Fill Out Your Co 1 Form

The Co 1 form, officially known as the Charitable Organization Registration Statement, is an essential document designed to ensure transparency for organizations seeking to solicit funds in Illinois. By submitting this form, organizations comply with the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act, thereby reinforcing their commitment to ethical fundraising practices. This registration requires organizations to provide vital information, including their legal entity type, mission, and the purposes for which contributions will be used. Furthermore, organizations must disclose if they intend to work with professional fundraisers, and they need to provide detailed information about past registrations. The form emphasizes the importance of maintaining accurate records and mandates that any changes in the organization's information are reported promptly. It is crucial to attach necessary documentation, such as articles of incorporation and financial records, which support transparency and accountability in charitable activities. The completion and submission of the Co 1 form serves as a foundation for building trust with potential donors and the community at large, ensuring that fundraising efforts are grounded in legality and ethical responsibility.

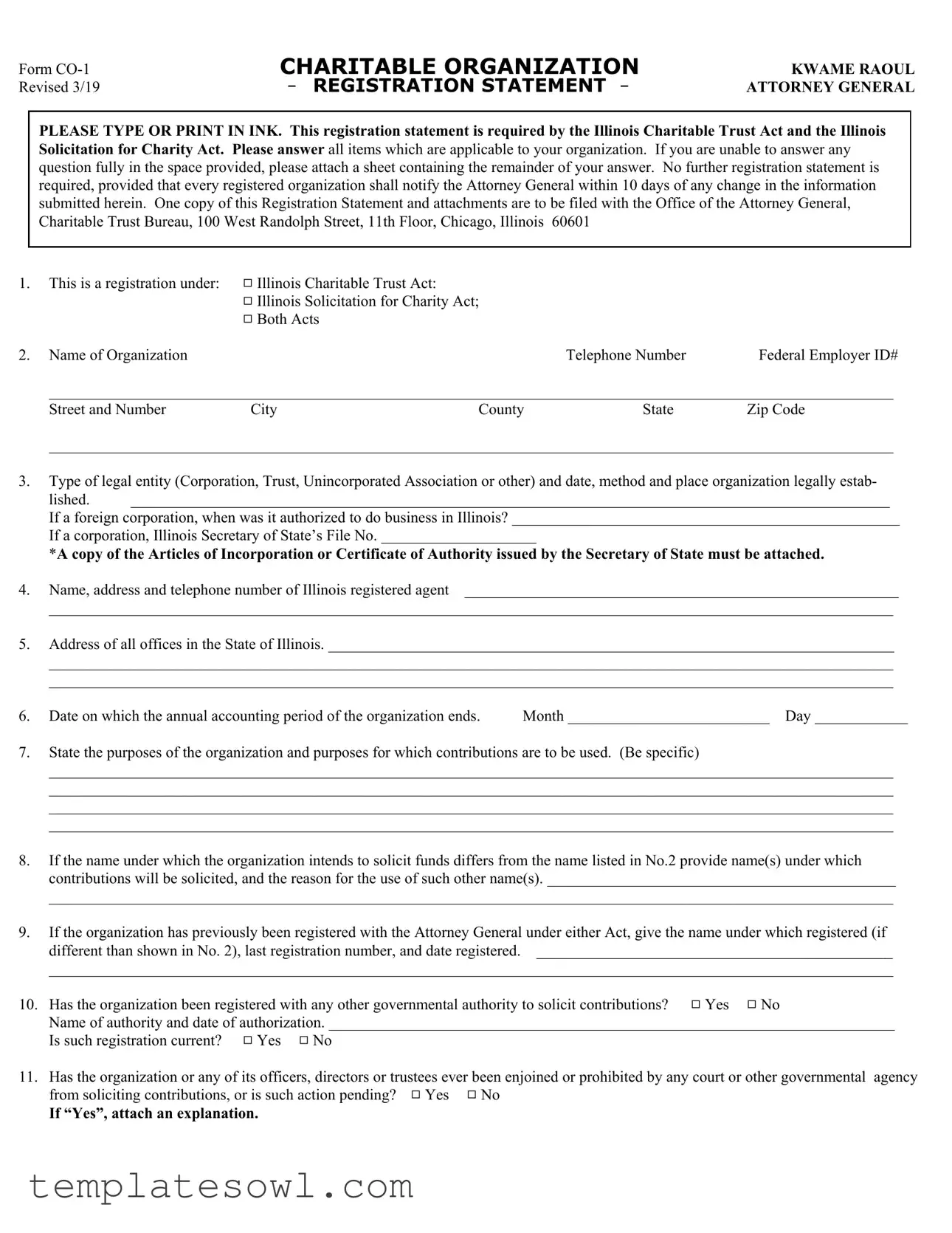

Co 1 Example

Form

CHARITABLE ORGANIZATION - REGISTRATION STATEMENT -

KWAME RAOUL ATTORNEY GENERAL

PLEASE TYPE OR PRINT IN INK. This registration statement is required by the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. Please answer all items which are applicable to your organization. If you are unable to answer any question fully in the space provided, please attach a sheet containing the remainder of your answer. No further registration statement is required, provided that every registered organization shall notify the Attorney General within 10 days of any change in the information submitted herein. One copy of this Registration Statement and attachments are to be filed with the Office of the Attorney General, Charitable Trust Bureau, 100 West Randolph Street, 11th Floor, Chicago, Illinois 60601

1.This is a registration under: 9 Illinois Charitable Trust Act:

9 Illinois Solicitation for Charity Act;

9 Both Acts

2. Name of OrganizationTelephone Number Federal Employer ID#

_____________________________________________________________________________________________________________

Street and Number CityCountyState Zip Code

_____________________________________________________________________________________________________________

3.Type of legal entity (Corporation, Trust, Unincorporated Association or other) and date, method and place organization legally estab- lished. __________________________________________________________________________________________________

If a foreign corporation, when was it authorized to do business in Illinois? __________________________________________________

If a corporation, Illinois Secretary of State’s File No. ____________________

*A copy of the Articles of Incorporation or Certificate of Authority issued by the Secretary of State must be attached.

4. Name, address and telephone number of Illinois registered agent ________________________________________________________

_____________________________________________________________________________________________________________

5.Address of all offices in the State of Illinois. _________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

6. Date on which the annual accounting period of the organization ends. |

Month __________________________ Day ____________ |

7.State the purposes of the organization and purposes for which contributions are to be used. (Be specific)

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

8.If the name under which the organization intends to solicit funds differs from the name listed in No.2 provide name(s) under which contributions will be solicited, and the reason for the use of such other name(s). _____________________________________________

_____________________________________________________________________________________________________________

9.If the organization has previously been registered with the Attorney General under either Act, give the name under which registered (if different than shown in No. 2), last registration number, and date registered. ______________________________________________

_____________________________________________________________________________________________________________

10. |

Has the organization been registered with any other governmental authority to solicit contributions? 9 Yes 9 No |

|

Name of authority and date of authorization. _________________________________________________________________________ |

|

Is such registration current? 9 Yes 9 No |

11. |

Has the organization or any of its officers, directors or trustees ever been enjoined or prohibited by any court or other governmental agency |

|

from soliciting contributions, or is such action pending? 9 Yes 9 No |

If “Yes”, attach an explanation.

12. Do you intend to use the services of a professional fund raiser as defined by “An Act to Regulate Solicitation and Collection of Funds for

Charitable Purposes”? 9 Yes 9 No If “Yes”, answer a, b, and comply with c below.

a.Name and address of professional fund raiser(s): ___________________________________________________________________

_____________________________________________________________________________________________________________

b. Has the professional fund raiser registered and filed a bond with the Office of the Attorney General as required? |

9 Yes 9 No |

c. Attach copies of all contracts with professional fund raiser(s).

13.Have any of organization’s officers, directors, executive personnel, or have any of the organization’s employees who have access to funds, ever been charged with or convicted of a misdemeanor involving misapplication or misuse of money of another, or any

felony? 9 Yes 9 No If “Yes”, give the following information: (IRS 1981 ch.. 23, sec. 5109) |

|

|

NAME AND ADDRESS OF COURT |

NATURE OF OFFENSE |

DATE OF CONVICTION(Mo./Yr.) |

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

14.State the board, group or individual having final discretion as to the distribution and use of contributions received.

_____________________________________________________________________________________________________________

15. Will you use any of the following methods of solicitation? |

9 Unordered Merchandise |

9 Distribution or Sale of Seals |

||

9 Telephone Appeals |

9 Coin Collection Containers |

9 Special Events |

9 Ad Books |

9 Direct Mail |

9 Other |

|

|

|

|

16.List name, mailing address and title of the chief executive or staff officer of the organization. __________________________________

_____________________________________________________________________________________________________________

17.Attach a list of names, mailing addresses, and daytime phone numbers of all officers and directors, or trustees of the organization.

18. Has the United States Internal Revenue Service determined that this organization is tax exempt? |

9 Yes |

9 No |

If “Yes”, attach a copy of the determination letter. Is application pending? |

9 Yes |

9 No |

*All organizations with tax exempt status or an application pending must attach a copy of |

|

|

Federal Form 1023 “Application for Recognition of Exemption” or an exemption letter. |

|

|

19. Has organization’s tax exempt status ever been questioned, audited, denied or cancelled at any time by any governmental agency?

9 Yes |

9 No If “Yes”, attach the facts. |

20.Organizations which have been in operation for over one (1) year must attach a copy of the form

21.Approximate amount of contributions solicited or income received from persons in this State during the organization’s last annual accounting period $ _____________________________

22.EVERY REGISTERING ORGANIZATION MUST ATTACH THE FOLLOWING APPLICABLE DOCUMENTS: Corporation....................................The Articles of Incorporation and/or Certificate of Authority, Amendments and

Testamentary Trust.........................Will, Probate number and Decree of Distribution Inter Vivos Trust.............................Instrument Creating Trust

Note: The President and the Chief Financial Officer or other authorized officer are both required to sign. This must be two different individuals. If entity is a Trust, all Trustees must sign.

UNDER PENALTY OF PERJURY, THE UNDERSIGNED DECLARE AND CERTIFY THAT THE INFORMATION CONTAINED IN THIS STATEMENT AND ALL ATTACHED SHEETS IS TRUE AND CORRECT TO THE BEST OF OUR KNOWLEDGE.

Signature______________________________________________________________Title__________________________________Date_________________________

Signature______________________________________________________________Title__________________________________Date_________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This form is governed by the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. |

| Registration Requirement | Organizations must submit this registration statement to the Attorney General's Office to solicit contributions legally. |

| Notification of Change | Registered organizations must notify the Attorney General within 10 days of any changes to their initially submitted information. |

| Documentation Needed | Attachments like Articles of Incorporation or other governing documents are required to accompany the registration form. |

| Tax Exemption | If applicable, organizations must submit proof of IRS tax-exempt status or the pending application with the registration. |

Guidelines on Utilizing Co 1

Completing the Co 1 form is an important step in ensuring your organization is properly registered and compliant with Illinois laws governing charitable organizations. Below is a guide to help you fill out the form accurately and efficiently.

- Identify the registration type: Indicate whether you are registering under the Illinois Charitable Trust Act, the Illinois Solicitation for Charity Act, or both by checking the appropriate box.

- Provide organization details: Enter the name of your organization, telephone number, and Federal Employer ID number. Fill in the street address, city, county, state, and zip code.

- Specify legal entity: State the type of legal entity (such as Corporation, Trust, Unincorporated Association) and provide details about how and when it was established. If it’s a foreign corporation, include the authorization date for business in Illinois.

- Identify registered agent: Enter the name, address, and telephone number of your Illinois registered agent.

- List office addresses: Provide the addresses for all offices located in Illinois.

- State annual accounting period: Indicate the month and day when your organization’s annual accounting period ends.

- Define organizational purpose: Clearly state the purposes of your organization and what contributions will be used for.

- Identify solicitation name: If your organization plans to use a different name for soliciting funds, provide that name along with the reason for using it.

- Previous registration: If your organization has registered previously under a different name, provide that name, last registration number, and the registration date.

- Check other registrations: Indicate whether your organization has been registered with any other authority to solicit contributions and provide the relevant details.

- Court prohibitions: Answer whether any officers or trustees have ever been prohibited from soliciting contributions, and if so, attach an explanation.

- Professional fundraisers: If using a professional fundraiser, indicate 'Yes' or 'No', and provide necessary details if 'Yes'. Attach all relevant contracts.

- Criminal history: State whether individuals with access to funds have been charged or convicted of certain crimes. If 'Yes', provide details.

- Decision-making body: Identify the individual or group responsible for distributing contributions.

- Solicitation methods: Check all applicable solicitation methods your organization will use and explain any other methods used.

- Executive contact: List the name, mailing address, and title of the chief executive or staff officer of your organization.

- List of officers: Attach a separate list of all officers, directors, or trustees along with their contact information.

- Tax-exempt status: Indicate whether the IRS has determined your organization's tax-exempt status, and attach documentation if applicable.

- Previous tax questions: State whether your tax status has ever been questioned or cancelled and attach relevant information if applicable.

- Financial information: If operational for over one year, attach Form AG990-IL or relevant Federal returns. For less than one year, attach Form CO-2.

- Contributions amount: Enter the approximate amount of contributions received during the last accounting period.

- Attach necessary documents: Ensure to attach all required documents relevant to your organization's type, such as articles of incorporation or trust instruments.

- Signatures: Obtain signatures from the President and the Chief Financial Officer or other authorized officer. All trustees must sign if a Trust.

After filling out the form, review the details to ensure accuracy before submission. This process helps maintain transparency and accountability, key principles that contribute to the integrity of charitable organizations. Once completed, send the registration statement along with all attachments to the Attorney General’s office as specified.

What You Should Know About This Form

What is the purpose of Form CO-1?

Form CO-1 serves as a registration statement required by the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. Organizations looking to solicit contributions or operate as a charitable entity in Illinois must complete this form to formally register and provide essential information about their operations.

Who needs to file Form CO-1?

Any organization that solicits contributions in Illinois or operates as a charitable entity is required to file Form CO-1. This includes corporations, trusts, and unincorporated associations. If your organization has a different name under which you solicit funds, that must also be indicated on the form.

What information must be provided on Form CO-1?

The form requires various details, including the organization's name, address, legal entity type, the purposes of the organization, annual accounting period, and information about officers and directors. It also requires documentation reflecting the organization’s legal formation, such as Articles of Incorporation or certificates of authority.

What documents need to accompany the Form CO-1 submission?

Along with Form CO-1, organizations must attach relevant documents based on their legal structure. For corporations, include Articles of Incorporation and By-Laws. Unincorporated associations must submit their constitution and By-Laws. Trusts need to attach the instrument creating the trust, and any organization must provide records of their tax-exempt status, if applicable.

Is there a fee to file Form CO-1?

The registration process itself does not require a specific filing fee, but organizations may incur costs associated with gathering necessary documents or seeking legal assistance to complete the form properly. It’s advisable to check the latest regulations or guidelines from the Illinois Attorney General’s office for any updates on fees.

When should Form CO-1 be submitted?

Form CO-1 must be filed with the Office of the Attorney General prior to starting any solicitation of contributions. If there are any changes in the information previously submitted, the organization must update the Attorney General within 10 days of the change. This ongoing requirement ensures that the Attorney General has the most current and accurate information about the organization.

What happens if an organization fails to submit Form CO-1?

If an organization does not file Form CO-1, it may face penalties, including fines or restrictions on their ability to solicit contributions in Illinois. Non-compliance can also jeopardize an organization’s standing and undermine public trust. It is crucial to meet registration requirements to operate legally and ethically.

Common mistakes

Filling out the CO-1 form correctly is crucial for organizations seeking registration in Illinois. One common mistake is providing incomplete answers. Each section of the form requires specific details, and failing to answer fully in the given space may lead to delays or rejections. It’s essential to address all applicable items thoroughly, and if space is insufficient, clearly attach additional sheets with the necessary information.

Another frequent error occurs when organizations fail to include required attachments. For instance, corporations must attach a copy of their Articles of Incorporation or Certificate of Authority. Many applicants overlook this requirement, assuming it’s unnecessary. This oversight can hinder the registration process significantly and may result in the Attorney General’s office returning the incomplete application.

Misidentifying the organization’s legal entity type also complicates matters. Organizations can be corporations, trusts, or unincorporated associations, among others. Providing incorrect information can lead to regulatory issues. Ensuring the correct legal designation is paramount, as it influences the regulatory requirements the organization must comply with.

Additionally, neglecting to provide updated information about the organization’s registered agent is a mistake that can have serious ramifications. The registered agent is responsible for receiving legal documents. If this information is not current, the organization may miss critical communications from the state, potentially affecting its standing and ability to operate.

People often forget to declare whether the organization intends to use the services of a professional fund raiser. Failing to answer this, or incorrectly indicating ‘no’ when the organization plans to engage a professional, can lead to compliance issues down the line. If the organization does plan to engage a professional, it must meet additional requirements under the law.

Finally, not disclosing any legal challenges faced by the organization or its officers can result in significant risks. The form specifically asks whether any officers have been enjoined or prohibited from soliciting contributions. Applicants should provide this information openly and attach explanations as necessary. Full transparency helps build trust with regulators and the public.

Documents used along the form

The CO-1 form plays a critical role in the registration of charitable organizations in Illinois. Along with it, several other forms and documents are often required to ensure compliance with state regulations and to maintain transparency in charitable operations. Below is a list of these documents, each fulfilling a unique purpose.

- Articles of Incorporation: This document formalizes the creation of a corporation and outlines its structure, purpose, and governance. It must be filed with the Secretary of State.

- Certificate of Authority: For foreign corporations, this certificate is necessary to authorize them to operate in Illinois. It demonstrates that the organization is legally recognized in its home state.

- By-Laws: These internal rules govern the operation of the organization, detailing procedures for meetings, voting, and management structure. By-laws provide clarity on how the organization's affairs are conducted.

- Financial Information Form CO-2: Organizations in operation for less than one year must submit this form, which provides a summary of financial information to ensure financial accountability.

- AG990-IL: Established charitable organizations must attach this form, which serves as an annual financial report to the Attorney General’s office. It details income and expenditures related to charitable activities.

- IRS Form 1023: This application for tax-exempt status must be included if the organization has obtained tax-exempt status or if such an application is pending. It verifies the organization's charitable purpose to the IRS.

- Determination Letter from the IRS: If applicable, this letter confirms the organization’s tax-exempt status. It should be attached to provide evidence of compliance with federal tax laws.

Each of these documents works in tandem with the CO-1 form to create a comprehensive picture of the organization’s legal, operational, and financial status. Ensuring that all relevant forms are correctly completed and submitted is essential for compliance and for fostering public trust in charitable organizations.

Similar forms

- Form 1023: This IRS form is used by organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Like the CO 1 form, it seeks comprehensive information about the organization's purpose, activities, and governance structure.

- Form 990: A public document required by the IRS for tax-exempt organizations. It details financial information and operational activities annually, similar to how the CO 1 form collects necessary organizational information for state registration.

- Articles of Incorporation: This foundational document outlines the creation and structure of a non-profit corporation. It is attached to the CO 1 form to establish legal entity status in alignment with state requirements.

- By-Laws: These are internal rules governing an organization's operations. The CO 1 form requires them for organizational transparency and structure, paralleling the necessity for clear operational guidelines.

- Certificate of Authority: Required for foreign corporations to operate in Illinois, this document verifies an organization's legal standing in the state, similar to the CO 1 form's need for registration details.

- Form AG990-IL: This is an annual financial reporting form for charitable organizations in Illinois. It mirrors the CO 1 form’s requirement for financial and operational transparency over the organization’s length of operation.

- Trust Instruments: These documents define the establishment of trusts. The CO 1 form requires such instruments for charitable trusts to confirm their legal formation and operational intent.

- Financial Information Form CO-2: For organizations in operation for less than one year, this form captures financial data. It parallels the CO 1 form by ensuring that even new entities provide clear financial insight.

Dos and Don'ts

When filling out the Co 1 form, it’s important to take a careful approach to ensure accuracy and compliance. Here’s a list of dos and don’ts to guide you.

What to Do:

- Do type or print your answers clearly in ink.

- Do provide all required information; if a question doesn’t apply, state that clearly.

- Do attach any necessary documents, such as the Articles of Incorporation, as specified.

- Do notify the Attorney General about any changes in your organization’s information within 10 days.

- Do keep copies of everything you submit for your records.

What Not to Do:

- Don’t leave any required sections blank; provide an explanation if necessary.

- Don’t forget to have two different authorized individuals sign the form, if applicable.

- Don’t submit the form without checking that all attachments are included.

- Don’t use a name for solicitation that differs from your registered name without proper explanation.

- Don’t assume earlier registrations are still active; always check current status before submitting.

Misconceptions

Misconceptions about the CO-1 form can lead to confusion and potential issues for charitable organizations. Here are seven common misunderstandings and clarifications for each:

- All Charitable Organizations Must Register Annually: Many people believe that they need to submit a new CO-1 form every year. In reality, organizations must only register once, as long as they inform the Attorney General about any changes within 10 days.

- Only Large Charities Need to Register: Some think that only larger organizations are required to complete the CO-1 form. This is incorrect. Every charitable organization that solicits contributions in Illinois, regardless of size, must register.

- Tax-Exempt Status Automatically Grants Registration: A common misconception is that being recognized as a tax-exempt organization by the IRS eliminates the need for CO-1 registration. However, organizations must separately register with the state, even if they are tax-exempt federally.

- Professional Fundraisers Handle Registration: Some organizations may believe that hiring a professional fundraiser absolves them from the registration responsibility. This is misleading. The organization itself is required to ensure compliance with state regulations.

- Failure to Register Is a Minor Issue: Many think that failing to submit the CO-1 form is not a serious infraction. However, not registering can lead to significant penalties, including fines and restrictions on fundraising activities.

- All Information is Confidential: There is a misconception that all information provided on the CO-1 form is confidential. In fact, some details may be public record, which means transparency is crucial in the registration process.

- You Can Submit Incomplete Forms: Some people believe that they can submit the CO-1 form without fully completing all sections. This is incorrect. The form must be filled out completely, and if there isn’t enough space, additional sheets must be attached.

By clarifying these misconceptions, organizations can better navigate the registration process and ensure compliance with state laws. Understanding the requirements can lead to a smoother experience for all involved.

Key takeaways

When filling out and using the CO-1 form for registering a charitable organization in Illinois, it is crucial to follow some key guidelines:

- Complete All Applicable Sections: Ensure that every item that applies to your organization is answered. If more space is needed, attach additional sheets as necessary.

- Notify of Changes: After registration, organizations must inform the Attorney General within 10 days about any changes in the information provided in the registration form.

- Attach Required Documents: Include necessary documents such as Articles of Incorporation, tax exemption determination letters, and financial information forms, as specified in the instructions.

- Two Signatures Required: The form must be signed by two different individuals, typically the President and Chief Financial Officer, or other authorized officers. If the entity is a Trust, all Trustees must provide their signatures.

Browse Other Templates

How to File Fafsa as Independent - Independent Reviews must be conducted by knowledgeable individuals, not integrated team members.

Pet Sitting Agreement - Pet owners are encouraged to engage in discussions about their pets' specific needs beforehand.