Fill Out Your Absa 3740 Ex Form

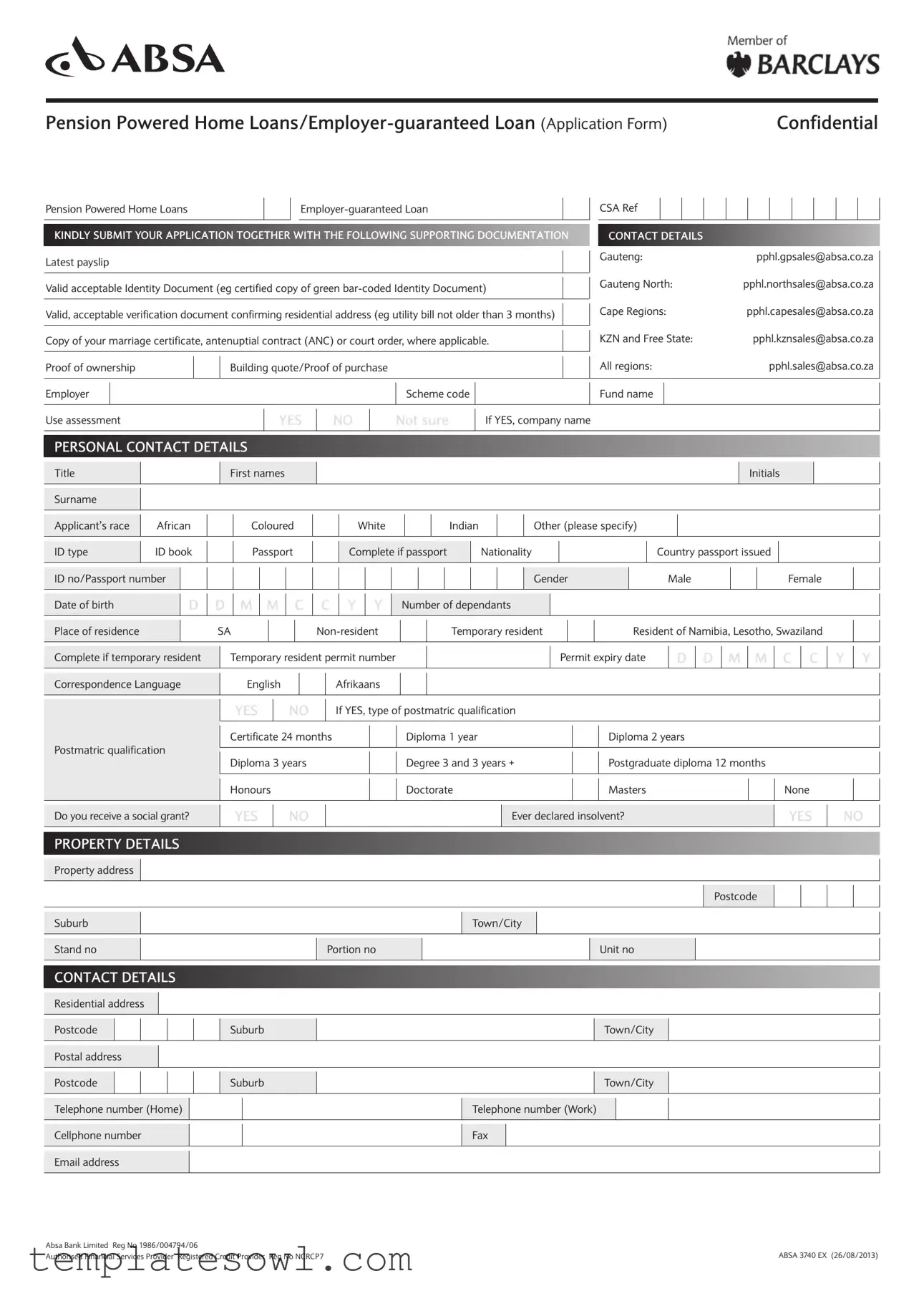

The Absa 3740 Ex form plays a crucial role in helping applicants secure Pension Powered Home Loans or employer-guaranteed loans. It is designed to ensure that lenders collect all necessary information and documentation from prospective borrowers to evaluate their applications effectively. This form includes important sections such as personal contact details, employment status, and financial information. Notably, applicants must provide verification of identity, residential address, and income documentation, such as the latest payslip. There are also sections dedicated to property details and loan specifics, enabling applicants to specify their desired loan amounts and terms. In addition, it covers essential declarations to confirm that the loan will be used for housing-related purposes, while also allowing for the sharing of personal and financial information among the bank, the employer, and any relevant financial institutions. Understanding these aspects of the Absa 3740 Ex form is critical for anyone looking to navigate the application process successfully.

Absa 3740 Ex Example

Pension Powered home |

confidential |

Pension Powered Home Loans

CSA Ref

Kindly submit your aPPlication together with the following suPPorting documentation |

|

contact details |

|

|

|||||||||||||

Latest payslip |

|

|

|

|

|

|

|

|

|

|

|

Gauteng: |

pphl.gpsales@absa.co.za |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gauteng North: |

pphl.northsales@absa.co.za |

|

|

Valid acceptable Identity Document (eg certified copy of green |

|

|

|

|

|||||||||||||

|

|

|

|||||||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cape Regions: |

pphl.capesales@absa.co.za |

|

|

Valid, acceptable verification document confirming residential address (eg utility bill not older than 3 months) |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

KZN and Free State: |

pphl.kznsales@absa.co.za |

|

|||||

Copy of your marriage certificate, antenuptial contract (ANC) or court order, where applicable. |

|

|

|

||||||||||||||

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

All regions: |

pphl.sales@absa.co.za |

|

||

Proof of ownership |

|

Building quote/Proof of purchase |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer |

|

|

|

|

|

|

Scheme code |

|

|

|

|

|

|

Fund name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Use assessment |

|

yes |

no |

|

not sure |

If YES, company name |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal contact details

Title

Surname

First names

Initials

Applicant’s race |

African |

|

|

Coloured |

|

|

|

|

White |

|

|

|

|

|

|

Indian |

|

|

Other (please specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID type |

ID book |

|

|

Passport |

|

|

|

Complete if passport |

|

Nationality |

|

|

|

|

|

|

Country passport issued |

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

Female |

|

|

|||||

ID no/Passport number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth |

|

d |

d |

m |

m |

|

c |

c |

|

y |

|

y |

|

Number of dependants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place of residence |

|

|

SA |

|

|

|

|

|

|

|

|

|

Temporary resident |

|

|

|

|

Resident of Namibia, Lesotho, Swaziland |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete if temporary resident |

|

Temporary resident permit number |

|

|

|

|

|

|

|

|

|

|

|

|

Permit expiry date |

|

d |

d |

m |

m |

|

c |

c |

y |

y |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Correspondence Language |

|

|

English |

|

|

|

Afrikaans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

yes

no

If YES, type of postmatric qualification

Postmatric qualification |

|

Certificate 24 months |

|

Diploma 1 year |

|

Diploma 2 years |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diploma 3 years |

|

Degree 3 and 3 years + |

|

Postgraduate diploma 12 months |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Honours |

|

|

|

|

Doctorate |

|

Masters |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

yes |

|

no |

|

|

|

|

|

|

|

yes |

|

no |

|

|

Do you receive a social grant? |

|

|

|

|

|

Ever declared insolvent? |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ProPerty details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property address

Suburb

Stand no

Postcode

Town/City

Portion no |

|

Unit no |

|

|

|

contact details Residential address

Postcode |

|

|

|

|

|

|

Suburb |

|

|

|

Town/City |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

Suburb |

|

|

|

Town/City |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number (Home) |

|

|

|

|

Telephone number (Work) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cellphone number |

|

|

|

|

Fax |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Absa Bank Limited Reg No 1986/004794/06 |

|

Authorised Financial Services Provider Registered Credit Provider Reg No NCRCP7 |

ABSA 3740 EX (26/08/2013) |

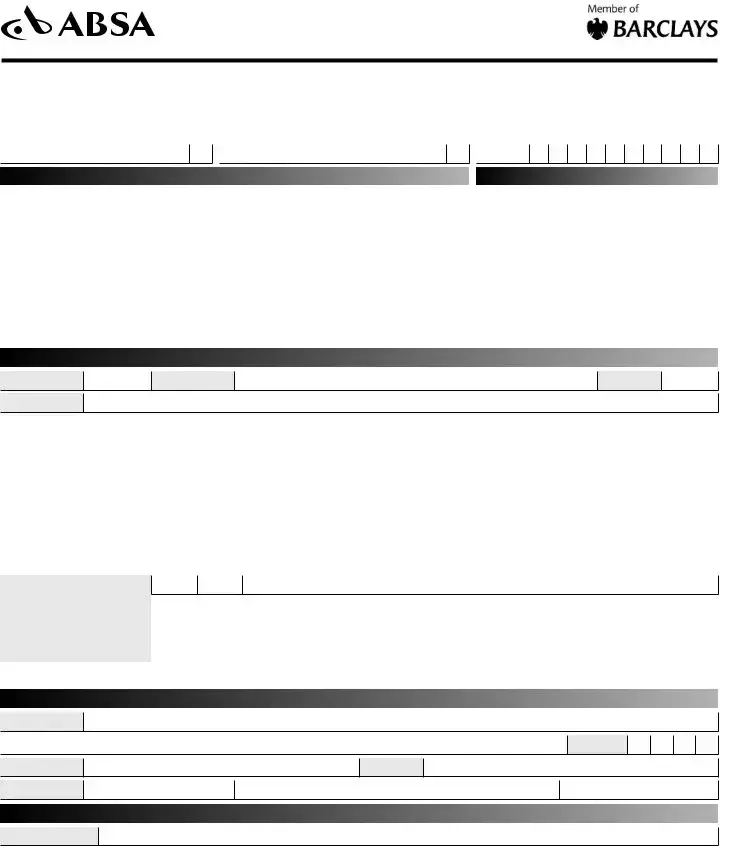

emPloyment details

Employment status |

|

Temporary |

|

Contract |

|

Occupation |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee number |

|

|

|

Fund membership number |

|

|

Union number |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

loan details

Existing PPHL Loan |

|

yes |

no |

unsure |

(Please note that we will confirm if there is an existing account. If so we will use that account to add |

|

|

|

the additional funds.) |

|

|||||

|

|

|

|

|

|

|

|

Preferred minimum payment (to be confirmed) |

|

|

|

|

r |

|

|

New loan amount – new loan amount/Additional funds required |

|

|

r |

|

|||

|

|

|

|||||

Application loan terms in months – Preferred loan term in months (term will be adjusted according to scheme rules, interest, retirement age and maximum allowed term)

Purpose of loan

Deposit on property

Purchase land

Purchase of property

Renovations/Enhancements

credit Protection Plan

Credit Life Assurance required with Absa |

yes |

no |

|

If YES, please choose Benefit Option |

|

|

|

|

|

|

|

|

|

|

|

Death and Disability

Death, Disability and Retrenchment

electronic disbursement details

yes no

beneficiary details (account loan to be paid into and proof of bank details attached)

beneficiary 1

beneficiary 2

beneficiary 3

Name of bank

Credit account number

Account type

Branch

Branch clearing code

Accountholder’s name

Amount |

r |

r |

r |

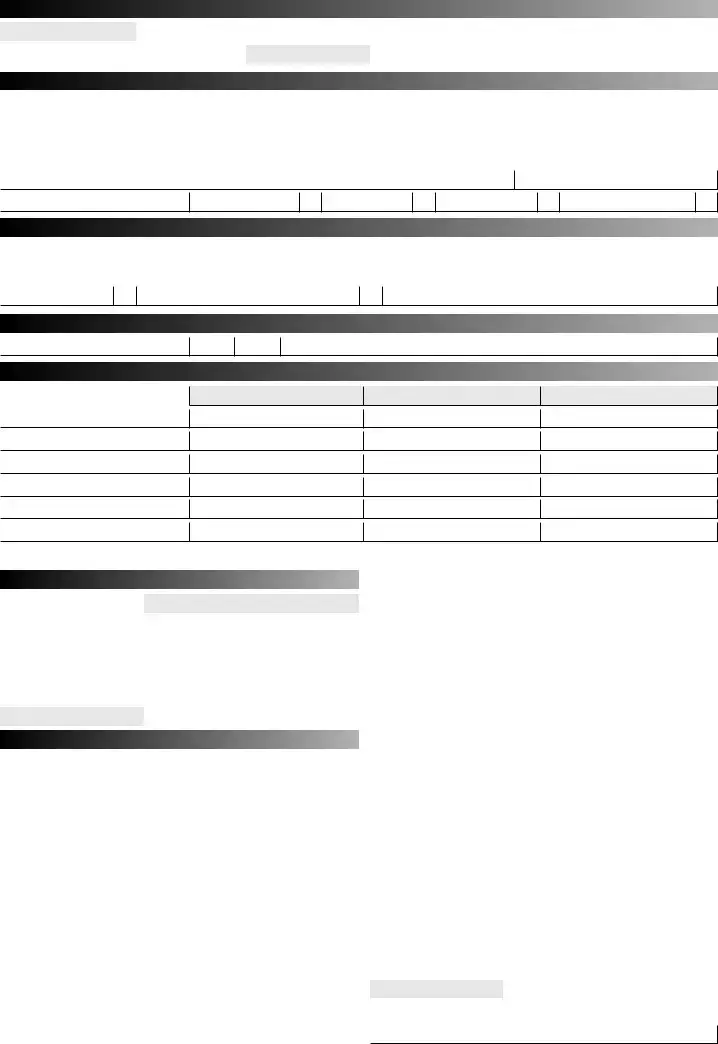

affordability details

client |

spouse (only coP) |

combined |

|

|

|

net salary: as per payslip |

|

r |

|

|

|||

other income: (please specify and |

|

|

r |

|

|

|

|

|

|

|

|

|

|

||

attach proof thereof) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

r |

|

|

|

|

|

|

|

|

|

|||

|

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

total income |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

exPenses |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Mortgage/Rent |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

Loan/Overdraft |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit card/Retail accounts |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Finance/Lease repayment |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

Other (please specify) |

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lights and water |

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rates and taxes |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

Domestic worker |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Gardening services |

r |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Security services |

r |

|

|

||||

|

|

|

|

|

|||

Vehicle instalment |

r |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Fuel |

r |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Parking |

|

|

r |

|

|

|

|

client |

spouse (only coP) |

combined |

|

|

|

Other transport costs |

r |

|

|

|

|

|

|

r |

|

|

|

|

|

|

|

Life insurance |

r |

|

|

|

|

|

|

|

|

|

|

Funeral policies |

r |

|

|

|

|

|

|

Groceries |

r |

|

|

|

|

|

|

Clothing |

r |

|

|

|

|

|

|

|

|

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

Tuition fees |

r |

|

|

|

|

|

|

Telephone |

r |

|

|

|

|

|

|

|

|

|

|

Cell |

r |

|

|

|

|

|

|

|

|

|

|

Membership subscription |

r |

|

|

|

|

|

|

Personal loans |

r |

|

|

|

|

|

|

|

|

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

Bank charges |

r |

|

|

|

|

|

|

Medical bills |

r |

|

|

|

|

|

|

|

|

|

|

Medical aid |

r |

|

|

|

|

|

|

|

|

||

Other (please specify) |

r |

|

|

|

|

||

Total expenses |

r |

|

|

|

|

|

|

net income

1I/We acknowledge that the information given by me/us will form the basis on which my/our application is to be considered and that all such information is of material importance and directly relevant to the consideration of my/our application.

2I/We warrant that all information I/we gave is to the best of my/our knowledge and belief true and correct in all material respects and I am/we are not aware of any other information which, should it become known to you, would affect the consideration of my/our application in any way.

3I/We declare that the proceeds of the loan for which I am/we are applying will be used for housing purposes as described if the loan is subject to the Pension Funds Act, 24 of 1956 or any replacement legislation.

4I/We declare that the property is/will be my/our primary residence that is/will be occupied by me and/or my spouse and/or my dependant(s).

5 I/We declare that:

5.1I am/we are the lawful owner;

5.2my spouse and I are lawful owners;

5.3my spouse is the lawful owner;

of the property for which the proceeds of the loan will be used.

6I/We acknowledge that Absa or my/our fund or any of its nominees reserves the right to inspect our premises to ensure that the loan is in fact being used for housing purposes.

7I/We consent to the Bank, my fund and/or its fund administrator as well as my employer sharing any of my personal and financial information among them as may be required to proceed and implement this loan that I have applied for.

8I/We declare and warrant that:

8.1I/We have fully and truthfully disclosed my/our income and expenditure to you prior to signing this application;

8.2I am/we are not under debt counselling or subject to debt review;

8.3I/We have disclosed to you all other applications for credit that I/we have made to other credit providers, whether they have been processed or not at the date of this application;

8.4entering into this agreement will not cause me/us to become

Signed at |

on |

|

|

Applicant’s signature |

|

Signed at |

on |

Spouse’s signature (Only COP, if applicable)

Spouses’s first names and surnameSpouse’s ID number

Signature on behalf of employer (if applicable)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is titled "Absa 3740 Ex" and is used for Pension Powered Home Loans and Employer-Guaranteed Loans. |

| Purpose | This application form is designed to gather necessary information for individuals applying for home loans backed by pension funds. |

| Submission Requirements | Applicants must submit the form along with various supporting documents, including a valid ID and payslip. |

| Contact Information | Contact details are provided for different regions in South Africa, including Gauteng, Cape Regions, KZN, and Free State. |

| ID Requirements | A valid identity document, such as a certified green bar-coded ID, is required to process the application. |

| Property Use Declaration | Applicants must declare that the loan proceeds are intended for housing-related purposes as per the Pension Funds Act, 24 of 1956. |

| Employment Status | The form includes a section for applicants to indicate their employment status, which can influence loan approval. |

| Loan Purpose Options | The form allows applicants to specify the purpose of the loan, such as buying property or renovations. |

| Affordability Assessment | Applicants must provide detailed income and expense information to assess their financial capacity for the loan. |

| Governing Laws | This form operates under South African law, specifically relating to the Pension Funds Act, 24 of 1956. |

Guidelines on Utilizing Absa 3740 Ex

The Absa 3740 Ex form is an essential document to initiate your application for a Pension Powered Home Loan or an Employer-Guaranteed Loan. To ensure a smooth application process, follow these steps carefully and gather the required information and supporting documents before you begin.

- Download and print the Absa 3740 Ex form from the appropriate source.

- Fill in your personal details accurately. Include your title, surname, first names, initials, ID type, and passport information if applicable.

- Provide your contact information, including residential and postal addresses, telephone numbers, fax number, and email address.

- Indicate your race and gender. Ensure to specify your date of birth and the number of dependants.

- If you are a temporary resident, complete the additional section requesting your temporary resident permit number and its expiry date.

- Choose your correspondence language and list any postmatric qualifications you have obtained.

- Answer the questions regarding your employment status, occupation, employee number, and any union representation.

- Provide details about your loan, including existing loan status, preferred payment amount, new loan amount, and purpose of the loan.

- Check if you require credit protection plans and choose the option that suits your needs.

- Complete the electronic disbursement section if necessary, detailing beneficiary information for bank transfers.

- Fill out the affordability section, including income from different sources and all monthly expenses.

- Review and confirm the declarations section, affirming that the information provided is accurate and true.

- Sign and date the form. If applicable, have your spouse sign as well and include their details.

- Attach all required supporting documents such as a valid Identity Document, recent payslip, proof of residency, and marriage certificate if necessary.

- Submit the completed form and supporting documents to the appropriate contact email based on your region.

What You Should Know About This Form

What is the Absa 3740 Ex form?

The Absa 3740 Ex form is an application form for Pension Powered Home Loans and employer-guaranteed loans. It is designed for individuals who seek financial assistance for housing-related expenses. The form requires personal details, employment information, and documentation to support the application. By completing this form, applicants express their intent to utilize the loan for a primary residence, as regulated under the Pension Funds Act.

What supporting documents are necessary when submitting the Absa 3740 Ex form?

Applicants must provide several supporting documents to complete their application. These include a valid Identity Document, a recent payslip, proof of ownership or a building quote for the property, a verification document that confirms the residential address, and a marriage certificate or court order if applicable. Additional documents may be required based on individual circumstances.

Where should I submit my completed form and documents?

You can submit your completed Absa 3740 Ex form along with the supporting documents to different email addresses based on your geographical location. For Gauteng, send to pphl.gpsales@absa.co.za. For Gauteng North, use pphl.northsales@absa.co.za. For the Cape Regions, send to pphl.capesales@absa.co.za, and for KZN and Free State, please use pphl.kznsales@absa.co.za. If you are located in another region, you can submit your documents to pphl.sales@absa.co.za.

What types of loans can be applied for using the Absa 3740 Ex form?

The form allows applicants to request Pension Powered Home Loans for various housing purposes, such as purchasing property, making renovations, or covering the deposit for a new home. If you are uncertain about which type of loan best suits your needs, please consider discussing your options with a financial advisor.

Can I apply for a loan if I have a previously existing loan with Absa?

Yes, if you have an existing Pension Powered Home Loan with Absa, you can still apply for an additional loan using the Absa 3740 Ex form. The new application will reference your current account, and if funds are approved, they can be added to your existing loan. This process will be confirmed during the application review.

What should I include in the affordability details section?

This section requires a clear overview of your income and expenses. It’s crucial to provide accurate information about your net salary, any other sources of income, and a comprehensive breakdown of your monthly expenses. This includes costs such as mortgage or rent payments, utilities, groceries, insurance, and other financial responsibilities. This information helps assess your ability to manage the new loan comfortably.

How does Absa ensure my information remains confidential?

Absa is committed to maintaining the confidentiality of your personal and financial information. All data provided on the Absa 3740 Ex form will be used exclusively for the purpose of evaluating your loan application. Absa adheres to strict privacy policies and regulations to ensure your sensitive information is protected at all times.

What happens after I submit my application?

Once your application and all supporting documents are submitted, Absa will review the information provided. They may contact you for additional clarification or documentation if necessary. If approved, you will receive further instructions regarding the loan disbursement and terms. It is important to remain reachable and respond promptly to any inquiries during this review process.

Common mistakes

Filling out the Absa 3740 Ex form, which is crucial for securing a Pension Powered Home Loan, can be straightforward if you avoid common pitfalls. Unfortunately, many applicants make mistakes that can delay processing or even lead to rejection. Understanding these mistakes can help you navigate the application process more smoothly.

One frequent error involves providing inaccurate personal details. Applicants sometimes confuse their title or misspell their names, which can lead to discrepancies in identity verification. Make sure your name matches your identity document exactly, as any mismatch could raise red flags. Additionally, forgetting to include an ID number or passport number can slow down your application significantly.

Another mistake pertains to the supporting documentation. Many people fail to include all necessary documents, such as the latest payslip or valid proof of residential address. It's crucial to ensure that these documents are recent and meet the specified requirements. For instance, using a utility bill that is older than three months will not be accepted. Missing or outdated documents can lead to unnecessary delays.

Applicants often misinterpret the requirements regarding financial details. Inaccurate representations of income or expenses can jeopardize the application. Ensure that all figures are correct and consistent with your payslip and other financial records. This includes providing clear disclosures of all existing debts and income sources, as failing to do so may suggest financial instability.

Incomplete sections of the application are another common issue. Some applicants overlook minor details like the correspondence language or the property description. Any blank spaces might result in follow-up questions or could even result in a need for re-submission of the form. Double-check that every section is filled out completely and accurately.

Another mistake is related to the affirmation of financial details. When applicants overlook acknowledging that the information provided is true and correct, it can lead to significant consequences. It is imperative to read and understand the declaration at the end of the form—it serves as a legal affirmation of your financial honesty.

There is often confusion surrounding the loan purpose declaration. Some applicants do not clearly specify how they intend to use the funds, leading to difficulties in processing the application. Clearly state whether the loan will be used for purchasing a property or for renovations, as vague descriptions could result in rejection.

Lastly, the electronic disbursement section can be mismanaged. Forgetting to indicate how many beneficiaries should receive funds or failing to provide accurate bank details for disbursement can lead to delays. It is essential to ensure that all banking information is correct and that you have attached proof of these details.

By paying careful attention to these common mistakes, applicants can enhance their chances of a successful application. Take your time, review each section, and consult the instructions as needed. A well-prepared application paves the way for a smoother approval process.

Documents used along the form

When applying for an Absa 3740 Ex form, you may need to submit additional documents to support your application. Below are five common forms and documents that often accompany this loan application.

- Proof of Income: This usually includes the latest payslip or income statement. It verifies your earnings and helps lenders assess your ability to repay the loan.

- Identity Document: A certified copy of a valid ID is required to confirm your identity. This could be a green bar-coded ID book or a passport.

- Residential Address Verification: A recent utility bill or another official document that shows your name and current address is necessary. This document must be no older than three months.

- Marriage Certificate or Legal Document: If applicable, provide a copy of your marriage certificate, antenuptial contract, or court order. This confirms your marital status and any related legal obligations.

- Proof of Ownership or Building Quote: Documentation demonstrating ownership of the property or a building quote is essential to verify that the purpose of the loan aligns with home-related expenses.

Gathering these documents along with the Absa 3740 Ex form will streamline your application process and enhance your chances of approval. Make sure everything is current and clearly legible for the best results.

Similar forms

Loan Application Form: Similar to the Absa 3740 Ex form, a standard loan application form collects personal and financial details. Both require proof of income and eligibility, ensuring that the applicant meets the necessary criteria for loan approval.

Mortgage Application Form: This document serves as a request for a mortgage loan. Like the Absa 3740 Ex, it requires detailed personal information and documentation to verify income and loan purpose.

Personal Loan Application Form: Similar in structure, this form is used to apply for unsecured loans. Both forms assess the applicant's financial standing and repayment ability.

Home Equity Loan Application: This application shares similarities with the Absa 3740 Ex in that it also requires details about existing financial obligations and the intended use of the loan funds.

Credit Card Application Form: While generally less extensive, this form gathers personal and financial information to determine eligibility. Both forms aim to assess credit risk before approval.

Student Loan Application: This document involves personal and financial assessments similar to the Absa 3740 Ex form. Applicants must demonstrate their ability to repay the loan while providing relevant supporting documents.

Auto Loan Application Form: This application requires information about the borrower's financial status and vehicle details. It is similar to the Absa 3740 Ex in that it evaluates the applicant's ability to repay a specific loan type.

Business Loan Application: This form gathers pertinent information about business finances and ownership. The overall goal of assessing risk is shared with the Absa 3740 Ex form.

Debt Consolidation Loan Application: Similar to the Absa 3740 Ex form, this application reviews multiple income sources and debts to determine the feasibility of consolidating loans.

Government Grant Application Form: While focused on grant requests, it also demands extensive personal and financial documentation, mirroring the rigorous evaluation process reflected in the Absa 3740 Ex.

Dos and Don'ts

When filling out the Absa 3740 Ex form, it's important to be thorough and precise. Here are some dos and don'ts to keep in mind:

- Do: Provide all requested supporting documentation, such as your latest payslip and a valid Identity Document.

- Do: Review your information for accuracy before submitting the form.

- Do: Ensure you have included your current residential address verification, like a recent utility bill.

- Do: Use clear and legible handwriting if filling out the form by hand.

- Do: Be honest about your financial status and any existing loans.

- Do: Make sure to sign the form where required, as this indicates your agreement with the application.

- Don't: Forget to indicate your preferred communication language, as it helps in processing your application efficiently.

- Don't: Leave any sections blank; if something does not apply to you, indicate that clearly.

- Don't: Submit the form without double-checking the documents attached to ensure they are all current.

- Don't: Use outdated or illegible documents for proof of identity or address.

- Don't: Provide false information, as this can lead to rejection of your application.

- Don't: Rush through the completion of the form, as this may result in errors that could delay your application.

Misconceptions

There are several misconceptions surrounding the Absa 3740 Ex Form, which can lead to confusion for applicants. Here are ten common myths, clarified for your understanding:

- This form is only for pensioners. Many believe that the Absa 3740 Ex Form is exclusively for pensioners. In reality, it is available to a wider audience, including employees who may have employer-guaranteed loans.

- All supporting documents are optional. Some might think that the listed supporting documents can be skipped. However, submitting all required documents is essential for processing the application efficiently.

- Only homeowners can apply. While it might seem that only those who already own property can utilize the form, it is also intended for individuals looking to purchase property or make renovations.

- Married applicants must provide a marriage certificate every time. A common misconception is that a marriage certificate is always necessary. This is true only when applicable; if not married, applicants can bypass this requirement.

- Applying guarantees loan approval. Applicants often believe that completing the form will ensure their loan is approved. Approval is contingent upon multiple factors, including financial assessment and documentation.

- There are no limits on loan amounts. Many assume they can request any loan amount. However, there are set limits that take into account income and the lending policies of Absa.

- Income disclosure is optional. Some people think they can choose whether or not to disclose their income. In fact, it is crucial for assessing eligibility and must be included in the application process.

- The form can be submitted without verification documents. Some candidates might believe it’s okay to submit the form without proper verification documents for identity and address. This is not correct; all verification documents are mandatory.

- Emailing the application guarantees a quick response. While submitting via email may seem efficient, response times can vary based on processing workloads, and applicants should be prepared for possible delays.

- All communication must be in English. It is a misconception that all communication regarding the form must be in English. Absa accommodates other languages, so applicants can indicate their preferred language for correspondence.

Understanding these points can help demystify the Absa 3740 Ex Form and assist applicants in navigating the loan application process more effectively.

Key takeaways

When filling out the Absa 3740 Ex form for Pension Powered Home Loans or employer-guaranteed loans, consider the following key points to ensure your application is processed smoothly:

- Gather Required Documentation: Before you start filling out the form, collect all necessary supporting documents such as your latest payslip, a valid identity document, and proof of residence.

- Complete All Personal Information: Ensure that your personal details, including your name, race, ID number, and date of birth, are accurately filled in. Mistakes here can delay your application.

- Email Contacts: Be mindful of the designated email addresses for your region when submitting your application. Each region has a specific email for queries and submissions.

- Understand Employment Status: Clearly indicate your employment status (full-time, temporary, or contract) as this may impact your loan eligibility and terms.

- Loan Purpose and Details: State the purpose of the loan clearly—whether it’s for purchasing property, renovations, or deposits—and make sure to specify the desired loan amount.

- Consents and Declarations: Read the consent and declaration section carefully. By signing, you confirm that all information is true and that the loan will be used for housing purposes.

- Affordability Assessment: Prepare your affordability details, including income and expenses. This information is crucial for the assessment of your loan application.

- Electronic Disbursement Information: If you choose electronic disbursement, ensure you provide complete bank details for the funds to be transferred correctly.

Being thorough with these aspects will improve the chances of your application being approved efficiently. Act promptly, as delays in documentation or incomplete information can prolong the process.

Browse Other Templates

Ssdi Form - Providing comprehensive data from SSA keeps your client information up to date.

560/50 - Students can earn SSL hours for approved volunteer activities with registered organizations.

Lancaster Tax Rate - The Local Tax Lancaster form is for Lancaster County residents to report their earned income tax.