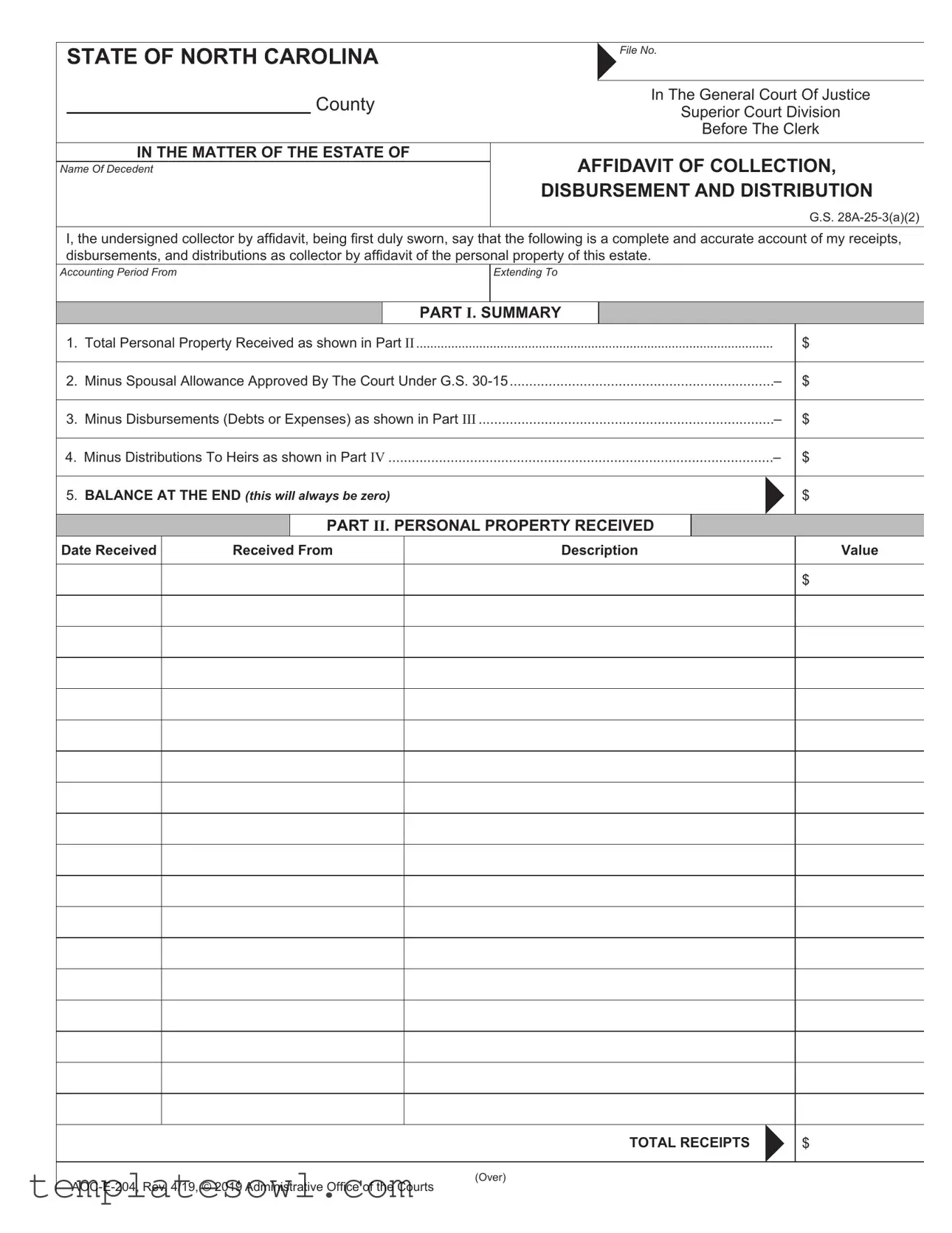

Fill Out Your Aoc E 204 Form

The AOC E 204 form serves as an essential document in the management of an estate in North Carolina. This affidavit is used by individuals designated as collectors of the estate to provide a comprehensive account of all personal property, expenses, and distributions associated with the estate of a deceased person. The form includes multiple sections, starting with a summary that outlines total personal property received, minus various allowances and disbursements, ultimately leading to a balance that must equal zero. Detailed records of assets and financial transactions are crucial, as outlined in the form's sections: Personal Property Received, Disbursements for debts or expenses, and Balances Distributed to heirs. Each part requires accurate reporting of amounts, dates, and involved parties to ensure transparency and compliance with legal standards. The completion of the AOC E 204 not only fulfills legal requirements but also aids in protecting the interests of the heirs and maintaining the integrity of the estate's administration. When filed correctly, it reflects the diligent handling of the estate's resources during a challenging time for the beneficiaries.

Aoc E 204 Example

STATE OF NORTH CAROLINA

County

File No.

In The General Court Of Justice

Superior Court Division

Before The Clerk

IN THE MATTER OF THE ESTATE OF

Name Of Decedent

AFFIDAVIT OF COLLECTION,

DISBURSEMENT AND DISTRIBUTION

G.S.

I, the undersigned collector by affidavit, being first duly sworn, say that the following is a complete and accurate account of my receipts, disbursements, and distributions as collector by affidavit of the personal property of this estate.

Accounting Period From

Extending To

PART I. SUMMARY

1. |

.......................................................................................................Total Personal Property Received as shown in Part II |

|

$ |

||||

|

|

|

|

|

|

|

|

2. |

Minus Spousal Allowance Approved By The Court Under G.S. |

– |

$ |

||||

|

|

|

|

|

|

|

|

3. |

Minus Disbursements (Debts or Expenses) as shown in Part III |

– |

$ |

||||

|

|

|

|

|

|

||

4. Minus Distributions To Heirs as shown in Part IV |

– |

$ |

|||||

|

|

|

|

|

|

|

|

5. |

BALANCE AT THE END (this will always be zero) |

|

|

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

PART II. PERSONAL PROPERTY RECEIVED |

|

|

||

Date Received |

Received From |

|

Description |

|

Value |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RECEIPTS

$

(Over)

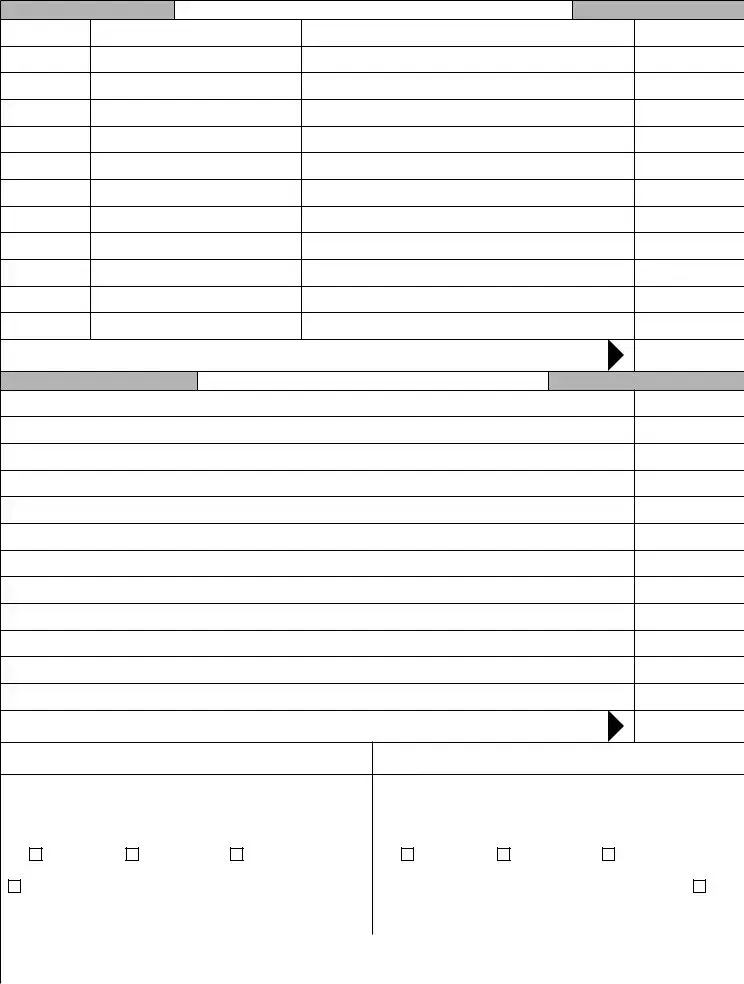

PART III. DISBURSEMENTS (DEBTS OR EXPENSES)

Date Paid |

To |

For |

Amount |

$

TOTAL DISBURSEMENTS

$

PART IV. BALANCE DISTRIBUTED TO HEIRS

Heirs

Amount

$

TOTAL BALANCE

$

Signature Of Affiant 1 |

Signature Of Affiant 2 |

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

||||||

|

|

|

|

|

|

||

Date |

|

Signature Of Person Authorized To Administer Oaths |

Date |

Signature Of Person Authorized To Administer Oaths |

|||

|

|

|

|

|

|

|

|

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

||

|

|

|

|

|

|

|

|

Notary |

Date Commission Expires |

|

Date Commission Expires |

|

|

Notary |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

SEAL |

County Where Notarized |

|

County Where Notarized |

|

|

SEAL |

|

|

|

|

|

|

|

|

|

© 2019 Administrative Office of the Courts

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The AOC E 204 form is used in North Carolina to report the collection, disbursement, and distribution of personal property in the estate of a decedent. |

| Governing Law | This form is governed by North Carolina General Statutes, specifically G.S. 28A-25-3(a)(2) for the affidavit of collection. |

| Usage Timing | The form is typically completed after the collection of the decedent’s personal property but before final distributions to heirs. |

| Summary Section | Part I provides a summary of total personal property received, minus spousal allowances, disbursements, and distributions to heirs, noting that the final balance should always be zero. |

| Personal Property Details | Part II details the items and values of personal property received during the accounting period, facilitating transparency and accuracy. |

| Disbursement Accounting | In Part III, collectors must list all debts or expenses paid from the estate, ensuring all significant financial activities are documented. |

| Distribution to Heirs | Part IV outlines how the balance of the estate is distributed to heirs, providing clarity on the final allocation of assets. |

| Signature Requirement | The form must be signed by the affiant, and it requires witnessing by a notary or an authorized person to validate the affidavit. |

| Expiration of Notary | The notary's commission expiration date must be included on the form, ensuring that all signatures were made under valid authority. |

Guidelines on Utilizing Aoc E 204

Filling out the AOC E 204 form involves providing a detailed account of the receipts, disbursements, and distributions related to an estate's personal property. Below are the steps you need to follow to complete this form accurately.

- Identify the Relevant Information: Write the name of the decedent and the county where the estate is being settled at the top of the form.

- Fill in the File Number: Include the file number assigned to the estate.

- Complete the Accounting Period: Indicate the start and end dates for the accounting period provided.

- Part I: Summary:

- Record the total personal property received in Part II.

- Subtract the spousal allowance approved by the court from the total.

- List any disbursements (debts or expenses) in Part III and subtract this amount.

- Subtract the distributions to heirs from Part IV.

- Enter zero as the balance at the end, as it reflects accurate accounting.

- Part II: Personal Property Received:

- For each receipt, include the date received, from whom the property was received, a description of the property, and its value.

- Calculate the total receipts and include it in the appropriate section.

- Part III: Disbursements:

- List the date each payment was made, the name of the payee, a brief description of what the payment was for, and the amount paid.

- Sum the total disbursements and enter this amount in the designated area.

- Part IV: Balance Distributed to Heirs:

- Identify each heir and the amount they are receiving.

- Total the balance that has been distributed and record it.

- Signatures: Each affiant must sign in the spaces provided, affirming the information is correct.

- Notary Section: Have the document sworn/affirmed and signed by an authorized person, including the date and the expiration date of their commission.

What You Should Know About This Form

What is the purpose of the AOC E 204 form?

The AOC E 204 form is a legal document used in North Carolina to provide a detailed account of the personal property collected from the estate of a decedent. It serves as an affidavit for collectors, ensuring that all receipts, disbursements, and distributions are documented accurately. This form helps validate the management of the estate's assets and ensures compliance with state laws governing estate property handling.

Who needs to fill out the AOC E 204 form?

The form must be completed by the individual designated as the collector by affidavit, who is typically a personal representative or an heir responsible for managing the estate's personal property. This individual should have a comprehensive understanding of the estate's assets, liabilities, and any distributions made to heirs.

What information is required on the AOC E 204 form?

The form requires detailed information organized into several parts. Part I provides a summary that includes total personal property received, approved spousal allowances, disbursements, and distributions. Part II lists the personal property received, detailing the date, source, description, and value. Part III outlines any disbursements for debts or expenses. Finally, Part IV summarizes the balance distributed to heirs. Accurate record-keeping is crucial, as this documentation supports the administration of the estate's assets.

Is there a deadline for submitting the AOC E 204 form?

Common mistakes

Filling out the AOC E 204 form correctly is essential for ensuring smooth processing in the collection, disbursement, and distribution of the estate. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide complete information. Each section of the form requires specific details, and missing data can cause the form to be returned or denied.

Another common mistake is incorrectly calculating totals. The balance at the end of the form should always equal zero, and errors in summation can indicate inaccuracies elsewhere. It is vital to carefully check all calculations in Part I, Part II, Part III, and Part IV.

People often overlook the signatures required on the document. Both affiants must sign and date the form, and if there are multiple affiants, their signatures must also appear in the designated sections. Omitting a signature can lead to processing delays.

Not providing proper documentation for all received personal property is another mistake. Each entry in Part II must include a description and value. Skipping a detailed account can raise questions about the assets of the estate and may delay approval.

Additionally, some persons do not account for spousal allowances correctly, which are subtracted in Part I. Understanding which allowances apply under G.S. 30-15 requires thorough knowledge and can be easily miscalculated.

Individuals often make the mistake of using outdated versions of the form. It is crucial to ensure that the most current version, such as Rev. 4/19, is being utilized to avoid any discrepancies that may arise from outdated regulations.

Another issue arises when people neglect the notarization requirement. The signatures must be sworn or affirmed before a legally authorized individual. Failure to have the document properly notarized can invalidate the submission altogether.

One last common mistake involves inaccurate or incomplete records of disbursements and distributions. Every entry made in Part III and Part IV must be backed by accurate records to support the claims being made. Insufficient records can lead to questions or challenges to the account provided.

Addressing these mistakes proactively can ensure that the AOC E 204 form is completed accurately, facilitating a more efficient process in the management of the estate.

Documents used along the form

The AOC E 204 form is a crucial document for handling the collection, disbursement, and distribution of an estate's personal property in North Carolina. Alongside this form, there are several other documents often utilized to ensure a smooth processing of estate matters. Below is a list of some commonly associated forms and documents that may be required in conjunction with the AOC E 204.

- Affidavit of Heirship: This document provides proof of the rightful heirs to the decedent's estate, helping to establish who is entitled to inherit property when there is no will.

- Letters Testamentary: Issued by the court, this document confirms the appointment of an executor who will manage the estate according to the will and oversee the distribution of assets.

- Inventory of Estate Assets: An inventory lists all the assets that belong to the estate. This list is important for transparency and ensures that all property is accounted for during the administration process.

- Final Account of Estate: This document summarizes all financial transactions that have occurred during the administration of the estate. It provides a final accounting to the court regarding how assets were managed and distributed.

- Will: If a decedent left behind a will, it serves as a guiding document that outlines their wishes regarding asset distribution, making it essential in the probate process.

- Notice to Creditors: This is a formal notice published to inform creditors of the probate process. It allows them to make claims against the estate for debts that were owed by the decedent.

- Petition for Letters of Administration: In cases where there is no will, this petition is filed to request the appointment of an administrator to handle the estate, similar to an executor for a testate estate.

- Order for Summary Administration: In situations where the estate is small or uncomplicated, this order allows for a quicker settlement of the estate, bypassing some of the more formal probate procedures.

These documents work together to provide the necessary structure and clarity to the estate administration process. Understanding their roles can make navigating estate management more manageable and efficient.

Similar forms

The AOC E 204 form is specifically designed for the collection, disbursement, and distribution of an estate's personal property in North Carolina. Here are four other documents that share similarities with it:

- Affidavit of Heirship: This document establishes the heirs of a deceased person, confirming their identities and relationships. Like the AOC E 204, it serves as a sworn statement to facilitate the distribution of an estate’s assets.

- Executor’s Final Accounting: An executor submits this document to report all financial transactions related to the estate. Similar to the AOC E 204, it provides a detailed record of receipts and disbursements, ensuring transparency in estate management.

- Inventory of Assets: An inventory lists all valuables and properties within an estate. This form complements the AOC E 204 by cataloging assets before they are disbursed to heirs, helping to clarify what is available for distribution.

- Petition for Settlement: This legal request asks the court to approve the handling of an estate's affairs. It often includes details about assets, debts, and distributions, much like the AOC E 204 outlines personal property transactions for approval.

Dos and Don'ts

When filling out the AOC E 204 form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do double-check all personal information for accuracy.

- Do provide a clear and detailed account of all receipts and disbursements.

- Do sign the affidavit where required, ensuring the signature is legible.

- Do keep copies of the completed form and any supporting documents for your records.

- Do seek assistance if unsure about any part of the form.

- Don't leave any sections blank; fill out all applicable fields.

- Don't submit the form without confirming that the total balance is zero.

- Don't use incorrect terminology or abbreviations that may lead to confusion.

- Don't forget to include dates and signatures of the authorized persons.

- Don't ignore the notarization requirement, as it is essential for validation.

Misconceptions

- Misconception 1: The AOC E 204 form is only for large estates.

- Misconception 2: This form is optional for collectors of an estate.

- Misconception 3: You can fill out the form without any formal training.

- Misconception 4: All debts and distributions must be itemized in detail.

Many people believe that this form is only necessary for significant estates. In reality, the AOC E 204 is applicable to any estate with personal property, regardless of its size. If you are the collector of the estate, you may need to file this form to properly account for all assets, no matter how modest.

Some individuals think that the AOC E 204 is optional and can be bypassed if they choose. However, the form serves a crucial legal purpose. It ensures that the distribution of the estate is transparent and that all transactions are documented, keeping the process clear and accountable. Failure to file may lead to complications down the line.

While the form can be completed by anyone tasked with collecting an estate, understanding its contents and requirements can be complex. It's advisable to seek guidance, whether from office staff or legal professionals, to ensure accuracy. A small error can lead to significant delays or legal challenges.

Some collectors assume they must provide extensive details for every transaction on the AOC E 204. While a summary of debts and distributions is necessary, extensive itemization is not always required. The form allows for a clear overview, focusing more on totals than on minute details, so long as the necessary information is presented accurately.

Key takeaways

Filling out the AOC E 204 form is an important step in managing the estate of a deceased person in North Carolina. Here are some key takeaways to keep in mind:

- Thorough Documentation Is Crucial: Ensure that you accurately document all personal property received, disbursements made, and distributions to heirs. This detailed account protects you and the estate's integrity.

- Understand the Structure of the Form: The AOC E 204 form is divided into clear sections: a summary of the estate's financials, details of property received, disbursements, and distributions to heirs. Familiarizing yourself with these components helps prevent mistakes.

- Balance Check: At the end of the form, you should always arrive at a balance of zero. This indicates that all assets have been accounted for after covering spousal allowances, debts, and distributions.

- Signature Requirements: Ensure that all required signatures are gathered. Both the affiant and a person authorized to administer oaths need to sign, maintaining the form's legal validity.

Browse Other Templates

Syndicate Bank Savings Account Interest Rate - Since account holders may be liable for errors, the form encourages accuracy in all provided details.

Notice of Remote Appearance - Enables parties to communicate barriers to in-person appearances effectively.