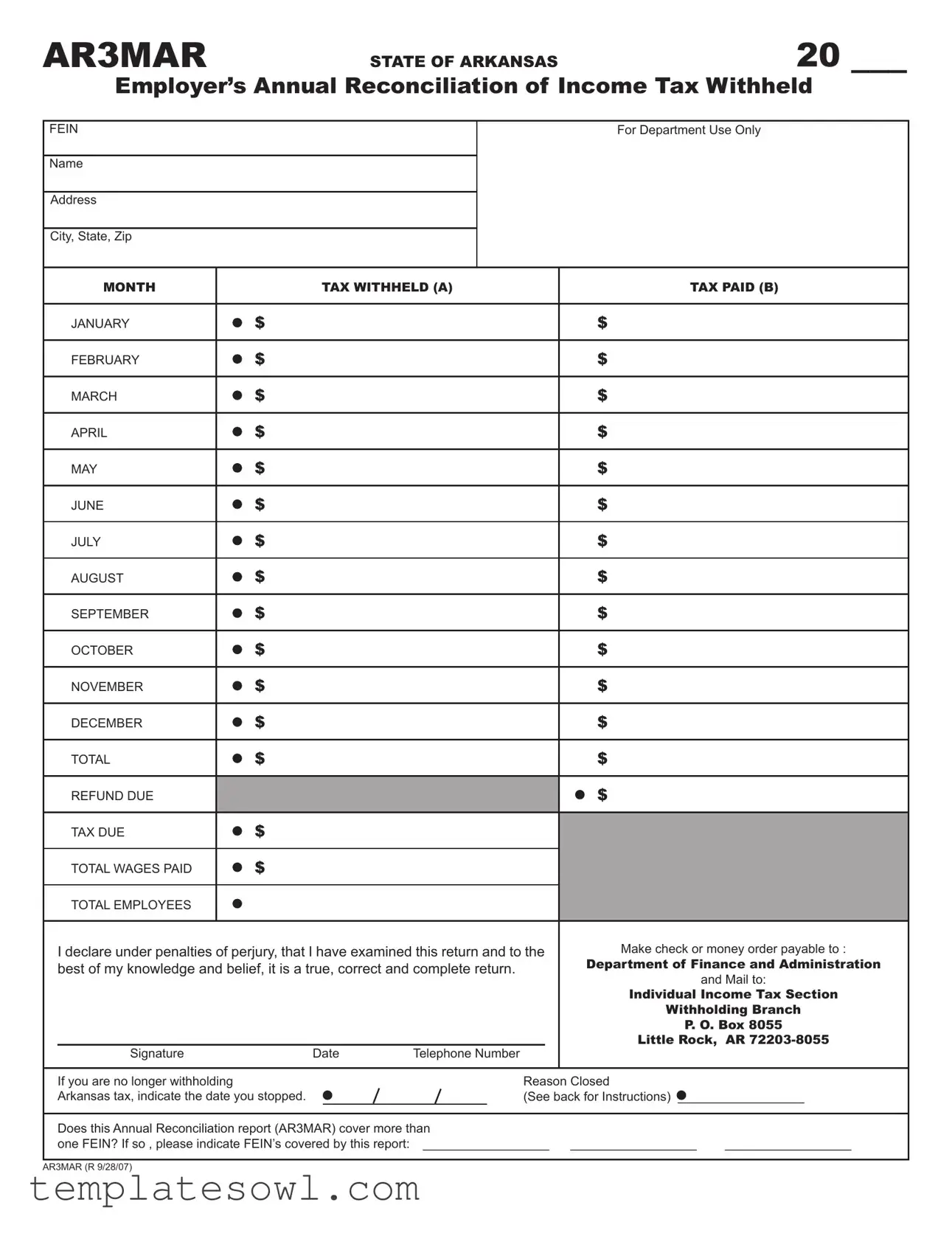

Fill Out Your Ar3Mar Form

The AR3MAR form is a crucial document for employers in Arkansas, playing an integral role in the annual reconciliation of income tax withheld from employee wages. Each year, businesses are required to complete this form to report the amount of state tax withheld on a monthly basis, as well as the corresponding amounts paid to the state. The form includes columns to record monthly figures for tax withheld and tax paid, ultimately leading to totals for the entire year. Employers must also declare the total wages paid and the number of employees they had at the end of the reporting period. Accuracy is vital; discrepancies between the total tax withheld and the total tax paid can lead to either a tax due or a refund. Employers must submit the form by February 28 of the year following the tax year to comply with state regulations. Additionally, if an employer has stopped withholding Arkansas tax, they must indicate the date this occurred along with the reason for discontinuation. This form serves to ensure transparency and accountability in payroll practices, ultimately benefiting both the state and the employers who adhere to its guidelines.

Ar3Mar Example

AR3MAR |

STATE OF ARKANSAS |

20 ___ |

Employer’s Annual Reconciliation of Income Tax Withheld

FEIN

Name

Address

City, State, Zip

For Department Use Only

|

MONTH |

|

TAX WITHHELD (A) |

TAX PAID (B) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

JANUARY |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEBRUARY |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARCH |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APRIL |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAY |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JUNE |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JULY |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUGUST |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEPTEMBER |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OCTOBER |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOVEMBER |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECEMBER |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFUND DUE |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX DUE |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL WAGES PAID |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EMPLOYEES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I declare under penalties of perjury, that I have examined this return and to the |

Make check or money order payable to : |

|||||||||

best of my knowledge and belief, it is a true, correct and complete return. |

Department of Finance and Administration |

|||||||||

and Mail to: |

||||||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Individual Income Tax Section |

||

|

|

|

|

|

|

|

|

Withholding Branch |

||

|

|

|

|

|

|

|

|

P. O. Box 8055 |

||

|

|

|

|

|

|

|

|

Little Rock, |

AR |

|

|

Signature |

Date |

Telephone Number |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

If you are no longer withholding |

|

|

|

Reason Closed |

|

|||||

Arkansas tax, indicate the date you stopped. |

|

(See back for Instructions) __________________ |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Does this Annual Reconciliation report (AR3MAR) cover more than |

|

|

||||||||

one FEIN? If so , please indicate FEIN’s covered by this report: |

__________________ |

__________________ |

__________________ |

|||||||

AR3MAR (R 9/28/07)

INSTRUCTIONS FOR COMPLETING FORM AR3MAR

THIS PAGE IS YOUR ANNUAL RECONCILIATION OF MONTHLY WITHHOLDING. PLEASE READ

THE FOLLOWING INSTRUCTIONS AND COMPLETE THE FORM ON THE REVERSE SIDE.

(A)An Annual Reconciliation form must be completed and returned to our office by February 28 of the year immedi- ately following the tax year you are filing.

(B)For each month listed, fill in the actual amount of Arkansas tax withheld in Column A and the net amount of with- holding tax actually paid in Column B. The net amount paid is the total amount paid minus refunds you may have received for certain periods.

(C)Total the amounts in Column A for the whole year and write the total in the appropriate box. This amount should equal the total amount of Arkansas Tax withheld on the

(D)List total amount of wages paid and the total number of employees in the appropriate boxes.

(E)If the total amount of tax paid in Column B is greater than the total amount withheld in Column A, you will receive a refund. List this amount in the Refund box. If the total amount withheld in Column A is greater than the total amount paid in Column B, then you owe an additional amount of tax. List this amount in the Tax Due box and attach a check for that amount.

(F)DATE CLOSED: Enter the date the business closed or stopped withholding Arkansas Taxes. This will close your withholding account with the State of Arkansas until you

(G)REASON CLOSED: Enter the number of the appropriate reason.

1.Business discontinued

2.Business transferred to successor

3.Change in organization

4.Discharged all employees but continuing business

5.Other

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The AR3MAR form is used for the annual reconciliation of income tax withheld by employers in Arkansas. |

| Filing Deadline | Employers must submit the AR3MAR form by February 28 of the year following the tax year being reported. |

| Payment Instructions | Checks or money orders should be made payable to the Department of Finance and Administration and sent to the Individual Income Tax Section in Little Rock. |

| Legal Reference | The AR3MAR form is governed by Arkansas state law on income withholding taxation. |

Guidelines on Utilizing Ar3Mar

Completing the AR3MAR form requires attention to detail and accuracy. By the end of this process, you will have submitted your Employer’s Annual Reconciliation of Income Tax Withheld to the State of Arkansas. Follow these straightforward steps to ensure your form is filled out correctly.

- Enter the tax year in the designated "20 ___" space at the top of the form.

- Provide your Employer Identification Number (FEIN), name, address, city, state, and zip code in the specified fields.

- For each month from January to December, fill in the actual amount of Arkansas tax withheld in the "TAX WITHHELD (A)" column.

- Next, record the net amount of withholding tax actually paid in the "TAX PAID (B)" column. Make sure to adjust for any refunds received.

- Sum the amounts in the "TAX WITHHELD (A)" column and enter the total in the appropriate box labeled "TOTAL." Ensure that this figure matches the total amount withheld reported on the W-2 forms.

- Provide the total amount of wages paid during the year and the total number of employees in their respective boxes.

- If the amount paid in "TAX PAID (B)" exceeds the total withheld in "TAX WITHHELD (A)," indicate the refund due in the designated box. Conversely, if "TAX WITHHELD (A)" is greater, enter the additional tax amount due in the "TAX DUE" box and include a check for that amount.

- If you are no longer withholding Arkansas tax, complete the "DATE CLOSED" field to indicate when this occurred.

- In the "REASON CLOSED" section, select the number corresponding to your reason for stopping withholding from the provided options.

- Sign and date the form. Include your telephone number for any inquiries that may arise.

- If applicable, indicate whether the AR3MAR report covers more than one FEIN by listing them in the provided space.

Once you have completed these steps, ensure that the form is accurate and then mail it to the address provided for the Arkansas Department of Finance and Administration. Make sure to keep a copy for your records. This process helps maintain compliance with state requirements and facilitates the proper handling of your tax obligations.

What You Should Know About This Form

What is the purpose of the AR3MAR form?

The AR3MAR form serves as the Employer’s Annual Reconciliation of Income Tax Withheld for the State of Arkansas. Employers are required to report the total amount of income tax withheld from employees throughout the year and reconcile it with the total tax paid to the state. This helps ensure that the correct amount of tax is collected and reported.

When is the AR3MAR form due?

The form must be completed and submitted to the Arkansas Department of Finance and Administration by February 28 of the year following the tax year you are reporting. Timely submission is essential to avoid penalties.

How should I fill out the AR3MAR form?

To complete the form, enter the amounts of Arkansas tax withheld for each month in Column A. In Column B, report the net amount of withholding tax actually paid. Total these amounts for the year and write them in the designated boxes. It’s important that these totals match the amounts reflected on employee W-2 forms.

What if I owe money or am due a refund?

If the total tax paid in Column B exceeds the total amount withheld in Column A, you will receive a refund. Enter this refund amount in the Refund box. Conversely, if the amount withheld is greater than the tax paid, you will owe the difference. In this case, list the owed amount in the Tax Due box and include a check for that amount with your submission.

What information is needed regarding wages and employees?

It's crucial to report the total amount of wages paid to employees and the total number of employees in the designated sections on the form. This information provides the state with insight into your payroll and withholding practices.

What should I indicate if I am no longer withholding Arkansas tax?

If you have stopped withholding Arkansas income tax, you must indicate the date on which you ceased withholding. This step is necessary to close your withholding account with the state until you choose to re-register for withholding purposes.

Which reasons can I provide if my business has closed?

You must select a reason for closing your withholding account if applicable. The options include: 1) Business discontinued, 2) Business transferred to successor, 3) Change in organization, 4) Discharged all employees but continuing business, or 5) Other. Be sure to clearly indicate the reason on the form.

Does the AR3MAR form cover more than one FEIN?

If your annual reconciliation applies to multiple Federal Employer Identification Numbers (FEINs), you can list those additional FEINs on the form. This allows for a comprehensive report of all tax withheld under your various business accounts.

Common mistakes

Completing the AR3MAR form requires careful attention to detail. However, many individuals make common mistakes that can lead to errors or delays in processing. One frequent error is failing to report the correct amounts in the appropriate columns. In Column A, you must list the actual amounts of tax withheld for each month, and in Column B, the amounts paid. Miscalculating these figures can create discrepancies that could complicate your tax filing.

Another common mistake involves the totals. It's essential to accurately total the amounts in Column A for the entire year. This total should match the amount of Arkansas tax withheld on your W-2 forms. Forgetting this key detail can lead to further confusion when reconciling your tax obligations and may hinder your ability to receive any refunds.

Many people overlook the necessity of filling in the sections regarding total wages paid and the total number of employees. Leaving these boxes blank can raise red flags during review. State authorities use this information to ensure that all relevant employees are accounted for, which is crucial for accurate tax assessments.

When it comes to refund claims, a common pitfall is not understanding the relationship between the amounts listed in Columns A and B. If your total tax paid exceeds the amount withheld, you may be eligible for a refund. Failing to indicate this in the refund box, if applicable, can result in missing out on money that is rightfully owed to you.

It's also important to provide accurate information regarding your business's status. If you are no longer withholding Arkansas tax, be sure to indicate when you stopped. Some individuals forget to do this, which can lead to complications in handling your account with the state.

Additionally, failing to check if the reconciliation report covers multiple FEINs is another mistake that can complicate your filing process. If applicable, make sure to clearly indicate each FEIN covered by the report. Forgetting this can create misunderstandings about your tax obligations.

Last but not least, don't forget to sign and date the form before submitting it. A missing signature could result in the form being considered incomplete, leading to delays in processing. Paying attention to these details can make a significant difference in your experience and help you fulfill your tax obligations successfully.

Documents used along the form

The AR3MAR form is a vital document for employers in Arkansas, as it reconciles income tax withheld over the year. However, several other forms and documents are often used alongside it to ensure compliance with tax regulations. Understanding these documents can help streamline the process.

- W-2 Form: This form reports the total wages paid to each employee and the taxes withheld. Employers must provide W-2s to employees by January 31 each year, as it is essential for individual tax filings.

- 1040 Form: This is the individual income tax return form that employees use to report their earnings, including information from their W-2s. It's crucial for employees to accurately complete this form during tax season.

- 1099 Form: If an employer pays contractors or freelancers, they may need to issue a 1099 form. This form reports income paid to non-employees, which is also important for tax purposes.

- Form I-9: This is the Employment Eligibility Verification form. Employers must complete this form for every employee to verify their identity and employment authorization within the United States.

- Withholding Certificate (Form W-4): Employees complete this form to indicate their tax withholding preferences. It helps employers determine the right amount of income tax to withhold from employees’ paychecks.

- Payroll Records: While not a specific form, keeping accurate payroll records is crucial for compliance. Records should include details about wages paid, deductions made, and hours worked.

- State Tax Registration: This document confirms a business’s registration with the state for tax purposes. It is necessary for employers before they start withholding state income tax from employees.

By understanding these forms and documents, employers can better manage their tax responsibilities and ensure they comply with state and federal regulations. Staying organized will make the annual reconciliation process smoother and more efficient.

Similar forms

The AR3MAR form is crucial for employers in Arkansas as it facilitates the annual reconciliation of income tax withheld from employees. Several other forms and documents serve similar purposes in different contexts. Here are five such documents:

- W-2 Form (Statement of Earnings): The W-2 form summarizes an employee's total earnings and taxes withheld for the year. Similar to the AR3MAR, it provides a yearly overview of income tax withheld, ensuring that employees have the information necessary to file their own tax returns.

- Form 941 (Employer's Quarterly Federal Tax Return): Like the AR3MAR, Form 941 is used for reporting employment taxes. It is filed quarterly and includes details about federal income tax withheld, social security, and Medicare taxes. Both forms require meticulous accounting of taxes withheld and paid, though they serve different reporting periods.

- Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return): Form 940 is another annual document, focusing on unemployment taxes. While the AR3MAR centers around income tax withheld, both forms share the annual reconciliation objective and require clear, accurate reporting to the respective authorities.

- State Income Tax Withholding Form (varies by state): Each state has its own version of an income tax withholding reconciliation form. Like the AR3MAR, these forms allow employers to report and reconcile the amounts withheld from employees’ wages for state tax purposes. The underlying purpose remains consistent across states: to ensure accurate tax compliance.

- Form 1099-MISC (Miscellaneous Income): While primarily used for reporting payments to independent contractors, Form 1099-MISC and AR3MAR both relate to the accurate reporting of income. Though they serve different audiences, both demand careful record-keeping of payments and withholding for compliance with tax obligations.

Each of these documents plays a vital role in ensuring compliance with tax regulations, providing necessary information for both employers and employees. Understanding their similarities can enhance the clarity and accuracy of tax reporting practices.

Dos and Don'ts

When filling out the AR3MAR form, careful attention is crucial. Here are some guidelines to follow, as well as common pitfalls to avoid.

- Do check that all information is accurate before submitting the form.

- Do fill in the actual amounts for tax withheld each month.

- Do ensure that the total amounts in Column A match the amounts on the W-2 forms.

- Do submit the form by the deadline of February 28 each year.

- Do indicate the reason for closing your withholding account if applicable.

- Don't leave any sections blank unless they are not applicable to your situation.

- Don't forget to include a check for any taxes due with your submission.

Following these dos and don’ts can help ensure a smooth filing process. Take your time and verify each entry.

Misconceptions

Here are five common misconceptions about the AR3Mar form:

- All businesses need to file every year. Not all businesses are required to submit the AR3Mar form annually. If a business has not withheld Arkansas income tax for any part of the year, it may not need to file.

- The form is only for large employers. This is incorrect. Any employer who withholds Arkansas income tax from employee wages must complete the AR3Mar form, regardless of the size of the business.

- Your W-2 totals do not need to match. This is a misconception. The total amount withheld reported on the AR3Mar should align with the amounts listed on the W-2 forms provided to employees. Discrepancies can lead to issues with the state.

- You can file the form any time before the deadline. This is misleading. Although you can prepare the form at any time, it must be submitted by February 28 of the year following the tax year you are reporting. Late submissions may result in penalties.

- If taxes paid exceed taxes withheld, a refund is automatic. While it’s true that overpayments can lead to refunds, businesses must still accurately calculate and report these amounts to receive any refund. It’s not processed automatically without proper documentation.

Key takeaways

When filling out the AR3Mar form for the State of Arkansas, it is essential to ensure accuracy and compliance. Here are seven key takeaways that can guide you through the process:

- Deadline Awareness: The AR3Mar form must be submitted by February 28 of the year following the tax year being reported. Late submissions may result in penalties.

- Accurate Monthly Reporting: For each month, record both the amount of Arkansas tax withheld and the actual tax paid, subtracting any refunds from the total paid.

- Totaling for Accuracy: Ensure that the total amount of tax withheld throughout the year on the form matches what is reported on the W-2s issued to employees.

- Employee and Wage Reporting: Clearly state the total wages paid and the number of employees to provide a complete picture of the tax situation.

- Refunds and Taxes Due: If more tax was paid than withheld, report the refund amount. Conversely, if you owe money, list that amount and include a check for payment.

- Closure Information: If the business has ceased operations, include the date you stopped withholding and the reason for closure. This will help update your withholding account status with the State.

- Multiple FEIN Reporting: If the AR3Mar report covers more than one Federal Employer Identification Number (FEIN), all applicable numbers must be indicated on the form.

Completing the AR3Mar form accurately is crucial for maintaining compliance with state requirements. Ensuring that every detail is verified can prevent future complications.

Browse Other Templates

Oklahoma Traffic Collision Report - In cases of fatalities, proper documentation is especially important for legal investigations.

New York Sales Tax Exemption Certificate,Official Government Occupancy Tax Exemption Form,ST-129 Tax Exemption Application,Hotel Occupancy Exemption Certificate,State and Local Sales Tax Waiver Form,Government Employee Hotel Tax Exemption,Tax Exempti - A completed ST-129 form confirms that hotel charges are being paid by a government agency.

Bsa - Each participant must understand their role and responsibilities in activities.