Fill Out Your Boe 400 Elf Form

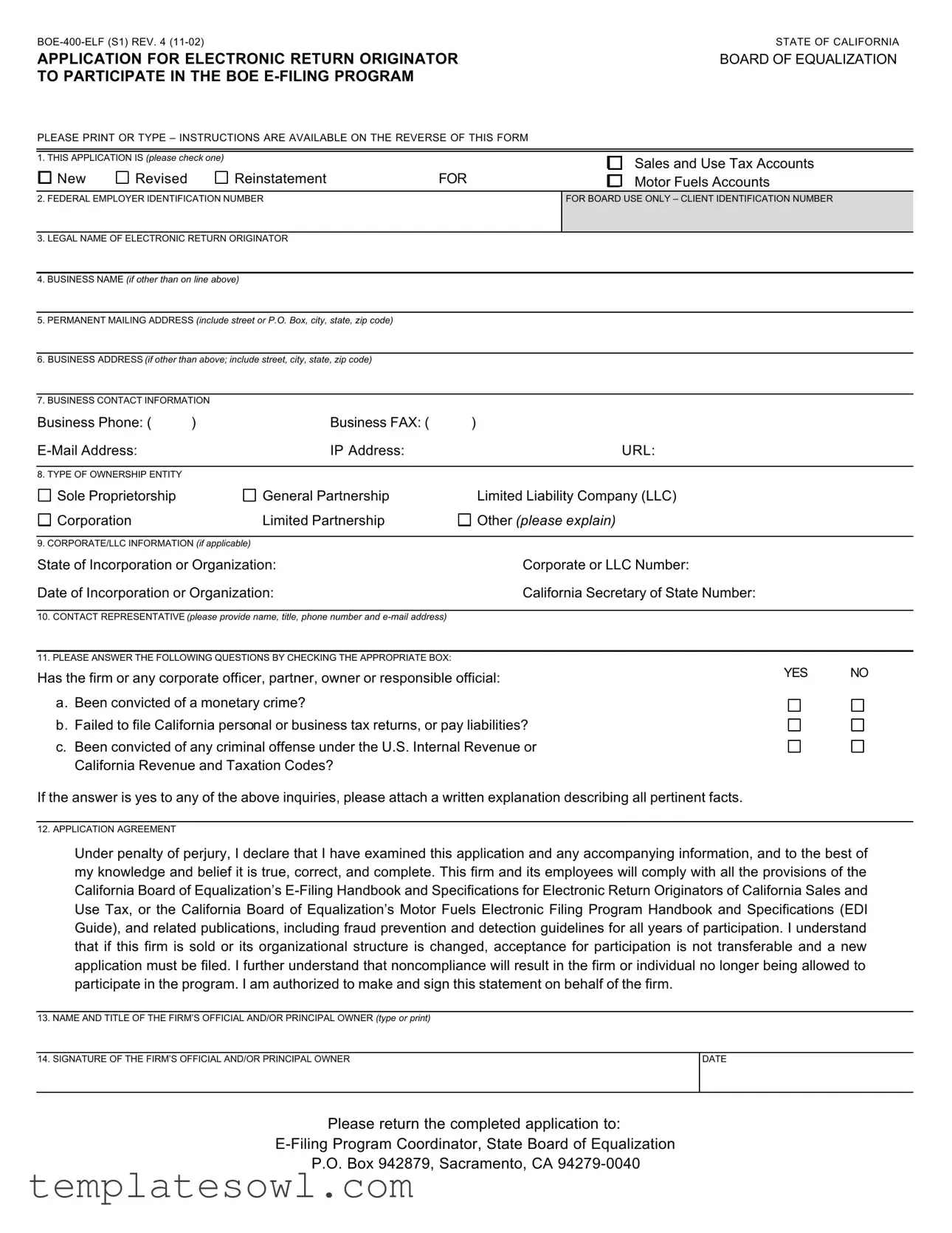

When navigating the world of tax compliance in California, the BOE 400 Elf form plays a crucial role for businesses seeking approval as Electronic Return Originators. This application not only opens the door to participate in the Board of Equalization’s e-filing program, but it also establishes a foundation for streamlined tax reporting. Completing the BOE 400 Elf form involves a number of significant steps, including specifying whether the application is new, revised, or a reinstatement, and providing essential information such as both legal and business names, permanent mailing address, and business contact details. There is also an important section regarding the type of ownership entity, which includes options like sole proprietorships, corporations, and limited liability companies. Moreover, applicants are required to disclose any previous legal issues such as convictions for monetary crimes or failures to file taxes. As the form demands careful attention to detail, understanding each aspect is pivotal for ensuring compliance and securing ongoing participation in this vital program. The urgency of submitting a complete and accurate application cannot be overstated; noncompliance can lead to disqualification from future participation, emphasizing the importance of this form within California’s tax landscape.

Boe 400 Elf Example

BOE400ELF (S1) REV. 4 (1102) |

STATE OF CALIFORNIA |

APPLICATION FOR ELECTRONIC RETURN ORIGINATOR |

BOARD OF EQUALIZATION |

TO PARTICIPATE IN THE BOE EFILING PROGRAM |

|

PLEASE PRINT OR TYPE – INSTRUCTIONS ARE AVAILABLE ON THE REVERSE OF THIS FORM |

|

1. THIS APPLICATION IS (please check one)

New |

Revised |

ReinstatementFOR

Sales and Use Tax Accounts Motor Fuels Accounts

2. FEDERAL EMPLOYER IDENTIFICATION NUMBER |

FOR BOARD USE ONLY – CLIENT IDENTIFICATION NUMBER |

|

|

3.LEGAL NAME OF ELECTRONIC RETURN ORIGINATOR

4.BUSINESS NAME (if other than on line above)

5.PERMANENT MAILING ADDRESS (include street or P.O. Box, city, state, zip code)

6.BUSINESS ADDRESS (if other than above; include street, city, state, zip code)

7.BUSINESS CONTACT INFORMATION

Business Phone: ( |

) |

Business FAX: ( |

) |

EMail Address: |

|

IP Address: |

URL: |

|

|

|

|

8. TYPE OF OWNERSHIP ENTITY |

|

|

|

Sole Proprietorship

Corporation

General Partnership Limited Partnership

Limited Liability Company (LLC)

Other (please explain)

9. CORPORATE/LLC INFORMATION (if applicable) |

|

|

State of Incorporation or Organization: |

Corporate or LLC Number: |

|

Date of Incorporation or Organization: |

California Secretary of State Number: |

|

|

|

|

10. CONTACT REPRESENTATIVE (please provide name, title, phone number and email address) |

|

|

|

|

|

11. PLEASE ANSWER THE FOLLOWING QUESTIONS BY CHECKING THE APPROPRIATE BOX: |

|

|

Has the firm or any corporate officer, partner, owner or responsible official: |

YES |

NO |

|

|

a. Been convicted of a monetary crime?

b. Failed to file California personal or business tax returns, or pay liabilities? c. Been convicted of any criminal offense under the U.S. Internal Revenue or

California Revenue and Taxation Codes?

If the answer is yes to any of the above inquiries, please attach a written explanation describing all pertinent facts.

12. APPLICATION AGREEMENT

Under penalty of perjury, I declare that I have examined this application and any accompanying information, and to the best of my knowledge and belief it is true, correct, and complete. This firm and its employees will comply with all the provisions of the California Board of Equalization’s EFiling Handbook and Specifications for Electronic Return Originators of California Sales and Use Tax, or the California Board of Equalization’s Motor Fuels Electronic Filing Program Handbook and Specifications (EDI Guide), and related publications, including fraud prevention and detection guidelines for all years of participation. I understand that if this firm is sold or its organizational structure is changed, acceptance for participation is not transferable and a new application must be filed. I further understand that noncompliance will result in the firm or individual no longer being allowed to participate in the program. I am authorized to make and sign this statement on behalf of the firm.

13. NAME AND TITLE OF THE FIRM’S OFFICIAL AND/OR PRINCIPAL OWNER (type or print)

14. SIGNATURE OF THE FIRM’S OFFICIAL AND/OR PRINCIPAL OWNER |

DATE |

|

|

Please return the completed application to:

EFiling Program Coordinator, State Board of Equalization

P.O. Box 942879, Sacramento, CA 942790040

BOE400ELF (S2) REV. 4 (1102) |

STATE OF CALIFORNIA |

APPLICATION FOR ELECTRONIC RETURN ORIGINATOR |

BOARD OF EQUALIZATION |

TO PARTICIPATE IN THE BOE EFILING PROGRAM |

|

INSTRUCTIONS

General Information

Who needs to file

To become an Electronic Return Originator as defined in the California Board of Equalization’s EFiling publications, you must submit your application and complete system testing prior to transmitting your first transaction.

Where to file |

|

Send your completed application to: |

EFiling Program Coordinator |

|

State Board of Equalization |

|

P.O. Box 942879 |

|

Sacramento, CA 942790040 |

If you have questions

Sales and Use Tax: You may contact the Sales and Use Tax EFiling Program Coordinator at 9163236353, 7:30 a.m. through 4:30 p.m. (Pacific Time), Monday through Friday, by email at Efile@boe.ca.gov or FAX 9163245996.

Motor Fuels: You may contact the Motor Fuels EFiling Program Coordinator at 9163229669, 8:00 a.m. through 5:00 p.m. (Pacific Time), Monday through Friday, by email at Efile@boe.ca.gov or FAX 9163239352.

Specific Instructions

Line 1 Check the appropriate boxes.

Line 2 Enter your firm’s Federal Employer Identification Number (FEIN).

Line 3 If your firm is a sole proprietorship, enter the name of the sole proprietor. If your firm is a corporation, LLC, partnership or any other type of entity, enter the legal name of the entity as shown on your income tax return.

Line 4 If your firm uses a fictitious business name, enter that name.

Line 5 Enter the permanent mailing address for the firm.

Line 6 Enter the address of the physical location of the firm if different than the address listed on line 5. Line 7 Enter the business phone number, FAX, business email address, URL and IP address.

Line 8 Check the box that indicates your firm’s organizational structure. If your firm’s structure is not listed, please check “Other” and provide a description. If you have selected either General or Limited Partnership, please include a copy of your partnership agreement.

Line 9 If your firm is a corporation or LLC, please enter the state in which you are incorporated or formed the LLC, the date it became effective and your corporate or LLC number. Corporations doing business in California are required to register with the California Secretary of State. Please provide the number assigned by them.

Line 10 Enter the name, title, phone number and email address of the person you have designated as the contact for this program .

Line 11 Answer “Yes” or “No” as appropriate. If “Yes,” please provide a written explanation. Monetary crimes include, but are not limited to: money laundering, embezzlement, stock fraud, etc.

Line 12 No additional information is required. Please read this section carefully prior to signing this application.

Lines 13 The person authorized to act and sign for the firm in legal matters should complete these lines. An and 14 original signature is required to complete this application.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This application allows Electronic Return Originators to participate in the Board of Equalization's E-filing program for Sales and Use Tax or Motor Fuels accounts. |

| Authorizing Body | The California Board of Equalization governs this form under the California Revenue and Taxation Code. |

| Required Information | The form requires the submission of the legal name of the business, contact information, and details regarding ownership and compliance history. |

| Application Types | Applicants must check whether their application is new, revised, or a reinstatement. |

| Submission Instructions | Completed applications should be sent to the E-Filing Program Coordinator at the specified P.O. Box in Sacramento, CA. |

Guidelines on Utilizing Boe 400 Elf

Filling out the BOE 400 ELF form accurately is essential for participating in California's e-filing program. This process requires attention to detail and adherence to specific guidelines. Please follow the instructions below to ensure the application is completed correctly.

- Check the appropriate box in line 1 to indicate if this application is new, revised, or a reinstatement for Sales and Use Tax Accounts or Motor Fuels Accounts.

- In line 2, enter your firm’s Federal Employer Identification Number (FEIN).

- For line 3, provide the legal name of your electronic return originator. If your firm is a sole proprietorship, enter the sole proprietor's name.

- If applicable, complete line 4 with your fictitious business name (if it differs from line 3).

- Enter your permanent mailing address in line 5, including the street or P.O. Box, city, state, and zip code.

- Complete line 6 with your business address if it differs from the permanent mailing address.

- In line 7, provide your business phone number, fax number, email address, IP address, and URL.

- Line 8 requires you to check the box indicating your firm’s ownership structure. If your structure is not listed, choose "Other" and describe it.

- If your firm is a corporation or LLC, fill out line 9 with the state of incorporation, corporate or LLC number, the date of incorporation or organization, and the California Secretary of State number.

- Complete line 10 with the name, title, phone number, and email address of your contact representative.

- Answer the questions in line 11 by checking "Yes" or "No." If "Yes," provide a written explanation of the circumstances.

- Read and sign the application agreement detailed in line 12, confirming understanding of the provisions and compliance.

- In line 13, type or print the name and title of the firm's official or principal owner.

- Lastly, sign and date the application in line 14 to complete the form.

After completing the form, send it to the E-Filing Program Coordinator at the address provided. Ensure that all information is accurate and complete, as any errors could delay processing. If questions arise, refer to the contact information provided for assistance.

What You Should Know About This Form

What is the purpose of the BOE-400 ELF form?

The BOE-400 ELF form serves as an application for Electronic Return Originators who wish to participate in California's E-Filing program for Sales and Use Tax or Motor Fuels Accounts. By completing this form, businesses can offer electronic filing services, enhancing the efficiency of tax return submissions for their clients. It's crucial to submit the application and successfully complete system testing before transmitting your first transaction, ensuring compliance with all relevant regulations.

Who is eligible to apply for the BOE-400 ELF program?

Eligibility for the BOE-400 ELF program extends to various types of organizations including sole proprietorships, corporations, partnerships, and limited liability companies (LLCs). However, it’s vital that the applicant adheres to guidelines set by the California Board of Equalization. This includes not having any unresolved tax issues or criminal convictions related to financial crimes. If individuals or firms do have such histories, they must provide a detailed written explanation with their application.

What information is required to complete the BOE-400 ELF form?

To successfully fill out the BOE-400 ELF form, several pieces of information are necessary. Applicants must provide their Federal Employer Identification Number (FEIN), legal name, business name (if different), and both permanent and business addresses. Additionally, specific ownership structure details, corporate information (if applicable), and contact information for a representative are essential. Each applicant also must answer questions about prior criminal convictions and tax compliance, which helps the Board assess eligibility.

How should the BOE-400 ELF form be submitted?

Once completed, the BOE-400 ELF form should be mailed to the E-Filing Program Coordinator at the State Board of Equalization. The mailing address is P.O. Box 942879, Sacramento, CA 94279-0040. If any questions arise during the process, applicants can reach out to the appropriate E-Filing Program Coordinator for assistance, either for Sales and Use Tax or for Motor Fuels. It's crucial to ensure that the application is entirely accurate to avoid delays in approval.

Common mistakes

Filling out the BOE-400 ELF form is a straightforward process, but many applicants make critical mistakes that can delay their approval. One common mistake is failing to check the appropriate boxes in Line 1. Applicants often neglect to specify whether they are submitting a new application, a revision, or a reinstatement. This oversight can lead to confusion and may result in unnecessary processing delays.

Another frequent error involves the Federal Employer Identification Number (FEIN) in Line 2. Some applicants either leave this section blank or provide an incorrect number. The FEIN must match exactly with what the IRS has on file. An incorrect FEIN can halt the entire application process, making it essential to double-check this information.

In Line 3, applicants sometimes forget to provide the legal name of the Electronic Return Originator, or worse, they use a business name instead. The legal name should be consistent with what's on the income tax return. Failing to provide the correct legal name can lead to discrepancies, causing the application to be rejected.

Line 11 asks specific yes-or-no questions regarding criminal history and tax compliance. Applicants often misconstrue these questions, giving vague answers or omitting pertinent details. If an applicant answers "yes" to any of the inquiries, additional explanations are required. It’s crucial to answer honestly and provide complete information to avoid complications later.

Finally, completeness is essential. Lines 13 and 14 require the name, title, and signature of the firm's official. Applicants sometimes overlook these lines entirely or fail to provide an original signature. An unsigned application will not be processed, which adds yet another layer of delay and frustration. Attention to detail ensures a smoother application process and avoids unnecessary setbacks.

Documents used along the form

The BOE 400 Elf form is an essential document for those looking to participate in California's E-Filing Program with the Board of Equalization. Along with this form, there are several other documents that may be necessary to complete your application or to maintain compliance with state regulations. Here’s a brief overview of related forms and documents you might encounter.

- BOE 401: This form is used to register for a seller’s permit in California. If your business plans to sell tangible goods, this document is crucial for collecting sales tax.

- BOE 802: The BOE 802 form allows businesses to report their sales and use tax liability. Filing this document is essential for ensuring that all taxes owed are accurately calculated and remitted.

- BOE 443: This is the application for a seller’s permit or a license for selling motor fuels. Businesses involved in this sector will need this form to legally operate.

- Partnership Agreement: For firms structured as partnerships, this document outlines the terms and conditions agreed upon by partners. It’s often required to clarify roles and responsibilities within the partnership.

- Corporate Bylaws: If your firm is a corporation, this document details the rules governing its operations and management. It is often requested to verify compliance with corporate governance.

- California Secretary of State Registration: This document proves that your entity is registered in California. It’s necessary for companies to be recognized legally in the state.

Understanding these associated documents is key to navigating the application process and maintaining compliance. Each one plays a role in ensuring your business operates within California's legal framework. Take the time to gather these forms so your submission can be smooth and efficient.

Similar forms

The BOE-400 ELF form is an important application for Electronic Return Originators participating in California's e-filing program. It shares similarities with several other important documents. Below is a list of eight documents and how they are similar:

- IRS Form 2848: This form allows individuals to authorize a representative to act on their behalf before the IRS, much like the BOE-400 ELF allows a firm to register for e-filing status on behalf of its clients.

- California Form 540: Just as the BOE-400 ELF requires personal information about the business entity, Form 540 gathers personal and financial information from individual taxpayers for state income tax purposes.

- Form SS-4: This application for an Employer Identification Number (EIN) parallels the BOE-400 ELF in that both require the entity's legal name and details about ownership structure.

- California Form LLC-1: This form is used to register a Limited Liability Company in California. Similar to the BOE-400 ELF, it requires disclosure of organizational details, including business address and incorporation information.

- California Form 565: This form is for Limited Partnerships and requires similar ownership information and verification, akin to the requirements in the BOE-400 ELF.

- Form 8821: This is the IRS Tax Information Authorization form that allows third-party authorization to access taxpayer information, similar to how the BOE-400 ELF allows Electronic Return Originators to act on behalf of clients.

- California Form 100: This California corporation franchise or income tax return requires comprehensive details about the corporation, paralleling the BOE-400 ELF’s requirement for corporate information.

- Application for Seller’s Permit: This document is necessary for businesses intending to sell taxable goods in California. Like the BOE-400 ELF, it confirms eligibility to operate within the state’s tax framework.

Dos and Don'ts

When completing the BOE 400 ELF form, it is crucial to adhere to certain guidelines to avoid delays and ensure accuracy. Below is a list of important dos and don’ts for filling out the form.

- Do check off the correct application type (new, revised, reinstatement) in Line 1.

- Do provide accurate Federal Employer Identification Number in Line 2.

- Do enter the legal name of the entity on Line 3 as it appears on tax documents.

- Do ensure that the permanent mailing address on Line 5 is complete and correct.

- Do provide detailed contact information on Line 7, including business phone and email.

- Don't leave any sections blank; fill in all required information to prevent processing delays.

- Don't forget to sign where indicated in Lines 13 and 14; an original signature is mandatory.

- Don't provide a fictitious business name unless it’s on Line 4 if one is used.

- Don't ignore the requirement to explain any "Yes" answers in Line 11 regarding prior convictions or tax issues.

Misconceptions

- Misconception 1: The BOE 400 Elf form is only for large businesses.

- Misconception 2: Completing the BOE 400 Elf form guarantees acceptance into the program.

- Misconception 3: Only certain types of businesses can use the e-filing program.

- Misconception 4: There's no need to provide a Federal Employer Identification Number (FEIN).

- Misconception 5: All sections of the form must be filled out even if they don’t apply.

- Misconception 6: Past criminal convictions automatically disqualify you from applying.

- Misconception 7: The BOE 400 Elf form has no set deadline for submission.

- Misconception 8: Once approved, you can use the program indefinitely without any further requirements.

- Misconception 9: The application process is completely online.

- Misconception 10: It’s not necessary to read the E-Filing Handbook before applying.

This form is applicable for all sizes of businesses, including small sole proprietorships. Anyone who wants to become an Electronic Return Originator can apply.

Submitting the form does not automatically secure a place in the program. The Board evaluates each application based on specific criteria.

The program is open to various types of business entities, including corporations, LLCs, partnerships, and sole proprietorships.

The FEIN is a mandatory part of the application, used to identify your business for tax purposes, and is essential for processing your application.

You only need to fill out the sections that are relevant to your business. However, incomplete forms may be rejected.

While certain convictions must be disclosed, each case is reviewed individually, and context matters. You may still qualify depending on the circumstances.

There are specific deadlines for submitting the application, often aligned with tax business cycles. Check to ensure your application is timely.

Participation requires adherence to guidelines. Noncompliance may lead to termination of participation, necessitating a new application for reinstatement.

While there may be resources available online, the completed application form must be mailed to the specified address. A physical submission is necessary.

It is highly recommended to read the guidelines in the E-Filing Handbook before application. This will ensure you understand requirements and can avoid mistakes during submission.

Key takeaways

Understand the purpose of the BOE 400 Elf form. It allows businesses to apply to participate as an Electronic Return Originator for the California Board of Equalization's e-filing program.

Determine the type of application. You must select whether your application is new, revised, or a reinstatement.

Include your Federal Employer Identification Number (FEIN) as it is necessary for processing your application.

Provide both your legal name and your business name, if applicable. Ensure these match your tax returns and registration documents.

Clearly state your permanent mailing address and any additional business address if different.

Fill out your contact information thoroughly including phone numbers, email, URL, and IP address.

Identify your ownership entity, such as corporation, LLC, partnership, or sole proprietorship. Provide clarification if your entity is not listed.

If applicable, provide corporate or LLC information including the state of incorporation and the date.

Designate a contact representative with their name, title, phone number, and email.

Answer the inquiry questions honestly. If there are any 'yes' responses, be prepared to attach explanations.

The application must be signed by an authorized individual. The signature confirms the truthfulness of the provided information.

Submit your completed application to the designated E-Filing Program Coordinator address as outlined in the instructions.

Compliance with all provisions outlined in the BOE E-Filing Handbook is essential to maintain your status as an Electronic Return Originator.

Browse Other Templates

Parent Sample Letter to Judge for Child Custody - The MC-031 form is frequently required in various types of legal proceedings.

Lien Waiver Form Wisconsin - Ultimately, the Lien Waiver Wisconsin form streamlines the final payment processes in construction projects.