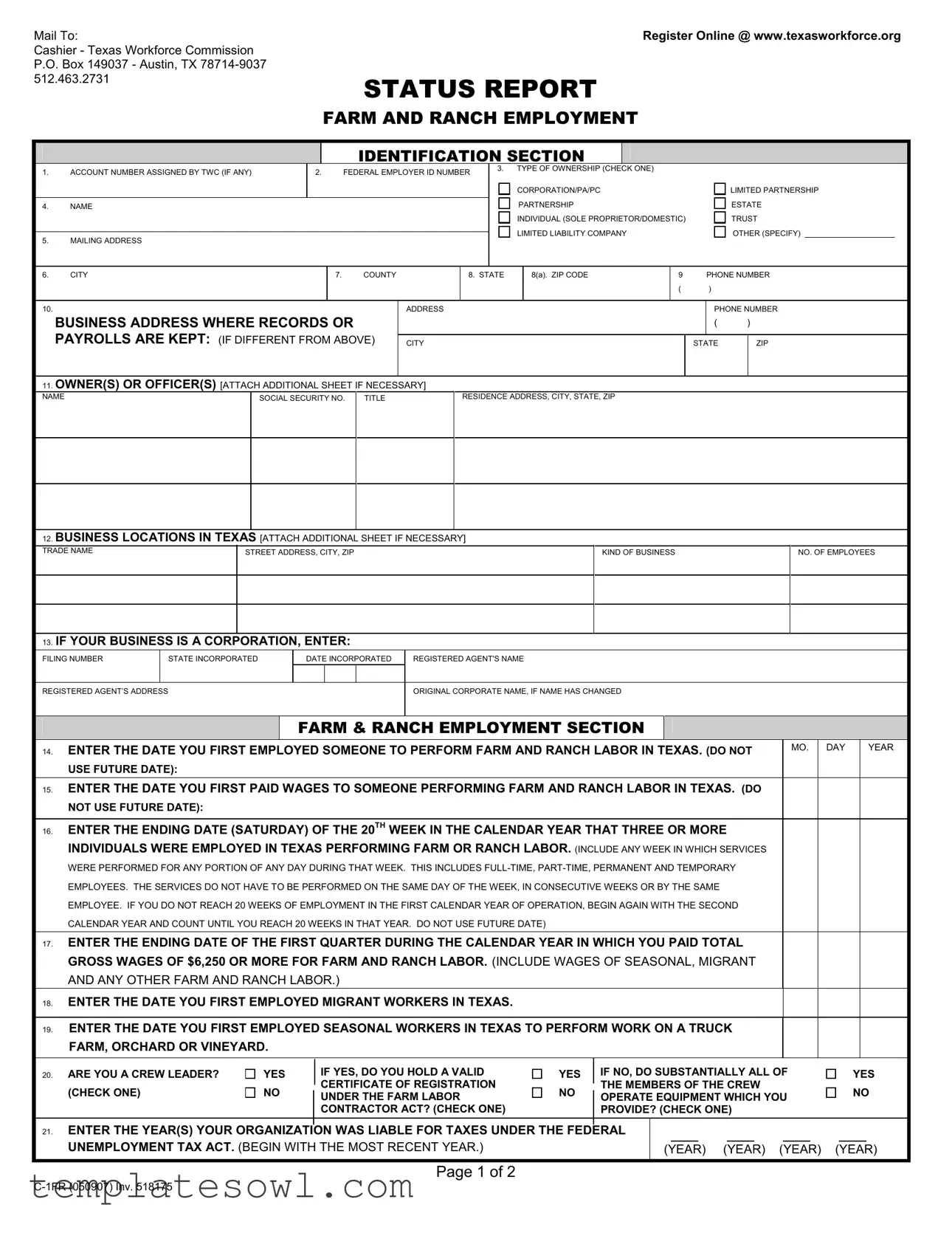

Fill Out Your C 1Fr Form

The C 1Fr form is a crucial document for entities involved in farm and ranch employment in Texas. Primarily issued by the Texas Workforce Commission (TWC), it serves as a status report for businesses that employ individuals for agricultural work. Various sections of the form collect essential information such as the business's account number, Employer Identification Number, and type of ownership. The form requires details about the owner or officers, their mailing addresses, and contact numbers. Additionally, it captures significant employment dates and statistics, including when the business first employed farm labor and when wages were paid. Important questions about the nature of employment, including the hiring of migrant and seasonal workers, are also included. Furthermore, the form addresses the voluntary unemployment tax election for non-liable employers, allowing them to opt into state unemployment tax responsibilities. The integrity of the completed form is affirmed by a signature, certifying that the provided information is true and accurate. Therefore, the C 1Fr form plays a foundational role in complying with Texas employment regulations specific to agricultural businesses.

C 1Fr Example

Mail To:

Cashier - Texas Workforce Commission P.O. Box 149037 - Austin, TX

Register Online @ www.texasworkforce.org

STATUS REPORT

FARM AND RANCH EMPLOYMENT

IDENTIFICATION SECTION

1. |

ACCOUNT NUMBER ASSIGNED BY TWC (IF ANY) |

|

2. FEDERAL EMPLOYER ID NUMBER |

3. |

TYPE OF OWNERSHIP (CHECK ONE) |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

CORPORATION/PA/PC |

|

|

|

|

LIMITED PARTNERSHIP |

||||

|

|

|

|

|

|

|

|

|

|

|

PARTNERSHIP |

|

|

|

|

ESTATE |

||||

4. |

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL (SOLE PROPRIETOR/DOMESTIC) |

|

|

TRUST |

||||||

|

|

|

|

|

|

|

|

|

|

|

LIMITED LIABILITY COMPANY |

|

|

|

|

OTHER (SPECIFY) |

||||

5. |

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. |

CITY |

|

7. |

COUNTY |

|

|

8. STATE |

|

8(a). ZIP CODE |

9 |

|

|

PHONE NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

10. |

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

PHONE NUMBER |

||||||

BUSINESS ADDRESS WHERE RECORDS OR |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

||||||

PAYROLLS ARE KEPT: (IF DIFFERENT FROM ABOVE) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

CITY |

|

|

|

|

|

STATE |

|

ZIP |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

11. OWNER(S) OR OFFICER(S) [ATTACH ADDITIONAL SHEET IF NECESSARY] |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

NAME |

|

|

SOCIAL SECURITY NO. |

TITLE |

|

|

RESIDENCE ADDRESS, CITY, STATE, ZIP |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.BUSINESS LOCATIONS IN TEXAS [ATTACH ADDITIONAL SHEET IF NECESSARY]

TRADE NAME |

STREET ADDRESS, CITY, ZIP |

KIND OF BUSINESS |

NO. OF EMPLOYEES |

13. IF YOUR BUSINESS IS A CORPORATION, ENTER:

13. IF YOUR BUSINESS IS A CORPORATION, ENTER:

FILING NUMBER |

|

STATE INCORPORATED |

DATE INCORPORATED |

REGISTERED AGENT'S NAME |

||

|

|

|

|

|

|

|

REGISTERED AGENT’S ADDRESS |

|

|

|

|

ORIGINAL CORPORATE NAME, IF NAME HAS CHANGED |

|

|

|

|

|

|

|

|

FARM & RANCH EMPLOYMENT SECTION

14. ENTER THE DATE YOU FIRST EMPLOYED SOMEONE TO PERFORM FARM AND RANCH LABOR IN TEXAS. (DO NOT |

MO. DAY YEAR |

|

|

USE FUTURE DATE): |

|

15.ENTER THE DATE YOU FIRST PAID WAGES TO SOMEONE PERFORMING FARM AND RANCH LABOR IN TEXAS. (DO NOT USE FUTURE DATE):

16.ENTER THE ENDING DATE (SATURDAY) OF THE 20TH WEEK IN THE CALENDAR YEAR THAT THREE OR MORE

INDIVIDUALS WERE EMPLOYED IN TEXAS PERFORMING FARM OR RANCH LABOR. (INCLUDE ANY WEEK IN WHICH SERVICES WERE PERFORMED FOR ANY PORTION OF ANY DAY DURING THAT WEEK. THIS INCLUDES

17.ENTER THE ENDING DATE OF THE FIRST QUARTER DURING THE CALENDAR YEAR IN WHICH YOU PAID TOTAL GROSS WAGES OF $6,250 OR MORE FOR FARM AND RANCH LABOR. (INCLUDE WAGES OF SEASONAL, MIGRANT AND ANY OTHER FARM AND RANCH LABOR.)

18. ENTER THE DATE YOU FIRST EMPLOYED MIGRANT WORKERS IN TEXAS.

19.ENTER THE DATE YOU FIRST EMPLOYED SEASONAL WORKERS IN TEXAS TO PERFORM WORK ON A TRUCK FARM, ORCHARD OR VINEYARD.

20.ARE YOU A CREW LEADER? (CHECK ONE)

YES

NO

IF YES, DO YOU HOLD A VALID CERTIFICATE OF REGISTRATION UNDER THE FARM LABOR CONTRACTOR ACT? (CHECK ONE)

YES

NO

IF NO, DO SUBSTANTIALLY ALL OF THE MEMBERS OF THE CREW OPERATE EQUIPMENT WHICH YOU PROVIDE? (CHECK ONE)

YES

NO

21.ENTER THE YEAR(S) YOUR ORGANIZATION WAS LIABLE FOR TAXES UNDER THE FEDERAL UNEMPLOYMENT TAX ACT. (BEGIN WITH THE MOST RECENT YEAR.)

(YEAR) (YEAR) (YEAR) (YEAR)

Page 1 of 2

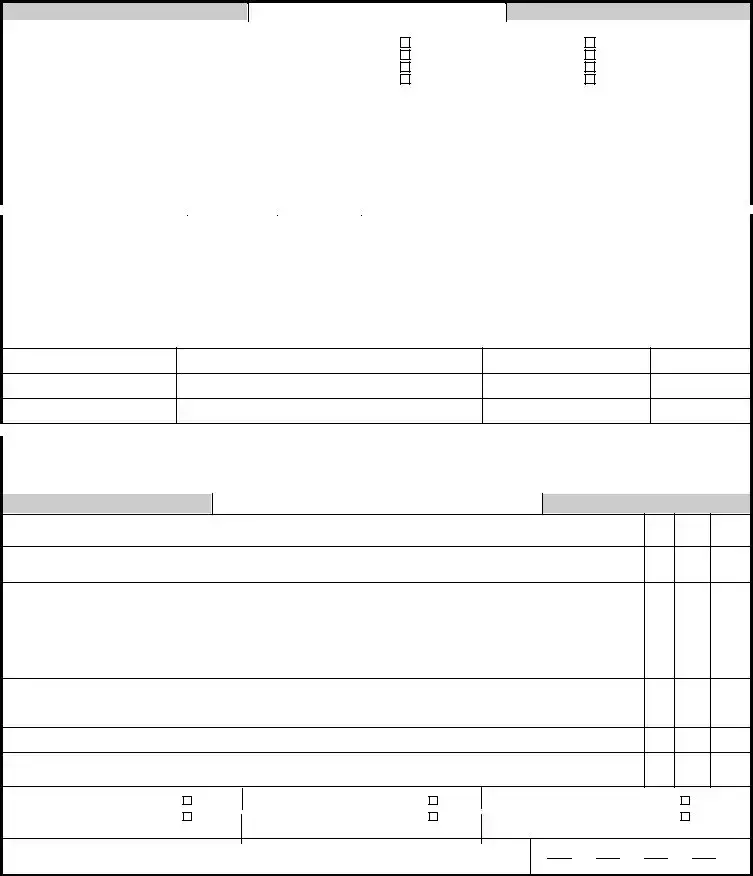

FARM & RANCH EMPLOYMENT SECTION -

22. |

|

|

|

|

MO. |

|

DAY |

YEAR |

||

IF YOUR |

|

|

|

|

|

|||||

A. ENTER THE DATE YOU RESUMED EMPLOYING SOMEONE ON A FARM OR RANCH IN TEXAS. |

|

|

|

|

|

|

||||

ACCOUNT |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

HAS BEEN |

|

|

|

|

|

|

|

|

|

|

B. ENTER THE DATE YOU RESUMED PAYING WAGES TO SOMEONE PERFORMING FARM OR RANCH |

|

|

|

|

|

|

||||

INACTIVE: |

|

|

|

|

|

|

||||

LABOR IN TEXAS. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

23 |

PREVIOUS OWNER’S TWC ACCOUNT NUMBER (IF KNOWN) |

|

DATE OF ACQUISITION |

|

|

|

|

|||

IF THE BUSINESS |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

IN TEXAS WAS |

|

|

|

|

|

|

|

|

|

|

ACQUIRED FROM |

|

|

|

|

|

|

|

|

|

|

NAME OF PREVIOUS OWNER(S) |

|

|

|

|

|

|

|

|

||

ANOTHER LEGAL |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

ENTITY, YOU |

|

|

|

|

|

|

|

|

|

|

MUST COMPLETE |

|

|

|

|

|

|

|

|

|

|

ADDRESS |

CITY |

|

STATE |

|||||||

ITEMS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHAT PORTION OF BUSINESS WAS ACQUIRED? (CHECK ONE) |

|

|

|

|

|

|

|

|

|

|

ALL |

|

|

|

|

|

|

|

|

|

|

PART (SPECIFY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24.

ON THE DATE OF THE ACQUISITION, WAS THE PREVIOUS OWNER(S), OR ANY PARTNER(S), OFFICER(S), SHAREHOLDER(S), OTHER OWNER(S) OR A PERSON RELATED BY BLOOD OR MARRIAGE TO ANY OF THESE INDIVIDUALS, HOLDING A LEGAL OR EQUITABLE INTEREST IN THE PREDECESSOR BUSINESS, ALSO AN OWNER, PARTNER, OFFICER, SHAREHOLDER, OR OTHER OWNER OF A LEGAL OR EQUITABLE INTEREST IN THE SUCCESSOR BUSINESS?

YES

NO

IF “YES”, CHECK ALL THAT APPLY:

SAME OWNER, OFFICER, PARTNER, OR SHAREHOLDER SAME PARENT COMPANY

SOLE PROPRIETOR INCORPORATING OTHER (DESCRIBE BELOW)

25. |

|

|

|

|

|

IF “NO,” ON THE DATE OF THE ACQUISITION, DID THE PREVIOUS OWNER(S), PARTNER(S), OFFICER(S), |

|

|

|

|

SHAREHOLDER(S), OTHER OWNER(S) OR A PERSON RELATED BY BLOOD OR MARRIAGE TO ANY OF |

|

|

|

|

THESE INDIVIDUALS, HOLDING A LEGAL OR EQUITABLE INTEREST IN THE PREDECESSOR BUSINESS, HOLD |

YES |

NO |

|

|

AN OPTION TO PURCHASE SUCH AN INTEREST IN THE SUCCESSOR BUSINESS? |

|||

|

|

|

|

|

26. |

|

|

|

|

|

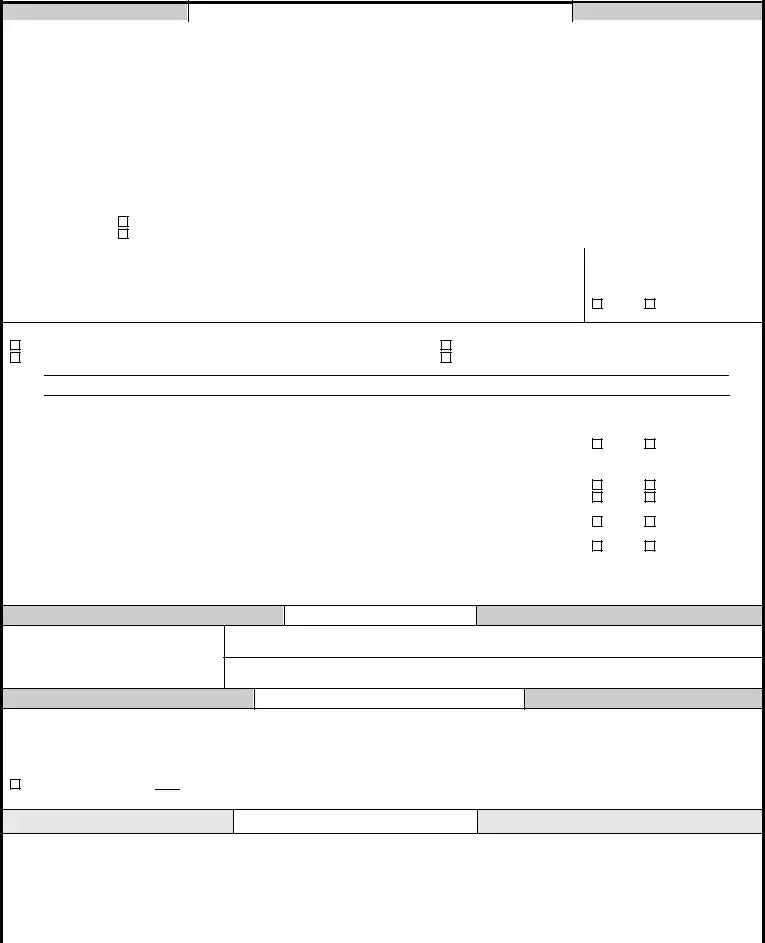

AFTER THE ACQUISITION, DID THE PREDECESSOR CONTINUE TO: |

|

|

|

|

• OWN OR MANAGE THE ORGANIZATION THAT CONDUCTS THE ORGANIZATION, TRADE OR BUSINESS? |

YES |

NO |

|

|

• OWN OR MANAGE THE ASSETS NECESSARY TO CONDUCT THE ORGANIZATION, TRADE OR |

YES |

NO |

|

|

BUSINESS? |

|

|

|

|

• CONTROL THROUGH SECURITY OR LEASE ARRANGEMENT THE ASSETS NECESSARY TO CONDUCT |

YES |

NO |

|

|

THE ORGANIZATION, TRADE OR BUSINESS? |

|

|

|

|

• DIRECT THE INTERNAL AFFAIRS OR CONDUCT OF THE ORGANIZATION, TRADE OR BUSINESS? |

YES |

NO |

|

|

IF “YES” TO ANY OF ABOVE, DESCRIBE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

NATURE OF ACTIVITY

27.

DESCRIBE FULLY THE NATURE OF

ACTIVITY IN TEXAS AND LIST THE

PRINCIPAL PRODUCTS OR SERVICES

IN ORDER OF IMPORTANCE.

VOLUNTARY ELECTION SECTION

28.

A

YES, EFFECTIVE JAN. 1, 2 I WISH TO COVER ALL EMPLOYEES (EXCEPT THOSE PERFORMING SERVICE(S) WHICH ARE SPECIFICALLY EXEMPT IN THE TEXAS UNEMPLOYMENT COMPENSATION ACT).

SIGNATURE SECTION

I HEREBY CERTIFY THAT THE PRECEDING INFORMATION IS TRUE AND CORRECT, AND THAT I AM AUTHORIZED TO EXECUTE THIS STATUS REPORT ON BEHALF OF THE EMPLOYING UNIT NAMED HEREIN. (THIS REPORT MUST BE SIGNED BY THE OWNER, OFFICER, PARTNER OR INDIVIDUAL WITH A VALID WRITTEN AUTHORIZATION ON FILE WITH THE TEXAS WORKFORCE COMMISSION)

|

MONTH |

DAY |

YEAR |

|

TITLE |

DATE OF |

|

|

|

SIGN HERE |

|

|

|

|

|

||

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

DRIVER'S LICENSE NUMBER |

STATE |

||||

|

|

|

|

|

|

Individuals may receive, review, and correct information that TWC collects about the individual by emailing to |

|

open.records@twc.state.tx.us or writing to TWC Open Records, 101 East 15th St., Rm. 266, Austin, TX |

|

Page 2 of 2 |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used to report employment status within the farm and ranch sector in Texas. |

| Submission Address | Mail to: Cashier - Texas Workforce Commission, P.O. Box 149037, Austin, TX 78714-9037. |

| Contact Number | You can reach the Texas Workforce Commission at 512.463.2731. |

| Governing Law | The form complies with the Texas Unemployment Compensation Act. |

| Account Identification | Requires an Account Number assigned by TWC and a Federal Employer ID Number. |

| Business Ownership | Must indicate type of ownership such as Corporation, Limited Partnership, or Sole Proprietorship. |

| Employee Information | Includes fields for employee counts and types of employment, including migrant and seasonal workers. |

| Tax Liability | Employers must report whether their organization was liable for taxes under the Federal Unemployment Tax Act. |

| Voluntary Election | A non-liable employer may choose to pay state unemployment tax voluntarily for a minimum of two years. |

| Correction Rights | Individuals can receive, review, and correct their information by contacting TWC’s Open Records. |

Guidelines on Utilizing C 1Fr

After gathering the necessary information, you can fill out the C-1FR form. Each section must be completed accurately to ensure proper processing. Be prepared to provide information regarding your business, employment practices, and any relevant history.

- Begin by entering your Account Number assigned by TWC, if applicable, in Section 1.

- Provide your Federal Employer ID Number.

- Select the Type of Ownership by checking one of the options: Corporation/PA/PC, Limited Partnership, Partnership, Estate, or another.

- Fill in the Name of the individual, trust, or business.

- Insert your Mailing Address, including city, county, and state.

- Enter your ZIP Code and Phone Number.

- If applicable, provide the Business Address where records or payrolls are kept.

- List the Owner(s) or Officer(s) with names, Social Security numbers, titles, and addresses. Attach an additional sheet if necessary.

- Document Business Locations in Texas, including trade name, street address, and number of employees. Attach an additional sheet if necessary.

- If a corporation, enter the required details about your incorporation, such as filing number, state, and date of incorporation.

- In Section 14, enter the date you first employed someone for farm and ranch labor in Texas.

- Provide the date you first paid wages to farm and ranch laborers in Texas.

- Detail the ending date of the 20th week when three or more individuals were employed for farm or ranch labor.

- Indicate the ending date of the first quarter in which total gross wages of $6,250 or more were paid for farm and ranch labor.

- Enter the date you first employed migrant workers in Texas.

- Provide the date you first employed seasonal workers on a truck farm, orchard, or vineyard.

- For Section 20, answer if you are a crew leader and check if you hold a valid certificate of registration.

- Enter the year(s) your organization was liable under the Federal Unemployment Tax Act.

- Complete Sections 22-26 regarding any acquisition of your business.

- Describe the Nature of Activity in Texas and list the principal products or services.

- Decide if you wish to make a voluntary election regarding state unemployment tax and complete that section if applicable.

- Finally, sign and date the form, providing your title, driver's license number, and email address.

What You Should Know About This Form

What is the purpose of the C 1Fr form?

The C 1Fr form is used to report farm and ranch employment to the Texas Workforce Commission (TWC). It gathers essential information about employers, including ownership type, business locations, and the employment history related to farm and ranch labor. Businesses must file this form to ensure compliance with Texas labor laws and to determine liability for state unemployment taxes.

Who needs to fill out the C 1Fr form?

Any individual or entity engaging in farm and ranch labor in Texas is required to complete the C 1Fr form. This includes sole proprietors, corporations, partnerships, and limited liability companies. If a business has employees performing labor on a farm or ranch, it must file this form with the TWC, regardless of the number of employees.

How do I submit the C 1Fr form?

The form can be submitted either by mail or online. For mail submissions, send the completed form to the Cashier at the Texas Workforce Commission, P.O. Box 149037, Austin, TX 78714-9037. If you prefer to register online, you can do so by visiting www.texasworkforce.org. Ensure all required sections are filled out accurately to avoid delays.

What information do I need to provide on the C 1Fr form?

You will need to provide information such as your Texas Workforce Commission account number, Federal Employer ID number, type of ownership, business address, and the date you first employed someone for farm or ranch labor in Texas. Other details include the nature of your business and information about employees and previous ownership if applicable. Be thorough to ensure compliance.

What happens if I do not file the C 1Fr form?

Failure to file the C 1Fr form may result in penalties and legal complications, including liability for state unemployment taxes without appropriate registration. Not filing can lead to an inability to access certain benefits or assistance from TWC. Businesses engaging in farm and ranch labor should prioritize submitting this form to maintain compliance with state laws.

Common mistakes

Filling out the C-1FR form correctly is crucial for compliance with state regulations, yet many individuals make repeated errors. Awareness of common mistakes can help ensure a smoother submission process. One frequent error involves neglecting to provide the Federal Employer ID Number. Without this number, your application may not be processed efficiently.

Another common mistake is misidentifying the Type of Ownership. This section is straightforward; however, individuals may accidentally check more than one box or fail to select the correct ownership structure, leading to complications. Taking the time to understand and accurately describe your business’s structure will prevent delays.

It’s also important to provide a full Mailing Address. Omitting details or using an incorrect format can result in miscommunication and hinder the processing of your form. Double-check the spelling and structure to ensure all information is complete.

People often overlook the Phone Number section as well. Providing either an incomplete number or failing to include area codes can create barriers to communication with the Texas Workforce Commission. Ensure your contact information is accurate and include a secondary number if possible.

Section 14 asks for the date you first employed someone. A common oversight is entering a Future Date. This will result in immediate rejection of your form. It’s crucial to only include past dates that accurately reflect your employment history.

Additionally, many applicants struggle with the Ending Date of the 20th Week. Misunderstanding this requirement can lead to inaccurate reporting. This date must reflect the conclusion of a week when three or more individuals were employed; thus, be sure to track your employment records carefully.

Individuals sometimes confuse the terms Migrant Workers and Seasonal Workers, leading to inaccuracies in sections 18 and 19 of the form. Clearly defining your workforce type will ensure compliance and indication of your employment practices.

Another critical error is not completing the Signature Section properly. The form must be signed by someone authorized to do so. Many applicants mistakenly assume their form is valid without a proper signature, which can lead to significant delays in processing.

Finally, don’t forget to review your form for any last-minute typos or mistakes. Even minor errors can lead to complications. A final proofread can save time and alleviate potential headaches. Understanding these common missteps can enhance your experience and ensure your C-1FR form is processed correctly.

Documents used along the form

The C 1Fr form is crucial for employers operating in Texas who wish to report their farm and ranch employment activities. Along with this essential document, several other forms are usually required to ensure compliance with state regulations. Here is a list of related documents that are often utilized and their brief descriptions.

- Texas Employer's Quarterly Report (Form C-3) - This form is used to report wages paid to employees and to calculate unemployment insurance contributions for a quarterly period.

- Texas Employment Notification Form (Form C-6) - Employers must submit this document to report any new hires or rehires. This helps state agencies track employment trends and ensure compliance with child support laws.

- Worker's Compensation Insurance Policy - Employers in Texas may need to secure this insurance to cover the costs of workplace injuries or illnesses. This policy provides benefits for medical expenses and lost wages.

- Employee Withholding Allowance Certificate (Form W-4) - New employees must fill out this IRS form to determine the amount of federal income tax to withhold from their paychecks.

- Federal Employer Identification Number (EIN) Application (Form SS-4) - Businesses must apply for an EIN to identify their business for tax purposes. This number is necessary for payroll taxes and tax reporting.

- Texas Unemployment Compensation Act Registration - New employers must register with the Texas Workforce Commission to report wages and pay unemployment taxes. This registration is essential for compliance.

- Payroll Records - Keeping accurate payroll records is mandatory. They must include employee names, hours worked, and wages paid. These records support compliance and provide necessary information during audits.

- Form I-9 - Employment Eligibility Verification - This form must be completed by all new hires to verify their eligibility to work in the United States. It helps employers comply with immigration laws.

- Job Safety Analysis (JSA) Forms - These documents outline potential hazards associated with specific tasks and the necessary safety measures. Employers use them to promote workplace safety and prevent accidents.

- Texas Labor Code Posting Requirements - Employers must display certain labor law notices in the workplace. These postings inform employees of their rights under state labor laws.

These documents collectively enhance the compliance framework for employers engaging in farm and ranch operations in Texas. Accurate and timely submissions of these forms are vital for maintaining good standing with state agencies and protecting both employees and employers alike.

Similar forms

- Form 941: Similar to the C 1Fr form, Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. Both forms require detailed information about employment status and wages paid, ensuring compliance with state and federal tax regulations.

- W-2 Form: The W-2 form reports the annual wages of employees and the taxes withheld from their pay. Like the C 1Fr, it captures essential employee data and payments made within a fiscal period, including Social Security and Medicare information.

- Form 1099-MISC: This form is used to report payments made to independent contractors and other non-employees. Both the C 1Fr and Form 1099-MISC involve providing employment details, but the latter focuses on non-employee compensation and diverse income types.

- Texas Workforce Commission (TWC) Employer Account Registration: This document initiates the employer's account with the TWC. It shares similarities with the C 1Fr by gathering ownership, business information, and relevant employment details to establish compliance with state employment laws.

- Form I-9: This form verifies the identity and employment authorization of individuals hired for employment in the United States. While the focus is different, both the C 1Fr and Form I-9 require essential employee information and help employers meet legal reporting requirements.

Dos and Don'ts

When filling out the C-1FR form, there are important guidelines to follow. Here are six things you should and shouldn't do:

- Do provide accurate information. Ensure all your details are correct to avoid complications later.

- Don't use future dates. Only enter dates that reflect past employment or payments.

- Do include all required attachments. If additional sheets are necessary, make sure to include them with your submission.

- Don't leave blank spaces for required information. Fill in every section unless it is not applicable.

- Do sign and date the form. Your signature is crucial for the form's validity.

- Don't wait until the last minute to submit the form. Timely submission is essential for compliance.

By following these guidelines, you can ensure a smoother process when submitting your C-1FR form.

Misconceptions

The C-1FR form is essential for reporting farm and ranch employment in Texas. However, several misconceptions surround its purpose and requirements. Here are ten common misunderstandings:

- The C-1FR form is only for large farming operations. Many believe only large farms need to file this form. In reality, any business employing workers for farm and ranch labor must comply, regardless of size.

- You can use future dates on the form. Some think they can enter future employment dates. The form explicitly states that future dates are not allowed; all dates must be in the past.

- All owners need to be listed individually. There is a belief that every individual owner or officer must be listed. However, it’s sufficient to provide the main contact and relevant details about the business structure.

- The form must be submitted only once. Many assume they only need to file this form at the start of their business. Depending on changes in employment status or structure, it may need re-submission.

- A phone number is optional. While some think providing a phone number is unnecessary, including accurate contact information is crucial for prompt communication with the Texas Workforce Commission.

- You cannot change your answers once submitted. Some people mistakenly believe that all answers on the form are final. You can correct errors by submitting an updated form or through other communication with the Commission.

- Only agricultural activities are covered. A misconception exists that the form is only for traditional agriculture. It also applies to various farm and ranch-related activities, including aquaculture and landscaping services.

- You don’t need a federal employer ID number if you are a sole proprietor. Many sole proprietors think they can skip this. However, obtaining a Federal Employer Identification Number (FEIN) is often necessary, even for sole proprietors.

- Assistance is not available for filing. Some believe help is unavailable when filling out the form. In fact, the Texas Workforce Commission provides resources and assistance for businesses navigating the process.

- All businesses in Texas must file the C-1FR. Not every business has to use this form. Only businesses that employ individuals for farm and ranch work need to file it.

Clarifying these misconceptions can help ensure compliance and smooth the reporting process with the Texas Workforce Commission.

Key takeaways

Here are some important points to remember when filling out and using the C-1FR form for farm and ranch employment:

- Complete All Sections: Ensure that every section of the form is filled out accurately. Incomplete information may delay processing.

- Use a Valid Mailing Address: Make sure to provide a current mailing address for the business. This is crucial for any correspondence from the Texas Workforce Commission.

- Track Employment Dates: Record the correct dates for when employment began, wages were first paid, and when the 20-week mark is reached. Accurate dates help in determining tax liability.

- Provide Details on Ownership: Clearly specify the type of ownership, whether it be a corporation, partnership, or sole proprietorship, by checking the appropriate box.

- Include All Relevant Owners: List all owners or officers associated with the business. Provide their names, titles, and addresses. Attach additional sheets if necessary.

- Note Special Circumstances: If the business was acquired, ensure to complete sections regarding the previous owner's account and the nature of the acquisition.

- Voluntary Election Option: Understand that a non-liable employer can choose to pay state unemployment tax voluntarily. This decision must be made with careful consideration of the obligations involved.

- Sign and Date the Form: Make sure the form is signed by an authorized individual. This adds legitimacy and confirms that the information provided is accurate.

Browse Other Templates

Fl-210 - This form represents a formal beginning to legal proceedings regarding parentage.

Sf-50 Form - The SF 50 is an official form used by federal agencies to notify employees of personnel actions.