Fill Out Your Acd 31015 Form

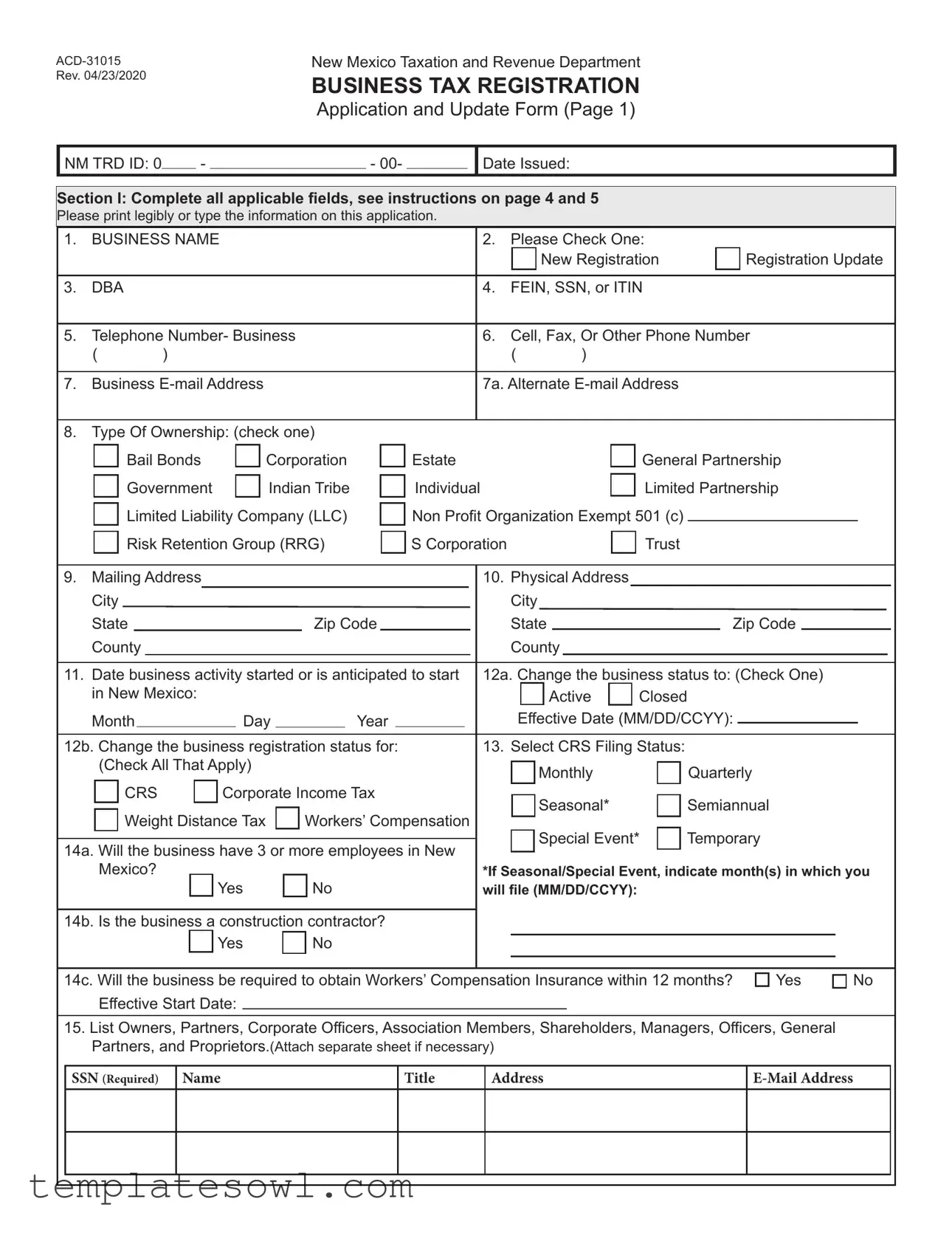

The ACD-31015 form, officially titled the Business Tax Registration Application and Update Form, is an essential document for anyone engaging in business activities within New Mexico. This form serves multiple functions, allowing businesses to either register for the first time or update their existing registration status with the New Mexico Taxation and Revenue Department. Key fields require information such as the business name, ownership type, contact details, and applicable tax statuses. Furthermore, the form delineates various tax classifications, ensuring that businesses indicate how they will report and remit taxes like gross receipts, withholding, and workers' compensation. Additionally, it prompts applicants to disclose specifics related to their sector, including if they are involved in special tax programs such as gaming, tobacco sales, or natural resource extraction. Completing the ACD-31015 accurately is not only a legal obligation but also a crucial step in maintaining compliance and fostering a smooth operational experience in New Mexico's regulatory landscape.

Acd 31015 Example

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 1)

NM TRD ID: 0 |

|

- |

|

- 00- |

Date Issued:

Section I: Complete all applicable fields, see instructions on page 4 and 5

Please print legibly or type the information on this application.

1. |

BUSINESS NAME |

2. |

Please Check One: |

|

|

|||

|

|

|

|

|

|

New Registration |

|

Registration Update |

|

|

|

|

|

|

|

||

3. |

DBA |

|

4. |

FEIN, SSN, or ITIN |

|

|

||

|

|

|

|

|||||

5. |

Telephone Number- Business |

6. |

Cell, Fax, Or Other Phone Number |

|||||

|

( |

) |

|

( |

) |

|

|

|

|

|

|

|

|

||||

7. |

Business |

7a. Alternate |

|

|

||||

|

|

|

|

|

|

|

|

|

8. Type Of Ownership: (check one)

Bail Bonds |

|

Corporation |

Government |

|

Indian Tribe |

|

Estate Individual

General Partnership Limited Partnership

Limited Liability Company (LLC)

Non Profit Organization Exempt 501 (c)

|

|

Risk Retention Group (RRG) |

|

|

S Corporation |

|

|

|

|

Trust |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Physical Address |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

State |

|

|

|

|

|

|

|

|

Zip Code |

|

|

|

|

|

State |

|

|

|

|

|

Zip Code |

|

|

|

|

|

|||||||||||||||||||||||

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Date business activity started or is anticipated to start |

12a. Change the business status to: (Check One) |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

in New Mexico: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Active |

|

|

Closed |

|

|

|

|

|

|

||||||||||||||||||||

Month |

|

|

|

Day |

|

|

|

Year |

|

|

|

|

|

Effective Date (MM/DD/CCYY): |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12b. Change the business registration status for: |

|

|

|

13. Select CRS Filing Status: |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

(Check All That Apply) |

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

Quarterly |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

CRS |

|

|

|

Corporate Income Tax |

|

|

|

|

|

|

Seasonal* |

|

|

|

Semiannual |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

Weight Distance Tax |

|

|

|

|

Workers’ Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Special Event* |

|

|

Temporary |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

14a. Will the business have 3 or more employees in New |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

*If Seasonal/Special Event, indicate month(s) in which you |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Mexico? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

will file (MM/DD/CCYY): |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14b. Is the business a construction contractor? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14c. Will the business be required to obtain Workers’ Compensation Insurance within 12 months? |

Yes |

No |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Effective Start Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

15.List Owners, Partners, Corporate Officers, Association Members, Shareholders, Managers, Officers, General

Partners, and Proprietors.(Attach separate sheet if necessary)

SSN (Required)

Name

Title

Address

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 2)

16.Method of accounting

Cash

Cash

Accrual

Accrual

17. Please check all that apply: |

Yes No |

a. Does the business have a physical presence in New Mexico? |

|

b. Is the business a marketplace provider? |

|

c. Is the business a marketplace seller? |

|

18.Give a brief description of nature of business:

19.I declare that the information reported on this form and any attached supplement(s) are true and correct:

Print Name |

Signature |

Title |

Date |

SECTION II: Complete this section if you answered question 13 as a monthly, quarterly, or

20. Liquor License Type/Number |

21. Secretary of State Business ID |

22. Contractor’s License Number |

|||||||||||

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add |

Delete |

Change |

Add |

Delete |

Change |

Add |

Delete |

Change |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special Tax Programs: |

|

|

|

|

|

|

|

|

|

Yes No |

|||

23. Will business sell Gasoline? Note: Bond may be required. |

|

|

|

|

|

|

|

||||||

If yes, is business: |

Distributor |

Indian Tribal |

|

Retailer |

Wholesaler |

24. Will business sell Special Fuels? Note: Bond may be required.

If yes, is business: |

Supplier |

Wholesaler |

Retailer

25. Will business sell Cigarettes?

Rack Operator

Rack Operator

Rack Operator

If yes, is business:

Distributor

Distributor

Wholesaler

Wholesaler

26. Will business sell Tobacco Products?

Manufacturer |

Retailer |

If yes, is business: |

Distributor |

Manufacturer |

Retailer |

Wholesaler

27.Will business be a Water Producer? If yes, Type of Water System:

28.Will business be involved in Gaming Activities?

|

If yes, is business: |

Bingo and Raffle |

Distributor |

Gaming Operator |

|

|

Manufacturer |

|

|

29. |

Will business sell Liquor? |

|

|

|

|

If yes, if business: |

Direct Shipper |

Manufacturer |

Retailer |

|

|

Wholesaler |

|

|

30. |

Will business sell Prepaid Wireless Communication, Landline, or Wireless Services? |

|||

|

If yes, |

|

|

|

Oil and Gas: |

|

|

|

|

31.Will business engage in Serving Natural Resources?

32.Will business engage in Processing Natural Resources?

33.Will business be a Natural Gas Processor?

34.Will business be an Oil and Gas Taxes Filer?

35.Will business be a Master Operator (Equipment tax)?

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 3)

36.If applicable, provide former owner’s:

NM TRD ID No.:

Business Name:

37.Are you operating any other business(es) in New Mexico?  Yes

Yes

No

No

If yes, provide: NM TRD ID No.

Business Name:

38.Primary type of business in NM (Check all that apply)

Add Delete

Accommodation, Food

Services, and Drinking

Places

Administrative and Sup- port Services

39. |

Is the business a Government Entity? |

Yes |

No |

40. |

Is the business a Government Hospital? |

Yes |

No |

41. |

Is the business a |

Yes |

No |

42. |

Is the business a Retail Food Store? |

Yes |

No |

43. |

Is the business a Health Care Practitioner who will deduct receipts under |

||

|

Section |

Yes |

No |

If yes, please briefly explain the type of health care services provided.

Effective date (MM/DD/CCYY):

Explain where the payments that will be deducted are coming from:

44. Health Care Quality Surcharge: SEE INSTRUCTIONS |

|

|

||||

|

Is this business a health care facility? |

Yes |

No |

|||

|

If yes, provide: |

|

|

|||

|

New Mexico Department of Health License Number |

|

|

|||

|

|

|

|

|

|

|

|

List the following: |

|

|

|||

|

DBA: |

|

|

|

|

|

Administrator Name:

Administrator Phone Number:

Administrator Email Address:

45.Insurance Premium Tax:

Is this business licensed through the Office of the Superintendent of

Insurance? |

|

|

|

Yes |

No |

If yes, provide: |

|

|

|

|

|

National Association of Insurance Commissions (NAIC) Number: |

|

||||

|

|

|

|

|

|

Check all that apply: |

|

|

|

|

|

Life and Health |

Property |

Casualty |

Vehicle |

||

Surplus Lines? |

|

|

|

Yes |

No |

If yes, provide National Producer Number (NPN)

Agriculture, Forestry, Fishing and Hunting

Arts, Entertainment and Recreation Management

Construction

Educational Services

Extraction of Natural Resources

Finance and Insurance

Health Care and

Social Assistance

Information

Manufacturing

Oil and Gas Extraction and Processing

Professional, Scientific

and Technical Services

Real Estate and Leasing of Real Property

Rental and Leasing

of Tangible Personal

Property

Retail Trade

Transportation and Warehousing

Utilities

Wholesale Trade

Other Services

Check all that apply: |

Agency |

Agent |

Broker |

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Instructions (Page 4)

Who is required to submit

This Business Tax Registration Application & Update Form is for the following tax programs: Cigarette, Compensating, E911 Service, Gaming Taxes, Gasoline, Gross Receipts, Special Fuels, Tobacco Products, Withholding, Workers Compensation Fee, Master of Operations, Natural Gas, Resources, Severance, Special Fuels, Tobacco Products, Telecommunications Relay Service, and Water Producer. Registration is required by New Mexico Statute, Section

Should you need assistance completing this application, please contact the Department:

Once the completed forms and attachments have been reviewed and processed a registration certificate will be

mailed to the address provided.

New Applications:

Please complete the form in full. Provide completed pag- es 1 through 3 to the: NM Taxation and Revenue Depart- ment, Attn: Compliance Registration Unit, PO Box 8485,

Albuquerque, NM 87198 . All attachments must contain the business name. Mark questions which do not apply with n/a

(not applicable).

3.If entity operates under a different name than the busi- ness name, list the name the business is “doing busi- ness as” (DBA).

4.Enter Federal ID Number (FEIN), Social Security Num- ber (SSN), or Individual Taxpayer Identification Number

(ITIN).

5.Enter the business telephone number.

6.Enter a cell phone contact number for the business.

7.Enter business

8.Check the type of ownership for the business you are registering (choose only one). If the entity type has

changed, the ID must be closed and a new registration must be completed for the new entity type. If

9.Enter the address at which the business will receive mail from the Department (registration certificate, CRS

Filer’s Kits, etc.).

10.Specify the physical location address of the business. (Not a PO Box). If you have multiple locations, please attach an additional sheet.

11.Enter the date you initially derived receipts from per- forming services, selling property in New Mexico or leasing property employed in New Mexico; or the date you anticipate deriving such receipts; or the period in which the taxable event occurs. Enter month, day and year.

12.a) Enter the date business will close if you check TEM-

PORARY or SPECIAL EVENT on filing status in box 13.

If closing a business, request a Letter of Good Standing or a Certificate of No Tax Due.

Apply for a Business Tax ID Online:

You can apply for a Combined Reporting System (CRS)

number online using the Departments website,Taxpayer Access Point (TAP) https://tap.state.nm.us. From the TAP homepage, under Businesses select Apply for a CRS ID.

Follow the steps to complete the business registration.

Updating Business Registration:

If this is an update to an existing registration, answer ques- tions 1 through 4 and then any additional fields where

changes are being made.

Line Instructions:

SECTION I

1.Enter business name of the entity. If business name is an individual’s name, enter first name, middle initial, and last name.

2.Please mark the appropriate box indicating if this is a new registration or an update to an existing registra- tion. NOTE: If updating existing registration provide the NM TRD ID and Date Issued at the top of page 1 in the space provided.

b) Specify the tax program the business status refers to in 12a.

13.Filing status: Please select the appropriate filing sta- tus for reporting, submitting and paying the business’s

combined gross receipts, compensating and withhold- ing taxes.

a) Monthly - due by the 25th of the following month

if combined taxes due average more than $200 per month, or if you wish to file monthly regardless of the

amount due.

b)Quarterly – due by the 25th of the month following the end of the quarter if combined taxes due for the quarter are less than $600 or an average of less than $200 per month in the quarter. Quarters are January - March; April - June; July - September; October - December.

c)Semiannually – due by the 25th of the month follow- ing the end of the

d)Seasonal – indicate month(s) for which you will be filing.

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Instructions (Page 5)

e)Temporary – enter close date on # 12. The month in which the business files must be a period in which the registration is active.

f)Special event – enter close date on # 12. The month in which the business files must be a period in which the registration is active.

14.a) Indicate whether or not you will have 3 or more em- ployees in New Mexico.

b)Indicate whether the business is a construction con- tractor.

c)Indicate whether or not you will be required to pay the Workers’ Compensation fee to New Mexico. Every

employer who is covered by the Workers’ Compensa- tion Act, whether by requirement or election must file and pay the assessment fee and file form

Workers’ Compensation Fee Form

information contact the Workers’ Compensation Ad- ministration at (505)

nm.gov.

15.Required: Enter the Social Security Number (SSN) or

Individual Tax Identification Number (ITIN) for individu-

als; Name and Title, Address, Phone #, and

General Partners, and Proprietors. This information is required. Attached additional pages if necessary.

16.Check the method of accounting used by the business.

a)Cash - report all cash and other consideration re- ceived but exclude any sales on account (charge sales) until payment is received.

b)Accrual - report all sales transactions, including cash sales and sales on account (charge sales) but exclude cash received on payment of accounts receivable.

17.a) Indicate if the business has physical presence in New Mexico.

b)Indicate if the business is a marketplace provider, meaning a person who facilitates the sale, lease or license of tangible personal property or services or li- cense for use of real property on a marketplace seller’s behalf, or on the marketplace provider’s own behalf by listing or advertising the sale, or collecting payment from the customer and transmitting payment to the seller.

c)Indicate if the business is a marketplace seller, mean- ing a person who sells, leases or licenses tangible per-

sonal property or services or licenses the use of real property through a marketplace provider.

18.Briefly describe the nature of the type(s) of business in which you will be engaging.

19.The application should be signed by an Owner, Partner,

Corporate Officer, Association Member, Shareholder, or Authorized Representative.

SECTION II:

Complete this section if you answered question 13 as a monthly, quarterly, or

20.If applicable, provide your Liquor License Type and Number assigned by the Alcohol and Gaming Division

21.If applicable, provide your Secretary of State Business ID Number. They may be contacted at www.sos.state. nm.us or by phone at

22.If applicable, provide your Contractor’s License Num- ber assigned by the Construction Industries Division.

considered Special Tax Programs. Many of these pro- grams are required to file monthly. Please contact the

Special Tax Programs Unit at (505)

36.If this is not a new business, enter the former owner’s New Mexico Taxation and Revenue Department CRS ID Number (NM TRD ID Number) and business name. You may want to complete a form

37.Specify whether you are operating or have operated any other businesses in New Mexico. If so, enter NM TRD ID number and business name.

38.Select the primary type(s) of business in which you will engage. You may select more than one if necessary.

43.Answer the questions regarding activities as health care practitioner, if applicable.

44.If you are unsure if you are subject to the Healthcare Quality Surcharge please contact our Special Tax Pro- grams Unit at (505)

45.Answer the questions regarding Insurance Premium Tax, if applicable.

Form submission:

You can apply for and update your Business Registration online using TAP, https://tap.state.nm.us.

You can also mail or email your application to the Depart- ment: Important: Please return completed pages 1, 2, and 3 of the

& Update form.

Mail: NM Taxation and Revenue Department

Attn: Compliance Registration Unit

PO Box 8485

Albuquerque, NM 87198

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The ACD-31015 form is used for registering a business and updating its information with the New Mexico Taxation and Revenue Department. |

| Filing Requirement | Businesses must file this form to comply with New Mexico Statute, Section 7-1-12 NMSA 1978. |

| Ownership Options | Applicants can check various ownership types, including LLCs, S Corporations, Partnerships, and Non-Profit Organizations. |

| Contact Information | The form requires the submission of the business's telephone number and email address to ensure effective communication. |

| Completion Guidelines | Instructions are provided, indicating that all applicable fields should be completed or marked as not applicable (n/a). |

| Multi-Use | The form can be used for new registrations as well as updates to existing business registrations. |

Guidelines on Utilizing Acd 31015

Filling out the ACD-31015 form is a crucial step in registering your business in New Mexico. After submitting the form, it will be reviewed, and a registration certificate will be mailed to the provided address upon successful processing. Ensure that all information is accurate to avoid delays in registration.

- Begin by writing the business name in the designated field.

- Indicate whether this is a New Registration or a Registration Update by checking the appropriate box.

- If applicable, enter the “Doing Business As” (DBA) name.

- Provide the Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN).

- Enter the business telephone number.

- Fill in the cell, fax, or other phone number.

- Provide the business email address along with an alternate email address if necessary.

- Check the type of ownership. Only one option should be selected from the list provided.

- Enter the mailing address for the business.

- Specify the physical address where the business is located (not a P.O. Box).

- Provide the date when business activity started or is expected to start.

- If the business status will change, check the appropriate box and enter the effective date.

- Select the CRS Filing Status that applies by checking all relevant boxes.

- Answer whether the business will have three or more employees in New Mexico.

- Indicate if the business is a construction contractor.

- State if Workers’ Compensation Insurance will be required within twelve months.

- List all owners, corporate officers, and related individuals, including their Social Security Numbers (SSN), titles, addresses, and e-mail addresses. Attach a separate sheet if needed.

- Specify the method of accounting—Cash or Accrual.

- Indicate whether the business has a physical presence in New Mexico, if it is a marketplace provider, or if it is a marketplace seller.

- Provide a brief description of the nature of the business.

- Sign and print your name, title, and date to declare that the information is correct.

- Complete section II if you are a monthly, quarterly, or semi-annual filer by providing additional requested information.

- Finally, ensure that all applicable fields are completed and mail or email the entire form to the NM Taxation and Revenue Department.

What You Should Know About This Form

What is the purpose of the ACD-31015 form?

The ACD-31015 form is the Business Tax Registration Application and Update Form for New Mexico. This form is used to register new businesses or update existing business registrations with the New Mexico Taxation and Revenue Department. It covers various tax programs, including Gross Receipts, Compensating Tax, and Workers’ Compensation, among others.

Who is required to submit the ACD-31015 form?

Any entity operating a business in New Mexico is required to submit the ACD-31015 form. This includes sole proprietors, corporations, partnerships, non-profit organizations, and government entities. If the business registers for specific tax programs like Cigarette or Gaming Taxes, or if there are any updates to an existing registration, this form is mandatory.

What information is needed to complete this form?

To fill out the ACD-31015 form, you will need to provide details such as your business name, type of ownership, taxation numbers (FEIN, SSN, or ITIN), business telephone numbers, email addresses, and addresses for both mailing and physical locations. Additional information about owners, partners, and the nature of the business is also required.

How do I submit the ACD-31015 form?

You can submit the ACD-31015 form online through the Taxpayer Access Point (TAP) at https://tap.state.nm.us. Alternatively, you may mail the completed form to the New Mexico Taxation and Revenue Department or email it to Business.Reg@state.nm.us.

What happens after I submit the form?

Once you submit the ACD-31015 form, the New Mexico Taxation and Revenue Department will review the information provided. Once processed, a registration certificate will be mailed to your specified business address. It’s important to ensure that all information is accurate to avoid delays.

Is there a fee associated with submitting the ACD-31015?

There are no fees specifically for submitting the ACD-31015 form itself. However, businesses may incur fees related to specific tax programs they select or if they are required to obtain certain licenses or permits. Always check with the relevant authorities for any applicable fees related to your specific business operations.

Can I update my business information using this form?

Yes, the ACD-31015 form can be used to update existing business information. If you are making changes to an already registered business, mark the appropriate box on the form to indicate that this is an update. Make sure to provide the current NM TRD ID and other relevant information when submitting the update.

How can I get help if I have questions while completing the form?

If you encounter any questions or need assistance while completing the ACD-31015 form, you can contact the New Mexico Taxation and Revenue Department at 1-866-285-2996 or email them at Business.Reg@state.nm.us. They can provide guidance and additional information to help you through the application process.

Common mistakes

Filling out the ACD-31015 form can be an important step for anyone looking to register their business in New Mexico. However, it’s easy to make mistakes along the way. Understanding these common pitfalls can save a lot of time and effort.

One common mistake is overlooking the requirement to print legibly or type the information. If your handwriting is hard to read, it may lead to misunderstandings or delays in processing. Always fill out the application in a clear, concise manner. Making sure each letter is legible can prevent back-and-forth misunderstandings.

Many applicants fail to check the right box indicating whether they are submitting a new registration or an update. This choice is crucial as it affects how the Department processes your form. Taking a moment to carefully choose the right option can prevent unnecessary delays in your application.

Another common error is not providing a complete address for both the mailing and physical locations. It’s essential that these details are accurate. If you provide a P.O. Box for your physical address, it can cause complications. Ensure that the physical address reflects where the business will operate, as this will directly impact correspondence from the state.

Some individuals neglect to include the required information about owners or partners. Form section 15 asks for their names, titles, and social security numbers. Missing or incorrect details here could lead to rejections or requests for additional documentation. Providing accurate and complete information right away makes the process smoother.

Missing the accounting method section can also be problematic. Whether your business operates on a cash or accrual basis is significant for tax purposes. Make sure to select one method and provide any necessary explanations. This detail may seem minor, but it influences how the state views your business operations.

Finally, don’t forget to sign the application. It sounds simple, but a missing signature can halt the processing of your form. Before sending off the application, double-check that you’ve signed and dated it. Each of these steps is crucial in ensuring your ACD-31015 application goes off without a hitch.

Documents used along the form

When completing the ACD 31015 form for business tax registration in New Mexico, several additional forms and documents may be necessary to ensure compliance with various tax regulations. Below are five commonly used documents that might accompany the ACD 31015 form, each playing a crucial role in the registration and operational processes for businesses.

- ACD-31096 Tax Clearance Request: This form is essential for businesses seeking a tax clearance certificate. It verifies that the business has no outstanding tax obligations in New Mexico. It is often required when transferring ownership of a business or when closing a business.

- CRS Filer’s Kit: This kit provides detailed guidance on filing combined gross receipts and compensating taxes. It is beneficial for businesses that need to understand their obligations once they are registered and start operations in New Mexico.

- Workers’ Compensation Fee Form (WC-1): If a business has employees, this form must be filed to report and assess the Workers’ Compensation fee. This is mandatory for businesses that become liable under the Workers' Compensation Act in New Mexico.

- Business License Applications: Depending on the type of business, additional licenses may be required, such as a liquor license or contractor's license. These applications ensure that a business complies with local regulations related to its industry.

- IRS Determination Letter: For non-profit organizations, providing a letter from the IRS confirming tax-exempt status is often necessary. This document verifies that the organization meets federal requirements for non-profit status.

Each of these documents plays a vital role in establishing and maintaining a business’s legal and tax compliance in New Mexico. It’s important to ensure that all required forms are submitted accurately and on time to avoid penalties and ensure smooth operations.

Similar forms

Form SS-4: The SS-4 form is used to apply for an Employer Identification Number (EIN) from the IRS. Like the ACD-31015, it requires similar basic business information such as name, address, and ownership structure.

Form 1040 Schedule C: This schedule is essential for sole proprietors reporting income or losses from their business. Both the ACD-31015 and Schedule C require details about the nature of the business and the owner’s information.

Form 8832: This form allows businesses to elect their federal tax classification. Similar to the ACD-31015, it involves identifying the business and its structure.

State Business License Application: This application is often required for most businesses to operate legally. Like the ACD-31015, it collects pertinent information regarding business ownership and structure.

Form W-9: Used to request a Taxpayer Identification Number and certification, the W-9 form shares similarities with the ACD-31015 in requesting the business’s name, address, and tax identification number.

Form 1065: This partnership tax return requires details on the partnership's income and deductions. It also parallels the ACD-31015 in needing the names and addresses of partners and the nature of business operations.

Dos and Don'ts

When filling out the ACD 31015 form, there are several key practices to keep in mind. Below is a list of what you should and shouldn't do to ensure a smooth registration process.

- Do complete all applicable fields accurately, including business name, contact information, and ownership type.

- Do print legibly or type your responses to avoid any misunderstandings or errors.

- Do mark any questions that do not apply to your business with "n/a" to clarify your answers.

- Do provide a valid email address, as this will be crucial for communication regarding your application.

- Don't leave any required fields blank; missing information can cause delays in processing your application.

- Don't submit the form without reviewing it thoroughly to ensure that all information is correct and complete.

By adhering to these guidelines, you will enhance the likelihood of a timely and successful application process.

Misconceptions

Misconceptions about the ACD 31015 form can lead to confusion. Here are nine common misunderstandings that people often have:

- 1. It's only for new businesses: Many believe that this form is only necessary for starting a new business. However, it is also used for updating existing registrations.

- 2. You can submit it with incomplete information: Some think it's acceptable to submit the form without completing all required fields. In reality, all applicable sections must be filled out to ensure the application is processed.

- 3. It can be submitted online only: A common belief is that the ACD 31015 must be filled out online. While online submission is an option, you can also mail or email the completed form.

- 4. It’s only for specific businesses: Some people think this form is relevant only for certain industries. In fact, it applies to various business types and tax programs, including those in the healthcare and retail sectors.

- 5. An EIN is not needed: Many assume that businesses don’t need to provide a Federal Employer Identification Number (EIN) when submitting this form. This is not true, as either an FEIN, SSN, or ITIN is required.

- 6. You don’t need to specify type of ownership: People may overlook specifying their type of business ownership. This information is critical as it impacts how the business operates under state regulations.

- 7. The form can be signed by anyone: There’s a misconception that any employee can sign the form. Only authorized representatives, such as owners or corporate officers, are permitted to sign.

- 8. There’s no need for changes: Business owners sometimes assume they don’t need to update their registration unless there’s a major change. It’s essential to keep your registration current with accurate information, regardless of the scale of changes.

- 9. No confirming follow-up is necessary: Lastly, some believe that once they submit the form, they don't need to follow up. In reality, it's a good practice to verify that the submission was received and processed correctly.

Understanding these misconceptions can help you navigate the process of completing the ACD 31015 form more effectively.

Key takeaways

Filling out the ACD-31015 form is an essential process for business registration in New Mexico. Here are key points to consider:

- Complete all fields: Ensure that all applicable fields are filled out completely. This includes business name, type of ownership, and contact information.

- Print legibly: Use clear handwriting or type the information to avoid misunderstandings. An accurate submission can expedite processing.

- Select the correct filing status: Indicate whether your business will report taxes monthly, quarterly, semi-annually, or if it is a special event or seasonal operation. This choice affects your tax filing obligations.

- Provide ownership details: List all owners and corporate officers with their corresponding information. This is a crucial step, as it verifies the identities involved in the business.

- Check for special tax programs: Review if your business activities fall under any special tax programs like gaming or gasoline sales. Additional regulations may apply to these activities.

- Submit required documentation: Along with the completed form, include any necessary attachments, such as letters of determination or license numbers. Incomplete submissions can delay your application.

Taking the time to carefully follow these steps can help ensure your application is processed smoothly and efficiently. For assistance, the New Mexico Taxation and Revenue Department is available for questions and guidance.

Browse Other Templates

Wisconsin Tax Simplified Form,WI 2017 Income Adjustment Form,Wisconsin Amended Tax Return,WI-Z Income Tax Return,Wisconsin Tax Reporting Form,WI Joint Filing Form,Wisconsin Easy Tax Return,WI-Z Simple Tax Submission,Wisconsin 2017 Tax Revision Form,W - The WI-Z form is utilized for filing Wisconsin income tax returns.

How to Upload a Pdf to Wix - Section 12 allows you to highlight additional skills and experiences relevant to the job.