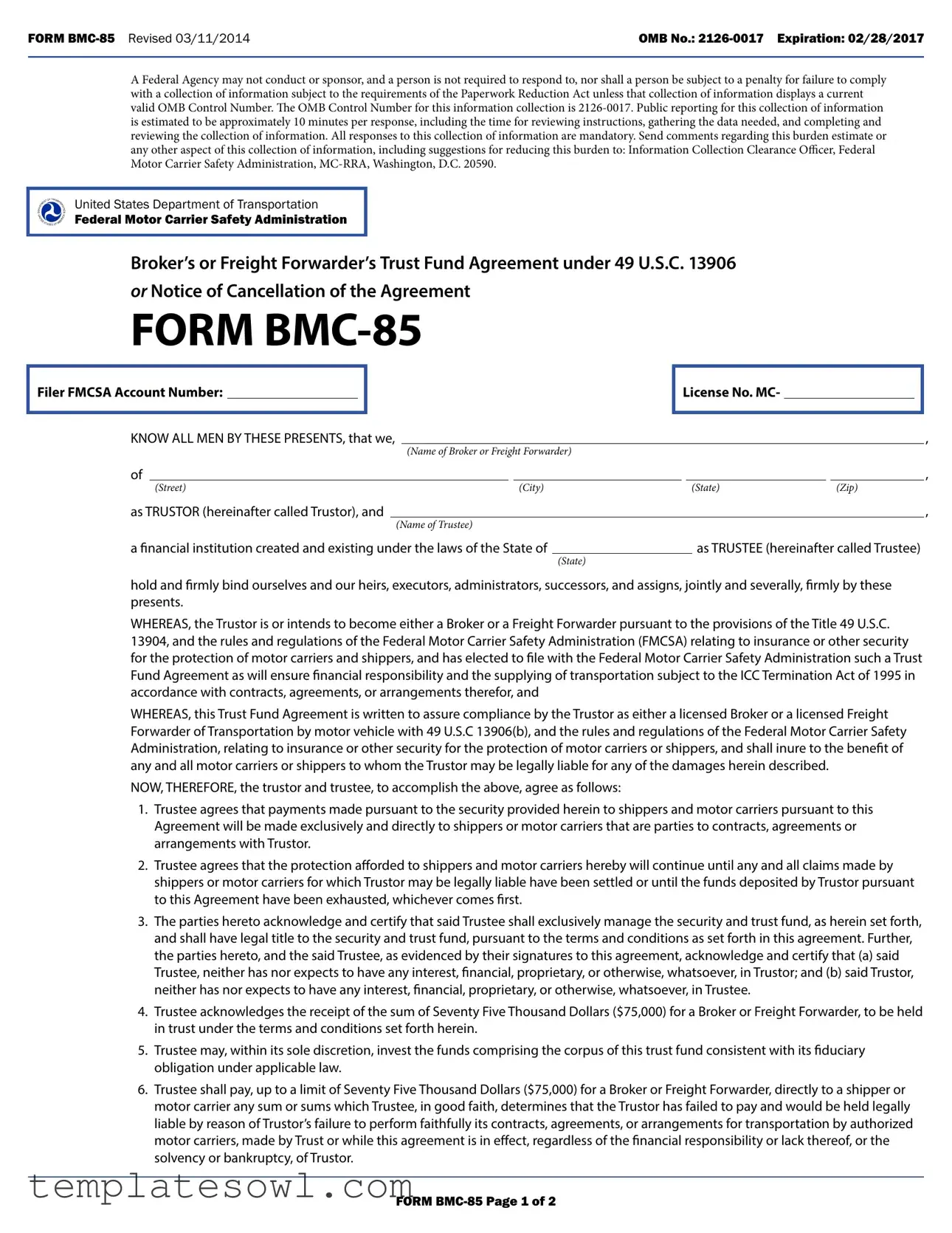

Fill Out Your Bmc 85 Form

The BMC 85 form is a crucial document for brokers and freight forwarders in the transportation industry, primarily governed by the Federal Motor Carrier Safety Administration (FMCSA). This agreement, officially titled the Broker’s or Freight Forwarder’s Trust Fund Agreement, plays a pivotal role in establishing financial trust between involved parties. It serves to ensure that there is adequate insurance or other forms of security to protect motor carriers and shippers against any financial liabilities that may arise from transportation contracts. By filing the BMC 85, a Trustor—typically a broker or freight forwarder—can demonstrate compliance with federal regulations, as outlined in 49 U.S.C. 13906. This form mandates that a specified sum, often set at $75,000, be held in trust to cover any claims made by shippers or motor carriers. The Trustee, often a financial institution, is responsible for managing these funds and ensuring that payments are made directly to the parties entitled to them. Additionally, the BMC 85 specifies the necessity of replenishing the trust fund should it dwindle below the required amount, thus maintaining the financial security promised to shippers and carriers alike. Overall, the BMC 85 is not just a regulatory requirement; it is a foundational element that fosters trust within the transportation industry.

Bmc 85 Example

ORM |

OMB No.: |

|

|

A Federal Agency may not conduct or sponsor, and a person is not required to respond to, nor shall a person be subject to a penalty for failure to comply with a collection of information subject to the requirements of the Paperwork Reduction Act unless that collection of information displays a current valid OMB Control Number. The OMB Control Number for this information collection is

United States Department of Transportation

Federal Motor Carrier Safety Administration

Broker’s or Freight Forwarder’s Trust Fund Agreement under 49 U.S.C. 13906 or Notice of Cancellation of the Agreement

FORM

Filer FMCSA Account Number:

License No. MC-

KNOW ALL MEN BY THESE PRESENTS, that we, |

|

, |

(Name of Broker or Freight Forwarder)

of |

|

|

|

|

|

|

|

|

|

|

, |

|

(Street) |

|

|

(City) |

|

|

(St te) |

|

(Zip) |

||

|

|

|

|

|

Alabama |

|

|

|

|||

as TRUSTOR (hereinafter called Trustor), and |

|

|

|

|

|

Alaska |

|

|

, |

||

|

|

(Name of Trustee) |

|

|

American Samoa |

|

|

|

|||

a financial institution created and existing under the laws of the State of |

|

|

|

|

|

||||||

|

|

|

as TRUSTEE (hereinafter called Trustee) |

||||||||

|

|

|

|

|

(St te) |

|

|

Arizona |

|

|

|

|

|

|

|

|

Alabama |

|

Arkansas |

|

|

|

|

hold and firmly bind ourselves and our heirs, executors, administrators, successors,Alaska and assigns, jointly and severally, firmly by these |

|||||||||||

presents. |

|

|

|

American Samoa |

|

California |

|

|

|

||

WHEREAS, the Trustor is or intends to become either a Broker or a Freight Forwarder pursuant to the provisions of the Title 49 U.S.C. |

|||||||||||

|

|

|

|

|

Arizona |

|

Colorado |

|

|

|

|

13904, and the rules and regulations of the Federal Motor Carrier Safety Administration (FMCSA) relating to insurance or other security |

|||||||||||

for the protection of motor carriers and shippers, and has elected to file |

Arkansas |

|

Connecticut |

|

|

|

|||||

with the Federal Motor Carrier Safety Administration such a Trust |

|||||||||||

Fund Agreement as will ensure financial responsibility and the supplying of transportation subject to the ICC Termination Act of 1995 in |

|

California |

Delaware |

accordance with contracts, agreements, or arrangements therefor, and Colorado |

District of Columbia |

WHEREAS, this Trust Fund Agreement is written to assure compliance by the Trustor as either a licensed Broker or a licensed Freight |

||

|

Connecticut |

Florida |

Forwarder of Transportation by motor vehicle with 49 U.S.C 13906(b), and the rules and regulations of the Federal Motor Carrier Safety |

||

|

|

Georgia |

Administration, relating to insurance or other security for the protection ofDelawaremotor carriers or shippers, and shall inure to the benefit of |

||

any and all motor carriers or shippers to whom the Trustor may be legally liable for any of the damages herein described. |

||

|

District of Columbia Guam |

|

NOW, THEREFORE, the trustor and trustee, to accomplish the above, agree as follows: |

Hawaii |

|

|

Florida |

|

1. Trustee agrees that payments made pursuant to the security provided herein to shippers and motor carriers pursuant to this |

||

|

Georgia |

Idaho |

Agreement will be made exclusively and directly to shippers or motor carriers that are parties to contracts, agreements or |

||

arrangements with Trustor. |

Guam |

Illinois |

|

|

Indiana |

2. Trustee agrees that the protection afforded to shippers and motor carriersHawaiihereby will continue until any and all claims made by |

||

shippers or motor carriers for which Trustor may be legally liable have been settled or until the funds deposited by Trustor pursuant |

|||

to this Agreement have been exhausted, whichever comes first. |

Idaho |

Iowa |

|

Illinois |

Kansas |

||

|

|||

3. The parties hereto acknowledge and certify that said Trustee shall exclusively manage the security and trust fund, as herein set forth, |

|||

|

Indiana |

Kentucky |

|

and shall have legal title to the security and trust fund, pursuant to the terms and conditions as set forth in this agreement. Further, |

|||

|

|

acknowledge and certify that (a) said |

|

the parties hereto, and the said Trustee, as evidenced by their signatures to this agreement, Louisiana |

|||

|

Iowa |

|

|

Trustee, neither has nor expects to have any interest, financial, proprietary, or otherwise, whatsoever, in Trustor; and (b) said Trustor, |

||

|

Kansas |

Maine |

neither has nor expects to have any interest, financial, proprietary, or otherwise, whatsoever, in Trustee. |

||

|

Kentucky |

Marshall Islands |

4. Trustee acknowledges the receipt of the sum of Seventy Five Thousand Dollars ($75,000) for a Broker or Freight Forwarder, to be held |

||

in trust under the terms and conditions set forth herein. |

Louisiana |

Maryland |

|

|

Massachusetts |

5. Trustee may, within its sole discretion, invest the funds comprising theMainecorpus of this trust fund consistent with its fiduciary |

||

obligation under applicable law. |

Marshall Islands |

Michigan |

6. Trustee shall pay, up to a limit of Seventy Five Thousand Dollars ($75,000) for a Broker or Freight F rwarder, directly to a shipper or |

|||

|

Maryland |

Micronesia |

|

motor carrier any sum or sums which Trustee, in good faith, determines that the Trustor has failed to pay and would be held legally |

|||

|

|

Minnesota |

|

liable by reason of Trustor’s failure to perform faithfully its contracts, agreementMassachusetts, or arrangements for transportation by authorized |

|||

motor carriers, made by Trust or while this agreement is in effect, regardless of the financial responMississippiibility or lack thereof, or the |

|||

solvency or bankruptcy, of Trustor. |

Michigan |

Missouri |

|

Micronesia |

|||

|

|||

|

Minnesota |

Montana |

|

|

FORM |

Nebraska |

|

|

Missouri |

Nevada |

|

ORM |

OMB No.: |

|

|

7. In the event that the trust fund is drawn upon and the corpus of the trust fund is a sum less than Seventy Five Thousand Dollars ($75,000) Brokers or Freight Forwarders, Trustor shall, within thirty (30) days, replenish the trust fund up to Seventy Five Thousand Dollars ($75,000) Brokers or Freight Forwarders by paying to the Trustee a sum equal to the difference between the existing corpus of the trust fund and Seventy Five Thousand Dollars ($75,000) Brokers or Freight Forwarders.

8. Trustee shall immediately give written notice to the FMCSA of all lawsuits filed, judgments rendered, and payments made under this trust agreement and of any failure by Trustor to replenish the trust fund as required herein.

9. This agreement may be canceled at any time upon thirty (30) days written notice by the Trustee or Trustor to the FMCSA on the form printed at the bottom of this agreement. The thirty (30) day notice period shall commence upon actual receipt of a copy of the trust fund agreement with the completed notice of cancellation at the FMCSA’s Washington, DC office. The Trustee and/or Trustor specifically agrees to file such written notice of cancellation.

10. All sums due the Trustee as a result, directly or indirectly, of the administration of the trust fund under this agreement shall be billed directly to Trustor and in no event shall said sums be paid from the corpus of the trust fund herein established.

11. Trustee shall maintain a record of all financial transactions concerning the Fund, which will be available to Trustor upon request and reasonable notice and to the FMCSA upon request.

|

|

|

|

12. This agreement shall be governed by the laws in the State of |

|

|

|

|

|

|

, to the extent not inconsistent with the rules |

|||||||||||||||||||||||||||||||

|

|

|

|

|

and regulations of the FMCSA. |

|

|

|

|

|

|

|

Alabama |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alaska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This trust fund agreement is effective the |

|

|

|

day of |

|

|

American Samoa , |

|

|

|

|

|

|

, 12:01 a.m., standard time at the |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st |

|

January |

|

|

2013 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

address of the Trustor as stated herein and shall continue in force Arizonauntil terminated as herein provided. |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd |

|

February |

|

|

2014 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arkansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trustee shall not be liable for payments of any of the damages hereinbefore described which arise as the result of any contracts, |

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd |

|

March |

|

|

2015 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

agreements, undertakings, or arrangements made by the Trustor Californiathe supplying of transportation after the cancellation of this |

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4th |

|

April |

|

|

2016 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agreement, as herein provided, but such cancellation shall not affect the liability of the Trustee for the payment of any such damages |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5th |

|

May |

|

|

2017 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

arising as the result of contracts, agreements, or arrangements madeConnecticutby the Trustor for the supplying of transportation prior to the date |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

such cancellation becomes effective. |

|

|

6th |

|

June |

|

|

2018 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

7th |

|

JulyDelaware |

|

|

2019 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

District of Columbia |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8th |

|

August |

|

|

2020 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IN WITNESS WHEREOF, the said Principal and Surety have9thexecuted this instrumentSeptembern the |

|

|

|

day of |

|

|

|

|

, |

|

. |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

1st |

|

|

|

|

|

January |

|

|

2013 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10th |

|

October |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11th |

|

|

|

Guam |

2nd |

|

|

|

|

|

February |

|

|

2014 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

TRUSTOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hawaii |

|

|

|

|

|

|

|

March |

|

|

2015 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12th |

|

|

|

|

TRUSTEE3rd |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13th |

|

|

|

Idaho |

4th |

|

|

|

|

|

April |

|

|

2016 |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14th |

|

|

|

Indiana |

5th |

|

|

|

|

|

May |

|

|

2017 |

|

|

||||

|

|

|

|

COMPANY NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

15th |

|

|

|

Iowa |

6th |

|

|

|

|

|

June |

|

|

2018 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY NAME |

|

|

|

|

|

July |

|

|

2019 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16th |

|

|

|

Kansas |

7th |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

17th |

|

|

|

|

STREET8thADDRESS |

|

|

|

|

|

August |

CITY |

|

2020 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

September |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18th |

|

|

|

Kentucky9th |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana10th |

|

|

|

|

|

October |

|

|

|

|

|

||||||

|

|

|

|

Alabama |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19th |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alabama |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

STATE |

|

|

|

|

|

|

|

ZIP CODE |

|

TELEPHONE NUMBER |

Maine |

|

|

|

|

|

|

ZIP CODE |

TELEPHONE NUMBER |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

Alaska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20th |

|

|

|

|

Alaska11th |

|

|

|

|

|

November |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marshall Islands |

|

|

|

|

|

December |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12th |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

American Samoa |

|

|

|

|

|

|

|

|

|

|

|

|

|

21st |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Samoa |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Arizona |

|

|

(type or print Principal officer’s name and title) |

|

|

|

Maryland13th (type or print Principal officer’s name and title) |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22nd |

|

|

|

|

Arizona |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23rd |

|

|

|

|

|

14th |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Arkansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ark |

sas |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

California |

|

(Principal officer’s signature) |

|

|

|

Michigan |

15th |

|

|

(Principal officer’s signature) |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24th |

|

|

|

|

California |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Micronesia |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Colorado |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25th |

|

|

|

|

|

16th |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Connecticut |

|

(type or print witness’s name)26th |

|

|

|

|

|

17th |

|

|

(type or print witness’s name) |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Connecticut |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mississippi |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Delaware |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27th |

|

|

|

|

|

18th |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Missouri |

19th |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

District of Columbia |

|

|

|

|

|

|

|

|

|

|

|

28th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Florida |

|

|

|

|

|

|

(witness’s signature) |

|

|

29th |

|

|

|

Montana |

20th |

|

|

|

(witness’s signature) |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30th |

|

|

|

Only financial21st institutions as defined under 49 CFR 387.307(c) may qualify |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

NOTICE OF CANCELLATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Guam |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31st |

|

|

|

to act as Trustee. Trustee, by the above signature, certifies that it is a financial |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guam |

22nd |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

This is to advise that the above Trust Fund Agreement executed on the |

|

|

NewinstitutionHampshireand has legal authority to assume the obligations of Trustee and |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

23rd |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

Hawaii |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

theHawaiifinancial ability to discharge them. |

|

|

|

|

|

|||||||||||

|

|

|

dayIdahoof |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

, |

|

|

|

|

is hereby cancelled as |

|

Idaho |

24th |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Mexico |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1st |

|

|

January |

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

25th |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

security in compIllinoisance with the FMCSA security requirements under 49 U.S.C. |

|

Illinois |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

2nd |

|

|

February |

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

New York26th |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Indiana |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

day of |

|

|

|

|

Indiana |

|

|

|

|

|

|

|

|

|

|

|

|

|||

13906(b) and 49 CFR 387.307, effective as of the |

|

|

|

|

|

|

|

|

|

North Carolina |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

3rd |

|

|

March |

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

27th |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Iowa |

|

|

|

|

|

|

|

|

|

|

|

1st |

|

|

|

|

|

|

|

|

Iowa |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4th |

|

|

April |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Dakota |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

28th |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

Kansas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kansas |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

, |

|

|

|

|

, 12:01 a.m., standard time at the address |

Northern Marianas |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5th |

|

|

May |

|

|

|

|

|

|

|

|

|

|

|

2nd |

|

|

|

|

|

|

|

|

|

29th |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

January |

|

Kentucky 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

of the trustor, provided such date is not less than thirty (30) days after the |

|

|

Ohio |

|

|

|

|

|

(affix Trustee seal) |

|

|

|

|

|

||||||||||||||||||||||||||||

|

6th |

|

|

June |

|

|

|

|

|

|

|

|

|

|

|

3rd |

|

|

|

|

|

|

|

|

|

30th |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

February |

|

Louisiana2014 |

|

|

|

|

|

|

|

|

4th |

|

|

|

|

|

|

|

|

Louisi na |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

actual receipt of this notice by the FMCSA. |

|

|

|

|

|

|

|

|

Oklahoma |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

7th |

|

|

July |

|

2015 |

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

31st |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

March |

|

Maine |

|

|

|

|

|

|

|

|

|

5th |

|

|

|

|

|

|

|

|

Maine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

8th |

|

|

August |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oregon |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

April |

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marshall Islands |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Marshall Islands |

|

|

|

|

|

|

|

|

6th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

9th |

|

|

September |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Palau |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

Signature of Authorized Representative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Date Signed |

|

Maryland2017 |

|

|

|

|

|

|

|

|

Maryland |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

May |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

10th |

|

|

October |

|

|

|

|

|

|

of Trustee or Trustor |

|

|

|

Pennsylvania |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

7th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

June |

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massa husetts |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Massachusetts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

11th |

|

|

November |

|

|

|

|

|

|

|

|

8th |

|

|

|

|

|

|

|

Puerto Rico |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

July |

|

Michigan 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

12th |

|

|

December |

|

|

|

|

|

|

|

|

9th |

|

|

|

|

|

|

|

Rhode Island |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

August |

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Micronesia |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

13th |

|

Micronesia |

|

|

|

|

|

|

|

|

|

10th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Carolina |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

September |

|

Minnesota |

|

|

|

|

|

|

|

|

|

11th |

|

|

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

14th |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Dakota |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

October |

|

Mississippi |

|

|

|

|

|

|

|

|

|

12th |

|

|

|

|

|

|

|

|

Mississippi |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

November15th |

|

Missouri |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tennessee |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TexasMissouri |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The BMC-85 form serves as a Broker’s or Freight Forwarder’s Trust Fund Agreement under 49 U.S.C. 13906. |

| Mandatory Responses | All responses to the BMC-85 form are mandatory, ensuring compliance with federal regulations. |

| OMB Control Number | The current OMB Control Number for this form is 2126-0017, which is required for compliance with the Paperwork Reduction Act. |

| Response Time | Estimated time to complete the form is approximately 10 minutes, including data gathering and review. |

| Trust Fund Amount | The trust fund amount set forth in the agreement is Seventy Five Thousand Dollars ($75,000). |

| Governing Law | The agreement is governed by the laws of the state in which it is filed, adhering to both 49 U.S.C. 13906 and 49 CFR 387.307. |

| Cancellation Notice | The agreement can be canceled with a thirty (30) day written notice to the FMCSA, following specific completion and submission instructions. |

Guidelines on Utilizing Bmc 85

Completing the BMC-85 form is a necessary step in establishing a trust fund agreement related to transportation duties. Follow these instructions carefully to ensure that all information is accurately provided.

- Obtain the BMC-85 form, which can typically be found on the Federal Motor Carrier Safety Administration (FMCSA) website.

- Fill in your FMCSA Account Number and License Number at the top of the form.

- Input the name of the Broker or Freight Forwarder in the designated field.

- Provide the complete street address, city, state, and zip code of the Broker or Freight Forwarder.

- Enter the name of the Trustee, which must be a financial institution compliant with legal requirements.

- Complete the transit address for the Trustee, including street, city, state, and zip code.

- Carefully read through the terms outlined in the form and check for any required signatures.

- Sign the form in the area designated for the Principal Officer of the Trustor and print their name and title below the signature.

- Have the witness sign and print their name in the respective sections.

- Attach any supporting documents that may be required for your specific situation.

- Submit the completed form as directed, typically to the FMCSA office in Washington, D.C.

Once you have submitted the completed BMC-85 form, be prepared for any follow-up communications from the FMCSA. This may include requests for additional information or clarification before your trust fund agreement is fully approved. Keep copies of all submitted documents for your records.

What You Should Know About This Form

What is the purpose of the BMC-85 form?

The BMC-85 form is a legal document that establishes a trust fund agreement between a broker or freight forwarder and a financial institution. This agreement ensures that the broker or freight forwarder meets financial responsibility requirements as outlined in federal regulations. It serves to protect shippers and motor carriers by providing a source of funds in case the broker or forwarder fails to honor financial commitments.

Who needs to file the BMC-85 form?

Any individual or company planning to operate as a registered broker or freight forwarder must file the BMC-85 form. This form is essential for demonstrating compliance with the financial security requirements set by the Federal Motor Carrier Safety Administration (FMCSA).

What is the amount required for the trust fund?

The trust fund must contain at least $75,000. This amount is designed to cover payments due to shippers or motor carriers in the event that the broker or freight forwarder does not fulfill their contractual obligations. This financial assurance is critical in building trust within the transportation industry.

How long is the BMC-85 form valid?

The BMC-85 form remains effective until it is canceled or modified by either the trustor (broker or freight forwarder) or trustee (financial institution). A written notice must be sent to the FMCSA to initiate cancellation, which requires a minimum of 30 days for processing. The agreement continues to protect shippers and motor carriers during this period.

What happens if the trust fund balance falls below $75,000?

If the trust fund is drawn upon and its balance dips below the mandated $75,000, the trustor is required to replenish the fund within 30 days. This replenishment must restore the balance to the original amount, ensuring that the trust account is always adequately funded for ongoing obligations.

Are there any fees associated with managing the trust fund?

Yes, the trustee may charge fees for administering the trust fund. These fees will be billed directly to the trustor and cannot be taken from the trust fund itself. It's important to review the terms of the agreement for specifics about potential fees and their implications for ongoing financial responsibilities.

What kind of records does the trustee maintain?

The trustee is required to keep detailed records of all transactions related to the trust fund. These records must be made available to the trustor upon reasonable request and must also be accessible to the FMCSA. Transparency in financial transactions is essential for maintaining trust and compliance.

Can the agreement be modified after it is signed?

Any modifications to the BMC-85 agreement must be made in writing and agreed upon by both the trustor and trustee. Changes should be documented and filed with the FMCSA to ensure that all parties are aware of the updated terms and conditions, preserving the integrity of the trust fund agreement.

What should be done if a claim is made against the trust fund?

In the event of a claim by a shipper or motor carrier, the trustee must investigate and determine if the claim is valid. If the trustor (broker or freight forwarder) is found to be liable under the trust fund agreement, the trustee will make payments directly to the claimant, up to the limit of the trust fund.

Where should comments or concerns regarding the BMC-85 form be directed?

Any questions, comments, or suggestions related to the BMC-85 form can be directed to the Information Collection Clearance Officer at the Federal Motor Carrier Safety Administration (FMCSA) in Washington, D.C. It's important for those involved to express any concerns regarding the burden or utility of this information collection.

Common mistakes

Filling out the BMC-85 form correctly is crucial for brokers and freight forwarders to meet their legal and financial obligations. However, many individuals make common mistakes that can lead to complications. Here are five frequent errors to avoid.

One of the most significant mistakes is neglecting to provide complete and accurate information. When you are not thorough, missing details, such as the full name of the broker or freight forwarder, can lead to delays or rejections. Always double-check that every section of the form is filled out correctly. A moment of carelessness can have lasting consequences.

Another common error involves the failure to enter the correct financial institution information. The trustee must be a financial institution that meets specific criteria. If you mistakenly provide incorrect details about the institution, it could render the entire agreement invalid. Ensuring that your trustee is appropriate not only adheres to regulations but also protects your legal interests.

Many also overlook the importance of signatures. Oftentimes, all required signatures must be present on the form. Missing a signature, particularly from a principal officer, is a common oversight. This situation can lead to unnecessary delays in processing. It's essential to ensure that all parties properly sign and date the document.

Additionally, failing to maintain compliance with the timeline for submitting the trust fund agreement can create problems. Make sure you understand any dates associated with the form. Submitting late could affect your financial standing and your ability to operate as a broker or freight forwarder. Timeliness is critical.

Lastly, individuals often underestimate the importance of keeping copies of submitted documents. After sending this crucial form, having a backup is necessary for your records. In case any disputes arise or additional information is required, you will be glad to have proof of what you originally submitted. Keeping organized records can save you time and stress down the line.

Documents used along the form

The BMC-85 form is an essential document used by brokers or freight forwarders to establish a trust fund agreement that ensures financial responsibility under federal regulations. Alongside this form, several other documents are typically required to provide additional information and support the compliance process. Below is a list of related forms and documents commonly associated with the BMC-85.

- BMC-34 Form: This is a Motor Carrier Surety Bond that guarantees payment for damages or claims that a broker might incur. It serves as a financial safeguard for those who contract with the broker.

- BMC-91 Form: Known as the Motor Carrier or Freight Forwarder Application and Permit, this form serves to apply for authority to operate as a freight broker or forwarder. It includes critical information about the applicant’s business activities.

- BMC-85 Notice of Cancellation: This document is used to cancel the trust fund agreement outlined in the BMC-85. It must be sent to the FMCSA to officially terminate the agreement.

- FMCSA Registration: This document confirms that the broker or freight forwarder is registered with the Federal Motor Carrier Safety Administration, an essential requirement for legal operation.

- Claims for Damages: Documentation that details any claims made against the trust fund, ensuring that there is a clear record of claims and payments made by the trustee.

- Financial Statements: Brokers and freight forwarders may need to provide recent financial statements to demonstrate their financial standing and capability to manage trust funds effectively.

- Trustee Agreement: A separate agreement outlining the responsibilities and obligations of the trustee handling the funds for the trust. This document provides clarity on fund management.

- Certificates of Insurance: Proof of insurance coverage indicating that the broker or freight forwarder meets the minimum insurance requirements mandated by federal regulations.

Understanding these documents is crucial for brokers and freight forwarders as they navigate the regulatory landscape. Each document plays a significant role in ensuring compliance, protecting financial interests, and maintaining operational authority within the transportation industry.

Similar forms

The BMC-85 form is a significant document in the realm of transportation regulation, specifically related to freight brokerage and forwarding. Several other documents share similar characteristics and purposes, which are vital for ensuring compliance and financial responsibility. Here is a list of seven documents that are similar to the BMC-85 form:

- Form BMC-84: This is a similar trust fund agreement that requires a guarantor for obligations related to freight transportation. It also emphasizes financial assurance for shippers and carriers, much like the BMC-85.

- Form BMC-83: This is a Surety Bond for Freight Brokers. It provides a guarantee to shippers that the broker will meet all contractual responsibilities, aligning closely with the BMC-85's purpose of ensuring accountability.

- Form BMC-91: The Broker's License Application form is where brokers apply for their licenses. It establishes the financial responsibility that brokers need to prove, a requirement mirrored in the BMC-85 agreement.

- Form BMC-92: This is an application for a freight forwarder license. Like the BMC-85, it involves proving financial competence and responsibility in transportation contracts.

- Form BMC-93: This application for permits for brokers or freight forwarders addresses the operational requirements, similar to how the BMC-85 outlines fiduciary duties and financial responsibilities.

- Surety agreements: These are not specific forms but rather contracts that a broker or freight forwarder engages in. They serve a parallel function to the BMC-85 by guaranteeing that financial responsibilities are met.

- Insurance certificates: While not forms per se, these documents affirm that brokers have required liability coverage. They relate to the BMC-85 in demonstrating the financial backing necessary to operate within industry standards.

Understanding these documents provides insight into the regulatory framework that guides freight brokerage activities. Each serves a distinct function yet aligns in purpose with the BMC-85 form, ensuring transparency and accountability in the transportation sector.

Dos and Don'ts

When filling out the BMC 85 form, consider the following guidelines to ensure accuracy and compliance:

- Read the instructions carefully. Familiarize yourself with the form's requirements before starting.

- Provide complete information. All sections must be filled out thoroughly and accurately.

- Use legible handwriting or type the form. Clear and readable text prevents miscommunication.

- Sign where required. An unsigned form may lead to delays or rejection.

- Verify financial institution eligibility. Ensure the trustee qualifies according to the specified standards.

- Don't leave any fields blank. Missing information can result in processing delays.

- Don't use incorrect dates. Ensure all dates are accurate and formatted correctly.

- Don't provide false information. This can lead to severe penalties and complications.

- Don't ignore submission deadlines. Timely submission is essential to maintain compliance.

By following these guidelines, you can enhance the accuracy of your submission and avoid potential issues during the process.

Misconceptions

- Misconception 1: The BMC 85 Form is optional for freight forwarders and brokers.

- Misconception 2: Submitting the BMC 85 Form guarantees automatic approval and coverage.

- Misconception 3: The trust fund amount specified in the BMC 85 is fixed and cannot be changed.

- Misconception 4: The BMC 85 agreement has no time limit and will remain in effect indefinitely.

This is not true. The BMC 85 Form is a mandatory requirement for brokers and freight forwarders who must demonstrate financial responsibility. Compliance with this form is essential to meet the regulatory standards set by the Federal Motor Carrier Safety Administration (FMCSA).

Filing the BMC 85 form does not guarantee approval. The application will still be reviewed, and eligibility will depend on various factors, including the proper completion of the form and compliance with FMCSA regulations.

While the typical trust fund amount is set at $75,000, it can be adjusted, and brokers or freight forwarders must ensure the fund is maintained at this level throughout the life of the agreement. If funds are drawn upon, they must be replenished.

This is incorrect. The trust fund agreement is not open-ended. It is effective until terminated, but a 30-day written notice of cancellation must be given to the FMCSA by either party, signifying that the agreement will eventually come to an end.

Key takeaways

Filling out the BMC-85 form is a crucial task for brokers and freight forwarders involved in transportation. Here are key takeaways that can help ensure the process is smooth and compliant:

- The BMC-85 form serves as a Broker’s or Freight Forwarder’s Trust Fund Agreement, which guarantees financial responsibility under the relevant federal regulations.

- It is important to include your FMCSA Account Number and License Number (MC) accurately at the top of the form.

- The form explicitly requires the name and address of the Trustor (broker or freight forwarder) and Trustee (the financial institution), which must be completed thoroughly.

- The Trustor must deposit a minimum of $75,000 into the trust fund, which the Trustee holds for disbursement to shippers and motor carriers if legal obligations arise.

- Understand that this agreement remains effective until either canceled by the Trustee or Trustor, or until the financial obligations are settled.

- Trustees have a fiduciary duty and are permitted to invest trust funds in accordance with applicable laws to maximize financial management.

- Any withdrawals or payments made from the trust fund must be reported to the FMCSA, ensuring that all parties remain informed.

- If the trust fund balance drops below $75,000, the Trustor is obligated to replenish it within 30 days, ensuring continuous compliance.

By adhering to these guidelines, you can navigate the complexities of the BMC-85 form more effectively, ensuring compliance with federal regulations and protecting all parties involved in the transportation process.

Browse Other Templates

How to Be a Notary in Mississippi - Failure to provide accurate telephone information can result in communication issues.

Tdi Calculator Ri - Filling out the form accurately is essential for a successful TDI claim.