Fill Out Your Additional Insured Form

The Additional Insured form plays a critical role in the landscape of commercial insurance, particularly within the scope of general liability coverage. This endorsement is designed to extend liability protection to other individuals or organizations—commonly referred to as additional insureds—who may face claims arising from operations performed by the primary insured. Imagine a contractor working on a construction site; the property owner may want to ensure that they are protected in case of any unfortunate incidents involving bodily injury or property damage tied to the contractor's work. The Additional Insured form outlines specific details, including the name of the additional insured and the location tied to the completed operations. Importantly, coverage granted through this endorsement is limited to conditions outlined by applicable laws and any contractual agreements in place. The form also specifies that the insurance provided cannot exceed the limits required by those agreements, ensuring that both the primary and additional insureds have clarity regarding their coverage. Overall, understanding the nuances of this form is essential for anyone involved in contracting or property leasing, as it helps safeguard against unforeseen liabilities while fostering stronger business relationships.

Additional Insured Example

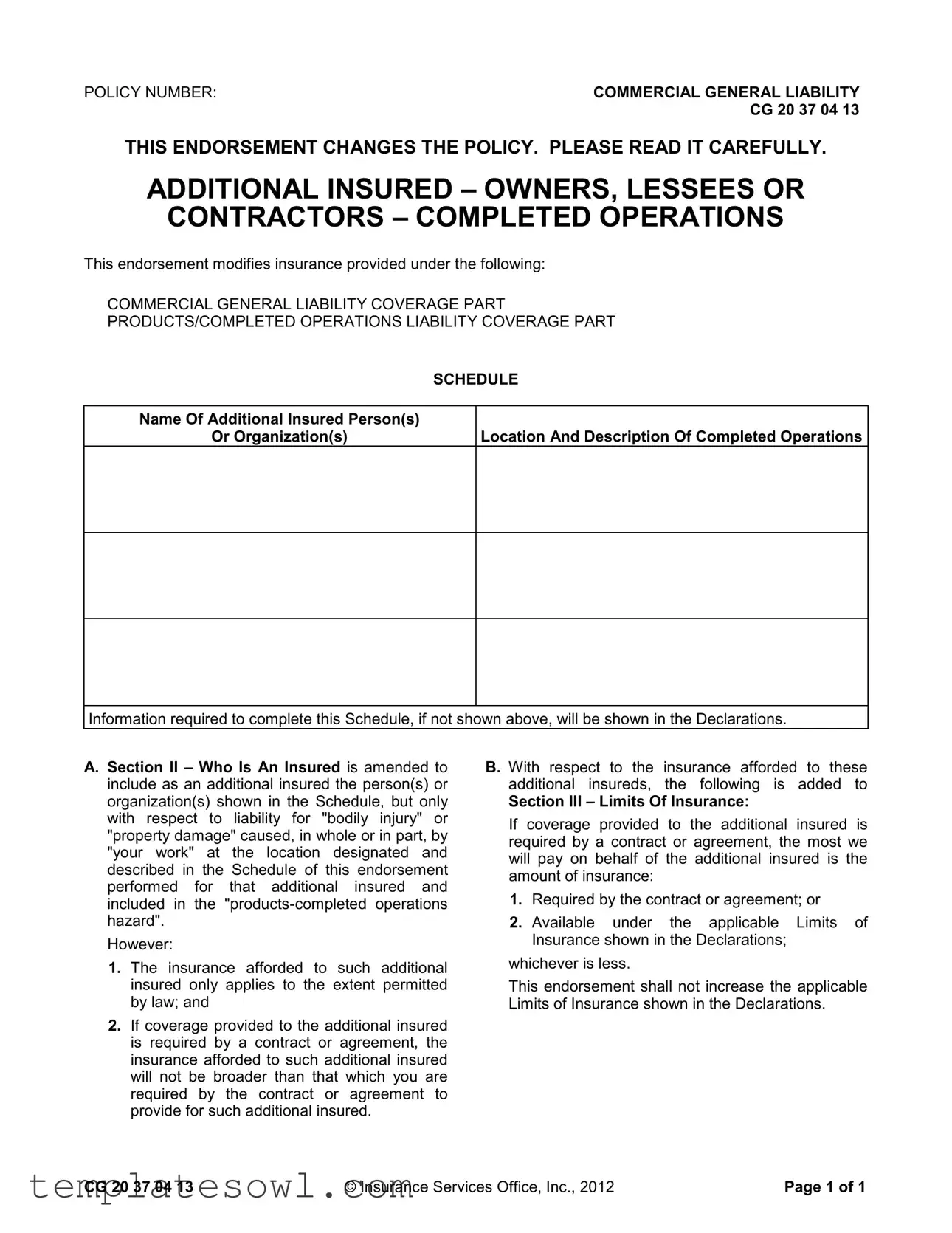

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 37 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR CONTRACTORS – COMPLETED OPERATIONS

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location And Description Of Completed Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A.Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury" or "property damage" caused, in whole or in part, by "your work" at the location designated and described in the Schedule of this endorsement performed for that additional insured and included in the

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

CG 20 37 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Endorsement | This form adds additional insured status for owners, lessees, or contractors for completed operations. It is specifically designed to provide coverage for liability related to work performed by the insured at a specified location. |

| Liability Coverage | The insurance covers bodily injury or property damage caused by the insured's work, but only to the extent allowed by law and within the scope defined by any contract obligations. |

| Limitations on Coverage | If the coverage is required by a contract, it will not exceed what is mandated by that contract or the amounts specified in the policy's Declarations, whichever is less. |

| Applicable Governing Laws | Various states may have specific laws governing additional insured endorsements. It's crucial to consult local regulations to understand how they may affect coverage and requirements. |

Guidelines on Utilizing Additional Insured

Once you have the Additional Insured form in hand, it’s important to carefully complete each section to ensure that the necessary information is accurately captured. This form is crucial for clarifying insurance coverage, especially when involving different parties in a project. Follow these steps to fill it out properly.

- Obtain the Required Information: Before starting, gather all relevant details such as the policy number and specifics about the additional insured party.

- Fill in the Policy Number: Locate the section labeled POLICY NUMBER and write in your commercial general liability policy number (e.g., CG 20 37 04 13).

- List the Additional Insured: In the space labeled "Name Of Additional Insured Person(s) Or Organization(s)," write the full name of the individual or organization you are adding as an additional insured.

- Describe the Operations: Provide the "Location And Description Of Completed Operations." Be clear about what the operations entail and where they took place.

- Review Information: Check the information you entered for accuracy. Ensure all names and descriptions match the documents you have.

- Sign the Form: If a signature is required, make sure the appropriate individual(s) signs and dates the form. This demonstrates consent and acceptance of terms.

After you have successfully completed the form, submit it to the appropriate parties as specified, ensuring that they receive the necessary documentation for their records.

What You Should Know About This Form

What is an Additional Insured form?

An Additional Insured form is a document that allows a party, such as an owner or contractor, to be covered under someone else's insurance policy. It typically applies to Commercial General Liability policies and is important in construction or service contracts where multiple parties are involved. This form adds protection for the additional insured against claims related to work performed for them.

Who benefits from an Additional Insured endorsement?

The main beneficiaries of an Additional Insured endorsement are owners, lessees, or contractors who require coverage for potential liabilities arising from the work completed on their behalf. This protects them from having to rely solely on their own insurance and can reduce financial exposure in case of accidents or damages related to the work.

What does the endorsement cover?

The endorsement covers liability for bodily injury or property damage that arises from your work performed for the additional insured. However, it's crucial to note that this coverage is limited to the specifics outlined in the endorsement and does not expand beyond what is required by law or contractual arrangements.

Does the Additional Insured form extend coverage beyond the primary policy?

No, the Additional Insured endorsement does not extend coverage beyond the limits defined in the primary policy. It clarifies that the protection offered to the additional insured is limited to what is required by a contract or what is stated in the insurance policy’s coverage limits.

Are there restrictions on the coverage?

Yes, there are restrictions. The coverage applies only to the extent allowed by law. Additionally, if the contract requires a specific level of insurance for the additional insured, the coverage cannot exceed that level. This ensures that both parties maintain an agreement that defines liability limits clearly.

How is the coverage impacted if multiple additional insureds are listed?

If multiple additional insureds are listed, each one is protected under the endorsement, but the coverage limits apply collectively. It means that the maximum amount payable for covered claims will not increase; it will remain within the limits set in the primary policy.

What information is necessary for completing the Additional Insured form?

To complete the Additional Insured form, you need specific information such as the names of the additional insured parties and a location or description of the completed operations being covered. This detail helps clarify which operations and parties are protected under the policy.

Does the Additional Insured form require renewal?

Can an Additional Insured form be modified?

What should I do if a claim arises?

If a claim occurs that involves an additional insured, it’s important to notify the insurance provider promptly. Documentation regarding the incident and any communications with the additional insured should be maintained. This will help ensure that the claim is processed correctly and that all parties understand their respective responsibilities regarding the incident.

Common mistakes

When filling out the Additional Insured form, many people make common mistakes that can lead to confusion or limited coverage. Understanding these pitfalls is crucial for proper insurance management.

One frequent error is incorrectly naming the additional insured. It's essential to provide the exact name of the individual or organization that should be included. Any discrepancies can lead to complications when a claim arises. This mistake often stems from assumptions about the name's format or order, so confirm the correct spelling and structure.

Many individuals also fail to specify the location and description of completed operations. This section needs to be clear. Without it, the additional insured may not receive coverage for the intended work. Ensure that the location is precise and that the operations described align with what the policy covers.

Another mistake occurs when individuals neglect to read the entire policy. The document contains significant details regarding the coverage limits. Ignoring this information can lead to unintentional over-promising of protection. It’s vital to understand the clauses that limit coverage based on contractual obligations.

People often overlook the law requirement provisions as outlined in the policy. Coverage for additional insureds only applies to the extent permitted by law. Misunderstanding this could result in assumptions about broader protection than is legally allowed. Always check local laws to understand the limitations of coverage.

Many do not realize that the coverage provided may not exceed what is required by contract. If there are specific contractual mandates, the coverage offered will adhere strictly to those terms. This means that if less coverage is mandated than what your general policy provides, you won’t receive extra protection beyond the contract’s specifications.

A final common mistake involves the failure to obtain necessary signatures. Some people submit the form without securing all required approvals or signatures from relevant parties. This can invalidate the form, rendering it ineffective. Make sure to gather all necessary endorsements before submitting the form.

Documents used along the form

The Additional Insured form plays a vital role in business operations, especially for contractors and service providers. To fully understand its use, several other related documents are often utilized. Below is a brief overview of common forms that complement the Additional Insured form.

- Certificate of Insurance (COI): This document provides proof of insurance coverage, including types and limits. It is commonly requested by clients to verify that contractors hold the appropriate insurance, including additional insured status.

- General Liability Insurance Policy: This policy outlines the coverage for liability claims. It specifies the protections offered against bodily injury, property damage, and personal injury claims, ensuring the insured understands the extent of their coverage.

- Indemnity Agreement: This is a contract where one party agrees to compensate another for certain damages or losses. It often works alongside the Additional Insured form to clarify liability issues among parties involved in a project.

- Hold Harmless Agreement: This document protects one party from liability for damages caused by another party's actions. It often operates in conjunction with the Additional Insured form to allocate risk and liability responsibilities.

- Subcontractor Agreement: This contract outlines the terms and conditions between the main contractor and a subcontractor. It often includes clauses about insurance requirements, including the need for additional insured status.

- Endorsement Requests: These are formal requests to add coverage or modify an existing policy. They are relevant when changes need to be made regarding additional insured status or other important coverage aspects.

Understanding these documents will enhance your grasp of the insurance landscape related to business operations. Whether you are a contractor, client, or legal advisor, being informed about these forms can help you navigate liability and coverage more effectively.

Similar forms

The Additional Insured form is often used in insurance policies to extend coverage to other parties. Here are nine documents that share similarities with the Additional Insured form:

- The Certificate of Insurance: This document provides proof of insurance coverage, listing additional insureds and coverage details.

- The Named Insured Endorsement: Like the Additional Insured form, it identifies individuals or entities covered under a policy, though it focuses on the primary insured.

- The Waiver of Subrogation: This agreement prevents insurance companies from seeking reimbursement from third parties, similar to how the Additional Insured form protects those listed from liability claims.

- The Additional Named Insured Endorsement: This is used to add more primary insured parties to a policy, much like the inclusion of additional insureds but with a broader scope of rights.

- The Broad Form Property Damage Endorsement: This expands the policy's coverage to include all types of property damage, similar to the Additional Insured form’s coverage definitions.

- The Completed Operations Coverage: This section of a policy pertains to liabilities that arise after a job is completed, paralleling how the Additional Insured form specifically addresses completed operations.

- The Premises Liability Coverage: Like the Additional Insured form, this coverage addresses liabilities that arise from a location or premises, ensuring parties at those locations are protected.

- The Indemnity Clause: This part of a contract allocates risk between parties, providing a framework for protection akin to the Additional Insured form.

- The Umbrella Policy: This offers additional layers of liability coverage and can include additional insured provisions, similar in purpose to the Additional Insured form.

Each of these documents serves to clarify and expand the protections offered under insurance policies, ensuring that various parties have clear rights and responsibilities in the face of potential liabilities.

Dos and Don'ts

When filling out the Additional Insured form, it's important to be careful and precise. Here’s a list of things you should and shouldn’t do:

- Do provide the correct policy number clearly.

- Don't leave sections blank; fill in all required fields.

- Do specify the name of the additional insured accurately.

- Don't forget to describe the completed operations thoroughly.

- Do ensure the information matches what is in the contract.

- Don't assume any coverage; read the limits and conditions carefully.

- Do keep a copy of the completed form for your records.

- Don't rush; take your time to avoid mistakes that could lead to issues later.

Misconceptions

The Additional Insured form is often misunderstood. Here are ten common misconceptions about this form:

- All parties automatically get full coverage. Many believe that adding someone as an additional insured guarantees them complete coverage. However, coverage is limited to specific liabilities and is contingent on the terms set out in the endorsement and any applicable contracts.

- Additional insured status means equal coverage. It is a misconception that additional insureds receive the same coverage as the primary insured. In reality, the coverage for additional insureds is more restricted and typically only covers specific types of incidents.

- Construction projects don’t need the form. Some assume that additional insured forms are unnecessary for construction projects. In fact, they are crucial in protecting all parties involved from potential claims arising from completed work.

- Coverage is unlimited. Many mistakenly think that the coverage limit for additional insureds is limitless. The coverage is subject to the overall limits of the policy, requiring careful review of the policy details.

- This form replaces the main policy. There is a common belief that the Additional Insured form acts as a standalone policy. It merely modifies the existing policy, providing additional protections under specific conditions.

- It applies to all claims. Some individuals think that this endorsement covers all types of claims. In fact, it usually only covers liabilities related to specific operations as outlined in the endorsement.

- All contracts require the same coverage. A misconception exists that the coverage required for additional insureds is uniform across all contracts. The coverage specifics can vary widely based on the negotiated terms.

- It provides coverage for past operations. Many believe that additional insured status applies to past work. However, it typically only covers future liability arising from ongoing operations, as specified in the contract.

- This endorsement is automatically included. Some people assume that every insurance policy automatically includes this endorsement. It's essential to verify its existence and specifics to ensure adequate coverage.

- Once obtained, it’s permanent. There is a misconception that once the Additional Insured status has been granted, it remains in effect indefinitely. The coverage is subject to renewal terms and can be revoked or changed.

Understanding these misconceptions can help individuals and organizations appreciate the intricacies of liability coverage and ensure appropriate protections are in place.

Key takeaways

Filling out and utilizing the Additional Insured form correctly is crucial for ensuring the right protection. Here are nine key takeaways to keep in mind:

- Identify the additional insured: Clearly state the name of the person or organization that will be added as an additional insured.

- Specify the location: Include a detailed description of the location where the completed operations occurred.

- Understand the limitations: Coverage only applies for liability connected to "bodily injury" or "property damage" related to your work.

- Legal compliance: The insurance for additional insureds applies only to the extent allowed by law.

- Contractual obligations: If a contract or agreement specifies coverage limits, those limits govern the additional insured's coverage.

- Policy limits: Insurance for the additional insured will not exceed the maximum limits set in the policy declarations.

- Completed operations hazard: Ensure that the completed operations are included to extend coverage effectively.

- Review endorsements: Regularly check the endorsement’s language to confirm it aligns with current agreements.

- Documentation: Keep a record of communication and agreements involving additional insureds for future reference.

Understanding these points will aid in effectively managing insurance risks and ensuring appropriate coverage.

Browse Other Templates

Handicap Placard Sc - It also necessitates a signature certifying the truthfulness of the provided information.

Llc in Tennessee Cost - All information submitted on the SS-4231 form is considered public record in Tennessee.

Pompano Beach Fire Rescue - List the number of stories in the building to help assess evacuation routes.