Fill Out Your Ap 1 Ins Form

The AP-1 Ins form is a crucial document for entities managing unclaimed property in Massachusetts. Each year, various organizations—including corporations, banks, life insurance companies, and public authorities—must complete and submit this form to the State Treasury's Unclaimed Property Division. The deadline for submission is November 1, except for life insurance companies, which have a deadline of May 1. Compliance is mandatory, as outlined by Massachusetts General Law Chapter 200A. Reporting requirements are strict, and any submissions that do not adhere to prescribed standards risk being returned, which may lead to fines or penalties. The form includes essential information such as the unclaimed property holder's contact details, the total value of reported assets, and various account types that might be subject to unclaimed property laws. Notably, electronic filing is required, and providers can request a preformatted disk package to assist with their submission. Each report requires verification of its accuracy, which must be sworn by an authorized individual. The form also contains a checklist to help fill out the report accurately, covering various types of unclaimed property such as account balances, insurance policy amounts, and other miscellaneous items. Keeping track of previous holders and changes in business structure is also necessary to ensure compliance.

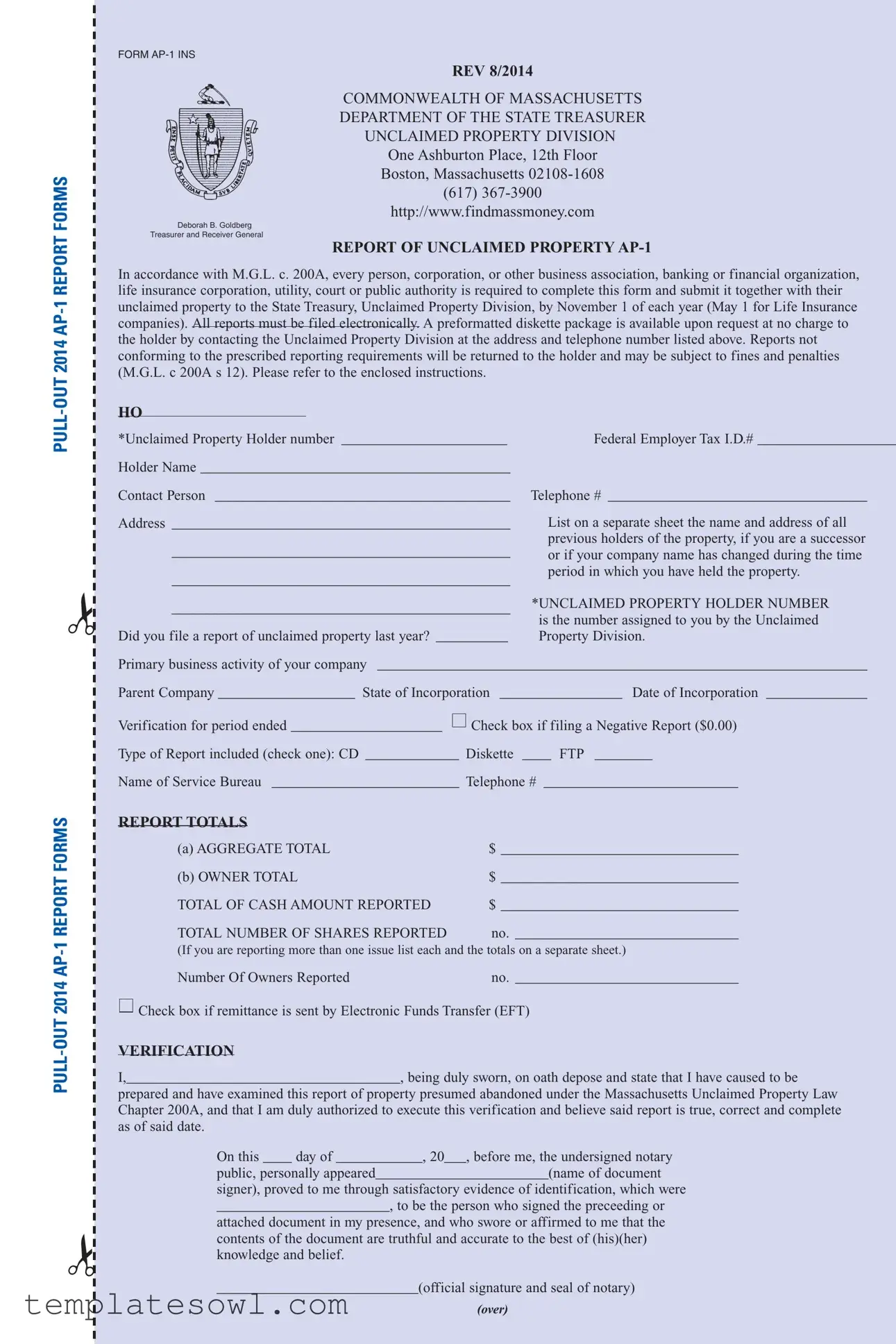

Ap 1 Ins Example

OUT 2014

FORM

REV 8/2014

COMMONWEALTH OF MASSACHUSETTS

DEPARTMENT OF THE STATE TREASURER

UNCLAIMED PROPERTY DIVISION

One Ashburton Place, 12th Floor

Boston, Massachusetts

(617)

http://www.findmassmoney.com

Deborah B. Goldberg

TREASURER AND RECEIVER GENERAL

REPORT OF UNCLAIMED PROPERTY

In accordance with M.G.L. c. 200A, every person, corporation, or other business association, banking or financial organization, life insurance corporation, utility, court or public authority is required to complete this form and submit it together with their unclaimed property to the State Treasury, Unclaimed Property Division, by November 1 of each year (May 1 for Life Insurance companies). All reports must be filed electronically. A preformatted diskette package is available upon request at no charge to the holder by contacting the Unclaimed Property Division at the address and telephone number listed above. Reports not conforming to the prescribed reporting requirements will be returned to the holder and may be subject to fines and penalties (M.G.L. c 200A s 12). Please refer to the enclosed instructions.

PULL-

✁

HO

*Unclaimed Property Holder number _______________________

Holder Name ___________________________________________

Contact Person _________________________________________

Address _______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

Did you file a report of unclaimed property last year? __________

Federal Employer Tax I.D.# ____________________

Telephone # ____________________________________

List on a separate sheet the name and address of all previous holders of the property, if you are a successor or if your company name has changed during the time period in which you have held the property.

*UNCLAIMED PROPERTY HOLDER NUMBER is the number assigned to you by the Unclaimed Property Division.

✁

Primary business activity of your company ____________________________________________________________________

Parent Company ___________________ State of Incorporation _________________ Date of Incorporation ______________

Verification for period ended _____________________ |

Check box if filing a Negative Report ($0.00) |

Type of Report included (check one): CD _____________ Diskette ____ FTP ________

Name of Service Bureau __________________________ Telephone # ___________________________

REPORT TOTALS

(a) AGGREGATE TOTAL |

$ _________________________________ |

(b) OWNER TOTAL |

$ _________________________________ |

TOTAL OF CASH AMOUNT REPORTED |

$ _________________________________ |

TOTAL NUMBER OF SHARES REPORTED |

no. _______________________________ |

(If you are reporting more than one issue list each and the totals on a separate sheet.)

Number Of Owners Reported |

no. _______________________________ |

Check box if remittance is sent by Electronic Funds Transfer (EFT)

VERIFICATION

I,______________________________________, being duly sworn, on oath depose and state that I have caused to be

prepared and have examined this report of property presumed abandoned under the Massachusetts Unclaimed Property Law Chapter 200A, and that I am duly authorized to execute this verification and believe said report is true, correct and complete as of said date.

On this ____ day of ____________, 20___, before me, the undersigned notary

public, personally appeared________________________(name of document

signer), proved to me through satisfactory evidence of identification, which were

________________________, to be the person who signed the preceeding or

attached document in my presence, and who swore or affirmed to me that the contents of the document are truthful and accurate to the best of (his)(her) knowledge and belief.

____________________________(official signature and seal of notary)

(OVER)

FORM

REV 8/2014

CHECKLIST OF PROPERTY REPORTED

YES |

NO |

ACCOUNT BALANCES (3 years inactive) |

YES |

NO |

TRUST, EQUITY AND |

|

|

|

|

|

|

DEBT ACCOUNTS (3 years inactive) |

|

_____ |

_____ A. Checking accounts |

_____ |

_____ |

A. Paying agent accounts |

||

_____ |

_____ |

B. Savings accounts |

_____ |

_____ |

B. Unclaimed dividends (portfolio) |

|

_____ |

_____ |

C. Matured certificates of deposit |

_____ |

_____ |

C. Funds held in a fiduciary capacity |

|

|

|

or savings certificates |

|

|

|

|

_____ |

_____ |

D. Christmas Club accounts |

_____ |

_____ |

D. Funds paid toward the purchase of |

|

|

|

|

|

|

|

shares, or interest in a financial or |

|

|

|

|

|

|

business organization |

_____ |

_____ |

E. Money on deposit to secure funds |

_____ |

_____ |

E. Funds received for redemption of |

|

|

|

|

|

|

|

stocks and bonds |

_____ _____ F. Security deposits |

_____ |

_____ |

F. Stocks (underlying and undeliverable) |

|||

_____ |

_____ |

G. Unidentified deposits |

_____ |

_____ |

G. Bonds (matured bond principal) |

|

_____ |

_____ |

H. Suspense accounts |

_____ |

_____ |

H. Any other certificates of ownership |

|

_____ |

_____ |

I. Any sum owing to a shareholder, |

_____ |

_____ |

I. |

Suspense liabilities |

|

|

certificate holder, member, bond |

|

|

|

|

|

|

holder or other security holder, or |

|

|

|

|

|

|

participating member of a cooperative, |

YES |

NO |

OFFICIAL CHECKS (3 years inactive) |

|

|

|

such as: |

|

|

|

|

_____ |

_____ |

1. dividends (underlying and undeliverable) |

_____ |

_____ |

A. Certified checks |

|

_____ |

_____ |

2. interest |

_____ |

_____ |

B. Cashier’s checks |

|

_____ |

_____ |

3. principal payments |

_____ |

_____ |

C. Registered checks |

|

_____ |

_____ |

4. equity payments |

_____ |

_____ |

D. Treasurer’s checks |

|

_____ |

_____ |

5. profits |

_____ |

_____ |

E. Drafts |

|

_____ |

_____ |

6. other distributions |

_____ |

_____ |

F. Warrants |

|

_____ |

_____ |

J. Escrow Funds |

_____ |

_____ |

G. Money orders |

|

|

|

|

_____ |

_____ |

H. Travelers checks (15 years inactive) |

|

|

|

|

_____ |

_____ |

I. |

Foreign exchange |

|

|

|

_____ |

_____ |

J. |

Other official checks or exchange items |

✁

MISCELLANEOUS CHECKS AND

INTANGIBLE PERSONAL PROPERTY

HELD IN THE ORDINARY COURSE

OF BUSINESS (3 years inactive)

YES |

NO |

|

YES |

NO |

INSURANCE (3 years inactive) |

_____ |

_____ A. Wages, payroll or salary |

_____ |

_____ |

A. Amounts due and payable under |

|

|

|

|

|

|

terms of insurance policies |

_____ |

_____ |

B. Commissions |

_____ |

_____ |

B. Claim payments |

_____ |

_____ |

C. Expense checks |

_____ |

_____ |

C. Drafts not presented for payment |

_____ |

_____ |

D. Workman’s Compensation benefits |

_____ |

_____ |

D. Matured whole life, term endowment |

_____ |

_____ |

E. Pension checks |

_____ |

_____ |

E. Other amounts due under insurance |

|

|

|

|

|

policies or annuities, policy terms or |

_____ |

_____ |

F. Credit checks or memos |

|

|

supplementary contracts |

_____ |

_____ |

G. Payments for goods and services |

_____ |

_____ |

F. Premium Refunds |

✁

_____ |

_____ |

H. Customer overpayment |

YES |

NO |

UTILITIES (3 years inactive) |

_____ |

_____ |

I. Unidentified remittances |

|

|

|

_____ |

_____ |

J. |

_____ |

_____ |

A. Utility deposits |

_____ |

_____ |

K. Accounts payable |

_____ |

_____ |

B. Membership fees |

_____ |

_____ |

L. Credit |

_____ |

_____ |

C. Refunds or rebates |

_____ |

_____ |

M Discounts due |

|

|

|

_____ |

_____ |

N. Refunds or rebates |

|

|

|

_____ |

_____ |

O. Vendor checks |

YES |

NO |

DISSOLUTIONS/LIQUIDATIONS (1 year) |

_____ |

_____ |

P. Mineral proceeds |

|

|

|

_____ |

_____ |

Q. Royalties |

_____ |

_____ |

All property distributable in the course |

_____ |

_____ |

R. Any other miscellaneous |

|

|

of voluntary or involuntary dissolution or |

|

|

outstanding checks |

|

|

liquidation which is unclaimed within |

_____ |

_____ |

S. Any checks that have been written off to income |

|

one year after the date for final distri- |

|

_____ |

_____ |

T. Any other miscellaneous intangible |

|

|

bution is presumed abandoned. |

|

|

personal property |

|

|

|

YES |

NO |

COURT DEPOSITS (3 years inactive) |

YES |

NO |

TANGIBLE PROPERTY (7 years inactive) |

_____ _____ |

A. Escrow funds |

_____ _____ |

A. Contents of safe deposit boxes |

||

_____ _____ |

B. Condemnation awards |

_____ _____ |

B. Contents of any other safekeeping |

||

_____ _____ |

C. Missing heirs funds |

_____ _____ |

depository |

||

_____ _____ |

D. Suspense accounts |

_____ _____ |

C. Other tangible property |

||

_____ _____ |

E. Any other type of deposit made with |

|

|

|

|

|

|

a court or public authority |

|

|

|

Form Characteristics

| Fact Title | Description |

|---|---|

| Governing Law | The AP-1 Ins form is governed by Massachusetts General Laws Chapter 200A. |

| Filing Deadline | Entities must submit the form by November 1 each year, or by May 1 for life insurance companies. |

| Electronic Submission | All reports must be filed electronically to comply with state regulations. |

| Penalties for Non-Compliance | Reports not meeting requirements may be returned and can incur fines under M.G.L. c. 200A, section 12. |

| Contact Information | The Unclaimed Property Division can be reached at (617) 367-3900 for assistance. |

| Holder Identification | Each holder must list their Unclaimed Property Holder number assigned by the Unclaimed Property Division. |

| Verification Requirement | A sworn verification affirming the accuracy of the submitted report must accompany the filing. |

Guidelines on Utilizing Ap 1 Ins

Completing the AP-1 Ins form is a straightforward process, essential for filing your report of unclaimed property. Thoroughly follow these steps to ensure accuracy and compliance with requirements. Remember to submit the form electronically by the deadline applicable to your organization.

- Obtain the Form: Download the AP-1 Ins form from the Massachusetts Unclaimed Property Division website or request a preformatted diskette package.

- Fill in Holder Information: Enter your Unclaimed Property Holder number, name, contact person, and complete address.

- Federal Employer Tax ID: Provide your Federal Employer Tax Identification Number.

- Prior Year Report: Indicate whether you filed a report of unclaimed property last year.

- Previous Holders: If applicable, list all previous holders of the property on a separate sheet.

- Business Details: Fill in the primary business activity, parent company, state of incorporation, and date of incorporation.

- Report Verification: Check the box if filing a Negative Report. Select the type of report being submitted.

- Total Values: Enter the aggregate total and owner total, alongside the total cash amount and number of shares reported.

- Owner Count: Fill in the total number of owners reported.

- Electronic Transfer: Check if remittance is sent via Electronic Funds Transfer (EFT).

- Verification Statement: Sign and date the verification section, and provide your name and title.

- Notary Section: Arrange for notarization by a notary public. The notary will complete their section after confirming your identity.

- Checklist Completion: Review the checklist of property reported, marking “Yes” or “No” as required for each type of property held.

Ensure that all entries are correct before submitting your form electronically. Check that you have retained a copy for your records. Submitting the form accurately and on time will help you avoid fines or penalties.

What You Should Know About This Form

What is the purpose of the AP-1 Ins form?

The AP-1 Ins form is designed for individuals, corporations, and various organizations in Massachusetts to report unclaimed property. It ensures that entities fulfill their obligations under Massachusetts General Laws, Chapter 200A, by documenting any property presumed abandoned and returning it to the state treasury.

Who is required to file the AP-1 Ins form?

Any person, corporation, business association, banking or financial institution, utility, court, or public authority that holds unclaimed property must complete this form. This requirement applies annually, so it's important for all applicable parties to stay informed.

When is the submission deadline for the AP-1 Ins form?

The deadline for submitting the AP-1 Ins form is November 1 each year. However, life insurance companies need to submit their reports by May 1. Failing to meet these deadlines may result in fines or penalties.

How should the AP-1 Ins form be submitted?

Reports must be filed electronically. Additionally, a preformatted diskette package can be requested at no cost from the Unclaimed Property Division, which simplifies the submission process for holders.

What happens if the AP-1 Ins form does not meet reporting requirements?

If the report does not conform to the necessary reporting standards, it will be returned to the submitter. Holders may face fines and penalties if they fail to comply with the prescribed requirements set out in the Massachusetts General Laws.

Is there a specific format required for the AP-1 Ins form?

Yes, the AP-1 Ins form requires specific information, such as the unclaimed property holder number, the nature of the business, and details about the unclaimed properties. There are sections for listing account balances, owner totals, and additional information needed for verification purposes.

What types of property are reported on the AP-1 Ins form?

The form covers various types of unclaimed property, including bank accounts, stocks, bonds, insurance proceeds, and even tangible assets like safe deposit box contents. Holders should review the checklist included with the form for complete guidance on what to report.

Are there any penalties for failing to file the AP-1 Ins form?

Yes, penalties can be imposed for not filing the AP-1 Ins form or for submitting it late. The Massachusetts General Laws outline the ramifications, which can include fines that collect over time for each occurrence of non-compliance.

Where can I find assistance with completing the AP-1 Ins form?

For assistance, you can contact the Massachusetts Unclaimed Property Division via their website or by phone. Additionally, detailed instructions are available with the form, offering guidance on how to complete and submit it correctly.

Common mistakes

Filling out the AP-1 Ins form can be challenging, and several common mistakes can lead to delays or complications. One significant error occurs when individuals fail to provide the Unclaimed Property Holder Number. This number is essential as it uniquely identifies the reporting entity. Omitting it can cause the form to be returned, delaying the processing of the unclaimed property.

Another frequent mistake involves incomplete or incorrect information regarding the contact person. The contact person’s name and details should be accurate and up to date. If these details are wrong, it can hinder communication and follow-up by the Unclaimed Property Division. Individuals sometimes assume that a generic business title will suffice. However, a specific name can greatly streamline the process.

Many people also overlook the requirement to report on all previous holders of the property. If an individual or business is a successor or if the company name has changed, they must list this information on a separate sheet. Failing to do so can result in incomplete reporting and potential penalties. It's critical to gather all relevant information beforehand to avoid this pitfall.

Additionally, some filers check the wrong box when indicating the type of report included, such as CD, diskette, or FTP. This seemingly small oversight can lead to significant confusion during processing. It is always best to double-check the options selected before submitting the form, ensuring that the correct method of submission is clearly marked.

Finally, many individuals neglect to verify their signature and date on the verification section of the form. This step is crucial, as any missing elements here can delay the verification process. Signatures not only authenticate the document but also ensure that all statements made on the report are accurate. Therefore, taking the time to carefully review and sign the form can ultimately save time and hassle.

Documents used along the form

The AP-1 Ins form is an important document for reporting unclaimed property in Massachusetts. However, it often needs to be accompanied by several other forms and documents. Each of these has its own role in ensuring compliance with unclaimed property laws. Below is a list of such documents, along with brief descriptions of their purposes.

- Verification Affidavit: This document is a sworn statement confirming that the information provided in the AP-1 Ins form is accurate and complete. The signer must verify the details under oath before a notary public.

- Prior Year Reporting Documentation: If applicable, this includes past reports and records detailing previous holders of the unclaimed property. It helps establish a continuity of reporting and compliance.

- Electronic Filing Confirmation: This serves as proof that the report has been filed electronically. Holders must maintain this confirmation as a record of compliance.

- Negative Report Documentation: If the entity is filing a negative report (indicating no unclaimed property), this document confirms that no property exists for the reporting period.

- Service Bureau Agreement: If a service bureau is used for reporting, this agreement outlines the relationship and responsibilities between the service provider and the reporting entity.

- Remittance Receipts: These are records of payment sent to the state for any unclaimed property. Keeping these receipts provides proof of remittance and compliance with funding obligations.

- Additional Property Checklists: This document lists various types of property that may be unclaimed, helping the holder ensure they have reviewed all potential assets that need to be reported.

Understanding these additional forms and documents can greatly enhance the process of reporting unclaimed property. Each one builds upon the due diligence required to manage obligations responsibly and meet state laws effectively.

Similar forms

The AP-1 INS form serves as a comprehensive report for unclaimed property in Massachusetts. Several other documents have similarities in purpose, structure, and reporting requirements. Below is a list of eight documents akin to the AP-1 INS form:

- Form 1099-MISC: This tax form reports miscellaneous income. Similar to AP-1 INS, it requires detailed information about payments made to individuals or businesses, typically for freelance work or contractual services.

- Unclaimed Property Report Form (different states): Many states have their specific versions of unclaimed property reports. These documents also require holders to submit an annual report listing unclaimed assets, deadlines for submission, and potential penalties for non-compliance.

- IRS Form 8822: This form notifies the IRS of a change of address. Like the AP-1 INS, it demands accurate personal or business information to ensure correct record-keeping and compliance with federal regulations.

- W-2 Form: This document reports annual wage and tax information for employees. It, too, must be submitted on a strict deadline and contains detailed identifying information about both the employer and employee, much like the AP-1 INS form.

- Form 990: Non-profit organizations file this form to provide the IRS with annual information about their finances. It shares similarities with AP-1 INS in that it collects extensive data about assets and complies with legal reporting obligations.

- State Sales Tax Return: Businesses submit this document to report and remit sales tax they collected. It requires accurate records and reporting, echoing the financial accountability found in the AP-1 INS filing process.

- Business License Application: This application collects essential business details for licensing purposes. Like the AP-1 INS, it mandates specific information about the business entity and its activities for regulatory compliance.

- Form 941: This quarterly report is used to report income taxes, Social Security tax, or Medicare tax withheld from employee wages. Similar to AP-1 INS, it requires detailed reporting and adherence to federal guidelines.

By understanding the parallels among these documents, stakeholders can better prepare for their compliance obligations and ensure accurate reporting across various regulatory frameworks.

Dos and Don'ts

When filling out the AP 1 Ins form, several considerations can help you avoid common mistakes. Below is a list of things you should and shouldn't do.

- Do ensure that all information is accurate and complete.

- Do file the report electronically by the required deadline.

- Do keep copies of your submitted forms for your records.

- Do provide details about previous holders of the property, if applicable.

- Do verify that the unclaimed property holder number is correctly entered.

- Don't submit incomplete or inconsistent information, as this may delay processing.

- Don't forget to check if remittance is sent by Electronic Funds Transfer (EFT).

- Don't ignore the instructions regarding the reporting format required by the State Treasury.

- Don't delay in sending the form, as late submissions may incur fines.

Misconceptions

Misconceptions about the AP-1 INS form can lead to confusion among businesses and individuals preparing to report unclaimed property. Here are six common misunderstandings:

- Only large businesses need to file the AP-1 INS form. Many people believe only corporations with significant assets have to report unclaimed property. However, any person or entity that holds unclaimed property, regardless of size, must file this form.

- Filing is optional if the amount is small. Some individuals think that they can skip filing if the unclaimed property is minimal. This is incorrect. The law requires all holders of unclaimed property to file the report annually, regardless of the amount.

- The deadline is flexible. There is a misconception that the submission deadline varies each year. The deadline for most entities is always November 1, while life insurance companies must submit by May 1. This deadline is firm.

- You can file a paper report. Many believe they can submit a physical copy of the form. All reports must be filed electronically. Paper submissions will not be accepted.

- If you've filed before, you don’t need to report again. Some holders think that if they have reported in the past, they don’t need to file again each year. This is false. The law requires an annual report, so continuous reporting is necessary.

- Filing is too complicated. Many individuals hesitate to file because they assume it involves a complex process. In reality, the form is straightforward to complete with available guidance. Resources can help simplify the filing experience.

Understanding these misconceptions can help ensure compliance with Massachusetts unclaimed property laws and facilitate smoother reporting processes.

Key takeaways

- Ensure you file the AP-1 Ins form by the November 1 deadline each year (or May 1 for Life Insurance companies).

- The form must be submitted electronically. A preformatted diskette package can be requested at no charge.

- Provide complete and accurate information to avoid fines or penalties; incomplete forms will be returned.

- Document any previous holders of the property if there has been a change in your company name or ownership.

- Verification of the report is crucial. Ensure that the person signing the document is authorized and has knowledge of the contents.

- Review the checklist of property reported on the form. Ensure that all applicable categories are included.

- Understand that unclaimed property includes a wide range of assets, from bank accounts to insurance claims; failure to report could result in loss.

Browse Other Templates

Prior Authorization Training Free - Make sure the member ID number is accurate to avoid errors.

Ny Ct-3 - The authorized person must certify the return for it to be valid.