Fill Out Your Ar 0026 Form

The AR 0026 form, known as the Uniform Vehicle Dealer Surety Bond, plays a crucial role in the licensing process for vehicle dealers in Michigan. This bond serves as a financial guarantee, ensuring that dealers adhere to ethical business practices while providing recourse for any customers or agencies that may suffer monetary loss due to the dealer's fraudulent behavior. Specifically, it protects against fraud, cheating, or misrepresentation by the dealer or their employees, offering coverage up to $10,000. The form outlines essential obligations for both the principal (the dealer) and the surety (the bonding company), establishing conditions under which indemnification or reimbursement will occur. This bond is not only required for license application but also remains in force continuously, provided that all necessary conditions are met and documentation is accurately completed. The details of this form include stipulations regarding business name listings, signature requirements, and provisions for changes in business structure or address, emphasizing the importance of precision in the application process. Ultimately, the AR 0026 form is a vital document that safeguards both the dealer's integrity and consumer confidence in the automotive marketplace.

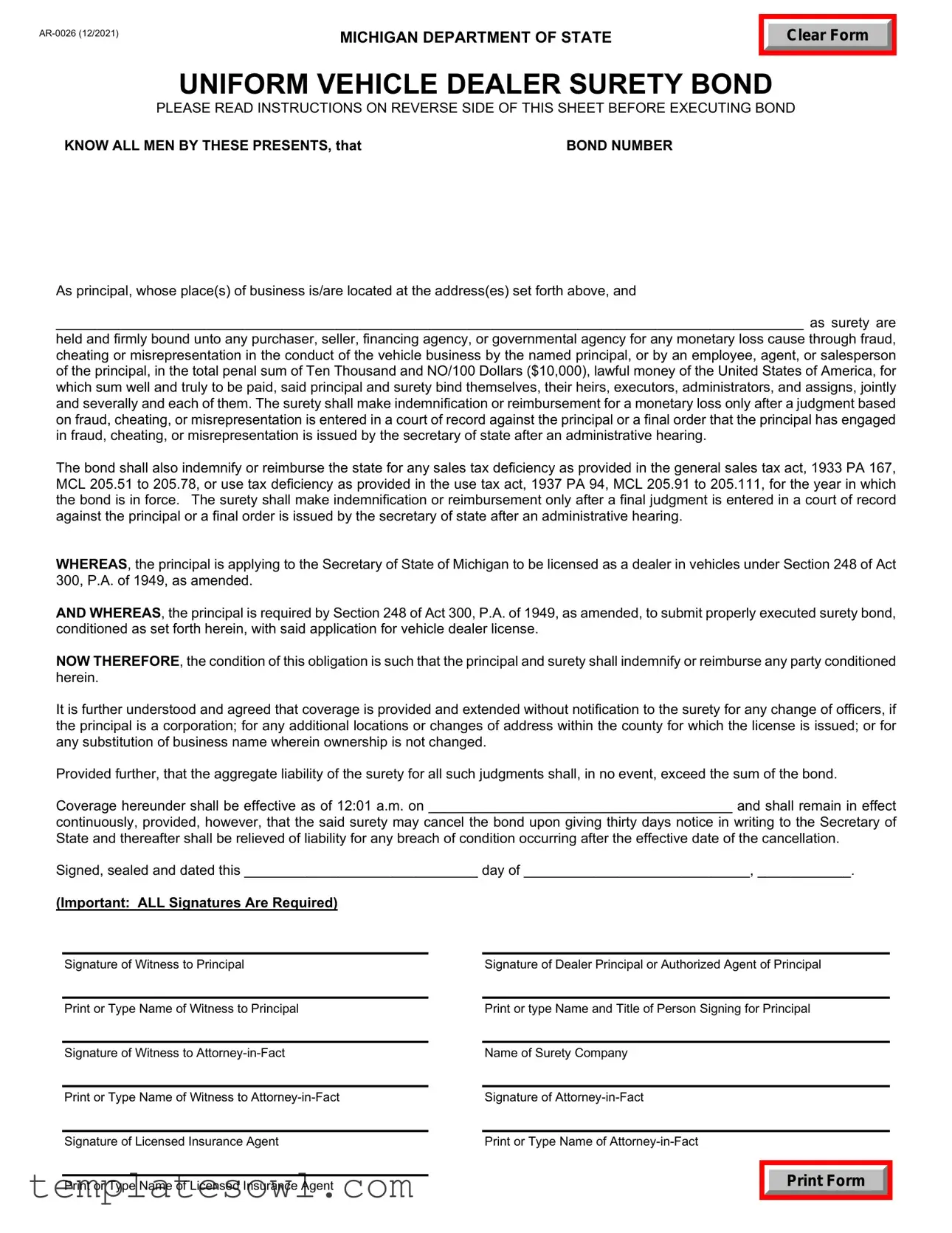

Ar 0026 Example

MICHIGAN DEPARTMENT OF STATE |

Clear Form |

|

|

UNIFORM VEHICLE DEALER SURETY BOND

PLEASE READ INSTRUCTIONS ON REVERSE SIDE OF THIS SHEET BEFORE EXECUTING BOND

KNOW ALL MEN BY THESE PRESENTS, that |

BOND NUMBER |

As principal, whose place(s) of business is/are located at the address(es) set forth above, and

________________________________________________________________________________________________ as surety are

held and firmly bound unto any purchaser, seller, financing agency, or governmental agency for any monetary loss cause through fraud, cheating or misrepresentation in the conduct of the vehicle business by the named principal, or by an employee, agent, or salesperson of the principal, in the total penal sum of Ten Thousand and NO/100 Dollars ($10,000), lawful money of the United States of America, for which sum well and truly to be paid, said principal and surety bind themselves, their heirs, executors, administrators, and assigns, jointly and severally and each of them. The surety shall make indemnification or reimbursement for a monetary loss only after a judgment based on fraud, cheating, or misrepresentation is entered in a court of record against the principal or a final order that the principal has engaged in fraud, cheating, or misrepresentation is issued by the secretary of state after an administrative hearing.

The bond shall also indemnify or reimburse the state for any sales tax deficiency as provided in the general sales tax act, 1933 PA 167, MCL 205.51 to 205.78, or use tax deficiency as provided in the use tax act, 1937 PA 94, MCL 205.91 to 205.111, for the year in which the bond is in force. The surety shall make indemnification or reimbursement only after a final judgment is entered in a court of record against the principal or a final order is issued by the secretary of state after an administrative hearing.

WHEREAS, the principal is applying to the Secretary of State of Michigan to be licensed as a dealer in vehicles under Section 248 of Act 300, P.A. of 1949, as amended.

AND WHEREAS, the principal is required by Section 248 of Act 300, P.A. of 1949, as amended, to submit properly executed surety bond, conditioned as set forth herein, with said application for vehicle dealer license.

NOW THEREFORE, the condition of this obligation is such that the principal and surety shall indemnify or reimburse any party conditioned herein.

It is further understood and agreed that coverage is provided and extended without notification to the surety for any change of officers, if the principal is a corporation; for any additional locations or changes of address within the county for which the license is issued; or for any substitution of business name wherein ownership is not changed.

Provided further, that the aggregate liability of the surety for all such judgments shall, in no event, exceed the sum of the bond.

Coverage hereunder shall be effective as of 12:01 a.m. on _______________________________________ and shall remain in effect

continuously, provided, however, that the said surety may cancel the bond upon giving thirty days notice in writing to the Secretary of State and thereafter shall be relieved of liability for any breach of condition occurring after the effective date of the cancellation.

Signed, sealed and dated this ______________________________ day of _____________________________, ____________.

(Important: ALL Signatures Are Required)

Signature of Witness to Principal

Print or Type Name of Witness to Principal

Signature of Witness to

Print or Type Name of Witness to

Signature of Licensed Insurance Agent

Print or Type Name of Licensed Insurance Agent

Signature of Dealer Principal or Authorized Agent of Principal

Print or type Name and Title of Person Signing for Principal

Name of Surety Company

Signature of

Print or Type Name of

Print Form

NOTICE: Vehicle Dealer License Applicant, Surety Bonding Companies and Agents –

THIS BOND MUST BE CORRECTLY COMPLETED OR A DEALER LICENSE CANNOT BE ISSUED.

DEALER: DOUBLE CHECK these points!

Follow the instructions and avoid unnecessary delay and expense.

The EXACT business name and address of the dealership must appear on the face of the bond as it appears on the dealer license application.

Individual owners and partners MUST be listed in addition to the business name and address.

Corporate officers, etc. do not need to be listed for a corporation. ONLY the corporate name (d/b/a assumed name, any) and the address need to appear.

BOND NUMBER must be on the face of the bond.

Name of Surety must be listed.

SIGNATURES ARE REQUIRED for:

•

•Witness to the

•Licensed Insurance Agent (Agent licensed to sell insurance in Michigan)

•Principal (dealer license applicant)

•Witness to Principal

A power of attorney for the

Remember, if the bond is not correctly completed, a dealer license cannot be issued.

UNIFORM VEHICLE DEALER SURETY BOND INSTRUCTIONS

1.Every applicant for a vehicle dealer license must file with such application an executed surety bond in the amount of Ten Thousand and NO/100 Dollars ($10,000.00). (Class “C”, “E”, “F”, “G”, “R”, and “W” Dealers exempt.)

2.The Department of State has prescribed a standard form of bond for vehicle dealers which is set forth on the reverse side hereof. This bond must be executed by the principal and surety and filed with the Department of State at the time of filing application for vehicle dealer license.

3.This bond must be executed by the principal (dealer) and surety company and filed with the Department of State at the time of filing application for vehicle dealer license. Application for dealer license will not be acted upon until the application, bond and all other required documents are filed, and the appropriate fees paid to the Department of State in Lansing.

4.Each licensee, whether an individual, corporation, or partnership, must be named in the bond as principal. In the case of an individual proprietorship, the individual’s name, as well as the name under which business is being conducted, must be listed. In case of partnerships, each individual partner, as well as the name of the partnership itself, must be listed. In the case of corporations, the corporation itself must be shown on the bond but, the officers whose names appear on the application for license need not be listed on the bond. The location of the business must also be listed. If a licensee is doing business at more than one location within a county, all such locations must be listed.

5.This is a continuous surety bond, the effective date of which may be the date of execution or a later date; however, the bond must be effective at the date of filing of application for a vehicle dealer license even though the license may not be issued until a subsequent date.

6.The bond must be executed by a surety company authorized to do business in Michigan. Every bond must be executed by an agent of the company licensed to do business in Michigan.

7.The

8.The affidavit of the power of attorney must be executed on the same date as the bond, or after the date of the bond, but not before.

9.A dealer is only authorized to conduct business if a $10,000 bond is in effect. Therefore, if the surety company pays any claim under this bond, it will have the effect of reducing the bond coverage afforded to the dealer by the amount of the claim that is paid. If this occurs, the dealer will no longer be covered by the full, required amount of $10,000.

Surety companies are requested to notify the Department of State of the payment of any claims under this bond.

Form Characteristics

| Fact Name | Description |

|---|---|

| Bond Requirement | A vehicle dealer must file a surety bond for $10,000 with their application for a dealer license in Michigan. This is required under Section 248 of Act 300, P.A. of 1949. |

| Indemnification Conditions | The bond provides indemnification for monetary losses resulting from fraud, cheating, or misrepresentation by the principal or their employees. However, payments occur only after a final judgment or administrative order confirms such wrongdoing. |

| Continuous Bond | This bond is continuous, meaning it remains in effect even if the principal’s business changes locations or structures, unless a cancellation notice is issued to the Secretary of State. The surety must provide at least 30 days' notice for cancellation. |

| Filing and Execution | The bond must be executed by both the principal and an authorized surety representative. Additionally, a power of attorney must be submitted, ensuring the attorney-in-fact is authorized to sign on behalf of the surety company. |

Guidelines on Utilizing Ar 0026

Following the proper steps to fill out the AR-0026 form ensures a smooth process in applying for a vehicle dealer license. Accurately completed documentation is critical for approval. Each section must be filled out completely and properly to avoid delays.

- Obtain the form AR-0026 from the Michigan Department of State's website or your local office.

- Locate the BOND NUMBER section at the top of the form and enter the unique bond number assigned to your surety bond.

- Provide the principal's name or the dealer's name as it appears on the dealer license application.

- List the physical address of the principal's business location(s) next to the dealer's name.

- Identify the surety company by typing its name in the designated area.

- Ensure that the total penal sum of the bond is stated as Ten Thousand and NO/100 Dollars ($10,000). Verify that this amount is clearly visible.

- Specify the effective date of the bond in the space provided. The bond must be effective on or before the date the license application is submitted.

- Ensure that all required signatures are collected: the dealer principal or authorized agent, the licensed insurance agent, the attorney-in-fact for the surety, and the witnesses. Each signature must be accompanied by the printed or typed names.

- Check the form for accuracy and completeness to avoid unnecessary delays.

- Once completed, submit the bond with your application for the vehicle dealer license to the Michigan Department of State.

Ensure that you have attached any necessary documents, such as a power of attorney for the attorney-in-fact, to the submitted bond. This form must be filed along with your dealer license application. If any part is incorrect or incomplete, a dealer license will not be issued.

What You Should Know About This Form

1. What is the purpose of the AR 0026 form?

The AR 0026 form, also known as the Uniform Vehicle Dealer Surety Bond, is required for individuals or businesses applying for a vehicle dealer license in Michigan. It serves as a financial guarantee to any party that may experience a monetary loss due to fraud, cheating, or misrepresentation in the vehicle business. The bond ensures that the dealer or their agents are held accountable for their actions, offering protection to buyers, sellers, and lending agencies.

2. How much coverage does the AR 0026 bond provide?

The AR 0026 bond provides coverage in the total penal sum of $10,000. This means that if a claim is made against the bond due to fraud or misrepresentation, the surety will indemnify the affected party up to this limit, provided that the necessary legal conditions are met, including a judgment or administrative order against the principal.

3. Who is required to sign the AR 0026 form?

Multiple parties must sign the AR 0026 form for it to be valid. These include the principal (dealer license applicant), the surety company's attorney-in-fact, a licensed insurance agent, and witnesses for both the principal and the attorney-in-fact. Each signature is critical, as the absence of any required signatory can result in delays or rejections of the dealer license application.

4. How does the bond protect against sales tax deficiencies?

The surety bond also includes indemnification for any sales tax deficiencies as outlined in Michigan's General Sales Tax Act. If the bond is active, it ensures that the principal will reimburse the state for any owed sales or use taxes during the period the bond is in force. This additional clause enhances the bond’s protective measures, ensuring compliance with state tax regulations.

5. What happens if a claim is made under the bond?

If the surety company pays a claim made under the AR 0026 bond, the total coverage available to the dealer will decrease by the amount of the claim paid. For instance, if a $5,000 claim is honored, the remaining coverage will drop to $5,000. It is also essential for surety companies to inform the Department of State about any claims paid, ensuring transparency and updating the records accordingly.

6. Can the bond be canceled, and if so, how?

Yes, the AR 0026 bond can be canceled by the surety company. They must provide a written notice to the Secretary of State at least thirty days in advance. Once the cancellation notice is effective, the surety will no longer be liable for any breaches of the bond’s conditions occurring after that date. This is a critical aspect for surety companies and dealers to monitor closely.

7. What should I do if my bond is not filled out correctly?

If the AR 0026 bond is improperly completed, the dealer license application cannot be processed. To avoid unnecessary delays, carefully review the bond form to ensure all information aligns with the dealer license application. Check for the correct business name, addresses, and required signatures. If there are errors, correct them before submitting to the Department of State.

Common mistakes

Filling out the AR 0026 form is a critical step for anyone looking to obtain a vehicle dealer license in Michigan. However, many applicants make common mistakes that can delay their application process. Here are six of the most frequent errors.

One of the primary pitfalls involves the business name and address. Applicants must ensure that the exact business name and address match those on their dealer license application. If there are discrepancies, even minor ones, it could lead to a rejection. A keen eye for detail is essential in this step.

Another frequent mistake is failing to include individual owners and partners. If the dealership is owned by multiple individuals, each must be listed alongside the business name and address. For corporations, only the corporate name needs to be confirmed, but individual owners in partnerships should not be overlooked.

Additionally, many people forget to include the bond number on the face of the bond. This number is crucial for the proper processing of the application. Without it, the bond may not be considered valid, resulting in unnecessary delays.

Signatures also play a vital role. A common error is neglecting to gather all required signatures. The form demands the signatures of the Attorney-in-Fact for the surety, a witness for the Attorney-in-Fact, a licensed insurance agent, and the principal. If even one signature is missing, the application cannot progress, so it’s vital that this part is double-checked.

Moreover, applicants often overlook the need for a power of attorney document. This document must accompany the bond or be on file with the Michigan Department of State. Without it, the Attorney-in-Fact's authority to sign for the surety company may come into question.

In conclusion, submitting the AR 0026 form requires attention to detail. The required business information, individual names for ownership, bond number, signatures, and power of attorney documentation are all critical components. By avoiding these common mistakes, applicants can help ensure a smoother application process.

Documents used along the form

The AR 0026 form, which is a Uniform Vehicle Dealer Surety Bond, is often accompanied by several other important documents that facilitate the licensing process for vehicle dealers in Michigan. The following list outlines six common forms and documents that are typically required or associated with the submission of the AR 0026 form.

- Dealer License Application: This document is required for individuals or businesses seeking to obtain a license to operate as a vehicle dealer. It includes pertinent information about the applicant and the nature of the business.

- Power of Attorney: A Power of Attorney is necessary for an attorney-in-fact representing the surety company. This document authorizes the attorney-in-fact to sign the surety bond on behalf of the surety company.

- Affidavit of Authority: This affidavit confirms the authority of the individual signing the bond on behalf of the surety company. It is usually prepared in conjunction with the Power of Attorney.

- Proof of Insurance: Dealers must provide evidence of insurance coverage as part of the licensing process. This often includes liability insurance to protect against potential claims arising from the conduct of the vehicle business.

- Business Registration Documents: Depending on the type of business entity, registration documents such as Articles of Incorporation or Partnership Agreements may be required. These documents establish the legal structure of the business.

- Financial Statements: In some cases, dealers may be required to provide financial documentation that demonstrates their financial stability and ability to fulfill any obligations related to the surety bond.

Each document serves a unique purpose in ensuring compliance with state regulations and in protecting the interests of all parties involved. It is important for vehicle dealers to submit all required documentation accurately and timely to avoid delays in their licensing process.

Similar forms

Surety Bond Form: Like the AR-0026, other surety bond forms are essential for protecting parties against potential losses caused by the principal's actions. Each form requires appropriate signatures and amounts specified by law, ensuring financial backing.

Dealer License Application: A dealer license application often accompanies the AR-0026. Both documents must be correctly completed and submitted together to ensure that the dealer is authorized to conduct business. Without one, the other may not be processed.

Power of Attorney Document: This document grants authority to an individual to act on behalf of the surety company in bond matters. Both the AR-0026 and a power of attorney require signatures to be valid, ensuring that the right people are executing the agreements.

Financial Guarantee Agreement: Similar to the AR-0026, financial guarantee agreements provide assurances against non-payment or default. They outline the conditions under which repayment will occur and often require indemnification after certain legal judgments.

Indemnity Agreement: This type of agreement is often related to surety bonds and outlines the responsibilities of the parties involved. Just like the AR-0026, it includes clauses that govern the indemnification process and protections for parties affected by fraud or misconduct.

Dos and Don'ts

When filling out the AR 0026 form, consider the following dos and don'ts:

- Ensure the exact business name and address of the dealership are listed as they appear on the dealer license application.

- List individual owners and partners in addition to the business name and address.

- Verify that the BOND NUMBER is clearly included on the face of the bond.

- Include the name of the Surety and ensure all required signatures are present.

Conversely, avoid the following mistakes:

- Do not omit the signatures of required parties such as the Attorney-in-Fact and witnesses.

- Refrain from using an unauthorized surety to execute the bond.

- Do not neglect to include a power of attorney for the Attorney-in-Fact with the bond.

- Avoid errors in naming conventions; ensure all names are accurate and complete.

Misconceptions

Many people have misunderstandings about the AR 0026 form, which is essential for vehicle dealer licensing in Michigan. Here are six common misconceptions:

- The bond covers all claims without limits. While the AR 0026 form provides for coverage up to $10,000, surety companies are only liable up to that amount for each individual claim. This means that if a claim is paid, the remaining coverage could be significantly reduced.

- Only the principal needs to sign the bond. This isn’t true. The bond requires multiple signatures, including those of the surety’s attorney-in-fact, witnesses, and a licensed insurance agent. This ensures that all parties are legally bound and acknowledge the agreement.

- The surety bond is optional for dealer license applicants. This is incorrect. The AR 0026 form is a mandatory requirement for obtaining a vehicle dealer license. If the bond is not filed correctly, the license cannot be issued.

- Any surety company can issue the bond. This is a misconception. The surety company must be authorized to do business in Michigan. Only then can they provide the necessary coverage and file the bond with the state.

- The bond is effective immediately upon signing. Actually, the bond must be effective at the time of filing the dealer license application, even if the license itself is issued later. This is crucial for ensuring continuous coverage.

- The bond is only to protect consumers. While it primarily safeguards consumers against fraud and misrepresentation by the dealer, it also serves to indemnify the state for any tax deficiencies incurred during the license period.

Understanding these misconceptions can help potential vehicle dealers comply with Michigan’s requirements for licensing and avoid unnecessary complications. It’s crucial to approach the AR 0026 form with accurate information to ensure a smooth application process.

Key takeaways

1. Correct Completion is Essential: Ensure that every section of the AR 0026 form is filled out accurately. If the form is not completed correctly, your dealer license application will not be processed.

2. List Required Information: Include the exact business name and address as they appear on your dealer license application. Individual owners and partners must also be listed alongside the business name.

3. Signatures are Mandatory: Collect all necessary signatures, including those of the Attorney-in-Fact for the surety, a witness to the Attorney-in-Fact, the licensed insurance agent, and the principal (dealer license applicant).

4. Continuous Bond Coverage: The bond is continuous, meaning it must be active when you submit your application, even if your license isn’t issued until later. Keep in mind that any claims paid will decrease your bond coverage.

5. Ensure Surety Compliance: Work with a surety company that is authorized to operate in Michigan. The Attorney-in-Fact signing for the surety must have the proper authorization, which must be attached to the bond.

Browse Other Templates

Coconut Bowl Hiring - Consent to inspections of company property used during employment.

Cms-1490s Printable Form - Ensure that claims submitted include the patient’s Medicare number exactly as it appears on the card.