Fill Out Your A2 Form

The A2 form plays a crucial role in facilitating various financial transactions involving foreign exchange. Designed specifically for payments that do not pertain to imports or remittances covering intermediary trade, this form ensures that applicants provide essential information while adhering to regulations. Applicants must include personal information such as their name, address, and account details. Additionally, the form requires clarity on the amount of foreign exchange needed, stated in the specified currency. With several options listed, applicants can authorize their bank to carry out specific actions, such as issuing drafts, remitting foreign exchange directly, or providing travelers' cheques. The A2 form also includes a declaration under the Foreign Exchange Management Act (FEMA) of 1999, confirming that the amount requested falls within the limits set by the Reserve Bank of India for the calendar year. Completing the form involves selecting appropriate purpose codes, ensuring all financial transactions comply with relevant reporting requirements. Overall, the A2 form is a vital tool in the landscape of international payments, enabling smoother financial operations while promoting regulatory compliance.

A2 Example

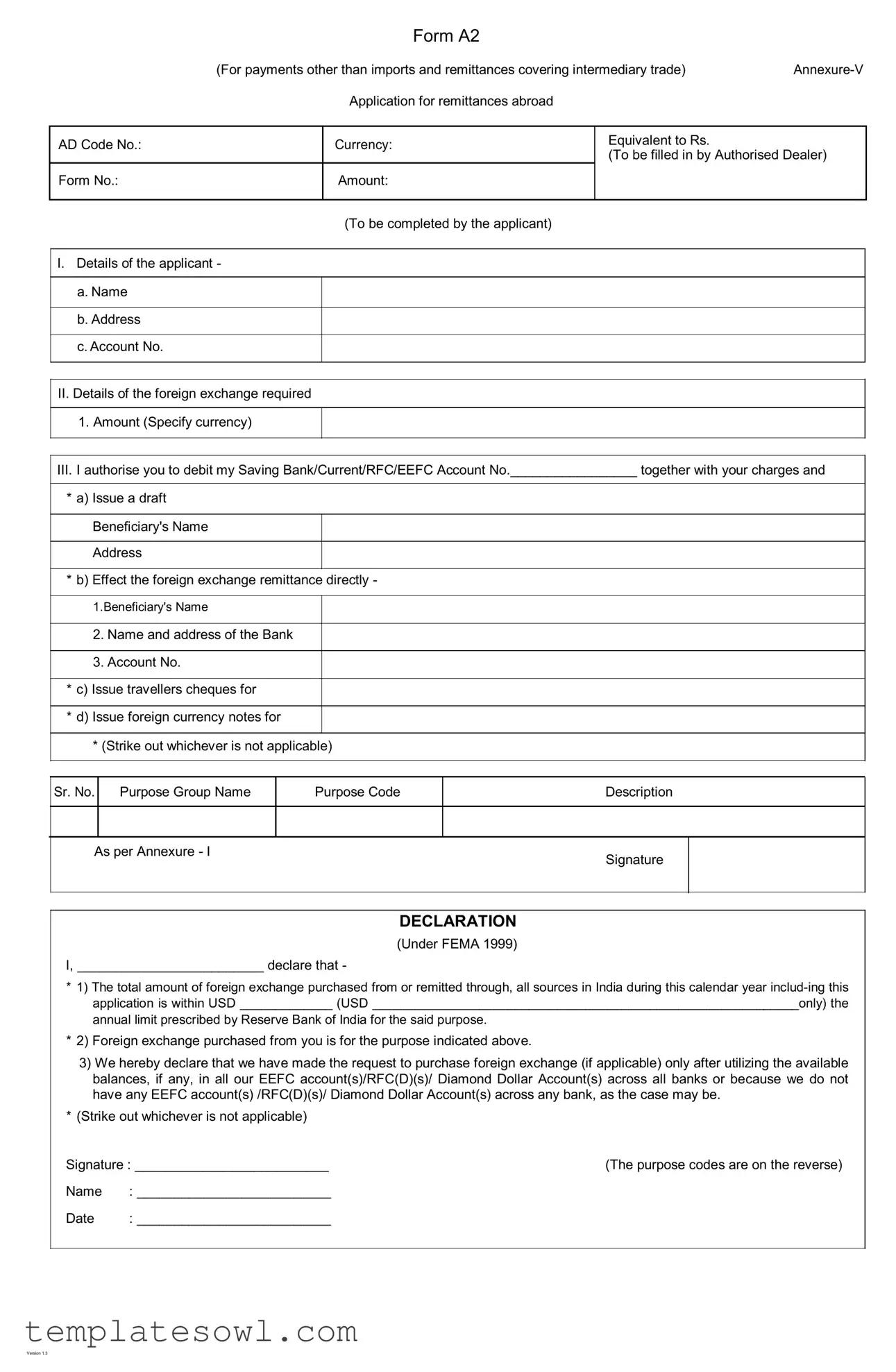

Form A2

(For payments other than imports and remittances covering intermediary trade) |

|

Application for remittances abroad |

|

AD Code No.:

Form No.:

Currency:

Amount:

Equivalent to Rs.

(To be filled in by Authorised Dealer)

(To be completed by the applicant)

I.Details of the applicant -

a.Name

b.Address

c.Account No.

II. Details of the foreign exchange required

1.Amount (Specify currency)

III.I authorise you to debit my Saving Bank/Current/RFC/EEFC Account No._________________ together with your charges and * a) Issue a draft

Beneficiary's Name

Address

*b) Effect the foreign exchange remittance directly -

1.Beneficiary's Name

2.Name and address of the Bank

3.Account No.

*c) Issue travellers cheques for

*d) Issue foreign currency notes for

* (Strike out whichever is not applicable)

Sr. No.

Purpose Group Name

Purpose Code

Description

As per Annexure - I

Signature

DECLARATION

(Under FEMA 1999)

I, _________________________ declare that -

*1) The total amount of foreign exchange purchased from or remitted through, all sources in India during this calendar year

*2) Foreign exchange purchased from you is for the purpose indicated above.

3)We hereby declare that we have made the request to purchase foreign exchange (if applicable) only after utilizing the available balances, if any, in all our EEFC account(s)/RFC(D)(s)/ Diamond Dollar Account(s) across all banks or because we do not have any EEFC account(s) /RFC(D)(s)/ Diamond Dollar Account(s) across any bank, as the case may be.

*(Strike out whichever is not applicable)

Signature : __________________________ |

(The purpose codes are on the reverse) |

|

Name |

: __________________________ |

|

Date |

: __________________________ |

|

Version 1.3

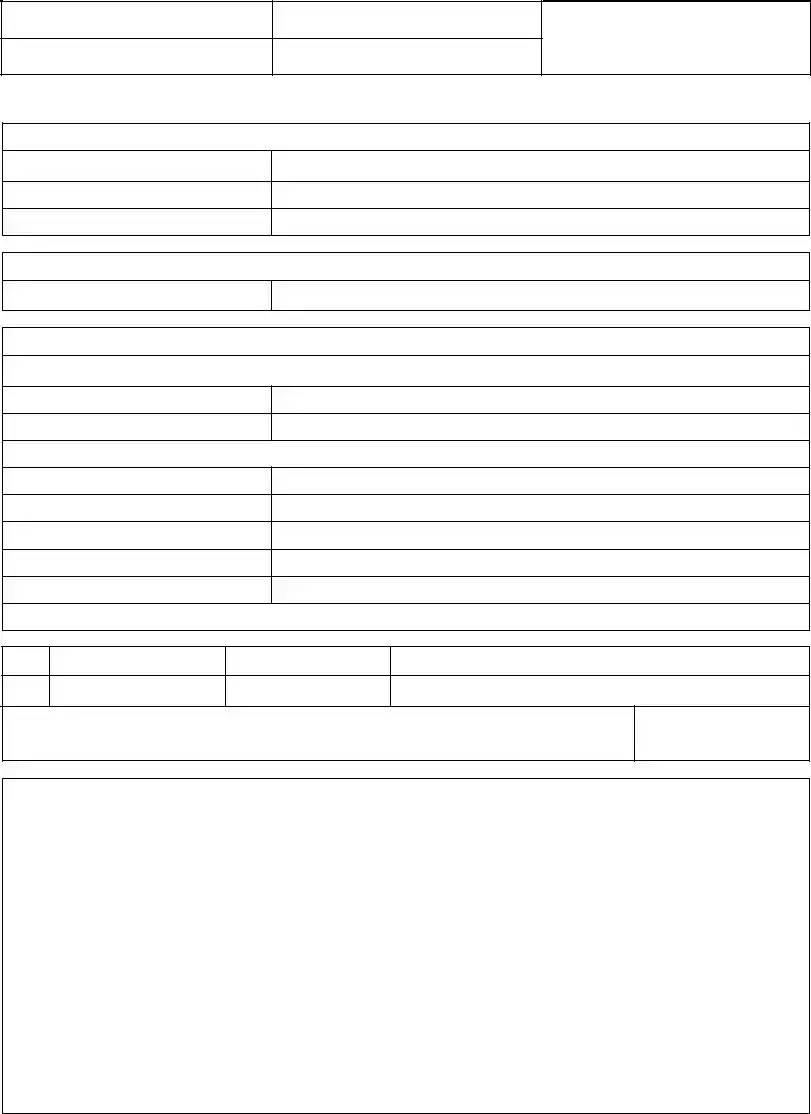

Annex I: Purpose codes for Reporting under FETERS A. Payment Purposes(for use in BOP file)

ADs should put a tick () against an appropriate purpose code. (In case of doubt/difficulty, consult customer/RBI.)

GR. |

Purpose |

|

Purpose |

|

Description |

|

|

|

|||

No. |

Group Name |

Code |

|

|

|

0 |

Capital |

|

|

|

Acquisition of |

|

Account |

|

S0017 |

|

sets like patents, copyrights, trademarks etc., land acquired by government, |

|

|

|

|

|

use of natural resources) – Government |

|

|

|

|

|

|

|

|

|

|

|

Acquisition of |

|

|

|

S0019 |

|

assets like patents, copyrights, trademarks etc., use of natural resources) |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

Capital transfers ( Guarantees payments, Investment Grand given by the |

|

|

|

S0026 |

|

government/international organisation, exceptionally large |

|

|

|

|

|

ance claims) – Government |

|

|

|

|

|

|

|

|

|

|

|

Capital transfers ( Guarantees payments, Investment Grand given by the |

|

|

|

S0027 |

|

|

|

|

|

|

|

Government |

|

|

|

|

|

|

|

|

|

S0099 |

|

Other capital payments not included elsewhere |

|

|

|

|

|

|

|

Financial Account |

|

|

||

|

|

|

|

|

|

|

Foreign |

|

S0003 |

|

Indian Direct investment abroad (in branches & wholly owned subsidiaries) |

|

Direct |

|

|

in equity Shares |

|

|

|

|

|

||

|

Investments |

|

|

|

|

|

|

|

Indian Direct investment abroad (in subsidiaries and associates) in debt |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0004 |

|

instruments |

|

|

|

|

|

|

|

|

|

S0006 |

|

Repatriation of Foreign Direct Investment made by overseas Investors in |

|

|

|

|

India – in equity shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0007 |

|

Repatriation of Foreign Direct Investment in made by overseas Investors |

|

|

|

|

India – in debt instruments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0008 |

|

Repatriation of Foreign Direct Investment made by overseas Investors in |

|

|

|

|

India – in real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign |

|

S0001 |

|

Indian Portfolio investment abroad – in equity shares |

|

Portfolio |

|

|

|

|

|

|

S0002 |

|

Indian Portfolio investment abroad – in debt instruments |

|

|

Investments |

|

|||

|

|

|

|

||

|

S0009 |

|

Repatriation of Foreign Portfolio Investment made by overseas Investors |

||

|

|

|

|

||

|

|

|

|

in India – in equity shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0010 |

|

Repatriation of Foreign Portfolio Investment made by overseas Investors in |

|

|

|

|

India – in debt instruments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External |

|

S0011 |

|

Loans extended to |

|

Commercial |

|

|

|

|

|

S0012 |

|

Repayment of long & medium term loans with original maturity above one |

||

|

Borrowings |

|

|||

|

|

year received from |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Short |

|

S0013 |

|

Repayment of short term loans with original maturity up to one year re- |

|

term Loans |

|

ceived from |

||

|

|

|

|||

|

|

|

|

|

|

|

Banking |

|

S0014 |

|

Repatriation of |

|

Capital |

|

|

|

|

|

|

S0015 |

|

Repayment of loans & overdrafts taken by ADs on their own account. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

S0016 |

|

Sale of a foreign currency against another foreign currency |

|

|

|

|

|

|

|

Financial |

|

|

Payments made on account of margin payments, premium payment and |

|

|

Derivatives |

S0020 |

|

settlement amount etc. under Financial derivative transactions. |

|

|

and Others |

|

|

|

|

|

S0021 |

|

Payments made on account of sale of share under Employee stock option |

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

S0022 |

|

Investment in Indian Depositories Receipts (IDRs) |

|

|

|

|

|

|

|

|

|

S0023 |

|

Remittances made under Liberalised Remittance Scheme (LRS) for Individuals |

|

|

|

|

|

|

|

External |

|

S0024 |

|

External Assistance extended by India. e.g. Loans and advances extended by India |

|

Assistance |

|

to Foreign governments under various agreements |

||

|

|

|

|||

|

|

|

|

|

|

|

|

|

S0025 |

|

Repayments made on account of External Assistance received by India. |

|

|

|

|

|

|

1 |

Transport |

S0201 |

|

Payments for surplus freight/passenger fare by foreign shipping compa- |

|

|

|

|

|

nies operating in India |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0202 |

|

Payment for operating expenses of Indian shipping companies operating |

|

|

|

|

abroad |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0203 |

|

Freight on imports – Shipping companies |

|

|

|

|

|

|

|

|

|

S0204 |

|

Freight on exports – Shipping companies |

|

|

|

|

|

|

|

|

|

S0205 |

|

Operational leasing/Rental of Vessels (with crew) |

|

|

|

S0206 |

|

Booking of passages abroad – Shipping companies |

|

|

|

|

|

|

|

|

|

S0207 |

|

Payments for surplus freight/passenger fare by foreign Airlines companies |

|

|

|

|

operating in India |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0208 |

|

Operating expenses of Indian Airlines companies operating abroad |

|

|

|

|

|

|

|

|

|

S0209 |

|

Freight on imports – Airlines companies |

|

|

|

|

|

|

|

|

|

S0210 |

|

Freight on exports – Airlines companies |

|

|

|

|

|

|

|

|

|

S0211 |

|

Operational leasing / Rental of Vessels (with crew) – Airline companies |

|

|

|

|

|

|

|

|

|

S0212 |

|

Booking of passages abroad – Airlines companies |

|

|

|

|

|

|

|

|

|

S0214 |

|

Payments on account of stevedoring, demurrage, port handling charges |

|

|

|

|

etc.(Shipping companies) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0215 |

|

Payments on account of stevedoring, demurrage, port handling charges, |

|

|

|

|

etc.(Airlines companies) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0216 |

|

Payments for Passenger - Shipping companies |

|

|

|

|

|

|

|

|

|

S0217 |

|

Other payments by Shipping companies |

|

|

|

|

|

|

|

|

|

S0218 |

|

Payments for Passenger - Airlines companies |

|

|

|

|

|

|

|

|

|

S0219 |

|

Other Payments by Airlines companies |

|

|

|

|

|

|

|

|

|

S0220 |

|

Payments on account of freight under other modes of transport (Internal |

|

|

|

|

Waterways, Roadways, Railways, Pipeline transports and others) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0221 |

|

Payments on account of passenger fare under other modes of transport |

|

|

|

|

(Internal Waterways, Roadways, Railways, Pipeline transports and others) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0222 |

|

Postal & Courier services by Air |

|

|

|

|

|

|

|

|

|

S0223 |

|

Postal & Courier services by Sea |

|

|

|

|

|

|

|

|

|

S0224 |

|

Postal & Courier services by others |

|

|

|

|

|

|

2 |

Travel |

|

S0301 |

|

Business travel. |

|

|

|

|

|

|

|

|

|

S0303 |

|

Travel for pilgrimage |

|

|

|

|

|

|

|

|

|

S0304 |

|

Travel for medical treatment |

|

|

|

|

|

|

|

|

|

S0305 |

|

Travel for education (including fees, hostel expenses etc.) |

|

|

|

|

|

|

|

|

|

S0306 |

|

Other travel (including holiday trips and payments for settling internation- |

|

|

|

|

al credit cards transactions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

C o n s t r u c - |

|

|

Construction of projects abroad by Indian companies including import of |

|

|

tion |

Ser- |

S0501 |

|

goods at project site abroad |

|

vices |

|

|

|

|

|

|

S0502 |

|

Cost of construction etc. of projects executed by foreign companies in India. |

|

|

|

|

|

||

|

|

|

|

|

|

4 |

I n s u ra n c e |

S0601 |

|

Life Insurance premium except term insurance |

|

|

and Pension |

|

|

|

|

|

S0602 |

|

Freight insurance – relating to import & export of goods |

||

|

Services |

|

|

|

|

|

|

|

S0603 |

|

Other general insurance premium including reinsurance premium; and |

|

|

|

|

term life insurance premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0605 |

|

Auxiliary services including commission on insurance |

|

|

|

|

|

|

|

|

|

S0607 |

|

Insurance claim Settlement of |

|

|

|

|

term insurance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0608 |

|

Life Insurance Claim Settlements |

|

|

|

|

|

|

|

|

|

S0609 |

|

Standardised guarantee services |

|

|

|

|

|

|

|

|

|

S0610 |

|

Premium for pension funds |

|

|

|

|

|

|

|

|

|

S0611 |

|

Periodic pension entitlements e.g. monthly quarterly or yearly payments |

|

|

|

|

of pension amounts by Indian Pension Fund Companies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0612 |

|

Invoking of standardised guarantees |

|

|

|

|

|

|

GR. |

Purpose |

|

|

Purpose |

|

Description |

|

|

|

|

|

|

|||

No. |

Group Name |

|

Code |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Financial |

|

|

S0701 |

|

Financial intermediation, except investment banking - Bank charges, col- |

|

|

Services |

|

|

|

lection charges, LC charges etc. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

S0702 |

|

Investment banking – brokerage, under writing commission etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

S0703 |

|

Auxiliary services – charges on operation & regulatory fees, custodial ser- |

|

|

|

|

|

|

vices, depository services etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Telecommu- |

|

S0801 |

|

Hardware consultancy/implementation |

|

|

|

nication, |

|

|

|

|

|

|

|

|

|

S0802 |

|

Software consultancy / implementation |

||

|

Computer & |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|||

|

Information |

|

S0803 |

|

Data base, data processing charges |

|

|

|

Services |

|

|

S0804 |

|

Repair and maintenance of computer and software |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

S0805 |

|

News agency services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S0806 |

|

Other information services- Subscription to newspapers, periodicals |

|

|

|

|

|

|

|

|

|

|

|

|

|

S0807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0808 |

|

Telecommunication services including electronic mail services and voice |

|

|

|

|

|

|

mail services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S0809 |

|

Satellite services including space shuttle and rockets etc. |

|

|

|

|

|

|

|

|

|

7 |

Charges |

for |

|

S0901 |

|

Franchises services |

|

|

the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

use of |

|

|

|

|

Payment for use, through licensing arrangements, of produced originals |

|

|

intellectual |

|

|

|

|

||

|

|

S0902 |

|

or prototypes (such as manuscripts and films), patents, copyrights, trade- |

|

||

|

p r o p e r t y |

|

|

|

|||

|

|

|

|

marks and industrial processes etc. |

|

||

|

n.i.e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8 |

Other Busi- |

S1002 |

|

Trade related services – commission on exports / imports |

|||

|

ness |

Ser- |

|

|

|

|

|

|

|

S1003 |

|

Operational leasing services (other than financial leasing) without operating |

|||

|

vices |

|

|

|

|||

|

|

|

|

crew, including charter hire- Airlines companies |

|||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

S1004 |

|

Legal services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1005 |

|

Accounting, auditing, |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1006 |

|

Business and management consultancy and public relations services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1007 |

|

Advertising, trade fair service |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1008 |

|

Research & Development services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1009 |

|

Architectural services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1010 |

|

Agricultural services like protection against insects & disease, increasing of |

|

|

|

|

|

|

harvest yields, forestry services. |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

S1011 |

|

Payments for maintenance of offices abroad |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1013 |

|

Environmental Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1014 |

|

Engineering Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1015 |

|

Tax consulting services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1016 |

|

Market research and public opinion polling service |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1017 |

|

Publishing and printing services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1018 |

|

Mining services like |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1020 |

|

Commission agent services |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1021 |

|

Wholesale and retailing trade services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1022 |

|

Operational leasing services (other than financial leasing) without operating |

|

|

|

|

|

|

crew, including charter hire- Shipping companies |

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

S1023 |

|

Other Technical Services including scientific/space services. |

|

|

|

|

|

|

|

|

|

|

|

|

|

S1099 |

|

Other services not included elsewhere |

|

9Personal,

|

Cultural & |

|

|

|

||

|

Recreational |

S1101 |

|

duction, distribution and projection services. |

||

|

services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1103 |

|

Radio and television production, distribution and transmission services |

|

|

|

|

|

|

|

|

|

|

|

S1104 |

|

Entertainment services |

|

|

|

|

|

|

|

|

|

|

|

S1105 |

|

Museums, library and archival services |

|

|

|

|

|

|

|

|

|

|

|

S1106 |

|

Recreation and sporting activities services |

|

|

|

|

|

|

|

|

|

|

|

S1107 |

|

Education (e.g. fees for correspondence courses abroad ) |

|

|

|

|

|

|

|

|

|

|

|

S1108 |

|

Health Service (payment towards services received from hospitals, doctors, |

|

|

|

|

|

nurses, paramedical and similar services etc. rendered remotely or |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

S1109 |

|

Other Personal, Cultural & Recreational services |

|

|

|

|

|

|

|

|

10 |

Govt. |

not |

S1201 |

|

Maintenance of Indian embassies abroad |

|

|

included else- |

|

|

|

|

|

|

S1202 |

|

Remittances by foreign embassies in India |

|||

|

where (G.n.i.e.) |

|

||||

|

|

|

|

|

|

|

11 |

Secondary |

|

S1301 |

|

Remittance for family maintenance and savings |

|

|

Income |

|

|

|

|

|

|

|

S1302 |

|

Remittance towards personal gifts and donations |

||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

S1303 |

|

Remittance towards donations to religious and charitable institutions abroad |

|

|

|

|

|

|

|

|

|

|

|

S1304 |

|

Remittance towards grants and donations to other governments and chari- |

|

|

|

|

|

table institutions established by the governments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1305 |

|

Contributions/donations by the Government to international institutions |

|

|

|

|

S1306 |

|

Remittance towards payment / refund of taxes. |

|

|

|

|

|

|

|

|

|

|

|

S1307 |

|

Outflows on account of migrant transfers including personal effects |

|

|

|

|

|

|

|

|

12 |

Primary |

|

S1401 |

|

Compensation of employees |

|

|

Income |

|

|

|

|

|

|

|

S1402 |

|

Remittance towards interest on |

|

|

|

|

|

|

|

||

|

|

|

S1403 |

|

Remittance towards interest on loans from |

|

|

|

|

|

External Commercial Borrowings, Trade Credits, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1405 |

|

Remittance towards interest payment by ADs on their own account (to |

|

|

|

|

|

VOSTRO a/c holders or the OD on NOSTRO a/c.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1408 |

|

Remittance of profit by FDI enterprises in India (by branches of foreign |

|

|

|

|

|

companies including bank branches) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1409 |

|

Remittance of dividends by FDI enterprises in India (other than branches) |

|

|

|

|

|

on equity and investment fund shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1410 |

|

Payment of interest by FDI enterprises in India to their Parent company abroad. |

|

|

|

|

|

|

|

|

|

|

|

S1411 |

|

Remittance of interest income on account of Portfolio Investment in India |

|

|

|

|

|

|

|

|

|

|

|

S1412 |

|

Remittance of dividends on account of Portfolio Investment in India on eq- |

|

|

|

|

|

uity and investment fund shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Others |

|

S1501 |

|

Refunds / rebates / reduction in invoice value on account of exports |

|

|

|

|

|

|

|

|

|

|

|

S1502 |

|

Reversal of wrong entries, refunds of amount remitted for |

|

|

|

|

|

|

|

|

|

|

|

S1503 |

|

Payments by residents for international bidding |

|

|

|

|

|

|

|

|

|

|

|

S1504 |

|

Notional sales when export bills negotiated/ purchased/ discounted are |

|

|

|

|

|

dishonored/ crystallised/ cancelled and reversed from suspense account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S1505 |

|

Deemed Imports (exports between SEZ, EPZs and Domestic tariff areas) |

|

|

|

|

|

|

|

|

14 |

Maintenance |

S1601 |

|

Payments on account of maintenance and repair services rendered for |

|

|

|

and repair |

|

|

|

Vessels, ships, boats, warships, etc. |

|

|

s e r v i c e s |

|

|

|

|

|

|

|

|

Payments on account of maintenance and repair services rendered for air- |

|

||

|

n.i.e |

|

S1602 |

|

|

|

|

|

|

crafts, space shuttles, rockets, military aircrafts, helicopters, etc. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Manufactur- |

|

|

|

|

|

|

ing services |

S1701 |

|

Payments for processing of goods |

|

|

|

(goods |

for |

|

|

|

|

|

processing) |

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of Form A2 | Form A2 is an application for remittances abroad for payments other than imports and remittances covering intermediary trade. |

| Governing Law | This form is governed by the Foreign Exchange Management Act (FEMA) 1999 in India. |

| AD Code Requirement | Each applicant must provide an Authorized Dealer (AD) Code number to process the remittance. |

| Details Required | Applicants must fill in personal information, including their name, address, and account number. |

| Foreign Exchange Specifications | The form mandates applicants to specify the currency and amount of foreign exchange needed. |

| Payment Options | Applicants can choose different payment methods, such as issuing a draft, remittance directly, or issuing foreign currency notes. |

| Purpose Codes | The form includes predefined purpose codes to categorize the reason for the remittance, which must be chosen by the applicant. |

| Signature Requirement | The applicant must provide a signature to confirm the details and compliance with the provided information. |

| Annual Limit Declaration | Applicants must declare that the total amount of foreign exchange purchased remains within the annual limit set by the Reserve Bank of India. |

Guidelines on Utilizing A2

After gathering your personal information and details regarding the foreign exchange you need, you are ready to proceed with filling out Form A2. Ensuring each section is completed accurately is vital for a smooth transaction. Below are the steps to follow when filling out this form.

- Start with the AD Code No., which can be obtained from your bank.

- Enter the Form No. assigned to your request.

- Specify the Currency for your remittance and the Amount you wish to transfer.

- Provide the Equivalent to Rs. amount, which your bank will fill.

- Fill in your personal details:

- Name

- Address

- Account No.

- Indicate the Amount needed, specifying the currency.

- Authorize your bank by filling in your saving, current, RFC, or EEFC account number and specify if charges should be debited.

- Select your preferred option for remittance:

- Issue a draft to the beneficiary's name and address.

- Effect the foreign exchange remittance directly, including:

- Beneficiary's Name

- Name and Address of the Bank

- Account No.

- Issue travellers cheques.

- Issue foreign currency notes.

- Complete the purpose details by adding the:

- Sr. No.

- Purpose Group Name

- Purpose Code

- Description as per Annexure - I

- Sign the form and date it in the designated areas.

- In the declaration section, confirm the declared total amount of foreign exchange for the calendar year and provide necessary details about previous transactions as needed.

Once you have completed the form, review it carefully for any errors or missing information before submitting it to your authorized dealer. This will help ensure your remittance process goes as smoothly as possible.

What You Should Know About This Form

What is the A2 Form?

The A2 Form is a necessary document used in India for specific types of foreign remittances that are not related to imports or individual transfers. It is primarily aimed at facilitating payments for various purposes, including investments and services. This form is submitted to banks or authorized dealers when individuals or entities seek to transfer funds outside of India.

Who needs to fill out the A2 Form?

Individuals or entities planning to make payments abroad for purposes like investment, business services, or educational expenses need to complete the A2 Form. It helps ensure compliance with the rules set by the Reserve Bank of India regarding foreign exchange transactions.

What details are required in the A2 Form?

Applicants must provide personal information, including their name, address, and account number. Additionally, details regarding the foreign exchange required must be specified, such as the amount and purpose of the payment. The form has sections for authorizing the bank to debit the applicant’s account and to detail how the funds should be processed, including issuing drafts or forex notes.

How do I determine which purpose code to use?

The A2 Form requires users to select a purpose code that corresponds to their transaction. A detailed list of these codes is provided in the annexure of the form. If there is uncertainty regarding which code to select, it is advisable to consult the bank or refer to the guidelines from the Reserve Bank of India.

Is it mandatory to declare previous foreign exchange purchases?

Yes, applicants must declare any foreign exchange purchased or remitted during the calendar year. This includes the current application amount. The declaration is crucial to ensure compliance with the annual limit set by the Reserve Bank of India for each individual.

What happens if the funds are not transferred for the specified purpose?

If the funds are not used for the purpose indicated in the A2 Form, it could lead to legal complications or penalties. The Reserve Bank of India requires adherence to the stated purpose to prevent misuse of foreign exchange transactions.

Can I use the A2 Form for both personal and business transactions?

The A2 Form can be used for a variety of transactions, covering both personal and business-related purposes. However, depending on the nature of the transaction, different supporting documents and details might be needed to validate the request.

What is the significance of striking out non-applicable sections in the form?

Striking out sections that do not apply to the transaction helps clarify the applicant's intentions and ensures that the form is processed accurately. It reduces potential errors and misinterpretations by the bank or authorized dealer.

Where can I submit my completed A2 Form?

The completed A2 Form should be submitted to an Authorized Dealer, such as a designated bank, that handles foreign exchange transactions. Applicants should also retain copies of the form and any related documents for their records.

Common mistakes

Filling out the A2 form can sometimes feel overwhelming, but avoiding common mistakes can make a significant difference in processing your application efficiently. One prevalent mistake is omitting important personal details. Applicants often leave out crucial information such as their name or address. Each section needs to be carefully completed. If your details aren’t fully supplied, it may lead to a delay or even the rejection of your request.

Another frequent error involves the application of the incorrect purpose code. The purpose codes guide the use of foreign exchange for specific transactions. Many individuals fail to check if the code they select accurately reflects the reason for their remittance. Using a wrong purpose code not only confuses the processing but can also breach compliance with regulations.

Sometimes, applicants miscalculate the total amount of foreign exchange. The A2 form requires that you accurately declare all foreign exchange transactions for the calendar year, including the current application. If the subtotal is not correct, it could exceed the annual limit set by the Reserve Bank of India. Such a mistake can create complications and lead to potential penalties.

Another common pitfall is not striking out the inapplicable options. The form gives several choices regarding the method of remittance, and failing to strike out the options you don't intend to use can lead to confusion. This oversight might result in improper processing of your request.

Confirmation of the account information is also critical. Sometimes people provide an incorrect bank account number or choose the wrong type of account, like a Savings instead of a Current account. Ensure that all bank details are double-checked for accuracy before submitting the form to avoid unnecessary complications.

Lastly, applicants sometimes overlook the need for signatures. It may seem simple, but missing a signature on the declaration section is a fundamental error that can halt the entire application process. Always sign and date the application to confirm that the information you provided is true and accurate.

Documents used along the form

The A2 form is critical for individuals and businesses looking to make remittances abroad for various purposes, and it often works hand-in-hand with other documents. Understanding these accompanying forms can help streamline the process of transferring funds and ensure compliance with regulations.

- Annexure-V: This is attached to the A2 form and provides specific details about the transaction and purpose of the remittance. It serves as an essential appendix that outlines additional information required by the banks.

- Application for Remittance: This document is usually filled out to formally request the remittance amount. It details the purpose of the remittance and must be presented alongside the A2 form.

- Identity Proof: Valid identification, such as a passport or driver's license, is necessary to confirm the identity of the individual making the remittance. This helps ensure that funds are not being misused or sent for illicit purposes.

- Address Proof: Recent utility bills, bank statements, or government-issued documents serve as proof of the applicant's current residence. This is important for record-keeping and compliance.

- Bank Statement: A recent statement from the applicant's bank account demonstrates the source of funds being remitted. It verifies that there are sufficient funds available for the requested transaction.

- Foreign Exchange Form (FE Form): Typically required for government reporting, this form documents the details of foreign exchange transactions. It helps maintain transparency and records of currency flow.

- Purpose Code Documentation: This document includes codes that correspond to the specific reason for the remittance. It may be needed by the Authorised Dealer to classify the transaction appropriately.

- Tax Certificate: Depending on the destination country, a tax certificate might be necessary to ensure compliance with local laws regarding remittances. This document can help avoid unexpected taxes or regulations overseas.

- Specific Approval Letters: Certain types of remittances may require additional approvals from government bodies or banks, especially for larger amounts. This ensures that all regulatory measures are followed.

Each of these documents adds a layer of security and compliance to the remittance process. Familiarity with them can help avoid complications and ensure that your funds reach their intended destination without unnecessary delays.

Similar forms

-

Form A1: Similar to A2, this form is used for remittance requests related to imports and foreign currency exposure. It also includes details about the applicant, currency, and the amount required, allowing authorized dealers to process remittances abroad.

-

Form A3: This form facilitates remittances for business purposes, such as investment or capital transactions. Both forms require the declaration of the purpose of the exchange and provide a structure for details regarding the applicant and the transaction.

-

Form A4: Used for remittances towards salaries and other employment-related payments. It shares similar requirements for applicant information and purposes of the remittance, ensuring compliance with regulations.

-

Form A5: This form is intended for remittances related to travel expenses. Just like A2, it requires specific information from the applicant, including the amount and purpose of the transaction.

-

Form FIRC: The Foreign Inward Remittance Certificate provides documentation for inward remittances. Both A2 and FIRC involve the notification of foreign exchange transactions, though A2 focuses on outward remittances.

-

Form RCU: The Remittance Credit Unit form deals with transactions for credits received. Similar to A2, it requires details about the transaction purpose and the entities involved in the transaction.

-

Form LRS: The Liberalized Remittance Scheme form allows individuals to remit money abroad for various purposes. Both A2 and LRS forms necessitate detailed purposes and limits to ensure compliance with the regulatory framework.

-

Form ECB: External Commercial Borrowing applications involve remittances for large-scale borrowing. A2 and ECB both require detailed applicant information and the specific purpose for remittances.

-

Form TCS: Tax Collected at Source forms track payments that may be subjected to tax deductions. While A2 is focused on remittances, both forms ensure transparency and compliance regarding funds in international transactions.

-

Form SML: The Special Money Loan form involves loans for specific purposes. It shares with A2 the need for applicant credentials, the nature of the remittance, and compliance with financial regulations.

Dos and Don'ts

When filling out the A2 form, consider the following do's and don'ts:

- Do: Ensure all personal information is accurate. Double-check your name, address, and bank account number.

- Do: Specify the purpose of your remittance clearly. This helps the authorized dealer understand your needs.

- Do: Sign the form where indicated. Your signature is essential for validation.

- Do: Keep a copy of the completed form for your records. It is useful for future reference.

- Do: Review the currency and amount requested before submission. Mistakes can delay your transaction.

- Don't: Leave any section blank. Every field must be filled out to avoid rejection.

- Don't: Use abbreviations or shorthand. Clear and complete wording is essential.

- Don't: Underspecify your purpose code. Choose accurately from the provided list to ensure compliance.

- Don't: Forget to strike out any options that do not apply. Clarity reduces confusion.

- Don't: Submit without checking for errors. Simple mistakes can lead to delays or complications.

Misconceptions

- Misconception 1: The A2 form is only required for sending money for business purposes.

- Misconception 2: Only banks can fill out the A2 form.

- Misconception 3: Filling out the A2 form guarantees approval for the remittance.

- Misconception 4: There are no limits on the amount that can be remitted using the A2 form.

- Misconception 5: The purpose codes are optional.

- Misconception 6: Only residents can fill out the A2 form.

- Misconception 7: The A2 form is the same for all currency types.

Many believe that the A2 form is strictly for business-related transactions. In reality, it is also required for various personal remittances, including travel expenses, medical treatment, and donations.

While banks play a role in processing the A2 form, it is the applicant's responsibility to complete it. Providing accurate information is crucial to avoid delays.

Completing the A2 form does not guarantee that your remittance will be approved. The final decision rests with the authorized dealer, who will assess the application based on various factors.

There are specific limits on how much can be sent abroad under various categories. Users must stay within the annual limits set by the Reserve Bank of India to avoid complications.

Purpose codes on the A2 form are not optional; they are essential for categorizing the nature of the remittance. A correct purpose code ensures compliance with regulations.

While primarily designed for residents, specific non-residents may also use the A2 form, particularly for payments related to investments or other allowable transactions.

The A2 form may have different requirements depending on the currency being used. Certain currencies might have more stringent regulations or documentation needed.

Key takeaways

When completing and utilizing the A2 form, there are several key points that applicants should keep in mind to ensure a smooth process. Here are the essential takeaways:

- Accurate Information: Ensure that all personal details, such as name, address, and account number, are filled out correctly. Mistakes can lead to delays or complications.

- Required Documentation: Have any necessary documents ready. This may include identification or proof of the purpose for which you are seeking foreign exchange.

- Specific Purpose Code: Select the correct purpose code from Annex I for your payment. This helps streamline the transaction and ensures compliance with regulatory requirements.

- Declaration Under FEMA: It's crucial to declare the total amount of foreign exchange purchased for the calendar year accurately. This helps adhere to the annual limits set by the Reserve Bank of India.

- Account Charges: Be aware that charges may apply to transactions. Authorize the bank to deduct these fees from your specified account as you fill out the form.

- Submission and Follow-Up: After submitting the form, follow up with your bank to confirm it has been received and is being processed. This proactive approach can help avoid any issues.

Being mindful of these takeaways can lead to a more efficient experience with the A2 form, ensuring that your foreign exchange needs are met without unnecessary hassles.

Browse Other Templates

Rent Roll Template Google Sheets - This form serves as a snapshot of the rental landscape of a property.

Laney College Admissions Phone Number - The first two transcripts requested by students are free, but this applies only to regular delivery.