Fill Out Your Cbt 150 Form

The CBT-150 form, officially titled the Statement of Estimated Tax for Corporations, is a critical component for corporate taxpayers in New Jersey. This form not only provides guidelines for making estimated tax payments but also outlines who is required to file based on their previous year’s tax liability. Taxpayers who had a liability exceeding $500 must make four separate payments, while those with gross receipts of $50 million or more in the prior year follow a slightly different schedule. Furthermore, the form includes a provision for those eligible to make a single estimated payment instead of quarterly installments. An electronic filing mandate requires all corporations to submit their Corporation Business Tax returns and estimated payments online, enhancing efficiency and accessibility. To assist in the computation of estimated taxes, taxpayers are provided with worksheets, which help in calculating payment amounts due and determining credits from overpayments in previous tax years. Additionally, failure to meet payment deadlines can lead to financial penalties, reinforcing the importance of timely and accurate submission. As such, understanding the nuances of the CBT-150 form is essential for compliance and effective financial planning for any corporation operating within the state.

Cbt 150 Example

2022 |

Statement of Estimated Tax for Corporations

(Separate or Combined Filers)

Instructions

Who Must File

Taxpayers whose prior year tax liability is greater than $500 must make four 25% estimated tax payments in the fourth, sixth, ninth and 12th months of its accounting period towards the current year’s tax, except for tax- payers with gross receipts of $50 million or more for the prior privilege period must make installment payments as follows: 25% in the 4th month, 50% in the 6th month and 25% in the 12th month. A taxpayer whose prior year tax liability is $500 from

Electronic Filing Mandate

All taxpayers and tax preparers must file Corporation Business Tax returns and make payments electronically. This mandate includes all estimated payments. Visit the Division’s website or check with your software provider to see if they support these filings.

How to Determine Your Estimated Tax

Computation of the estimated tax should be made on the basis of a full accounting period. Taxpayers should determine their expected liabilities on the basis of cir- cumstances existing at the time prescribed for filing. Use the estimated tax worksheet on page 3 or 4, whichever is applicable, for computing each installment due.

Estimated Tax Worksheet

A worksheet is provided to assist in computing the amounts of installment payments due for any taxpayer required to file a statement.

Overpayment Credit From

If the prior year’s return is overpaid and the taxpayer elected to apply that overpayment as a credit to the current tax year, take credit for that amount when calcu- lating the estimated payments. However, if the taxpayer elected to have any portion or all of the overpayment on the prior year’s return refunded, this amount cannot be claimed as a credit.

Underpayment of Estimated Tax

Any taxpayer who is required to file a statement of es- timated tax must file each estimate together with remit- tance covering the estimated tax due on the required due date. Failure to remit such estimated payment or making an underpayment of such tax or any install- ment thereof, will result in the imposition of interest at an annual rate of 3% above the average predominant prime rate for each month or part of a month that the underpayment exists. The average predominant prime rate to be used is the rate as determined by the Board of Governors of the Federal Reserve System, quoted by commercial banks to large businesses on December 1st of the calendar year immediately preceding the calendar year in which the payment was due or as redetermined by the Director in accordance with N.J.S.A.

In general, a taxpayer will be considered as having un- derpaid if the total amount of the estimated tax payments for the tax year are less than 90% of the total tax liability reported on the current year’s tax return and less than 100% of the total tax liability reported on the prior year’s tax return. The addition to the tax on any underpay- ment of any installment payment is computed on form

When to File

The appropriate estimated tax payment due dates for both calendar and fiscal year taxpayers can be found in the Calendar of Due Dates on page 2.

How to Pay

You must pay your New Jersey estimated Corporation Business Tax electronically by

If you are not currently enrolled in the Electronic Funds Transfer program with the Division of Reve- nue and Enterprise Services, visit their website at: www.state.nj.us/treasury/taxation/online.shtml.

Calendar Year and Fiscal Year Taxpayers

All taxpayers should enter the appropriate tax year to which the remittance should be credited. Fiscal year tax- payers must also enter the beginning and ending dates of their accounting period.

1

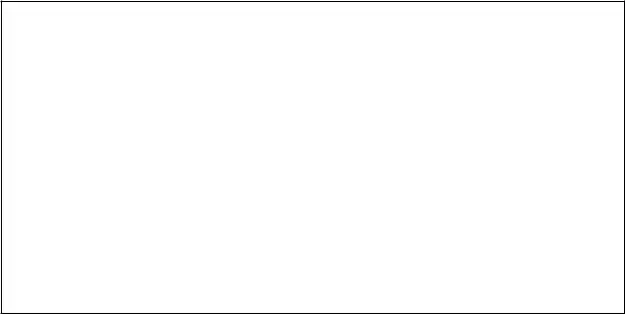

Calendar of Due Dates*

For Your Current Tax |

|

Installment Due Dates |

|

|

Year Ended |

Voucher 1 |

Voucher 2 |

Voucher 3 |

Voucher 4 |

12/31 |

4/15 |

6/15 |

9/15 |

12/15 |

1/31 |

5/15 |

7/15 |

10/15 |

1/15 |

2/28 |

6/15 |

8/15 |

11/15 |

2/15 |

3/31 |

7/15 |

9/15 |

12/15 |

3/15 |

4/30 |

8/15 |

10/15 |

1/15 |

4/15 |

5/31 |

9/15 |

11/15 |

2/15 |

5/15 |

6/30 |

10/15 |

12/15 |

3/15 |

6/15 |

7/31 |

11/15 |

1/15 |

4/15 |

7/15 |

8/31 |

12/15 |

2/15 |

5/15 |

8/15 |

9/30 |

1/15 |

3/15 |

6/15 |

9/15 |

10/31 |

2/15 |

4/15 |

7/15 |

10/15 |

11/30 |

3/15 |

5/15 |

8/15 |

11/15 |

*If the due date falls on a weekend or a legal holiday, the payment is due on the following business day.

Amount of Installments Due. For taxpayers with gross receipts less than $50 million in the prior privilege period, a 25% installment payment of the current accounting year’s estimated tax liability must be submitted with each of the four vouch- ers on or before the 15th day of the fourth, sixth, ninth, and 12th months of that year. Taxpayers with gross receipts of $50 million or more for the prior privilege period must pay a 25% installment in the fourth month, a 50% installment in the sixth month and a 25% installment in the 12th month. If any due date prescribed for filing these installment vouchers falls on

a Saturday, Sunday, or a legal holiday recognized by the State of New Jersey, the next succeeding business day will be considered the due date.

2

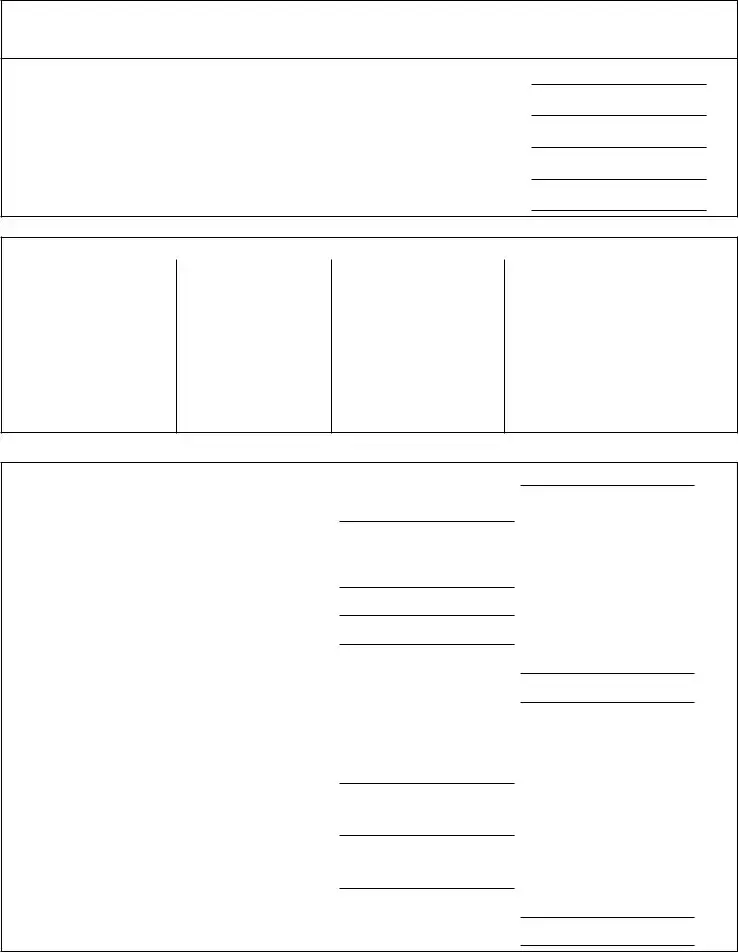

Estimated Tax Worksheet for Taxpayers With Gross Receipts

Less Than $50,000,000 in the Prior Privilege Period

(Keep for your records – DO NOT FILE)

1. |

Total estimated tax for the current year |

1. |

2. |

Voucher 1 due (enter 25% of line 1) |

2. |

3. |

Voucher 2 due (enter 25% of line 1) |

3. |

4. |

Voucher 3 due (enter 25% of line 1) |

4. |

5. |

Voucher 4 due (enter 25% of line 1) |

5. |

Record of Estimated Tax Payments

Voucher |

(a) |

(b) |

(c) |

(d) |

|

Overpayment Credit From |

Total Amount Paid and Credited For |

||||

Number |

Date |

Amount |

|||

Last Year’s Return |

This Installment (Add (b) and (c)) |

||||

|

|

|

|||

1 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

Total

Amended Computation (Use if your estimated tax changes after you have filed one or more estimated tax vouchers.)

1. Enter the amended estimated tax.........................................................................

2. Less (a) Amount of overpayment credit from last

year’s return (see instructions)...............

(b) Previous estimated tax payment(s)

made this year:

From Voucher 1.....................................

From Voucher 2.....................................

From Voucher 3.....................................

(c) Total lines 2a and 2b...............................................................................

3. Unpaid balance (subtract line 2c from line 1).........................................................

4. Unpaid balance to be paid as follows:

(a) On Voucher 2 if unused – 50% of amended estimated tax (line 1) less payments made (line 2c).......................

(b) On Voucher 3 if unused – 75% of amended estimated tax (line 1) less payments made.....................................

(c) On Voucher 4 – 100% of amended estimated tax (line 1) less payments made......................................................

(d) Total of lines 4a, 4b, and 4c....................................................................

5. Subtract line 4d from line 3. (If result is not zero, review calculations)..................

3

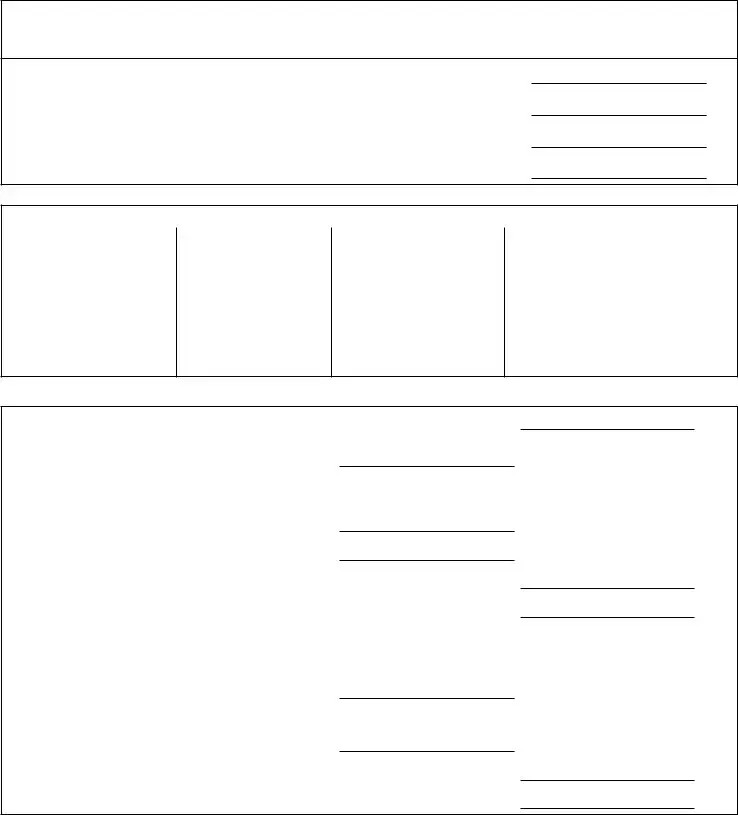

Estimated Tax Worksheet for Taxpayers With Gross Receipts

of $50,000,000 or More in the Prior Privilege Period

(Keep for your records – DO NOT FILE)

1. |

Total estimated tax for the current year |

1. |

2. |

Voucher 1 due (enter 25% of line 1) |

2. |

3. |

Voucher 2 due (enter 50% of line 1) |

3. |

4. |

Voucher 4 due (enter 25% of line 1) |

4. |

Record of Estimated Tax Payments

Voucher |

(a) |

(b) |

(c) |

(d) |

|

Overpayment Credit From |

Total Amount Paid and Credited For |

||||

Number |

Date |

Amount |

|||

Last Year’s Return |

This Installment (Add (b) and (c)) |

||||

|

|

|

|||

1 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

Total

Amended Computation (Use if your estimated tax changes after you have filed one or more estimated tax vouchers.)

1. Enter the amended estimated tax.........................................................................

2. Less (a) Amount of overpayment credit from last

year’s return (see instructions)...............

(b) Previous estimated tax payment(s)

made this year:

From Voucher 1.....................................

From Voucher 2.....................................

(c) Total lines 2a and 2b...............................................................................

3. Unpaid balance (subtract line 2c from line 1).........................................................

4. Unpaid balance to be paid as follows:

(a) On Voucher 2 if unused – 75% of amended estimated tax (line 1) less payments made (line 2c).......................

(b) On Voucher 4 – 100% of amended estimated tax (line 1) less payments made......................................................

(c) Total of lines 4a and 4b...........................................................................

5. Subtract line 4c from line 3. (If result is not zero, review calculations)...................

4

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Requirement | Corporations with a prior year tax liability greater than $500 must file the CBT-150 form and make estimated payments. |

| Payment Schedule | Depending on gross receipts, payments due include quarterly installments of 25% or a combination of 25%, 50%, and 25% of the estimated tax liability. |

| Electronic Filing Mandate | All taxpayers and preparers must file Corporation Business Tax returns electronically, including estimated payments. |

| Underpayment Consequences | Taxpayers can incur interest for underpayment. Interest is assessed at an annual rate of 3% above the average predominant prime rate. |

| New Jersey Governing Law | The CBT-150 form is governed by N.J.S.A. 54:48-2, which outlines the tax payment requirements and processes for corporations in New Jersey. |

Guidelines on Utilizing Cbt 150

Completing the CBT 150 form involves gathering your tax information and carefully following steps to ensure accurate submission. This guide will assist you in navigating the process to avoid any errors that could lead to complications.

- Obtain the CBT 150 form from the New Jersey Division of Taxation's website or through your tax preparer.

- Review the form to understand the sections that need to be filled out.

- Enter the appropriate tax year for which you are making the estimated payments.

- For fiscal year taxpayers, input the beginning and ending dates of your accounting period in the designated sections.

- Calculate your total estimated tax for the current year. Use the estimated tax worksheet on pages 3 or 4 of the instructions to aid in this calculation.

- For taxpayers with gross receipts less than $50 million, enter 25% of your estimated tax this year for each of the four vouch-ers on the appropriate lines. The due dates for these vouchers are the 15th day of the fourth, sixth, ninth, and twelfth months of your accounting period.

- For taxpayers with gross receipts of $50 million or more, enter 25% for Voucher 1, 50% for Voucher 2, and 25% for Voucher 4 as instructed in the relevant sections of the form.

- If there was an overpayment from your prior year’s tax return that you want to apply as a credit, ensure you correctly include that credit amount in your calculations.

- Ensure you have calculated your installment due dates and that they align with the calendar provided in the instructions.

- After filling out the form, review all calculations and information for accuracy.

- Submit the completed CBT 150 form electronically, following the instructions for electronic filing and payment methods detailed on the Division's website.

After submitting your form, pay attention to confirmation of receipt to ensure that everything is processed correctly. Monitoring your estimated tax obligations will help you stay compliant and avoid any potential penalties.

What You Should Know About This Form

What is the purpose of the CBT-150 form?

The CBT-150 form is used by corporations in New Jersey to report their estimated tax payments. Taxpayers whose prior year tax liability exceeds $500 are required to make estimated payments towards their current year's tax. This helps ensure that corporations are paying an appropriate amount throughout the year rather than facing a large bill when they file their annual tax returns.

Who is required to file the CBT-150 form?

Corporations whose previous year tax liability was greater than $500 must file the CBT-150 form. Additionally, corporations with gross receipts of $50 million or more from the previous year have specific payment guidelines, paying 25% in the fourth month, 50% in the sixth month, and the remaining 25% in the twelfth month of their accounting period. However, smaller corporations can opt to make a single estimated payment based on their prior year tax liability if it is $500 or less from CBT-100 or CBT-100U, or $375 from CBT-100S.

How should payments be made according to the CBT-150 form?

All payments for the New Jersey Corporation Business Tax, including estimated payments, must be made electronically. Taxpayers can use methods such as e-checks, electronic funds transfers, or credit cards. This electronic filing mandate includes the CBT-150 form itself, so taxpayers are encouraged to check with their software providers or visit the Division’s website for assistance with electronic filing options.

What happens if a taxpayer underpays their estimated tax?

If a corporation fails to submit the required estimated payments or pays less than the amount owed, interest will accrue on the underpaid amount. The interest rate can be as high as 3% above the average predominant prime rate for each month the payment is overdue. To avoid these penalties, it is essential for all taxpayers to track their estimated payments closely and ensure they meet the due dates provided in the CBT-150 instructions.

Where can I find the estimated tax payment due dates?

The due dates for estimated tax payments are outlined in the Calendar of Due Dates found in the CBT-150 form instructions. Taxpayers should consult this calendar to know the specific dates for each installment based on their accounting periods. If a due date falls on a weekend or recognized holiday, the payment will be due on the next business day.

Common mistakes

Many people face challenges when completing the CBT 150 form, leading to common mistakes. One significant error is misclassifying the tax payment schedule based on the taxpayer's gross receipts. Taxpayers with gross receipts less than $50 million must make four equal quarterly payments of 25% of their estimated tax liability. In contrast, those with gross receipts of $50 million or more need to pay 25% in the fourth month, 50% in the sixth month, and 25% in the twelfth month. Failure to distinguish between these categories can result in incorrect payment amounts.

Another common mistake is neglecting to take into account any overpayment credit from the prior year. Taxpayers often overlook the necessity to apply any credits from CBT-100, CBT-100U, or CBT-100S against their current year’s estimated payments. If an overpayment is not credited correctly, this may lead to underpaying. Consequently, taxpayers may incur unnecessary interest charges due to underpayment penalties.

Additionally, many individuals misinterpret deadlines. Each installment payment has specific due dates, which vary depending on the type of taxpayer. Missing these deadlines due to a misunderstanding can worsen a taxpayer's financial situation. It is crucial for taxpayers to verify the due dates for their specific fiscal year to avoid incurring penalties.

Finally, some taxpayers fail to navigate the electronic filing requirements adequately. All Corporation Business Tax returns and payments must be made electronically. Taxpayers not familiar with the mandate or the online payment system risk noncompliance. Structure and accessibility issues can derail the filing process if not addressed. To avoid complications, taxpayers should familiarize themselves with the electronic filing system well in advance of the due dates.

Documents used along the form

When preparing to file the CBT-150 Form, there are several companion documents and forms that you may need to consider. Each of these plays a specific role in ensuring your tax obligations are accurately met. Understanding their purpose can help streamline the filing process and assist in compliance with tax requirements.

- CBT-100: This is the primary form for filing Corporate Business Tax returns for corporations operating in New Jersey. It outlines the corporation's total income, expenses, and the resulting tax liability. The information provided in this form is crucial for accurately calculating estimated tax payments.

- CBT-100U: This form serves a similar purpose to the CBT-100 but is specifically designed for corporations that are unincorporated entities. It helps those businesses report their income and calculate their tax obligations appropriately.

- CBT-100S: Designed for S Corporations, this form allows those businesses to report income and decide on their tax liabilities while also ensuring compliance with the S Corporation tax requirements in New Jersey.

- CBT-160-A and CBT-160-B: These forms are used to calculate any penalties related to underpayment of estimated taxes. They help taxpayers understand the additional amount owed due to insufficient tax payments throughout the fiscal year.

- Estimated Tax Worksheet: Included with the CBT-150, this worksheet assists taxpayers in calculating their estimated tax payments based on their expected income and prior year's tax liability. Using this worksheet can facilitate the preparation of the estimated payments.

- Calendar of Due Dates: This is a critical reference document outlining important tax payment deadlines. Keeping track of these dates helps avoid penalties associated with late payments and ensures compliance with tax obligations.

Having these documents on hand and understanding their functions will make your tax filing process smoother. Each form connects to the overall picture of corporate tax compliance, allowing you to focus on running your business while meeting your tax obligations efficiently.

Similar forms

The CBT-150 form is associated with other important tax documents that serve similar purposes. Here are six documents that share similar functions, each designed for specific taxpayers or scenarios:

- CBT-100: This is the Corporation Business Tax Return for corporations doing business in New Jersey. Like the CBT-150, it helps taxpayers calculate and report their tax liability, but it covers the entire tax year rather than just estimated tax payments.

- CBT-100S: This form is for New Jersey S-Corporations. Similar to the CBT-150, it allows the S-Corporation to report its income, losses, and deductions, helping the entity fulfill its tax obligations.

- CBT-100U: This form is used for unitary corporations, which are groups of corporations that file a single return. It aligns with the CBT-150 in that it aids in reporting tax liability, emphasizing the payment of estimated taxes based on combined earnings.

- CBT-160-A: This form deals with the addition to tax for underpaid estimated tax payments. It is closely related to the CBT-150 as it addresses scenarios where estimated payments were insufficient or late, resulting in potential penalties.

- CBT-160-B: Similar to CBT-160-A, this form is designed specifically for taxpayers who underpaid their estimated tax. It allows taxpayers to calculate and report any necessary penalties in a structured manner, akin to the CBT-150's provisions on estimated tax payments.

- Estimated Tax Worksheets: These worksheets assist taxpayers with calculating their estimated tax payments each year. They complement the CBT-150 by providing a structured method to determine the proper amount due, ensuring compliance with estimated payment rules.

Dos and Don'ts

When completing the CBT 150 form, attention to detail is essential. Below are some important dos and don'ts to ensure a smooth filing process.

- Do: File your estimated tax payments electronically. This requirement applies to all taxpayers and tax preparers.

- Do: Determine your estimated tax based on a full accounting period. Be sure to assess your expected liabilities accurately.

- Do: Use the provided estimated tax worksheet to compute installment payments. This tool helps verify that you are submitting the correct amounts.

- Don't: Overlook the requirement to remit payments by the due dates. Late payments can lead to interest charges.

- Don't: Claim an overpayment credit if you opted for a refund last year. You may only credit amounts previously applied to this year’s tax.

- Don't: Use outdated information. Always check the Division’s website for the latest interest rates and payment deadlines.

Misconceptions

The following misconceptions about the CBT-150 form are common among taxpayers:

- Only large corporations need to file the CBT-150. This is not true. Any corporation that had a prior year tax liability greater than $500 must file estimated tax payments using the CBT-150, regardless of size.

- Electronic filing is optional for the CBT-150. This misconception can lead to serious issues. All taxpayers and tax preparers are mandated to file Corporation Business Tax returns and make payments electronically. Ignoring this requirement can result in penalties.

- Estimating taxes is the same as filing taxes. In reality, filing the CBT-150 is a way to make estimated payments toward the current year’s tax liability. Actual tax returns must still be filed at the end of the tax year.

- Making an underpayment on estimated taxes is not a big deal. Failing to meet estimated tax obligations can lead to penalties. Interest will accrue on any underpayment, which means taxpayers could owe more than they initially expected.

Key takeaways

- Eligibility: Taxpayers with a prior year tax liability greater than $500 must file the CBT-150 form and make estimated tax payments throughout the year.

- Payment Schedule: Payments are typically due in four installments, on the 15th of the fourth, sixth, ninth, and twelfth months of the tax year.

- Higher Gross Receipts: If your prior year gross receipts exceeded $50 million, the payment structure changes; you'll pay 25% in the fourth month, 50% in the sixth month, and 25% in the twelfth.

- Single Payment Option: Taxpayers with a $500 liability from the CBT-100 forms can choose to make a single payment of 50% of prior year's tax instead of quarterly payments.

- Credit for Overpayments: If you overpaid in the prior year and applied that overpayment to the current year, be sure to account for that credit when calculating your estimated payment.

- Electronic Filing Required: All forms of Corporation Business Tax returns must be filed electronically, including estimated payments. Check with your software provider for support.

- Consequences of Underpayment: If you underpay or fail to remit on time, be prepared for penalties. Interest will accrue at a rate of 3% above the prime rate for each month the payment is overdue.

Browse Other Templates

Midlands College Online Application for 2024 Undergraduate - Indicate your preferred campus for study among the options available.

Payment Rejected by Bank - If you wish to cancel a stop payment request, it must be done in writing.