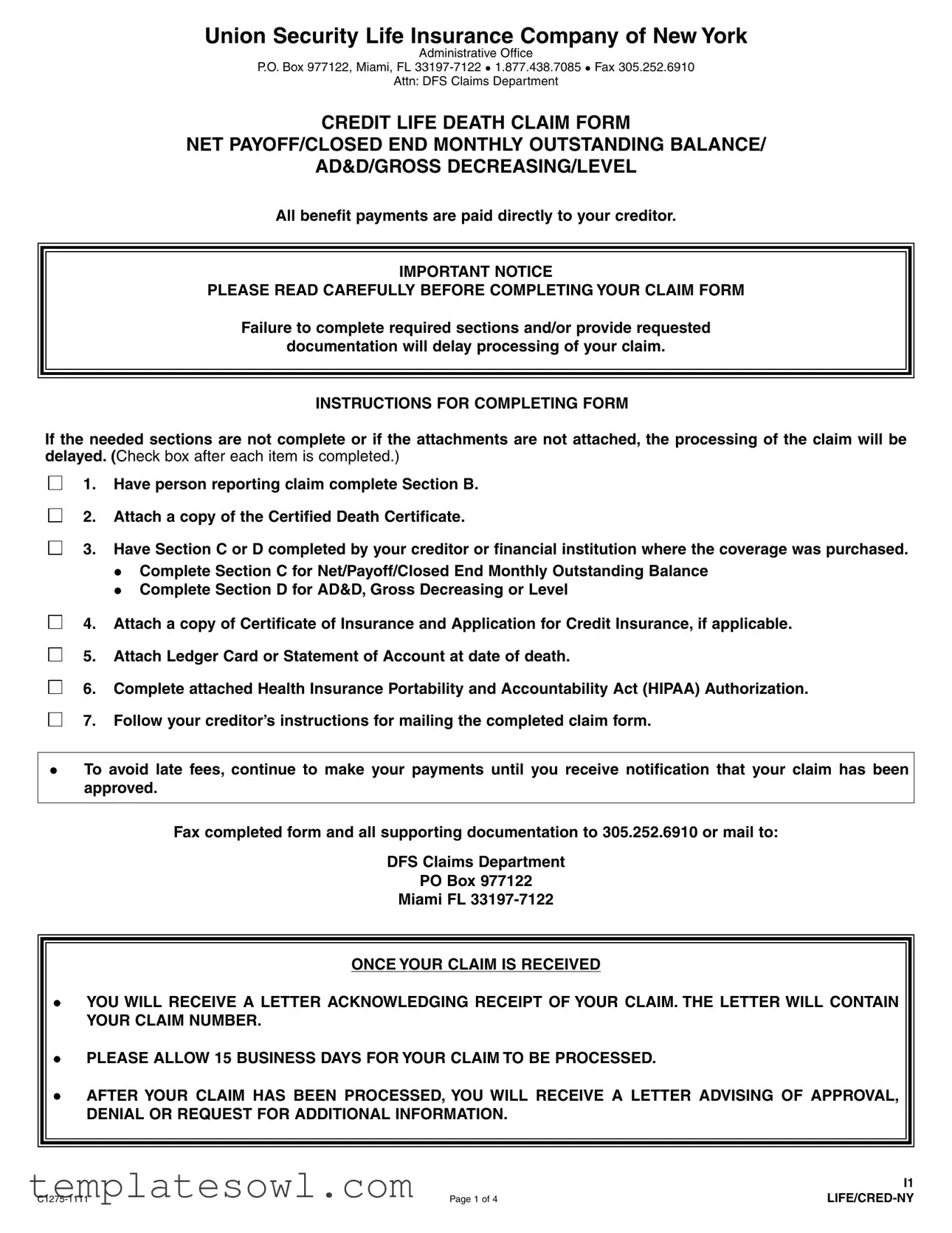

Fill Out Your C1275 1111 Form

The C1275 1111 form is a crucial document for individuals filing a death claim under a credit life insurance policy. It is specifically designed by Union Security Life Insurance Company of New York to streamline the claims process. This form includes vital sections that require input from various parties, including the claimant, the creditor, and medical providers. Key components of the form involve providing a certified death certificate and the completion of several sections dependent on the insurance product—such as Net Payoff, Closed End Monthly Outstanding Balance, or Accidental Death and Dismemberment. The instructions emphasize the importance of thoroughly completing each section to avoid delays in processing. After submission, claimants can expect a confirmation letter with a unique claim number within 15 business days, outlining the next steps based on the claim assessment. Proper documentation and adherence to guidelines are essential for a smooth and efficient claims experience.

C1275 1111 Example

Union Security Life Insurance Company of New York

Administrative Office

P.O. Box 977122, Miami, FL

Attn: DFS Claims Department

CREDIT LIFE DEATH CLAIM FORM

NET PAYOFF/CLOSED END MONTHLY OUTSTANDING BALANCE/

AD&D/GROSS DECREASING/LEVEL

All benefit payments are paid directly to your creditor.

IMPORTANT NOTICE

PLEASE READ CAREFULLY BEFORE COMPLETING YOUR CLAIM FORM

Failure to complete required sections and/or provide requested

documentation will delay processing of your claim.

INSTRUCTIONS FOR COMPLETING FORM

If the needed sections are not complete or if the attachments are not attached, the processing of the claim will be delayed. (Check box after each item is completed.)

1. Have person reporting claim complete Section B.

2. Attach a copy of the Certified Death Certificate.

3. Have Section C or D completed by your creditor or financial institution where the coverage was purchased. Complete Section C for Net/Payoff/Closed End Monthly Outstanding Balance

Complete Section D for AD&D, Gross Decreasing or Level

4. Attach a copy of Certificate of Insurance and Application for Credit Insurance, if applicable.

5. Attach Ledger Card or Statement of Account at date of death.

6. Complete attached Health Insurance Portability and Accountability Act (HIPAA) Authorization.

7. Follow your creditor’s instructions for mailing the completed claim form.

To avoid late fees, continue to make your payments until you receive notification that your claim has been approved.

Fax completed form and all supporting documentation to 305.252.6910 or mail to:

DFS Claims Department

PO Box 977122

Miami FL

ONCE YOUR CLAIM IS RECEIVED

YOU WILL RECEIVE A LETTER ACKNOWLEDGING RECEIPT OF YOUR CLAIM. THE LETTER WILL CONTAIN YOUR CLAIM NUMBER.

PLEASE ALLOW 15 BUSINESS DAYS FOR YOUR CLAIM TO BE PROCESSED.

AFTER YOUR CLAIM HAS BEEN PROCESSED, YOU WILL RECEIVE A LETTER ADVISING OF APPROVAL, DENIAL OR REQUEST FOR ADDITIONAL INFORMATION.

Page 1 of 4 |

I1

Union Security Life Insurance Company of New York

Administrative Office

P.O. Box 977122, Miami, FL

Attn: DFS Claims Department

CREDIT LIFE DEATH CLAIM FORM

NET PAYOFF/CLOSED END MONTHLY OUTSTANDING BALANCE/

AD&D/GROSS DECREASING/LEVEL

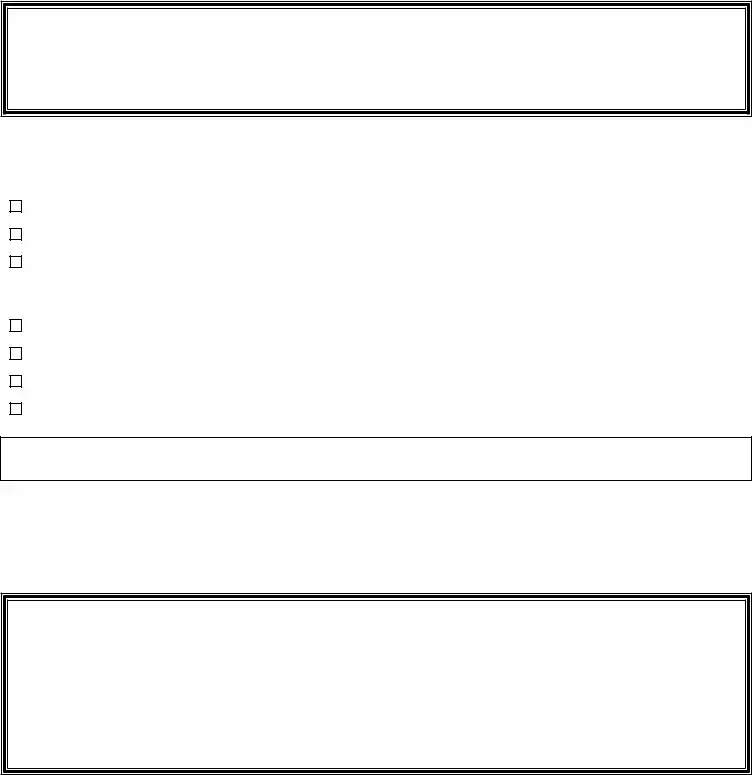

A. DEATH CERTIFICATE

Attach a copy of the certified death certificate.

B. PERSON REPORTING CLAIM |

PLEASE PRINT |

This section must be completed if death occurred within 2 years of policy effective date.

Names and addresses of all physicians who attended deceased during last illness and during the five years prior to death:

NAME |

STREET ADDRESS / CITY / STATE / ZIP CODE |

|

TELEPHONE NUMBER |

DATE OF ATTENDANCE |

DISEASE OR CONDITION |

|

|

|

|

|

|

|

|

|

|

( |

) |

/ |

/ |

|

|

|

( |

) |

/ |

/ |

|

AUTHORIZATION TO OBTAIN INFORMATION

I AUTHORIZE any employer, physician, hospital, clinic, other medical or medically related facility, the Medical Information Bureau, Inc., consumer reporting agency, insurance or reinsuring company, insurer, law enforcement agency, fire department, Social Security Administration, Internal Revenue Service, or other organization, or person having any records, data or information concerning this claim to furnish such record, data or information to the insurance company issuing my policy as requested. I understand that in executing this authorization, I waive the right for such information to be privileged as it pertains to the processing or investigation of my claim(s). A photocopy of this authorization shall be considered as effective and valid as the original.

I understand and acknowledge that this authorization extends to all or any part of the records being requested, which may include treatment for physical and mental illness, alcohol/drug abuse, and/or HIV/AIDS test results or diagnosis and treatment. I expressly consent to the release of information as designated above.

The above information is true and correct. If, in fact, the furnished information is false, thereby inducing payment of claim, and the insurance company issuing my policy determines that the incorrect information constitutes an aiding and abetting the filing of a fraudulent claim, the insurance company issuing my policy may furnish the above information to the appropriate state authorities to be used in its discretion as the basis for action authorized under applicable state law. In addition, I agree any statements made on this or any other form found to be false shall give to the insurance company issuing my policy the right to void my policy.

I, or my authorized representative, have the right to receive a copy of this authorization.

This authorization shall remain valid for the duration of the claim.

WARNING: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

PRINT NAME |

SIGNATURE |

RELATIONSHIP TO DECEASED |

DATE |

|

|||

|

X |

|

|

|

/ |

/ |

|

STREET ADDRESS / APT # |

|

CITY |

STATE |

ZIP CODE |

TELEPHONE NUMBER |

|

|

|

|

|

|

|

( |

) |

|

Page 2 of 4 |

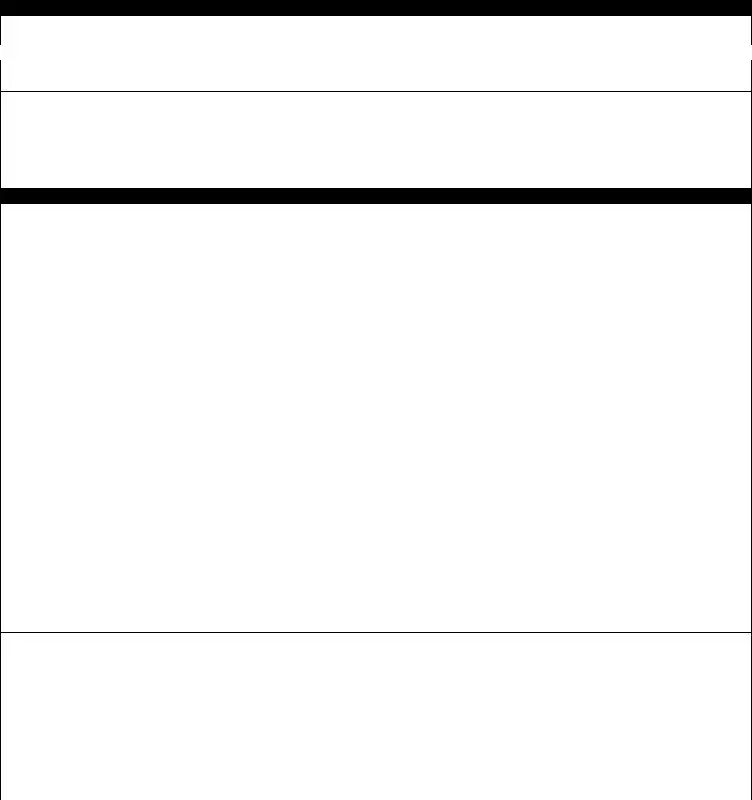

C. CREDITOR’S STATEMENT - Net Payoff/Closed End Monthly Outstanding Balance |

PLEASE PRINT |

1. Please attach a copy of the Certified Death Certificate, Payoff Statement, Ledger Card, Insurance Certificate/Policy and Application for Credit Insurance, if applicable.

2. FULL NAME OF DECEASED

3. POLICY/CERTIFICATE NO. |

|

|

4. DATE OF ISSUE |

|

5. TERM (Mos) |

6. LOAN |

7. TYPE LOAN |

|

8. AGENT CODE |

|

9. INS. EXPIRES |

||||||||||||||||||

|

(INCLUDE PREFIX) |

|

|

MO/DAY/YEAR |

|

INS. |

|

LOAN |

APR |

|

|

|

Simple Interest |

|

|

|

|

|

|

|

|

|

MO/DAY/YEAR |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

Precomputed |

|

|

|

|

|

|

|

|

|

/ |

/ |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

10. Health questions used |

|

|

Yes |

|

No |

If yes, attach copy of completed application. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

CALCULATION |

|

11. |

If Precomputed Loan (see item 7 above) — Check method of Interest Rebate: |

|

|

|

Rule of 78s |

|

|

|

Actuarial |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

12. |

Initial amount of Insurance (Principal Amount of Loan) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

$ |

______________ |

||||||||||

|

|

. |

. . . . . . . . |

. . . . . . . . |

. . . |

. |

|

. . . . . . . . . . . . . . . |

. |

. |

. . . . |

. . . . . . . |

|||||||||||||||||

|

|

13. |

Net Payoff Balance of Loan at Date of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

BENEFIT |

|

|

Amount is after deduction of all unearned credit insurance products other than credit life |

|

Yes |

|

|

|

No |

$ |

______________ |

||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

14. |

Less any Principal Amount Included in Line 13 over 60 days delinquent |

|

|

|

|

|

|

|

|

|

|

|

. |

$ |

______________ |

|||||||||||||

|

|

. . . |

. |

|

. . . . . . . . . . . . . . . |

. |

. |

. . . . |

. . . . . . . |

||||||||||||||||||||

|

|

15. |

Amount due to First Beneficiary (Creditor) (Line 13 minus Line 14) . |

. . . . . . . . |

. . . |

. |

|

. . . . . . . . . . . . . . . |

. |

. |

. . . . |

. . . . . . . . |

$ |

______________ |

|||||||||||||||

|

|

16. |

Payments made, prior to but, not scheduled until after the date of death |

. . . |

. |

|

. . . . . . . . . . . . . . . |

. |

. |

. . . . |

. . . . . . . . |

$ |

______________ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

17. NAME OF SECOND BENEFICIARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF BIRTH |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

18. STREET ADDRESS / APT # |

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

19. NAME OF DEALER OR BRANCH WHERE INSURANCE WAS PURCHASED (if applicable) |

|

|

|

|

|

|

|

|

|

DEALER NUMBER |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

20. FIRST BENEFICIARY / CREDITOR |

|

|

|

|

|

FAX NUMBER |

|

|

|

|

TELEPHONE NUMBER |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

21. STREET ADDRESS |

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

22. NAME OF PERSON COMPLETING THIS SECTION (PLEASE PRINT) |

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

DATE |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

D. CREDITOR’S STATEMENT – AD&D, Gross Decreasing or Level |

|

|

|

|

|

|

|

|

|

PLEASE PRINT |

|||||||||||||||||||

1. Please attach a copy of the Certified Death Certificate, Payoff Statement, Ledger Card, Insurance Certificate/Policy and Application for Credit Insurance, if applicable.

2. FULL NAME OF DECEASED

3. POLICY/CERTIFICATE NO. |

4. DATE OF ISSUE |

5.TERM IN MONTHS 6. FIRST PAYMENT DUE DATE 7. POLICY/CERT. EXPIRES 8. AGENT CODE |

(INCLUDE PREFIX) |

MO/DAY/YEAR |

MO/DAY/YEAR |

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

/ |

/ |

|

/ |

/ |

|

|

|

|||||||

9. Health questions used |

|

Yes |

|

|

No |

If yes, attach copy of completed application. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

CALCULATION |

10. |

Initial Amount of Insurance Coverage |

. . . . . |

. . . . . |

. . . . . . |

. . . . . . . . |

. . . . . . . |

. |

. . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . |

$ |

______________ |

|||||||||||||||

11. |

If Decreasing Coverage, Amount of Decrease |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

( |

|

|

) ÷ ( |

|

) = |

( |

|

) x ( |

) |

= |

. . . . . . |

. . . . . . . . |

$ |

______________ |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Initial Amt. (Line 10) |

Term (Line 5) |

|

Monthly Decrease |

Mos. in Effect |

|

|

|

|

|

|

|

|

|

||||||||||||||

12. |

Amount of Insurance Coverage at Date of Death (Line 10 minus Line 11) |

|

|

|

|

|

|

|

. |

$ |

______________ |

|||||||||||||||||

BENEFIT |

. . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . |

|||||||||||||||||||||||||

13. |

Less Amount claimed by First Beneficiary (Creditor) (Net Balance Due) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Amount is after deduction of all unearned credit insurance products other than credit life |

|

|

Yes |

|

|

No |

$ |

______________ |

|||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Balance, if any, payable to Second Beneficiary (Line 12 minus Line 13) |

. . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . |

$ |

______________ |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

15. NAME OF SECOND BENEFICIARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF BIRTH |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

16. STREET ADDRESS / APT # |

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

17. NAME OF DEALER OR BRANCH WHERE INSURANCE WAS PURCHASED (if applicable) |

|

|

|

|

|

DEALER NUMBER |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18. FIRST BENEFICIARY / CREDITOR |

|

|

|

|

|

|

FAX NUMBER |

|

|

|

TELEPHONE NUMBER |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

( |

|

) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

STATE |

ZIP CODE |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

20. NAME OF PERSON COMPLETING THIS SECTION (PLEASE PRINT) |

SIGNATURE |

|

|

|

|

|

|

|

|

DATE |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

/ |

/ |

|||

Page 3 of 4 |

Union Security Life Insurance Company of New York

Administrative Office

P.O. Box 977122, Miami, FL

Attn: DFS Claims Department

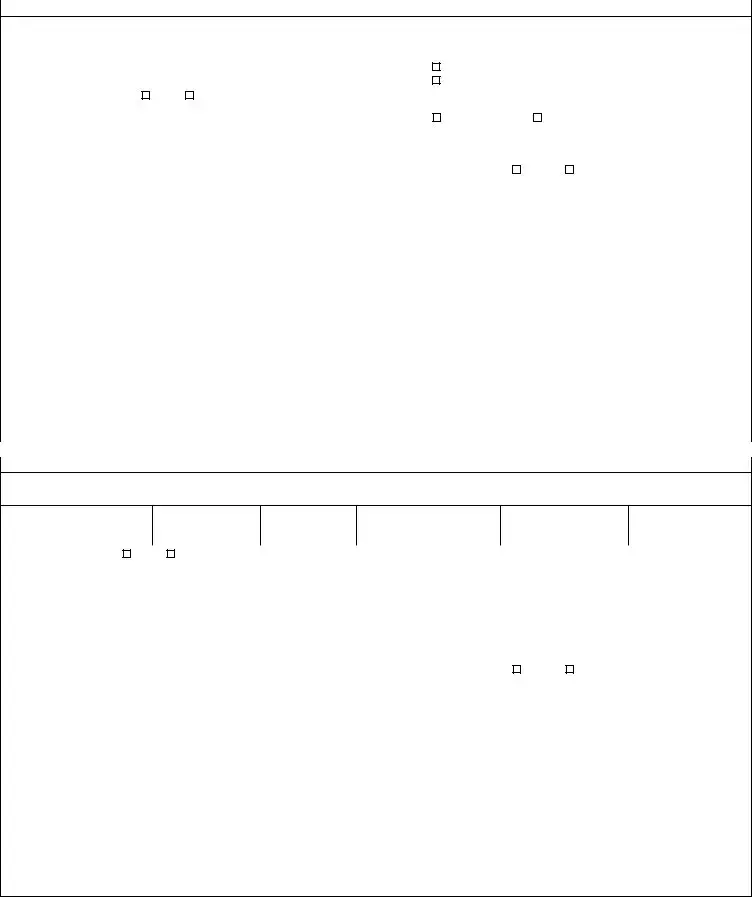

Authorization for Release of Protected Health Information

The Health Insurance Portability and Accountability Act (HIPAA) requires us to get your written permission to obtain specific health information about you. We are requesting this information in order to process the claim you are presenting to our company. Therefore, please complete in detail, sign, date, and return the following form to us. We cannot process your claim until we have this form returned to us.

I UNDERSTAND THAT THIS AUTHORIZATION IS VOLUNTARY

I hereby authorize the medical providers listed below to release the following information to Union Security Life Insurance Company of New York.

INSURED INFORMATION

NAME |

|

|

|

SOCIAL SECURITY NUMBER |

BIRTH DATE |

|

DAYTIME TELEPHONE NUMBER |

|

|||||

|

|

|

|

- |

|

- |

/ |

/ |

( |

) |

|

|

|

STREET ADDRESS |

|

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|||||

MEDICAL PROVIDER (doctor, hospital, etc.) WHO I AUTHORIZE TO RELEASE MY PERSONAL INFORMATION: |

|

||||||||||||

NAME |

|

|

|

|

|

|

|

|

DAYTIME TELEPHONE NUMBER |

|

|||

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

|

CITY |

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

DESCRIPTION OF INFORMATION TO BE RELEASED |

|

|

|

|

|

|||||

ENTIRE MEDICAL RECORD |

HIV/AIDS TEST RESULTS OR DIAGNOSIS AND TREATMENT |

|

|

|

|

|

|

||||||

Yes |

No |

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I UNDERSTAND THAT: |

|

|

|

|

|

|

|

|

|

|

|

||

a. |

This Authorization may be revoked by me at any time by writing to the company and clearly stating that I wish to revoke |

||||||||||||

|

this Authorization. |

|

|

|

|

|

|

|

|

|

|

|

|

b. |

1. This Authorization will expire without any action by me one year after the date of my signing below. |

|

|||||||||||

|

2. This Authorization shall be valid for the duration of the claim (Arizona residents only). |

|

|

|

|

||||||||

c. |

Revocation will not apply to my insurance company when the law provides my insurance company the right to contest a |

||||||||||||

|

claim under my policy. |

|

|

|

|

|

|

|

|

|

|

|

|

d. |

This authorization is voluntary and I have the right to refuse to sign it. |

|

|

|

|

|

|

||||||

e. |

If I revoke this information, it will not apply to information that has already been released prior to my revocation. |

|

|||||||||||

f. |

Information released by this authorization may include information concerning treatment of physical and mental illness, |

||||||||||||

|

alcohol/drug abuse and past medical history. |

|

|

|

|

|

|

|

|

||||

g. |

Information released by this authorization may be subject to redisclosure by the recipient and may not be protected any |

||||||||||||

|

longer by the HIPAA Privacy Rule. |

|

|

|

|

|

|

|

|

||||

h. |

I agree that a photocopy of this authorization shall be as valid as the original. |

|

|

|

|

|

|

||||||

i. |

I, or my authorized representative, have the right to receive a copy of this authorization. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||

YOUR SIGNATURE (INSURED OR LEGAL REPRESENTATIVE) |

|

|

|

|

|

DATE |

|

||||||

X |

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

AND if signing on behalf of a minor or as legal representative of another:

NAME OF PERSON YOU ARE SIGNING FOR (PROOF OF YOUR AUTHORIZATION MAY BE REQUIRED)

ONE FORM MUST BE COMPLETED FOR EACH MEDICAL PROVIDER

Please photocopy this form if you need additional copies.

Page 4 of 4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The C1275 1111 form is governed by New York State laws, specifically those applicable to credit life insurance claims. |

| Claim Submission Process | To submit a claim, the claimant must complete multiple sections of the form, including attaching a certified death certificate and a HIPAA authorization. |

| Payment Process | Benefit payments are sent directly to the creditor as specified in the policy terms. |

| Claim Acknowledgment | Once the claim is received, the claimant will receive a letter confirming its acknowledgment and providing a claim number; processing takes approximately 15 business days. |

Guidelines on Utilizing C1275 1111

When filling out the C1275 1111 form, precise information and supporting documents are essential to ensure efficient processing of your claim. It is critical to adhere to the instructions carefully, as any incomplete sections or missing documents can significantly delay the review process. Follow the steps outlined below to complete the form correctly.

- Have the person reporting the claim fill out Section B.

- Attach a copy of the certified death certificate.

- Complete either Section C or D, depending on your coverage type, with assistance from the creditor or financial institution where the coverage was purchased.

- Complete Section C for Net/Payoff/Closed End Monthly Outstanding Balance or Section D for AD&D, Gross Decreasing, or Level Insurance.

- Attach any required documents, such as the Certificate of Insurance and Application for Credit Insurance if applicable.

- Include a Ledger Card or Statement of Account as of the date of death.

- Fill out the attached Health Insurance Portability and Accountability Act (HIPAA) Authorization form.

- Follow your creditor’s mailing instructions to send the completed form and all supporting documents.

- To avoid late fees, continue making payments until you receive notice that your claim has been approved.

- Fax the completed form and all supporting documentation to 305.252.6910 or mail it to: DFS Claims Department, P.O. Box 977122, Miami, FL 33197-7122.

Once your claim has been submitted, an acknowledgment letter will be sent to you, which will include your claim number. Processing typically requires around 15 business days. You will then receive further correspondence regarding the claim’s approval, denial, or a request for more information.

What You Should Know About This Form

What is the C1275 1111 form?

The C1275 1111 form is the Credit Life Death Claim Form from Union Security Life Insurance Company of New York. It is used to claim benefits from a credit life insurance policy upon the death of the insured individual. This form facilitates the process of notifying the insurance company and providing the necessary documentation for the claim to be processed effectively.

Who should complete the C1275 1111 form?

The individual reporting the claim, which may be a family member of the deceased or a legal representative, should complete the form. It is essential that this person provides accurate information and all mandated documents to avoid delays in processing the claim.

What documents are required to submit with the form?

You need to include several documents when submitting the C1275 1111 form. Required items are a certified death certificate, an application for credit insurance, a certificate of insurance, and a ledger card or statement of account. It’s crucial not to skip any documents, as missing information can result in claim delays.

How can I ensure that my claim is processed quickly?

To expedite the processing of your claim, make sure to complete all sections of the C1275 1111 form. Double-check that you’ve attached all necessary documents, such as the certified death certificate and any additional required statements from the creditor. Following instructions carefully will help prevent delays.

How long does it take to process the claim?

Once your claim is received, you can expect to receive a letter acknowledging receipt of your claim within a few days. Typically, the processing time for the claim is around 15 business days. Patience is important during this time, as claims require careful review by the insurance company.

What should I do if my claim is denied or I need additional information?

If your claim is denied or if the insurance company requires more information, you will receive a letter explaining the reasons for the denial or requesting further documentation. It’s important to respond promptly and provide any additional information the company requires to support your claim.

What if I need to make payments during the claim process?

To avoid late fees, you should continue making your payments until you receive notification regarding your claim. Even while waiting for the claim approval, staying current on payments is vital to manage your debts and maintain a good standing with your creditors.

Can I submit my claim via fax or mail?

You have the option to submit your completed C1275 1111 form either by fax or by mailing it to the insurance company. If you choose to fax it, send it to 305.252.6910. Alternatively, you can mail it to the DFS Claims Department at the provided address. Ensure that you retain copies for your records.

Is my personal information protected during this process?

Yes, your personal information is protected, but you will need to complete a Health Insurance Portability and Accountability Act (HIPAA) authorization. This form allows the insurance company to obtain necessary medical information to process your claim while ensuring your privacy rights are respected.

What happens after I submit the claim?

After you submit your claim, you will receive acknowledgment from the insurance company, which will include your claim number. Following that, the company will process your claim and send you a letter advising you whether it has been approved, denied, or if they require additional information.

Common mistakes

Filling out the C1275 1111 form, known as the Credit Life Death Claim Form, is a crucial step for beneficiaries seeking claims for life insurance benefits. However, there are common mistakes individuals make that can significantly delay processing times. Identifying these errors can help ensure a smoother experience.

One frequent mistake is failing to attach the certified death certificate. This document is essential as it verifies the death of the insured. Without it, claims processing will stall, leaving beneficiaries waiting longer for their payouts. Always ensure that this vital document is attached before submitting the form.

Another error is not completing all required sections. The instructions clearly state that each section must be filled out appropriately. Missing any part of the form can result in unnecessary delays. Double-checking the form against the checklist provided can help avoid this pitfall.

Incorrectly filling out the creditor’s statement is another common mistake. This section requires specific details regarding the insurance policy and the insured. For instance, omitting information such as the policy number can lead to confusion and delay. Providing all requested data accurately is essential.

Some individuals overlook the need to complete the HIPAA Authorization. This form allows the insurance company to obtain necessary health information relevant to the claim. Without this completed authorization, the company cannot process the claim, so it's vital to include it.

Beneficiaries sometimes delay mailing the completed claim form, hoping to receive instructions from the creditor first. This can be problematic, as the instructions specify that submissions should be sent promptly. It's recommended to follow the outlined steps and send the claim as soon as possible to avoid late payment issues.

Lastly, some claimants neglect to consider continuing payments until claims are approved. Although it may seem counterintuitive, keeping up with payments ensures there are no penalties or additional fees while waiting for claim processing. Communicating with the creditor about the ongoing situation can also provide clarity and peace of mind.

Avoiding these common mistakes can significantly impact the efficiency of processing claims through the C1275 1111 form. By being diligent and thorough, beneficiaries can ensure quicker resolutions and receive the benefits intended for them.

Documents used along the form

When filing a claim with the C1275 1111 form, several other documents may be required to facilitate the process. These additional forms help establish the context of the claim and ensure accurate processing. Here’s a closer look at four forms and documents often used alongside the C1275 1111.

- Certified Death Certificate: This document serves as official proof of a person's death. It is crucial for verifying the claim and must be attached to the claim form. The certified version is necessary; standard copies may not suffice.

- Creditor’s Statement: This statement outlines the details of the debt owed by the deceased, including loan amount, payments made, and outstanding balances. This document can provide clarity on how the insurance benefits will be applied to debts left behind.

- Ledger Card or Statement of Account: This document details the financial activities related to the deceased’s account with the creditor. It should include all relevant transactions leading to the date of death, helping to validate the claim's figures.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: This form authorizes the release of the deceased’s medical information. Completing this is crucial if specifics about the deceased's health status are required to process the claim.

Ensuring that each of these documents is completed and submitted can significantly streamline the claims process. Being diligent in gathering these materials helps avoid delays and supports a smoother interaction with the insurance company. Always remember, clarity and thoroughness are your best allies when dealing with claims.

Similar forms

-

Claim Form for Life Insurance Benefits: Like the C1275 1111 form, this document is essential for initiating a claim on a life insurance policy. It requires detailed information about the policyholder, beneficiary, and the circumstances surrounding the death, mirroring the structured approach of the C1275 1111. Both forms mandate the submission of a certified death certificate and other necessary documentation to ensure timely processing.

-

Accidental Death and Dismemberment (AD&D) Claim Form: This form is similar in purpose and structure. It requests specific information relating to the deceased's circumstances that qualify for an AD&D benefit. Just as the C1275 1111 requires creditor details and outstanding balances, the AD&D form often seeks similar financial information and supporting documents to process claims efficiently.

-

Health Insurance Claim Form: This form focuses on claims related to medical expenses incurred due to health conditions. It, too, requires proof of the medical services rendered. Similar to the C1275 1111, the health claim form emphasizes the need for detailed documentation to ensure prompt processing of the claims.

-

Policy Change Request Form: This document is necessary when a policyholder wishes to modify their current insurance coverage. The process shares similarities with the C1275 1111, as it often requires the completion of specific sections and the submission of additional documentation to validate the request.

-

Beneficiary Designation Form: Both forms require crucial personal information and signatures to ensure that the correct parties receive benefits. The C1275 1111 also highlights the need for beneficiary details, reflecting a procedure in which accurate identification of individuals is vital to process claims without delays.

-

Request for Medical Records Authorization Form: Like the HIPAA Authorization included with the C1275 1111, this form allows insurance companies to obtain necessary medical information. The structure is consistent, emphasizing patient consent and detailing the medical providers involved, crucial for any claim's successful processing.

Dos and Don'ts

When filling out the C1275 1111 form, it's essential to ensure accuracy and completeness to avoid processing delays. Here are some guidelines to follow:

- Do: Complete all required sections accurately. Missing information will lead to delays.

- Don’t: Skip attaching the Certified Death Certificate, as it is mandatory.

- Do: Have Sections C or D filled out by your creditor or financial institution, depending on the type of coverage.

- Don’t: Provide incomplete or incorrect information, as this may lead to claim denial.

- Do: Attach any required documents like the Certificate of Insurance and Ledger Card.

- Don’t: Forget to follow your creditor’s mailing instructions for submitting the form.

- Do: Keep a copy of all documents submitted for your records.

- Don’t: Delay making payments on your loan until you receive notification regarding your claim status.

Misconceptions

Understanding the C1275 1111 form can sometimes be confusing. Many people have misconceptions about its purpose and requirements. Here are seven common misconceptions, explained in detail.

- It is only needed if the death occurred within a year. Many believe that the form is only applicable for deaths within a year of policy issuance. However, this form must be completed regardless of the timing, as long as the policy was in effect.

- Only the beneficiary can submit the claim. Some may think that only the designated beneficiary is allowed to file this form. In fact, anyone who has the necessary information and authorization can help report the claim.

- The death certificate is not mandatory. There is a misconception that all that is needed is a claim form filled out. In reality, a certified death certificate must always be attached for the claim to be processed.

- Claims are processed immediately upon receipt. Many individuals assume that claims will be handled swiftly. However, the processing can take up to 15 business days, so patience is essential.

- Payment issues are solely the fault of the insurance company. There's a belief that delays or issues in payment are always due to the insurance company. Often, failures to complete required sections or submit necessary documentation can contribute to these problems.

- There is no need to continue payments after submitting the claim. Some might think they can stop making payments on their policy after submitting the claim. However, maintaining payments is crucial to avoid late fees until the claim has been officially approved.

- Once the form is submitted, no further action is needed. It is a common thought that after submission, individuals can simply wait for payment. However, claimants should follow up if they do not receive acknowledgment or updates within the expected time frame.

These misunderstandings can add unnecessary stress during an already difficult time. By clarifying these points, it is hoped that individuals will feel more confident in navigating the claims process.

Key takeaways

When filling out the C1275 1111 form, it’s crucial to follow specific guidelines to ensure smooth processing of your claim. Here are four key takeaways:

- Complete All Required Sections: Make sure every section of the form, especially Sections B, C, or D, is filled out accurately.

- Attach Necessary Documentation: A certified death certificate, Ledger Card, and Certificate of Insurance are just a few examples of the documentation needed for your claim.

- Mail to the Correct Address: Always send the completed form and attachments to the DFS Claims Department at the designated address in Miami, FL.

- Keep Making Payments: It’s vital to continue any payments until you receive confirmation that your claim has been approved to avoid late fees.

By adhering to these points, you can facilitate a more efficient claims process and ensure all necessary information is submitted.

Browse Other Templates

How to Add Dependents to Va Disability - Identification numbers, such as Social Security numbers, are necessary for processing.

What Happens When You Declare Cash at Customs - Incomplete or inaccurate reports can lead to additional scrutiny from authorities.

Uscis Forms - Understand that your application may be subject to an interview or biometrics.