Fill Out Your Cf Es 2337 Form

The CF-ES 2337 form, commonly known as the ACCESS Florida Application, plays a crucial role in helping individuals and families apply for various types of assistance, including food, medical, and cash benefits. This application is designed to be user-friendly, allowing applicants to start the process by simply providing their name and address and signing the application. While filling out the form, it is beneficial to respond to as many questions as possible to expedite the assistance process. Those needing support or interpretation can seek help from Community Partners or contact the Customer Call Center for guidance. Application processing times can vary. For food assistance requests, the turnaround can be between 7 to 30 days, with expedited cases receiving assistance within just a week. There are specific conditions that qualify households for expedited assistance, including financial thresholds related to gross income and liquid assets. It is also essential to understand that the application collects personal information, including Social Security numbers, and that this information will be verified for accuracy and compliance. The form allows applicants to designate a head of household and offers necessary information for immigrant applicants, ensuring their status does not affect the assistance they seek. With clear instructions and accessible resources, the CF-ES 2337 form is pivotal in providing support to those facing financial challenges or other needs in the state of Florida.

Cf Es 2337 Example

ACCESS FLORIDA APPLICATION

Before You Begin

Before You Begin

You are ready to start your application. Here is some important information when applying and what to expect.

Applying for Benefits

You may apply for help by giving us just your name, address, and signing your application. We encourage you to answer as many questions as you can, and sign your application today. This will allow us to help you more quickly. If you need help in completing this application or need interpreter services, there may be Community Partners in your area who can help. Visit our website at www.myflorida.com/accessflorida or contact our Customer Call Center at

Processing Your Application

Processing begins with the date we receive your signed application. It may take 7 to 30 days to process your food assistance application. Expedited households may get food assistance benefits within seven days. Your answers on the application will decide if your household meets expedited food assistance criteria. Expedited households must have: 1. Monthly gross income less than $150 and liquid assets less than $150; 2. Monthly gross income plus liquid assets less than the household rent or mortgage plus utility costs; or, 3. Be a destitute migrant or seasonal farmworker with liquid assets less than $100. Applications for Medical Assistance and Temporary Cash Assistance may take 30 to 45 days, and Medical Assistance applications may take longer if we need to determine if someone is disabled. You may check the status of your application by visiting the ACCESS Florida website at http://www.myflorida.com/accessflorida and click on the "My ACCESS Account" link.

An Application for Assistance may be submitted to any Department of Children and Families Economic

Head of Household

The household may select an adult parent of children (of any age) living in the household, or an adult who has parental control over children (under 18 years of age) living in the household, as the head of household provided all adult household members agree to the selection. Households may select the head of household at application, at each review, or when there is a change in household composition. If all adult household members do not agree to the selection, or decline to select an adult parent as the head of household, the state agency may designate the head of household or permit the household to make another selection. If the household does not consist of adult parents and children or adults who have parental control of children living in the household, the state agency shall designate the head of household or permit the household to do so.

Social Security Number

We may treat household members who are ineligible, or who are not applying for benefits, as

Important Information for Immigrants

Applying for or receiving Food Assistance (SNAP) benefits or Medical Assistance will not affect you or your family members' immigration status or ability to get permanent resident status (green card). Receiving Temporary Cash Assistance or long term institutional care, such as nursing home benefits might create problems with getting that status, especially if the benefits are your family's only income.

Public Assistance Fraud / Notice of Penalties

If you are found guilty (by a state or federal court, or an administrative disqualification hearing, or sign a hearing waiver) of intentionally making a false or misleading statement, concealing or withholding facts in order to receive or in an attempt to receive food assistance or Temporary Cash Assistance (TCA) or committing any act that violates the Food and Nutrition Act of 2008, food assistance regulations, or any state statute for purposes of using, presenting, transferring, acquiring, receiving, or possessing food assistance benefits, you will be disqualified. You will be ineligible for food assistance or TCA for 12 months for the first violation, 24 months for the second violation, and permanently for the third violation. If you are convicted of trafficking food assistance benefits of $500 or more, you will be disqualified permanently. Trafficking of food assistance includes:

1.Buying, selling, stealing, or exchanging benefits for cash;

2.Exchanging firearms, ammunition, explosives, or illegal drugs for benefits;

3.Buying sodas, water, or other items in a container to get the cash deposit;

4.Buying an item with food assistance and then purposely selling the item for cash; and

5.Trading cash for items paid for with food assistance benefits.

If you are convicted of these acts, depending on the severity, you may be fined up to $250,000, imprisoned for up to 20 years, or both. You may also be subject to prosecution under other applicable Federal and State Laws. You may be barred from receiving food assistance for an additional 18 months if court ordered. If you are convicted by a state or federal court of making a fraudulent statement with respect to identity or residency in order to receive food assistance or TCA in more than one state at the same time, you will be ineligible to participate in the Food Assistance Program or TCA for a period of 10 years.

If you are fleeing to avoid prosecution, custody, or confinement, after conviction for a crime or an attempt to commit a crime, which is a felony, or are in violation of probation or parole imposed under a federal or state law, you are ineligible for food assistance and Temporary Cash Assistance. This information may be disclosed to other federal and state agencies for official examination, and to law enforcement officials for the purpose of apprehending persons fleeing to avoid the law.

If you are found guilty of a

Income and Eligibility Verification System (IEVS)

We will request information through computer matches in IEVS and may verify the information if we find differences based on the answers you gave on your application. We may use the information found in IEVS to affect your eligibility and level of benefits.

Reporting Requirements

For all programs, households are encouraged to report any change in the household living and/or mailing address. For programs except Food Assistance (SNAP), households must report changes in who lives in the household, employment, and income. Food Assistance (SNAP) households must report when the total monthly household gross income exceeds 130% of the federal poverty level for the household size and when the work hours of

Requesting a Fair Hearing

You have the right to ask for a hearing before a state hearings officer. You can bring with you or be represented at the hearing by a lawyer, relative, friend, or anyone you choose. If you want a hearing, you must ask for the hearing by writing, calling the Customer Call Center, or coming into the office within 90 days from the mailing date of your notice of case action. If you ask for a hearing by the end of the last day of the month prior to the effective date of the adverse action, your benefits may continue at the prior level until the hearing decision. You will be responsible to repay any benefits continued if the hearing decision is not in your favor. If you need information about how to receive free legal advice, you can call the Customer Call Center toll free at

Medical Assistance Applications

Use this application to see what coverage choices you qualify for such as free or

What Happens Next

Submit your signed application at any Department of Children and Families Economic

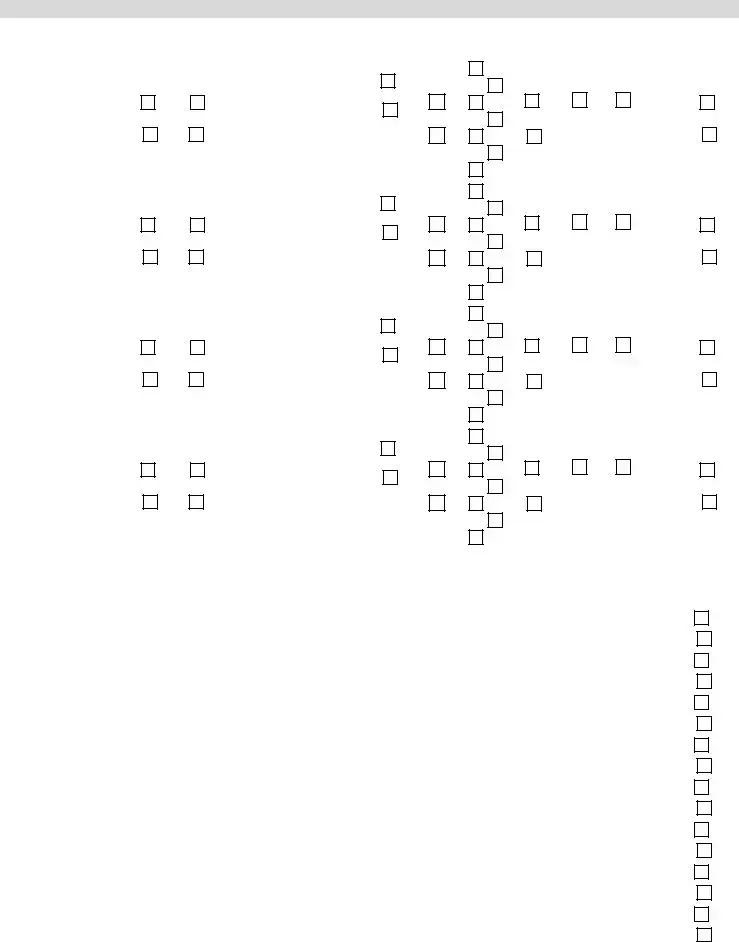

ACCESS FLORIDA APPLICATION

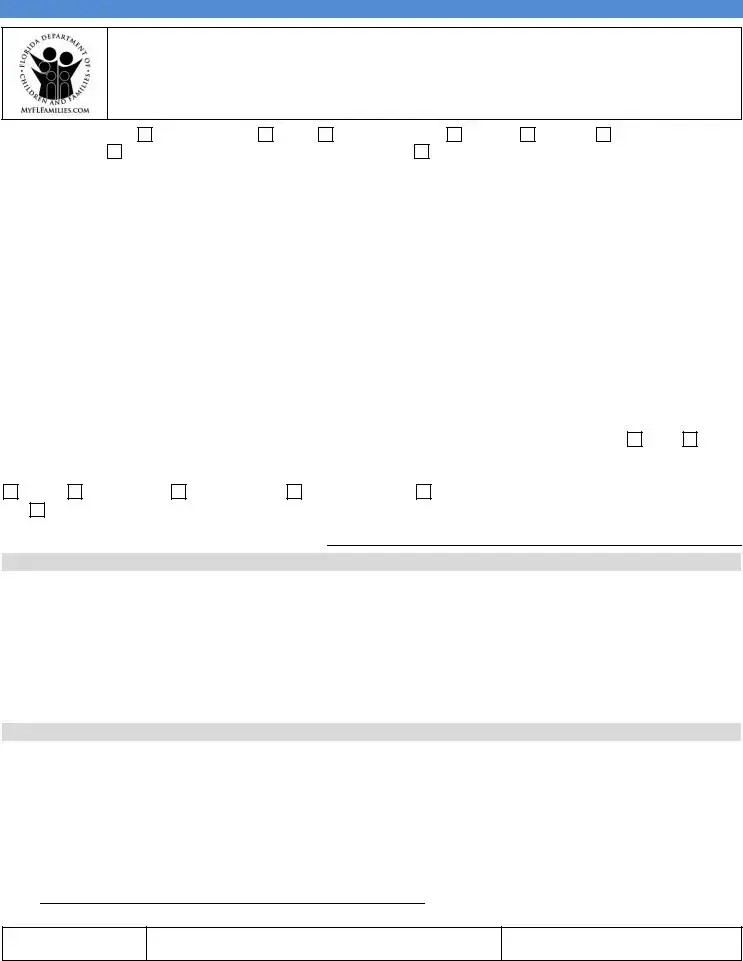

I would like to apply for: |

Food Assistance |

Cash |

Relative Caregiver |

|

Medical |

Hospice |

OSS/Optional State |

|||||

Supplementation |

Medicaid Waiver/Home & Community Based Services |

Nursing Home Care – Living address prior to entering Nursing |

||||||||||

Home: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

Name: (Head of Household – see “Before You Begin” section) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

Middle |

|

|

|

Last |

|

|

|

|

Home Address: (Leave blank if you do not have one.) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

Apt. No. |

City |

|

State |

|

Zip Code |

County |

|

|

|

|

Address where you get your mail: (if different from where you live) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Street/P. O. Box |

|

|

City |

|

State |

|

Zip Code |

|

|

|

|

|

Home or Message Phone Number: |

|

Work Phone Number: |

|

|

|

Cell Phone Number: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to get information |

|

YES |

NO |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

about this application by email? |

|||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you have a reason that makes it difficult for you to come to the office for an interview?

Illness |

Transportation |

Work or Training |

Live in a Rural Area |

Care for a sick or Disabled Household Member |

|

Other (explain): |

|

|

|

|

|

What is your preferred spoken or written language (if not English)?

STATEMENT OF UNDERSTANDING

I understand that information that I provide with this application, interview, or when requesting other benefits, including computer information matches with other agencies, is subject to verification by DCF and other Federal and State agencies including Division of Public Assistance Fraud (DPAF). I understand and agree to the following: DCF, DPAF, and authorized Federal Agencies may verify the information I give on this form, interview, or when requesting other benefits. Information may be obtained from my past or present employers. My signature authorizes release of such information to DCF and/or DPAF. As a condition of participation in Medicaid, I consent to review and release of all medical records deemed necessary by Medicaid under its auditing and investigatory powers. If any information is incorrect, benefits may be reduced or denied and I may be subject to criminal prosecution or disqualified from the program for knowingly providing incorrect or false information or hiding information. I have read my Rights and Responsibilities. I certify under penalty of perjury that the information on this form is true to the best of my knowledge, including the citizen or noncitizen status of those who are applying for benefits. I hereby acknowledge receipt of the Florida DCF CFOP

SIGNATURES

|

Signature of Adult Household Member / Date Signed |

|

|

Signature of Witness if signed with an “X” |

|

|

|

|

|

|

|

||

Authorized/Designated Representative – Please print |

Name |

|

||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Address |

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

Signature of Authorized/Designated Representative

FOR OFFICE USE ONLY

Community Access Site Participant Name/Phone Number:

Date Stamp:

* Indicates information optional for the Food Assistance Program |

Page 1 |

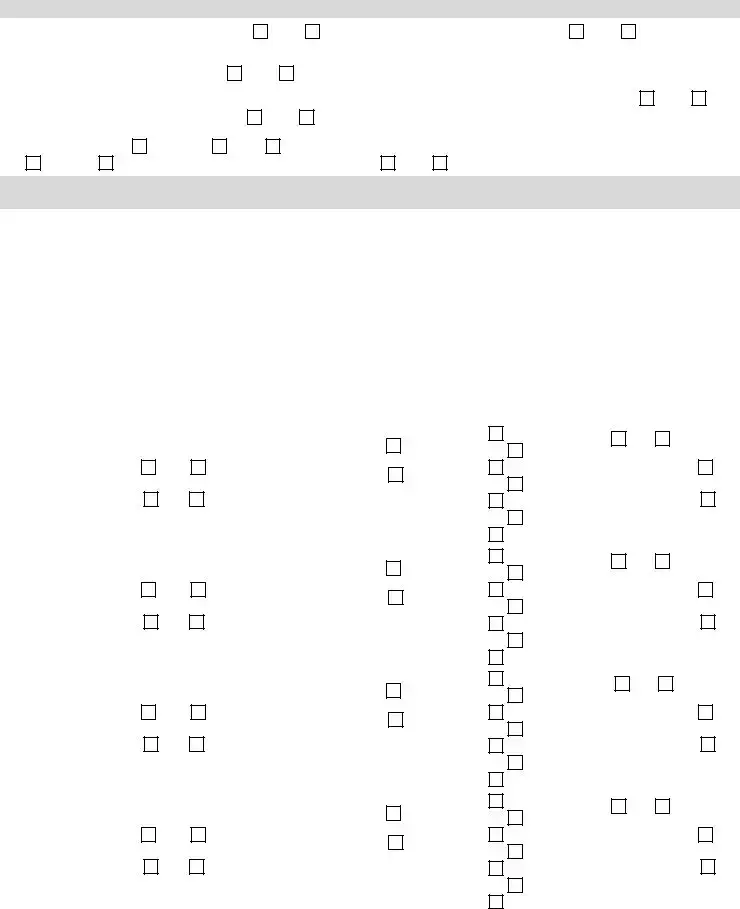

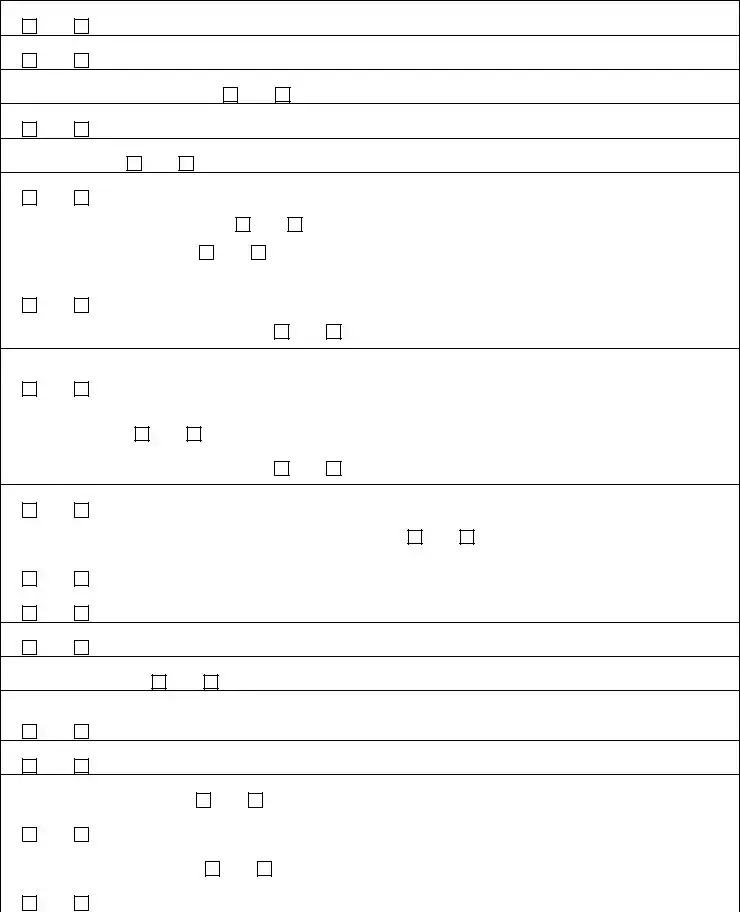

EXPEDITED FOOD ASSISTANCE: Eligible households may receive benefits within 7 days.

Is your household’s gross income less than $150? |

YES |

NO |

Do you pay to heat or cool your home? |

YES |

NO |

|

|||

|

|

|

|

|

|

|

|

|

|

Are your total liquid assets (such as |

|

|

|

What is the monthly amount of your rent or mortgage? $ |

|

||||

cash, bank accounts, etc) less than $100? |

YES |

NO |

|

||||||

|

|

|

|

|

|||||

|

|

|

|

||||||

Is your household’s monthly gross income plus your total liquid assets less |

Has all of your household’s income recently stopped? |

YES |

NO |

||||||

than your monthly rent or mortgage plus utilities? |

YES |

NO |

If yes, WHEN? |

|

|

|

|||

|

|

|

|

|

|

||||

Check the bills you pay: |

Electricity |

Gas |

Water |

Is anyone in your household a migrant or seasonal farmworker? |

|

||||

Sewage |

Phone |

|

|

|

YES |

NO If yes, WHO? |

|

|

|

|

|

|

|

|

|

|

|

|

|

HOUSEHOLD INFORMATION: If you need extra space in the following sections, please use extra pages. Please provide as much information as you can to help us determine your eligibility quickly.

In Sections A and B, list yourself and all people living in your home even if you are not applying for them. If you are not applying for a member, you do not have to give their SSN or citizenship status. Include your spouse, your children under 21 who live with you, anyone you include on your tax return, even if they do not live with you, and anyone else under 21 who you take care of and lives with you. If living in a nursing home or other institutional arrangement, list only self, spouse and dependents.

ETHNICITY (Voluntary/Optional Information): A = Hispanic or Latino or, |

B = Not Hispanic or Latino |

|

|

|

|

|||||||||||

RACE (Voluntary/Optional Information): You may choose one or more numbers: 1 – American Indian or Alaskan Native; |

2 – Asian or Pacific |

|||||||||||||||

Islander; 3 – Black or African American, Not of Hispanic Origin; |

4 – White, Not of Hispanic Origin; 5 – Southeast Asian; 6 – Other; |

or, |

||||||||||||||

7 – Unknown. This will not affect eligibility or the level of benefits. The reason we ask for this information is to assure program benefits are |

||||||||||||||||

distributed without regard to race, color, or national origin. |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION A – List All Adults Living At Your Address |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Adult’s Legal Name |

Want to |

|

Social Security |

Date and |

|

U.S. |

Ethnicity |

Race |

Marital |

Attends School/ |

Buys and |

|||||

|

Number (see |

|

# Hours / Week/ |

|||||||||||||

Sex |

|

Place |

|

|

(see |

Eats Food |

||||||||||

First, Middle, Last |

Apply? |

|

instructions |

of Birth* |

|

Citizen |

above) |

(see above) |

Status |

Last Grade |

with You |

|||||

|

|

|

|

above) |

|

|

|

|

Completed* |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

1. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|||

|

|

|

|

|

|

|

|

|

week: |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

||

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

||

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

||||||

ship to |

SELF |

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

2. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|||

|

|

|

|

|

|

|

|

|

week: |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

||

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

||

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

||||||

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

N |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

3. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|||

|

|

|

|

|

|

|

|

|

week: |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

||

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

||

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

||||||

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

1 |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

4. |

|

|

|

|

|

|

|

|

|

|

|

# hours per |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Yes |

F |

|

|

|

|

No |

|

|

A |

3 |

|

Yes |

|||

|

|

|

|

|

|

|

|

|

week: |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

||

|

|

No |

M |

|

|

|

|

|

|

|

B |

|

* Last Grade |

No |

||

Relation- |

|

|

|

|

|

USCIS # |

|

|

5 |

|

||||||

ship to |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Completed: |

|

|

you |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Indicates information optional for the Food Assistance Program |

Page 2 |

SECTION B – List All Children Living At Your Address. If anyone is pregnant, list “unborn” as the name and the due date as the date of birth.

|

|

|

|

Social Security |

Date and |

|

Ethnicity |

Race |

*Child |

|

|

|

Buys |

|

Child’s Legal Name |

Want to |

|

Number (see |

U.S. |

under |

Attends School/ |

*Date To |

and Eats |

||||||

Sex |

Place |

(see |

(see |

|||||||||||

First, Middle, Last |

Apply? |

instructions |

Citizen |

Age 5 |

School Name/ |

Graduate |

Food |

|||||||

|

of Birth* |

page 2) |

page 2) |

|||||||||||

|

|

|

|

above) |

|

Immunized |

|

|

|

with You |

||||

|

|

|

|

|

|

Yes |

|

1 |

|

|

|

|

|

|

1. |

|

|

|

|

|

|

2 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

Yes |

No |

|

|

|||

|

Yes |

F |

|

|

|

A |

3 |

|

Yes |

|||||

|

|

|

|

No |

|

|||||||||

|

|

|

|

|

|

|

4 |

|

School Name: |

|

|

|||

|

|

No |

M |

|

|

|

B |

|

|

No |

||||

Relation- |

|

|

|

USCIS # |

5 |

No |

|

|||||||

|

|

|

|

|

|

|||||||||

ship to |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

you |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

1 |

|

|

|

|

|

|

2. |

|

|

|

|

|

|

2 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

Yes |

No |

|

|

|||

|

Yes |

F |

|

|

|

A |

3 |

|

Yes |

|||||

|

|

|

|

No |

|

|||||||||

|

|

|

|

|

|

|

4 |

|

School Name: |

|

|

|||

|

|

No |

M |

|

|

|

B |

|

|

No |

||||

Relation- |

|

|

|

USCIS # |

5 |

No |

|

|||||||

|

|

|

|

|

|

|||||||||

ship to |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

you |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Yes |

|

1 |

|

|

|

|

|

|

3. |

|

|

|

|

|

|

2 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

Yes |

No |

|

|

|||

|

Yes |

F |

|

|

|

A |

3 |

|

Yes |

|||||

|

|

|

|

No |

|

|||||||||

|

|

|

|

|

|

|

4 |

|

School Name: |

|

|

|||

|

|

No |

M |

|

|

|

B |

|

|

No |

||||

Relation- |

|

|

|

USCIS # |

5 |

No |

|

|||||||

|

|

|

|

|

|

|||||||||

ship to |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

you |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

1 |

|

|

|

|

|

|

4. |

|

|

|

|

|

|

2 |

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

Yes |

No |

|

|

|||

|

Yes |

F |

|

|

|

A |

3 |

|

Yes |

|||||

|

|

|

|

No |

|

|||||||||

|

|

|

|

|

|

|

4 |

|

School Name: |

|

|

|||

|

|

No |

M |

|

|

|

B |

|

|

No |

||||

Relation- |

|

|

|

USCIS # |

5 |

No |

|

|||||||

|

|

|

|

|

|

|||||||||

ship to |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

you |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

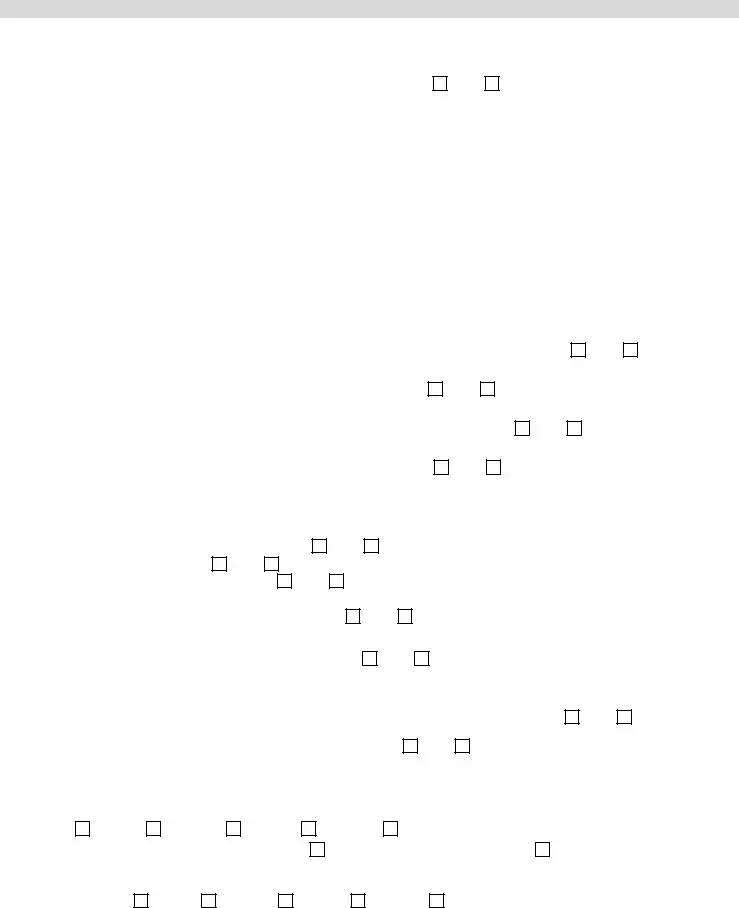

SECTION C – ABSENT PARENT INFORMATION: Provide the following information for each child in Section B whose mother and/or father is not in the home.

|

|

|

|

|

Social Security |

Race |

|

|

Child’s |

|

|

Name, Address, Phone number |

Date of Birth |

(see |

Reason for Absence |

|

Legal |

||

|

|

Number |

|

||||||

|

|

|

|

|

page 2) |

|

|

Parent? |

|

|

|

|

|

|

|

|

|

||

|

Mother |

|

|

|

|

|

|

|

YES |

Child |

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

||

1 |

Father |

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

Mother |

|

|

|

|

|

|

|

YES |

Child |

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

||

2 |

Father |

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

Mother |

|

|

|

|

|

|

|

YES |

Child |

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

||

3 |

Father |

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

Mother |

|

|

|

|

|

|

|

YES |

Child |

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

||

4 |

Father |

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

* Indicates information optional for the Food Assistance Program |

|

|

Page 3 |

||||||

SECTION D – GENERAL INFORMATION: Answer the following questions about the people listed in Sections A and B who are applying for assistance.

Is anyone in your home fleeing the law due to a felony or a probation or parole violation?

YES |

NO If yes, who? |

Has anyone in your home sold or given away any property or assets in the last 3 months (food assistance purposes) or 5 years (Medicaid)?

YES |

NO If yes, who? |

Has anyone in your home been convicted of a drug trafficking felony including agreeing, conspiring, combining, or confederating with another person to

commit the act committed after 8/22/1996? |

YES |

NO If yes, who? |

Did anyone in your home quit a job in the last 60 days or is anyone on strike?

YES |

NO If yes, who? |

Has anyone in your home been convicted on or after 8/22/96, of receiving food assistance, temporary cash assistance, or Medicaid in more than one

state at the same time? |

YES |

NO If yes, who? |

Has anyone in your home received food, cash, or medical assistance from another state or source in the last 30 days?

YES |

NO |

If yes, who? |

|

|

|

|

Is everyone a resident of the state of Florida? |

YES |

NO |

If no, who is not? |

|||

|

|

|

|

|||

Is anyone in the household pregnant? |

YES |

NO |

If yes, who? |

|||

Due Date: |

|

Number of Babies Due: |

|

|||

*Has anyone attended a school conference for any of the children who are ages |

||||||

YES |

NO |

If yes, who? |

|

|

|

When? |

Is anyone in your household a sponsored noncitizen? |

YES |

NO If yes, who? |

||||

Is anyone living in a special setting such as a homeless shelter, drug treatment center, nursing home, assisted living facility, adult family care home, mental health residential treatment facility, or other institution?

YES |

NO If yes, who? |

|

|

|

|

Facility name and Type: |

|

|

|

|

|

Is anyone a foster child? |

YES |

NO If yes, who? |

|

||

|

|

|

|||

Was anyone in Florida foster care at age 18 or older? |

YES |

NO If yes, who? |

|||

*If you are applying for nursing home type services, do you have a child (of any age) living in your home who is blind or disabled?

YES |

NO |

If yes, who? |

What is their relationship to you? |

|

Has anyone been determined disabled by Social Security or the State of Florida? |

YES |

NO If yes, who? |

||

|

|

|

||

*Has anyone been denied Supplemental Security Income (SSI) in the past 90 days? |

|

|

||

YES |

NO |

If yes, who? |

|

When? |

*Does anyone in your household need help with Medicare premiums or medical bills from the past three (3) months? |

||||

YES |

NO |

If yes, who? |

|

|

*Does anyone who was denied for disability have a new medical condition not considered by the Social Security Administration?

YES |

NO If yes, who? |

Is anyone in your household a victim of human trafficking? (Victims of human trafficking are people taken, kept, or moved by force or fraud for sexual

exploitation or forced labor.) |

YES |

NO If yes, who? |

Have you or any member of your household been convicted of trading food assistance benefits for drugs, convicted of buying or selling food assistance benefits over $500, or convicted of trading food assistance benefits for guns, ammunitions, or explosives?

YES |

NO If yes, who? |

Does anyone in the household pay for a room (Roomer) or for room and meals (Boarder)?

YES |

NO If yes, who? |

*Does anyone have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, dressing, daily chores, etc.) or live

in a medical faciltiy or nursing home? |

YES |

NO |

If yes, who? |

|

||

*Is any child limited or prevented in any way in his or her ability to do the same things most children of the same age do? |

|

|||||

YES |

NO |

If yes, who? |

|

|

|

|

*Does anyone need or get special therapy, such as physical, occupational or speech therapy, or treatment or counseling for an emotional, |

|

|||||

developmental, or behavioral problem? |

YES |

NO |

If yes, who? |

|

||

*Does any child need or use more medical care, mental health, or educational services than is usual for most children of the same age? |

|

|||||

YES |

NO |

If yes, who? |

|

|

|

|

* Indicates information optional for the Food Assistance Program |

Page 4 |

|||||

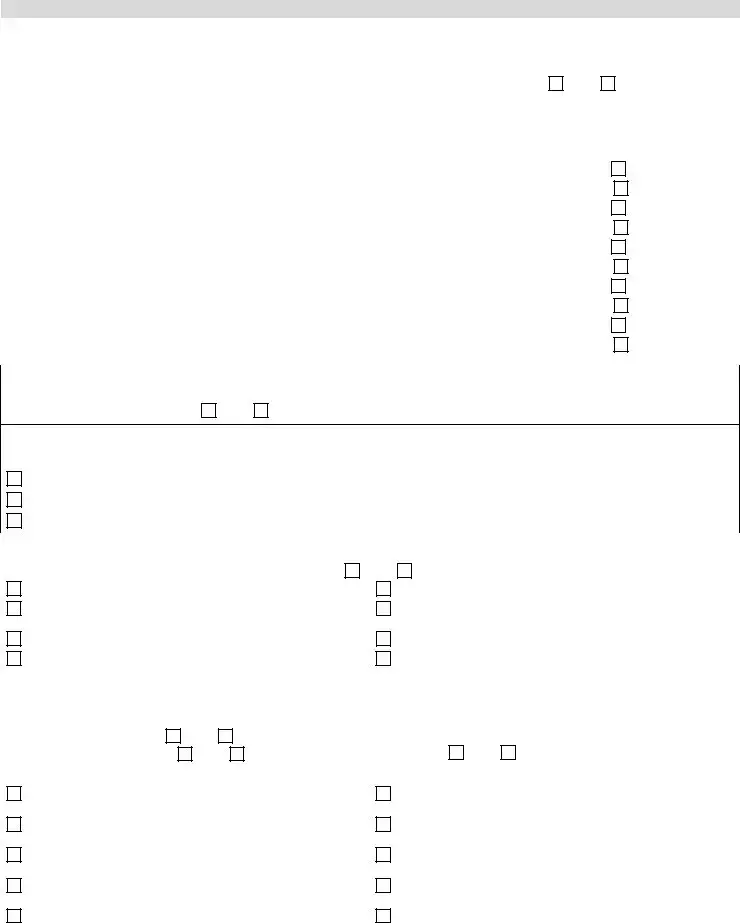

SECTION E – ASSETS: Answer the following questions about the people listed in Sections A and B who are applying for assistance. If you need extra space in the following sections, please use extra pages.

Does anyone you are applying for own all or part of any assets, such as: *vehicles, bank accounts, tax sheltered accounts, property, Certificates of Deposit (CDs), cash, mortgage notes, promissory notes, *loans, *IRAs, *401Ks, bonds, *annuities, stocks, real estate, life estate, trusts, *Keogh plans, *continuing care retirement community or life care community contracts, burial contracts/plots, prepaid funeral expenses, savings bonds or certificates, business assets, large sums of money received in last 3 months,

applicants if living in the home and assets/insurance of spouses of applicants if living in the home. |

YES |

NO If yes, list below: |

*IMPORTANT INFORMATION FOR OWNERS OF AN ANNUITY: In accordance with Public Law

*DCF must determine the value of assets of Medicaid applicants and recipients of aged (65 or older), blind, or disabled individuals. Applicants and recipients must agree to allow DCF to ask for financial records from any bank, savings and loan, credit union, or other financial institution by completing the Financial Information Release, form

Individual |

Type of Asset or |

Vehicles |

Amount Owed on |

Location of Asset/Insurance |

Account # or |

Amount or |

|

Insurance |

Year, Make, Model* |

Vehicle/Property |

Bank/Company Name and Address |

Insurance ID # |

Value |

||

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Are any of the above assets set |

YES |

NO |

If yes, which? |

|

|

|

|

|

aside to cover burial expenses? |

Amount? |

|

|

|

|

|||

|

|

|

|

|

|

|||

Has anyone closed bank accounts or other investments, added anyone to the title of an asset, given away assets or property, or |

YES |

NO |

||||||

liquidated assets greater than $3,000 to buy another asset or service in the last 3 months (food assistance) or 5 years (Medicaid)? |

||||||||

|

|

|||||||

If yes, who? |

|

|

|

|

|

|

|

|

What? |

|

|

|

When? |

Value? |

|

|

|

Are any assets jointly owned with a person that does not live with you? |

YES |

NO |

|

|

||||

If yes, who? |

|

|

|

|

|

|

|

|

What? |

|

|

|

When? |

Value? |

|

|

|

YOU CAN APPLY TO REGISTER TO VOTE HERE

If you are not registered to vote where you live now, would you like to register to vote here today? Check YES if you would like to apply to register to vote or update your voter registration information. If you check the NO box or do not check a box, you will be considered to have decided not to apply to register to vote or update your voter registration information. Checking YES, NO, or leaving this question blank, will not affect your receipt of benefits.

YES |

NO |

NOTICE OF RIGHTS

Help: If you would like help in filling out your voter registration application, we will help you. The decision whether to seek or accept help is yours. You may fill out the voter registration application in private.

Benefits: If you are applying for public assistance from this agency, applying to register, or declining to register to vote will not affect the amount of assistance you will be provided by this agency.

Privacy: Your decision not to register or update your record and the location where you applied to register or update your voter registration record is confidential and may only be used for voter registration purposes.

Formal Complaint: If you believe someone has interfered with either your right to apply to register or to decline to register to vote, your right to privacy in deciding whether to apply to register to vote, or your right to choose your own political party or other political preference, you may file a complaint with: Florida Secretary of State, Division of Elections, NVRA Administrator, R.A. Gray Building, 500 S. Bronough Street, Tallahassee, Florida

[Authority: National Voter Registration Act (42 U.S.C. 1973 gg); ss. 97.023, 97.058 and 97.0585, F.S.]

* Indicates information optional for the Food Assistance Program |

Page 5 |

SECTION F – INCOME: Answer the following questions about the people listed in Sections A and B who are applying for assistance.

Does anyone that you are applying for receive any type of income, such as: wages, tips,

allowances, etc? (Include the income of parents living at home with minor child |

|

|

|

YES |

NO |

If yes, list below: |

|

|

|

|

|||||||||

applicants and income of spouses and dependents of applicants if living in the home.) |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Employer or |

|

|

Phone Number |

|

Monthly |

How Often |

|

Pay Day on |

Weekly |

|||||

Individual |

Type of Income |

|

|

|

|

Amount |

Received |

|

|

What Day |

# of |

||||||||

|

Source of Income |

|

|

of Employer |

|

|

Before |

(weekly/biweekly |

Work |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions |

/monthly) |

|

|

of the Week |

Hours |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|||||||||||||||

Has anyone’s income in the household ended or had their work hours reduced in the last 60 days or the past year? |

YES |

|

NO |

|

|||||||||||||||

If yes, who? |

|

|

|

|

|

When? |

|

|

|

|

|

|

Source? |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Will anyone in your household receive additional income from the source that ended? |

|

YES |

NO |

Gross amount (before deductions |

|||||||||||||||

|

received in this |

|

|

|

|

||||||||||||||

If yes, who? |

|

|

|

|

|

When? |

|

|

|

|

|

|

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

month only? |

|

|

|||||

Does anyone have a pending application for Social Security or Unemployment Compensation benefits? |

YES |

NO |

|

|

|

|

|||||||||||||

If yes, who? |

|

|

|

|

|

|

|

Which Benefit? |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||||||

Have deposits been made to Income or Miller Type Trusts in any of the past 3 months? |

|

YES |

NO |

If yes, whose |

|

|

|

|

|||||||||||

trust? |

|

|

|

|

Date(s) and amount of deposit(s)? |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||||||||||

If |

|

|

|

|

|

Monthly net income amount (profits after paying business expenses): |

|||||||||||||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

*Do you plan to file a federal income tax return NEXT YEAR? |

YES |

NO |

If yes, answer the questions below: |

|

|

|

|

||||||||||||

*Will you file jointly with your spouse? |

YES |

NO If yes, what is your spouse’s name? |

|

|

|

|

|

|

|||||||||||

*Will you claim any dependents on your tax return? |

YES |

NO |

If yes, list the names of |

|

|

|

|

|

|

||||||||||

dependents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Will someone else claim you as a dependent on their tax return? |

YES |

|

NO |

If yes, what is the name of the tax |

|

|

|

|

|||||||||||

filer? |

|

|

|

|

|

How are you related to this tax filer? |

|

|

|

|

|

|

|||||||

*Is anyone listed on this application offered health coverage from a job? |

YES |

NO If yes, who? |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

*Who can we contact about employee health coverage at this job? |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

||||||||||||||||

*Are you currently eligible for coverage offered by this employer, or will you become eligible in the next 3 months? |

YES |

NO |

|

||||||||||||||||

|

|

|

|

||||||||||||||||

*Does the employer offer a health plan that meets the minimum value standard? |

|

YES |

NO [An |

||||||||||||||||

value standard” if the plan’s share of the total allow ed benefit costs covered by the plan is no less than 60 percent of such costs. Section 36B(c)(2)(C)(ii) of the Internal Revenue Code of 1986.] |

|||||||||||||||||||

|

|||||||||||||||||||

*For the |

|||||||||||||||||||

programs, provide the premium the employee would pay if he/she received the maximum discount for any tobacco cessation programs, and did not |

|||||||||||||||||||

receive another discount based on wellness programs. How much would the employee have to pay in premiums for this plan? $ |

|

|

|

|

|||||||||||||||

How often? |

Weekly |

Biweekly |

|

Monthly |

Quarterly |

Yearly |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|||||||||||||||||

*What change will the employer make for the new plan year? |

Employer won’t offer health coverage |

Employer will start offering health |

|||||||||||||||||

coverage to employees or change the premium for the |

|

||||||||||||||||||

standard. How much will the employee have to pay in premiums for that plan? $ |

|

|

|

|

|

|

|

|

|

|

|||||||||

How often? |

Weekly |

Biweekly |

Monthly |

Quarterly |

|

Yearly |

Date of change? |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|||||||||||||

* Indicates information optional for the Food Assistance Program |

|

|

|

|

Page 6 |

||||||||||||||

SECTION G – EXPENSES: Answer the following questions about the people listed in Sections A and B who are applying for assistance.

Is anyone that you are applying for required to pay expenses, such as: rent, mortgage, property tax, homeowner’s insurance, condo/maintenance fees,

gas, electric, fuel, LIHEAP, medical bills such as but not limited to: prescriptions, glasses, transportation, doctor visits, dental, health aides, hospitalization, nursing home bills, or insurance or Medicare premiums not covered by insurance or another third party, telephone, child or adult care, or

court ordered child support for a child not in your household? Include the expenses of parents of |

YES |

NO If yes, list below: |

minor child applicants if living in the home and expenses of spouse of applicants if the spouse is living at home. |

Failure to report and/or verify any of the listed expenses will be considered as a statement by the household that they do not want to receive a deduction for the unreported expense.

Type of |

Who is Obligated |

If a Medical Expense, |

Monthly |

|

|

Still |

For Court Ordered |

||

Who Received the |

Paid to Whom |

Date Paid |

Child Support Only, |

||||||

Expense |

To Pay This Expense |

Amount |

Owed? |

Name of Child for |

|||||

Medical Service? |

|

|

|||||||

|

|

|

|

|

|

Whom Support is Paid |

|||

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

||

How do you heat or cool your home? |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

Does anyone help you pay expenses? |

YES |

NO If yes, who? |

|

|

|

|

|||

If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower. You should not include a cost you already considered in your answer to net

Alimony paid $ |

|

|

...........................................How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Student loan interest $ |

................................ How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Other deductions, Type: |

|

................................................................ How often? |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

SECTION H – YOUR FAMILY’S HEALTH COVERAGE: Answer the questions for anyone who needs health coverage. |

||||||||||||||||||||||||||||

*Is anyone enrolled in health coverage now from any of the following? |

YES |

NO If yes, write their name(s) next to the coverage they have. |

||||||||||||||||||||||||||

Medicaid: |

|

|

|

|

|

|

|

|

|

|

|

|

Florida KidCare: |

|

|

|

|

|

|

|

||||||||

Medicare: |

|

|

|

|

|

|

|

|

|

|

|

TRICARE: |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(for TRICARE, |

do not |

check if you have direct care or Line of Duty) |

|||||||||||||

VA health programs: |

|

|

|

|

|

|

Peace Corps: |

|

|

|

|

|

|

|

||||||||||||||

Employer insurance: |

|

|

|

|

|

|

Other: |

|

|

|

|

|

|

|

||||||||||||||

Name of Insurance: |

|

|

|

|

|

|

Name of Health Insurance: |

|

|

|||||||||||||||||||

Name of person insured: |

|

|

|

|

Name of person insured: |

|

|

|

|

|

||||||||||||||||||

Policy number: |

|

|

|

|

|

|

|

|

|

|

|

Policy number: |

|

|

|

|

|

|

|

|||||||||

Is this COBRA coverage? |

YES |

NO |

|

Is this a |

||||||||||||||||||||||||

Is this a retiree health plan? |

|

YES |

NO |

|

|

|

|

|

YES |

NO |

||||||||||||||||||

|

||||||||||||||||||||||||||||

*Has anyone voluntarily canceled health insurance for children in the last two months for any of these reasons? |

||||||||||||||||||||||||||||

The cost of an applicant child’s health insurance is more |

|

The employer providing the applicant child’s coverage canceled the |

||||||||||||||||||||||||||

than 5% of your family’s income. |

|

|

coverage. |

|

|

|

|

|

||||||||||||||||||||

Domestic violence led to the loss of coverage for an |

|

The applicant child’s coverage ended because the child reached the |

||||||||||||||||||||||||||

applicant child. |

|

|

|

|

|

|

|

|

|

|

|

maximum lifetime coverage limit or an annual benefit limit. |

||||||||||||||||

Parent lost a job that provided |

|

An applicant child has a medical condition that, without medical care, |

||||||||||||||||||||||||||

coverage for an applicant child. |

|

|

|

|

would cause serious disability, loss of function, or death. |

|||||||||||||||||||||||

The coverage does not cover the applicant child’s health |

|

The applicant child’s parent canceled COBRA coverage or the |

||||||||||||||||||||||||||

care needs. |

|

|

|

|

|

|

|

|

|

|

|

COBRA coverage reached its legal limit. |

||||||||||||||||

Parent who had the health coverage for an applicant child |

|

A |

||||||||||||||||||||||||||

is deceased. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Indicates information optional for the Food Assistance Program |

|

|

|

|

Page 7 |

|||||||||||||||||||||||

YOU MAY BE ELIGIBLE FOR REDUCED TELEPHONE RATES

Check YES if you would like DCF to release your Name, SSN, Phone Number, and the fact that you receive food assistance, Temporary Cash

Assistance, or Medicaid to the local telephone company so you may receive a reduced telephone rate through the Lifeline Program. |

YES |

NO |

SECTION I – AMERICAN INDIAN OR ALASKA NATIVE FAMILY MEMBER: Complete this section if you or a family member are American Indian or Alaska Native.

American Indians and Alaska Natives can get services from the Indian Health Services, tribal health programs, or urban Indian health programs. They also may not have to pay cost sharing and may get special monthly enrollment periods. Answer the following questions to make sure your family gets the most help possible. If you have more people to include, make a copy of this page and attach.

Name |

Member of a |

Has this person ever received a service from the Indian Health Service, a tribal health |

||||

First, Middle, Last |

Federally recognized tribe |

program, or urban Indian health program, or through a referral from one of these programs? |

||||

|

YES |

NO |

|

|

If no, is this person eligible to get services from |

|

|

If yes, tribe name: |

YES |

NO |

one of these programs? |

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

YES |

NO |

|

|

If no, is this person eligible to get services from |

|

|

If yes, tribe name: |

YES |

NO |

one of these programs? |

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

YES |

NO |

|

|

If no, is this person eligible to get services from |

|

|

If yes, tribe name: |

YES |

NO |

one of these programs? |

|

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

YES |

NO |

|

|

If no, is this person eligible to get services from |

|

|

If yes, tribe name: |

YES |

NO |

one of these programs? |

|

|

|

|

|

|

|

YES |

NO |

*Certain money received may not be counted for Medicaid or the Children’s Health Insurance Program (CHIP). List any income reported on your application that includes money from these sources:

Per capita payments from a tribe that come from natural resources, usage rights, leases, or royalties? |

YES |

NO |

||||

If yes, who? |

|

|

|

Amount: $ |

|

|

Payments from natural resouces, farming, ranching, fishing, leases, or royalties from |

|

|

|

|

||

land by the Department of Interior (including reservations and former reservations? |

YES |

NO |

|

|

||

If yes, who? |

|

|

|

Amount: $ |

|

|

Money from selling things that have cultural significance? |

YES |

NO |

|

|

|

|

If yes, who? |

|

|

|

Amount: $ |

|

|

AUTHORIZED REPRESENTATIVE

You can give a trusted person permission to talk about this application with us, see your information, and act for you on matters related to this application, including getting information about your application and signing your application on your behalf. This person is called an “authorized representative”. If you are a legally appointed representative for someone on this application, submit proof with the application. By entering the information on page 1, you allow this person to sign your application, get official information about this application, and act for you on all future matters with this agency.

FOR CERTIFIED APPLICATION COUNSELORS, NAVIGATOR, AGENTS, AND BROKERS ONLY: Complete this section if you are a certified application counselor, navigator, agent, or broker filling out this application for somebody else.

Application start date (mm/dd/yyyy):

Name: First, Middle, Last:

Organization Name and ID number (if applicable):

SIGNING THIS APPLICATION: By signing this application you are confirming and attesting that:

•*No one applying for health insurance on this application is incarcerated.

•*The information provided on this application establishes the identity of children under age 16.

•You have read and understand your rights and responsibilities.

•*You are giving the Medicaid agency rights to pursue and get any money from other health insurance, legal settlements, or other third parties. You are also giving the Medicaid agency rights to pursue and get medical support from a spouse or parent.

•*You know this information will be used to check your eligibility for help paying for health coverage if you choose to apply. We will check your answers using information in our electronic databases and databases from the Internal Revenue Service (IRS), Social Security, Department of Homeland Security, and/or a consumer reporting agency.

* Indicates information optional for the Food Assistance Program |

Page 8 |

Form Characteristics

| Fact | Description |

|---|---|

| 1. Purpose of Form | The CF-ES 2337 form is the ACCESS Florida Application, used to apply for various public assistance benefits, including food assistance, medical assistance, and temporary cash assistance. |

| 2. Processing Time | After submission, processing your food assistance application can take between 7 to 30 days. Eligible expedited households may receive benefits within 7 days. |

| 3. Eligibility Requirements | Eligibility for expedited food assistance depends on monthly gross income being below $150, or having limited liquid assets. Specific criteria also apply to destitute migrants or seasonal farmworkers. |

| 4. Application Submission | Applications can be submitted in person, via mail, fax, or electronically. The submission date is considered when the application is received during business hours. |

| 5. Rights of the Applicant | Applicants may file for benefits the same day they contact the Department of Children and Families (DCF). Completing an interview isn’t necessary before filing. |

| 6. Social Security Number Requirement | While household applicants must provide Social Security Numbers, non-applicants and those applying solely for emergency medical assistance may not need to disclose their SSNs. |

| 7. Head of Household Designation | Households may choose their head of household from adult members, provided everyone agrees. If no consensus is reached, a state agency may designate the head. |

| 8. Verification of Information | The information provided is subject to verification through various means, including matches with other federal and state agencies to ensure compliance and eligibility. |

| 9. Governing Laws | This application is governed by the Food and Nutrition Act of 2008 and state statutes (referencing 65A-1.205, Florida Administrative Code). |

Guidelines on Utilizing Cf Es 2337

After submitting the CF-ES 2337 form, your application will undergo processing. It can take anywhere from 7 to 45 days, depending on the type of assistance requested. If you have provided all necessary information, you may qualify for expedited services and receive benefits within a week. Be prepared to follow up as required, and remember that assistance eligibility can change.

- Visit the ACCESS Florida website or contact the Customer Call Center for assistance if needed.

- Indicate the type of assistance you are applying for by checking the relevant box on the form.

- Fill out your personal information as the head of household. Include your full name, home address, phone number, and email address.

- State if you wish to receive updates about your application via email.

- Provide details about any difficulties in attending an office interview, if applicable.

- Choose your preferred spoken or written language, if not English.

- Read and acknowledge the statement of understanding regarding information verification and requirements.

- Sign and date the application, with a witness if necessary.

- Complete sections regarding expedited food assistance eligibility by answering all questions accurately.

- List all adults and children living in your household, ensuring to include necessary identification information.

- Complete the absent parent information section if applicable, providing necessary details.

- Make copies of required documents and send the application either by mail, in person, or via fax as preferred.

What You Should Know About This Form

What is the CF-ES 2337 form used for?

The CF-ES 2337 form, also known as the ACCESS Florida Application, is used to apply for various public assistance programs. This includes food assistance, cash assistance, medical assistance, and additional services such as health coverage from Medicaid or the Children's Health Insurance Program (CHIP).

How can I apply for benefits using the CF-ES 2337 form?

You can apply for benefits by providing your name, address, and signing the application. While it is encouraged to answer as many questions as possible for quicker processing, even minimal information allows the application to be submitted. The form can be submitted in person, by mail, fax, or electronically through the ACCESS Florida website.

How long does it take to process the application?

Processing times for the application can vary. Food assistance applications typically take 7 to 30 days. Households that meet expedited food assistance criteria may receive benefits within seven days. Applications for medical assistance and temporary cash assistance can take 30 to 45 days to process.

What are the expedited food assistance criteria?

To qualify for expedited food assistance, a household must meet one of the following conditions: have a monthly gross income less than $150 and liquid assets below $150; have combined monthly income and liquid assets below the monthly rent or mortgage plus utility costs; or be a destitute migrant or seasonal farmworker with liquid assets less than $100.

Can someone else submit the application on my behalf?

Yes, an application can be submitted by you or someone acting on your behalf. This can be done in person, by mail, fax, or electronically through the internet. It is important to sign the application and provide the necessary information for eligibility verification.

What information is required for non-applicants?

Non-applicants, which include household members not applying for benefits, do not need to provide a social security number. If a household member is applying for specific emergency assistance, their immigration status does not need to be proven for the application process.

What happens if I do not meet the eligibility requirements?

If an applicant is found ineligible for food assistance, it does not affect their eligibility for other programs. The household will still have the opportunity to apply for benefits that they may qualify for. Additionally, information provided on the application will be verified to confirm eligibility status.

What should I do if my situation changes after applying?

Households are encouraged to report any changes in living or mailing addresses, income, or household composition. Specifically, for food assistance, it is important to report when the total monthly household gross income exceeds 130% of the federal poverty level or if work hours of able-bodied adults fall below 20 hours per week averaged monthly.

How can I appeal a decision regarding my application?

If you wish to contest a decision made regarding your application, you have the right to request a fair hearing. This can be initiated by writing, calling the Customer Call Center, or visiting an office within 90 days of the decision date. During this process, you may have representation and potentially continue receiving prior benefits until the hearing concludes.

Common mistakes

Filling out the CF-ES 2337 form can be a crucial step towards getting the assistance you need. However, many people make mistakes that can delay processing or even lead to denials. Here are six common pitfalls to avoid.

1. Incomplete Information: One of the biggest mistakes is leaving out key information. Even if you don’t have all the answers, it’s important to fill in as much as you can. The more details you provide, the quicker the processing can be. Missing details can slow things down and create unnecessary hurdles.

2. Incorrect Social Security Numbers: Entering the wrong Social Security Number (SSN) can lead to significant problems. Ensure that you double-check this information before submitting it. Any errors could cause delays in verifying your eligibility, potentially putting the benefits you need at risk.

3. Not Reporting Changes: If your household experiences any changes—like a new job or a family member moving in—reporting these changes promptly is essential. Failing to do so can result in overpayments or underpayments, which could create complications down the line.

4. Forgetting Signatures: Forgetting to sign the application is a common oversight. Without a signature, your application may be deemed invalid and rejected. Always make sure that each required party has signed where indicated.

5. Ignoring the Deadline: It's important to be aware of deadlines for submitting your application and any required documentation. Applications submitted late can jeopardize your chance of receiving assistance in a timely manner. Keeping track of when things are due can save you from unnecessary stress.

6. Relying Solely on Paper Methods: While you can apply by mail or in person, many people don’t realize that applying online can be faster and easier. If you’re comfortable with technology, consider filling out the CF-ES 2337 form online. This can speed up processing and may help avoid clerical errors associated with paper submissions.

By avoiding these common mistakes, you can help ensure that your application for assistance is processed quickly and accurately. Good luck!

Documents used along the form

The CF-ES 2337 form is an essential document for individuals applying for food assistance and other public benefits within the state of Florida. Along with this form, several other documents may be required to complete the application process or to provide further information. Here are some commonly used forms and documents that often accompany the CF-ES 2337 form:

- Medical Assistance Applications: This form is used to evaluate eligibility for Medicaid and the Children’s Health Insurance Program (CHIP). Applicants need to provide information regarding income, family size, and any existing health coverage.