Fill Out Your Az Tpt 1 Form

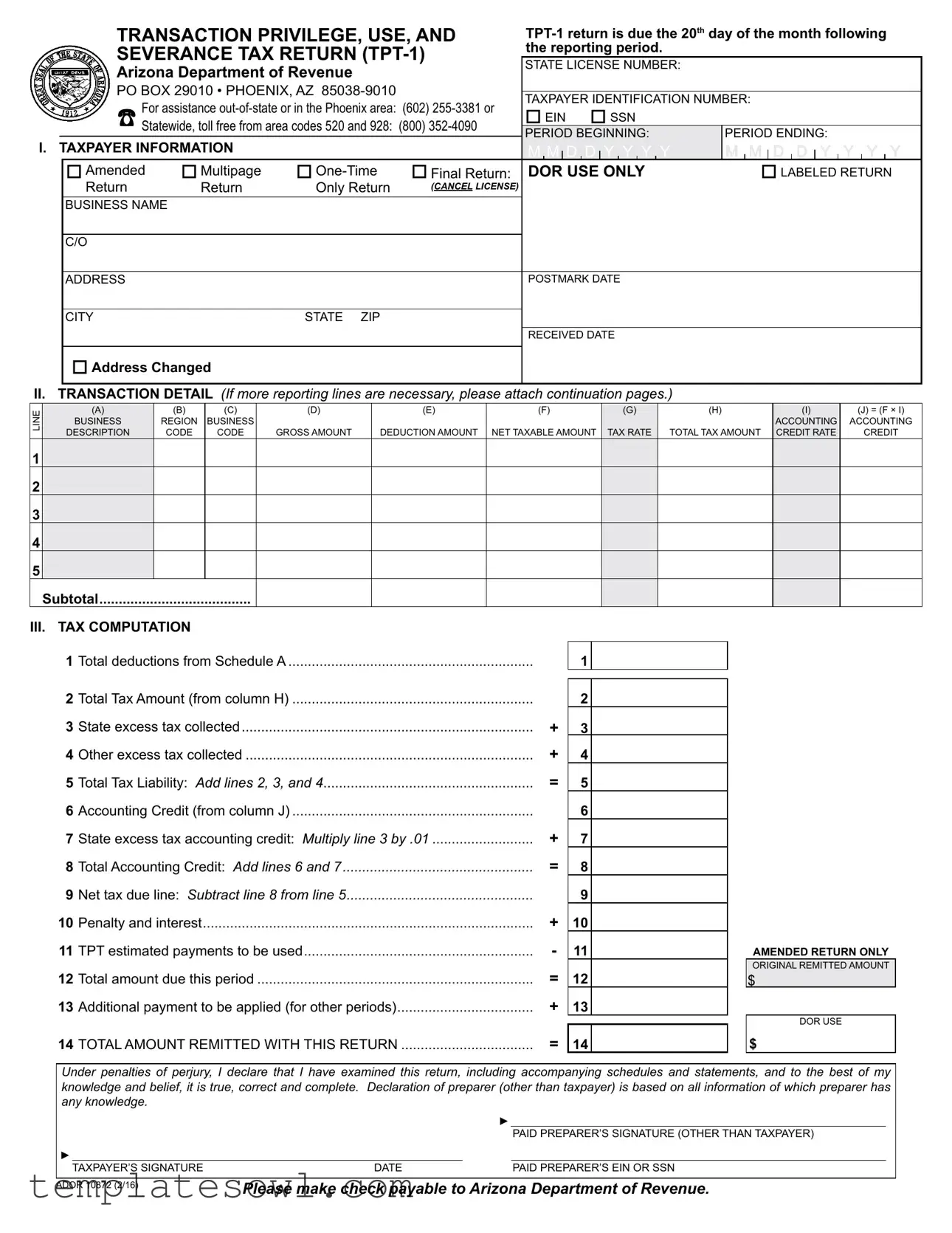

The Arizona Transaction Privilege, Use, and Severance Tax Return, commonly known as Form TPT-1, serves as a critical document for businesses navigating their tax obligations in Arizona. Primarily, this form consolidates reporting requirements for various types of taxes levied on businesses, including transaction privilege, use tax, and severance tax. Due on the 20th of the month following the reporting period, it requires taxpayers to provide detailed information about their revenue, deductions, and the total tax owed. The form comprises multiple sections that guide users through inputting crucial taxpayer information, including state license numbers and taxpayer identification numbers. Furthermore, Section II focuses on transaction details, where businesses must report gross amounts, deduction amounts, and total taxable amounts across different business regions through specific lines. Notably, taxpayers must also complete Schedule A for detailing deductions, ensuring that the provided figures align with the main form. This detailed approach is vital for maintaining accuracy and avoiding potential penalties. Additionally, the TPT-1 allows for amended returns, providing businesses with a pathway to correct previous submissions. As such, understanding the intricacies of the TPT-1 form is essential for compliance and effective tax management in Arizona.

Az Tpt 1 Example

TRANSACTION PRIVILEGE, USE, AND |

||

SEVERANCE TAX RETURN |

the reporting period. |

|

STATE LICENSE NUMBER: |

||

Arizona Department of Revenue |

||

|

PO BOX 29010 • PHOENIX, AZ |

|

TAXPAYER IDENTIFICATION NUMBER: |

|

|

|

|

||

FOR ASSISTANCE |

(602) |

|

|

|

|

|||

EIN |

SSN |

|

|

|

|

|

||

STATEWIDE, TOLL FREE FROM AREA CODES 520 AND 928: (800) |

PERIOD BEGINNING: |

PERIOD ENDING: |

|

|

|

|||

|

|

|

|

|

||||

I. TAXPAYER INFORMATION |

|

M M D D Y Y Y Y |

M M D D |

Y |

Y |

Y |

Y |

|

Amended |

Multipage |

Final Return: DOR USE ONLY |

LABELED RETURN |

|||

Return |

Return |

Only Return |

(CANCEL LICENSE) |

|

||

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

C/O |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

POSTMARK DATE |

|

|

|

|

|

|

|

|

CITY |

|

STATE ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED DATE |

|

Address Changed

II. TRANSACTION DETAIL (If more reporting lines are necessary, please attach continuation pages.)

LINE |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) = (F × I) |

BUSINESS |

REGION |

BUSINESS |

|

|

|

|

|

ACCOUNTING |

ACCOUNTING |

|

|

|

|

|

|

|

|||||

|

DESCRIPTION |

CODE |

CODE |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

CREDIT |

1

2

3

4

5

Subtotal.......................................

III. TAX COMPUTATION |

|

|

|

|

|

|

|

Total deductions from Schedule A |

|

|

|

|

|

1 |

|

1 |

|

|

|

|

|

Total Tax Amount (from column H) |

|

|

|

|

|

2 |

|

2 |

|

|

|

|

3 |

State excess tax collected |

+ |

3 |

|

|

|

4 |

Other excess tax collected |

+ |

4 |

|

|

|

5 |

Total Tax Liability: Add lines 2, 3, and 4 |

= |

5 |

|

|

|

6 |

Accounting Credit (from column J) |

|

6 |

|

|

|

7 |

..........................State excess tax accounting credit: Multiply line 3 by .01 |

+ |

7 |

|

|

|

8 |

Total Accounting Credit: Add lines 6 and 7 |

= |

8 |

|

|

|

9 |

Net tax due line: Subtract line 8 from line 5 |

|

9 |

|

|

|

10 |

Penalty and interest |

+ |

10 |

|

|

|

11 |

TPT estimated payments to be used |

- |

11 |

|

|

AMENDED RETURN ONLY |

|

|

|

|

|

|

ORIGINAL REMITTED AMOUNT |

12 |

Total amount due this period |

= |

12 |

|

|

$ |

13 |

Additional payment to be applied (for other periods) |

+ |

13 |

|

|

|

14 TOTAL AMOUNT REMITTED WITH THIS RETURN |

= |

14

DOR USE

$

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

►

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

►

TAXPAYER’S SIGNATURE |

DATE |

PAID PREPARER’S EIN OR SSN |

ADOR 10872 (2/16)

Please make check payable to Arizona Department of Revenue.

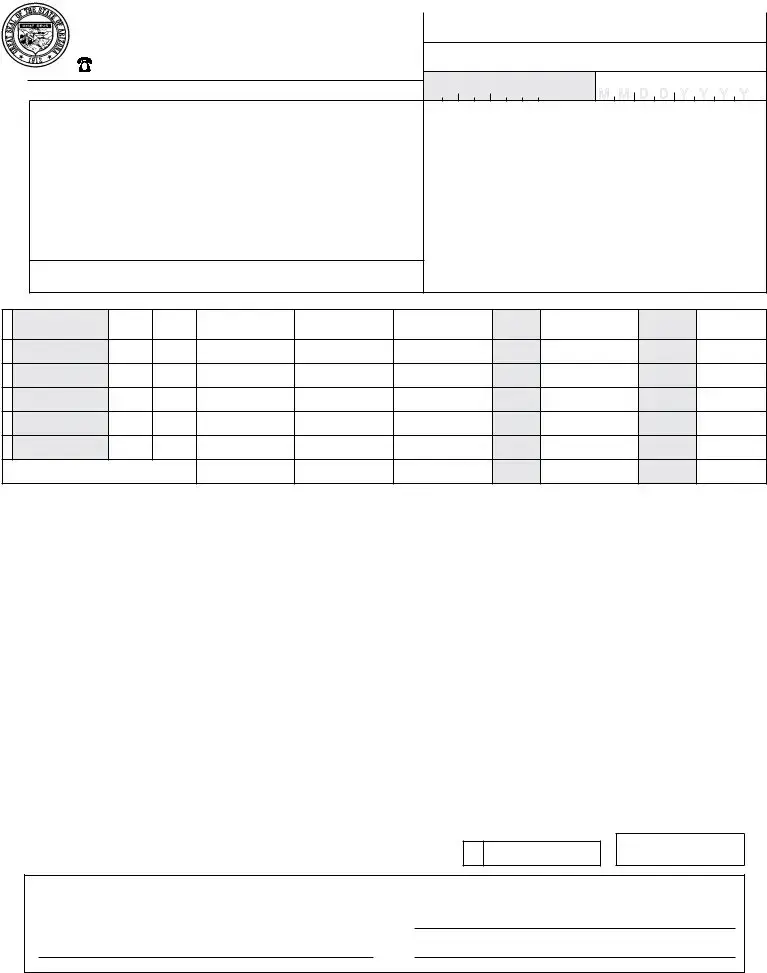

Transaction Privilege, Use, and Severance Tax Return |

LICENSE NO. ______________________ |

|

|

Schedule A: Deduction Detail Information

The deduction amounts that have been listed on the lines in Section II, Column E must be itemized by category for each Region Code and Business Code reported. The total of the amounts listed in Schedule A must equal the total of the Deduction Amounts listed on page 1. (See page 4 of the

Deduction Codes for itemizing deductions, with a paraphrased description of the deduction (or exemption), are listed at www.azdor.gov. Some of the codes may be used for more than one business code. Several additional Deduction Codes, as well as the statutory wording and any administrative guidance for each deduction code, are provided on the Department’s web site. The actual text of the statutory deduction, exemption or exclusion is controlling for amounts taken as deductions on Form

|

|

|

|

SCHEDULE A |

|

|

Deduction Detail |

|

|

|

|

|

|

|

|

|

|

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

|

DEDUCTION |

DEDUCTION |

DESCRIPTION OF |

|

|

REGION CODE |

BUSINESS CODE |

CODE |

AMOUNT |

DEDUCTION CODE |

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

10 |

|

|

|

|

|

11 |

|

|

|

|

|

12 |

|

|

|

|

|

13 |

|

|

|

|

|

14 |

|

|

|

|

|

15 |

|

|

|

|

|

16 |

|

|

|

|

|

17 |

|

|

|

|

|

18 |

|

|

|

|

|

19 |

|

|

|

|

|

20 |

|

|

|

|

|

21 |

|

|

|

|

|

22 |

|

|

|

|

|

23 |

|

|

|

|

|

ASubtotal of Deductions ..............................

BDeduction Totals from Additonal Page(s) ..

CTotal Deductions (line A + line B = line C)..

Total Must Equal Total on Page 1, Section III, line 1

ADOR 10872 (2/16)

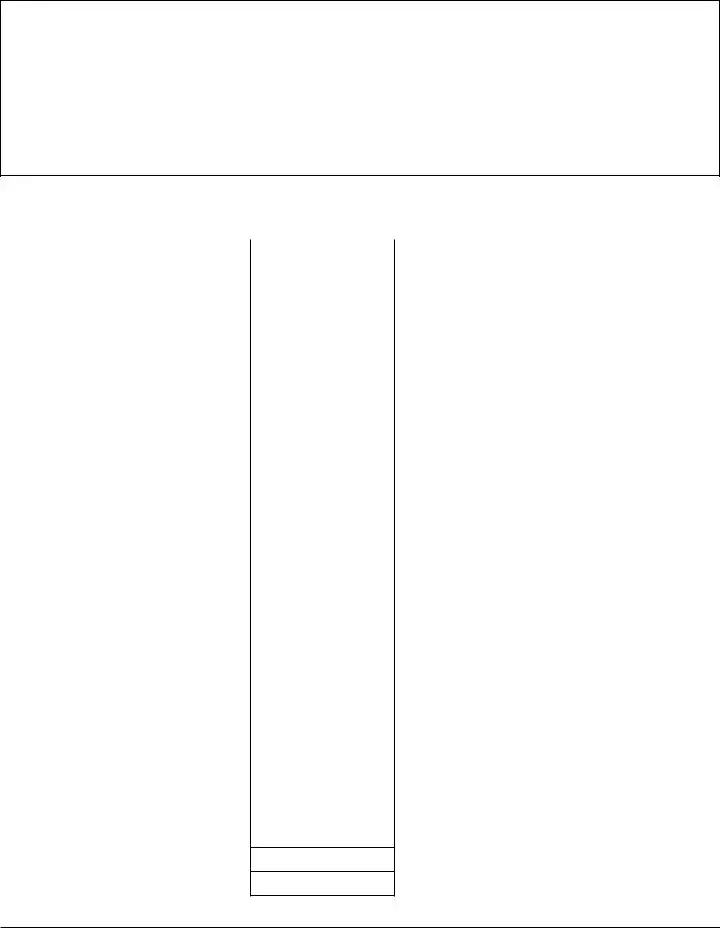

Transaction Privilege, Use, and Severance Tax Return |

LICENSE NO. ______________________ |

|

|

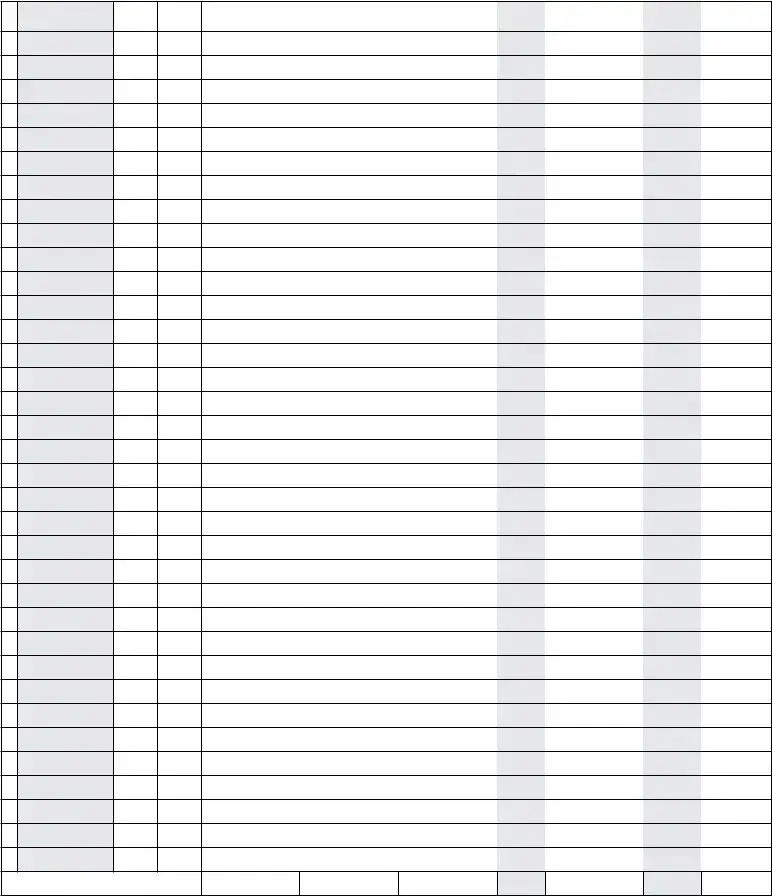

TRANSACTION DETAIL (ADDITIONAL TRANSACTIONS)

LINE

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

(A)

BUSINESS

DESCRIPTION

(B)(C)

REGION BUSINESS

CODE CODE

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) = (F × I) |

|

|

|

|

|

ACCOUNTING |

ACCOUNTING |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

CREDIT |

|

|

|

|

|

|

|

Subtotal ....................................

ADOR 10872 (2/16)

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of Form | The TPT-1 form is used for reporting transaction privilege, use, and severance taxes in Arizona. |

| Filing Deadline | Returns are due by the 20th day of the month following the reporting period. |

| Department of Revenue | Forms must be submitted to the Arizona Department of Revenue, located in Phoenix, AZ. |

| Identification Numbers | Taxpayers must provide either their Employer Identification Number (EIN) or Social Security Number (SSN) on the form. |

| Transaction Details | Section II requires detailed reporting of business activity, including gross amounts, deductions, and net taxable amounts. |

| Amended Returns | Taxpayers can indicate if the return is amended by checking the appropriate box on the form. |

| Payment Calculation | Total tax liability is calculated by adding total tax amounts and excess taxes collected, minus any credits. |

| Schedule A | Taxpayers must complete Schedule A to itemize any deductions claimed. |

| Penalties for Errors | Incorrect or unsubstantiated deductions may result in the disallowance of claimed amounts, plus penalties and interest. |

| Governing Law | The form is governed by Arizona state tax laws regarding transaction privilege and use taxes. |

Guidelines on Utilizing Az Tpt 1

Completing the Az Tpt 1 form is a critical step for fulfilling tax responsibilities in Arizona. Each section requires attention to detail to ensure accurate reporting of your transaction privilege and use taxes. Follow each step carefully to avoid potential errors that might lead to penalties or complications.

- Gather Your Information: Before starting the form, collect all necessary data including your State License Number, Taxpayer Identification Number (EIN or SSN), and details regarding your business transactions.

- Fill Out Your Personal Information: In Section I, input your business name, address, city, state, and zip code. Check the appropriate boxes for amended returns, multipage submissions, or final returns.

- Specify Reporting Period: Enter the period beginning and ending dates clearly in the designated fields. Make sure the dates are formatted correctly.

- Detail Your Transactions: In Section II, list each transaction by completing the line items for business region, accounting codes, gross amounts, and deductions. Ensure that totals reflect accurate calculations.

- Complete Schedule A: If you are claiming deductions, provide detailed itemizations in Schedule A, ensuring the total matches the deductions listed in Section II.

- Compute Tax Liability: In Section III, complete the tax computation by adding all necessary values to determine your total tax liability. Pay special attention to any credits and penalties reflected in the calculations.

- Sign the Form: Ensure both the taxpayer and any paid preparers sign the form. Include the dates and taxpayer identification numbers as required.

- Remit Payment: If there is a balance due, make your check payable to the Arizona Department of Revenue and attach it with your mailed return.

- Submit the Form: Send the completed form to the specified address, ensuring it is postmarked by the 20th day of the month following your reporting period.

Each step in the process of filling out the Az Tpt 1 form is crucial for accurate compliance with Arizona tax regulations. Careful attention will help minimize the risks associated with erroneous submissions, ensuring you meet your obligations effectively.

What You Should Know About This Form

What is the AZ TPT-1 form?

The AZ TPT-1 form is the Transaction Privilege, Use, and Severance Tax Return form in Arizona. Businesses use this form to report and pay their transaction privilege taxes. This includes any tax amounts that they have collected from their customers. It is due on the 20th of the month following the reporting period.

Who needs to file the AZ TPT-1 form?

Any business operating in Arizona and making taxable transactions needs to file the AZ TPT-1 form. This applies whether the company has a physical location in the state or conducts business remotely. It is important for businesses to understand if their activities fall under the transaction privilege tax classification to ensure compliance.

What happens if the AZ TPT-1 form is filed late?

If the AZ TPT-1 form is not filed by the due date, there may be penalties and interest applied to any tax amounts due. It’s crucial to submit the form on time to avoid these additional costs. Businesses should keep a calendar reminder set for the 20th of each month after their reporting period to help prevent late submissions.

How do I calculate my tax liability on the AZ TPT-1 form?

To calculate your tax liability, first, list your gross amounts and deductions in Section II of the form. Then, move to Section III to sum up the deductions, excess tax collected, and any accounting credits. The final amount due will be the net tax after subtracting credits and adding any penalties or interest, if applicable.

Where can I get help or additional information about the AZ TPT-1 form?

If you need assistance or more information, you can reach the Arizona Department of Revenue. For those in the Phoenix area, call (602) 255-3381. If you are located outside of that area, a toll-free line is available at (800) 352-4090. They can provide guidance on filling out the form and understanding tax obligations.

Common mistakes

Filling out the Arizona Transaction Privilege Tax (TPT-1) form can seem straightforward, but there are common pitfalls that often lead to mistakes. Understanding these missteps can be incredibly helpful. Here are ten common errors to watch out for.

First and foremost, many people forget to include their State License Number and Taxpayer Identification Number. These numbers are crucial for correctly identifying your business to the Arizona Department of Revenue. Omitting these numbers can lead to delays or rejections of your return.

Another common mistake is incorrect reporting periods. The form requires specific start and end dates for the reporting period, but some individuals enter the wrong dates. This error can cause complications, as the return must align with the fiscal periods established by the state.

Third, many fail to accurately calculate their total deductions. All deductions on Schedule A must match what’s reported on the main part of the form. Inaccurate totals may trigger audits or result in penalties. Remember, unsubstantiated deductions will not be honored!

Some individuals mistakenly select the wrong type of return. The form offers options such as Amended, Multipage, One-Time, and Final Return. Choosing the wrong type can not only complicate the processing but may also result in issues with your tax status going forward.

In addition, filling out the transaction detail section can be quite tricky. People often make errors in line descriptions or miscalculate gross amounts. Check each entry carefully to ensure that the numbers add up as intended.

Many overlook reading the instruction page, which is vital for clarity. This oversight can lead to further errors, particularly regarding deductions and the accounting codes needed. Familiarizing yourself with the guidelines can save a lot of headaches later on.

Another significant mistake is not signing the form. Not you? Make sure the taxpayer and any paid preparer sign and date the return. Without a signature, the form is considered incomplete and cannot be processed.

Moreover, some tend to ignore the penalty and interest calculations. Failing to account for potential penalties can lead to surprises down the line. Always double-check to confirm that you've included any penalties or interests that apply.

Additionally, many people do not double-check that all pages are included. Especially when amendments or multiple pages are involved, missing pages can cause delays and complications. Keep your documentation organized!

Finally, ensuring that the payment methods follow the instructions is critical. Confusion about how to submit payment could lead to missed deadlines, and nobody wants extra fees due to haste.

By being mindful of these common mistakes when filling out the TPT-1 form, you can make the process smoother and avoid unnecessary complications. A little attention to detail goes a long way in ensuring your tax return is processed efficiently!

Documents used along the form

The Arizona Transaction Privilege, Use, and Severance Tax Return (TPT-1) is a vital document for businesses operating in Arizona. It allows them to report their transaction privilege taxes owed to the state. However, businesses often use several other forms and documents alongside the TPT-1 to ensure compliance with state tax regulations. Below is a list of these associated forms, along with brief descriptions of each.

- Schedule A: This form itemizes the various deductions claimed by a business that are reported on the TPT-1. It must be completed and attached to the TPT-1 for the deductions to be valid. Accurate and substantiated deductions are necessary to avoid penalties.

- TPT-2: Also known as the Transaction Privilege Tax Exemption Certificate, this document is used by purchasers to claim an exemption from TPT for qualifying transactions. Businesses accepting this certificate should keep it on file for their records.

- TPT-3: This form is intended for businesses that are making an estimated payment of TPT throughout the year. It allows companies to predict their tax liabilities and avoid underpayment penalties.

- AZ Form 5000: This is an application for a transaction privilege tax license. New businesses are required to submit this form to obtain the necessary license before conducting business activities that trigger TPT responsibilities.

- Form W-9: While not specific to the TPT, this form is critical for businesses that use independent contractors or freelancers. It collects the taxpayer identification information of these workers, which is essential for accurate reporting of taxes.

- Form 941: Known as the Employer's Quarterly Federal Tax Return, it is required for businesses maintaining payroll. Though focused on federal employment taxes, it reflects expenses that may indirectly relate to TPT obligations.

Understanding these forms helps streamline the process of tax compliance. Each document plays a specific role in maintaining accurate records and ensuring that businesses meet their obligations under Arizona tax law. Proper management of these documents can facilitate smoother financial operations and prevent potential issues with tax authorities.

Similar forms

- Form 1040 - This is the U.S. Individual Income Tax Return. Just like the TPT-1 form, it serves as a way for individuals to report income, calculate taxes owed, or request a refund. Both forms require detailed financial information and calculations that determine the final tax obligation.

- Sales Tax Return - Similar to the TPT-1, a sales tax return collects information about sales and associated taxes owed to the state. Both documents detail revenue generated, deductions available, and the amount required to be remitted to the tax authority after accounting for any permissible deductions.

- Business Property Declaration - This form allows businesses to declare their property and its assessed value for tax purposes. Like the TPT-1, it involves reporting specific business assets and calculating any taxes owed based on the value of those assets.

- Form 941 - This is the Employer’s Quarterly Federal Tax Return that reports income taxes, Social Security taxes, or Medicare taxes withheld from employee paychecks. Just like the TPT-1, this form summarizes income and taxes over a specific reporting period and may offer deductions or credits that affect the total amount due.

- Form 1065 - Known as the U.S. Return of Partnership Income, this form is filed by partnerships to report income, deductions, gains, and losses. It’s comparable to the TPT-1 as both require businesses to report financial details clearly, leading to the tax obligations calculated from reported figures.

- Schedule C - This form is used by sole proprietors to report income from business activities. Like the TPT-1, it involves calculating net profit or loss, collecting expenses, and reporting to the tax authority based on the earnings and deductions detailed on the form.

- Form 940 - This is the Employer’s Annual Federal Unemployment (FUTA) Tax Return. Similar to TPT-1, this form collects specific tax information over an annual period, requiring accurate reporting of unemployment taxes based on employee compensation.

- Arizona Corporate Income Tax Return (Form 120) - Used by corporations to report income and calculate taxes owed to the state, just like the TPT-1. Both forms necessitate specific data about revenue, deductions, and credits that contribute to the final tax calculation.

Dos and Don'ts

When filling out the Az Tpt 1 form, adhere to the following guidelines:

- Double-check your taxpayer identification number for accuracy.

- Ensure the period beginning and ending dates are correctly filled.

- Clearly label the form as amended, one-time, or final return when applicable.

- Itemize deductions accurately in Schedule A to ensure compliance and avoid penalties.

- Use the correct deduction codes as listed on the Arizona Department of Revenue website.

Avoid these common mistakes:

- Do not leave any mandatory fields blank.

- Avoid using incorrect deduction amounts that may lead to audits.

- Do not submit the form late; it’s due on the 20th of the month following the reporting period.

- Refrain from assuming that previous submissions were error-free; always review before filing.

Misconceptions

- It's just a tax form. While the TPT-1 form is a tax return, it includes detailed information about transactions and deductions, which are crucial for accurate tax reporting.

- Anyone can file the form without training. Although it might seem straightforward, understanding the TPT-1's details often requires specific knowledge about Arizona's tax regulations.

- Filing late doesn't have serious consequences. Filing the TPT-1 form late can lead to penalties and interest accrual, which can significantly increase the total tax bill.

- Only large businesses need to file this form. Small businesses, freelancers, and even some individuals who conduct taxable transactions must also submit the TPT-1 form.

- The deductions are automatic. Deductions must be substantiated and properly itemized on Schedule A, otherwise they will be disallowed, leading to higher tax liability.

- Filing an amended return is complicated. While it may seem daunting, filing an amended TPT-1 is a straightforward process if the correct steps are followed.

- I don't need to keep records. Maintaining accurate records is essential. The Arizona Department of Revenue may require evidence for claimed deductions, and poor record-keeping can lead to issues.

Key takeaways

Filling out the Az Tpt 1 form can seem complex, but understanding its key components makes the process manageable. Here are important takeaways that can help simplify your experience:

- The due date for the TPT-1 return is the 20th day of the month following the reporting period.

- Include your state license number and taxpayer identification number accurately, as these are essential for proper identification.

- Complete the transaction detail section carefully, ensuring that all reported lines align with your attached support documents, especially if more lines are needed.

- Itemize your deductions on Schedule A, making sure that the total deductions match those listed on page 1. This is crucial for deductions to be allowed.

- If applicable, review the detailed deduction codes available on the Arizona Department of Revenue website. Understanding these can assist in taking full advantage of your allowable deductions.

- Make certain to include penalties and interest where applicable, and always double-check for accuracy to avoid unnecessary complications and delays in processing.

By keeping these takeaways in mind, individuals can navigate the TPT-1 form with greater confidence and accuracy.

Browse Other Templates

End Stage Renal Disease Enrollment Form,ESRD Medicare Application,Medicare Kidney Disease Certification,Chronic Kidney Disease Registration Document,Renal Disease Patient Entitlement Form,ESRD Patient Medical Evidence Report,Kidney Transplant Eligibi - Mailing addresses for the patient must be kept updated for communication.

Public Title Portal - Mailing addresses provided must match official records except for certain updates.