Fill Out Your Ca Qr7 Form

The CA QR7 form is an essential document for individuals receiving General Relief benefits in Los Angeles County. This form serves as a quarterly report, ensuring that your benefits continue without interruption. Each quarter, recipients must sign and submit the QR7 by specific deadlines to avoid delays. It is crucial to report all forms of income received during the designated reporting month, as this will impact your benefits. The form requires details on your income sources, such as wages, government assistance, and any support received from family or friends. You must also report significant changes in your household, like new members moving in or alterations in income. Certain changes, like an increase in earned income over specified amounts or changes with immigration status, must be reported within five days. Failure to provide complete and accurate information may lead to changes or interruptions in your benefits. Completing the QR7 accurately helps maintain your eligibility and ensures you receive the support you need.

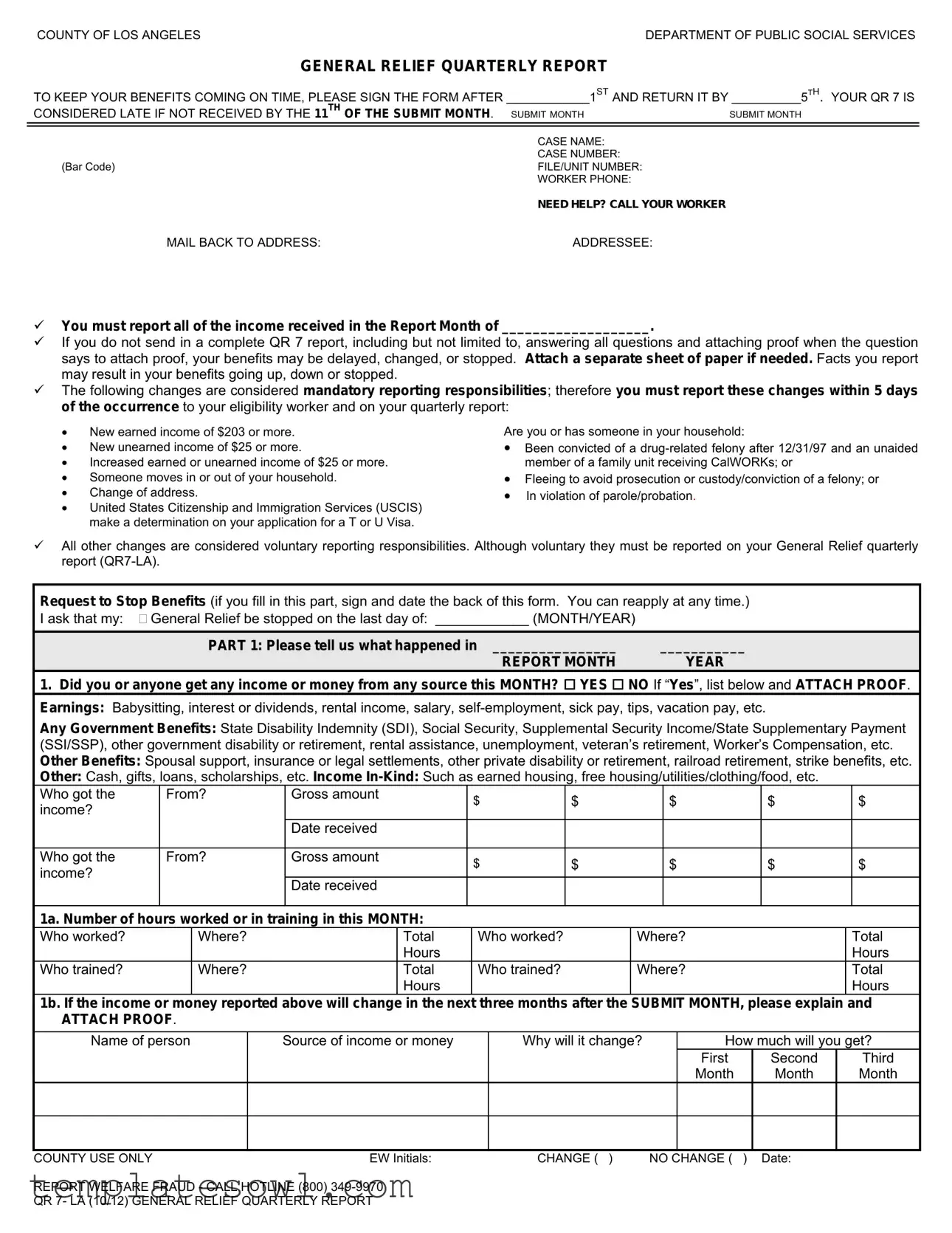

Ca Qr7 Example

COUNTY OF LOS ANGELESDEPARTMENT OF PUBLIC SOCIAL SERVICES

GENERAL RELIEF QUARTERLY REPORT

TO KEEP YOUR BENEFITS COMING ON TIME, PLEASE SIGN THE FORM AFTER ____________1ST AND RETURN IT BY __________5TH. YOUR QR 7 IS

CONSIDERED LATE IF NOT RECEIVED BY THE 11TH OF THE SUBMIT MONTH. SUBMIT MONTH |

SUBMIT MONTH |

CASE NAME: CASE NUMBER:

(Bar Code)FILE/UNIT NUMBER: WORKER PHONE:

NEED HELP? CALL YOUR WORKER

MAIL BACK TO ADDRESS: |

ADDRESSEE: |

9You must report all of the income received in the Report Month of ___________________.

9If you do not send in a complete QR 7 report, including but not limited to, answering all questions and attaching proof when the question says to attach proof, your benefits may be delayed, changed, or stopped. Attach a separate sheet of paper if needed. Facts you report may result in your benefits going up, down or stopped.

9The following changes are considered mandatory reporting responsibilities; therefore you must report these changes within 5 days of the occurrence to your eligibility worker and on your quarterly report:

•New earned income of $203 or more.

•New unearned income of $25 or more.

•Increased earned or unearned income of $25 or more.

•Someone moves in or out of your household.

•Change of address.

•United States Citizenship and Immigration Services (USCIS) make a determination on your application for a T or U Visa.

Are you or has someone in your household:

•Been convicted of a

•Fleeing to avoid prosecution or custody/conviction of a felony; or

•In violation of parole/probation.

9All other changes are considered voluntary reporting responsibilities. Although voluntary they must be reported on your General Relief quarterly report

Request to Stop Benefits (if you fill in this part, sign and date the back of this form. You can reapply at any time.) I ask that my: General Relief be stopped on the last day of: ____________ (MONTH/YEAR)

PART 1: Please tell us what happened in ________________ |

___________ |

REPORT MONTH |

YEAR |

1.Did you or anyone get any income or money from any source this MONTH?

YES

NO If “Yes”, list below and ATTACH PROOF. Earnings: Babysitting, interest or dividends, rental income, salary,

Any Government Benefits: State Disability Indemnity (SDI), Social Security, Supplemental Security Income/State Supplementary Payment (SSI/SSP), other government disability or retirement, rental assistance, unemployment, veteran’s retirement, Worker’s Compensation, etc. Other Benefits: Spousal support, insurance or legal settlements, other private disability or retirement, railroad retirement, strike benefits, etc. Other: Cash, gifts, loans, scholarships, etc. Income

Who got the |

From? |

Gross amount |

$ |

$ |

$ |

$ |

$ |

income? |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Date received |

|

|

|

|

|

|

|

|

|

|

|

|

|

Who got the |

From? |

Gross amount |

$ |

$ |

$ |

$ |

$ |

income? |

|

|

|||||

|

|

|

|

|

|

|

|

|

Date received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. Number of hours worked or in training in this MONTH:

Who worked? |

Where? |

Total |

Who worked? |

Where? |

|

|

Hours |

|

|

Who trained? |

Where? |

Total |

Who trained? |

Where? |

|

|

Hours |

|

|

Total Hours

Total Hours

1b. If the income or money reported above will change in the next three months after the SUBMIT MONTH, please explain and

ATTACH PROOF.

Name of person

Source of income or money

Why will it change?

How much will you get?

First |

Second |

Third |

Month |

Month |

Month |

|

|

|

COUNTY USE ONLY |

EW Initials: |

CHANGE ( ) |

NO CHANGE ( ) Date: |

REPORT WELFARE FRAUD - CALL HOTLINE (800)

QR 7- LA (10/12) GENERAL RELIEF QUARTERLY REPORT

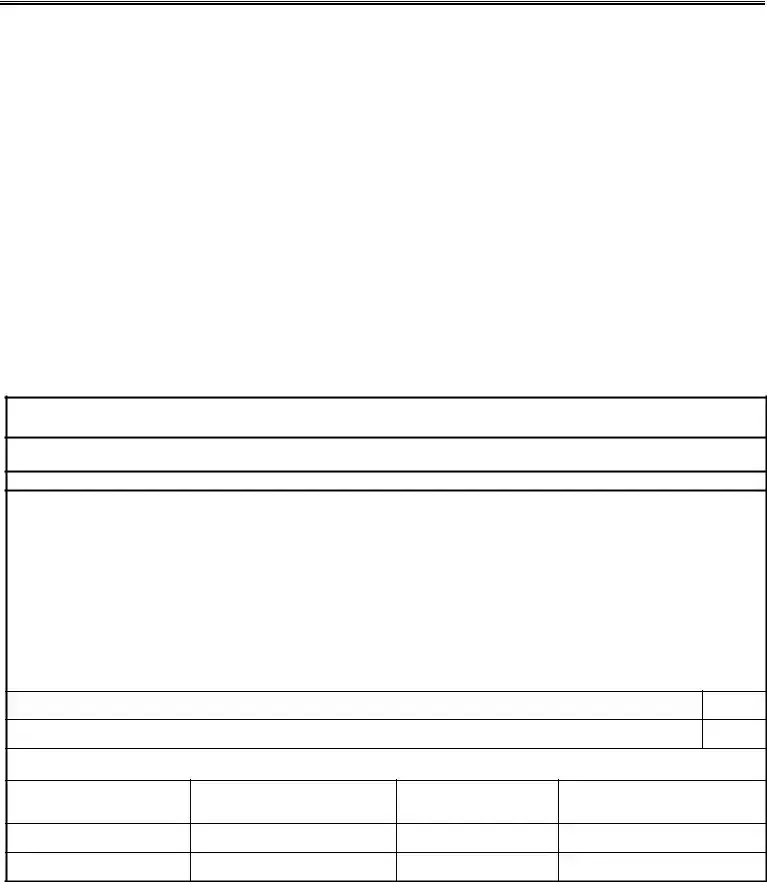

PART 2: What Has Happened SINCE Your Last Report?

1.Did anyone: Get, buy, sell, trade, or give away any property, land, home, cars, bank accounts, money, payments (such as; lottery or casino winnings, retroactive social security, tax refunds), or other property items since last report?

YES NO

If “YES”, list all items below and ATTACH PROOF.

Who owns, sold, traded, or gave away?

Type of Property

When?

Value

$

Bought |

Sold |

Won |

Gift |

Traded |

Gave |

Received |

|

Away |

Checking Account Opened |

Closed Balance $ |

Savings Account Opened Closed Balance $

2. Has anyone moved into or out of your home, or did you move in with someone else? |

YES NO |

||

Full name of person |

Relationship to you |

Moved in or out? |

When? |

|

|

|

|

3.Are you or has someone in your household:

A.Been convicted of a

B.Fleeing to avoid prosecution or custody/conviction of a felony; or

C.In violation of parole/probation

YES NO |

If “YES”, Name: |

Where convicted? |

Date of conviction: |

|

|

||

4. Have any of the following or any other changes happened to anyone in your home? |

YES NO |

||

If “YES”, list below and ATTACH PROOF. Attach a separate sheet of paper if needed.

Family Change [Married, divorced, separated, registered as a California Domestic Partnership (DP), have a

Disability (Became disabled or recovered from a disability or major illness?)

Work (Started or stopped working, refused a job or training, number of hours worked or in training went up or down, or went out on strike?)

Immigration (Citizenship or immigration status change, or got a new card, form, or letter from USCIS/INS?) Insurance (Started, stopped, or changed health, dental, or life insurance benefits, including MEDICARE?) Custody (Any change in the amount of time you care for/have custody of your children?)

School Attendance (For Student - stopped or started attending school regularly?)

Other:

Name of person (s)

Relationship to you

What happened?

Date of change

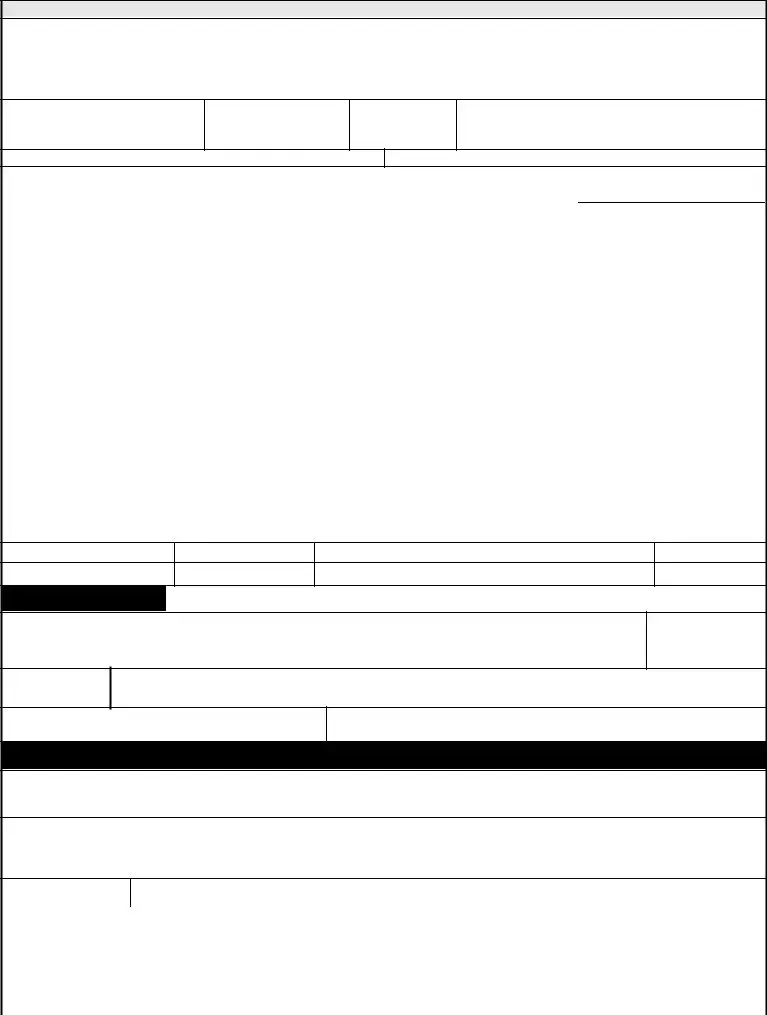

ADDRESS CHANGE Fill in this section ONLY if you have moved or have a new mailing address.

NEW Home Address (Number, Street Name, Avenue, Blvd., Etc.) Apt. No.

City |

State |

Zip Code |

New Phone Number

( )

Date Moved

NEW Mailing Address (if different from Home Address) |

|

|

City |

State |

Zip Code |

Do you have housing costs at this new address? YES NO If yes, how much $

Do you have to pay heating/cooling costs separate from your housing cost? YES NO If yes, how much? $

CERTIFICATION – FRAUD WARNING

I UNDERSTAND THAT: If on purpose I do not report all facts or give wrong facts about my income, property, or family status to get or keep getting aid or benefits, I can be legally prosecuted. I may also be charged with committing a felony if more than $950 in General Relief, is wrongly paid out as a result of such action. I have received a copy of the Instructions and Penalties for the General Relief Eligibility Status Report.

YOU MUST SIGN AND DATE THIS REPORT AFTER THE LAST DAY OF THE MONTH THIS REPORT IS FOR OR IT WILL BE CONSIDERED INCOMPLETE.

I declare under penalty of perjury under the laws of the United States and the State of California that the facts contained in this report are true and correct and complete.

WHO MUST SIGN BELOW:

You and your aided spouse or aided domestic partner if living in the home.

SIGNATURE OR MARK |

DATE SIGNED |

HOME PHONE |

CONTACT/CELL PHONE |

||

|

|

( ) |

( |

) |

|

|

|

|

|

|

|

SIGNATURE OF AIDED SPOUSE OR AIDED |

DATE SIGNED |

SIGNATURE OF WITNESS TO MARK, INTERPRETER OR |

|

DATE SIGNED |

|

DOMESTIC PARTNER. |

|

OTHER PERSON COMPLETING FORM |

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Submission Deadlines | The CA QR 7 form must be signed and returned by the 5th of the month following the reporting month. Late submissions are those received after the 11th. |

| Mandatory Reporting Changes | Certain changes require immediate reporting within five days. These include new earned income of $203 or more and any household changes like someone moving in or out. |

| Potential Consequences | If the QR 7 is incomplete or filed late, benefits may be delayed, reduced, or stopped altogether. Completing the form accurately is crucial. |

| Governing Laws | This form is governed by the laws of the State of California, specifically under the regulations surrounding General Relief and CalWORKs. |

Guidelines on Utilizing Ca Qr7

Completing the CA QR7 form is an important step to ensure that you continue receiving your benefits without interruption. Following the clear instructions will help avoid any potential delays or issues with your case. Below are the steps to successfully fill out the form.

- Start by entering the Report Month and Year at the top of the form.

- Clearly fill in your Case Name and Case Number. Make sure to include the File/Unit Number.

- Record the Worker Phone number for any questions you may have.

- Indicate the Submit Month right after the section that requires your signature.

- Answer the first question about any income received during the Report Month by checking either YES or NO. If “YES,” list all types of income and attach proof.

- For the section regarding hours worked or in training, provide the number of hours and the related details of employment or training.

- If any changes to your income are expected in the next three months, explain why and how over the designated area, including attachments as proof.

- Move to the next section regarding changes since your last report, and respond to each question with YES or NO. If “YES,” list details and attach the necessary proof.

- If no changes have occurred, this section may be skipped, but make sure previous sections are complete.

- Fill out the Address Change section only if applicable. Provide the new address, phone number, and any housing cost details.

- Sign and date the form after the last day of the report month to validate your report.

- Include the signatures of any aided spouse or domestic partner if applicable.

Once completed, return the form to the address specified. Ensuring that everything is accurate and submitted on time can greatly affect your eligibility for benefits. Take care to double-check all entries and attachments for completeness to avoid any potential complications.

What You Should Know About This Form

What is the purpose of the CA QR7 form?

The CA QR7 form functions as a General Relief Quarterly Report for individuals or families receiving assistance in Los Angeles County. By completing and submitting this form, beneficiaries ensure that their financial situation is accurately reported, which directly affects the continuation and amount of their benefits. It collects crucial information about income, property changes, and household status over the reporting period.

When is the CA QR7 form due?

The form must be filled out, signed, and returned by the 5th day of the month following the reporting month. It is essential to remember that if it is not received by the 11th, it will be considered late. Timely submission helps prevent any interruption in the benefits, which can significantly impact financial stability.

What happens if the CA QR7 form is submitted late?

Submitting the CA QR7 form late can lead to serious consequences. Benefits may be delayed, altered, or even stopped altogether. To avoid such complications, it is advisable to keep track of submission dates and ensure that the form is sent in on time. Late reports can create additional stress and uncertainty during an already challenging time.

What information must be reported on the CA QR7 form?

Beneficiaries must report all sources of income received during the designated report month. This includes earnings from work, government benefits, and any other financial support. Moreover, any changes in household composition, such as new residents or moving addresses, must also be reported. Inaccuracies or incomplete information might result in changes to the benefits received.

What are mandatory reporting responsibilities in the CA QR7?

The CA QR7 outlines specific changes that beneficiaries are required to report within five days. This includes new earned income exceeding $203, unearned income over $25, any increase in previously reported income, changes in household composition, address changes, and updates regarding immigration status concerning T or U Visas. Failure to disclose mandatory changes can have significant repercussions on benefit eligibility.

What is considered voluntary reporting on the CA QR7?

While the form primarily highlights mandatory reporting requirements, there are also voluntary reporting obligations. Beneficiaries are encouraged to report additional income or changes that, while not explicitly required, may influence their aid situation. This voluntary disclosure can provide a more comprehensive view of an individual's financial circumstances.

How should one address errors or issues in the CA QR7 report?

If there are errors or omissions in the report, it is crucial to address them promptly. Beneficiaries should contact their eligibility worker immediately and provide any necessary corrections. Thoroughly reviewing the form before submission helps minimize mistakes, ensuring that all information presented is accurate and complete, which is critical for maintaining benefits.

Can someone request to stop their benefits using the CA QR7 form?

Yes, the CA QR7 form includes a section where beneficiaries can request to stop their General Relief benefits. By indicating the last month for which they wish to receive assistance, they can formally communicate their decision. It is important to note that once benefits are stopped, individuals have the option to reapply at any time should their circumstances change.

What is the importance of the signature on the CA QR7 form?

Signing the CA QR7 form is a critical step in the reporting process. It serves as a declaration that the information provided is accurate and complete to the best of the beneficiary’s knowledge. Signing also signifies an understanding of the legal implications surrounding benefit reporting. Failure to sign can render the form incomplete, possibly affecting benefit disbursement.

Common mistakes

Filling out the Ca QR7 form can be daunting, and several common mistakes can lead to delays or changes in benefits. One frequent error occurs when individuals forget to report all income received during the report month. Income from various sources, including government benefits and private sources, needs to be accurately disclosed. Omitting information not only complicates the review process but also risks having benefits reduced or halted.

Another mistake is failing to provide proof of income. The form specifically requires proof for any income reported, which includes documents for earnings or government benefits. When proof is missing or incorrectly submitted, the form is considered incomplete. This oversight can result in a hold on benefits while the information is verified, increasing financial stress.

People often neglect to update their contact information or address changes promptly. It is crucial to notify the department of any move or change in your household structure. Such changes must be reported within five days, and not doing so could lead to complications in receiving benefits or continue to receive correspondence in an old address.

Some individuals mistakenly assume that all reporting is optional. However, there are mandatory changes that must be reported, such as new earned income or significant shifts in household composition. Ignoring these requirements can lead to serious repercussions, including delayed processing of claims or loss of benefits.

Additionally, a lack of clear communication with the eligibility worker can be detrimental. If unsure about what to report, reaching out for assistance is essential. Many forms are completed incorrectly simply due to misunderstanding what is necessary. Clear and open communication helps ensure all facts are reported accurately and timely.

It is also common for people to overlook necessary signatures. The form clearly states that it must be signed and dated after the last day of the report month. Failing to do so renders the submission incomplete, further delaying the process of maintaining benefits.

Moreover, individuals sometimes forget to attach a separate sheet if additional information is needed. When the form does not provide enough space to adequately respond to certain questions or report changes, overlooking this requirement can lead to confusion and potential denial of benefits.

Lastly, a common but critical mistake is failing to review the completed form before submission. Errors in names, income amounts, or dates can lead to significant issues in processing. Taking a moment to double-check entries can save time and ensure accuracy.

Documents used along the form

The California QR 7 form, necessary for General Relief recipients, is often accompanied by several other important documents. Each of these documents serves a specific purpose in ensuring accurate reporting of income and changes in circumstances. Understanding these forms can help recipients maintain their benefits without interruption.

- General Relief Application: This document is used to apply for General Relief benefits. It collects detailed information about an applicant's financial status, household composition, and any other relevant data necessary for eligibility determination.

- Eligibility Status Report: This report helps the Department of Public Social Services confirm ongoing eligibility for benefits. It requires recipients to report any changes in their circumstances since their last application or report.

- Change of Address Form: When recipients move to a new address, they must submit this form to update their case records. It ensures that all correspondence and benefits are directed to the correct location.

- Income Verification Documents: These documents provide proof of all income sources, such as pay stubs, bank statements, or benefit letters. They are crucial for verifying reported income on the QR 7 form.

- Overpayment Notice: If a recipient receives more benefits than entitled, this notice informs them of the overpayment, the reasons why it occurred, and how it will impact their future benefits.

- Request to Stop Benefits: In situations where recipients want to discontinue their benefits, this form allows them to formally request a stop. It includes necessary information about the recipient and the date benefits should end.

- Fraud Reporting Form: This document is used to report suspected fraudulent activity concerning General Relief benefits. The form helps ensure that resources are protected from misuse.

- Documentation of Citizenship or Immigration Status: Recipients may need to provide proof of their legal status in the United States. This is necessary for verifying eligibility in the General Relief program.

- Identity Verification Document: Forms of identification, such as a driver’s license or state ID, are needed to confirm the identity of the recipient when applying or when changes occur in their status.

Gathering and completing these documents accurately can streamline the reporting process and help ensure continued access to necessary benefits. Recipients are encouraged to maintain complete, updated records to support their information submission and compliance with program requirements.

Similar forms

- CalWORKs Quarterly Report - Similar to the QR 7, this document is used to report income and changes in household circumstances. It is necessary for maintaining benefits, and failure to submit it on time can lead to delays or loss of aid.

- Monthly Income Report - Like the QR 7, this report requires recipients to disclose their income and any changes. Timely submission is essential to ensure the continuation of welfare benefits.

- Supplemental Nutrition Assistance Program (SNAP) Recertification Form - This form also collects information on income and household composition. Its purpose is to reassess eligibility for food assistance and ensure correct benefit levels.

- Department of Public Social Services Request for Benefits - This document requests assistance and requires detailed information about income and living arrangements, much like the QR 7, to determine eligibility.

- Unemployment Benefits Eligibility Report - Similar in function, this report collects detailed information about applicants’ work history and any income received. Accuracy is crucial, as incorrect information can affect benefit eligibility.

- Child Protective Services (CPS) Report - While focused on reporting child welfare issues, this CPS report includes sections to disclose changes in household composition and income, paralleling the QR 7's information gathering.

- Housing Assistance Recertification Form - This form requires applicants to report changes in income and family status. Its purpose aligns with the QR 7 in maintaining housing benefits in response to new information.

Dos and Don'ts

- Do: Read the entire form carefully to ensure you understand all the questions being asked.

- Do: Provide complete and accurate information for each section of the form.

- Do: Attach any required proof when specifically requested in the form instructions.

- Do: Include your signature and date after the last day of the month the report covers.

- Do: Report any changes in income or household dynamics promptly and accurately.

- Do: Maintain a copy of the completed form for your records before submitting it.

- Do: Reach out to your eligibility worker if you have any questions or need clarification.

- Don't: Leave any sections blank; ensure that all questions are answered.

- Don't: Submit the form late, as this may delay or affect your benefits.

- Don't: Ignore the requirements for reporting changes in your financial situation or household composition.

- Don't: Provide false or misleading information, as this could lead to serious legal consequences.

- Don't: Forget to sign the form; your signature validates that the information you provided is true.

- Don't: Hesitate to attach additional documentation on a separate sheet if needed—this can support your claims.

- Don't: Assume that your benefits will not change; always report any relevant information that may affect your eligibility.

Misconceptions

There are several misconceptions surrounding the CA QR7 form that can lead to confusion regarding the General Relief application process. The following list outlines ten common misunderstandings and provides clarification for each.

- The QR7 form is only for those receiving General Relief. In fact, the QR7 form is necessary for reporting changes that may affect the eligibility for various benefits, not just General Relief.

- Income reporting is optional on the QR7 form. This is incorrect. Reporting all income received during the report month is mandatory, and failing to do so can result in delays or changes to benefits.

- Changes can be reported at any time. Many individuals believe changes can be reported whenever convenient; however, specific changes must be reported within five days of occurrence to avoid issues with eligibility.

- All changes are mandatory to report. Not all changes need to be reported on the QR7 form. Only certain changes, such as new earnings above specific amounts or changes in household composition, are mandatory; others may be reported voluntarily.

- Proof of income is not necessary. Individuals often think they can simply report income without providing proof. This is incorrect; proof of income must be attached to support what is reported on the form.

- The QR7 form can be submitted late. Submitting the QR7 form after the due date can have negative consequences. The form is considered late if not received by the 11th of the month.

- You do not have to report temporary jobs. Even temporary jobs that result in earnings above mandatory reporting thresholds must be reported, regardless of their duration.

- Your benefits won’t be affected if you provide incorrect information. Providing false or incomplete information can lead to legal repercussions, including the termination of benefits or criminal charges.

- Only the applicant must sign the QR7 form. If there is an aided spouse or partner living in the home, they must also sign the form to validate the report.

- You can ignore the certification section. The certification section is crucial. Ignoring this section can render the report incomplete, putting benefits at risk.

Understanding the truth behind these misconceptions can help ensure that the benefits process runs smoothly and that individuals maintain their eligibility for assistance.

Key takeaways

Completing the Ca QR7 form accurately is crucial. A complete submission is necessary to avoid delays or changes in your benefits. This includes answering all questions and providing required proof for your income and changes in circumstances.

Timeliness is essential. Your QR7 must be submitted by the 5th of the month following your report month. If received after the 11th, it will be deemed late, which may negatively affect the continuation of your benefits.

Mandatory reporting responsibilities include significant changes in income or household composition. Report any new earned income over $203 or new unearned income exceeding $25 within five days, as well as changes in address or household members.

While some changes are considered voluntary, they should still be included in your report. Transparency about all income sources, even non-mandatory ones, ensures you receive the correct benefits.

Remember, signing the QR7 form is important. It serves as a certification that the information provided is accurate. Failure to sign after the reporting month may result in your report being considered incomplete, further complicating your benefits.

Browse Other Templates

George E Cole Legal Forms - Lessee is responsible for payment of utilities like water, gas, and electricity.

Roll Over Ira - The IRA Withholding form allows you to elect state income tax withholding from your IRA payments.