Fill Out Your 97Ci Form

The 97Ci form, officially known as the Navy Federal® Change of Information/Add Joint Owner, is an essential tool for primary account holders aged 18 and older who need to update personal details or add joint owners to their accounts. This form facilitates changes such as updating your name, address, and contact information, as well as adding a joint owner to existing accounts. Primary account holders must fill out specific sections to indicate what information is changing. It’s important to provide clear and accurate details, as certain changes, particularly those involving your name or date of birth, require additional documentation. The form also covers sections regarding employment information, survivorship designations, and the necessary disclosures that accompany account management. If you're looking to make updates, understanding the ins and outs of the 97Ci form can help you navigate the process more smoothly, ensuring that your account remains up-to-date and compliant with Navy Federal's requirements.

97Ci Example

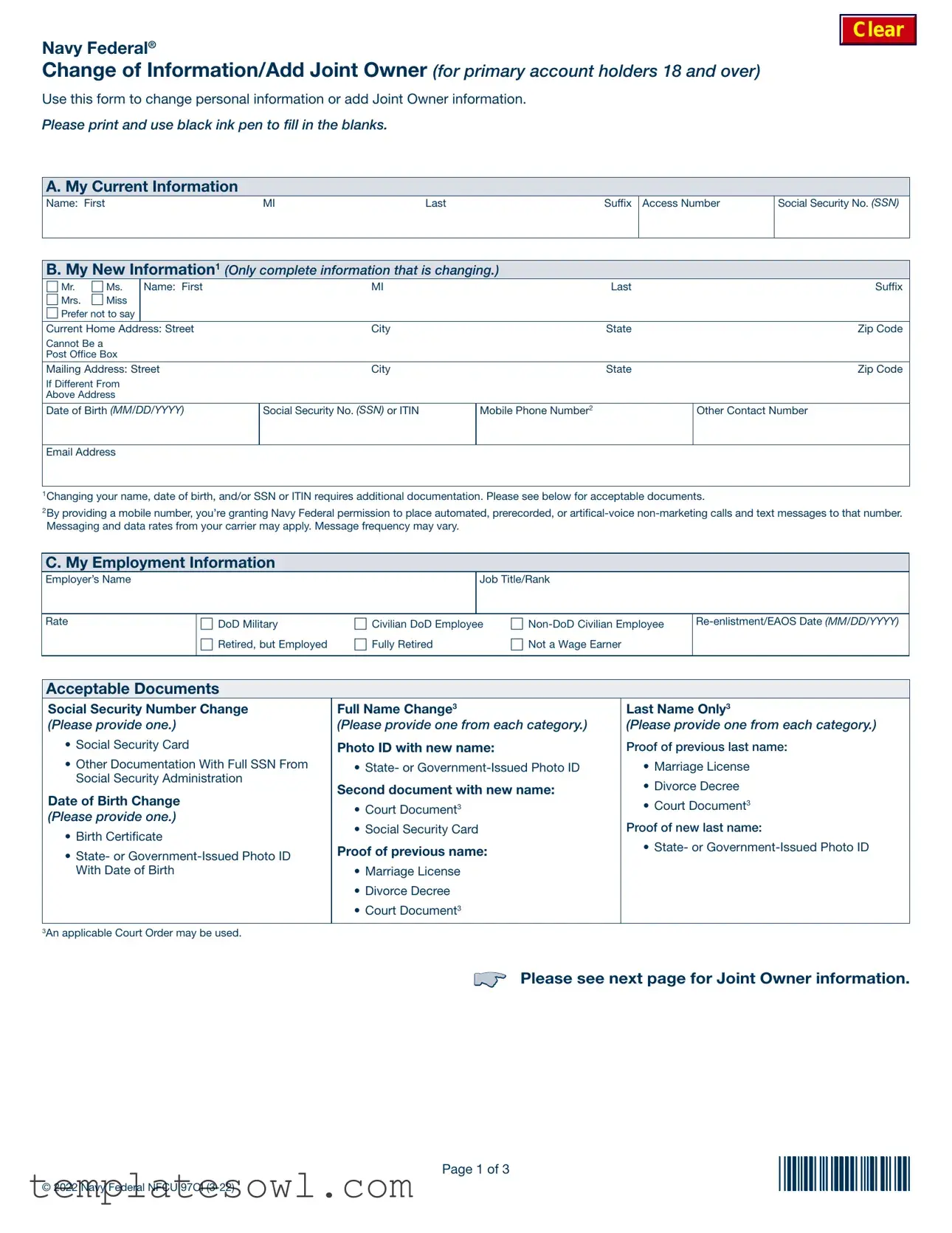

Navy Federal®

Change of Information/Add Joint Owner (for primary account holders 18 and over)

Use this form to change personal information or add Joint Owner information.

Please print and use black ink pen to fill in the blanks.

Clear

A. My Current Information

Name: First |

MI |

Last |

Suffix |

Access Number

Social Security No. (SSN)

B. My New Information1 (Only complete information that is changing.)

☐Mr. ☐ Ms.

☐Mrs. ☐ Miss

☐Prefer not to say

Name: First |

MI |

Last |

Suffix |

Current Home Address: Street |

City |

State |

Zip Code |

Cannot Be a |

|

|

|

Post Office Box |

|

|

|

Mailing Address: Street |

City |

State |

Zip Code |

If Different From |

|

|

|

Above Address |

|

|

|

Date of Birth (MM/DD/YYYY)

Social Security No. (SSN) or ITIN

Mobile Phone Number2

Other Contact Number

Email Address

1Changing your name, date of birth, and/or SSN or ITIN requires additional documentation. Please see below for acceptable documents. |

|

2By providing a mobile number, you’re granting Navy Federal permission to place automated, prerecorded, or |

calls and text messages to that number. |

Messaging and data rates from your carrier may apply. Message frequency may vary.

C. My Employment Information

Employer’s Name |

|

|

Job Title/Rank |

|

|

||

|

|

|

|

|

|

|

|

Rate |

☐ DoD Military |

☐ Civilian DoD Employee |

☐ |

||||

|

☐ Retired, but Employed |

☐ Fully Retired |

☐ Not a Wage Earner |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acceptable Documents |

|

|

|

|

|

|

|

Social Security Number Change |

Full Name Change3 |

|

|

Last Name Only3 |

|||

(Please provide one.) |

|

(Please provide one from each category.) |

|

(Please provide one from each category.) |

|||

• Social Security Card |

|

Photo ID with new name: |

|

|

Proof of previous last name: |

||

• Other Documentation With Full SSN From |

• State- or |

|

• Marriage License |

||||

Social Security Administration |

Second document with new name: |

|

• Divorce Decree |

||||

Date of Birth Change |

|

|

|||||

|

• Court Document3 |

|

|

• Court Document3 |

|||

(Please provide one.) |

|

• Social Security Card |

|

|

Proof of new last name: |

||

• Birth Certificate |

|

|

|

||||

|

Proof of previous name: |

|

|

• State- or |

|||

• State- or |

|

|

|||||

|

|

|

|

||||

|

|

|

|

|

|

||

With Date of Birth |

|

• Marriage License |

|

|

|

|

|

|

|

• Divorce Decree |

|

|

|

|

|

|

|

• Court Document3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3An applicable Court Order may be used.

☛ Please see next page for Joint Owner information.

© 2022 Navy Federal NFCU 97CI |

Page 1 of 3 |

*P7CI* |

|

|

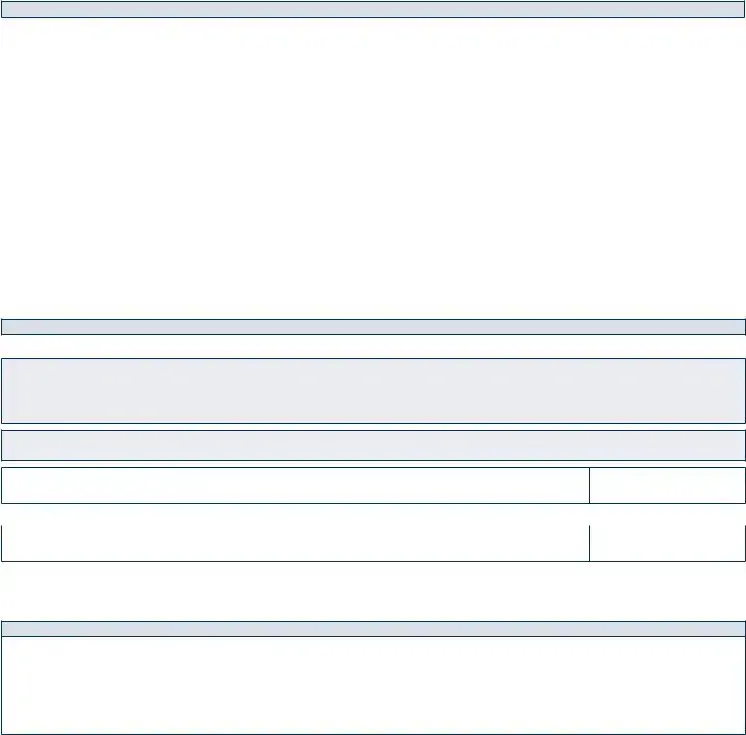

D. Joint Owner Information

A Joint Owner who wishes to be removed from an account will need to complete a Voluntary Removal of Joint Owner request, NFCU 596. Current members only need to fill in the Access Number and accounts that he/she should be added to, and complete the signature area.

Add Joint Owner to the following accounts: (Please list full account numbers below.)

☐ All primary savings, checking, and MMSA accounts |

☐ All |

|

|||||||||||||

☐ Savings |

|

|

|

☐ List Certificates: |

|

|

|

|

|

|

|

|

|||

☐ Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

☐ MMSA/Jumbo MMSA |

|

|

Issue Joint Owner: |

☐ Navy Federal Debit Card (checking account required) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joint Owner Access No. |

☐ Mr. |

☐ Ms. |

Name: First |

|

MI |

Last |

|

Suffix |

Date of Birth (MM/DD/YYYY) |

|

|||||

|

|

|

☐ Mrs. |

☐ Miss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Prefer not to say |

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. (SSN) or ITIN

Current Home Address: Street |

City |

State |

Zip Code |

Cannot Be a

Post Office Box

Mailing Address: Street |

|

City |

|

State |

Zip Code |

If Different From |

|

|

|

|

|

Above Address |

|

|

|

|

|

No. of Years at Residence |

Driver’s License, Government ID, or State ID |

|

Issue Date (MM/DD/YYYY) |

Exp. Date (MM/DD/YYYY) |

|

|

ID No. |

State |

|

|

|

☐ Enroll me in Navy Federal |

Email Address (required for Online Banking) |

|

Mobile Phone No.2 |

Other Contact No. |

|

|

|

|

|

||

Online Banking |

|

|

|

|

|

|

|

|

|

|

|

2By providing a mobile number, you’re granting Navy Federal permissions to place automated, prerecorded or

E. Joint Owner Employment Information

Employer’s Name |

|

|

Job Title/Rank |

|

|

|

|

|

|

|

|

Rate |

☐ DoD Military |

☐ Civilian DoD Employee |

☐ |

||

|

☐ Retired, but Employed |

☐ Fully Retired |

☐ Not a Wage Earner |

|

|

|

|

|

|

|

|

The survivorship designation on your membership/savings account applies to all other joint accounts with the same joint owner, unless specifically designated otherwise for a particular account in writing. If a survivorship option has not been indicated here, your accounts will be designated as Joint With Survivorship.

☐Joint

(On the death of an account owner, the deceased’s shares pass to the surviving owner.)

☐Joint

(On the death of an account owner, the deceased’s shares pass to the estate.)

☛Please see next page for important disclosures, required signatures, and submission instructions.

Page 2 of 3

© 2022 Navy Federal NFCU 97CI

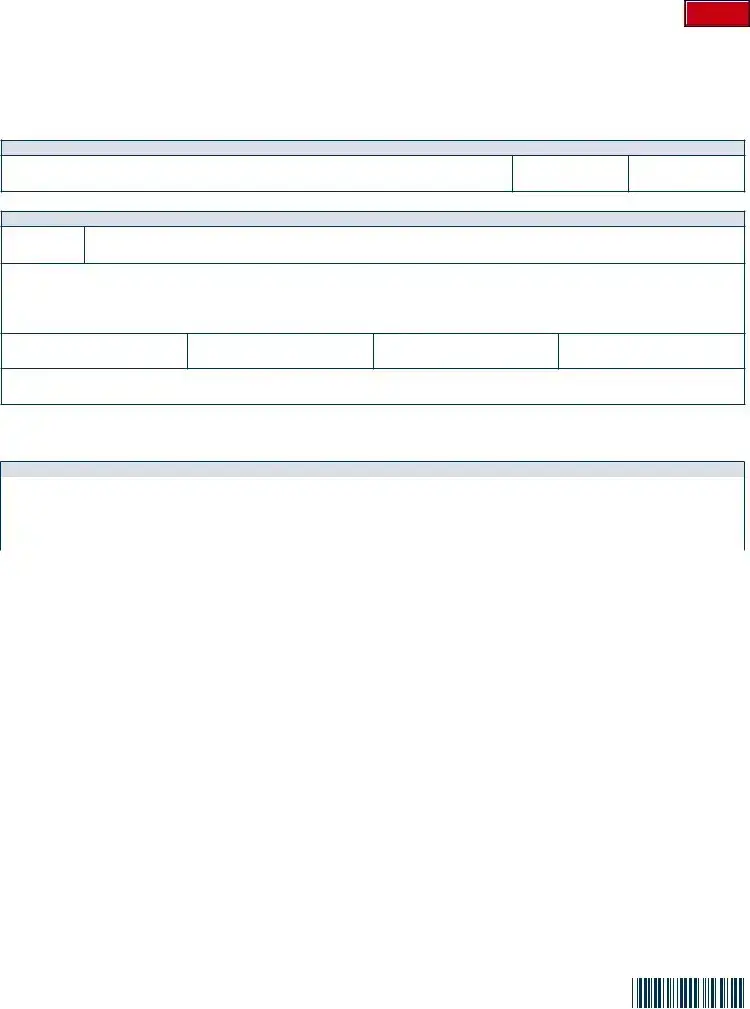

F. Disclosure Agreement and Survivorship Designation

Account Disclosures: I/We acknowledge that membership at Navy Federal comes with certain ongoing responsibilities. By signing this document, I/we acknowledge receipt of and agree to all terms and conditions in the Important Disclosure booklet and all other disclosed terms and conditions of all accounts and services that I/we may receive at Navy Federal. These terms and conditions will be disclosed in accordance with applicable state and federal laws. I/We understand that Navy Federal may restrict or suspend my/our access to products or services if I/we engage in conduct that is abusive to the credit union or its membership.

Consumer Reports: I/We authorize Navy Federal to obtain a consumer credit report to evaluate my/our creditworthiness so that I/we may be considered for other Navy Federal products and services. I/We also authorize Navy Federal to obtain consumer reports for the purposes of evaluating this membership application and reviewing any Navy Federal accounts I/we open. I/We understand these reports may be used in decisions to deny account applications, close accounts, and/or restrict accounts or services.

Escheatment: I/We acknowledge that my/our property may be transferred to the appropriate state (i.e., “escheated”) if there has been no activity on any of my/our accounts within the time period specified by state law.

Identification: Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account, including joint owners and authorized signers. What this means for you: When

you open an account, we will ask you for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents. It may be necessary for Navy Federal to restrict account access or delay the approval of loans pending further verification of your identity or documentation related to your eligibility.

Statutory Lien: I/We acknowledge and pledge to Navy Federal a statutory lien in my/our shares and dividends on deposit in all joint and individual accounts and any monies held by Navy Federal now and in the future, to the extent of any loan made and any charges payable. The statutory lien does not apply to shares in any Individual Retirement Account.

Security Interest: I/We acknowledge and pledge to Navy Federal a security interest in the collateral securing loan(s) that l/we have with Navy Federal now and in the future, including any type of change or increase, and any proceeds from the sale of such collateral and of insurance thereon, not to exceed the unpaid balance of the loan. This security interest in collateral securing loans does not apply to any loan(s) on my/our primary residence.

Contractual Lien: I/We authorize Navy Federal to transfer funds from any accounts in which I/we have an ownership interest to correct a negative or overdrawn amount on any account on which my/our name(s) appear(s). My/ Our authorization applies to all funds I/we voluntarily deposit into Navy Federal accounts, including Social Security funds, as permitted by law.

G. Required Signatures and Tax Certification

By signing, I/we acknowledge that I/we have read and agree to the information/disclosure above.

Tax Certification (This certification does not apply if I have checked the box below my signature.)

Under penalty of perjury, I certify that (1) the SSN/ITIN provided is correct, (2) I am not subject to backup withholding, and (3) I am a US Citizen or US resident alien.

The FATCA code certification does not apply.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Signature of Applicant (required)

▶

Date (MM/DD/YYYY)

☐By checking this box, I certify that I am not (or, if signing for a minor, the minor is not) a U.S. citizen or a green card holder and that I have completed form

Signature of Joint Owner (if applicable) |

Date (MM/DD/YYYY) |

▶

☐By checking this box, I certify that I am not (or, if signing for a minor, the minor is not) a U.S. citizen or a green card holder and that I have completed form

Note: If you are the

Submission Instructions

Fax: Fax completed form and supporting documents to

Mail: Send completed form and photocopy of supporting documents to Navy Federal Credit Union, P.O. Box 3002, Merrifield, VA

Online: Sign in to Online Banking ➤ Select “Messages” tab ➤ Select “Send us a message” tab ➤ Under “My Message is About,” select “General” ➤ Under “Regarding,” select “Add/Remove Joint Owner” ➤ Fill out subject as “Change of Information” ➤ Attach completed 97CI and any supporting documents according to “Acceptable Documents” (on page 1).

Branch: Go to

|

|

For Office Use |

Only |

|

Documents Used to Produce Name Change |

Specify document used as proof of maiden name (e.g., Marriage License, Divorce Decree) |

SOB Code |

||

(Please indicate which documents were used.) |

|

|

|

|

|

|

|

|

|

Documents Accepted to Change Last Name Only |

☐ Driver’s License |

☐ Passport |

☐ Military ID |

Employee Number |

|

||||

(Must have one form of ID that shows new name.) |

☐ Court Document (specify): __________________________________________________________________ |

|

||

|

|

|

|

|

Documents Accepted to Change Full Name |

☐ Driver’s License |

☐ Passport |

☐ Military ID |

Access Number |

|

||||

(Must have two forms of ID that show new name.) |

☐ Court Document (specify): __________________________________________________________________ |

|

||

|

|

|

|

|

Page 3 of 3

© 2022 Navy Federal NFCU 97CI

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | This form is used to update personal information or add a joint owner to an account. |

| Eligibility | Only primary account holders aged 18 and over may use this form. |

| Required Information | Users must provide their name, address, date of birth, Social Security Number (SSN), and other identifying details. |

| Documentation | Changes to name, date of birth, or SSN/ITIN require additional documentation like a Social Security card or marriage license. |

| Submission Methods | Completed forms can be submitted via fax, mail, online messages, or in person at a branch. |

| Governing Laws | This form is governed by applicable federal laws, as well as state-specific regulations regarding financial transactions and identity verification. |

| Survivorship Designation | Account holders may choose between Joint Account With Survivorship or No Survivorship options, affecting posthumous ownership. |

Guidelines on Utilizing 97Ci

Completing the 97Ci form requires careful attention to detail. After successfully filling out the form, you will submit it along with any required documentation. This ensures that your personal information or joint owner changes are processed accurately. Follow the steps below to fill out the 97Ci form.

- Gather Required Documents: Before starting, collect any necessary documentation that may be needed to support your changes.

- Use Black Ink: It's important to print clearly and use a black ink pen to fill in all the required information on the form.

- Section A - Current Information: Enter your current information including your name, access number, and Social Security number.

- Section B - New Information: Fill in sections for changes, such as name, address, date of birth, Social Security Number or ITIN, and contact information. Only include the information that is changing.

- Section C - Employment Information: Indicate your employer’s name, job title, and employment status while providing the necessary dates.

- Section D - Joint Owner Information: If applicable, fill out the joint owner’s information, including their name, access number, address, and contact details.

- Section E - Joint Owner Employment Information: Provide the employment details for the joint owner in the same manner as for yourself.

- Section F - Disclosure Agreement: Read the agreement carefully and acknowledge your understanding by signing and dating the declaration.

- Section G - Required Signatures: Sign the form yourself and, if applicable, have the joint owner sign as well. Ensure you date the signatures.

- Submit the Form: Choose your preferred method for submission (fax, mail, online, or in person) and attach any needed documents before sending it off.

What You Should Know About This Form

What is the purpose of the 97Ci form?

The 97Ci form is used by primary account holders of Navy Federal Credit Union to change personal information or add a joint owner to their account. This form ensures that all information is current and accurate for account management.

Who is eligible to complete the 97Ci form?

Only primary account holders who are 18 years old or older may complete this form. This includes current members looking to update their personal information or add a joint owner to their account.

What information do I need to provide on the form?

You will need to provide your current information, including name, access number, and Social Security Number (SSN). If you're changing information, only the details that are changing should be filled out. Additionally, if adding a joint owner, their personal details are required as well.

What documents are required for specific changes?

Changes to your name, date of birth, or SSN require additional documentation. This may include a Social Security card, a government-issued photo ID, or legal documents like a marriage license or court order. Check the form for a complete list of acceptable documents.

How do I submit the 97Ci form?

You can submit the completed form by faxing it to 703-206-4600, mailing it to Navy Federal Credit Union at P.O. Box 3002, Merrifield, VA 22116-9887, or through the online banking system. For in-person assistance, visit a local branch.

Can I change my address using this form?

Yes, the form allows you to change your home and mailing addresses. Ensure that the new mailing address cannot be a P.O. Box. Provide the complete new address and indicate if it is different from the home address.

What happens if I need to remove a joint owner from my account?

If you wish to remove a joint owner, they must complete a separate form, the Voluntary Removal of Joint Owner request (NFCU 596). Only current members can initiate this process.

What is the survivorship designation option?

The survivorship designation indicates what happens to the account balance when one account owner passes away. You can choose between "With Survivorship" (shares pass to the surviving owner) or "No Survivorship" (shares pass to the deceased's estate).

Will my personal information remain confidential?

Navy Federal takes privacy seriously. All personal information provided on the 97Ci form is kept confidential and used only for account management purposes, in accordance with applicable laws and regulations.

Common mistakes

Completing the 97Ci form can be a straightforward task, but many people make common mistakes that can lead to delays or complications in processing. One of the most frequent errors occurs in the section where you are asked to provide your current information. It's imperative to ensure that every detail is accurate, as missing or incorrect information can result in your request being declined. For instance, omitting your full name, including middle initials or suffixes, can cause confusion and ultimately slow down the processing.

Another mistake is related to providing the new information. When filling out this section, some individuals only complete parts of the form. It's crucial to fill in all relevant sections that pertain to the changes being made. For example, if you're changing your home address, remember to update both the current and mailing addresses, especially if they differ. Failure to do so might lead to important documents being sent to the wrong location.

People occasionally neglect to check boxes that clarify details about their marital status. Indicating whether you prefer 'Mr.,' 'Mrs.,' 'Ms.,' or 'Miss' is essential. Omitting this section may lead to misunderstandings in future interactions with the credit union. Additionally, pet owners tend to forget to provide either a mobile number or an alternative contact number. This information is vital for seamless communication, particularly if the credit union needs to follow up.

A frequent oversight involves the documentation required for name, date of birth, or Social Security Number changes. Individuals often skip reading this section thoroughly, leading to missing out on necessary supporting documents. For example, when changing your name, you may need to present a marriage license or divorce decree; neglecting to include these documents can cause your application to be set aside.

Additionally, using a pen color other than black is a mistake that seems trivial but can be very impactful. Different colors of ink may make the form harder to read and lead to misunderstandings, especially if the form is scanned for processing. Always use black ink to ensure clarity.

People also sometimes forget to complete the signature section at the end of the form. This can be problematic since signatures are required to verify that the information provided is accurate and that the signer agrees to the terms laid out in the document. Make sure to sign and date the form before submission to avoid unnecessary delays.

Finally, some individuals don't pay attention to the submission instructions. Each method of submission—whether fax, mail, online, or in-person—comes with specific requirements and steps. Ignoring these can result in incomplete submissions that will not be processed efficiently. Always double-check the guidelines based on your chosen submission method to ensure everything is correctly submitted.

Documents used along the form

When making changes to your Navy Federal account, you may need several other forms and documents in addition to the 97Ci form. Each document serves a specific purpose and is essential for different situations. Below is a list of commonly required forms along with a brief description of each.

- NFCU 596: This form is used for the voluntary removal of a joint owner from an account. Both current and former joint owners are required to fill it out, ensuring clear documentation of the change.

- Power of Attorney (POA): If you are signing on behalf of someone else, a POA document is necessary. This legal document grants you the authority to make decisions regarding the account for another person.

- Social Security Administration Forms: These forms might be required to update your Social Security number. Specific documentation may vary, but providing proof is essential.

- Proof of Identity Documents: A driver's license, passport, or state-issued ID may be necessary to verify your identity when making changes. Ensure it shows your current name and photograph.

- Marriage License or Divorce Decree: If your name change is due to marriage or divorce, you will need to provide either your marriage license or divorce decree as proof.

- Birth Certificate: This document may be required, especially if you are changing your date of birth or providing verification of identity.

- Court Documents: Certain changes, such as changing your name or date of birth through a legal process, will require appropriate court documents for verification.

- Tax Certification Form: This form is used to certify your tax identification number and to confirm you are not subject to backup withholding, which may be necessary for account processing.

- NFCU Membership Application: For new members or joint owners, this application may be required to establish accounts with Navy Federal Credit Union.

Understanding the required documentation can significantly streamline the process of changing your account information. Make sure to check the specific needs based on your circumstances and gather the necessary documents to facilitate a smooth update.

Similar forms

-

Form 8822 - This IRS form is used to notify the Internal Revenue Service of a change of address. It requires updated personal information, similar to the 97Ci form for changing details at Navy Federal. Both forms prioritize current and new information to ensure accurate records.

-

Form SS-5 - This is the application for a Social Security card, which can be used to update personal details such as a name change. Like the 97Ci, it requests personal identification information and confirms the individual's identity.

-

VA Form 22-5490 - Used for applying for VA survivor benefits, this form collects personal data such as Social Security numbers and addresses. Both forms are utilized to provide current and accurate details to the respective agencies.

-

Form I-90 - The application to replace a green card, this form also requires personal identification and change of address information. It emphasizes the need for clear and updated personal data, aligning closely with the objectives of the 97Ci form.

-

Change of Address Form (USPS) - This form allows individuals to update their address with the United States Postal Service. While simpler in scope, it parallels the 97Ci form by requiring users to provide both current and new address information.

-

Form W-8BEN - Non-U.S. persons use this form to certify foreign status for tax purposes. It requires personal identification details that are essential for confirming identity, much like the 97Ci form requires for banking purposes.

-

Form 1065 - This is the return of partnership income, where partners must provide their names and identifying numbers. The collection of detailed ownership information reflects the aims of ensuring accuracy in the 97Ci.

-

Joint Account Opening Form - Many banks require this document to add a joint account owner. Similar to the 97Ci, it requests detailed personal information from both parties involved, ensuring that all records are up-to-date.

Dos and Don'ts

When filling out the 97Ci form, adhering to certain guidelines will facilitate a smoother process. Below are six important do's and don'ts to consider:

- Do print clearly in black ink to ensure all information is legible.

- Don’t include a Post Office Box as your mailing address; use a physical home address instead.

- Do provide accurate and complete information where changes are being made.

- Don’t forget to include necessary documentation for name or SSN changes; missing documents can delay your request.

- Do review the form thoroughly before submission to catch any mistakes or omissions.

- Don’t hesitate to contact customer support if you have any questions throughout the process.

Misconceptions

- Misconception 1: The 97Ci form is exclusively for account holders changing their names.

- Misconception 2: You can send the 97Ci form using any type of mailing address.

- Misconception 3: No supporting documents are needed when changing a name.

- Misconception 4: All changes can be made electronically.

- Misconception 5: Once you submit the form, your changes will be effective immediately.

- Misconception 6: You don’t need to add a joint owner if you intend to remove one.

- Misconception 7: Any type of identification can be used to verify your identity.

- Misconception 8: You can use a Post Office Box for your new mailing address.

- Misconception 9: If you provide your mobile number, there are no consequences.

- Misconception 10: The survivorship designation on joint accounts is automatic.

This form can also be used to change other personal information, such as addresses or contact numbers, in addition to adding a joint owner.

The mailing address must be to Navy Federal Credit Union's specific P.O. Box 3002 in Merrifield, VA, avoiding postal services like P.O. boxes for personal information updates.

Changing your name on the 97Ci form requires relevant documentation, such as a marriage license or divorce decree, to validate the change.

While some updates can be sent online, forms must still be physically returned or submitted through specific channels if they involve document verification.

Processing times can vary. It is important to allow for necessary verification and adjustments to take place before assuming your changes are final.

The removal of a joint owner requires a separate action, specifically filling out the Voluntary Removal of Joint Owner request, as outlined in the guidelines.

Federal regulations require specific forms of identification, such as driver's licenses or military IDs, to ensure compliance with identity verification procedures.

The form explicitly states that the new mailing address cannot be a P.O. Box, ensuring that your information remains secure and verifiable.

Granting your mobile number allows for automated calls and messages from Navy Federal, and you may incur messaging and data rates from your carrier.

Unless specified otherwise, all joint accounts are designated as Joint With Survivorship, meaning the default rule applies unless you communicate otherwise in writing.

Key takeaways

Key Takeaways about the 97Ci Form

- The 97Ci form is essential for Navy Federal members wishing to change personal information or add a joint owner to their account.

- Always use a black ink pen and print clearly when completing the form to ensure legibility.

- To change significant details like your name or social security number, be prepared to provide supporting documentation.

- When adding a joint owner, indicate specifically which accounts they will be linked to—be thorough in listing account numbers.

- Submission can be done via multiple methods, including fax, mail, online messages, or in person at a Navy Federal branch.

Browse Other Templates

Horse Training Contract Template - This contract serves as an agreement for horse training services between the Trainer and the Owner.

How to Obtain a Background Check on Myself - Past employers and education institutions may be contacted as part of verification.

Aoa Rental Agreement Pdf - Describes fees associated with returned checks or late rent payments.