Fill Out Your Amc 1003 Form

The AMC 1003 form is a critical document for Appraisal Management Companies (AMCs) operating in Illinois, encapsulating important obligations and financial safeguards. This form establishes a surety bond, which serves as a financial guarantee to the Illinois Department of Financial and Professional Regulation, ensuring that AMCs fulfill their responsibilities under state law. When a business applies for registration as an AMC, it must present this form to demonstrate its commitment to comply with the Illinois Appraisal Management Company Registration Act. The bond amount is set at $25,000, which can be called upon to cover any fines, fees, or expenses imposed by the Obligee due to non-compliance with the Act. It’s essential for the principal and surety to understand that this bond is not just a one-time obligation but a continuous requirement for maintaining registration. The specifics of the bond, including its expiration and renewal procedures, provide a clear framework for accountability and adherence to legal standards. This form must be completed with careful attention to detail and timely notifications regarding its status are paramount for fulfilling legal and professional commitments.

Amc 1003 Example

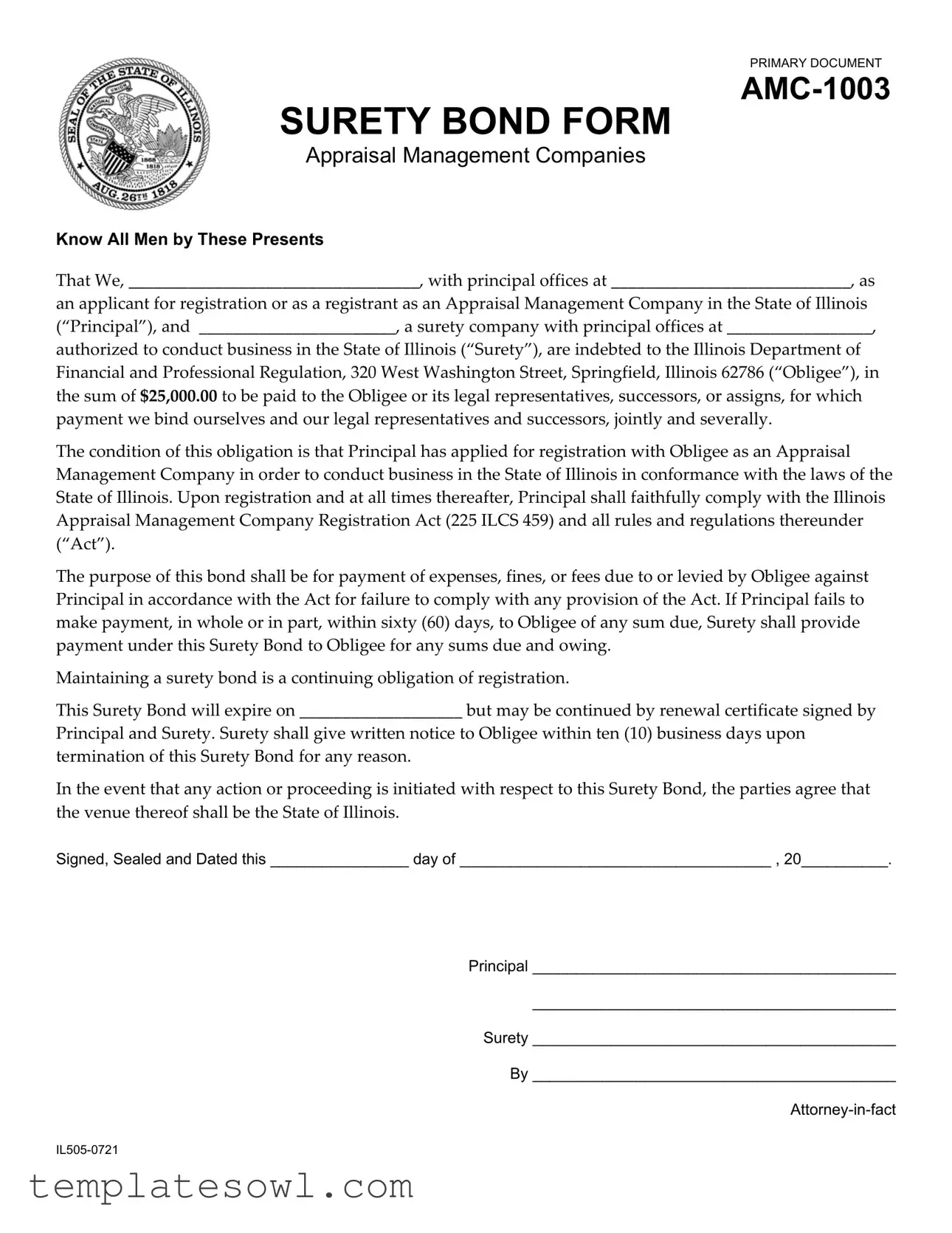

PRIMARY DOCUMENT

SURETY BOND FORM

Appraisal Management Companies

Know All Men by These Presents

That We, __________________________________, with principal offices at ____________________________, as

an applicant for registration or as a registrant as an Appraisal Management Company in the State of Illinois (“Principal”), and _______________________, a surety company with principal offices at _________________,

authorized to conduct business in the State of Illinois (“Surety”), are indebted to the Illinois Department of Financial and Professional Regulation, 320 West Washington Street, Springfield, Illinois 62786 (“Obligee”), in the sum of $25,000.00 to be paid to the Obligee or its legal representatives, successors, or assigns, for which payment we bind ourselves and our legal representatives and successors, jointly and severally.

The condition of this obligation is that Principal has applied for registration with Obligee as an Appraisal Management Company in order to conduct business in the State of Illinois in conformance with the laws of the State of Illinois. Upon registration and at all times thereafter, Principal shall faithfully comply with the Illinois Appraisal Management Company Registration Act (225 ILCS 459) and all rules and regulations thereunder (“Act”).

The purpose of this bond shall be for payment of expenses, fines, or fees due to or levied by Obligee against Principal in accordance with the Act for failure to comply with any provision of the Act. If Principal fails to make payment, in whole or in part, within sixty (60) days, to Obligee of any sum due, Surety shall provide payment under this Surety Bond to Obligee for any sums due and owing.

Maintaining a surety bond is a continuing obligation of registration.

This Surety Bond will expire on ___________________ but may be continued by renewal certificate signed by

Principal and Surety. Surety shall give written notice to Obligee within ten (10) business days upon termination of this Surety Bond for any reason.

In the event that any action or proceeding is initiated with respect to this Surety Bond, the parties agree that the venue thereof shall be the State of Illinois.

Signed, Sealed and Dated this ________________ day of ____________________________________ , 20__________.

Principal __________________________________________

__________________________________________

Surety __________________________________________

By __________________________________________

Form Characteristics

| Fact Name | Detail |

|---|---|

| Document Type | AMC-1003 is a Surety Bond Form specifically for Appraisal Management Companies. |

| Principal | The principal refers to the Appraisal Management Company applying for registration in Illinois. |

| Surety Company | The surety company guarantees the bond and must be authorized to operate in Illinois. |

| Obligee | The obligee is the Illinois Department of Financial and Professional Regulation. |

| Bond Amount | The bond amount is set at $25,000.00, which must be paid to the obligee. |

| Governing Law | This form is governed by the Illinois Appraisal Management Company Registration Act (225 ILCS 459). |

| Payment Condition | Payment via the bond is required for expenses, fines, or fees owed to the obligee due to non-compliance. |

| Renewal | The bond will expire on a specified date but can be renewed through a signed certificate. |

| Notice Requirement | The surety must notify the obligee in writing within ten business days of bond termination. |

| Venue for Disputes | Any legal actions related to this form must take place in the State of Illinois. |

Guidelines on Utilizing Amc 1003

After gathering information about your company and surety arrangements, you are ready to proceed with filling out the AMC 1003 form. This form is essential for registering an Appraisal Management Company in Illinois, ensuring compliance with the necessary legal standards.

- At the top of the form, enter the name of your Appraisal Management Company in the blank space provided for "Principal."

- Next, indicate the principal office address of your company in the designated area following the name.

- In the space labeled for "Surety," write the name of the surety company that is providing the bond.

- Proceed to supply the address of the surety company in the following line after its name.

- Specify the amount of the bond, which is $25,000.00, clearly stating this in the appropriate space.

- Move on to complete the Obligee section by writing the address of the Illinois Department of Financial and Professional Regulation.

- Fill in the date on which you are signing the form in the provided space.

- Next, review and ensure that the "Principal" section is correctly signed by an authorized representative of your company.

- In the "Surety" section, have an authorized representative of the surety company sign the form.

- Finally, make sure an attorney-in-fact from the surety company completes the signature line for verification.

What You Should Know About This Form

What is the AMC 1003 form?

The AMC 1003 form is a surety bond specifically designed for Appraisal Management Companies (AMCs) in Illinois. It serves as a financial guarantee that the company will comply with the Illinois Appraisal Management Company Registration Act and will fulfill its financial obligations to the state.

Who needs to fill out the AMC 1003 form?

Anyone applying for registration as an Appraisal Management Company in Illinois must complete the AMC 1003 form. This applies to new applicants as well as existing registrants who need to renew their surety bond.

How much is the bond amount on the AMC 1003 form?

The bond amount required on the AMC 1003 form is $25,000. This amount guarantees that the Appraisal Management Company will adhere to the state's regulations and pay any fees, fines, or costs if necessary.

What happens if the Appraisal Management Company does not comply with the regulations?

If the Appraisal Management Company fails to comply with the regulations as stated in the Illinois Appraisal Management Company Registration Act, the surety company may be required to pay any owed amounts up to $25,000. This ensures financial protection for the state against non-compliance.

How long is the AMC 1003 form valid?

The AMC 1003 form does not have a specific expiration date originally, but it will expire on the date provided in the form. However, it can be renewed through a renewal certificate signed by both the Principal and the Surety.

What must be done if the surety bond is terminated?

If the surety bond is terminated for any reason, the surety company must notify the Illinois Department of Financial and Professional Regulation in writing within ten business days. This ensures all parties are aware of the bond's status.

What is the role of the surety company in this bond?

The surety company acts as a guarantor for the Appraisal Management Company. In the event that the company does not fulfill its financial obligations, the surety will cover the amount owed, up to the bond limit.

Where should any legal disputes regarding the AMC 1003 bond be handled?

Any disputes or legal actions related to the AMC 1003 bond must be filed in the state of Illinois. This stipulation is included to ensure that all involved parties are aware of the proper venue for legal proceedings.

Common mistakes

Filling out the AMC 1003 form can be straightforward, but several common mistakes may lead to complications. One frequent error is leaving blank spaces in the form. Every section should be completed fully. If a particular section does not apply, make sure to indicate so, rather than omitting it entirely. This ensures that reviewers understand the information provided.

Another mistake involves inaccuracies in the Principal's name and address. Providing the legal business name along with the correct physical address is crucial. Discrepancies can delay processing and may result in the application being rejected or returned for correction.

People often misread the financial obligations stated in the form. It is important to accurately understand the $25,000 bond requirement and the obligations tied to it. Misrepresenting these amounts or failing to acknowledge them can lead to significant issues with compliance and registration.

Many applicants overlook the expiration date of the Surety Bond. Failing to renew or to provide a signed renewal certificate can automatically void the bond. Attention to this detail ensures the registration remains valid and maintains compliance with the Illinois Appraisal Management Company Registration Act.

Some filers neglect to obtain the necessary signatures. All relevant parties, including the Surety and any designated Attorney-in-fact, must sign the form. Incomplete signatures can render the application invalid, causing potential delays.

Another common pitfall is providing insufficient notice duration to the Obligee in case of termination of the Surety Bond. The form clearly states that Surety should notify Obligee within ten business days. Lack of compliance with this requirement could lead to misunderstandings regarding the bond’s status.

Finally, individuals sometimes fail to understand the jurisdiction stated. The venue for any legal actions related to the Surety Bond is the State of Illinois. Being unaware of this requirement may leave some applicants unprepared for future disputes or claims against the bond.

Documents used along the form

The AMC 1003 form, or Surety Bond Form, is an important document for Appraisal Management Companies (AMCs) operating in Illinois. In addition to this form, there are several other documents that might be used during the registration and compliance process. Understanding these forms can help ensure a smooth application process and ongoing adherence to regulations.

- Application for Registration: This is the initial form completed to register an appraisal management company with the Illinois Department of Financial and Professional Regulation. It gathers essential information about the business, its owners, and its operations.

- Appraisal Management Company Registration Act (225 ILCS 459): This legislation outlines the requirements and rules governing AMCs in Illinois. Familiarity with this act is crucial for compliance and operation.

- Insurance Policy Proof: AMCs may need to provide documentation that demonstrates they have sufficient liability insurance coverage as part of their registration process.

- Operating Agreement: This internal document outlines how the company will be managed and operated. It usually details the roles of members and management practices.

- Financial Statements: Submission of current financial statements may be required to assess the company’s stability and ability to meet regulatory obligations.

- List of Directors and Officers: This document provides names and backgrounds of individuals in key positions within the AMC, ensuring transparency in leadership.

- Surety Bond Continuation Certificate: If the AMC wishes to renew its surety bond, a continuation certificate is used to keep the bond in effect without interruption.

- Background Check Authorization: AMCs often need to submit this form to allow for background checks on key personnel as part of the registration and compliance verification process.

Each of these documents plays a significant role in the registration and compliance processes for Appraisal Management Companies. Being well-prepared with the necessary forms can facilitate a more efficient application and ongoing adherence to regulatory requirements.

Similar forms

-

Form 1003 (Uniform Residential Loan Application): This form is used to evaluate a borrower's eligibility for a mortgage. Like the AMC 1003, it requires detailed information about parties involved, financial obligations, and compliance with state regulations.

-

Surety Bond Form (Standardized Version): Similar to the AMC 1003 form, a surety bond form ensures that obligations will be met. Both documents outline the responsibilities of the principal and surety and establish monetary penalties for non-compliance.

-

Commercial Lease Agreement: This document outlines the terms of renting commercial property. It shares common elements with the AMC 1003 in that both set forth obligations and rights, and require adherence to state laws.

-

Business Registration Application: Like the AMC 1003, this application is crucial for obtaining necessary permissions from the state. It gathers similar information about the business operators and their intent to comply with regulatory requirements.

-

Licensing Application for Professionals: This form addresses the qualifications of professionals seeking to operate legally within a state. It mirrors the AMC 1003 in its emphasis on compliance and accountability.

-

Financial Disclosure Statement: This document requires individuals or companies to provide a comprehensive view of their financial status. Like the AMC 1003, it integrates aspects of financial responsibility and transparency, holding the applicant accountable.

-

Tax Identification Form (W-9): This form is used by entities to report their taxpayer identification number to the IRS. It has similarities with the AMC 1003 since both require clear identification and compliance with financial obligations.

-

Indemnity Agreement: This document binds one party to compensate another for losses incurred. Similar to the AMC 1003, it emphasizes accountability and compliance with legal standards.

Dos and Don'ts

When filling out the AMC 1003 form, it is essential to approach the task with care and attention to detail. Below is a list of five important actions to take and avoid during this process.

- Do ensure all information is accurate. Carefully verify all names, addresses, and other details provided on the form.

- Do read the instructions thoroughly. Make sure you fully understand the requirements and conditions of the form.

- Do keep a copy for your records. Always make and retain a copy of the completed form for future reference.

- Do seek assistance if needed. If you encounter any questions or uncertainties, consider seeking help from a knowledgeable professional.

- Do submit the form on time. Ensure that you meet the deadline for submitting the AMC 1003 form to avoid potential issues.

- Don’t leave any fields blank. Every section of the form requires attention—omitting information can lead to processing delays.

- Don’t rely solely on memory. Gather all necessary documents and details beforehand to avoid mistakes.

- Don’t rush through the form. Take your time to carefully complete each section, ensuring clarity and accuracy.

- Don’t ignore the importance of the signature. Make sure that the designated individuals sign the form where required; unsigned forms will not be processed.

- Don’t hesitate to ask questions. If something about the form is unclear, not asking for clarification could result in an incorrect submission.

Following these dos and don’ts can help facilitate a smoother experience while completing the AMC 1003 form, ultimately ensuring compliance and reducing the risk of complications.

Misconceptions

There are several misconceptions concerning the AMC 1003 form. Understanding these can help applicants and registrants navigate the registration process smoothly.

- This form is only for newly established Appraisal Management Companies. This is incorrect. The AMC 1003 form is required for any company applying for registration or renewing their registration, regardless of how long they have been operating.

- The surety bond amount is negotiable. This misconception is false. The bond amount is set at $25,000 as per regulations, and this figure is consistent across all applicants.

- The bond automatically covers all potential fines and expenses. Not quite. The bond serves to cover fines or fees due to non-compliance with the Illinois Appraisal Management Company Registration Act, but only if the principal fails to meet his or her financial obligations.

- Once the surety bond is obtained, compliance is not necessary. This is misleading. Obtaining the bond does not exempt the registrant from adhering to the laws and regulations. Continuous compliance is a requirement.

- All surety bonds are the same. This is a misconception. Surety bonds can vary by state and by type of obligation. Each bond is specific to the regulations governing the particular industry.

- The bond does not need to be renewed regularly. This is not accurate. The AMC 1003 bond must be renewed and the Surety must provide written notice of termination to the Obligee, ensuring ongoing coverage.

Clear understanding of these points can help in achieving compliance and ensuring smooth operation within the requirements set forth by the state.

Key takeaways

The AMC 1003 form is essential for Appraisal Management Companies (AMCs) operating in Illinois. Here are nine key takeaways regarding the form:

- The form serves as a surety bond, indicating a financial obligation of $25,000 to the Illinois Department of Financial and Professional Regulation.

- Both the applicant (Principal) and the surety company must fill in specific information, including their names and addresses.

- The bond guarantees that the Principal will comply with the Illinois Appraisal Management Company Registration Act.

- If the Principal fails to meet obligations, the Surety is responsible for making payments to the Obligee.

- The Surety Bond must be maintained continuously throughout the registration period.

- The bond has an expiration date and can be renewed through a signed certificate by both the Principal and the Surety.

- Written notice from the Surety to the Obligee is required within ten business days if the bond is terminated.

- Any legal actions related to the bond must take place in the State of Illinois.

- Completing and filing the AMC 1003 form accurately is vital for compliance and avoiding fines or penalties.

Browse Other Templates

Pearl Carroll Insurance - Use the provided address for mailing your claim form.

First Report of Injury Form - Employers are reminded to retain copies of the submitted forms for their records.

How to Obtain College Transcripts - Ensure all information is accurate to avoid processing delays.