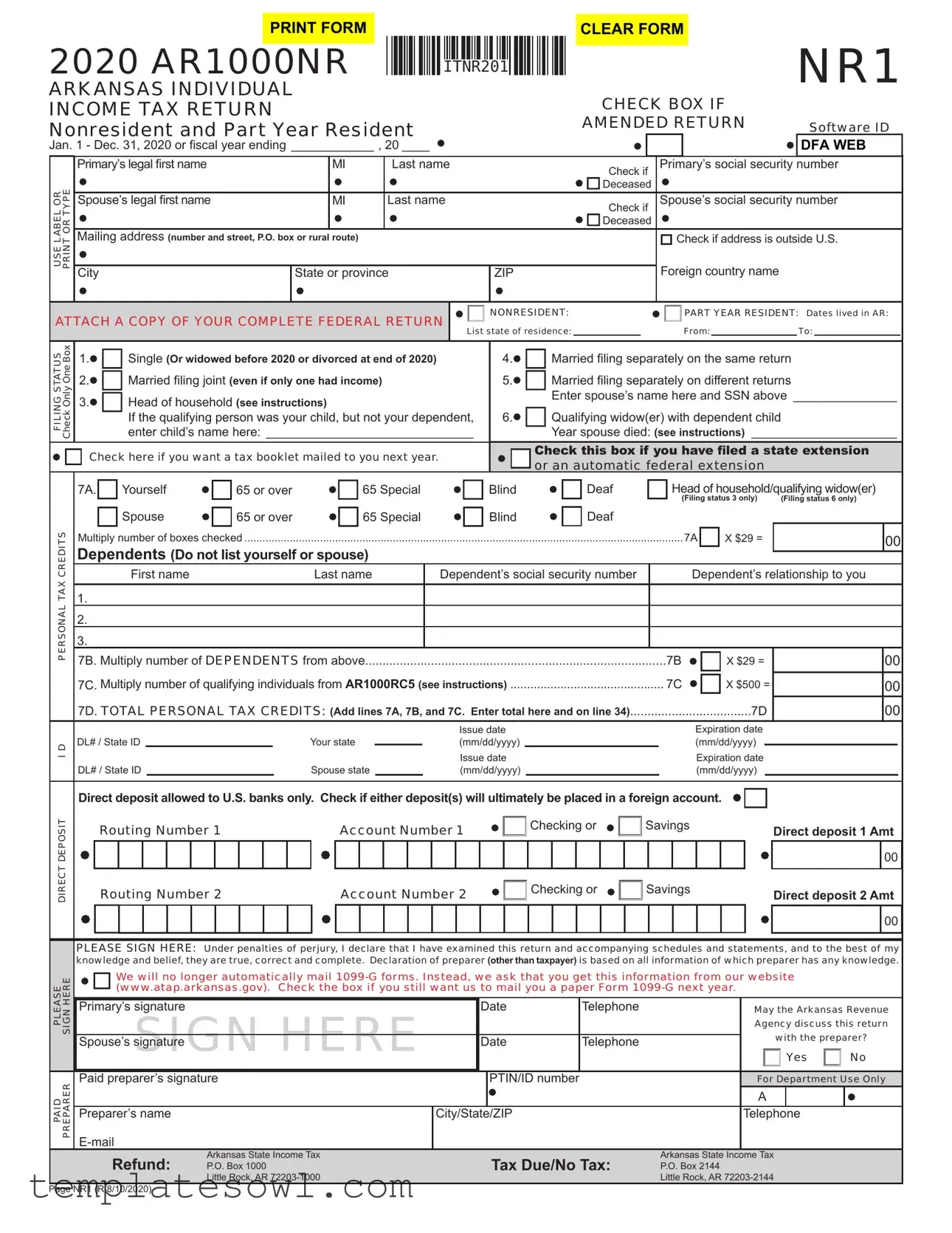

Fill Out Your Ar1000Nr Form

The AR1000NR form is essential for nonresidents and part-year residents of Arkansas when filing their state income tax returns. It offers a streamlined process for reporting income and calculating tax liabilities, ensuring that taxpayers can accurately reflect their financial situation for the year. This form requires basic personal information, such as names, social security numbers, and mailing addresses. Taxpayers need to select their filing status, which may include options like Single, Married Filing Jointly, or Head of Household. Income from various sources must be documented, including salaries, unemployment benefits, and other income types, which helps determine the total earnings for the fiscal year. The AR1000NR also includes sections for personal tax credits and deductions that can help lower tax obligations. Taxpayers can opt for direct deposit to receive refunds quickly or check a box for any preferred communication methods regarding their tax return. Understanding the details and requirements of the AR1000NR can significantly simplify the tax filing process for those living outside Arkansas or only residing in the state for part of the year.

Ar1000Nr Example

PRINT FORM

2020 AR1000NR

ARKANSAS INDIVIDUAL

ITNR201

ITNR201

CLEAR FORM

NR1

INCOME TAX RETURN

Nonresident and Part Year Resident

CHECK BOX IF |

|

AMENDED RETURN |

Software ID |

Jan. 1 - Dec. 31, 2020 or fiscal year ending ____________ , 20 ____

|

|

|

|

|

|

MI |

Last name |

|

|

|

|

Primary’s legal first name |

|

|

|||||||

TYPEOR |

|

|

|

|||||||

|

Spouse’s legal first name |

|

|

|

MI |

Last name |

|

|

||

OR |

|

|

|

|

|

|

||||

LABEL |

Mailing address (number and street, P.O. box or rural |

|

route) |

|

|

|

|

|||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

USE |

|

City |

|

State or province |

|

ZIP |

||||

|

|

|

||||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DFA WEB |

Check if |

Primary’s social security number |

||

Deceased |

|

|

|

Check if |

Spouse’s social security number |

||

Deceased |

|

|

|

|

|

Check if address is outside U.S. |

|

|

|

Foreign country name |

|

|

|

|

|

ATTACH A COPY OF YOUR COMPLETE FEDERAL RETURN

NONRESIDENT:

NONRESIDENT:

List state of residence:

PART YEAR RESIDENT: Dates lived in AR:

From:To:

FILING STATUS Check Only One Box

1. |

Single (Or widowed before 2020 or divorced at end of 2020) |

4. |

Married filing separately on the same return |

||

2. |

Married filing joint (even if only one had income) |

5. |

Married filing separately on different returns |

||

3. |

Head of household (see instructions) |

|

|

Enter spouse’s name here and SSN above _______________ |

|

|

|

|

|||

|

|

If the qualifying person was your child, but not your dependent, |

6. |

Qualifying widow(er) with dependent child |

|

|

|

enter child’s name here: ______________________________ |

|

|

Year spouse died: (see instructions) _____________________ |

|

Check here if you want a tax booklet mailed to you next year. |

|

|

&KHFNWKLVER[LI\RXKDYHÀOHGDVWDWHH[WHQVLRQ |

|

|

|

|

|||

|

|

|

or an automatic federal extension |

||

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL TAX CREDITS

DIRECT DEPOSITI D

PLEASE SIGN HERE

7A. |

|

Yourself |

|

65 or over |

|

|

65 Special |

|

|

Blind |

|

Deaf |

|

|

Head of household/qualifying widow(er) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deaf |

|

|

(Filing status 3 only) |

(Filing status 6 only) |

|||||

|

|

Spouse |

|

65 or over |

|

|

65 Special |

|

|

Blind |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Multiply number of boxes checked |

|

|

|

|

|

|

|

|

|

|

|

|

7A |

|

X $29 = |

|

00 |

|||||||||

Dependents (Do not list yourself or spouse) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

First name |

|

|

|

Last name |

Dependent’s social security number |

|

|

Dependent’s relationship to you |

||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.......................................................................................7B. Multiply number of DEPENDENTS from above |

|

|

|

|

|

|

|

|

7B |

|

X $29 = |

|

00 |

|||||||||||||

7C. Multiply number of qualifying individuals from AR1000RC5 (see instructions) |

|

|

|

|

7C |

|

X $500 = |

|

00 |

|||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||

7D. TOTAL PERSONAL TAX CREDITS: (Add lines 7A, 7B, and 7C. Enter total here and on line 34) |

|

|

|

|

7D |

|

00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Issue date |

|

|

|

|

Expiration date |

|

|

|

||||||

DL# / State ID |

|

|

|

|

Your state |

|

|

(mm/dd/yyyy) |

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

||||||||

DL# / State ID |

|

|

|

|

Spouse state |

|

|

Issue date |

|

|

|

|

Expiration date |

|

|

|

||||||||||

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

||||||||||

Direct deposit allowed to U.S. banks only. Check if either deposit(s) will ultimately be placed in a foreign account.

Routing Number 1 |

Account Number 1 |

Checking or |

Savings |

Direct deposit 1 Amt |

|

|

|||

|

|

|

|

00 |

Routing Number 2 |

Account Number 2 |

Checking or |

Savings |

Direct deposit 2 Amt |

|

|

|

|

00 |

PLEASE SIGN HERE: Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

We will no longer automatically mail

|

Primary’s signature |

Date |

Telephone |

May the Arkansas Revenue |

||||

|

SIGN HERE |

|

|

|

|

Yes |

|

No |

|

|

|

|

Agency discuss this return |

||||

|

Spouse’s signature |

Date |

Telephone |

|

with the preparer? |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s signature

PTIN/ID number

For Department Use Only

PREPARER |

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

PAID |

|

|

|

|

|

|

|

Preparer’s name |

|

City/State/ZIP |

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

Refund: |

Arkansas State Income Tax |

Tax Due/No Tax: |

Arkansas State Income Tax |

|||

|

P.O. Box 1000 |

P.O. Box 2144 |

|||||

|

|

Little Rock, AR |

|

Little Rock, AR |

|||

Page NR1 (R 8/10/2020)

ITNR202

ITNR202

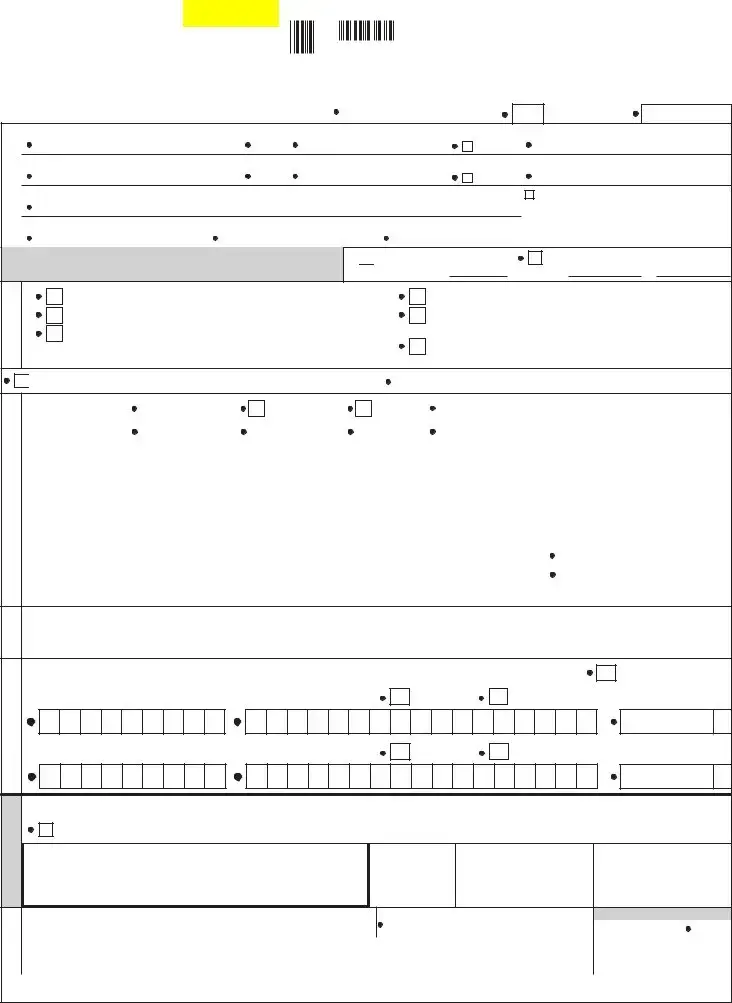

NR2

Primary SSN _______-

|

|

ROUND ALL AMOUNTS TO WHOLE DOLLARS |

|

|

|

|

|

(A) Primary/Joint |

(B) Spouse’s Income |

(C) |

Arkansas |

|||||||||||||||||

2(s)/1099(s) |

|

|

|

|

|

|

|

Income |

Status 4 Only |

|

Income Only |

|||||||||||||||||

8. |

Wages, salaries, tips, etc: (Attach |

|

|

|

|

|

|

8 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

9. |

Military pay: |

Primary |

|

|

00 |

|

Spouse |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

10. |

Interest income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

10 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

11. |

Dividend income: (If over $1,500, Attach AR4) |

|

|

|

|

|

|

11 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

of W- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12. |

Alimony and separate maintenance received: |

|

|

|

|

|

|

12 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

on top |

13. |

Business or professional income: (Attach federal Schedule C) |

|

|

|

13 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||

14. |

Capital gains/(losses) from stocks, bonds, etc: (See instr. Attach federal Schedule D) |

|

|

14 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||||

check |

15. |

Other gains or (losses): (Attach federal Form 4797 and/or AR4684 if applicable) |

|

|

|

15 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||

16. |

|

|

|

16 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||||

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Military retirement: Primary |

|

|

|

00 |

|

Spouse |

|

|

|

00 |

|

|

00 |

|

|

00 |

|

00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18A.Primary employer pension plan(s)/qualified IRA(s):(Attach all 1099Rs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Attach |

$Less6,000 |

18A |

|

|

|

00 |

|

|

|

|

|

|

00 |

|||||||||||||||

/ |

Gross distribution |

|

|

00 |

Taxable amt |

|

|

00 |

|

|

|

|

|

|

|

|

|

|||||||||||

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

18B.Spouse employer pension plan(s)/qualified IRA(s): |

(Attach all 1099Rs) |

|

$Less6,000 |

|

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||||

2(s)/1099(s) |

Gross distribution |

|

|

00 |

Taxable amt |

|

|

00 |

18B |

|

|

|

|

|

|

|

|

|||||||||||

19. |

|

|

|

|

|

|

|

|

|

|

|

.......... |

|

|

19 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

|

Rents, royalties, partnerships, estates, trusts, etc.: (Attach federal Schedule E) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

20. |

Farm income: (Attach federal Schedule F) |

|

|

|

|

|

|

20 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

21. |

Unemployment: Primary/Joint |

|

|

|

|

00 |

Spouse |

|

|

|

00 |

21 |

|

00 |

|

|

00 |

|

00 |

|||||||||

W- |

|

|

|

|

|

|

|

|

||||||||||||||||||||

22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

|

Other income/depreciation differences: (Attach Form |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|||||||||||||||

Attach |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

23. |

TOTAL INCOME: (Add lines 8 through 22) |

|

|

|

|

|

|

23 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||

24. |

TOTAL ADJUSTMENTS: (Attach Form AR1000ADJ) |

|

|

|

24 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

25. |

ADJUSTED GROSS INCOME: (Subtract line 24 from line 23) |

|

|

|

25 |

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

||||||||||

|

26. |

Select tax table: (Select only one) |

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

27. |

Low income table ($0), For low income qualifications see line 26 instructions |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

COMPUTATION |

|

Standard deduction ($2,200 or $4,400 for filing status 2 only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Itemized deductions (Attach AR3) |

|

|

|

|

|

|

27 |

|

|

|

|

00 |

|

|

|

00 |

|

|

|

||||||||

28. |

NET TAXABLE INCOME: (Subtract line 27 from line 25) |

|

|

|

28 |

|

|

|

|

00 |

|

|

|

00 |

|

|

|

|||||||||||

29. |

TAX: (Enter tax from tax table) |

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

00 |

|

|

|

00 |

|

|

|

|||||

30. |

Combined tax: (Add amounts from line 29, columns A and B) |

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

00 |

||||||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

31. |

Enter tax from Lump Sum Distribution Averaging Schedule: (Attach AR1000TD) |

.............................................................................. |

|

|

|

|

|

|

|

|

|

31 |

|

|

00 |

|||||||||||||

|

32. |

Additional tax on IRA and qualified plan withdrawal and overpayment: (Attach federal Form 5329, if required) |

|

|

32 |

|

|

00 |

||||||||||||||||||||

|

33. |

...........................................................................................................................................TOTAL TAX: (Add lines 30 through 32) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

00 |

||||||||

CREDITS |

34. |

Personal tax credit(s): (Enter total from line 7D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

00 |

||||||||

35. |

Child care credit: (20% of federal credit allowed; Attach federal Form 2441) |

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

00 |

||||||||||||

36. |

Other credits: (Attach AR1000TC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

00 |

||||||

TAX |

37. |

TOTAL CREDITS: (Add lines 34 through 36) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

00 |

||||||||

38. |

NET TAX: (Subtract line 37 from line 33. If line 37 is greater than line 33, enter 0) |

...................................................................................... |

|

|

|

|

|

|

|

|

|

|

38 |

|

|

00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

PRORATION |

38A.Enter the amount from line 25, Column C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38A |

|

|

00 |

|||||||||

38B.Enter the total amount from line 25, Columns A and B: |

|

|

|

|

|

|

|

|

|

|

|

38B |

|

|

00 |

|||||||||||||

38C.Divide line 38A by 38B: (See instructions) |

|

|

|

|

|

|

|

|

|

38C |

|

|

|

|

|

|

|

|

||||||||||

.................................................................................................38D.APPORTIONED TAX LIABILITY: (Multiply line 38 by line 38C) |

|

|

|

|

|

|

|

|

|

|

|

38D |

|

|

00 |

|||||||||||||

|

39. |

Arkansas income tax withheld: (Attach state copies of |

|

|

|

|

|

|

|

|

|

|

39 |

|

|

00 |

||||||||||||

|

40. |

Estimated tax paid or credit brought forward from 2019: |

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

00 |

|||||||||||

PAYMENTS |

41. |

Payment made with extension: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

|

00 |

||||||||

42. |

AMENDED RETURNS ONLY - Previous payments: (See instructions) |

....................................................................................... |

|

|

|

|

|

|

|

|

|

|

42 |

|

|

00 |

||||||||||||

43. |

Early childhood program: Certification number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

00 |

||||||||

|

(20% of federal credit; Attach federal Form 2441 and Form AR1000EC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

44. |

TOTAL PAYMENTS: (Add lines 39 through 43) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

45. |

AMENDED RETURNS ONLY - Previous refund: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

00 |

|||||||||||

|

46. |

Adjusted total payments: (Subtract line 45 from line 44) |

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

00 |

|||||||||||

DUE |

47. |

AMOUNT OF OVERPAYMENT/REFUND: (If line 46 is greater than line 38D, enter difference) |

|

|

47 |

|

|

00 |

||||||||||||||||||||

48. |

Amount to be applied to 2021 estimated tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

48 |

|

|

|

00 |

|

|

|

|

|

|||||||||||

TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

49. |

........................................................Amount of |

|

|

|

|

|

49 |

|

|

|

00 |

|

|

|

|

|

||||||||||||

OR |

50. |

AMOUNT TO BE REFUNDED TO YOU: (Subtract lines 48 and 49 from line 47) |

..................................................... |

|

|

|

|

|

REFUND |

50 |

- |

|

00 |

|||||||||||||||

REFUND |

51. |

AMOUNT DUE: (If line 46 is less than line 38D, enter difference; If over $1,000, continue to 52A) |

TAX DUE |

51 |

/ |

|

00 |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

52A.UEP: Attach Form AR2210 or AR2210A. If required, enter exception in box 52A |

|

|

|

|

Penalty 52B |

|

|

|

00 |

|

|

|

|

|

||||||||||||||

52C. Add lines 51 and 52B: (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL DUE |

52C |

|

00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

PAY ONLINE: Please visit our secure site ATAP (Arkansas Taxpayer Access Point) at www.atap.arkansas.gov. ATAP allows taxpayers or their representatives to

log on, make payments and manage their account online. ATAP is available 24 hours. |

|

PAY BY CREDIT CARD: (See instructions) |

PAY BY MAIL: (See instructions) |

Page NR2 (R 3/2/2021)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The AR1000NR form serves as the Arkansas Income Tax Return for nonresidents and part-year residents, facilitating the accurate reporting of income earned within Arkansas during the tax year. |

| Filing Period | Taxpayers can file for the calendar year from January 1 to December 31 or for a fiscal year as indicated on the form. |

| Amendments | The form includes an option to indicate if it is an amended return, allowing for corrections to previous tax filings and accurate reporting of financial circumstances. |

| Required Attachments | Taxpayers must attach a complete copy of their federal tax return, which is essential for verifying income and tax credits claimed on the state return. |

| State Specific Law | The AR1000NR form adheres to the Arkansas Code Annotated, Title 26, which governs individual income tax regulations within the state. |

Guidelines on Utilizing Ar1000Nr

Filling out the AR1000NR form is an essential step in fulfilling your income tax obligations if you are a nonresident or part-year resident of Arkansas. This form collects information about your income, filing status, and any deductions or credits you may be eligible for. Preparing this information ahead of time can simplify the process. Follow these steps closely to ensure accuracy and completeness.

- Gather necessary documents such as your complete federal tax return, W-2 forms, and any other income statements.

- Start by indicating the tax year at the top of the form: Jan. 1 - Dec. 31, 2020, or the fiscal year ending date in the respective field.

- Fill in your last name, primary legal first name, and the middle initial in the designated boxes.

- Provide your spouse’s information by entering their last name and legal first name.

- Enter your mailing address details, including street number, city, state, and ZIP code.

- If applicable, check the box stating if either taxpayer is deceased.

- Indicate if your address is outside the United States and specify the foreign country name if necessary.

- In the section regarding residency, indicate whether you are a nonresident or part-year resident and fill out the relevant details.

- Select your filing status by checking only one box that corresponds to your situation (such as “Married filing jointly” or “Single”).

- If applicable, enter your spouse's name and Social Security Number above.

- Check the boxes for personal tax credits that apply to you, including those related to age, blindness, and dependents.

- Take time to list any dependents along with their Social Security numbers and relationships to you in the appropriate fields.

- For direct deposit information, provide the routing and account number for your bank accounts and check the appropriate boxes for checking or savings accounts.

- Proceed to enter all income sources in the designated lines, making sure to attach supporting documents where indicated.

- Calculate your total income, adjustments, and adjusted gross income by following the prompts and entering the required calculations.

- Select the tax table that applies to your situation.

- Compute your net taxable income and overall tax obligations as specified on the form.

- Complete the credits section by entering any eligible credits and calculating the total.

- Finally, sign and date the form, ensuring that all provided information is correct and complete.

Once you've completed the form, double-check all sections for accuracy. A well-prepared tax return sets the stage for timely processing and minimizes potential discrepancies. Be sure to submit the AR1000NR form by the specified deadline to avoid any penalties.

What You Should Know About This Form

What is the AR1000NR form?

The AR1000NR form is the Arkansas Individual Income Tax Return specifically designed for nonresidents and part-year residents. Individuals who earn income in Arkansas but do not reside in the state full-time must use this form to report their taxable income. It also allows individuals who moved into or out of Arkansas during the tax year to declare their income for the time they were residents.

Who should file the AR1000NR form?

What information is required to complete the AR1000NR form?

To complete the AR1000NR form, taxpayers must provide personal information such as their name, address, and Social Security Number, as well as details about their filing status. Income details should include W-2 forms, 1099s, or other income documentation. Additionally, certain deductions, credits, and federal return information must be attached if applicable.

How do I submit the AR1000NR form?

The AR1000NR form can be submitted by mail or electronically through the Arkansas Taxpayer Access Point (ATAP) website. Taxpayers may choose to pay any taxes owed online, by credit card, or by mailing a check, depending on their preference. It is important to keep a copy of the form for personal records.

What if I am filing an amended AR1000NR form?

If you need to amend your AR1000NR form, you should check the box indicating it is an amended return. This allows the Arkansas Revenue Agency to process your updates correctly. Attach any necessary documentation that supports the changes made, and ensure that the amended return is filed before the appropriate deadline to avoid penalties.

Common mistakes

Completing the AR1000NR form is a crucial step for non-residents filing their Arkansas income tax returns. Yet, many individuals stumble on some common pitfalls that can lead to delays or complications. One major mistake is forgetting to include a copy of the complete federal return. This requirement is not just a formality; it serves as the cornerstone for verifying income, deductions, and credits claimed. Without it, the state might question your reported income and could potentially reject your return altogether.

Another common misstep is neglecting the income reporting section. When filling out the various income lines, ensuring that every applicable source is included is essential. For instance, wage income should be reported accurately, and any income from self-employment needs to be documented in detail. Failing to provide adequate information can lead to discrepancies and unwanted tax liabilities. Moreover, ensuring that you are using the correct amounts, especially in regard to taxable IRA distributions and capital gains, can make a meaningful difference in your overall tax situation.

It is also important to properly select your filing status on the form. Many individuals mistakenly select an inappropriate status, thinking it will not significantly alter their tax situation. However, the differences in tax liabilities between statuses such as "Married Filing Jointly" and "Married Filing Separately" can be substantial. An incorrect selection can lead to inaccuracies in your tax calculation and might trigger unnecessary scrutiny from tax authorities.

Finally, failing to sign and date the form or the preparer’s signature is a surprisingly common error. This small oversight can render a completed return invalid, as signatures serve as declarations of the accuracy of the information provided. Moreover, neglecting to provide contact information for any preparer involved complicates communication with tax authorities if questions arise. Overall, careful attention to these details greatly enhances the likelihood of a smooth filing process and minimizes any risk of complications down the line.

Documents used along the form

The AR1000NR form is crucial for individuals filing their income tax returns in Arkansas, especially for non-residents and part-year residents. However, completing this form often necessitates the submission of other important documents to ensure compliance and accuracy. Below is a list of additional forms you may need to submit alongside the AR1000NR, each playing a significant role in the tax filing process.

- Federal Income Tax Return (Form 1040): This federal form is required for calculating total income and federal tax liability. A copy of this return must be submitted with the AR1000NR to provide a comprehensive view of your income and expenses.

- W-2 Form: Issued by employers, the W-2 Form details wages, tips, and other compensation received during the year. Attach copies from all employers to ensure accurate reporting of income on your state tax return.

- Form AR1000ADJ (Adjustment Form): This form helps report adjustments to your income, reductions, or additional credits. If applicable, it ensures that your adjusted gross income is accurately reflected on the AR1000NR.

- Form AR1000TC (Tax Credit Form): If you qualify for any tax credits, this form is necessary for reporting them. Proper documentation of credits can significantly affect your total tax obligation.

- Form AR1000EC (Early Childhood Program Credit): This form allows for a credit related to early childhood education programs. If you participated in such programs, include this form to claim the credit on top of your tax return.

Ensuring that all necessary documents are included with the AR1000NR is essential for a smooth tax filing process. These additional forms support your claims and enhance the accuracy of your tax return, potentially leading to a faster processing time. Remember to double-check that all forms are signed and dated before submission to avoid unnecessary delays.

Similar forms

- Form 1040: This is the standard individual income tax return form used by residents of the U.S. It requires taxpayers to report their income, deductions, and credits. Like the AR1000NR, it includes similar sections for income types and deductions.

- Form 1040NR: This form is specifically for non-resident aliens in the U.S. It shares the same purpose of reporting income earned in the country. Both forms collect similar information, including income earned, deductions, and filing status.

- Form 1065: Used for partnership income, this form allows partnerships to report their income, deductions, gains, and losses. Similar to the AR1000NR, it features detailed sections for various types of income and expenses.

- Form 8862: This form serves as a request for the reinstatement of eligibility to claim the Earned Income Credit. Both forms address tax credits and require detailed information for proper assessment and eligibility verification.

Dos and Don'ts

Things To Do:

- Read all instructions carefully before starting to fill out the form.

- Provide accurate information. Double-check your social security number and financial details.

- Use blue or black ink when completing the form to ensure legibility.

- Sign and date the form in the designated areas to validate your submission.

- Keep a copy of the completed form for your records.

Things Not To Do:

- Do not leave any applicable fields blank. Fill in all required information.

- Avoid using pencil or non-standard ink colors, as they can be difficult to read.

- Do not submit the form without attaching your complete federal return.

- Do not forget to check the correct filing status box based on your situation.

- Do not ignore the deadlines for submission; submit on time to avoid penalties.

Misconceptions

Here are ten common misconceptions about the AR1000NR form:

- Nonresidents cannot file the AR1000NR: Many people believe that only Arkansas residents can file this form. However, nonresidents and part-year residents can also use it to report income earned in Arkansas.

- The AR1000NR can be filed without attaching a federal return: Some assume it's unnecessary to include a federal return. In reality, a complete copy of the federal return must accompany the AR1000NR.

- Filing status is optional: Some assume they can skip reporting their filing status. However, you must select one filing status on the form to determine your tax obligations accurately.

- Dependents must reside in Arkansas: There is a misconception that all claimed dependents must live in Arkansas. You may claim dependents that live elsewhere as long as they meet the federal dependency requirements.

- Direct deposit is not available for nonresidents: Some believe that nonresidents cannot use direct deposit options. This is incorrect; nonresidents can opt for direct deposit if they have U.S. bank accounts.

- Only self-employed individuals use the AR1000NR: Some think that this form is exclusively for self-employed individuals. In fact, anyone earning income in Arkansas, regardless of employment type, may need to use it.

- There are no tax credits available for nonresidents: Many individuals believe nonresidents do not qualify for any tax credits. However, certain personal tax credits do apply to nonresidents filing the AR1000NR.

- It's impossible to amend the AR1000NR: Some believe that once the AR1000NR is submitted, it cannot be changed. You can amend your return by filing the AR1000NR again, marking it as an amended return.

- The deadline is the same for everyone: Some people think the deadline for filing the AR1000NR is uniform for all. In reality, deadlines may vary, especially for those with extensions.

- Filing electronically is not an option: There's a common belief that paper filing is the only method for submitting the AR1000NR. In fact, many taxpayers can file electronically, which can expedite processing.

Key takeaways

Here are some key takeaways about filling out and using the AR1000NR form:

- Understand Your Residency Status: Determine if you are a nonresident or a part-year resident of Arkansas before filling out the form.

- File All Necessary Documents: Attach a complete copy of your federal tax return to ensure your state filing is accurate.

- Choose Your Filing Status: Select your appropriate filing status carefully, as it affects your tax calculations.

- Check for Tax Credits: Review your eligibility for personal tax credits, which can reduce your tax burden.

- Accurate Income Reporting: Ensure you accurately report all sources of income. Double-check for W-2s and 1099s.

- Utilize Direct Deposit: If expecting a refund, consider opting for direct deposit to receive it faster.

- Sign and Date: Don’t forget to sign and date your return. Unsigned forms will not be processed.

- Understand Payment Options: Familiarize yourself with options for making payments, including online, by credit card, or by mail.

Browse Other Templates

Rental Charge Documentation Form - Part C identifies any additional charges that may accompany rent payments.

Clark Atl - The opportunity for counselors to express reservations allows for nuanced recommendations.