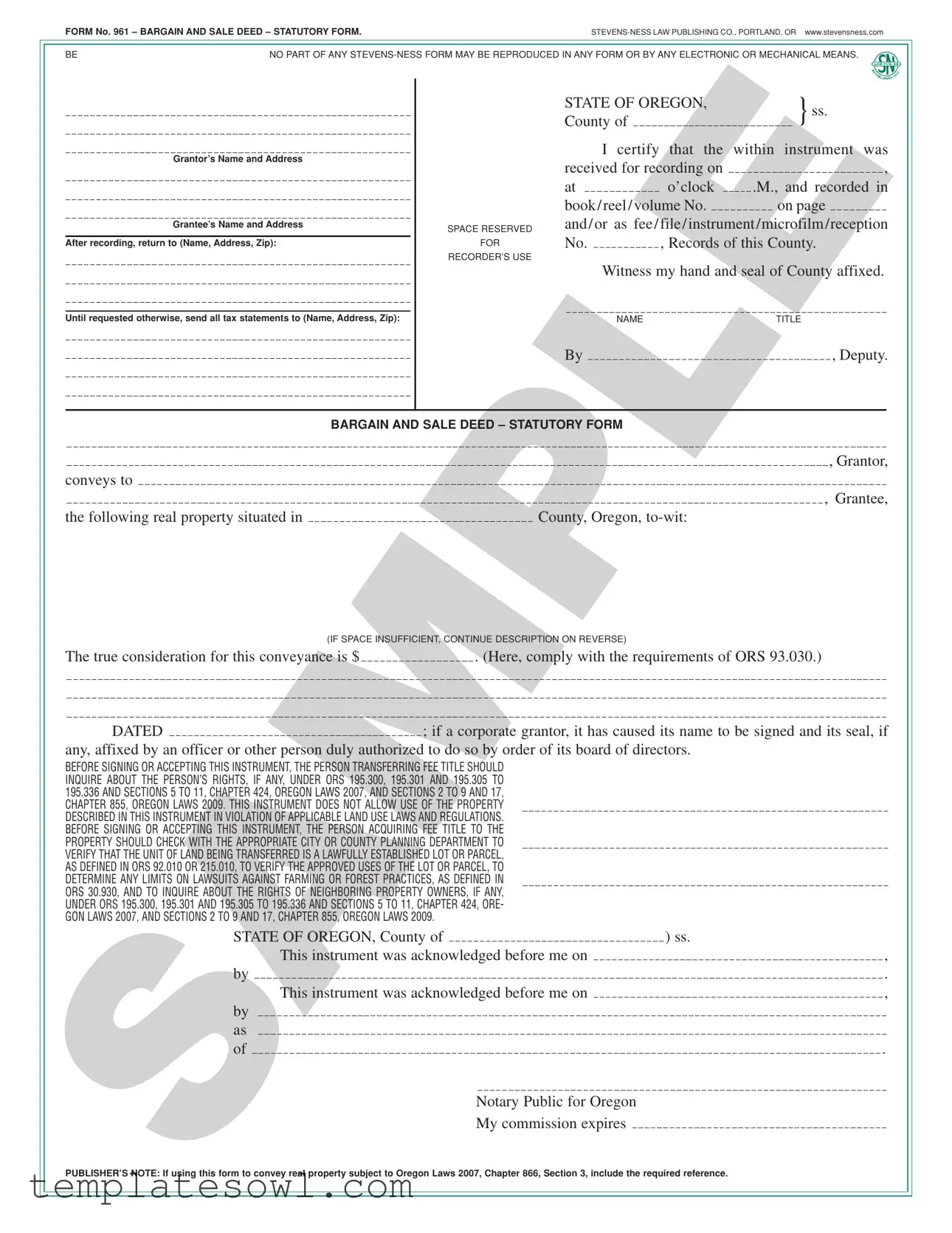

961 Example

FORM No. 961 – BARGAIN AND SALE DEED – STATUTORY FORM. |

BE |

NO PART OF ANY |

Grantor’s Name and Address

Grantee’s Name and Address

After recording, return to (Name, Address, Zip):

Until requested otherwise, send all tax statements to (Name, Address, Zip):

SPACE RESERVED

FOR

RECORDER’S USE

STATE OF OREGON, |

|

|

|

} ss. |

||||||||||||

County of |

|

|

|

|||||||||||||

|

|

I certify that the within instrument was |

||||||||||||||

received for recording on |

|

|

|

, |

||||||||||||

|

|

|||||||||||||||

at |

|

|

|

o’clock |

|

.M., and recorded in |

||||||||||

|

|

|||||||||||||||

book / reel / volume No. |

|

|

|

|

|

on page |

|

|

|

|

|

|

||||

|

|

|

|

|

||||||||||||

and / or as fee / file / instrument /microfilm /reception

No. |

|

|

|

, Records of this County. |

|

|

Witness my hand and seal of County affixed.

NAME |

TITLE |

By |

, Deputy. |

BARGAIN AND SALE DEED – STATUTORY FORM

, Grantor,

conveys to

, Grantee,

the following real property situated in |

|

|

|

County, Oregon, |

|

|

(IF SPACE INSUFFICIENT, CONTINUE DESCRIPTION ON REVERSE)

The true consideration for this conveyance is $ |

|

|

|

. (Here, comply with the requirements of ORS 93.030.) |

||

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATED; if a corporate grantor, it has caused its name to be signed and its seal, if any, affixed by an officer or other person duly authorized to do so by order of its board of directors.

BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON TRANSFERRING FEE TITLE SHOULD INQUIRE ABOUT THE PERSON’S RIGHTS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, OREGON LAWS 2007, AND SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009. THIS INSTRUMENT DOES NOT ALLOW USE OF THE PROPERTY DESCRIBED IN THIS INSTRUMENT IN VIOLATION OF APPLICABLE LAND USE LAWS AND REGULATIONS. BEFORE SIGNING OR ACCEPTING THIS INSTRUMENT, THE PERSON ACQUIRING FEE TITLE TO THE PROPERTY SHOULD CHECK WITH THE APPROPRIATE CITY OR COUNTY PLANNING DEPARTMENT TO VERIFY THAT THE UNIT OF LAND BEING TRANSFERRED IS A LAWFULLY ESTABLISHED LOT OR PARCEL, AS DEFINED IN ORS 92.010 OR 215.010, TO VERIFY THE APPROVED USES OF THE LOT OR PARCEL, TO DETERMINE ANY LIMITS ON LAWSUITS AGAINST FARMING OR FOREST PRACTICES, AS DEFINED IN ORS 30.930, AND TO INQUIRE ABOUT THE RIGHTS OF NEIGHBORING PROPERTY OWNERS, IF ANY, UNDER ORS 195.300, 195.301 AND 195.305 TO 195.336 AND SECTIONS 5 TO 11, CHAPTER 424, ORE- GON LAWS 2007, AND SECTIONS 2 TO 9 AND 17, CHAPTER 855, OREGON LAWS 2009.

STATE OF OREGON, County of |

|

|

|

) ss. |

|||||||||||

|

|

||||||||||||||

|

|

|

|

|

|

This instrument was acknowledged before me on |

, |

||||||||

by |

|

|

|

|

|

|

|

. |

|||||||

|

|

||||||||||||||

|

|

|

|

|

|

This instrument was acknowledged before me on |

, |

||||||||

by |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

as |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

of |

|

|

|

|

|

|

|

Notary Public for Oregon |

|

|

|

|

. |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

My commission expires |

|

|

|

|

|

|

|

PUBLISHER’S NOTE: If using this form to convey real property subject to Oregon Laws 2007, Chapter 866, Section 3, include the required reference.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | FORM No. 961 – Bargain and Sale Deed – Statutory Form. This form is used for the transfer of real property in Oregon. |

| Governing Laws | The form complies with relevant provisions under Oregon Revised Statutes (ORS), specifically ORS 93.030 and ORS 195.300 to 195.336. |

| Usage Restrictions | Use of the property described in this deed must comply with applicable land use laws and regulations. |

| Acknowledgment Requirement | This instrument must be acknowledged before a notary public. The notary’s commission details need to be provided upon notarization. |

Guidelines on Utilizing 961

Filling out the 961 form is a critical step in formalizing real estate transactions, particularly in Oregon. Doing so correctly helps to ensure that the transfer of property is valid and recognized by local authorities. Here are the steps to complete the form accurately.

- Gather Necessary Information: Collect the names and addresses of both the grantor (the seller) and the grantee (the buyer).

- Complete Grantor’s Section: Fill in the grantor’s name and address in the designated area of the form.

- Complete Grantee’s Section: Enter the grantee’s name and address next to the grantor’s information.

- Recording Information: In the “After recording, return to” section, list the name and address of the individual who should receive the recorded document.

- Tax Statements: Provide the name and address for sending all tax statements, which may be the same as the grantee’s information.

- Property Description: Describe the property being conveyed. Be detailed, but if space is insufficient, continue your description on the reverse side of the form.

- True Consideration: State the true consideration (or the total payment) for the property transfer in the specified field.

- Date and Sign: Insert the date of the transaction and ensure that the grantor signs the form. If the grantor is a corporation, an authorized person must sign on behalf of the corporation.

- Notarization: Leave the “acknowledged before me” section blank for notarization. A notary public will complete this section when the document is signed.

- Final Checks: Review the entire form for accuracy. Double-check all names, addresses, and property details before submission.

Once the form is filled out, it needs to be recorded with the appropriate county authority. Properly completing and filing this document can protect both parties involved in the real estate transaction and ensure compliance with state laws.

What You Should Know About This Form

What is Form 961?

Form 961, also known as the Bargain and Sale Deed, is a legal document used in Oregon to transfer ownership of real property. It is a statutory form that provides essential details about the transaction, including the names of the seller (grantor) and buyer (grantee), the property being transferred, and any financial considerations involved.

Who should use Form 961?

This form is suitable for anyone looking to sell or buy real estate in Oregon. However, it is particularly important for individuals or entities that want to ensure their property transfer follows state laws and maintains clear title to the property. Always consider consulting with a legal professional to confirm it meets your needs.

What information is required on Form 961?

The form requires several key pieces of information. You'll need to provide the names and addresses of both the grantor and grantee, a detailed description of the real property being transferred, and the sale price or consideration. Additionally, any corporate grantor will need to indicate which authorized person completed the signing.

Why is a legal description of the property important?

A legal description provides specific boundaries and characteristics of the property in question. It is crucial for identifying the exact property involved in the transaction. Using an inaccurate description can lead to disputes or complications in ownership down the line.

What does it mean when it states the "true consideration for this conveyance is $ .”?

This line refers to the actual financial amount exchanged for the property. It’s essential to fill it out accurately, as it can affect tax assessments and may have implications for future property valuations.

What are the legal implications of Form 961?

Signing this form signifies that the grantor is transferring their rights to the property to the grantee. It’s important to understand that this deed does not allow the property to be used in violation of any local laws or regulations, ensuring compliance with land use requirements.

Should the grantee check with city or county planning departments?

Yes, the grantee is strongly advised to verify that the property is a lawful lot or parcel. This ensures compliance with local zoning laws and prevents future legal issues regarding land use or the rights of neighboring property owners.

What happens after Form 961 is signed?

Once Form 961 is signed and acknowledged by a notary public, it should be recorded with the local county recorder’s office. Recording the deed is essential to protect the new owner's rights and establish a public record of the property transfer.

Can the content of Form 961 be altered?

It is generally discouraged to alter the content of any statutory form like Form 961 without proper legal advice. Making unauthorized changes can lead to the form being deemed invalid or unenforceable. Always consult legal counsel before making adjustments.

Where can I find more information about Form 961?

For more details, you can visit state or local government websites that provide legal forms and resources. You may also consult a real estate attorney or a professional specializing in property transactions for guidance tailored to your situation.

Common mistakes

Filling out Form 961 can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. Awareness of these mistakes can help you avoid unnecessary issues and ensure a smooth transaction when dealing with real property in Oregon.

One prevalent error occurs in the Grantor’s Name and Address section. It’s crucial to ensure that the name and address of the individual or entity transferring ownership are correctly entered. Often, people forget to double-check the spelling or provide updated information. An incorrect name may invalidate the deed or lead to disputes in ownership.

Another mistake arises when entering the Grantee’s Name and Address. Just like with the grantor, accuracy is essential here. Omitting middle names, using incorrect spellings, or forgetting to include a business title can cause significant problems. If the relevant party isn't correctly identified, it may create confusion during ownership transfer and in future property transactions.

Many signers also overlook the consideration amount for the property. This figure, which reflects the true monetary value exchanged in the transaction, is required by law. Some people either leave this field blank or enter a nominal amount, which could raise questions from tax authorities. It's always best to provide a truthful representation of the transaction value to avoid issues later on.

In addition, misunderstanding or failing to comply with the land use regulations can create headaches. The form includes disclaimers advising parties to check with local planning departments before signing. Skipping this step puts buyers at risk of discovering restrictions or limitations on their property usage after the transaction is complete. To protect yourself, verify all necessary zoning laws and any other regulations that may affect your property.

Finally, many forget to secure proper notary acknowledgment. This official signature is vital for the legality of the document. Without it, the form may not be enforceable. Ensure that you coordinate with a notary public before completing your transaction to validate the process.

Being mindful of these common mistakes will ultimately save time, stress, and potential financial difficulties. By taking a few extra moments to check your work, you can achieve a seamless experience with Form 961.

Documents used along the form

When dealing with transactions involving the 961 form, several other forms and documents often accompany it to ensure proper processing and compliance with the law. Here’s a brief overview of these commonly used documents:

- Property Transfer Disclosure Statement: This document provides essential information about the condition of the property. Sellers must disclose any known issues that could affect the value or desirability of the property.

- Affidavit of Identity: This affidavit identifies the parties involved in the transaction. It verifies their names and addresses, helping to establish clear ownership and connection to the property.

- Grant Deed: This document is used to transfer title of real property. Unlike a bargain and sale deed, a grant deed guarantees that the property hasn’t been sold to anyone else.

- Preliminary Title Report: Prepared by a title company, this report shows the current ownership status of the property as well as any liens or encumbrances that may affect it.

- Loan Documents: If financing is involved, there will be a set of loan documents that outline the terms and conditions of the mortgage. These documents protect both the lender and borrower.

- Purchase Agreement: This is a contract between the buyer and seller that outlines the details of the sale. It includes the purchase price, property description, and any contingencies.

- Notice of Sale: This document notifies interested parties of the upcoming sale of the property. It helps ensure that all relevant stakeholders are informed and can participate in the process.

- Quitclaim Deed: This is used to transfer any interest one party may have in a property without making any guarantees about the title. It’s often used to clear up title issues.

- Recording Request: This form is submitted to the county recorder’s office to request that the deed and other documents be officially recorded in the public record.

These additional documents work together with the 961 form to ensure a smooth and compliant transfer of property. Each document plays a vital role in clarifying ownership, conditions, and agreements between the involved parties.

Similar forms

The FORM No. 961, also known as the Bargain and Sale Deed, is a type of legal document used to transfer property ownership. There are several other documents that serve similar purposes in real estate transactions. Here are five such documents:

- Warranty Deed: This document guarantees that the seller (grantor) has clear title to the property and has the right to sell it. Unlike the Bargain and Sale Deed, a Warranty Deed provides more protection to the buyer (grantee) against future claims to the property.

- Quitclaim Deed: A Quitclaim Deed transfers any interest the grantor may have in the property without making any guarantees. It's often used to transfer ownership between family members or to clear up title issues, making it less formal than a Bargain and Sale Deed.

- Grant Deed: Like the Bargain and Sale Deed, a Grant Deed conveys title to a property. However, it also includes assurances that the property has not been sold to anyone else and that there are no encumbrances unless disclosed, providing a middle ground in terms of buyer protection.

- Trustee’s Deed: A Trustee’s Deed is used when a property is transferred from a trust. It operates similarly to a Bargain and Sale Deed but includes additional stipulations regarding the trust’s role and authority in the transfer process.

- Affidavit of Title: While not a deed per se, this document accompanies real estate transactions to affirm that the seller is the rightful owner of the property and that there are no outstanding liens or claims against it, similar in intent to the assurances provided by a Bargain and Sale Deed.

Dos and Don'ts

Filling out the 961 form, a Bargain and Sale Deed, requires care and attention to detail. Below are ten important do's and don’ts to assist in this process.

- Do verify all names and addresses for the Grantor and Grantee before completing the form.

- Do ensure that the legal description of the property is accurate and complete.

- Do provide the correct consideration amount reflecting the transaction value.

- Do check for any land use laws that might apply to the property being conveyed.

- Do consult with the planning department to confirm that the property is a lawful lot or parcel.

- Don't leave any sections of the form blank, as this may lead to delays or rejections.

- Don't neglect to obtain the necessary signatures from all required parties.

- Don't ignore the need for notarization, as it is vital for the form’s validity.

- Don't overlook understanding the rights of neighboring property owners as required by specific laws.

- Don't use the form without checking if any additional requirements are necessary under Oregon state laws.

These guidelines aim to facilitate a smoother experience when completing the 961 form. Attention to detail and adherence to legal standards will contribute to a successful property transfer.

Misconceptions

- Misconception 1: The 961 form is only for residential properties.

- Misconception 2: Once the form is filed, it's unchangeable.

- Misconception 3: There are no legal implications attached to the form.

- Misconception 4: Using the 961 form guarantees property title is clear.

- Misconception 5: Anyone can fill out the form without assistance.

- Misconception 6: It’s unnecessary to check local planning regulations if using the 961 form.

This form can be used for various types of real estate transactions, not just residential. It’s applicable for commercial properties and land transfers as well.

You can amend or modify the terms of the transaction after filing, provided that both the grantor and grantee agree to the changes. It’s a two-way street!

Filing this form legally binds the parties involved to the terms stated. It’s crucial to understand your rights and obligations before signing.

While the 961 form facilitates the transfer, it doesn't ensure that the property title is free of claims or liens. Conduct due diligence through a title search.

Though individuals can fill it out, seeking guidance from a professional is advisable. Doing so can help avoid costly mistakes.

It's essential to check with local planning authorities. The 961 form does not exempt property transactions from local land use laws and regulations.

Key takeaways

Here are some important points to remember when filling out and using Form 961, the Bargain and Sale Deed. This form pertains to the transfer of real property in the state of Oregon.

- Identify the Parties: Clearly list the Grantor (the seller) and the Grantee (the buyer) with their names and addresses. This ensures that all involved parties are correctly documented.

- Property Description: Provide a detailed description of the property being transferred. If space is limited, continue the description on the reverse side of the form.

- Consideration Amount: Specify the true consideration for the transfer (the amount being paid for the property). This is important for legal and tax purposes.

- Corporate Signatures: If the Grantor is a corporation, make sure it is signed by an authorized officer. The corporation’s seal should also be affixed, if applicable.

- Check Local Regulations: Before finalizing the document, confirm that the property complies with applicable land use laws and regulations. This may involve checking with local planning departments.

- Research Rights: Both the buyer and seller should inquire about their rights under Oregon's land laws. This includes understanding potential limits on land use and any rights of neighboring property owners.

- Notarization: The form must be acknowledged before a notary public. Ensure that this is done correctly to validate the document.

- Publisher's Note: If the property transfer is subject to specific Oregon laws, be sure to include any required references as indicated by the publisher's note.

Completing this form accurately is crucial for a smooth real estate transaction. Taking the time to understand each element can help avoid potential legal issues down the line.

Browse Other Templates

Nyc Doe Uft - Each section of the form plays a vital role in the overall claims process.

Example of a Biopsychosocial Assessment - Describing school experiences can highlight past challenges and strengths in social settings.

How to Fill Out W-9 Form for Individual - Financial obligations paid during the time of delinquent taxes are explored in the form.