Fill Out Your Car 100 M Form

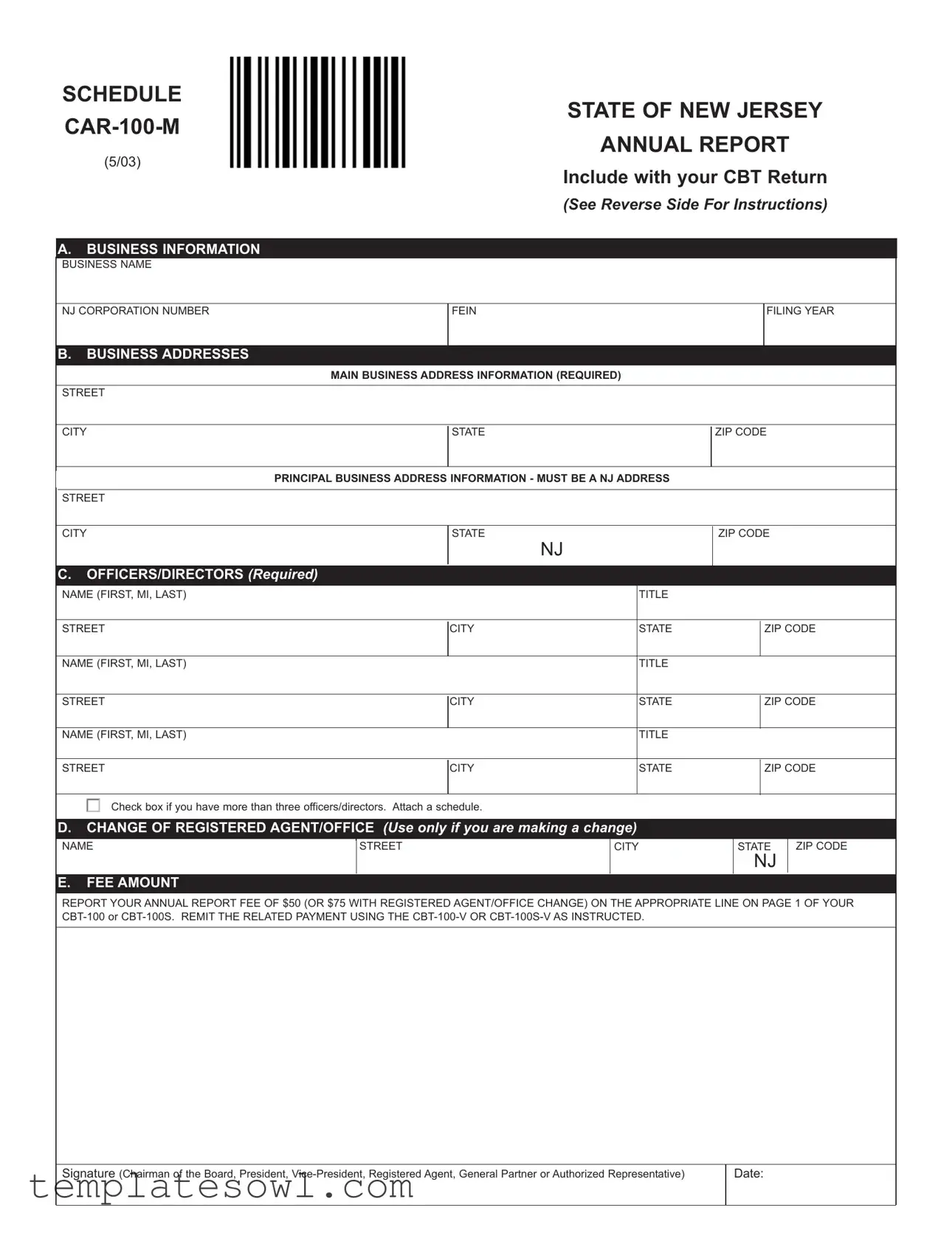

The Car 100 M form, also known as the Annual Report for businesses operating in New Jersey, serves as a crucial document for companies required to report their status and financial information to the state. This form must be included with the Corporation Business Tax (CBT) Return, ensuring that relevant business details such as name, NJ Corporation number, and Federal Tax ID are accurately provided. Business owners must fill out sections detailing their main and principal business addresses; while the main address requires a complete and updated entry, the principal address specifically necessitates a New Jersey location if one exists. Importantly, the form requires the listing of all officers and directors, along with their titles and addresses, to maintain accountability and transparency within the business structure. If there are changes to the registered agent or office, this form allows businesses to report those changes as well, while also indicating any applicable fees—the standard annual fee is $50, increasing to $75 if there are changes to the registered agent. This structure aims to keep the state informed on businesses' operations and compliance, contributing to a streamlined and efficient regulatory process.

Car 100 M Example

SCHEDULE

STATE OF NEW JERSEY

ANNUAL REPORT

(5/03)

Include with your CBT Return

(See Reverse Side For Instructions)

A.BUSINESS INFORMATION

BUSINESS NAME

NJ CORPORATION NUMBER

B.BUSINESS ADDRESSES

FEIN

FILING YEAR

MAIN BUSINESS ADDRESS INFORMATION (REQUIRED)

STREET

CITY

STATE

ZIP CODE

PRINCIPAL BUSINESS ADDRESS INFORMATION - MUST BE A NJ ADDRESS

STREET

CITY

STATE

NJ

ZIP CODE

C.OFFICERS/DIRECTORS (Required)

NAME (FIRST, MI, LAST)

STREET

NAME (FIRST, MI, LAST)

STREET

NAME (FIRST, MI, LAST)

STREET

|

|

TITLE |

|

|

|

|

|

|

|

CITY |

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

CITY |

|

STATE |

|

|

|

|

|

|

|

|

|

TITLE |

|

|

CITY |

STATE |

|

ZIP CODE |

|

|

||||

|

|

|

|

|

̊ Check box if you have more than three officers/directors. Attach a schedule.

D.CHANGE OF REGISTERED AGENT/OFFICE (Use only if you are making a change)

|

|

|

NAME |

STREET |

CITY |

|

|

|

|

|

|

E.FEE AMOUNT

STATE

NJ

ZIP CODE

REPORT YOUR ANNUAL REPORT FEE OF $50 (OR $75 WITH REGISTERED AGENT/OFFICE CHANGE) ON THE APPROPRIATE LINE ON PAGE 1 OF YOUR

Signature (Chairman of the Board, President,

Date:

5/03

Instructions for Completing Annual Report

Please read the following instructions and notices carefully before filling out your report.

A.Business Information and Fees Due

Business Name: This is the business name as shown on the State's Corporate Database.

NJ Corporation Number: This is the

Federal Tax ID: This is the Federal Employer ID Number assigned by the Federal Government and entered on the State's tax registration system. If the number is incorrect, please contact the Client Registration Bureau at

Filing Year: Indicates the calendar year for which you are filing the report. The filing year must be the same as the tax year print- ed on the

Fees: The annual report filing fee is $50 for all filers. If you file a change of registered agent and/or office (Block D), you must pay an additional $25. Please insure that you remit the appropriate filing fees as part of your CBT payment and record the amount on the appropriate line of your CBT return. Do not remit fee with

B.Business Addresses

Main Business Address (Required): Provide a complete, new address . A New Jersey address is not required here.

Principal Business Address (Optional): Provide a complete, new address. This address is reported if you maintain a business office in New Jersey other than the Main Business Address. A New Jersey address is required here.

C.Officers/Directors

List the names (First, MI, Last), titles and addresses for all officers, directors, trustees, members/managers or general partners, as applicable. You may use either home or office addresses.

D.Registered Agent/Office

Provide information only if you are changing your registered agent and/or office address. If you are making a change, enter the new agent name and/or address. If you are not making a change, leave these fields blank. If you are entering a new agent and/or office, remember that a registered agent may be an individual or a corporation duly registered and in good standing with the State of New Jersey. The registered office must be a New Jersey street address. A post office box may only be used if the street address is listed and both are in the same zip code. Any submission in this block requires the payment of the $25 agent change fee. See instruction A above.

E.Fee Amount

Report the correct amount as instructed on the appropriate line, page 1 of your

Signature

Have the appropriate party sign and date the annual report.

Important Notices:

1.Corporations, Limited Liability Companies, Limited Partnerships and Limited Liability Partnerships must submit a completed Annual Report. Failure to comply with this requirement for two consecutive years may result in the revocation of your business privilege in this State. Submission of a current year annual report does not guarantee that your account is up to date. See num- ber 2 below for instructions on how to verify your current business status and related information on file with the State.

2.To complete your annual report accurately, you may need to verify certain information about your business status, prior compli- ance with annual reporting and/or information currently on file with the State of New Jersey. To verify your business status (that is, whether you are active, revoked, etc.), the last date that you submitted an annual report, and/or business and registered agent address information currently on file, order a business status report from the Division of Revenue. Status reports are available online at www.accessnet.state.nj.us, or via the Commercial Recording Service Line at

3.If you wish to dissolve, cancel or withdraw your business, you must file the proper forms. The annual report form cannot be used to deactivate a business. Likewise, if your business is inactive, revoked or voided, you must file the proper forms to reinstate or reestablish your good standing with the State. The annual report form cannot be used to reinstate a business. Call the Commercial Recording Service Line at

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Fee | The annual report fee for CAR-100-M is $50. If there is a change in the registered agent or office, the fee increases to $75. |

| Required Information | Business name, NJ corporation number, and the complete main business address are mandatory for the submission. |

| State Law | This form adheres to New Jersey state law governing annual reporting for corporations and LLCs. |

| Consequences of Non-Compliance | Failure to file the CAR-100-M for two consecutive years may result in the revocation of your business privileges in New Jersey. |

Guidelines on Utilizing Car 100 M

Filling out the Car 100 M form requires thorough attention to detail to ensure all necessary information is included. Complete each section carefully to avoid delays in processing your annual report. Below are straightforward steps to guide you through filling out the form.

- Business Information: Enter your Business Name as it appears in the State's Corporate Database. Input your NJ Corporation Number, which is a ten-digit ID assigned during incorporation. Provide your Federal Employer ID Number (FEIN) and the Filing Year, which should match the tax year on your CBT return.

- Business Addresses: Fill in the Main Business Address information, including street, city, state, and ZIP code. For the Principal Business Address, this must be a New Jersey address, complete with the street, city, NJ, and ZIP code.

- Officers/Directors: List the names, titles, and addresses of all relevant officers and directors. Use first, middle initial, and last names. If you have more than three officers or directors, check the box provided and attach a separate schedule.

- Change of Registered Agent/Office: Complete this section only if making changes. Provide the new name and address if applicable. If no change is being made, leave this section blank.

- Fee Amount: State the annual report fee as $50 or $75 if there's a change of registered agent or office. Report this in the appropriate space on your CBT return, and remember not to attach payment with the CAR-100-M form.

- Signature: Ensure that the form is signed and dated by the Chairman of the Board, President, Vice-President, Registered Agent, General Partner, or an Authorized Representative of the company.

After completing these steps, double-check your entries for accuracy. Ensure all required information is present before submitting the form with your CBT return. Timely submission is essential to maintain your business standing with the state.

What You Should Know About This Form

What is the Car 100 M form?

The Car 100 M form is the annual report that corporations, limited liability companies, limited partnerships, and limited liability partnerships must file in New Jersey. This form collects essential business information, including the business name, addresses, and details about officers or directors. It is important to submit this form to maintain the business's active status in the state.

How do I complete the Car 100 M form?

To complete the Car 100 M form, you will need to provide specific information about your business. This includes the business name as registered in the State's Corporate Database, the NJ Corporation Number, and the Federal Tax ID number. You must also include the main business address and, if applicable, the principal business address in New Jersey. Additionally, you should list the names, titles, and addresses of all officers and directors. If you are changing your registered agent or office, you need to indicate that change and pay the applicable fee. Ensure that all required fields are filled in accurately before submission.

What are the fees associated with the Car 100 M form?

The annual report filing fee for the Car 100 M form is $50 for most filers. If you are also making a change to your registered agent or office, an additional fee of $25 will apply, making the total $75. It is essential to include these fees on the appropriate line of your CBT-100 or CBT-100S tax return rather than submitting a separate payment with the Car 100 M form. If you are filing for a short period return of six months or less, no fee is required.

What happens if I do not file the Car 100 M form?

Failure to file the Car 100 M form for two consecutive years could lead to the revocation of your business privilege in New Jersey. It is crucial to stay compliant with the annual reporting requirement to avoid the risk of losing your business's good standing. Additionally, even if you submit an annual report for the current year, this does not guarantee that all your business information is up to date. Verification of details might still be necessary.

Where can I find more information about my business status in New Jersey?

You can verify your business status and obtain information on compliances, such as whether your business is active or revoked, by ordering a business status report from the Division of Revenue. Status reports are available online at www.accessnet.state.nj.us, or via phone at 609-292-9292 (Option 4). The report is available for a fee, and you can also check your business name and ID online at no cost. This is a helpful step to ensure all necessary details are correct before completing the Car 100 M form.

Common mistakes

When filling out the Car 100 M form, individuals often make several common mistakes that can lead to complications or delays in processing. One significant error is providing incorrect information for the business name. It’s essential to match the business name exactly as it appears in the State's Corporate Database. Any discrepancies could result in denial of the application or additional scrutiny.

Another frequent mistake involves failing to update the Federal Employer ID Number (FEIN). This number must be accurate, as errors could necessitate contacting the Client Registration Bureau to request corrections. Individuals should ensure that their FEIN matches records held by the federal government, avoiding potential discrepancies.

Not including the correct filing year is another common oversight. The filing year on the form must align with the year listed on the related CBT tax return, so double-checking this can help prevent complications. A mismatched filing year may raise questions during processing.

Many people also overlook providing complete addresses in the business address section. For the principal business address, a full, accurate New Jersey address is required, and any omissions may lead to the form being returned for corrections. It’s vital to ensure that all addresses are updated and complete to avoid processing delays.

Another area of concern is the officer/director section. Some filers forget to list all required individuals or neglect to include their titles and addresses. If there are more than three officers or directors, they should be noted on an attached schedule, which must be included with the form. Incomplete information can lead to unnecessary back and forth with the state.

Improperly reporting the fee amount is also a common error. It's crucial to indicate the correct amount on the appropriate line and attach the payment as instructed. If the payment is incorrectly submitted, it can prolong the filing process, as the state may hold the report until correct fees are received.

Finally, failing to have an authorized party sign and date the report can invalidate the submission. Who signs the form matters too; the signature must come from the appropriate individual, such as the Chairman of the Board or Registered Agent. Without a valid signature, the state may reject the document, causing further delays in compliance.

Documents used along the form

The CAR-100 M form is an essential document for businesses in New Jersey, particularly for reporting annual information. Alongside the CAR-100 M form, several other documents are commonly utilized to ensure compliance with state regulations. Here are some of the key forms you may need:

- CBT-100: This is the Corporation Business Tax return for New Jersey corporations. It outlines your business income and determines your tax liability for the fiscal year.

- CBT-100S: Designed for S corporations, this form reflects the income, deductions, and credits of the corporation in order to calculate the necessary taxes owed.

- CBT-100-V: This form is used to submit payments related to the CBT-100 or CBT-100S. It is critical to ensure timely payment of business taxes to avoid penalties.

- Annual Report Status Report: Obtaining this report allows you to verify your business's current standing with the state, including whether you are active or revoked.

- Change of Registered Agent Form: If you need to update your registered agent information, this form is necessary to fulfill your obligation under state law.

- Dissolution Form: Should you decide to dissolve your business entity, this is the official form required to terminate your business status with the state legally.

- Reinstatement Form: If your business has been revoked or made inactive, use this form to re-establish your good standing with New Jersey.

Each of these documents plays a critical role in maintaining compliance with New Jersey business regulations. Make sure to review and submit them as needed to ensure your business remains in good standing.

Similar forms

The CAR-100 M form serves a specific purpose in reporting business details to the state of New Jersey. However, it's similar to other important documents in its structure and content requirements. Here are four documents that share characteristics with the CAR-100 M form:

- Annual Franchise Tax Report: Like the CAR-100 M, this report requires businesses to disclose their financial data, ownership information, and assists the state in determining tax obligations. Both documents need to be filed annually and include the proper payment amounts.

- Certificate of Incorporation: This document establishes a corporation's existence in New Jersey and includes essential information such as the business name, registered office address, and details about the incorporators. Much like the CAR-100 M, accuracy and good standing are critical for both documents.

- DBA (Doing Business As) Registration: If a business operates under a name different from its legal name, a DBA registration is necessary. Similar to the CAR-100 M, this document must be filed with state authorities and includes information on business ownership and address details.

- Business License Application: When starting or operating a business, an application for a license is essential. This document captures owner information, business activities, and location, aligning closely with the CAR-100 M's data requirements.

Dos and Don'ts

When filling out the Car 100 M form, it is essential to follow certain guidelines to ensure a smooth submission process. Here is a list of things you should and shouldn't do:

- Do verify your business information using the State's Corporate Database before completing the form.

- Do include a complete New Jersey address for the Principal Business Address if applicable.

- Do provide accurate names, titles, and addresses for all officers and directors.

- Do follow the correct fee submission procedures; do not attach payment to the Car 100 M form.

- Do ensure that the appropriate party signs and dates the form.

- Don't ignore the filing deadlines; failing to submit for two consecutive years may result in losing your business privileges.

- Don't use a P.O. Box as the registered office unless a street address is also provided.

- Don't leave empty fields in the form if you are making a change; enter all new information required.

- Don't forget to check the amount of the filing fee to avoid underpayment.

- Don't use the annual report form to dissolve or deactivate your business; appropriate forms must be used for that purpose.

Misconceptions

- Misconception 1: The CAR-100 M form can be used to deactivate a business.

- Misconception 2: You need to submit payment with the CAR-100 M form.

- Misconception 3: All business addresses reported need to be in New Jersey.

- Misconception 4: Filing the CAR-100 M guarantees that your business status is current.

- Misconception 5: You do not need to report information about officers and directors if there are none.

This is incorrect. The CAR-100 M form is strictly for annual reporting. To dissolve or cancel a business, different forms must be filed.

Actually, you do not attach payment to the CAR-100 M. The payment is submitted with the CBT return instead, and your account will be credited accordingly.

This misunderstanding arises from the distinction between the main business address and the principal business address. The main address does not need to be in New Jersey, but the principal business address must be.

Filing this form does not ensure your account is up to date. It is essential to verify your business status periodically to confirm compliance.

This is misleading. Even if there are no officers or directors, you must specify "none" in the relevant sections of the form.

Key takeaways

Filling out the CAR-100 M form is an essential process for businesses operating in the State of New Jersey. Here are key takeaways for successfully completing and utilizing this form:

- Business Information: Ensure that the business name matches exactly as listed in the State's Corporate Database. Incorrect information can lead to processing delays.

- Fees: Be aware that the standard filing fee is $50. If you are changing your registered agent or office, an additional $25 is required.

- Business Addresses: Provide a complete main business address. The principal business address must be a New Jersey address if you have one.

- Officers and Directors: List all relevant individuals' names, titles, and addresses accurately. This includes home or office addresses.

- Registered Agent Changes: Only fill out the registered agent section if a change is being made. Failure to do so could lead to unnecessary confusion.

- Signature Requirement: The form must be signed by an authorized representative, which may include titles like Chairman of the Board, President, or Registered Agent.

- Compliance and Verification: Regularly verify business status and ensure all prior reports are filed. Non-compliance for two consecutive years could lead to business revocation.

Completing the form properly ensures regulatory compliance and helps maintain good standing with State authorities.

Browse Other Templates

How to Fight a Ticket in Michigan - Check the appropriate box to indicate how you wish to appeal your violation.

Zirich - The risk review section outlines the objectives and frameworks of Zurich's risk management practices.

Gnc Jobs Near Me - Ensure you attend in person if a parent or guardian must sign your application.