Fill Out Your C 105 2 Form

Understanding the C-105.2 form is essential for businesses operating in New York State, especially those involved in industries where employee safety is a priority. This document serves as a Certificate of Workers' Compensation Insurance Coverage and plays a crucial role in ensuring that businesses comply with state regulations. Key elements of the C-105.2 include the legal name and address of the insured, the business’s telephone number, and the NYS Unemployment Insurance Employer Registration Number. Additionally, it requires input from the entity requesting proof of coverage and details about the insurance carrier, such as the policy number and effective period. Notably, this certificate confirms that the specified insurance carrier provides workers' compensation coverage as mandated by New York’s Workers' Compensation Law. It's important for businesses to recognize that this certificate is not just a formality. It acts as proof of insurance but does not confer additional rights beyond those defined in the associated policy. Furthermore, in case of a policy cancellation, businesses must be proactive in providing updated proof of coverage to maintain compliance with licensing and permitting requirements. In this article, we’ll delve deeper into the key components of the C-105.2 form, explore the implications of having or not having the required insurance, and guide you on what to watch for in the process.

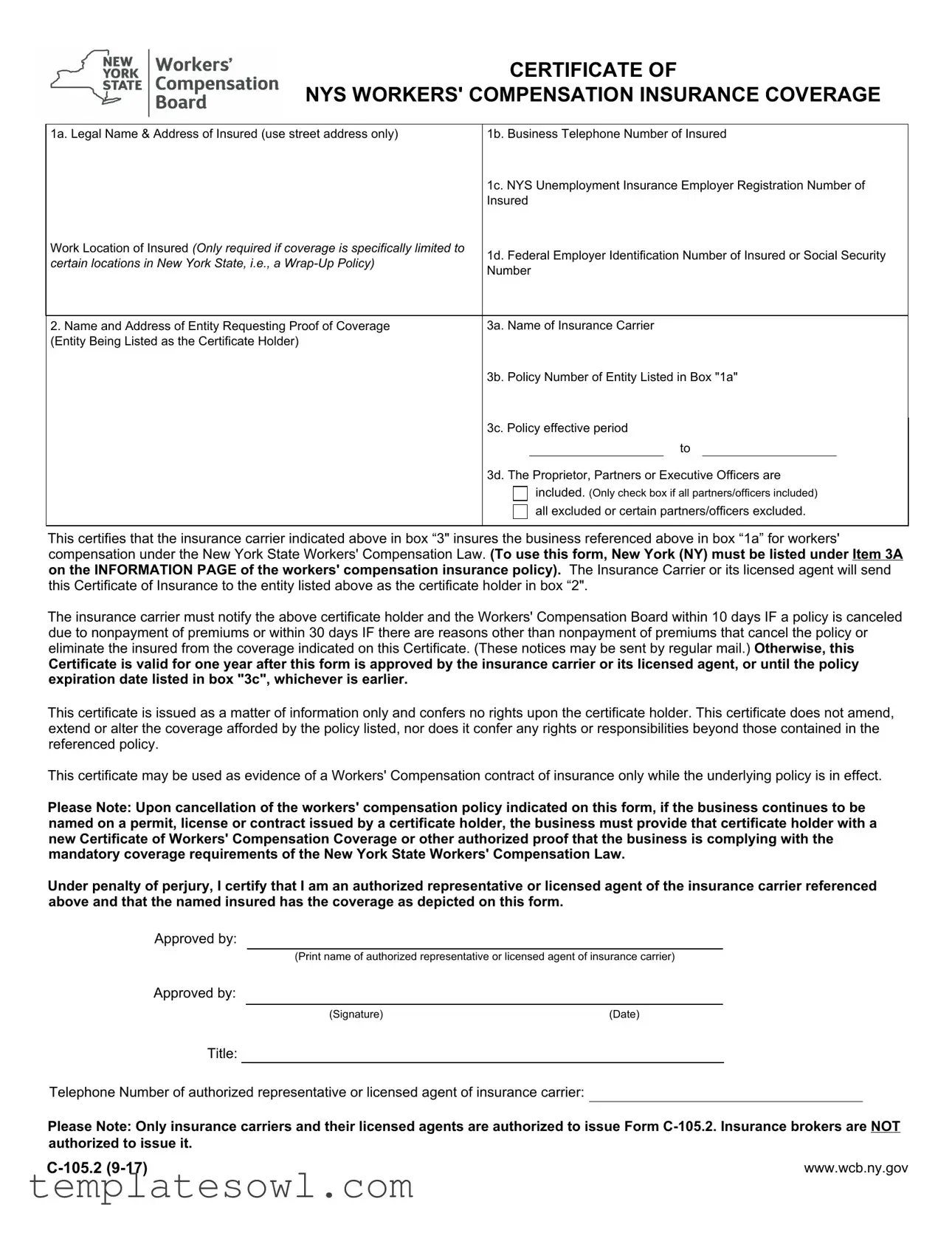

C 105 2 Example

CERTIFICATE OF

NYS WORKERS' COMPENSATION INSURANCE COVERAGE

1a. Legal Name & Address of Insured (use street address only) |

1b. |

Business Telephone Number of Insured |

|||||

|

1c. NYS Unemployment Insurance Employer Registration Number of |

||||||

|

Insured |

||||||

Work Location of Insured (Only required if coverage is specifically limited to |

1d. |

Federal Employer Identification Number of Insured or Social Security |

|||||

certain locations in New York State, i.e., a |

|||||||

Number |

|||||||

|

|||||||

|

|

|

|

|

|

|

|

2. Name and Address of Entity Requesting Proof of Coverage |

3a. |

Name of Insurance Carrier |

|||||

(Entity Being Listed as the Certificate Holder) |

|

|

|

|

|

|

|

|

3b. |

Policy Number of Entity Listed in Box "1a" |

|||||

|

|

|

|

||||

|

3c. Policy effective period |

||||||

|

|

|

|

to |

|

|

|

|

3d. The Proprietor, Partners or Executive Officers are |

||||||

|

|

|

included. (Only check box if all partners/officers included) |

||||

|

|

|

all excluded or certain partners/officers excluded. |

||||

|

|

|

|

|

|

|

|

This certifies that the insurance carrier indicated above in box “3" insures the business referenced above in box “1a” for workers' compensation under the New York State Workers' Compensation Law. (To use this form, New York (NY) must be listed under Item 3A on the INFORMATION PAGE of the workers' compensation insurance policy). The Insurance Carrier or its licensed agent will send this Certificate of Insurance to the entity listed above as the certificate holder in box “2".

The insurance carrier must notify the above certificate holder and the Workers' Compensation Board within 10 days IF a policy is canceled due to nonpayment of premiums or within 30 days IF there are reasons other than nonpayment of premiums that cancel the policy or eliminate the insured from the coverage indicated on this Certificate. (These notices may be sent by regular mail.) Otherwise, this

Certificate is valid for one year after this form is approved by the insurance carrier or its licensed agent, or until the policy expiration date listed in box "3c", whichever is earlier.

This certificate is issued as a matter of information only and confers no rights upon the certificate holder. This certificate does not amend, extend or alter the coverage afforded by the policy listed, nor does it confer any rights or responsibilities beyond those contained in the referenced policy.

This certificate may be used as evidence of a Workers' Compensation contract of insurance only while the underlying policy is in effect.

Please Note: Upon cancellation of the workers' compensation policy indicated on this form, if the business continues to be named on a permit, license or contract issued by a certificate holder, the business must provide that certificate holder with a new Certificate of Workers' Compensation Coverage or other authorized proof that the business is complying with the mandatory coverage requirements of the New York State Workers' Compensation Law.

Under penalty of perjury, I certify that I am an authorized representative or licensed agent of the insurance carrier referenced above and that the named insured has the coverage as depicted on this form.

Approved by:

(Print name of authorized representative or licensed agent of insurance carrier)

Approved by:

(Signature) |

(Date) |

Title:

Telephone Number of authorized representative or licensed agent of insurance carrier:

Please Note: Only insurance carriers and their licensed agents are authorized to issue Form

www.wcb.ny.gov |

Workers' Compensation Law

Section 57. Restriction on issue of permits and the entering into contracts unless compensation is secured.

1.The head of a state or municipal department, board, commission or office authorized or required by law to issue any permit for or in connection with any work involving the employment of employees in a hazardous employment defined by this chapter, and notwithstanding any general or special statute requiring or authorizing the issue of such permits, shall not issue such permit unless proof duly subscribed by an insurance carrier is produced in a form satisfactory to the chair, that compensation for all employees has been secured as provided by this chapter. Nothing herein, however, shall be construed as creating any liability on the part of such state or municipal department, board, commission or office to pay any compensation to any such employee if so employed.

2.The head of a state or municipal department, board, commission or office authorized or required by law to enter into any contract for or in connection with any work involving the employment of employees in a hazardous employment defined by this chapter, notwithstanding any general or special statute requiring or authorizing any such contract, shall not enter into any such contract unless proof duly subscribed by an insurance carrier is produced in a form satisfactory to the chair, that compensation for all employees has been secured as provided by this chapter.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The C-105.2 form certifies that a business has workers' compensation insurance coverage in New York State. |

| Governing Law | This form complies with the New York State Workers' Compensation Law, specifically Section 57. |

| Issuance Authority | Only licensed insurance carriers and their agents can issue the C-105.2 form; brokers are not authorized. |

| Notification Requirement | The insurance carrier must notify the certificate holder of policy cancellation within specific timeframes (10 days for nonpayment, 30 days for other reasons). |

| Validity Period | The certificate remains valid for one year or until the policy expiration date, whichever comes first. |

| Use as Evidence | This certificate can be used as proof of coverage only while the underlying insurance policy is active. |

| Mandatory Compliance | Upon cancellation of the insurance policy, the business must provide new proof of coverage to any relevant certificate holders. |

Guidelines on Utilizing C 105 2

Filling out the C-105.2 form requires precise information to ensure compliance with New York State Workers' Compensation Laws. The form is primarily used to certify that a business holds valid workers' compensation insurance. After completing the form, it should be sent to the designated entity requesting proof of coverage.

- Enter the Legal Name & Address of Insured in box 1a. Use street addresses only.

- Provide the Business Telephone Number of Insured in box 1b.

- Include the NYS Unemployment Insurance Employer Registration Number of the insured in box 1c.

- Fill in the Federal Employer Identification Number or Social Security Number of the insured in box 1d.

- Enter the Work Location of Insured if coverage is limited to specific locations.

- Write the Name and Address of Entity Requesting Proof of Coverage in box 2.

- List the Name of Insurance Carrier in box 3a, which represents the certificate holder.

- Input the Policy Number associated with the insured business in box 3b.

- Specify the Policy Effective Period in box 3c.

- Indicate if all Proprietors, Partners, or Executive Officers are included by checking the appropriate box in 3d.

- Have an authorized representative or licensed agent of the insurance carrier print their name and sign at the bottom.

- Include the Date and Telephone Number of this representative in the required fields.

What You Should Know About This Form

What is the C 105 2 form?

The C 105 2 form is a Certificate of New York State Workers' Compensation Insurance Coverage. It serves as proof that a business is covered by workers' compensation insurance as required by New York State law. This form is particularly important for businesses that need to prove their insurance coverage to obtain permits, licenses, or contracts for work involving employees.

Who can issue the C 105 2 form?

Only insurance carriers and their licensed agents are authorized to issue the C 105 2 form. Insurance brokers are not allowed to provide this certificate. It is essential to ensure that the certificate is issued by an authorized party to comply with New York State requirements.

What information is required on the C 105 2 form?

The C 105 2 form requires several pieces of information. This includes the legal name and address of the insured, the business telephone number, and the New York State Unemployment Insurance Employer Registration Number. Additionally, it needs the name and address of the entity requesting proof of coverage, the insurance carrier's name, policy number, and the effective period of the policy.

How long is the C 105 2 form valid?

The C 105 2 form is valid for one year after it is approved by the insurance carrier or its licensed agent, or until the expiration date of the insurance policy listed on the form. If the policy is canceled or there are changes, the insurance carrier must notify the certificate holder and the Workers' Compensation Board within specific time frames.

What should be done if the workers' compensation policy is canceled?

If the workers' compensation policy indicated on the C 105 2 form is canceled, the business must provide a new certificate of coverage or other proof of compliance to any permit, license, or contract issuer that still includes the business name. This ensures that the business remains compliant with New York State Workers' Compensation Law, even after coverage has changed.

Common mistakes

When completing the C-105.2 form, individuals often overlook crucial details that can lead to confusion or delays. One common mistake is failing to provide the full legal name and correct address of the insured. This information must reflect the official records and should not include abbreviations or alternate names. Inaccuracies in this section can result in complications when verifying coverage, which is essential for compliance with state regulations.

Another frequent error involves the omission of the business telephone number. Although this may seem insignificant, without a valid contact number, communication between the insurance carrier, the insured, and the certificate holder becomes difficult. It is vital to include accurate contact information to facilitate any necessary follow-up inquiries or urgent notifications regarding policy changes.

Many individuals also fail to include the NYS Unemployment Insurance Employer Registration Number of the insured. This number serves as an important identifier for the business within the state’s regulatory framework. Omitting this detail not only delays processing but may also raise questions about the legitimacy of the insurance coverage.

Additionally, people often misunderstand the requirement related to insurance coverage location. It is essential to specify if the coverage is limited to particular locations in New York State. Failing to clarify this can lead to misinterpretation and may leave businesses vulnerable if a claim arises at an unlisted location.

Another mistake occurs in the area of policy details. In Box 3a, the name of the insurance carrier must match exactly as documented in the insurance policy. Inconsistencies or errors in the listing can cause significant issues during the validation process. Ensuring this information is accurate is crucial for the validity of the certificate.

Finally, individuals often neglect to check the appropriate box regarding the inclusion or exclusion of partners, officers, or executives in the coverage. This detail directly affects liability and protection under the policy. Properly indicating whether all or certain individuals are included can prevent misunderstandings about who is covered under the workers' compensation insurance.

Documents used along the form

The C 105 2 form, known as the Certificate of New York State Workers' Compensation Insurance Coverage, serves as proof that a business has the required workers' compensation insurance. Alongside this form, several other documents are commonly utilized to ensure compliance with New York State regulations. Below is a list of these documents.

- Form C-105.1: This form serves as a certificate that summarizes a business’s workers’ compensation coverage. It contains similar information to the C 105 2 form but is often used for specific applications, such as obtaining permits or contracts.

- Form CE-200: The Certificate of Attestation of Exemption from NYS Workers' Compensation and/or Disability Benefits Coverage certifies that a business is exempt from the workers’ compensation requirement due to specific criteria, such as being a sole proprietor without employees.

- Form DB-120: This document is the New York State Disability Benefits Law Certificate of Insurance Coverage. It ensures that businesses provide disability insurance for their employees, in addition to workers' compensation coverage.

- Form DB-155: This is the Certificate of Exemption from Disability Benefits Law. Similar to CE-200, it certifies that a business or individual is exempt from the requirement to provide disability benefits coverage.

- EPLI Coverage Documents: Employment Practices Liability Insurance documents include proof of coverage against claims made by employees for unlawful employment practices such as discrimination or wrongful termination. These documents may be requested alongside workers' compensation insurance documentation in certain contractual or legal scenarios.

Each of these documents plays a crucial role in ensuring businesses adhere to employment laws and offer the necessary protections for themselves and their employees. Understanding these forms can facilitate smoother compliance with regulatory requirements and foster better workplace safety and fairness.

Similar forms

- Certificate of Insurance (COI): This document acts as proof that an entity has active insurance coverage, providing similar assurances as the C 105 2 form for workers' compensation. It contains details such as the policy number, coverage limits, and effective dates, ensuring that third parties are informed about the insured's coverage status.

- Workers' Compensation Insurance Policy: This comprehensive document outlines the terms, conditions, and extent of coverage for workers' compensation. Like the C 105 2 form, it specifies the insured, policy duration, and exclusions, affirming that employees are protected under the policy terms.

- Certificate of Good Standing: Issued by the state, it confirms that a business is registered and compliant with state laws. While for a different purpose, it similarly serves to provide assurance to third parties, much like the C 105 2 does regarding workers' compensation coverage.

- Affidavit of Exemption: This document is used by certain businesses to assert their exemption from workers' compensation requirements. Like the C 105 2 form, it provides necessary confirmation regarding compliance and coverage status, though in this case, it confirms lack of need for coverage.

- Insurance Verification Letter: This letter, typically issued by an insurance agent, confirms the existence of a specific insurance policy. Similar to the C 105 2 form, it reassures entities requesting proof of coverage that the insured has operational policies in place, though it may not be as formalized as a certificate.

Dos and Don'ts

When filling out the C 105 2 form, it is important to pay attention to detail and follow specific guidelines. The following list outlines some key dos and don'ts to keep in mind.

- Do provide the complete legal name and address of the insured in Box 1a, using only the street address.

- Do ensure the business telephone number is accurate in Box 1b.

- Do confirm that all information matches the insurance policy to avoid discrepancies.

- Do carefully check the policy effective period in Box 3c to ensure it reflects the correct dates.

- Don't leave any boxes blank if the information is applicable; all necessary information must be filled in to ensure validity.

- Don't alter or modify any parts of the form; it must remain in its original format.

By following these guidelines, you will help ensure that the C 105 2 form is completed accurately, facilitating a smoother process in obtaining proof of workers' compensation coverage.

Misconceptions

Misconceptions about the C-105.2 form can lead to confusion regarding its purpose and use. Here are six common misunderstandings:

- The C-105.2 form provides insurance coverage. Many believe that the form itself offers insurance. In reality, it serves as proof that a business has obtained workers' compensation coverage from a licensed insurance carrier.

- Only businesses with a high number of employees need the C-105.2 form. This form is required for any business in New York State that employs workers, regardless of the number of employees.

- The C-105.2 form is not necessary if a company has a Wrap-Up Policy. If the coverage is limited to specific locations and marked as such, the form is still needed to show compliance.

- Insurance brokers can issue the C-105.2 form. Only licensed insurance carriers and their agents have the authority to issue this form. Brokers do not have this capability.

- Once issued, the C-105.2 form remains valid indefinitely. The form is only valid for a year after approval or until the policy expiration date, whichever comes first.

- The C-105.2 form ensures all employees are covered. The form does not guarantee coverage for all employees. It can specify exclusions for certain partners or officers if indicated.

Key takeaways

Here are some key takeaways about filling out and using the C-105.2 form, which certifies workers' compensation insurance coverage in New York State:

- Accurate Information is Crucial: Ensure every detail, including names, addresses, and numbers, is filled out correctly to avoid delays.

- Use of Street Address: Always provide the street address for the insured, not just a P.O. box or general location.

- Only Authorized Parties Can Issue: Only insurance carriers and their licensed agents are permitted to issue the C-105.2 form.

- Submit Promptly: Once completed, the insurance carrier will send this form to the entity requesting proof of coverage.

- Keep Within Validity Period: The certificate is valid for one year or until the policy expiration, whichever comes first.

- Notification of Cancellations: If a policy is canceled, the insurance carrier must notify both the certificate holder and the Workers' Compensation Board within specific timeframes.

- Reporting Changes: If there are changes in coverage or if the business remains on a permit, a new certificate must be provided upon policy cancellation.

- Protection of Rights: This certificate does not grant the holder any rights beyond what is specified in the insurance policy.

- Authorized Signatures: The form must be signed by an authorized representative of the insurance carrier to be valid.

- Compliance is Mandatory: Businesses must comply with New York State Workers’ Compensation Law, including providing proof of coverage when needed for permits or contracts.

Understanding these key points will help in the proper use of the C-105.2 form and ensure compliance with state regulations.

Browse Other Templates

Lynn University Transcript - In case of discrepancies, students will need to contact the registrar's office for resolution.

Form Uia 1772 - The form asks for reasons for payroll or asset discontinuance.