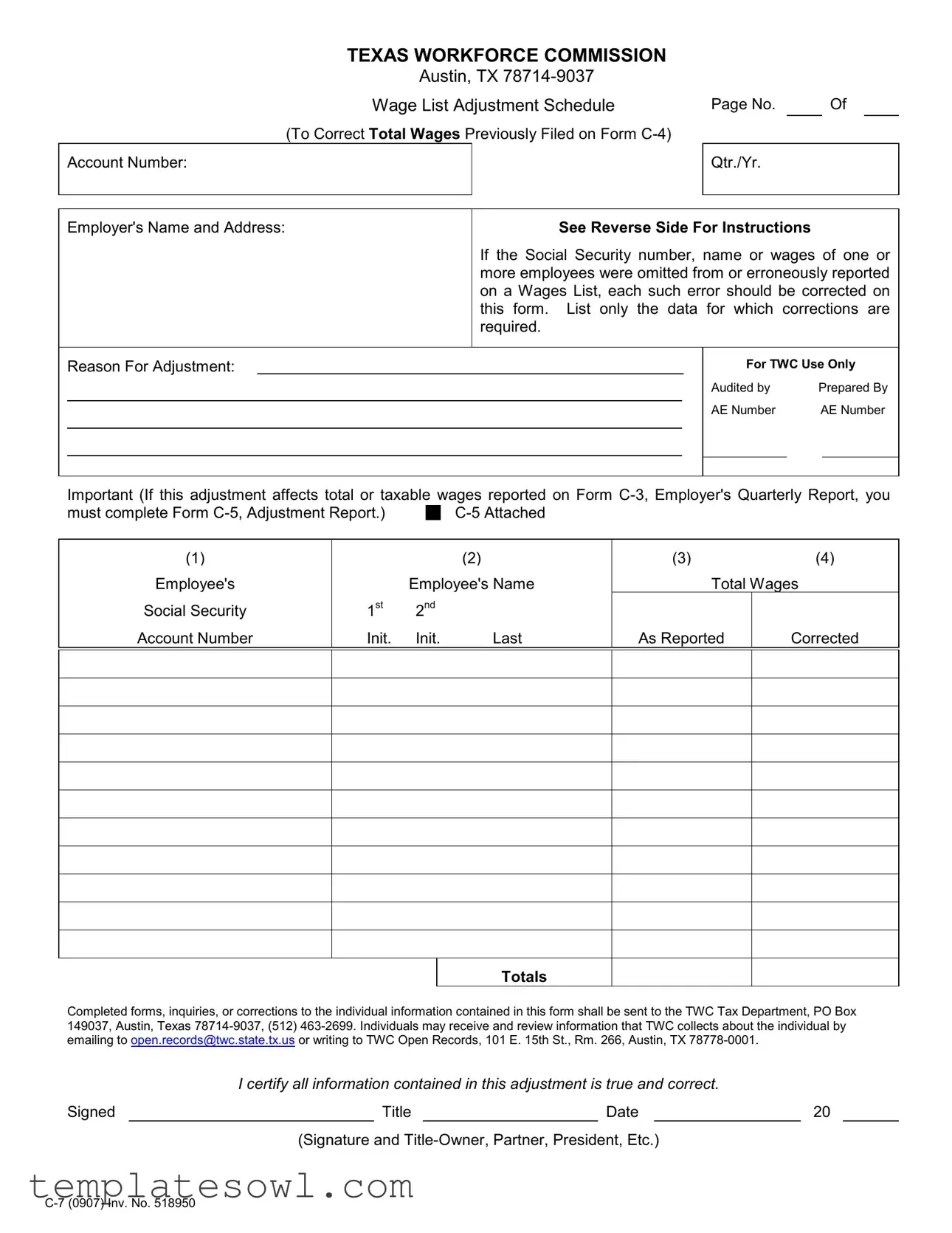

Fill Out Your C 7 Form

The C 7 form, also known as the Wage List Adjustment Schedule, is a crucial document used by employers in Texas to rectify errors related to employee wage reporting. If any employee's information—such as their Social Security number, name, or wages—has been omitted or incorrectly reported on a prior Wages List, this form must be utilized to make those adjustments. Employers are required to submit only the specific data that needs correction, rather than re-filing the entire wage report. This form helps maintain accurate wage records, ensuring that proper changes are reflected in the Texas Workforce Commission’s records. If the corrections made on the C 7 form affect total or taxable wages previously reported on Form C-3, a separate Form C-5, known as the Adjustment Report, must also be completed and attached. Importantly, each correction submitted through the C 7 form is certified by the employer, affirming the truthfulness of all information provided. The Texas Workforce Commission has established procedures for submitting this form, including providing both physical mailing addresses and contact details for inquiries, emphasizing the importance of accuracy and compliance in wage reporting.

C 7 Example

TEXAS WORKFORCE COMMISSION

Austin, TX

Wage List Adjustment Schedule

(To Correct Total Wages Previously Filed on Form

Account Number:

Page No. |

|

Of |

|

|

|

Qtr./Yr.

Employer's Name and Address:

See Reverse Side For Instructions

If the Social Security number, name or wages of one or more employees were omitted from or erroneously reported on a Wages List, each such error should be corrected on this form. List only the data for which corrections are required.

Reason For Adjustment:

For TWC Use Only

Audited by |

Prepared By |

AE Number |

AE Number |

Important (If this adjustment affects total or taxable wages reported on Form

must complete Form |

|

(1)

Employee's

Social Security

Account Number

(2)

Employee's Name

1st 2nd

Init. Init. Last

(3)(4)

Total Wages

As Reported |

Corrected |

Totals

Completed forms, inquiries, or corrections to the individual information contained in this form shall be sent to the TWC Tax Department, PO Box 149037, Austin, Texas

I certify all information contained in this adjustment is true and correct.

Signed |

|

Title |

|

Date |

|

20 |

(Signature and

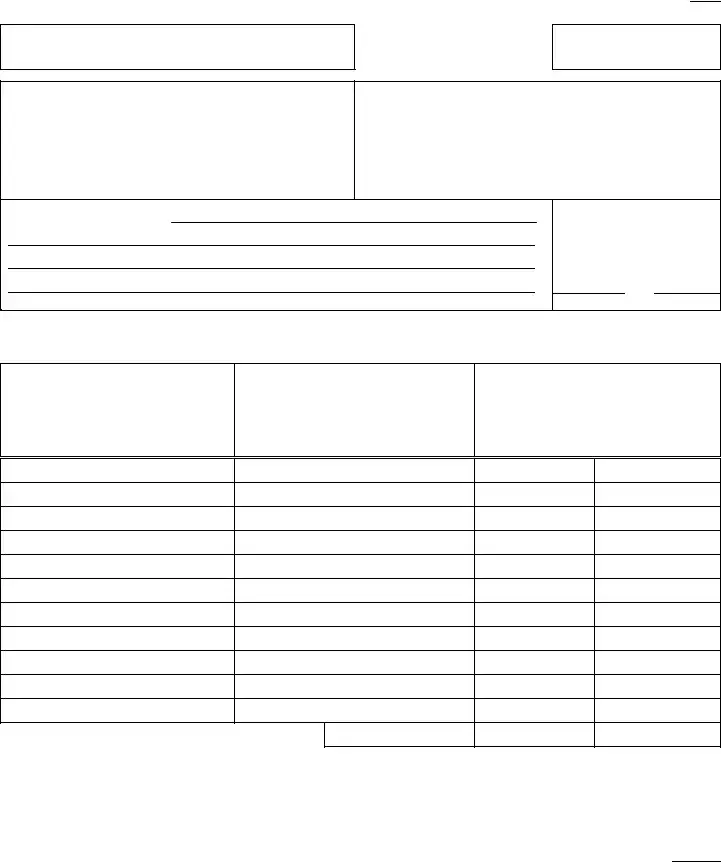

A Separate Form Must Be Filed For Each Quarter Being Corrected.

List Only The Data For Which Corrections Are Required

Examples To Correct Data Previously Reported or Omitted

(1)

Employee's

Social Security

Account Number

(2)

Employee's Name

1st 2nd

Init. Init. Last

(3)(4)

Total Wages

As Reported |

Corrected |

|

|

The following example illustrates the proper method to report either omitted Social Security Account Number(s) or Wage Amount(s). The Total Wages, As Reported, Column (3) will be

123

45 |

6789 |

J. A. DOE |

The following example illustrates the proper method to correct the amount of wages previously reported for J. A. Doe.

1,000.00

123

45

6789

J. A. DOE

1,000.00

1,200.00

The following example illustrates the proper method to correct wages erroneously reported for J. B. Doe instead of J. A. Doe.

123 |

45 |

6789 |

J. B. DOE |

1,000.00 |

|

123 |

45 |

6789 |

J. A. DOE |

1,000.00 |

The following example illustrates the proper method to correct the reporting of an erroneous Social Security Account Number.

123 |

54 |

6789 |

J. A. DOE |

1,000.00 |

|

123 |

45 |

6789 |

J. A. DOE |

1,000.00 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The C-7 form is used to correct wage reporting errors previously filed on Form C-4. |

| Governing Law | This form is governed under Texas labor laws related to wage reporting and adjustments. |

| Required Submissions | A separate C-7 form must be submitted for each quarter that requires corrections. |

| Contact Information | Completed forms and inquiries should be sent to the TWC Tax Department in Austin, Texas. |

| Review Process | Individuals can review information collected about them by contacting the TWC Open Records Division. |

Guidelines on Utilizing C 7

Once the C-7 form is filled out correctly and completely, you will be able to submit it to the Texas Workforce Commission for any necessary adjustments. This process helps ensure that employee wage records are accurate. Follow these steps to fill out the C-7 form.

- Write your Account Number at the top of the form.

- Indicate the page number and quarter/year being corrected.

- Enter the Employer's Name and Address in the specified area.

- State the Reason For Adjustment in the designated space.

- List each employee's Social Security Account Number in the first column.

- Fill in the employee's First, Second Initial, and Last Name in the next columns.

- In the Total Wages As Reported column, write the amount previously reported, or -0- if there was an omission.

- In the Corrected Totals column, enter the correct wage amount.

- Sign and date the form at the bottom to certify the information is true and correct.

- Submit completed forms either by mail or as directed regarding inquiries and corrections.

What You Should Know About This Form

What is the C 7 form used for?

The C 7 form is a Wage List Adjustment Schedule. It is specifically designed to correct total wages that an employer previously submitted on Form C-4. This form is crucial for ensuring that employee wage records accurately reflect the information reported to the Texas Workforce Commission (TWC).

When should I use the C 7 form?

You should use the C 7 form if you find that you have omitted or incorrectly reported an employee's social security number, name, or wage amounts on your Wages List. If these corrections affect the total or taxable wages reported on Form C-3, you must also complete Form C-5.

Who needs to fill out the C 7 form?

Employers who have submitted employee wage information to the TWC and need to make corrections must fill out the C 7 form. This applies to any business or individual responsible for reporting wages to the commission.

How do I complete the C 7 form?

To fill out the C 7 form, enter the employee's social security account number, their first name, middle initials (if applicable), last name, total wages as reported, and the corrected total wages. Only report the data that needs to be corrected. Be sure to provide a reason for the adjustment as well.

Is there any additional documentation required with the C 7 form?

Yes, if the corrections affect total or taxable wages reported on Form C-3, you must attach Form C-5. This ensures that the TWC has all the necessary information for processing your adjustments.

Where do I send the completed C 7 form?

Once you have completed the C 7 form, send it to the TWC Tax Department at PO Box 149037, Austin, Texas 78714-9037. Make sure to keep copies of all documents for your records.

What if I need to make corrections for multiple employees?

If you need to correct data for more than one employee, you will have to fill out a separate C 7 form for each quarter. Each form should only include the necessary corrections for the respective employee.

What is the certification at the bottom of the C 7 form for?

The certification at the bottom of the C 7 form is where the person completing the form, typically an owner or authorized representative, certifies that the information is true and correct. This declaration helps maintain the integrity of the data reported.

How can I review information that the TWC collects about me?

Individuals wishing to review information collected by the TWC can do so by emailing open.records@twc.state.tx.us or by writing to TWC Open Records at 101 E. 15th St., Rm. 266, Austin, TX 78778-0001.

What if I have additional questions about the C 7 form?

If you have further questions or need assistance regarding the C 7 form, you can contact the TWC Tax Department directly at (512) 463-2699 for support.

Common mistakes

Filling out the C-7 form can be a straightforward process, but certain common mistakes can lead to delays and complications. One prevalent error is failure to provide accurate employee information, particularly the Social Security number. If the Social Security number is omitted or incorrectly reported, it can result in the inability to properly attribute wages to employees. This not only complicates wage reporting but may also create issues during audits. Ensuring that each entry is correct is crucial for compliance and accuracy.

Another frequent mistake is neglecting to specify the reason for adjustment. This section is essential for the Texas Workforce Commission (TWC) to understand the context behind the corrections made. Without a clear reason documented on the form, the TWC may question the legitimacy of the adjustments, potentially prompting a follow-up that could delay the process. Always take a moment to provide this information to streamline the review process.

Many individuals also overlook the instruction to file a separate C-7 form for each quarter being corrected. Combining corrections for multiple quarters in one submission can lead to confusion for both the employer and the TWC. Each quarter has unique reporting requirements, and mixing them up can complicate audits and reporting. Adhering strictly to this guideline ensures clarity and prevents additional administrative challenges.

Inadequate signatures are another issue that often arises. The form requires the certification of information by an authorized individual, such as an owner or partner. If the signature or title is missing or written incorrectly, the TWC may reject the form entirely, necessitating resubmission. Double-check that the signature aligns with the title provided to avoid this hassle.

Lastly, some people fail to attach the appropriate forms needed for comprehensive adjustments. If a correction affects total or taxable wages reported on Form C-3, it is vital to complete and attach Form C-5 as well. Missing attachments can lead to incomplete records and potential penalties. Always confirm that all relevant documents accompany your C-7 submission to ensure a thorough review by the TWC.

Documents used along the form

The C-7 form is essential for employers in Texas who need to correct wage information previously reported. However, it is often used alongside other forms to ensure complete compliance with state regulations. Here’s a brief overview of seven other documents that may accompany the C-7 form.

- Form C-4: This is the original Wage List form used to report earnings and employee details. It serves as the foundation upon which adjustments, like those documented in the C-7 form, are made.

- Form C-3: The Employer's Quarterly Report outlines total taxable wages and is necessary for payroll tracking. Accurate figures here are crucial, especially when corrections are made using the C-7 form.

- Form C-5: If corrections on the C-7 affect total wages reported on Form C-3, you must fill out this Adjustment Report. It organizes all adjustments in a clear manner for easier reconciliation.

- Form C-1: This is the Employer's Registration form. When you hire new employees or establish a business, you will need this to register for Texas unemployment tax.

- Form C-8: This form addresses any disputes regarding wage claims. If a former employee contests reported wages or benefits, this form will help resolve the matter.

- Payroll Records: Keeping detailed payroll records is essential. These documents provide the necessary backup for figures reported on all forms, including corrections made on the C-7.

- Employee's Verification Form: This form collects employee consent to disclose or correct their information. It underscores the importance of privacy and accuracy when reporting payroll data.

Using the C-7 form alongside these documents helps ensure that employers maintain accurate records and meet their legal obligations. Always consult with a professional if you have questions or need guidance during this process.

Similar forms

- Form C-4: This form is used to report the initial total wages of employees. Similar to the C-7 form, it includes information about each employee's social security number and total wages.

- Form C-3: This is the Employer's Quarterly Report, which provides an overview of total wages paid in a specific quarter. Like the C-7 form, it tracks employee wages but does not allow for corrections.

- Form C-5: An Adjustment Report to be filed when total or taxable wages reported on Form C-3 change. The C-5 includes similar components concerning wage adjustments, similar to those in the C-7 form.

- Form W-2: This is the Wage and Tax Statement which reports an employee’s annual wages and taxes withheld. The format for reporting wages is similar, although W-2 focuses on year-end totals instead of quarterly adjustments.

- Form 941: The Employer's Quarterly Federal Tax Return is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Both forms require accurate employee identification and wage reporting.

- SS-4 Form: This form is used to apply for an Employer Identification Number (EIN). While it does not report wages, it shares the similarity of being a necessary document for employer compliance and identification.

- Form 1099-MISC: This form is used to report payments made to non-employees. It similarly requires accurate reporting of amounts, akin to the data needed for the C-7 form.

- Form 1095-C: The Employer-Provided Health Insurance Offer and Coverage, reports health coverage information. Like the C-7 form, it focuses on specific employee-related data.

- Form 1040: The U.S. Individual Income Tax Return also requires accurate income reporting for employees, making it similar in its emphasis on correct financial disclosures.

- Form 8850: This is a Pre-Screening Notice and Certification Request for the Work Opportunity Credit. It requires specific employee information similarly to the data required on the C-7.

Dos and Don'ts

When filling out the C-7 form, attention to detail is crucial. Here’s a list to help guide you through the process.

- Do read all instructions carefully before starting.

- Don't submit the form without ensuring all data is accurate.

- Do include only the information that needs correction.

- Don't use the form to make changes that are not related to wages or employee information.

- Do verify Social Security numbers and names for accuracy.

- Don't assume that previous entries were accurate; double-check everything.

- Do sign and date the form before submission.

- Don't forget to indicate if your adjustment affects other reports, like Form C-3.

- Do send the completed form to the correct address listed on the document.

- Don't delay your submission; timely corrections prevent penalties.

Following these guidelines will help ensure that your C-7 form is completed properly, reducing the likelihood of further issues.

Misconceptions

Misconceptions surrounding the C 7 form can lead to confusion and errors in wage reporting. Below are some common myths along with clarifications to help you understand the C 7 form better.

- The C 7 form is used for new wage reporting. This is incorrect. The C 7 form is specifically for correcting mistakes in previously reported wage data. It is not for submitting new wage information.

- You can make multiple corrections on one C 7 form. Each C 7 form should be used to correct data for one quarter only. If you have adjustments for multiple quarters, separate forms are required for each.

- The C 7 form is optional. If there are errors in your wage reporting, failing to submit a C 7 form can lead to penalties and inaccuracies in your employees' wage records.

- Using the C 7 form is the same as using the C-4 form. Although both forms deal with wage reporting, they serve different purposes. The C-4 form is for original wage reporting, while the C 7 is specifically for corrections.

- Once filed, corrections cannot be changed. This is a misconception. If further errors are discovered after submitting a C 7 form, additional forms can still be submitted to make subsequent corrections.

- You must correct all employees' information at once. You only need to report the specific data that requires correction. There is no requirement to correct all employees' records on the same form.

- The C 7 form is only for Social Security number corrections. While it can correct Social Security numbers, the form also addresses any incorrect wage amounts reported for employees.

- Filing the C 7 form guarantees no penalties. Filing the form does not automatically eliminate penalties. It is imperative to ensure accuracy to avoid fines from the Texas Workforce Commission.

- The C 7 form can be submitted online without a signature. This is false. Even if submitted electronically, a signed acknowledgment of the accuracy is still required. Make sure to include the required signature when filing.

Understanding these facts about the C 7 form can help prevent costly mistakes and ensure compliance with wage reporting regulations in Texas.

Key takeaways

Understanding how to fill out and use the C-7 form can streamline the process of correcting wage data. Below are key takeaways that provide insight into the use of this important document:

- Each C-7 form is designed for specific adjustments. It should only include the data that requires correction, which helps avoid confusion.

- A separate C-7 form must be filed for each quarter that requires adjustments. This ensures that records remain clear and organized.

- Errors must be clearly stated. When correcting an employee’s information, ensure the form lists their Social Security number, name, and the total wages as reported and corrected.

- To address total or taxable wages changes, be aware that the C-7 form may need to accompany a C-5 Adjustment Report. This is essential for accurate payroll reporting.

- Maintain clear and accurate records. For adjustments regarding omitted employee data, enter '-0-' in the “Total Wages As Reported” for clarity.

- Attention to detail is crucial. Small mistakes, such as incorrectly reported Social Security numbers, may lead to larger issues if not corrected promptly.

- If needed, contact the Texas Workforce Commission (TWC) for assistance. They can provide guidance on the correction process and answer specific inquiries.

Completing the C-7 form accurately not only ensures compliance but also helps maintain the integrity of an organization’s payroll records.

Browse Other Templates

Operator Performance Assessment,Equipment Operator Review Sheet,Heavy Machinery Evaluation Form,Forklift Operation Assessment,Lift Equipment Competency Check,Machinery Skills Evaluation,Operator Safety Proficiency Form,Lift Operation Verification She - Operators who need re-evaluation will get guidance on their areas of improvement.

Target List Worksheet - The form allows for the entry of dimensions, including length and width.