Fill Out Your Aoc E 506 Form

The AOC E 506 form is an essential tool in the estate administration process in North Carolina, specifically designed to provide a comprehensive overview of a decedent's estate or a trust. This form serves multiple purposes, including tracking the financial activities associated with the estate over a specified accounting period. It requires the fiduciary to document the total assets, which include personal property, real estate, and any current investments, alongside receipts and disbursements. In particular, it outlines the financial health of the estate by summarizing important figures such as total assets, losses from property sales, and distributions to heirs. Furthermore, the form includes sections that need to be completed only when filing an annual account, allowing for a clear report of any remaining balances held or invested. The fiduciary’s signature is also necessary to affirm the accuracy of the account, which must be notarized to verify its legitimacy. This structured format not only facilitates a transparent accounting process but also ensures compliance with North Carolina statutes governing estates and trusts.

Aoc E 506 Example

STATE OF NORTH CAROLINA

County

File No.

In The General Court Of Justice

Superior Court Division

Before The Clerk

|

IN THE MATTER OF THE ESTATE OF: |

|

|

|

ACCOUNT |

|

||||||||

Name |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

ANNUAL |

|

FINAL |

|||

|

|

|

|

|

|

|

|

|

G.S. |

|||||

|

Deceased |

Minor |

|

|

Incompetent |

Trust |

|

|||||||

|

|

|

|

|

|

|

|

|||||||

I, the undersigned representative, being irst duly sworn, say that the following is a complete and accurate account of my receipts, |

||||||||||||||

disbursements and other transactions as representative of this estate or trust. |

|

|

|

|

|

|

||||||||

Accounting Period From |

|

|

|

|

|

|

Extending To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

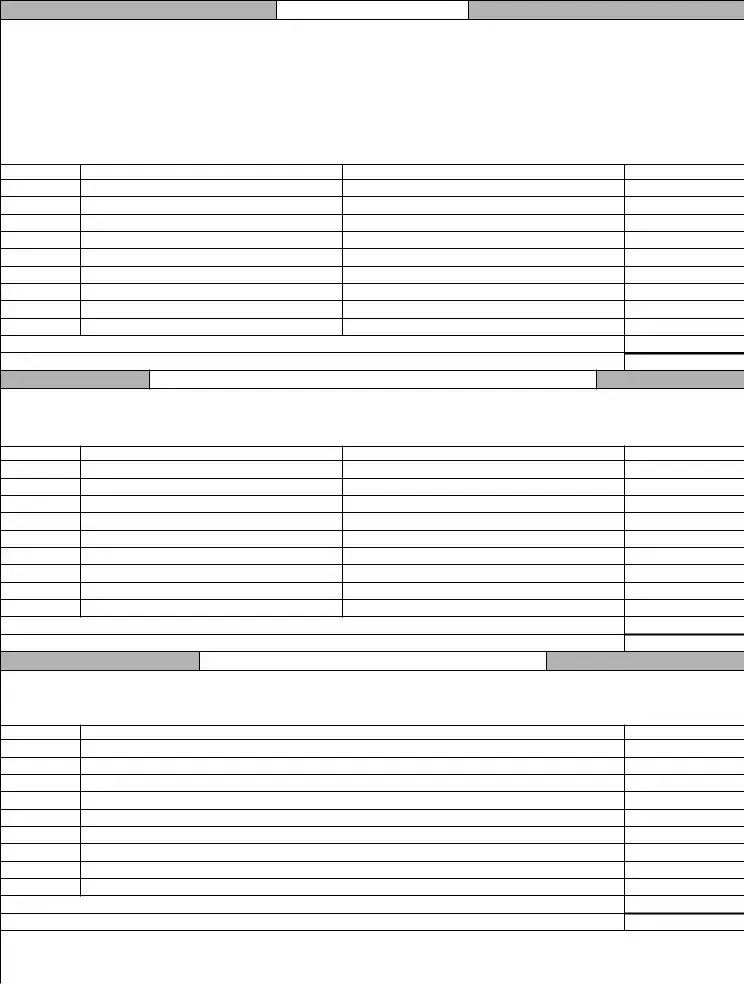

PART I. SUMMARY |

|

|

|

|

|

|

|

1. |

Subtotal Personal Property on Inventory or Subtotal Personal Property Held/Invested as Shown on Last Account |

$ |

||||||||||||

2. |

Minus Loss from Sale of Personal Property when Compared to Value Listed on Inventory or Prior Account |

|

||||||||||||

3. |

(Include or attach explanation.) |

|

|

|

|

|

|

|

|

|

– |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

4. |

Plus Total Receipts as Shown on Reverse [Part III.] |

(costs apply to this amount) |

|

|

|

+ |

$ |

|||||||

5. |

TOTAL ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6. |

Minus Disbursements (Debts or Expenses) as Shown on Reverse [Part IV.] |

|

|

|

|

– |

$ |

|||||||

7. |

SUBTOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

8. |

Minus Distributions (Inheritance to Heirs) as Shown on Reverse [Part V.] |

|

|

|

|

– |

$ |

|||||||

9. |

BALANCE AT END OF ACCOUNTING PERIOD (When iling Final Account, this should equal zero.) |

|

|

$ |

||||||||||

|

|

|

|

|

PART II. BALANCE HELD OR INVESTED |

|

|

|

|

|||||

(Complete ONLY when iling an Annual Account with assets remaining in the Estate.) |

|

|

|

|

|

|

||||||||

1. |

On Deposit in Banks, etc. |

|

|

|

|

|

|

|

|

Account No. |

Balance |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2. |

Invested in Securities, etc. |

|

|

|

|

|

|

|

$ |

|||||

3. |

Tangible Personal Property |

|

|

|

|

|

|

|

$ |

|||||

4. |

SUBTOTAL - PERSONAL PROPERTY |

|

|

|

|

|

|

|

$ |

|||||

5. |

Real Estate Willed to the Estate and Not Sold (fair market value at date of death) |

|

$ |

|

|

|

|

|||||||

6. |

Real Estate Acquired by the Estate Under G.S. |

|

|

|

|

|

$ |

|||||||

7. |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

TOTAL BALANCE HELD OR INVESTED (Must equal Balance shown in Part I. above) |

$ |

||||||||||

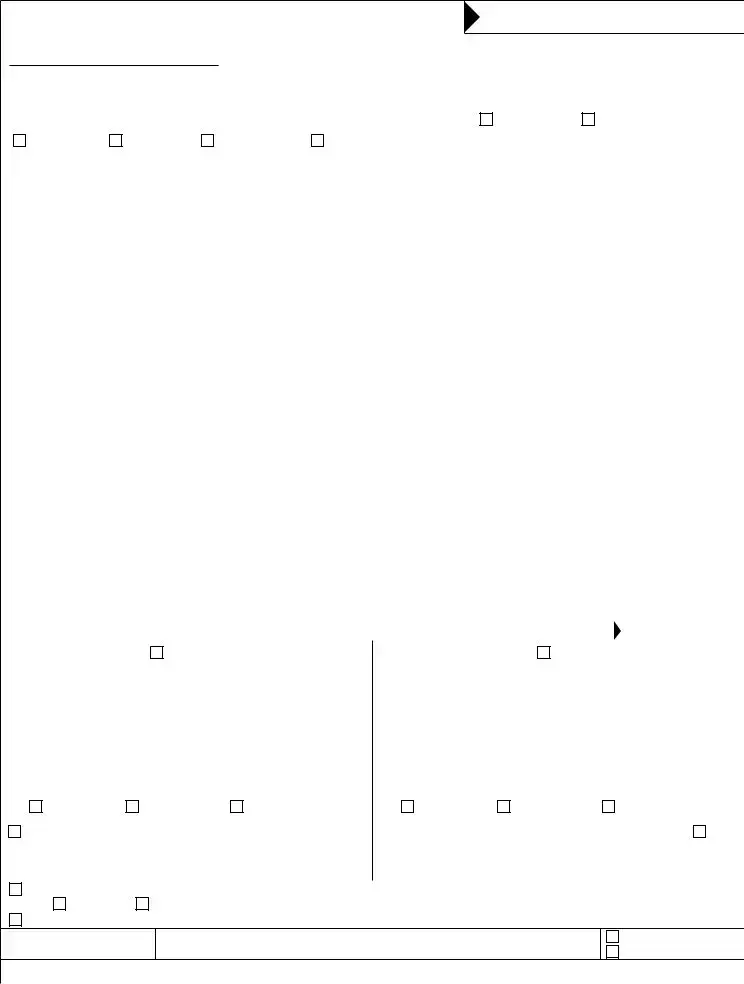

Name And Address Of Fiduciary |

Change Of Address |

|

Name And Address Of |

Change Of Address |

||||||||||

Signature Of Fiduciary |

Title |

Signature Of |

Title |

|

|

|

|

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

|||||||

|

|

|

|

|

|

|||

Date |

|

Signature Of Person Authorized To Administer Oaths |

Date |

Signature Of Person Authorized To Administer Oaths |

||||

|

|

|

|

|

|

|

|

|

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

|||

|

|

|

|

|

|

|

|

|

|

Date My Commission Expires |

|

Date My Commission Expires |

|

|

|||

Notary |

|

|

|

|

|

|

|

Notary |

|

|

|

|

|

|

|

|

|

SEAL |

County Where Notarized |

|

County Where Notarized |

|

|

SEAL |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

||||

The above account has been audited by me and the vouchers or veriied proofs submitted in support were examined. The account |

||||||||

is |

approved |

disapproved. |

|

|

|

|

|

|

As this is the inal account, the personal representative is discharged in accordance with G.S. |

|

|

||||||

Date

Signature

Assistant CSC

Clerk Of Superior Court

(Over) |

© 2014 Administrative Ofice of the Courts

PART III. RECEIPTS

NOTES: 1. Rent from real property not willed to the estate goes to the heirs and is not a receipt of the estate.

2.List loans to the estate for the purpose of paying claims.

3.If a sale of personal property results in a gain over the value listed on the Inventory

4.Do not report, as a receipt, changes in value (when compared to the value listed in the Inventory) of items which have not been sold.

5.If any real property willed to the estate has been sold, report the entire proceeds as a receipt.

6.If any real property not willed to the estate has been sold in a special proceeding to create assets with which to pay claims of the estate, report as a receipt only that portion of the proceeds received from the Commissioners (the balance not needed to pay claims of the estate is distributed in the special proceeding).

Date |

Received From |

Description |

Amount Or Value |

$

Total From Attachment, If Any $

TOTAL PART III.  $

$

PART IV. DISBURSEMENTS (Debts or Administrative Expenses)

NOTES: 1. Disbursements are expenditures of and for the estate and do not include expenses regarding real property not willed to the estate.

2.List payments to creditors out of loans to the estate, or reimbursements by the estate to persons who had directly paid creditors of the estate.

3.Provide copies of receipts, cancelled or imaged checks, or other satisfactory detailed proof of payments.

Date |

Paid Or Distributed To |

Description |

Amount Or Value |

$

Total From Attachment, If Any $

TOTAL PART IV.  $

$

PART V. DISTRIBUTIONS (Inheritance to Heirs)

NOTES: 1. Provide copies of receipts, cancelled or imaged checks, or other satisfactory detailed proof of delivery or distribution.

2.Attach itemized description of unrealized gains or losses or assets not sold but distributed. Do not include unrealized gain or loss amounts in Total Part V.

Date

Distributed To

Amount

$

Total From Attachment, If Any $

TOTAL PART V.  $

$

© 2014 Administrative Ofice of the Courts

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The AOC E 506 form is governed by North Carolina General Statutes G.S. 28A-21-1, -21-2, -21-3, -23-1; 35A-1264, -1266. |

| Purpose | This form is used to provide a complete and accurate account of receipts, disbursements, and other transactions related to an estate or trust. |

| Filing Requirement | The AOC E 506 form can be used for both annual and final accounts, depending on the status of the estate or trust. |

| Sections Included | The form comprises multiple parts, including a summary, balance held, receipts, disbursements, and distributions. |

| Signature Requirement | Signatures of the fiduciary and co-fiduciary, along with a person authorized to administer oaths, are required prior to submission. |

| Audit Process | The form undergoes an audit process, which must be documented, and the account must be approved or disapproved by the Assistant Clerk of Superior Court. |

Guidelines on Utilizing Aoc E 506

Filling out the AOC E 506 form requires attention to detail to ensure all financial transactions related to the estate or trust are accurately documented. Following the instructions carefully will help ensure compliance with legal requirements and facilitate the administrative process.

- Obtain a copy of the AOC E 506 form.

- Enter the State and County information at the top of the form.

- Fill in the File Number if applicable.

- Provide the full name of the Deceased, Minor, Incompetent, or Trust in the appropriate field.

- Indicate the Accounting Period by entering the start and end dates.

- In Part I, summarize the estate’s financials:

- List Subtotal Personal Property on Inventory or Held/Invested.

- Subtract any losses from the sale of personal property.

- Add any additional receipts as shown on the reverse side in Part III.

- Calculate the TOTAL ASSETS.

- Subtract disbursements (debts or expenses) as indicated on the reverse side in Part IV.

- Continue to subtract distributions (inheritance to heirs) as shown in Part V.

- Ensure the final BALANCE AT END OF ACCOUNTING PERIOD equals zero when filing the final account.

- In Part II, if applicable, detail the Balance Held or Invested: Fill in details for personal property, security investments, real estate, etc.

- Provide information for the Name and Address of Fiduciary and any co-fiduciaries.

- Sign and date as the fiduciary and co-fiduciary.

- Have the document notarized by an authorized individual.

- Attach any necessary documents to support receipts, disbursements, and distributions mentioned in Parts III, IV, and V.

What You Should Know About This Form

What is the AOC E 506 form used for?

The AOC E 506 form is utilized in the state of North Carolina to provide an annual or final account of the financial activities related to an estate or trust. This document details receipts, disbursements, and distributions during a specified accounting period. It is crucial for personal representatives to document their actions in managing the estate to ensure transparency and compliance with state laws.

Who needs to file the AOC E 506 form?

This form must be completed and filed by the personal representative of the estate or trust. This includes individuals appointed as executors or administrators after a loved one has passed away. If the estate is ongoing, an annual account is required. When the estate is final, a final account needs to be submitted to ensure all financial transactions have been accounted for.

What information must be included in the AOC E 506 form?

The AOC E 506 form requires a summary of the estate’s financial activities, including totals for personal property, receipts, disbursements, and distributions to heirs. Additionally, details about any losses from the sale of personal property and other related information about assets held or invested must be included. Proper documentation and receipts should accompany the form to support the reported amounts.

Where do I submit the AOC E 506 form?

The completed AOC E 506 form must be submitted to the Clerk of Superior Court in the county where the estate is being administered. This submission is essential for official record-keeping and to fulfill legal obligations involved in estate management.

Are there any fees associated with filing the AOC E 506 form?

Fees may be associated with filing the AOC E 506 form, depending on the specific court and the nature of the estate. It’s advisable to verify with the Clerk of Superior Court for any applicable fees that may be incurred during the filing process, as well as any potential costs for notarization or obtaining certified copies of the document.

What happens if the AOC E 506 form is not filed?

If the AOC E 506 form is not filed, the personal representative may face legal complications, including potential penalties. The court may require explanations for the absence of the report and may take action to ensure compliance with state laws. Failure to file can delay the closing of the estate and affect distributions to heirs.

Common mistakes

The AOC E506 form is crucial for accurately reporting the financial activities related to an estate. However, some common mistakes can lead to delays or complications in the processing of the form.

One frequent error is not including all necessary receipts. Often, individuals fail to list every transaction, particularly rental income from properties not willed to the estate. Such omissions can lead to incomplete financial reporting and may ultimately affect distributions to heirs.

Another mistake involves calculating totals incorrectly. Some people do not subtract losses from sales correctly. For instance, if personal property sells for less than its listed value, the loss must be reported on Part I. If this step is skipped or done incorrectly, it can cause discrepancies in the total assets reported.

In addition, failing to attach necessary documentation is a common oversight. The form requires copies of receipts, checks, or other proof of payments made. Without this documentation, the court may reject the submission or require additional information, prolonging the process.

Furthermore, errors in signatures can create issues. Some signers neglect to include their title or perform the signing outside the presence of a notary. Proper execution of this section is vital to ensure the form is considered valid and legally binding.

Lastly, inaccurately reporting balances can result in significant errors. The total balance held or invested must match the subtotal calculated in Part I. Any discrepancies will raise red flags during the review process and need to be addressed before approval.

By being aware of these common mistakes, individuals filling out the AOC E506 form can take steps to ensure completeness and accuracy, facilitating a smoother estate management process.

Documents used along the form

When dealing with the AOC E 506 form, various other documents may come into play to ensure a comprehensive understanding of the estate's financial dealings. Each of these forms serves to complement or clarify the details submitted in the AOC E 506. Understanding these documents can greatly assist individuals navigating the complex world of estate management.

- AOC E 505: This form details the inventory of the estate's assets. It lists all personal and real property owned by the deceased and is crucial for establishing the initial value of the estate.

- AOC E 511: Known as the "Notice of Appointment," this document informs interested parties that a personal representative has been officially appointed to manage the estate. It helps to provide transparency regarding the administration process.

- AOC E 512: The "Notice to Creditors" form is utilized to notify potential creditors of the estate. It gives creditors a designated time frame within which they can present their claims against the estate, ensuring a fair approach to managing debts.

- Form 1099: In cases where the estate produces income, the Form 1099 reports that income to the IRS. It is a key document for tax purposes and must be accurately maintained throughout the estate's administration.

- AOC E 530: This "Final Account" form provides an overview of the estate's financial activities and is often submitted alongside the AOC E 506 for final distribution to heirs. It summarizes receipts, disbursements, and distributions.

- Will: The last will and testament of the deceased outlines how assets should be distributed. It plays a foundational role in guiding the process of estate administration and must be reviewed alongside other documents.

- Letters Testamentary: Issued by the court, these letters grant the personal representative the legal authority to manage the estate. They are essential for conducting business on behalf of the estate.

- Accounting Ledger: This internal document is a detailed record of all transactions made by the personal representative. It ensures that all financial activities are monitored and transparent throughout the estate administration.

- Tax Returns: Personal and estate tax returns need to be filed to comply with federal and state laws. These ensure that all taxes are settled and help in preventing any future tax liabilities for the heirs.

Understanding these accompanying forms and documents provides a clearer picture of the estate administration process. By organizing and correctly filing these documents, individuals can simplify the complexities involved in managing and distributing an estate, ultimately ensuring a smoother transition for heirs.

Similar forms

- AOC-E-505: Inventory of Estate Assets - This form details the assets of the estate at the time of death. It allows for the initial assessment of value, providing a baseline for future accounting.

- AOC-E-507: Application for Certificate of Title - This document is used to transfer the title of property owned by the deceased. It ensures that the estate's assets are legally transferred to rightful heirs or the estate.

- AOC-E-508: Affidavit of Collection - This affidavit may simplify the distribution of personal property valued below a certain threshold, allowing heirs to collect assets without probate.

- AOC-E-509: Final Account for Decedent’s Estate - Similar to the AOC-E-506, this form provides a comprehensive overview of the estate's financial activity. It is used for final reporting and approval of the estate's accounts.

- AOC-G-201: Application for an Informal Administration - This application streamlines the process for small estates, reducing the complexity of formal probate when there are few assets to account for.

- AOC-G-100: Petition for Letters of Administration - This document initiates the probate process. It requests formal authority from the court to administer the estate, reflecting the need for oversight similar to the AOC E 506 form.

Dos and Don'ts

When completing the AOC E 506 form, it's important to adhere to certain guidelines to ensure accuracy and compliance. Below is a list of seven things you should do and avoid when filling out this form.

- Do provide accurate account details. Ensure all receipts, disbursements, and transactions are correctly listed.

- Do attach necessary documentation. Include copies of receipts, checks, or any relevant proof of payments and distributions.

- Do list all real property sales. Report the entire proceeds from any real property sold that was willed to the estate.

- Do verify all calculations. Check that total values and subtotals are correctly calculated to avoid discrepancies.

- Do submit the form on time. Ensure that you file the AOC E 506 by the required deadline to avoid penalties.

- Don't include unrelated expenses. Do not report expenses relating to real property not willed to the estate on this form.

- Don't forget to sign the form. Ensure all necessary signatures are obtained before submitting the document.

Misconceptions

Misconceptions about the AOC E 506 form can lead to confusion in managing the financial details of an estate. Below are five common misconceptions, along with clear explanations to help clarify each point.

- The AOC E 506 form is only for final accounts. Many people believe that this form is exclusively for final accounts. In reality, it can also be used for annual accounts when there are still assets remaining in the estate. Therefore, understanding the specific circumstances of each case is important.

- All receipts and disbursements must be itemized. While it's true that receipts and disbursements must be reported, there are exceptions regarding how detailed these reports need to be. For instance, receipts from properties not willed to the estate are considered the heirs' income, not estate income, and do not need to be reported on this form.

- Only monetary transactions need to be reported. This misconception misses the requirement to report certain non-cash transactions. For example, if a piece of property sells for a gain or loss, that transaction must be documented, no matter if it's cash or another form of value.

- Filing the AOC E 506 form is optional if there are no financial transactions. Some might think that if there have been no financial transactions, filing the form is unnecessary. However, even in such cases, the form must still be submitted to maintain transparency and as a formal record of the estate’s status.

- Once filed, the AOC E 506 cannot be amended. It is a common belief that once submitted, the information on this form is locked in. Amendments can indeed be made; adjustments may be necessary if new information comes to light or mistakes are discovered after filing.

Recognizing these misconceptions is crucial for those handling estates to follow proper procedures and ensure compliance with state requirements.

Key takeaways

The Aoc E 506 form is primarily used to report the financial activities of an estate or trust, including receipts, disbursements, and distributions.

Ensure all sections are accurately completed for the accounting period specified, which must cover all transactions related to the estate.

Attachments are essential. Include detailed documents like receipts and proof of payments to support the figures provided in the form.

The total assets reported should accurately reflect the balance at the end of the accounting period. A final account should ideally equal zero.

Clarifications or explanations of discrepancies should be attached to the form, particularly for any losses incurred from sales.

Fiduciaries must sign the form, affirming the accuracy of the reported information and ensuring all transactions are legitimate and documented.

Browse Other Templates

ATRRS Modification Request,ATRRS Update Form,ATRRS Change Application,ATRRS Adjustment Form,ATRRS Information Change Request,ATRRS Change Submission,ATRRS Request for Change,ATRRS Enrollment Modification Form,ATRRS Course Change Form,ATRRS Data Revis - Communicate any discrepancies through this change request.

Documents Needed for a Va Loan - The form inquires about the gender of the veteran for demographic purposes.