Fill Out Your A1 Form

The A1 form plays a crucial role in the import payment process in India, facilitating the necessary exchange of foreign currency for goods being brought into the country. Primarily designed for use by authorized dealers, this form serves as an application for remittance in foreign currency, capturing essential details about the transaction. It contains sections that require information about the goods being imported, including invoice details, import license particulars, and the Harmonized System classification of the goods. The importer is also tasked with declaring the currency they wish to purchase and the amount in both figures and words. Additionally, if multiple import licenses are involved, it becomes essential to provide details for each, ensuring clarity in the application. The form emphasizes compliance, as the applicant must confirm that they have not requested authorization from other banks and that the remittance aligns with legal requirements. There are checkpoints for reasons regarding partial remittances, and a declaration regarding the authenticity of the invoice value must be included. Moreover, it requires a certification from the authorized dealer, ensuring that all Exchange Control regulations have been followed, and specifying how the payment to the supplier will be executed. Overall, the A1 form meticulously captures the intricate details surrounding international imports, supporting both regulatory compliance and smooth international trade operations.

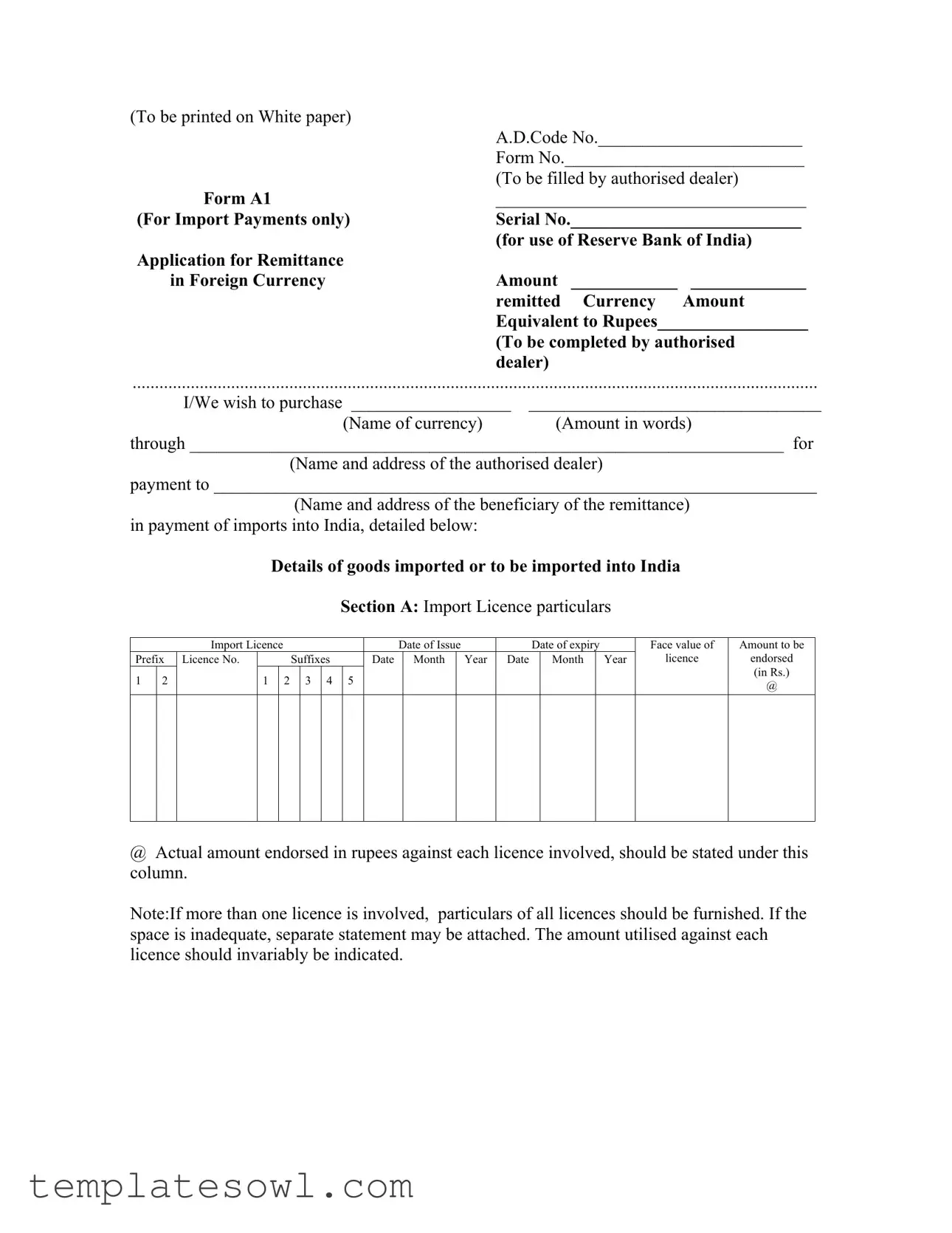

A1 Example

(To be printed on White paper) |

|

|

|

|

A.D.Code No._______________________ |

||

|

Form No.___________________________ |

||

|

(To be filled by authorised dealer) |

||

Form A1 |

___________________________________ |

||

(For Import Payments only) |

Serial No.__________________________ |

||

|

(for use of Reserve Bank of India) |

||

Application for Remittance |

|

|

|

in Foreign Currency |

Amount |

____________ |

_____________ |

|

remitted |

Currency |

Amount |

|

Equivalent to Rupees_________________ |

||

|

(To be completed by authorised |

||

|

dealer) |

|

|

.........................................................................................................................................................

I/We wish to purchase __________________ |

_________________________________ |

(Name of currency) |

(Amount in words) |

through ___________________________________________________________________ for

(Name and address of the authorised dealer)

payment to ____________________________________________________________________

(Name and address of the beneficiary of the remittance) in payment of imports into India, detailed below:

Details of goods imported or to be imported into India

Section A: Import Licence particulars

|

|

Import Licence |

|

|

|

|

|

|

Date of Issue |

|

|

Date of expiry |

|

||||||

Prefix |

Licence No. |

|

|

|

Suffixes |

|

Date |

|

Month |

|

Year |

Date |

|

Month |

|

Year |

|||

1 |

2 |

|

1 |

|

2 |

|

3 |

4 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Face value of |

Amount to be |

licence |

endorsed |

|

(in Rs.) |

|

@ |

|

|

@Actual amount endorsed in rupees against each licence involved, should be stated under this column.

Note:If more than one licence is involved, particulars of all licences should be furnished. If the space is inadequate, separate statement may be attached. The amount utilised against each licence should invariably be indicated.

Section B: Import particulars

|

Invoice Details |

|

Quantity |

Description |

Harmonised |

Country |

Country |

Mode of |

Date of |

|

No |

Terms |

Currency |

Amount |

of |

of goods |

System of |

of origin |

from |

shipment |

shipment |

and |

(c.i.f., |

|

|

goods |

|

Classification |

of goods |

which |

(air, sea |

(if not |

date |

f.o.b., |

|

|

|

|

|

|

goods |

post, rail |

known |

|

c.&.f. |

|

|

|

|

|

|

are |

river, |

approxi- |

|

etc.) |

|

|

|

|

|

|

consigne |

transport |

mate |

|

|

|

|

|

|

|

|

d |

port, etc.) |

date) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C: Other particulars |

|

|

1. Details of forward |

|

|

|

purchase contract, |

______________ |

_______________ |

____________ |

if any, booked against |

(No.& date of |

(Currency and |

(Balance under |

the import |

Contract |

Amount of |

the contract) |

|

|

Contract) |

|

2. If remittance to be |

|

|

|

made is less than |

|

|

|

invoice value, reasons |

|

|

|

therefor (i.e. part |

_____________________________ |

|

|

remittance,instalment |

_____________________________ |

|

|

etc.)

.........................................................................................................................................................

I/We hereby declare that the statements made by me/us on this form are true and that I/we have not applied for an authorisation through any other bank.

I/We declare and also understand that the foreign exchange to be acquired by me/us pursuant to this application shall be used by me/us only for the purpose for which it is acquired and that the conditions subject to which the exchange is granted will be complied with.

Stamp

Date:....................

.......................................................................

(Signature of Applicant/Authorised Official)

@Name and Address of Applicant Importer's Code Number...........................

@Nationality .................................................

@To be filled in capital letters ................

NOTE : For remittances covering intermediary trade, form A2 should be used.

Declaration to be furnished by Applicant

I/We declare that

(a)the import licence/s against which the remittance is sought is/are valid and has/have not been cancelled by DGFT.

(b)the goods to which this application relates account*

have been* imported into India on my/our own will be *

(c)the import is on behalf of @_______________________________________* and

(d)the invoice value of the goods which is declared on this form is the real value of the

goods |

imported * |

into in India. |

|

|

|

to be imported* |

|

If the |

I/We attach the relative |

||

Import |

|

|

Post parcel wrapper (for imports by post)*/Courier Wrapper |

has been |

|

|

(for imports through courier)* |

made |

|

|

|

|

|

|

or |

If the |

|

I/We undertake |

to produce within three months to the authorised dealer the relative |

import is |

|

||

to be |

|

Post parcel wrapper (for imports by post)*/Courier wrapper |

|

made |

|

|

(for imports through Courier)* |

* Strike out item not applicable

@Where the import is on behalf of Central/State Government Department or a company owned by Central/State Government/Statutory Corporation, Local Body, etc. the name of the Government Department, Corporation etc. should be stated.

Date:......................................................................................

(Signature of Applicant/Authorised Official)

_____________________________________________________________________________

Space for comments of the authorised dealer

(While forwarding the application to Reserve Bank for approval, reference to Exchange Control Manual paragraph/ A.D.Circular in terms of which the reference is made should invariably be cited. If any remittance application on account of the same import was referred to Reserve Bank earlier, reference to the last correspondence/approval should also be cited).

.........................................................................

Stamp

Date:....................

(Signature of Authorised Official)

Name ...............................................................

Designation ......................................................

Name and Address of ......................................

Authorised dealer.............................................

______________________________________________________________________________

Certificate to be Furnished by Authorised Dealer (Importer's Banker)

We hereby certify that

(a)this payment is

Put a |

(i) |

• |

an advance remittance |

tick (ü) |

|

|

|

in the |

(ii) |

• in retirement of bills under Letter of Credit opened through us |

|

relevant |

|

|

|

block |

(iii) |

• |

against documents received through our medium for collection |

(iv)• on account of documents received direct by the applicant/s against undertaking furnished by the latter to submit

(v)• on account of documents received direct by the applicant/s against

(vi)• ___________________________________________________________

(any other case, to be explained)

(b)all the Exchange Control regulations applicable to the remittance have been complied with

(c)the payment to the supplier of the goods has been* made

will be*

through_____________________________________________________________

(Name & Address of the foreign bank)

We also certify/undertake that the relevant

*shall be verified by us within three months

[vide certificate (a)(ii) and (iii) above].

*has been verified [vide certificate (a) (v) above].

*shall be obtained from the applicant/s within three months [vide certificate (a) (i) and (iv) above].

.......................................................................

(Signature of Authorised Official)

Name ..............................................................

Stamp

Date:....................

Designation......................................................

Name and Address of .....................................

Authorised dealer ............................................

______________________________________________________________________________

* Strike out item not applicable

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The A1 form is specifically designed for remittance in foreign currency for import payments into India. |

| Authorized Dealer Requirement | This form must be filled out by an authorized dealer designated to handle foreign exchange transactions. |

| Information Needed | Applicants must provide details about the imported goods, including invoice details, quantity, and country of origin. |

| Compliance Declaration | Applicants declare the truthfulness of the information and that funds will only be used for stated import purposes. |

| Legislation Reference | The use of the A1 form is governed by regulations established under the Foreign Exchange Management Act (FEMA) in India. |

| Processing Time | Submission of the A1 form to the authorized dealer is a step in the approval process, which can take varied time based on the dealer's procedures. |

Guidelines on Utilizing A1

Completing the A1 form is a necessary step for anyone looking to make remittance payments in foreign currency. It is essential to fill it out accurately and thoroughly to ensure timely processing. Follow the steps outlined below to complete the form correctly.

- Obtain the A1 Form: Ensure you have a printed copy of the A1 form on white paper.

- Fill in the Code Numbers: In the designated space, write the A.D. Code No. and Form No. as instructed.

- Enter Application Details: Specify the amount being remitted, the currency type, and the equivalent amount in Rupees.

- Provide Currency Purchase Details: Clearly indicate the currency name and the amount in words.

- Detail Beneficiary Information: Fill out the name and address of the beneficiary receiving the remittance.

- Complete Section A: Input the particulars of the import licence, including issuance and expiration dates, licence numbers, and the corresponding endorsement amounts.

- Complete Section B: Enter the invoice details, quantity, description, harmonised system of classification, country of origin, mode of shipment, and shipment date.

- Provide Forward Contract Details: If applicable, state the details of the forward purchase contract related to your import.

- Declare Remittance Reasons: If the remittance value is less than the invoice amount, provide the reasons for part or installment remittance.

- Sign the Declaration: Review the declaration statement for accuracy, and once confirmed, sign and date the form as the applicant or authorized official.

- Review for Completeness: Ensure all fields are filled correctly before submission.

- Submit to the Authorized Dealer: Present the completed form to your authorized dealer for further processing.

After filling out the form, the next step is to submit the completed document to your authorized dealer. Ensure that all required information is accurate to avoid any delays in your remittance request. Following this process will help facilitate smooth transactions.

What You Should Know About This Form

What is the A1 form used for?

The A1 form is primarily utilized for making remittances in foreign currency for import payments into India. Importers complete this form to request permission to exchange rupees for foreign currency, which will be used to pay foreign suppliers for goods imported into India. It ensures that the transaction complies with regulations set by the Reserve Bank of India.

Who needs to fill out the A1 form?

The A1 form should be filled out by individuals or businesses that are importing goods into India and require foreign currency to complete their payments. Authorized dealers such as banks typically assist in filling out and submitting this form. Importers must ensure that their import licenses are valid and have not been canceled when submitting the A1 form.

What information is required on the A1 form?

The A1 form requires detailed information, including the amount of foreign currency to be purchased, the beneficiary's details, particulars of the import license, invoice details, and the quantity and description of goods being imported. Additionally, it includes declarations regarding compliance with foreign exchange regulations and any relevant forward purchase contracts.

What should I do if my remittance amount is less than the invoice value?

If the remittance amount is lower than the total invoice value, the reason for the partial payment must be declared on the A1 form. Whether it is due to a partial remittance, an installment payment plan, or other circumstances, it is crucial to provide a clear explanation to ensure compliance with regulations.

What happens after submitting the A1 form?

Once the A1 form is submitted to the authorized dealer, they will process the application and may forward it to the Reserve Bank of India for approval. Upon approval, the foreign currency will be released, and the funds will be transferred to the beneficiary. The applicant must comply with the conditions outlined in the A1 form regarding the usage of the acquired foreign exchange.

Common mistakes

Filling out the A1 form can be a straightforward process, but many people make mistakes that can delay or jeopardize their applications. Here are eight common errors that applicants should watch out for.

First, many individuals forget to include their Importer's Code Number. This number is essential for processing the application. Without it, the application might be sent back, causing unnecessary delays.

Second, incomplete information often leads to problems. Applicants sometimes leave out important details about the import licence. Each import licence must have its full particulars filled in, including the date of issue and expiry. If a person submits the form without this information, it can lead to rejected applications.

The third mistake is incorrectly specifying the currency. When listing the currency being purchased, applicants sometimes miswrite the country or amount. It's crucial to double-check these entries. A simple typo can lead to significant confusion, especially when processing international payments.

The fourth error is inconsistencies in the invoice value of the goods. Applicants should ensure that the invoice value matches what is declared in the form. If these figures do not align, it raises red flags during the review process.

Additionally, failing to sign the form or missing the date is another common oversight. Every application needs a signature from the authorised official and a date to indicate when the application was submitted. Neglecting this can result in the form being considered incomplete.

The sixth mistake occurs in the section where applicants state reasons for remittance. When the remittance is less than the invoice value, it's critical to clearly explain the rationale. Applicants often assume this isn't necessary, but providing reasons helps clarify any questions that may come up later.

Moreover, some people attach the incorrect documentation. It’s essential to provide the necessary customs-stamped copies or relevant receipts as stated in the form. Missing or incorrect attachments can significantly complicate the approval process

Documents used along the form

The A1 form is an essential document for processing import payments. When submitting the A1 form, several other documents may be required to ensure compliance with regulations and to facilitate the remittance process. Below is a list of documents often used in conjunction with the A1 form.

- Form A2: This form is used for remittances covering intermediary trade. It details the nature of the transaction and must be submitted along with the A1 form for certain types of import payments.

- Bill of Entry: A document that customs officials use to assess goods entering the country. It provides details such as the quantity, value, and classification of the imported goods.

- Commercial Invoice: This invoice is issued by the seller to the buyer and contains details about the goods sold, including price, quantity, and terms of sale. It’s crucial for determining the invoice value for the A1 form.

- Import License: This official document permits the importation of specific goods into India. It must contain valid identification numbers and dates of issuance and expiry.

- Forward Purchase Contract: If applicable, this document outlines the terms of purchase for the currency needed in the transaction, including amounts and dates related to the import.

- Exchange Control Copy: This is a stamped copy of the Bill of Entry or parcel wrapper, which acknowledges the goods have been cleared by customs and exported from the country of origin.

- Certificate from Authorized Dealer: This certificate from the bank must confirm compliance with exchange control regulations and specify the nature of payment (advance, retirement of bills, etc.).

- Letter of Credit: This document is issued by the bank to the exporter, indicating that payment will be made once certain conditions are met, usually ensuring security for both the buyer and seller.

- Insurance Certificate: Depending on the transaction, a certificate proving that the goods are insured during transport may be required. It provides assurance against loss or damage during transit.

These documents assist in verifying details pertinent to the transaction and ensure adherence to regulatory guidelines. Make sure to prepare and submit all relevant forms alongside the A1 form to facilitate the import payment process efficiently.

Similar forms

- Form A2: Used for remittances covering intermediary trade. Similar to A1, but specifically tailored for transactions involving third parties.

- Form A3: This form is for personal remittances like gifts or inheritance. Like A1, it involves foreign currency but is meant for individual purposes rather than business imports.

- Form A4: Designed for the remittance of funds to foreign students studying abroad. A1 focuses on import payments, while A4 pertains to educational-related expenses.

- Form A5: Used for foreign travel payments. Similar to A1, it facilitates foreign currency needs, but is specific to travel expenses rather than import goods.

- Form A6: Applicable for capital account transactions. While A1 is for current account payments, A6 engages with investments and capital transfers.

- Form A7: This form requests remittances for export proceeds. Like A1, it deals with currency flow but focuses on payments received from foreign buyers instead of imports.

- Form A8: Used for the repatriation of earnings by foreign investors. A1 is for making payments, while A8 involves the return of funds to overseas investors.

- Form A9: This is for remittances made by non-resident Indians. It shares similarities with A1 in terms of form structure, but A9 is designed for transactions initiated by Indian nationals residing abroad.

- Form A10: Intended for high-value gifts and donations. Like A1, it includes remittance applications but is focused on charitable contributions rather than commercial transactions.

Dos and Don'ts

When filling out the A1 form, there are several important steps to keep in mind to ensure that the application is processed smoothly. Below is a list of do's and don'ts that can guide you through this process.

- Do fill out the form in clear, legible handwriting or use a typewriter/computer to avoid any errors.

- Do ensure that all required fields are completed, including the details of the import licence.

- Do include a valid reason if the remittance amount is less than the invoice value.

- Do attach any relevant documentation, such as the Customs-stamped Exchange Control copy of the Bill of Entry, if applicable.

- Don't leave any sections of the form blank; if a section does not apply, indicate this clearly by striking it out.

- Don't rush through the application. Taking your time ensures that all details are accurate and correctly entered.

Misconceptions

Misconception 1: The A1 Form is only for large corporations.

This is not true. While larger companies may frequently use the A1 Form for importing goods, small businesses and individual importers can also complete it. Any entity seeking to remit funds for import payments must use this form, regardless of size.

Misconception 2: The A1 Form guarantees approval for remittance.

Submitting an A1 Form does not automatically mean approval. The Reserve Bank of India reviews applications, and factors like compliance with regulations and accurate documentation will determine if the remittance is authorized.

Misconception 3: Once submitted, there’s no need to track the form.

It’s essential to follow up on the status of the A1 Form with the authorized dealer. Keeping an eye on its progress can help address any issues early, ensuring smooth processing.

Misconception 4: The A1 Form is only needed for new importers.

This form is a standard requirement for all import payments, whether you're a first-time importer or an established business. Familiarity with the form and its requirements is crucial for all parties involved in international trade.

Misconception 5: You can fill out the A1 Form without any documentation.

Documentation is vital. The form requires specific details about the goods being imported, including invoices and import licenses. Accurate and complete information ensures a smoother submission process and compliance with regulations.

Key takeaways

Filling out the A1 form involves several important steps and considerations. Here are the key takeaways to ensure compliance and accuracy:

- Purpose of the Form: The A1 form is specifically designed for remittances related to import payments. It is crucial that all sections are filled out correctly to avoid delays.

- Authorized Dealer: The form must be submitted to an authorized dealer who will help facilitate the transaction. Their involvement is necessary, as they need to complete designated sections of the form.

- Details of Import Licenses: It is essential to provide complete details regarding any import licenses involved. This includes the license number, dates of issue, and expiration. If more than one license is used, additional documentation may be required.

- Accurate Financial Information: Ensure that the amount to be remitted is stated both numerically and in words. This minimizes any risk of errors during processing.

- Required Declarations: The form includes various declarations that must be signed. This confirms that the information provided is true and that you are abiding by foreign exchange regulations.

- Supporting Documents: Attach any relevant documents such as the Customs-stamped Exchange Control copy of the Bill of Entry or post parcel wrapper. This provides proof of compliance and supports the application.

Timely and accurate completion of the A1 form can significantly impact the speed at which your remittance is processed. Always ensure that all required sections are filled and declarations made, as this can lead to a smoother transaction overall.

Browse Other Templates

Download D1 Form - Always read booklet INF1D before filling out the D1 form.

Form Ca-17 - Each medical facility visit must be reported separately, if applicable, on the form.

Social Communication Questionnaire Age Range - The questionnaire can assist in documenting progress in communication skills.