Fill Out Your Boe 448 Form

The Boe 448 form, officially titled as the "Statement of Delivery Outside California," is an essential document for both sellers and purchasers of vehicles who are involved in transactions where the vehicle is delivered outside of California. This form not only serves as evidence that the vehicle was indeed delivered beyond state lines but also plays a crucial role in determining tax responsibilities related to the sale. The form requires signatures from both the seller and purchaser at the delivery location, ideally in the presence of a notary, to help substantiate the claim that the sale occurred out-of-state. Sellers are reminded to retain the original Boe 448 for their records, as it supports any exclusions from California's Sales and Use Tax. Timely submission of this document, along with a copy of the purchase contract, is expected within 30 days of delivery. Both buyers and sellers should be cautious; if a vehicle is brought back into California within 12 months of the sale, taxation issues may arise, especially for California residents. Documentation proving where the vehicle was actually used during that period can be vital for avoiding potential tax penalties. It is recommended that individuals seek guidance if they have questions regarding their responsibilities linked to this form.

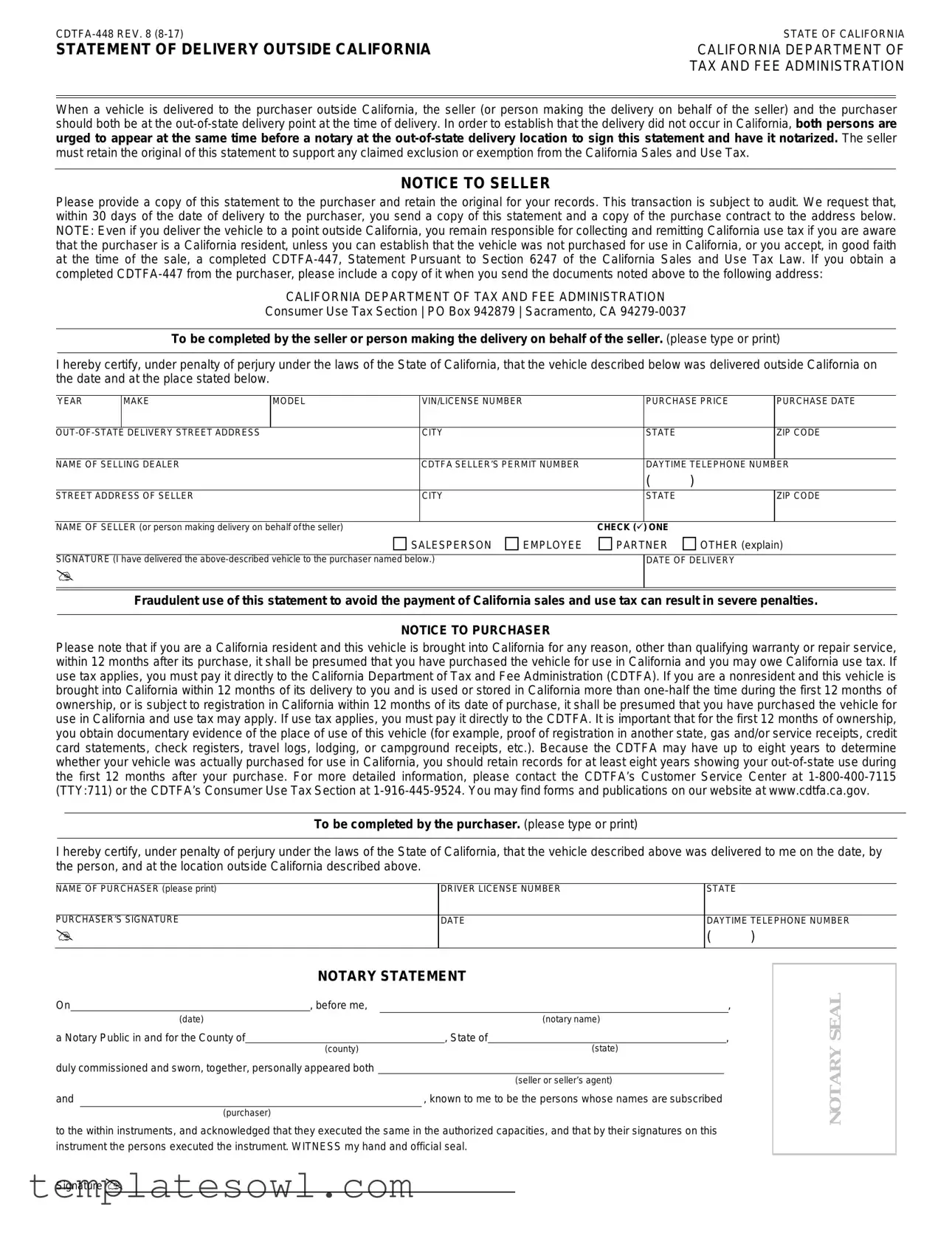

Boe 448 Example

STATE OF CALIFORNIA |

|

STATEMENT OF DELIVERY OUTSIDE CALIFORNIA |

CALIFORNIA DEPARTMENT OF |

|

TAX AND FEE ADMINISTRATION |

When a vehicle is delivered to the purchaser outside California, the seller (or person making the delivery on behalf of the seller) and the purchaser should both be at the

must retain the original of this statement to support any claimed exclusion or exemption from the California Sales and Use Tax.

NOTICE TO SELLER

Please provide a copy of this statement to the purchaser and retain the original for your records. This transaction is subject to audit. We request that, within 30 days of the date of delivery to the purchaser, you send a copy of this statement and a copy of the purchase contract to the address below. NOTE: Even if you deliver the vehicle to a point outside California, you remain responsible for collecting and remitting California use tax if you are aware that the purchaser is a California resident, unless you can establish that the vehicle was not purchased for use in California, or you accept, in good faith at the time of the sale, a completed

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

Consumer Use Tax Section | PO Box 942879 | Sacramento, CA

To be completed by the seller or person making the delivery on behalf of the seller. (please type or print)

I hereby certify, under penalty of perjury under the laws of the State of California, that the vehicle described below was delivered outside California on the date and at the place stated below.

YEAR |

MAKE |

MODEL |

VIN/LICENSE NUMBER |

PURCHASE PRICE |

PURCHASE DATE |

|

|

CITY |

STATE |

|

ZIP CODE |

||

NAME OF SELLING DEALER |

|

CDTFA SELLER’S PERMIT NUMBER |

DAYTIME TELEPHONE NUMBER |

|||

|

|

|

|

( |

) |

|

STREET ADDRESS OF SELLER |

|

CITY |

STATE |

|

ZIP CODE |

|

NAME OF SELLER (or person making delivery on behalf of the seller)

CHECK () ONE

SALESPERSON

EMPLOYEE

PARTNER

OTHER (explain)

SIGNATURE (I have delivered the

DATE OF DELIVERY

Fraudulent use of this statement to avoid the payment of California sales and use tax can result in severe penalties.

NOTICE TO PURCHASER

Please note that if you are a California resident and this vehicle is brought into California for any reason, other than qualifying warranty or repair service, within 12 months after its purchase, it shall be presumed that you have purchased the vehicle for use in California and you may owe California use tax. If use tax applies, you must pay it directly to the California Department of Tax and Fee Administration (CDTFA). If you are a nonresident and this vehicle is brought into California within 12 months of its delivery to you and is used or stored in California more than

To be completed by the purchaser. (please type or print)

I hereby certify, under penalty of perjury under the laws of the State of California, that the vehicle described above was delivered to me on the date, by the person, and at the location outside California described above.

NAME OF PURCHASER (please print) |

DRIVER LICENSE NUMBER |

STATE |

|

|

|

|

|

|

|

PURCHASER’S SIGNATURE |

DATE |

DAYTIME TELEPHONE NUMBER |

||

|

|

( |

) |

|

NOTARY STATEMENT

On |

, before me, |

|

|

|

|

|

, |

||||

|

|

(date) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(notary name) |

|

|

|||

a Notary Public in and for the County of |

|

|

|

, State of |

, |

||||||

|

|

|

|

(county) |

|

|

|

(state) |

|

|

|

duly commissioned and sworn, together, personally appeared both |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

(seller or seller’s agent) |

|

|

|

and |

|

|

, known to me to be the persons whose names are subscribed |

|

|

||||||

|

|

(purchaser) |

|

|

|

|

|

|

|

|

|

to the within instruments, and acknowledged that they executed the same in the authorized capacities, and that by their signatures on this instrument the persons executed the instrument. WITNESS my hand and official seal.

Signature

NOTARY SEAL

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Boe 448 form is used to document the delivery of a vehicle purchased in California when it is delivered to an out-of-state location. |

| Delivery Requirements | Both the seller and purchaser should be present at the delivery location outside California for the transaction to be valid. |

| Notarization | It is recommended that the form be notarized at the delivery point, confirming that the delivery occurred outside California. |

| Record Keeping | Sellers must keep the original Boe 448 form to support any claims for exemption from California Sales and Use Tax. |

| Audit Notice | This transaction is subject to audit, meaning the California Department of Tax and Fee Administration (CDTFA) may review your documents. |

| California Residency | If the purchaser is a California resident, they may still owe California use tax if the vehicle enters California within 12 months after purchase. |

| Supporting Evidence | It is crucial for purchasers to maintain records of the vehicle's out-of-state use for at least eight years after purchase. |

Guidelines on Utilizing Boe 448

The CDTFA-448 form must be filled out accurately to confirm the delivery of a vehicle outside California. It serves as a statement for the seller and the purchaser, establishing the details of the transaction and providing proof necessary for tax purposes. Here are the steps to complete the form.

- Obtain the Form: Download or print the CDTFA-448 form from the California Department of Tax and Fee Administration (CDTFA) website.

- Complete Seller Information: In the section designated for the seller, provide the following details:

- Year, make, model, and VIN/license number of the vehicle.

- Purchase price and purchase date.

- Out-of-state delivery address, including street address, city, state, and zip code.

- Name of the selling dealer and CDTFA seller’s permit number.

- Daytime telephone number of the seller.

- Name and title of the person making the delivery (and check the appropriate box).

- Sign and date the form to certify the delivery.

- Complete Purchaser Information: In the purchaser section, enter the following:

- Name of the purchaser and driver license number with the issuing state.

- Purchaser’s signature and the date.

- Daytime telephone number of the purchaser.

- Arrange for Notarization: Both the seller (or agent) and the purchaser must appear together before a notary public at the out-of-state delivery location. The notary will verify identities and witness the signing of the statement.

- Retain Copies: The seller must keep the original completed form for their records and provide a copy to the purchaser.

- Submit the Form: Within 30 days after delivery, send a copy of the CDTFA-448 form along with a copy of the purchase contract to the CDTFA at the specified address.

What You Should Know About This Form

What is the purpose of the BOE-448 form?

The BOE-448 form is used to document the delivery of a vehicle outside of California. It helps establish that the sale occurred outside the state, which may exempt the seller from charging California sales tax on that transaction.

Who needs to complete the BOE-448 form?

Both the seller and the purchaser must complete the BOE-448 form. The seller, or an authorized person making the delivery, must sign it alongside the purchaser at the out-of-state delivery point.

What should be included on the BOE-448 form?

The form requires specific information, including the vehicle's year, make, model, Vehicle Identification Number (VIN), purchase price, purchase date, out-of-state delivery location, and details about the seller and purchaser. Both parties need to provide their signatures and dates.

Is notarization required for the BOE-448 form?

Yes, it is strongly encouraged that both the seller and purchaser appear before a notary public at the out-of-state delivery location to sign the document. Notarization adds a layer of legitimacy to the transaction and helps avoid disputes regarding the sale's location.

What happens if the vehicle is later brought back to California?

If a California resident brings the vehicle into California within 12 months after purchase, it is presumed they bought it for use in California. They may owe California use tax unless they can prove otherwise. Nonresidents face similar requirements regarding use and registration within the same timeframe.

How long do I need to keep records related to the BOE-448 form?

Records should be kept for at least eight years. This includes any documentary evidence showing the vehicle's use outside California during the first year after purchase, to defend against any future tax assessments.

What should sellers do after completing the BOE-448 form?

Sellers are required to retain the original BOE-448 form for their records and must provide a copy to the purchaser. Additionally, they should submit a copy of the form and the purchase contract to the California Department of Tax and Fee Administration within 30 days of delivery.

What penalties may arise from fraudulent use of the BOE-448 form?

Using the BOE-448 form fraudulently to avoid paying California sales tax can lead to severe penalties, including fines and potential criminal charges. It is crucial to complete the form accurately and honestly to avoid such consequences.

Common mistakes

Filling out the CDTFA-448 form, titled "Statement of Delivery Outside California," is a critical task that requires careful attention. Many individuals make mistakes when completing this form, which could have serious implications for tax liability. One common error occurs when the seller fails to provide all required information. Essential details like the vehicle's year, make, model, and VIN need to be accurate and complete. Omitting any of these can lead to misunderstandings and potential audits.

Another significant mistake is not obtaining proper notarization. Both the seller and purchaser should appear together before a notary public at the out-of-state delivery location. If one party is absent at the time of notarization, the notarized statement may be deemed invalid. Without a valid notarized form, the seller may face challenges when trying to prove that the vehicle was delivered outside California.

Additionally, some sellers neglect their responsibility to keep accurate records. After completing the CDTFA-448 form, it is vital for the seller to retain the original and provide a copy to the purchaser. Forgetting to save these documents could complicate matters if an audit arises, as supporting documentation must be readily available to contest tax assessments.

A common misconception is that simply delivering a vehicle outside California absolves the seller from tax responsibilities. If the seller knows the buyer is a California resident, they are still required to collect and remit use tax unless certain criteria are met. Relying on the supposed exemption without proper documentation can lead to penalties down the line. It's crucial for sellers to verify the residence status of the purchasers.

Finally, individuals often overlook the necessity of including related documents when submitting the completed form. Alongside the CDTFA-448, submitting a copy of the purchase contract, and if applicable, the completed CDTFA-447 form, is critical. This oversight can create delays and complications in processing the tax exemption claim. Therefore, ensuring that all supporting documents are included is vital for a smooth submission process.

Documents used along the form

The CDTFA-448 form is crucial for documenting the delivery of a vehicle outside of California. It serves to establish that the seller delivered the vehicle out of state and aids in claiming exemptions from California sales tax. Several other forms and documents are often used alongside the CDTFA-448 to ensure compliance and proper record-keeping. The following list outlines six such documents.

- CDTFA-447: This form, titled "Statement Pursuant to Section 6247 of the California Sales and Use Tax Law," is used by sellers to obtain a declaration from purchasers, asserting their intention to use the vehicle outside of California. It is important for establishing the exempt status from California use tax.

- Bill of Sale: A bill of sale records the transaction details between the buyer and seller. It includes the vehicle’s description, purchase price, and the date of sale, and serves as proof of ownership transfer.

- Purchase Agreement: This document outlines the terms and conditions agreed upon by both parties regarding the vehicle sale. It may include payment terms, delivery conditions, and warranties.

- Notary Acknowledgment: A notary acknowledgment is often required to verify the authenticity of signatures on important documents, including the CDTFA-448. This adds a layer of credibility to the transaction, confirming that parties involved personally executed the documents.

- DMV Vehicle Registration Form: Once the vehicle is delivered, the buyer may need to complete a DMV registration form for their state. This helps in legally registering the vehicle out of California and establishes residency in the state where the vehicle will be used.

- Tax Exemption Certificate: Depending on the buyer's status, a tax exemption certificate may be necessary to clarify that the buyer qualifies for an exemption from certain taxes. This ensures compliance with state tax regulations.

Collecting and retaining the appropriate documentation is essential when dealing with vehicle sales across state lines. The listed forms and documents play a significant role in ensuring legal compliance and protecting both the seller and buyer from potential tax liabilities.

Similar forms

The CDTFA-448 form, also known as the Statement of Delivery Outside California, plays a crucial role in documenting the delivery of vehicles outside California. There are several other documents that share similar purposes and functions. Below is a list of six documents that relate closely to the CDTFA-448 form:

- Bill of Sale: This document serves as a receipt for the sale of a vehicle. It includes details about the transaction, such as the buyer's and seller's names, the vehicle's identification, and the purchase price. Like the CDTFA-448, it helps establish the legitimacy of the transaction and can be important for tax purposes.

- Purchase Contract: A purchase contract outlines the terms of the sale and may include details such as payment methods, warranties, and delivery dates. This document is often requested as supporting evidence, similar to how the CDTFA-448 must be accompanied by a copy of the purchase contract for verification purposes.

- Consignment Agreement: This agreement governs the sale of a vehicle through a third party. It details the responsibilities of each party and the terms of the sale. The consignment agreement provides clarity on ownership and sale conditions, paralleling the function of the CDTFA-448 in establishing the sales context and location.

- Notarized Affidavit of Vehicle Delivery: This document is specifically used to declare that a vehicle was delivered at a specified location. It requires notarization and confirms the details of delivery, mirroring the CDTFA-448's requirement for both buyer and seller to notarize the transaction to validate that it occurred outside California.

- CDTFA-447 (Statement Pursuant to Section 6247): This form is necessary when the seller believes the vehicle was not purchased for use in California. It must be completed by the buyer, similar to how the CDTFA-448 outlines seller responsibilities. Both forms help clarify the buyer's intent and residency status regarding sales tax obligations.

- Vehicle Title Transfer Document: This document is required for legally transferring ownership of a vehicle. The title transfer confirms that the purchaser is the new owner. This process needs to occur irrespective of the vehicle's delivery location and parallels the importance of the CDTFA-448 in documenting the sale's specifics.

These documents collectively provide essential evidence of the vehicle transaction and assist in addressing any tax implications that may arise from the sale.

Dos and Don'ts

When completing the Boe 448 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of what to do and what to avoid.

- Do ensure both the seller and purchaser are present at the out-of-state location during delivery.

- Do have the form notarized to verify the delivery outside California.

- Do retain the original Boe 448 form for your records.

- Do provide a copy of the statement to the purchaser promptly.

- Do send a copy of the statement and purchase contract within 30 days of delivery.

- Do not fail to collect California use tax if the purchaser is a California resident.

- Do not alter or falsify any information on the form.

- Do not ignore additional documentation requirements, such as including a completed CDTFA-447 if applicable.

- Do not neglect to keep records of out-of-state use for at least eight years.

Misconceptions

Misconceptions about the Boe 448 form often lead to confusion, especially for those involved in vehicle sales outside California. Understanding the truth behind these misconceptions helps ensure a smoother transaction process. Below are seven common misconceptions, along with a brief explanation for each.

- The Boe 448 form is just a formality. Many believe that filling out this form does not hold significant importance. In reality, it is crucial for proving that the vehicle was delivered outside California, which can affect tax obligations.

- Only the seller needs to be present at delivery. Some assume that only the seller's presence is necessary. In fact, both the seller and purchaser should be present at the out-of-state delivery point for the transaction to be valid.

- I don’t need a notary if I have the form. While having the form is essential, notarization helps to legally authenticate the delivery, providing additional protection against future tax claims.

- After signing, the seller can discard the form. This is a dangerous misconception. The seller must retain the original form to support any exclusion or exemption from California sales and use tax.

- Once the vehicle is delivered out of state, I have no more tax responsibilities. This is misleading. If the purchaser is a California resident, the seller might still have to collect and remit California use tax unless specific conditions are met.

- Documentation is unnecessary if I have the Boe 448 form. Many think that the form alone suffices. However, maintaining thorough records for at least eight years is advised, as the tax authority can review these documents to verify the details of the transaction.

- Use tax is only applicable to California residents. This is not accurate. Nonresidents may also have use tax obligations if the vehicle is brought into California and used or stored there for a significant portion of the year.

Addressing these misconceptions ensures that businesses and individuals can navigate vehicle transactions with confidence and comply with California tax regulations effectively.

Key takeaways

- Understand the Purpose: The BOE 448 form is used to certify that a vehicle was delivered outside of California. This helps sellers avoid California sales and use tax.

- Notary Requirement: Both the seller and the purchaser should meet at the delivery location to sign the form in front of a notary public. This reinforces the claim that the delivery occurred out of state.

- Document Retention: Sellers must retain the original BOE 448 form as evidence to support any claimed tax exclusion or exemption.

- Post-Delivery Responsibilities: Sellers are required to send a copy of the signed form and the purchase contract to the California Department of Tax and Fee Administration (CDTFA) within 30 days of delivery.

- California Residency Impact: If the purchaser is a California resident, the seller must collect and remit California use tax unless it can be proven that the vehicle was not purchased for use in California.

- Documentation of Vehicle Use: Purchasers should gather evidence of the vehicle's out-of-state use for the first 12 months to protect against potential tax liabilities.

- Long-Term Recordkeeping: Maintain records related to the vehicle's use outside of California for at least eight years, as the CDTFA can audit transactions up to that duration.

Browse Other Templates

Hostos Community College Transcript - This form is essential for anyone needing their official or student copy of their transcript.

Var Forms - Maintaining clear communication between parties can facilitate smoother contract execution.