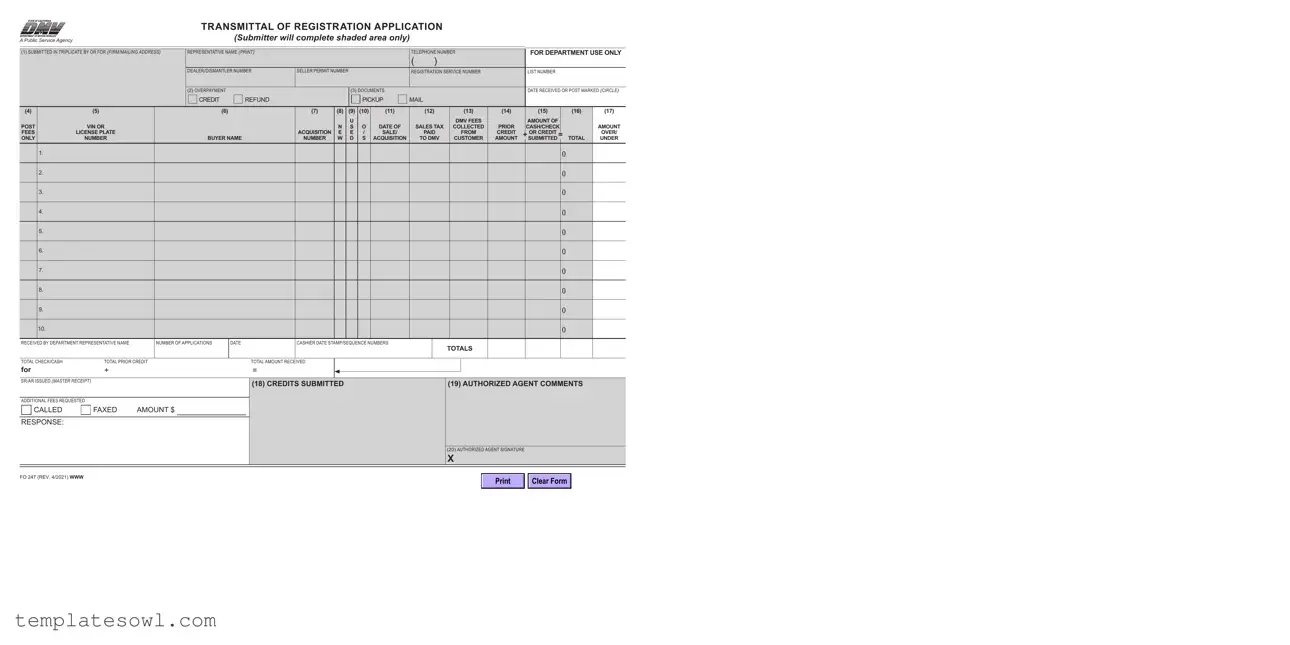

Fill Out Your Capf 50 1 Form

The Capf 50 1 form serves as a vital document for dealerships and dismantlers in California, ensuring the smooth processing of vehicle registration applications. This form must be submitted in triplicate, allowing for appropriate documentation by both the submitter and the Department of Motor Vehicles (DMV). It requires essential information such as the firm or mailing address, representative's name and contact details, and various identification numbers, including dealer, seller permit, and registration service numbers. Information on sales tax collected, DMV fees, and associated overpayments must also be disclosed. Timeliness is crucial, as late submissions can incur administrative service fees, further emphasizing the importance of following the correct procedure. Additionally, the form allows for refunds or credits for any overpayments, providing a clear path for financial adjustments. Overall, understanding how to accurately fill out the Capf 50 1 form not only helps to expedite registration processes but also aids in maintaining compliance within California's regulatory framework.

Capf 50 1 Example

TRANSMITTAL OF REGISTRATION APPLICATION

A Public Service Agency |

|

|

|

|

|

|

|

(Submitter will complete shaded area only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DEPARTMENT USE ONLY |

|||||||||||||||||

(1) SUBMITTED IN TRIPLICATE BY OR FOR (FIRM/MAILING ADDRESS) |

REPRESENTATIVE NAME (PRINT) |

|

|

|

|

|

|

|

TELEPHONE NUMBER |

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEALER/DISMANTLER NUMBER |

SELLER PERMIT NUMBER |

|

|

|

REGISTRATION SERVICE NUMBER |

|

|

LIST NUMBER |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) OVERPAYMENT |

|

|

|

|

|

|

|

(3) DOCUMENTS |

|

|

|

|

|

|

|

|

DATE RECEIVED OR POST MARKED (CIRCLE) |

|||||||

|

|

|

|

|

|

|

|

|

|

CREDIT |

REFUND |

|

|

|

|

|

PICKUP |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

(5) |

|

|

|

(6) |

|

|

|

(7) |

(8) |

|

(9) |

(10) |

(11) |

|

(12) |

|

(13) |

(14) |

|

(15) |

|

|

|

(16) |

(17) |

|||||||

POST |

|

|

VIN OR |

|

|

|

|

|

|

|

|

N |

|

U |

O |

DATE OF |

|

SALES TAX |

|

DMV FEES |

PRIOR |

|

AMOUNT OF |

|

|

|

|

AMOUNT |

||||||

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

COLLECTED |

|

CASH/CHECK |

|

|

|

|||||||||||||||

FEES |

|

LICENSE PLATE |

|

|

|

|

|

|

|

ACQUISITION |

|

E |

|

E |

/ |

SALE/ |

|

PAID |

|

|

FROM |

CREDIT |

+ |

OR CREDIT |

= |

|

|

OVER/ |

||||||

ONLY |

|

|

NUMBER |

|

|

|

BUYER NAME |

NUMBER |

W |

|

D |

S |

ACQUISITION |

|

TO DMV |

|

CUSTOMER |

AMOUNT |

|

SUBMITTED |

|

|

|

TOTAL |

UNDER |

|||||||||

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

RECEIVED BY DEPARTMENT REPRESENTATIVE NAME |

|

NUMBER OF APPLICATIONS |

DATE |

CASHIER DATE STAMP/SEQUENCE NUMBERS |

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

TOTAL CHECK/CASH |

|

|

TOTAL PRIOR CREDIT |

|

|

|

|

|

TOTAL AMOUNT RECEIVED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

for |

+ |

|

|

|

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SR/AR ISSUED (MASTER RECEIPT) |

|

|

|

|

|

|

(18) CREDITS SUBMITTED |

|

|

|

|

|

|

(19) AUTHORIZED AGENT COMMENTS |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDITIONAL FEES REQUESTED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

CALLED |

|

|

FAXED |

AMOUNT $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESPONSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(20) AUTHORIZED AGENT SIGNATURE |

|

|

|

|

|

|||||

X

FO 247 (REV. 4/2021) WWW

Clear Form

GENERAL INFORMATION

This form is designed for use by dealers/dismantlers but may also be used by individuals or companies submitting multiple registration applications.

In computing any fees or penalties due whether on a proration or otherwise, disregard a fraction of a dollar unless it exceeds fifty cents ($0.49). In this case, round the fee up to the next dollar.

Example: (If fee and/or penalty is $5.50, submit $6.00.) (If fee and/or penalty is $5.49, submit $5.00.)

Please do not submit odd cents.

It is not necessary to enter .00 in the money columns to indicate cents.

Applications not submitted to the Department in a timely manner are subject to the following Administrative Service Fees (ASF)/ Investigative Service Fee (ISF).

Submitted after 20/30 days from date of sale (ASF) |

$5.00 |

Submitted after 40/50 days from date of sale |

$25.00 |

In addition, whichever is appropriate: |

|

Submitted after 20 days from date the |

|

department first returned the application (ASF) |

$25.00 |

Submitted after 5 days from acquiring the vehicle (ISF) |

$15.00 |

Sacramento Headquarters will bill for any ASF/ISF due. The dealer/ dismantler or

PREPARE AN ORIGINAL AND TWO (2) COPIES

Original: Retained by the Department.

Copy: Returned to submitter with documents due after the applications have been processed.

Copy: If ISF fees are due, this copy will be forwarded by the field office to:

ASF/ISF Unit

P.O. Box 932366, M/S L224

Sacramento, CA

An application for vehicle registration is considered to be received by the Department only when it is accompanied by all necessary documents properly completed and the required fees. Penalties may accrue on applications submitted to the Department without fees.

|

Clear Form |

|

|

|

|

PROCEDURE TO COMPLETE THIS FORM

(Submitter will complete the shaded area only.)

1.As the submitter, enter your firm name, mailing address, dealer/dismantler number, Registration

Service number, or Seller Permit Number, if applicable. Print the representative’s name and telephone number. Note: Seller’s Permit Number is a

2.Indicate choice of refund or credit media for overpayment.

3.Indicate choice of pickup or mail for documents.

4.Enter “X” if the item is for Posting Fees Only.

5.Enter the Vehicle Identification number (VIN) or the California license plate number presently on the vehicle. Note: When completing this form, group all “used” vehicle transactions together, all “new” vehicles together, and all “out of state (O/S)” vehicles together.

6.Enter the buyer’s name.

7.Enter the Acquisition Number for the transaction.

8.Enter “X” if transaction is for a new vehicle

9.Enter “X” if transaction is for a used vehicle.

10.Enter “X” if vehicle will be registered O/S.

11.Enter the date of sale/acquisition for each transaction.

12.Enter the amount of sales tax collected based on the actual selling price of the vehicle. Note: Sales tax collected on other charges related to the vehicle (including, but not limited to the document fees, smog certification fees, and mandatory warranties) must be reported directly to

CDTFA on monthly sales and use tax returns.

13.Enter the amount of DMV fees collected from the customer.

14.Enter the prior credit amount, if any.

15.Enter the amount of cash/check or credit submitted.

16.Total for columns 14 plus 15.

17.To Completed by DMV personnel.

18.Indicate credits submitted; Bundle credit information, Z96, or write “none”.

19.Authorized agent’s comments.

20.Authorized agent’s signature.

NOTICE TO DEALERS

In the “Amount of Refund” column shown on the attached Bundle Listing sheet, the Department will indicate excess fees paid DMV. Refund of Excess Fees by Dealer (CVC §11713.4). If a purchaser of a vehicle pays the dealer an amount for the licensing or transfer of title of the vehicle, which amount is in excess of the actual fees due for such licensing or transfer, or which amount is in excess of the amount which has been paid, prior to the sale, by the dealer to the state in order to avoid penalties that would have accrued because of the late payment of such fees, the dealer shall return such excess amount to the purchaser, whether or not such purchaser requests the return of the excess amount.

FO 247 (REV. 4/2021) WWW

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used for the transmittal of multiple vehicle registration applications by dealers and dismantlers. |

| Submission Requirements | The form must be submitted in triplicate along with all necessary documents and fees. |

| Governing Law | The form follows the regulations set by California Vehicle Code (CVC) §11713.4. |

| Fee Calculation | Fees are rounded up if they exceed fifty cents, while odd cents should not be submitted. |

| Overpayments | The submitter must indicate the choice of credit or refund for any overpaid fees. |

| Timeliness | Late submissions can incur Administrative Service Fees (ASF) or Investigative Service Fees (ISF). |

| Importance of Completeness | An application is considered received only when accompanied by all required documents and fees. |

| Refund Policy | Dealers must return any excess fees collected from purchasers in compliance with CVC §11713.4. |

Guidelines on Utilizing Capf 50 1

Filling out the CAPF 50 1 form is a straightforward process that requires careful attention to detail. You will be providing specific information related to vehicle registration applications and associated fees. The goal here is to ensure that all the necessary information is submitted correctly, so that the process can move forward without delays.

- Begin by entering your firm name and mailing address in the appropriate fields. If applicable, also add your dealer/dismantler number, Registration Service number, or Seller Permit Number.

- Print the representative’s name and provide a telephone number.

- Indicate your choice of refund or credit media in the designated area for any overpayment.

- Choose between pickup or mail for documents.

- Mark an “X” if the item is for Posting Fees Only.

- Input the Vehicle Identification Number (VIN) or the California license plate number currently on the vehicle.

- Fill in the buyer’s name corresponding to the transaction.

- Enter the Acquisition Number for the relevant transaction.

- Mark an “X” if the transaction is for a new vehicle.

- Indicate with an “X” if the transaction involves a used vehicle.

- Mark an “X” if the vehicle will be registered out of state (O/S).

- Document the date of sale/acquisition for each transaction.

- Enter the amount of sales tax collected based on the vehicle's actual selling price.

- Input the amount of DMV fees collected from the customer.

- If applicable, list the prior credit amount.

- Specify the amount of cash/check or credit submitted.

- Calculate the total for columns 14 and 15.

- Leave the next section to be completed by DMV personnel.

- Indicate any credits submitted and provide the required details.

- Include any comments from the authorized agent as necessary.

- Sign the form in the authorized agent's signature field.

What You Should Know About This Form

What is the purpose of the CAPF 50 1 form?

The CAPF 50 1 form is primarily designed for use by vehicle dealers and dismantlers. It allows them, as well as individuals or companies, to submit multiple registration applications for processing. By consolidating registration applications into one submission, the form streamlines the registration process for both submitters and the Department.

How should I complete the form?

To fill out the CAPF 50 1 form, begin by entering your firm name, mailing address, and applicable identification numbers, such as the dealer or dismantler number and seller permit number. Make sure to print your name and a contact telephone number. Follow each section of the form carefully, providing necessary details for each transaction, including buyer information and amounts for fees and taxes collected. Be sure to submit an original and two copies of the completed form.

What happens if I submit the application late?

If the registration application is submitted after designated timeframes—such as 20 or 30 days from the date of sale—administrative service fees (ASF) will apply. These fees increase based on how late the submission is. For example, a fee of $5.00 applies if submitted after 20 days, while a fee of $25.00 is charged if submitted after 40 days. These charges are outlined on the form to ensure compliance.

Is there guidance on handling overpayments?

Yes, if an overpayment occurs, the form provides options for requesting either credit or a refund. When filling out the form, indicate your preference by checking the appropriate option. The Department will process the claim according to the specified instructions. This helps ensure that whichever route you choose, the situation gets resolved promptly.

What should I do if I have not received my documents after submission?

If you have not received your returned documents after submitting the CAPF 50 1 form, it's advisable to reach out to the Department directly. Keep a copy of the form for your records. There may be a delay in processing that you can clarify with the Department. It's also important to monitor the timeframe for document return to ensure timely receipt and avoid any penalties associated with late applications.

How is the fee calculation handled on this form?

When calculating fees on the CAPF 50 1 form, disregard fractions of a dollar unless they exceed $0.49. In such cases, round the fee up to the next whole dollar amount. For instance, if the fee is $5.50, submit $6.00; if it's $5.49, submit $5.00. This straightforward method simplifies the payment process and minimizes potential errors.

Common mistakes

Filling out the Capf 50 1 form can be straightforward, but some common mistakes make the process difficult. One significant error involves failing to submit the form in triplicate. The instructions state that the original and two copies are necessary for proper processing. Omitting any of these copies can result in delays or rejection of the application.

Another frequent mistake is neglecting to accurately enter the Vehicle Identification Number (VIN) or the California license plate number. Missing or incorrect details in this section can lead to complications later on in the registration process, potentially necessitating further time and effort to rectify the issue.

Individuals often forget to indicate how they prefer to handle any overpayment. This might mean not selecting whether they want credit or a refund, which can create confusion for both the submitter and the examination department. Choosing a method for reimbursement is essential to ensure the funds are returned appropriately.

Many applicants make the error of not rounding fees correctly. The instructions specify to disregard fractions of a dollar unless they exceed fifty cents; if so, round up to the next dollar. Consequently, some individuals either submit the incorrect total amount or omit cents entirely, which delays the processing of the form.

Leaving the prior credit amount blank is another common mistake. If there is a prior credit, it must be documented on the form. Failing to do so could lead to confusion regarding outstanding balances, ultimately affecting the registration process and any fees due.

Additionally, some people neglect to provide their representative’s name and telephone number. This information is vital for any follow-up questions and ensures that the application can be processed efficiently. Lack of contact details can often lead to unnecessary communication issues that could delay the process.

Lastly, signing the form is crucial. Despite all other information being accurate, an unsigned form will not be accepted. It is essential to remember that this signature confirms the accuracy of the information provided and will facilitate the application’s acceptance by the department.

Documents used along the form

The CAPF 50 1 form serves as a crucial instrument for vehicle registration applications within the framework of California's Department of Motor Vehicles (DMV). This document is pertinent for dealers and dismantlers who manage multiple vehicle registrations, helping to streamline their administrative processes. Various additional forms and documents accompany the CAPF 50 1 to ensure compliance and thoroughness in vehicle registration transactions.

- CAPF 30 Form: This is used to apply for a vehicle registration refund. The form collects essential details about the vehicle sale and the reasons for the refund request, facilitating a smooth refund process.

- CAPF 50 2 Form: This document is intended for reporting alterations to previously submitted registration applications. It allows dealers to update information quickly and maintain accurate records with the DMV.

- CAPF 50 3 Form: Designed specifically for vehicle disposal, this form is critical for sellers who are transferring ownership of dismantled vehicles. It records essential details to ensure regulatory compliance during the disposal process.

- CAPF 40 Form: This form applies when an individual or dealer seeks a temporary operating permit for a vehicle. It provides a legal basis for operating a vehicle while the standard registration process is still pending.

- Vehicle Identification Number (VIN) Verification: Often required to authenticate vehicle ownership, this document confirms the VIN against DMV records, helping to prevent fraud and ensure accurate registration.

- Sales Tax Statement: This statement detailing sales tax collected at the point of sale is crucial for record-keeping and must accompany the registration application to ensure compliance with state tax requirements.

- Payment Receipt: This is provided to confirm payment made towards registration fees. It serves as proof of fee payment and is useful for both the dealer and DMV in resolving any disputes over amounts collected.

- Power of Attorney (POA): A Power of Attorney form may be necessary if someone other than the vehicle owner is submitting the registration application. This document authorizes the representative to act on behalf of the owner in the registration process.

- Dealer's Statement of Fact: This form allows dealers to provide additional context or information about a vehicle sale, ensuring transparency in transactions and safeguarding against potential disputes.

Utilizing these forms in conjunction with the CAPF 50 1 enhances the accuracy and efficiency of the vehicle registration process. Proper documentation is integral for maintaining compliance with DMV regulations, protecting both the dealers' interests and the rights of vehicle buyers. Understanding the role of each document contributes to a smoother transaction experience and helps in preventing potential complications in the registration journey.

Similar forms

The CAPF 50 1 form serves as a vital tool in the vehicle registration process, particularly for dealers and dismantlers. It shares similarities with other documents commonly used in administrative and operational settings. Below is a list of ten documents that are similar, along with a brief explanation of their similarity to the CAPF 50 1 form.

- Application for a Business License: Similar in function, this document typically requires detailed information about the business, including the owner’s contact information and type of business, similar to how the CAPF 50 1 captures dealer and representative details.

- Tax Exemption Certificate: This form is used to officially document an entity’s tax-exempt status, noting necessary identification details, similar to tax calculations noted on the CAPF 50 1.

- Sales Tax Return Form: Businesses use this to report sales tax collected and remit it to taxing authorities. It parallels CAPF 50 1 by capturing financial details related to sales transactions.

- Vehicle Bill of Sale: This document legally transfers vehicle ownership and requires identification of the buyer, seller, and vehicle information, akin to how the CAPF 50 1 records buyer and vehicle details.

- Change of Address Form: Used to update an entity’s address with various agencies; it requires accurate information that is also emphasized in the CAPF 50 1 for registration accuracy.

- Permit Application Form: This is a request for permission to operate under certain conditions and requires similar information about the applicant, paralleling the requirements found on the CAPF 50 1.

- Invoice for Services Rendered: An invoice itemizes services provided and their costs, capturing similar financial details required on the CAPF 50 1.

- Employee Registration Form: This document collects personal and employment details about staff, similar to the information collected on the CAPF 50 1 regarding the submitter and representatives.

- Contractor Payment Application: This application is submitted by contractors to request payment for completed work, requiring detailed accountings much like CAPF 50 1 tracks payments and overpayments.

- Business Activity Report: Often used for periodic reporting to authorities about business operations, it collects specific data similar to the registration information on the CAPF 50 1.

These documents collectively highlight the importance of thorough and organized information gathering, central to administrative functions in various settings. The CAPF 50 1 form exemplifies this by facilitating the accurate processing of vehicle registrations, ensuring compliance with state regulations.

Dos and Don'ts

When filling out the Capf 50 1 form, following certain key practices can ensure a smooth process. Below are important do's and don'ts to consider:

- Do complete the form in triplicate – one original and two copies.

- Do provide accurate vehicle information, including the VIN or license plate number.

- Do specify the buyer's name clearly on the form.

- Do indicate whether you are requesting a refund or credit for overpayments.

- Don't submit applications without all required fees, as penalties may apply.

- Don't use odd cents in the fee calculations; round amounts as instructed.

- Don't forget to sign and include comments as the authorized agent.

Adhering to these guidelines can help avoid delays or complications during the registration process. Ensure all sections of the form are filled out fully and accurately for efficient processing by the Department.

Misconceptions

Misunderstandings about the CAPF 50 1 form can lead to confusion and unnecessary delays. Below are some common misconceptions to clear things up:

- The form is only for dealers. Many individuals and companies can use this form, especially those submitting multiple registration applications.

- It's not necessary to include payment with the application. Applications must be submitted with all required fees. Otherwise, penalties may accrue.

- Only the original form is needed. You must prepare an original and two copies. The Department keeps the original, while a copy is returned to you.

- Submitting the form late doesn't incur extra fees. Late submissions may be subject to Administrative Service Fees or Investigative Service Fees, depending on how late they are.

- Fees should always be rounded up. Only round fees that exceed fifty cents. If a fee is under that threshold, leave it as is.

- You must include cents in the money columns. It is unnecessary to enter .00 in the money columns to indicate cents on the form.

- All transactions can be grouped together. It's best to list all “used” vehicles together, all “new” vehicles together, and all “out of state” vehicles separately for clarity.

- The form has no specific order for information. Following the outlined procedure carefully helps ensure everything is filled out correctly, avoiding potential issues.

- The authorized agent does not need to sign the form. The authorized agent's signature is required for the application to be considered complete and valid.

Understanding these points can help streamline the application process and minimize errors. Make sure to stay informed and prepare your forms correctly to avoid complications.

Key takeaways

Here are some key takeaways for filling out and using the CAPF 50 1 Form:

- This form is primarily for dealers and dismantlers. Individuals or companies with multiple registration applications can also use it.

- Submit the form in triplicate. Retain one copy for the Department, one for your records, and send one to the ASF/ISF Unit if applicable.

- Enter your firm's information in the shaded area. Include the firm name, mailing address, dealer number, and contact details.

- Specify how you want to receive overpayments—via credit or refund—and indicate your preference for document delivery (pickup or mail).

- Use clear and precise entries for vehicle information, including VIN or license plate number. Group similar transactions together.

- Sales tax collected must reflect the actual selling price of the vehicle, excluding additional charges.

- Be mindful of deadlines to avoid administrative service fees. Late submissions can incur additional charges.

- The Department will notify you of any excess fees paid, which you must return to the purchaser.

Browse Other Templates

Mary K Cosmetics - Discounts can vary; check which ones apply to your order.

Home Health Forms - The DMV allows for multiple types of records to be ordered in one request for convenience.

Pa License Plate Peeling - Applicants must ensure all information is accurate, as misstatements can result in legal penalties.