Fill Out Your Arp 005 Form

The ARP 005 form serves as an essential tool for individuals looking to establish an Automatic Rollover Traditional IRA. This form is created when a retirement plan, as governed by the section of the Internal Revenue Code, automatically rolls over funds into an Individual Retirement Account when a participant fails to direct their distribution. It captures key information about the Account Owner, who must review and confirm the accuracy of the details provided, ensuring that their personal data, such as Social Security number and contact information, is correct. Additionally, the form requires the account owner to specify their preferences regarding account access and statements, allowing them to choose between online access or receiving paper statements. The designation of beneficiaries is another vital aspect; the Account Owner must fill out this section to indicate who will receive benefits in the event of their passing. Throughout the document, the responsibilities of both the Account Owner and the Custodian are delineated, ensuring clear expectations about account management and investment direction. Consequently, the ARP 005 form is not just a formality, but a foundational element for anyone looking to manage their retirement funds effectively with an Automatic Rollover IRA.

Arp 005 Example

2001 Spring Road, Suite 700

Oak Brook, IL 60523

877.682.4727 Telephone

630.368.5697 Fax

www.mtrustcompany.com

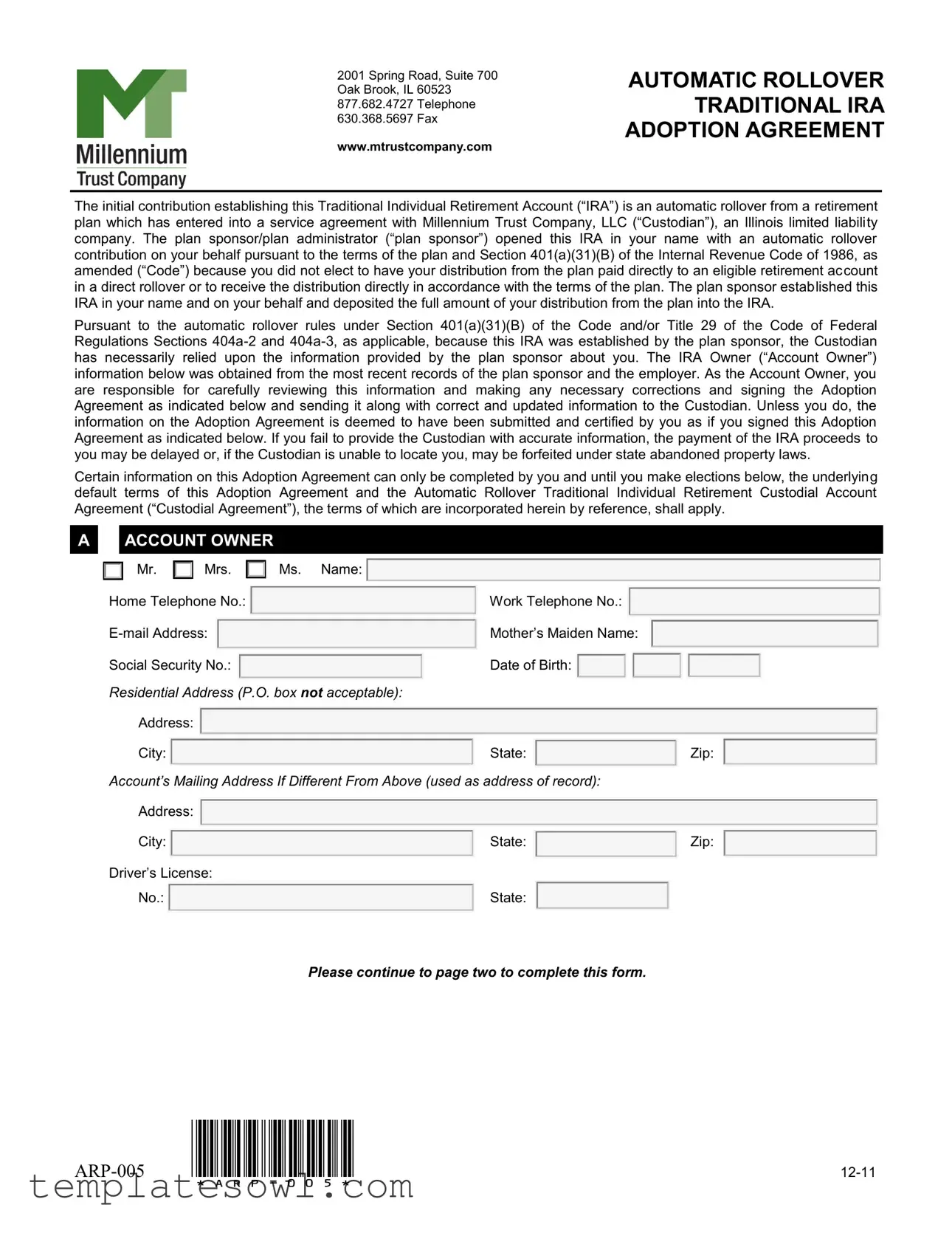

AUTOMATIC ROLLOVER TRADITIONAL IRA ADOPTION AGREEMENT

The initial contribution establishing this Traditional Individual Retirement Account (“IRA”) is an automatic rollover from a retirement plan which has entered into a service agreement with Millennium Trust Company, LLC (“Custodian”), an Illinois limited liability company. The plan sponsor/plan administrator (“plan sponsor”) opened this IRA in your name with an automatic rollover

contribution on your behalf pursuant to the terms of the plan and Section 401(a)(31)(B) of the Internal Revenue Code of 1986, as amended (“Code”) because you did not elect to have your distribution from the plan paid directly to an eligible retirement account

in a direct rollover or to receive the distribution directly in accordance with the terms of the plan. The plan sponsor established this IRA in your name and on your behalf and deposited the full amount of your distribution from the plan into the IRA.

Pursuant to the automatic rollover rules under Section 401(a)(31)(B) of the Code and/or Title 29 of the Code of Federal

Regulations Sections

information below was obtained from the most recent records of the plan sponsor and the employer. As the Account Owner, you are responsible for carefully reviewing this information and making any necessary corrections and signing the Adoption Agreement as indicated below and sending it along with correct and updated information to the Custodian. Unless you do, the information on the Adoption Agreement is deemed to have been submitted and certified by you as if you signed this Adoption Agreement as indicated below. If you fail to provide the Custodian with accurate information, the payment of the IRA proceeds to you may be delayed or, if the Custodian is unable to locate you, may be forfeited under state abandoned property laws.

Certain information on this Adoption Agreement can only be completed by you and until you make elections below, the underlying default terms of this Adoption Agreement and the Automatic Rollover Traditional Individual Retirement Custodial Account

Agreement (“Custodial Agreement”), the terms of which are incorporated herein by reference, shall apply.

A |

ACCOUNT OWNER

□Mr. □ Mrs. □ Ms. Name:

Home Telephone No.: |

Work Telephone No.: |

|

Mother’s Maiden Name: |

|

|

Social Security No.: |

Date of Birth: |

|

Residential Address (P.O. box not acceptable): |

|

|

Address: |

|

|

City: |

State: |

Zip: |

Account’s Mailing Address If Different From Above (used as address of record): |

|

|

Address: |

|

|

City: |

State: |

Zip: |

Driver’s License: |

|

|

No.: |

State: |

|

Please continue to page two to complete this form.

AUTOMATIC ROLLOVER TRADITIONAL IRA ADOPTION AGREEMENT, Page 2 of 3

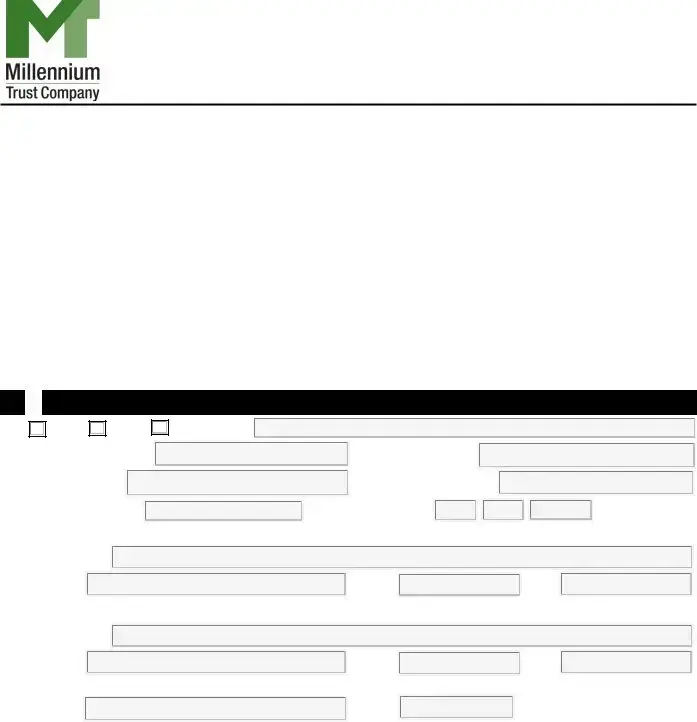

B |

ACCOUNT ACCESS AND STATEMENT PREFERENCE

Please indicate your preferences with respect to online account access

Prefer

I want online access to my account(s) and my statements.

I also want online Trading access.

Prefer

I want online access to my account(s) with online statements, and receive paper statements ($10.00 charge per statement) annually through the U.S. Mail.

I also want online Trading access

Decline 24 Hour Online Account Access and Receive Annual Statements in Mail

I decline online access and prefer to receive paper statements ($10.00 charge per statement) annually through the U.S. Mail.

C |

ACCOUNT BENEFICIARY INFORMATION

The designation of one or more beneficiaries to the IRA must be made by the Account Owner. If Custodian does not have a proper beneficiary designation on file at the time of the Account Owner’s death, the IRA will be paid as described in Article XII of

the Custodial Agreement. If you are married and designate a Primary Beneficiary other than your spouse, have your spouse sign the spousal consent below if you reside in one of the states listed below. If more than one primary or contingent beneficiary is designated, the assigned percentages must total 100% for all primary and 100% for all contingent beneficiaries, or the beneficiaries will be assigned equal percentages. Beneficiaries take hereunder only if they survive the Account Owner. Contingent Beneficiaries take hereunder only if all Primary Beneficiaries fail to survive the Account Owner. If multiple Primary or Contingent Beneficiaries are named, as to each Beneficiary that shall not survive the Account Owner, his or her share shall be distributed to the remaining Beneficiaries, Primary or Contingent as the case may be, in the relative proportions assigned. Additional beneficiary designations or changes must be made and submitted to Custodian via the proper form. I hereby make the following beneficiary designation. In the event of my death, pay benefits to the following named primary beneficiary(ies).

Full Name |

Relationship |

Soc Sec # |

Birth Date |

% to Beneficiary |

|

|

|

|

|

Primary Beneficiaries

Contingent Beneficiaries

Spousal Consent: Complete this section if (1) You are married and have designated a Primary Beneficiary other than your spouse; and (2) this IRA account includes property in which your spouse possesses a community property interest. As of January 1, 2012, community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.

I am the spouse of the Account Owner named above, I agree to my spouse’s naming of a Primary Beneficiary other than myself, and I acknowledge that I shall have no claim whatsoever against Millennium Trust for any payment to my spouse’s

beneficiary(ies).

Spouse’s Signature:

Spouse’s Name:

Please continue to page three to complete this form.

Date:

AUTOMATIC ROLLOVER TRADITIONAL IRA ADOPTION AGREEMENT, Page 3 of 3

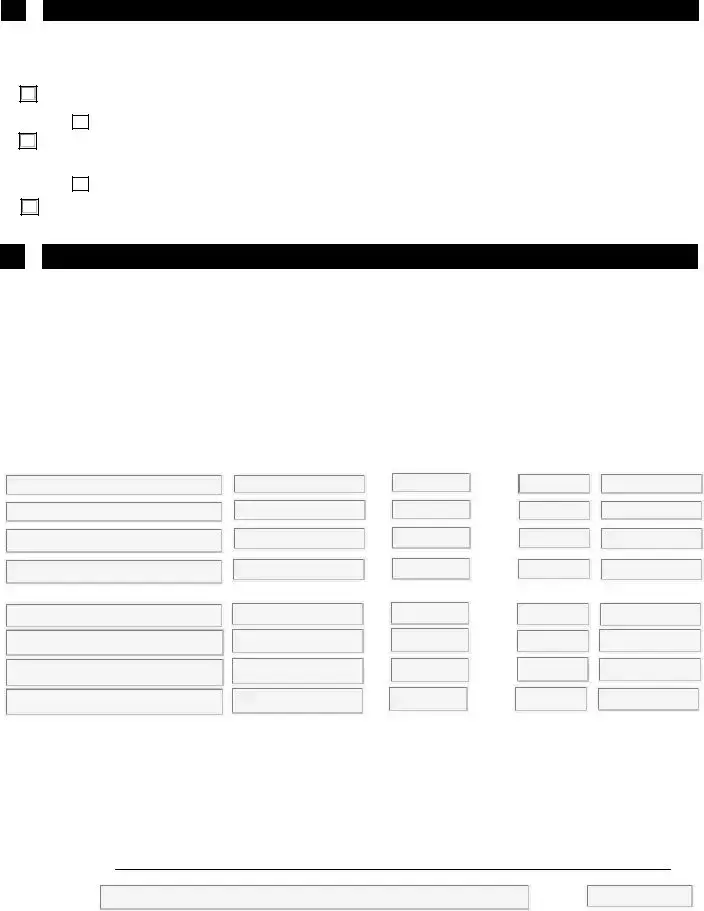

D |

ACKNOWLEDGEMENT

The IRA was opened and established by the plan sponsor in my name and on my behalf under Section 401(a)(31)(B) of the Code because I failed to make a distribution election, pursuant to the terms of the plan. I am no longer a participant in the plan and have full rights and authority as the Account Owner, including, without limitation, the right to enforce the terms of this Adoption Agreement and the Custodial Agreement. As the Account Owner, I acknowledge that I am responsible for the accuracy of the information contained on this Adoption Agreement, and I acknowledge that the Custodian will rely upon the information provided by the plan sponsor about me as accurate until such time as I provide written notice of any corrections or changes. If I do not provide any written notice or acknowledgement of receipt of this Adoption Agreement, I acknowledge that the Custodian will rely upon the information on this Adoption Agreement as if it was submitted and certified by me. I acknowledge that it is my sole responsibility to direct the investment of the assets of my IRA and that the Custodian shall have NO LIABILITY for any loss, damage, or tax, including a prohibited transaction tax, resulting from my failure to provide investment direction, or transactions executed by the Custodian based on directions received from me or my Investment Agent. I agree to hold the Custodian harmless for its actions hereunder which were directed by me or my Investment Agent, and for any inaction based upon my failure to provide investment direction to the Custodian. I will indemnify the Custodian for any and all claims and costs arising from transactions executed by the Custodian based on directions received from me or my Investment Agent and arising from inaction by the Custodian based upon my failure to provide investment direction, including but not limited to, court costs, attorney fees and other expenses incurred. I acknowledge that I am responsible for reading and understanding the Custodial Agreement and Disclosure Statement, and that I am responsible for the tax effects and

requirements noted therein. I acknowledge that I am responsible for meeting the requirement that future rollover contributions to the IRA must be made within sixty (60) days after I received an eligible distribution, if applicable, and that if I deposit a rollover contribution, I hereby elect to treat the deposit as such.

This IRA was opened and established by the |

|

|

|

Plan in the |

|

|

|

|

|

name of and on behalf of the Account Owner on |

|

pursuant to a services agreement with Custodian. |

||

|

|

|

|

|

E |

ACCOUNT OWNER CONFIRMATION

I confirm the accuracy of this Adoption Agreement (You will be deemed to have checked this box and signed below if you fail to return a signed copy of this Adoption Agreement to the Custodian.)

I submit changes to this Adoption Agreement.

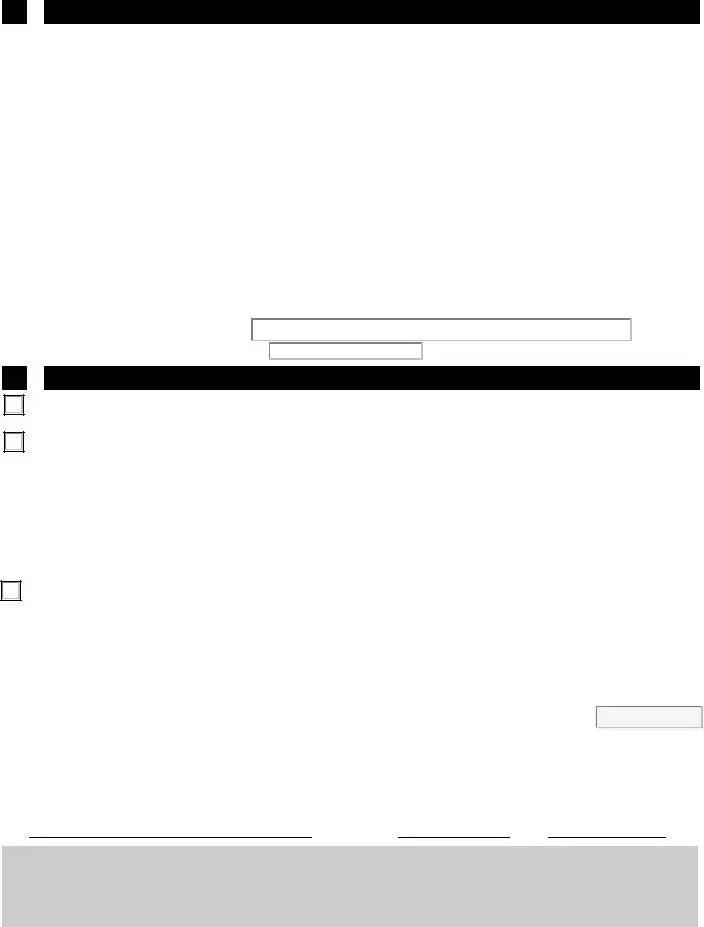

IMPORTANT USA PATRIOT ACT INFORMATION

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means to you: You must provide us with your name, residential address, social security number, date of birth and a clear copy of an unexpired government issued identification card (either a driver’s license, state ID, or passport)

before we can allow you to exercise control over your account. Additional documentation may be required for verification purposes in certain circumstances.

FOREIGN CITIZENS AND OTHER

Check here if you are a foreign citizen or other

U.S. CITIZENS OR OTHER U.S. PERSONS (INCLUDING A U.S. RESIDENT ALIEN)

Under penalties of perjury, I certify that: (1) the number shown on this form is my correct tax identification number; and (2) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding, or if so notified, such notice is no longer in effect; and (3) I am a U.S. citizen or other U.S. person (including a U.S. resident alien). The IRS does not require that I consent to any provisions of this document other than this certification to avoid backup withholding.

Account Owner (“Depositor”) Signature: |

|

Date: |

PLEASE SUBMIT A COPY OF YOUR UNEXPIRED GOVERNMENT ISSUED IDENTIFICATION CARD.

Accepted:

Millennium Trust Company, LLC

By:Account No.:Date:

FOR INTERNAL USE:

This Adoption Agreement and instructions for accessing the Custodial Agreement and Disclosure Statement were sent to the last known address of the IRA Owner as provided by the plan sponsor for review and acceptance on ____________. Any corrected or

updated information received by the Custodian from the IRA Owner will be updated in the Adoption Agreement and IRA records.

Form Characteristics

| Fact Title | Details |

|---|---|

| Form Name | Automatic Rollover Traditional IRA Adoption Agreement |

| Purpose | This form establishes a Traditional IRA via an automatic rollover from a retirement plan. |

| Governing Law | Section 401(a)(31)(B) of the Internal Revenue Code of 1986. |

| Custodian | The Custodian is Millennium Trust Company, LLC, an Illinois limited liability company. |

| Account Owner Responsibilities | The Account Owner must ensure the accuracy of their information and submit corrections if needed. |

| Beneficiary Designation | Account Owners must designate beneficiaries, and requirements differ based on marital status. |

| Fees | There is a $10 fee for each paper statement sent annually. |

Guidelines on Utilizing Arp 005

Filling out the ARP 005 form is an essential step in establishing your Automatic Rollover Traditional IRA. Ensure you carefully provide the required information, as any inaccuracies may delay your IRA processing. Follow the steps outlined below for a clear path to completion.

- Start by selecting your title: check either □Mr., □Mrs., or □Ms.

- Enter your Name in the designated field.

- Provide your Home Telephone No..

- Add your Work Telephone No.. (optional)

- Fill in your E-mail Address.

- Input your Mother’s Maiden Name for security purposes.

- Enter your Social Security No..

- Include your Date of Birth.

- Specify your Residential Address, ensuring it is not a P.O. box:

- Address:

- City:

- State:

- Zip:

- If your Account’s Mailing Address is different from above, provide that information:

- Address:

- City:

- State:

- Zip:

- Enter your Driver’s License No. and the State it was issued in.

- Proceed to confirm your preferences for Account Access and Statement Preference by checking one of the following options:

- Prefer 24-Hour Online Account Access with Annual Online Statements

- Prefer 24-Hour Online Access and Annual Statements in Mail

- Decline 24-Hour Online Account Access and Receive Annual Statements in Mail

- Provide your Beneficiary Information by listing your primary and contingent beneficiaries, ensuring percentages total 100% each.

- If married, complete the Spousal Consent section if designating a beneficiary other than your spouse.

- In the Acknowledgement section, read and confirm that you understand the information shared. Sign and date where indicated.

- Finally, confirm the accuracy of the Adoption Agreement by checking the appropriate box and adding your signature and date.

After completing the form, send it along with any required identification to the Millennium Trust Company. This ensures your IRA is set up accurately, and any future transactions are processed smoothly.

What You Should Know About This Form

What is the purpose of the ARP 005 form?

The ARP 005 form is used to establish an Automatic Rollover Traditional Individual Retirement Account (IRA) when an individual does not opt for a direct rollover or cash distribution from their retirement plan. This form is a formal agreement that allows for the transfer of funds from a qualified retirement plan to an IRA managed by Millennium Trust Company, LLC. It ensures compliance with specific IRS regulations governing automatic rollovers.

Who is the custodian for this IRA?

Millennium Trust Company, LLC serves as the custodian for this IRA. They are responsible for managing the account and ensuring that it complies with applicable laws and regulations. The custodian operates under a service agreement with the plan sponsor that opened the IRA on the account holder's behalf.

What information is required from the account owner?

The account owner must provide personal information, including their name, social security number, date of birth, and contact information. Additionally, the owner needs to designate beneficiaries and indicate preferences for account access and statement delivery. Accurate information is crucial to avoid delays in processing or payment of the IRA proceeds.

What happens if the information on the form is incorrect?

It is the account owner's responsibility to ensure the accuracy of the information provided on the ARP 005 form. If the information is incorrect and not updated, there can be significant consequences, including delayed payments or, in severe cases, forfeiture of the account under state abandoned property laws. The custodian will rely on the provided information until notified of any corrections.

How are beneficiaries designated on the form?

The account owner must explicitly name primary and contingent beneficiaries on the form. If the primary beneficiary is not the spouse, spousal consent is required in certain states. It’s essential for the account owner to ensure that the total percentages assigned to primary and contingent beneficiaries add up to 100%. This will help facilitate the smooth distribution of benefits in the event of the account owner's death.

What are the account access options available?

The form allows the account owner to choose between three options for account access and statement preferences. They can opt for 24-hour online access and receive annual online statements, prefer online access but receive paper statements by mail for a fee, or decline online access altogether and receive annual paper statements only. Choosing the appropriate option can impact how often and in what format the owner receives their account information.

What is the significance of the USA Patriot Act information included in the form?

The inclusion of USA Patriot Act information emphasizes the custodian’s obligation to verify the identity of each account holder. This requirement helps combat money laundering and the funding of terrorism. Therefore, account owners need to provide identification, such as a driver’s license or passport, along with their application to confirm their identity before gaining control of their account.

Common mistakes

Filling out the ARP 005 form can be straightforward, but mistakes can lead to delays or complications. One common mistake is failing to double-check personal information. Many people overlook this crucial step. Errors in your name, Social Security number, or date of birth can create significant problems later. It’s important to ensure that everything is correct as the Custodian relies on the information provided and delays may occur if corrections are needed.

Another frequent mistake is ignoring the beneficiary designation. Some individuals assume that designating beneficiaries is optional, but it's not. If you have not properly designated your beneficiaries, it can lead to uncertainties about how your IRA assets will be distributed after your passing. This can cause unnecessary stress for your loved ones after you’re gone.

Many people also skip providing an alternative mailing address. If your mailing address is different from your residential address, it’s vital to specify that. Omitting this information can result in missed correspondence, which might delay access to your account or important statements. Always include a correct mailing address, to ensure vital documents reach you effectively.

Another mistake occurs in not signing the form where required. While it may seem trivial, failing to sign the Adoption Agreement can lead to your application being considered incomplete. A signed form confirms your acknowledgment of the contents. If you forget to sign, your account may not get opened timely, putting your rollover funds at risk.

People frequently misunderstand the options for account access and statements. Selecting an option that doesn’t suit your preferences can lead to unintended costs or inconvenience. Read through the preferences carefully to determine whether you want online access or paper statements. Choosing a method not aligned with your expectations can result in additional fees or missed notifications.

Lastly, overlooking the acknowledgment section can be a critical error. This section stresses that you understand your responsibilities as the Account Owner. Baseless assumptions about the information being accurate can be dangerous. Review and acknowledge that you accept all associated terms before submitting the form. Not doing so could lead to future complications regarding your IRA.

Documents used along the form

When completing the ARP 005 form, several other forms and documents may be necessary to ensure all requirements are met properly. Each document serves a specific purpose and should be carefully reviewed and submitted along with your form.

- Custodial Agreement: This document outlines the terms and conditions under which the Custodian manages the account. It details both parties' responsibilities regarding the IRA.

- Disclosure Statement: This statement provides important information about the IRA, including fees, investment options, and any restrictions that may apply to the account.

- IRS Form W-8: Required for foreign citizens or non-U.S. persons, this form certifies non-U.S. status and may help clarify tax obligations.

- Beneficiary Designation Form: This form allows the account owner to specify who will receive the account's assets in the event of their death.

- Spousal Consent Form: If the account owner designates a primary beneficiary other than their spouse, this form confirms the spouse's acknowledgment and consent.

- ID Verification Form: A document used to verify the identity of the account owner. It often requires a copy of an unexpired government-issued ID.

- Initial Contribution Form: This form details the initial funding of the IRA and specifies whether it is coming from a rollover or another source.

- Account Access Request: If the account owner prefers online access, this request outlines the desired permissions and statement preferences for account management.

- Transaction Authorization Form: This form is necessary for transactions made within the IRA, providing written consent for specific actions.

It is essential to complete and submit these documents alongside the ARP 005 form to ensure a smooth establishment and management of the IRA. Proper attention to detail can prevent delays and ensure compliance with regulations.

Similar forms

- Form W-4: Similar to the Arp 005 form in that it requires personal identification details, including Social Security numbers and addresses, for tax-related purposes.

- IRS Form 1040: Like the Arp 005, this tax form collects relevant information on individual stakeholders, including names, filing status, and income details.

- Beneficiary Designation Form: This document also requires the identification of beneficiaries, similar to how the Arp 005 establishes primary and contingent beneficiaries for the IRA.

- Direct Rollover Request Form: It parallels the Arp 005 in that both involve the transfer of funds from one retirement account to another, often requiring identification of the account owner.

- Account Opening Form: This document gathers personal information and allows for the creation of accounts, much like the introduction of an IRA account via the Arp 005.

- Trust Account Agreement: Similar to the Arp 005, this agreement outlines the responsibilities of the account holder and the institution regarding account management and beneficiary designations.

- IRA Transfer Form: Both forms are used to initiate the movement of funds between retirement accounts. Each requires the account owner to provide specific identification details.

- Power of Attorney Form: Similar in nature, this document gives another individual the responsibility for managing an account and requires detailed information about the account holder.

Dos and Don'ts

When filling out the ARP 005 form, there are a number of essential practices to bear in mind to ensure that your submission goes smoothly. The following list highlights ten important dos and don’ts that can help guide you through the process.

- Do review all of your personal information carefully.

- Do ensure your Social Security number is entered correctly.

- Do provide accurate beneficiary information, including full names and relationships.

- Do sign and date the form to certify the information provided.

- Do include a clear copy of a government-issued ID as required.

- Don't leave any sections incomplete; provide all necessary information.

- Don't use a P.O. box for your residential address, as it is not acceptable.

- Don't forget to acknowledge receipt and understanding of the Custodial Agreement.

- Don't neglect to inform the Custodian of any corrections after submission.

- Don't wait until the last minute to submit your form; allow for processing time.

By adhering to these guidelines, you can help ensure that your ARP 005 form is processed efficiently and accurately, preventing delays or complications.

Misconceptions

When it comes to the ARP 005 form, misunderstandings are common. Here is a list of five common misconceptions, along with clarifications to help set the record straight.

- It's mandatory to fill out the entire form. While it’s essential to provide accurate information, not every section needs to be filled out. Focus on sections that apply to you and ensure all necessary fields are completed to avoid delays.

- All automatic rollovers are the same. Many believe the rules governing automatic rollovers are identical across all situations. However, they can vary based on the specific plan and state regulations. It's important to understand the terms associated with your account.

- You cannot change your beneficiary once designated. This is a misunderstanding. You can update your beneficiary designation as needed. Ensure you follow the proper procedure by using the designated forms to make these changes.

- The Custodian is responsible for managing your investments. Some people think the Custodian makes investment decisions on their behalf. In reality, as the Account Owner, you are solely responsible for directing how your IRA assets are invested. The Custodian executes your instructions but doesn't offer investment advice.

- If you don't respond, your information will be considered accurate. This is not true. If you do not confirm or correct any inaccuracies on the form, the information may be treated as certified, which could lead to issues down the line. Always review your information carefully!

Understanding these common misconceptions can aid in better managing your IRA and ensuring a smoother process. Don’t hesitate to ask questions or seek clarification if needed!

Key takeaways

Here are some key takeaways about filling out and using the ARP 005 form:

- Your information is essential. You must verify the accuracy of personal details such as your name, address, and Social Security number.

- Choose your statement preferences carefully. You can opt for online access or choose to receive paper statements, which may incur a fee.

- Designate your beneficiaries. Be sure to fill out this section completely to ensure that benefits are paid out correctly in the event of your death.

- Understand your responsibilities. As the Account Owner, you are responsible for investment direction and any inaccuracies on the form.

- If you are married, obtain spousal consent. This is necessary if you choose beneficiaries other than your spouse to ensure compliance with state laws.

Browse Other Templates

Navpers 1330/3 - Contact the Funeral Honors Office by phone or fax.

Commissioned Officer Application,Army Officer Appointment Request,Warrant Officer Application Form,Military Officer Selection Document,U.S. Army Officer Enrollment Application,Army Reserve Appointment Application,Applicant Information for Army Office - It is essential to understand the governing regulations that frame this application process.

Resident Insurance Agent Application,Insurance Agent License Request,Agent Licensing Form,Georgia Insurance License Application,Insurance Agent Registration Form,Insurance License Application GID-103,Insurance Agent Certification Form,Agent Applicati - The GID 103 AL is updated periodically, and applicants should use the latest version.