Fill Out Your Cbt 200 T Form

The CBT-200 T form serves as a crucial tool for corporations in New Jersey that need to file their tentative business tax returns and apply for an extension of time to submit their complete corporate tax documentation. This form primarily covers the reporting period that begins and ends in a specified year, allowing businesses to declare their estimated corporation business tax. Companies also utilize this form to indicate installment payments, specifically 50% of the estimated tax amount, which helps manage their tax obligations throughout the year. Additionally, professional corporations fill out the tentative professional corporation fee section, ensuring comprehensive reporting of their financial responsibilities. As part of the process, it is essential for the corporation to provide its Federal Employer Identification Number and New Jersey Corporation Number, as well as accurate contact details, including mailing address and zip code. Payments can be made electronically, which is encouraged for efficiency, though paper checks are accepted under certain circumstances. Understanding the various sections of this form not only aids businesses in compliance but also in managing their financial commitments effectively.

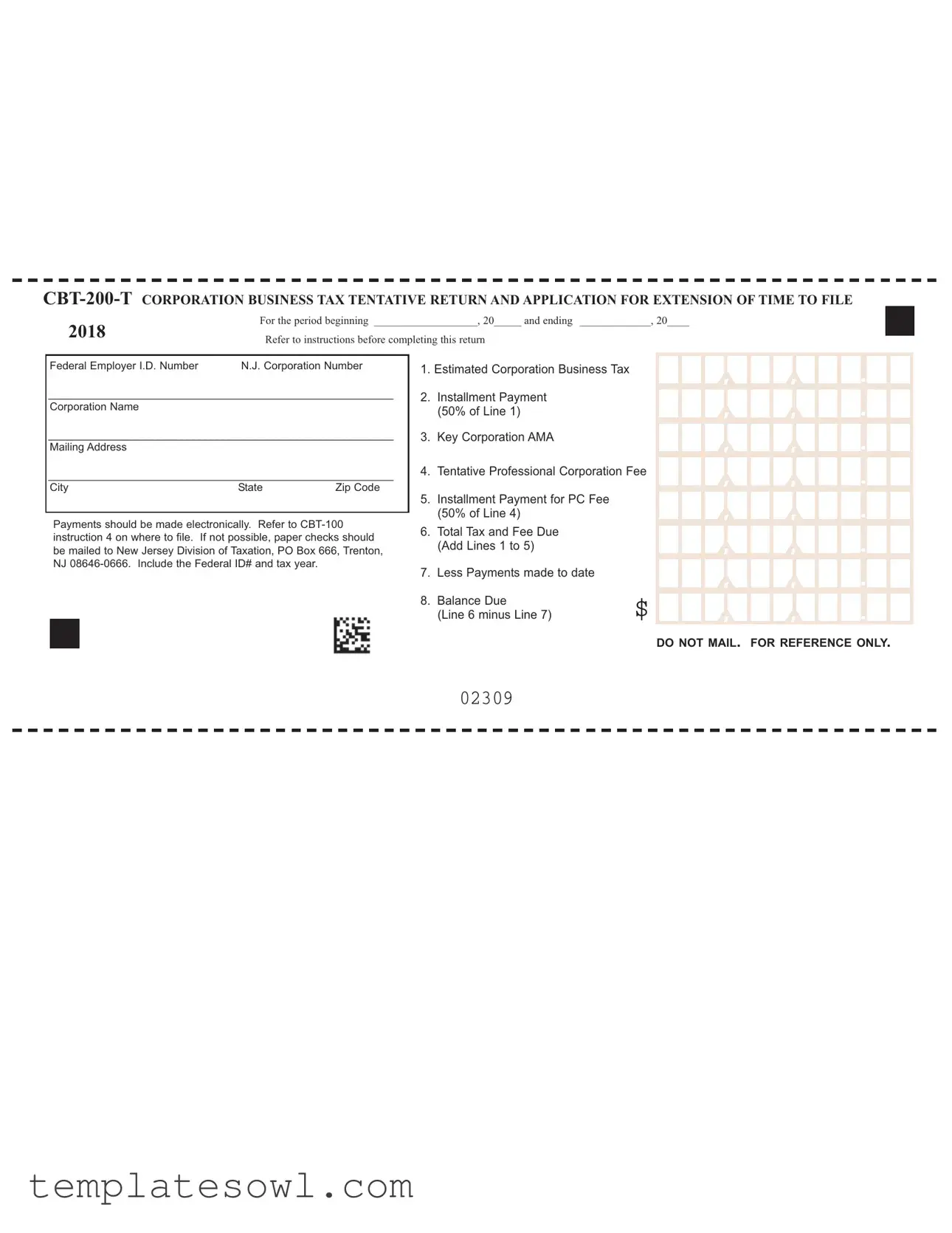

Cbt 200 T Example

For the period beginning ___________________, 20_____ and ending _____________, 20____

2018 |

Refer to instructions before completing this return |

|

Federal Employer I.D. Number N.J. Corporation Number

_________________________________________________________

Corporation Name

_________________________________________________________

Mailing Address

_________________________________________________________

City State Zip Code

Payments should be made electronically. Refer to

1. Estimated Corporation Business Tax

2. Installment Payment (50% of Line 1)

3. Key Corporation AMA

4. Tentative Professional Corporation Fee

5. Installment Payment for PC Fee (50% of Line 4)

6. Total Tax and Fee Due

(Add Lines 1 to 5) |

|

7. Less Payments made to date |

|

8. Balance Due |

$ |

(Line 6 minus Line 7) |

, |

, |

. |

, |

, |

. |

, |

, |

. |

, |

, |

. |

, |

, |

. |

, |

, |

. |

, |

, |

. |

, |

, |

. |

DO NOT MAIL. FOR REFERENCE ONLY.

02309

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CBT-200-T form is used by corporations to file a tentative return and apply for an extension of time to file their Corporation Business Tax. |

| Governing Law | This form is governed by the New Jersey Corporation Business Tax law. |

| Filing Period | Corporations fill out the form for a specific period, beginning and ending during the taxable year. |

| Payment Method | Payments should generally be made electronically. If electronic payment is not possible, paper checks can be mailed to the New Jersey Division of Taxation. |

| Key Entries | Key information such as the Federal Employer Identification Number (EIN) and New Jersey Corporation Number must be included to process the return accurately. |

| Installment Payments | The form includes sections for calculating installment payments, which are typically 50% of the estimated tax due. |

| Balance Due | The balance due is determined by subtracting any payments made to date from the total tax and fee due. |

Guidelines on Utilizing Cbt 200 T

Completing the CBT 200 T form is necessary for corporations that need to file a tentative return and request an extension of time to file. Careful attention to detail will help ensure that all required information is submitted accurately. Below are the steps you will need to follow to fill out the form correctly.

- Fill in the period details. In the designated spaces, write the beginning and ending dates for the tax period.

- Provide your Federal Employer I.D. Number. This number is essential for identifying your corporation.

- Enter the New Jersey Corporation Number. This number distinguishes your corporation within the state.

- Complete the corporation name field. Write the full legal name of your corporation.

- Input your mailing address. Include street address, city, state, and zip code.

- Record the estimated Corporation Business Tax. This amount should represent your best estimate for the tax period.

- Calculate the Installment Payment. This is 50% of the amount you recorded on Line 6.

- Indicate the Key Corporation AMA. Enter the relevant information as required.

- Provide the Tentative Professional Corporation Fee. Input the fee applicable to your corporation.

- Calculate the Installment Payment for PC Fee. Again, this will be 50% of the fee indicated in the previous line.

- Add Lines 1 to 5. Total these amounts to determine your Total Tax and Fee Due.

- List Payments Made to Date. Write down any payments you have already completed towards this tax obligation.

- Calculate your Balance Due. Subtract the amount on Line 7 from that on Line 6 to get your balance.

Once you have filled out the form completely, make sure to double-check for any errors. After confirming everything is accurate, you will need to submit the form. If electronic payments are not possible, send a paper check to the New Jersey Division of Taxation with the necessary details included.

What You Should Know About This Form

What is the CBT-200-T form used for?

The CBT-200-T form, also known as the Corporation Business Tax Tentative Return and Application for Extension of Time to File, is used by corporations operating in New Jersey to report their estimated business tax liability. This form allows corporations to calculate their expected tax amount for a specific period and apply for an extension of time to file the detailed return.

When should I file the CBT-200-T form?

The CBT-200-T form must be filed if your corporation wishes to apply for an extension for filing the final Corporation Business Tax return. Corporations typically need to file this form by the 15th day of the fourth month following the end of their accounting period. For most corporations operating on a calendar year, that means the form is due by April 15th.

How do I make payments for the CBT-200-T form?

Payments for the CBT-200-T form should be made electronically for convenience. If electronic payment is not possible, you can mail a paper check to the New Jersey Division of Taxation at PO Box 666, Trenton, NJ 08646-0666. When mailing a check, be sure to include your Federal Employer Identification Number and the tax year for proper processing.

What information is required to complete the CBT-200-T form?

To complete the CBT-200-T form, you will need to provide your corporation's name, mailing address, Federal Employer Identification Number, and New Jersey Corporation Number. You will also need to calculate your estimated Corporation Business Tax and any applicable fees. Make sure to fill out the lines accurately to determine the total tax and fee due, as well as any balance owed after considering previous payments.

What happens if I fail to file the CBT-200-T form on time?

Failing to file the CBT-200-T form on time may result in penalties or interest on any unpaid taxes. It's crucial to file the form by the due date to either minimize liabilities or secure an extension. If you know you will be late, be proactive by filing the form as soon as possible to avoid further complications with your tax obligations.

Common mistakes

Filling out the CBT-200-T form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is failing to provide the correct Federal Employer Identification Number. This number is crucial for the identification of your tax entity. Inaccurate information can lead to delays in processing your return and may incur additional penalties.

Another common mistake is neglecting to include the N.J. Corporation Number. Omitting this information can result in confusion regarding your company's identity and may hinder proper communication with tax authorities. Ensuring that all necessary identification numbers appear correctly on the form is essential.

People often forget to verify their corporation name and mailing address. Errors in these areas can affect where your tax documents are sent, potentially leading to missed notifications or deadlines. Carefully reviewing this information before submission can help prevent these issues.

Inaccuracies can also arise from miscalculations. Completing the sections for the estimated corporation business tax and installment payments requires attention to detail. Errors in these calculations may result in underpayment or overpayment, affecting your financial standing. Double-checking your math can save time and stress.

Another mistake that is frequently observed is not subtracting payments made to date correctly. This miscalculation can lead to incorrect balance due amounts, creating challenges when trying to resolve discrepancies with tax authorities. Keeping accurate records of payments made is vital for this process.

People sometimes misunderstand the structure of the form. For instance, forgetting to complete the section for Tentative Professional Corporation Fee can leave your return incomplete. Each line item on the form is important for calculating your total tax properly, and overlooking even one can cause complications.

Not referring to the accompanying instructions before filling out the form can lead to several mistakes. The CBT-200-T has specific guidelines that must be followed, and omission of these instructions can result in errors that might have otherwise been avoided. Taking the time to read the instructions ensures a smoother filing process.

Moreover, it’s crucial to remember that electronic payments should be prioritized. Some individuals forget to check their electronic payment methods, leading to delays or failure to pay by the deadline. Always confirm that payments are processed correctly to avoid potential penalties.

Lastly, individuals may inadequately prepare for potential additional documentation that may be required. It’s wise to gather any necessary papers ahead of time to ensure everything is in order. By attending to these details, you can create a more efficient and less stressful filing experience.

Documents used along the form

The CBT-200-T form is essential for corporations seeking to file a tentative return and apply for an extension of time to submit their Corporation Business Tax. Several other forms and documents are often used in conjunction with the CBT-200-T to ensure thorough and compliant tax reporting. Below is a list of these associated documents.

- CBT-100: This form is a standard Corporation Business Tax Return required to report the corporation's taxable income. It calculates the total tax liability based on income earned within New Jersey.

- CBT-160: This form is specifically for corporations to apply for a full or partial exemption from the Corporation Business Tax based on specific criteria. It provides details necessary for determining eligibility.

- CBT-100S: Used by S corporations, this form allows these corporations to report income, deductions, and credits. It is important for maintaining S corporation status while ensuring tax compliance.

- Form 8832: This IRS form allows entities to choose how they would like to be classified for federal tax purposes. It can impact state tax obligations, making it relevant for New Jersey corporations.

- Form 1065: Partnerships must file this form to report income, deductions, gains, and losses from their operations, which can affect the overall tax status of a corporation with partners.

- Market-Based Sourcing Election: This document allows a corporation to elect to use market-based sourcing for apportioning income. It can be crucial for the correct calculation of the corporation's tax liability in New Jersey.

- New Jersey Taxpayer's Bill of Rights: While not a specific form, this document provides essential information on taxpayer rights in New Jersey, including the processes for disputing tax assessments and seeking refunds.

Corporations should ensure that all relevant forms are completed accurately and submitted on time to meet their tax obligations. Consulting with a tax professional is advisable for additional guidance and compliance considerations.

Similar forms

- Form CBT-100: This is the primary corporation business tax return in New Jersey, similar to the CBT-200 T in that it outlines the total tax liability for a corporation. While the CBT-200 T is used for filing a tentative return and for extension requests, the CBT-100 is the final tax return, reflecting actual income and expenses for the year.

- Form CBT-150: This form is for the Corporation Business Tax - Amended Return. Like the CBT-200 T, it allows businesses to report changes and correct previous tax filings. Both forms are essential for ensuring accurate tax reporting, but CBT-150 is used after the original filing.

- Form CBT-160: This is the Corporation Business Tax Reconciliation form. Similar to the CBT-200 T, this form aids in reconciling estimated taxes with actual business tax liabilities, ensuring businesses report their earnings accurately.

- Form NJ-1065: This is a Partnership Return for New Jersey. It shares similarities with the CBT-200 T in that it is submitted by pass-through entities to report income and distributions to partners. Both are used for tax compliance, yet cater to different business types.

- Form NJ-REG: This is the Business Registration Application in New Jersey. While the CBT-200 T deals specifically with tax calculations, the NJ-REG helps businesses register for various taxes, showcasing compliance with state regulations. Both forms are critical in the business lifecycle in New Jersey.

- Form PT-100: This is the Professional Corporation Tax Return. Much like the CBT-200 T, this form is specifically for professional corporations, ensuring they report their estimated tax obligations. Both forms facilitate accurate reporting within their respective corporate structures.

Dos and Don'ts

When filling out the CBT-200-T form, there are several important dos and don’ts to keep in mind. Proper attention to detail can facilitate a smoother process.

- Do make sure to reference the instructions carefully before completing the form.

- Don’t forget to insert the correct dates for the period you are reporting.

- Do include your Federal Employer Identification Number.

- Don’t leave the Corporation Name field blank; it must be completed accurately.

- Do ensure your mailing address is current and complete, including city and zip code.

- Don’t make payments by check unless absolutely necessary; opt for electronic payments first.

- Do calculate the Total Tax and Fee Due correctly by adding all relevant lines.

- Don’t overlook the amounts paid to date, as this will affect your balance due.

- Do keep a copy of the filled form and any payments made for your records.

- Don’t mail the form to the New Jersey Division of Taxation; follow the instructions provided.

Misconceptions

Understanding the CBT-200-T form can be challenging, and there are several misconceptions about it. Here are eight common misunderstandings:

- 1. It is only for large corporations. Many believe that only large businesses need to fill out the CBT-200-T form. In reality, any corporation that operates in New Jersey, regardless of size, might need to file for an estimated business tax.

- 2. It must be submitted in paper form. Some think that the CBT-200-T can only be submitted on paper. However, it is encouraged to file electronically, making the process faster and more efficient.

- 3. The form is optional. A common misconception is that filing this form is optional. In truth, corporations that expect to owe certain amounts in taxes are required to file this form to avoid penalties.

- 4. Payments can be made any way. Many individuals think that any form of payment is acceptable. Payments should be made electronically when possible; only when that is unfeasible should a paper check be mailed, specifying details correctly.

- 5. It is only for the current tax year. Some mistakenly believe that the CBT-200-T form only relates to the current tax year. In fact, it is for the tax year that begins on the date indicated on the form and ends on the date listed for that specific period.

- 6. It's the final tax return. Some assume that the CBT-200-T is the final return for business tax. Instead, it is a tentative return that estimates tax liability and should be followed by the full return, typically filed later in the year.

- 7. The information is not shared with other agencies. Misunderstanding persists that the information provided on the CBT-200-T does not get reported elsewhere. However, the data may be shared with other state or federal tax agencies as required.

- 8. There's no need to keep records. Lastly, many people think that records do not need to be maintained after submitting the form. It's crucial to keep copies of the form and any related documentation for your records, in case of future audits or inquiries.

Clarifying these misconceptions can help ensure compliance and make the process smoother for all corporations filing in New Jersey.

Key takeaways

Filling out the CBT-200-T form accurately is crucial for corporate compliance in New Jersey. Here are some key takeaways to help you navigate the process:

- Understand the Purpose: The CBT-200-T form is designed for corporations to report their estimated business tax and to apply for an extension to file their complete return.

- Know Your Dates: Fill in the period for which you are reporting. Ensure you specify the correct beginning and ending dates to avoid discrepancies.

- Provide Accurate Identification: Include your Federal Employer Identification Number and New Jersey Corporation Number. This information is vital for processing.

- Complete All Relevant Lines: Carefully fill in lines 1 through 8, which include your estimated tax, professional corporation fee, and any prior payments.

- Electronic Payments: Payments should ideally be made electronically. This is the preferred method for the New Jersey Division of Taxation.

- Paper Checks: If electronic payment is not possible, send paper checks to the specified address. Include your Federal ID and tax year on the check.

- Avoid Common Mistakes: Double-check all entries. Errors can lead to penalties or delays in processing your form.

- Do Not Mail the Form: The form is for reference only and should not be mailed. Use it to guide your electronic or paper filings.

- Stay Informed: Always refer to the official instructions for the CBT-200-T form before submission to ensure compliance with current regulations.

Browse Other Templates

Trauma Patient - The form is designed to assess a candidate's ability to manage trauma patients effectively.

Florida Association of Realtors Forms - Handwritten or typewritten amendments to the contract prevail over preprinted terms, allowing for flexibility.