Fill Out Your Complaint Referral Form

The Complaint Referral form is a crucial tool for individuals seeking to report violations of federal securities laws. This form, managed by the United States Securities and Exchange Commission (SEC), caters to those who have experienced or witnessed potential misconduct within the financial sector. It gathers essential information about the complainant, including their contact details and preferred method of communication. Additionally, it allows for reporting any prior interactions with the SEC regarding the alleged violation, ensuring that the agency is well-informed about the complaint history. The form is designed to detail the individual or entity against which the complaint is made, specifying critical data like names, addresses, and business types. Complainants are encouraged to provide a thorough account of the complaint's nature, the occurrence date, and any supportive materials that enhance the credibility of their claims. Furthermore, the form includes eligibility requirements that determine the complainant's suitability for filing, making it imperative that each section is completed accurately. This structured approach not only facilitates a streamlined process for the SEC but also reassures complainants that their concerns will be addressed thoughtfully and comprehensively.

Complaint Referral Example

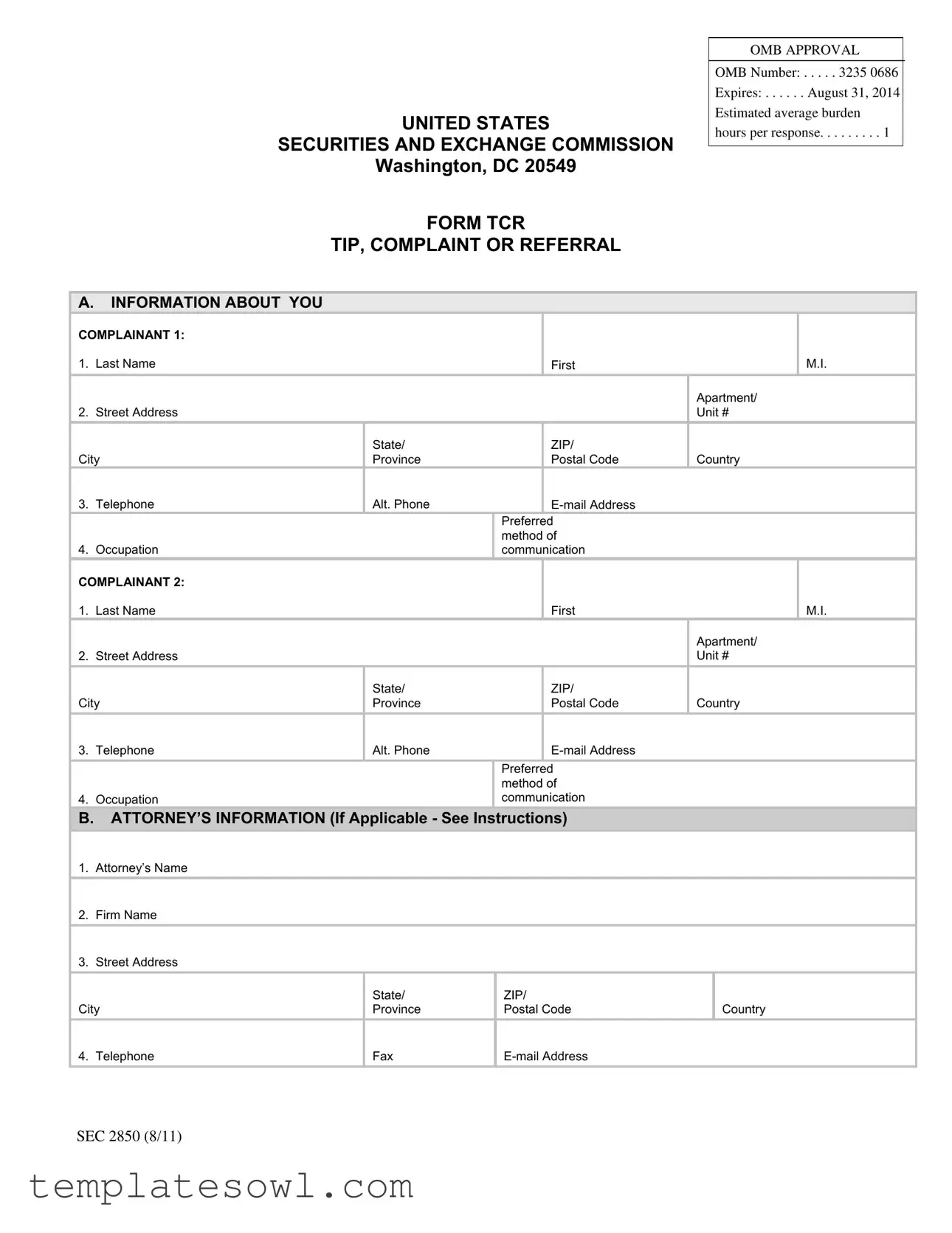

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM TCR

TIP, COMPLAINT OR REFERRAL

OMB APPROVAL

OMB Number: . . . . . 3235 0686

Expires: . . . . . . August 31, 2014 Estimated average burden hours per response. . . . . . . . . 1

A. |

INFORMATION ABOUT YOU |

|

|

|

|

|

|

COMPLAINANT 1: |

|

|

|

|

|

|

|

1. |

Last Name |

|

|

First |

|

|

M.I. |

|

|

|

|

|

Apartment/ |

||

2. |

Street Address |

|

|

|

Unit # |

||

|

|

|

|

|

|

|

|

|

|

State/ |

|

ZIP/ |

|

|

|

City |

Province |

|

Postal Code |

Country |

|||

3. |

Telephone |

Alt. Phone |

|

|

|

|

|

|

|

|

Preferred |

|

|

|

|

|

|

|

method of |

|

|

|

|

4. |

Occupation |

|

communication |

|

|

|

|

COMPLAINANT 2: |

|

|

|

|

|

|

|

1. |

Last Name |

|

|

First |

|

|

M.I. |

|

|

|

|

|

Apartment/ |

||

2. |

Street Address |

|

|

|

Unit # |

||

|

|

|

|

|

|

|

|

|

|

State/ |

|

ZIP/ |

|

|

|

City |

Province |

|

Postal Code |

Country |

|||

|

|

|

|

|

|

|

|

3. |

Telephone |

Alt. Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred |

|

|

|

|

|

|

|

method of |

|

|

|

|

4. |

Occupation |

|

communication |

|

|

|

|

B. ATTORNEY’S INFORMATION (If Applicable - See Instructions) |

|

|

|

||||

1. |

Attorney’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Firm Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State/ |

ZIP/ |

|

|

|

|

City |

Province |

Postal Code |

|

Country |

|||

|

|

|

|

|

|

|

|

4. |

Telephone |

Fax |

|

|

|

||

SEC 2850 (8/11)

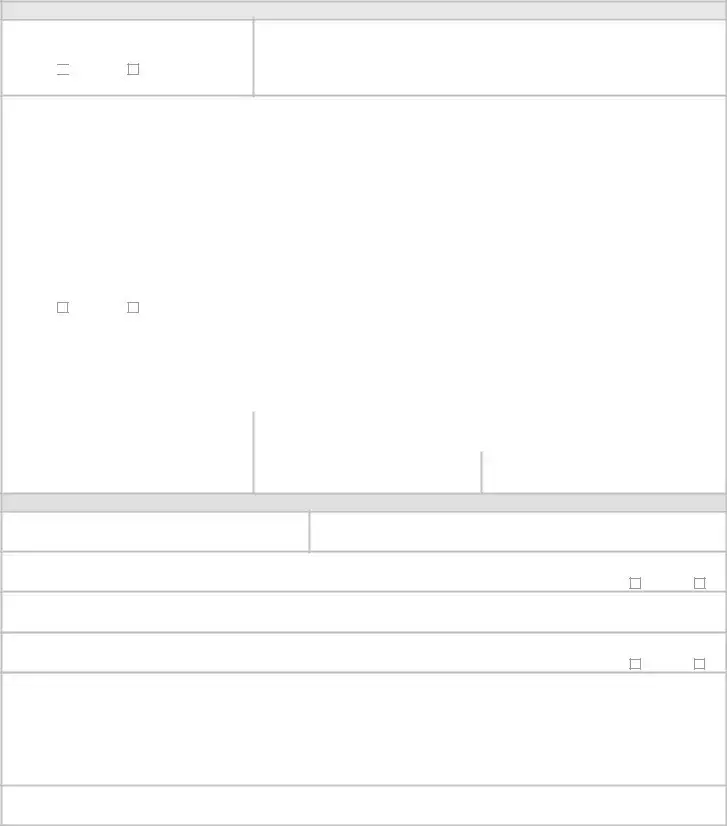

C.TELL US ABOUT THE INDIVIDUAL OR ENTITY YOU HAVE A COMPLAINT AGAINST

INDIVIDUAL/ENTITY 1:

1. Type:

Individual

Individual

Entity

If an individual, specify profession:

If an entity, specify type:

2. |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment/ |

3. |

Street Address |

|

|

|

|

Unit # |

|

|

|

|

|

|

|

|

|

|

|

|

|

State/ |

ZIP/ |

|

|

City |

|

|

Province |

Postal Code |

Country |

||

|

|

|

|

|

|

|

|

4. |

Phone |

|

|

|

Internet |

Address |

|

|

|

|

|

|

|

|

|

INDIVIDUAL/ENTITY 2: |

|

If an individual, specify profession: |

|

||||

|

|

|

|

|

|||

1. |

Type: |

Individual |

Entity |

If an entity, specify type: |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

2. |

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment/ |

|

|

|

|

|

|

|

Unit # |

3. |

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State/ |

ZIP/ |

|

|

City |

|

|

Province |

Postal Code |

Country |

||

|

|

|

|

|

|

|

|

4. Phone

Internet Address

D.TELL US ABOUT YOUR COMPLAINT

1. Occurrence Date (mm/dd/yyyy): |

/ |

/ |

2. Nature of complaint:

3a. Has the complainant or counsel had any prior communication(s) with the SEC concerning this matter? |

YES |

NO

3b. If the answer to 3a is “Yes,” name of SEC staff member with whom the complainant or counsel communicated

4a. Has the complainant or counsel provided the information to any other agency or organization, or has any other agency or organization requested the information or related information from you?

YES

NO

4b. If the answer to 4a is “Yes,” please provide details. Use additional sheets if necessary.

4c. Name and contact information for point of contact at agency or organization, if known

5a. |

Does this complaint relate to an entity of which the complainant is or was an officer, director, counsel, employee, consultant or contractor? |

|||

YES |

NO |

|

|

|

|

|

|||

5b. |

If the answer to question 5a is “Yes,” has the complainant reported this violation to his or her supervisor, compliance office, whistleblower hotline, |

|||

ombudsman, or any other available mechanism at the entity for reporting violations? |

YES |

NO |

||

5c. If the answer to question 5b is “Yes,” please provide details. Use additional sheets if necessary.

5d. Date on which the complainant took the action(s) described in question 5b (mm/dd/yyyy): |

/ |

/ |

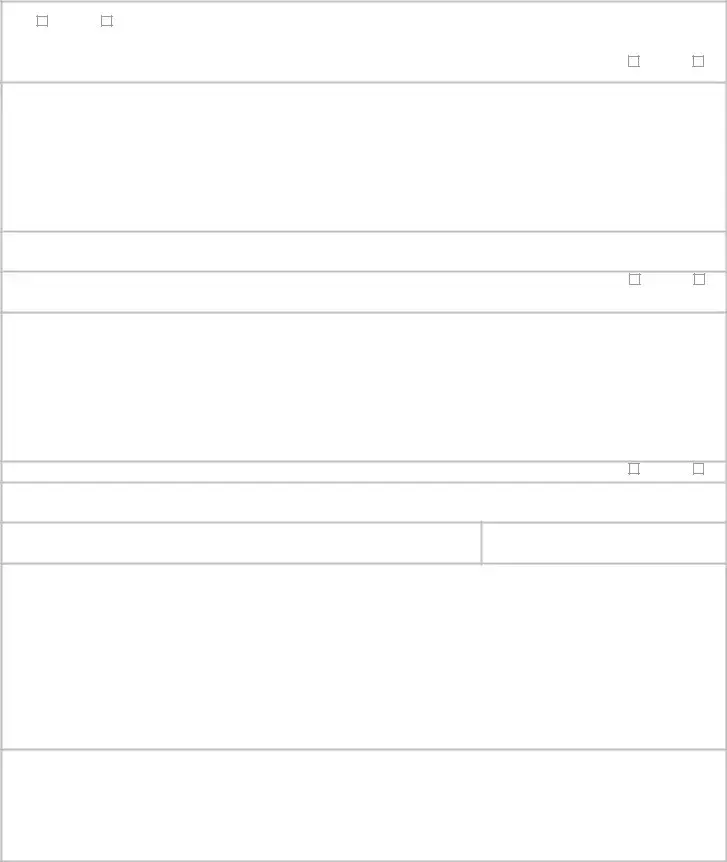

6a. Has the complainant taken any other action regarding your complaint? |

YES |

NO

6b. If the answer to question 6a is “Yes,” please provide details. Use additional sheets if necessary.

7a. Does your complaint relate to a residential |

YES |

NO |

7b. Type of security or investment, if relevant

7c. Name of issuer or security, if relevant

7d. Security/Ticker Symbol or CUSIP no.

8.State in detail all facts pertinent to the alleged violation. Explain why the complainant believes the acts described constitute a violation of the federal securities laws. Use additional sheets if necessary.

9.Describe all supporting materials in the complainant’s possession and the availability and location of any additional supporting materials not in complainant’s possession. Use additional sheets, if necessary.

10.Describe how and from whom the complainant obtained the information that supports this claim. If any information was obtained from an attorney or in a communication where an attorney was present, identify such information with as much particularity as possible. In addition, if any information was obtained from a public source, identify the source with as much particularity as possible. Attach additional sheets if necessary.

11.Identify with particularity any documents or other information in your submission that you believe could reasonably be expected to reveal your identity and explain the basis for your belief that your identity would be revealed if the documents were disclosed to a third party.

12. Provide any additional information you think may be relevant.

E.ELIGIBILITY REQUIREMENTS AND OTHER INFORMATION

1.Are you, or were you at the time you acquired the original information you are submitting to us, a member, officer or employee of the Department of Justice, the Securities and Exchange Commission, the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision; the Public Company Accounting Oversight Board; any law enforcement organization; or any national securities exchange, registered securities association, registered clearing agency, or the Municipal Securities Rulemaking Board?

YES

NO

2.Are you, or were you at the time you acquired the original information you are submitting to us, a member, officer or employee of a foreign government, any political subdivision, department, agency, or instrumentality of a foreign government, or any other foreign financial regulatory authority as that term is defined in Section 3(a)(52) of the Securities Exchange Act of 1934 (15 U.S.C. §78c(a)(52))?

YES

NO

3.Did you acquire the information being provided to us through the performance of an engagement required under the federal securities laws by an independent public accountant?

YES

NO

4. Are you providing this information pursuant to a cooperation agreement with the SEC or another agency or organization?

YES

NO

5.Are you a spouse, parent, child, or sibling of a member or employee of the SEC, or do you reside in the same household as a member or employee of the SEC?

YES

NO

6. Did you acquire the information being provided to us from any person described in questions 1 through 5?

YES

NO

7.Have you or anyone representing you received any request, inquiry or demand that relates to the subject matter of your submission (i) from the SEC,

(ii)in connection with an investigation, inspection or examination by the Public Company Accounting Oversight Board, or any

YES

NO

8.Are you currently a subject or target of a criminal investigation, or have you been convicted of a criminal violation, in connection with the information you are submitting to the SEC?

YES

NO

9.If you answered “yes” to any of the questions 1 through 8, use this space to provide additional details relating to your responses. Use additional sheets if necessary.

F. WHISTLEBLOWER’S DECLARATION

I declare under penalty of perjury under the laws of the United States that the information contained herein is true, correct and complete to the best of my knowledge, information and belief. I fully understand that I may be subject to prosecution and ineligible for a whistleblower award if, in my submission of information, my other dealings with the SEC, or my dealings with another authority in connection with a related action, I knowingly and willfully make any false, fictitious, or fraudulent statements or representations, or use any false writing or document knowing that the writing or document contains any false, fictitious, or fraudulent statement or entry.

Print name

Signature

Date

G. COUNSEL CERTIFICATION (If

I certify that I have reviewed this form for completeness and accuracy and that the information contained herein is true, correct and complete to the best of my knowledge, information and belief. I further certify that I have verified the identity of the whistleblower on whose behalf this form is being submitted by viewing the whistleblower’s valid, unexpired government issued identification (e.g., driver’s license, passport) and will retain an original, signed copy of this form, with Section F signed by the whistleblower, in my records. I further certify that I have obtained the whistleblower’s non- waiveable consent to provide the Commission with his or her original signed Form TCR upon request in the event that the Commission requests it due to concerns that the whistleblower may have knowingly and willfully made false, fictitious, or fraudulent statements or representations, or used any false writing or document knowing that the writing or document contains any false fictitious or fraudulent statement or entry; and that I consent to be legally obligated to do so within 7 calendar days of receiving such a request from the Commission.

Signature

Date

Privacy Act Statement

This notice is given under the Privacy Act of 1974. This form may be used by anyone wishing to provide the SEC with information concerning a possible violation of the federal securities laws. We are authorized to request information from you by various laws: Sections 19 and 20 of the Securities Act of 1933, Sections 21 and 21F of the Securities Exchange Act of 1934, Section 321 of the Trust Indenture Act of 1939, Section 42 of the Investment Company Act of 1940, Section 209 of the Investment Advisers Act of 1940 and Title 17 of the Code of Federal Regulations, Section 202.5.

Our principal purpose in requesting information is to gather facts in order to determine whether any person has violated, is violating, or is about to violate any provision of the federal securities laws or rules for which we have enforcement authority. Facts developed may, however, constitute violations of other laws or rules. Further, if you are submitting information for the SEC’s whistleblower award program pursuant to Section 21F of the Securities Exchange Act of 1934 (Exchange Act), the information provided will be used in connection with our evaluation of your or your client’s eligibility and other factors relevant to our determination of whether to pay an award to you or your client.

The information provided may be used by SEC personnel for purposes of investigating possible violations of, or to conduct investigations authorized by, the federal securities law; in proceedings in which the federal securities laws are in issue or the SEC is a party; to coordinate law enforcement activities between the SEC and other federal, state, local or foreign law enforcement agencies, securities self regulatory organizations, and foreign securities authorities; and pursuant to other routine uses as described in

Furnishing the information requested herein is voluntary. However, a decision not provide any of the requested information, or failure to provide complete information, may affect our evaluation of your submission. Further, if you are submitting this information for the SEC whistleblower program and you do not execute the Whistleblower Declaration or, if you are submitting information anonymously, identify the attorney representing you in this matter, you may not be considered for an award.

Questions concerning this form maybe directed to the SEC Office of the Whistleblower, 100 F Street, NE,

Washington, DC 20549, Tel. (202)

Submission Procedures

After manually completing this Form TCR, please send it by mail or delivery to the SEC Office of the Whistleblower, 100 F Street, NE, Washington, DC 20549, or by facsimile to (703)

You have the right to submit information anonymously. If you are submitting anonymously and you want to be considered for a whistleblower award, however, you must (1) be represented by an attorney in this matter and (2) complete Sections B and G of this form. If you are not submitting anonymously, you may, but are not required to, have an attorney. If you are not represented by an attorney in this matter, you may leave Sections B and G blank.

If you are submitting information for the SEC’s whistleblower award program, you MUST submit your information either using this Form TCR or electronically through the SEC’s Tips, Complaints and Referrals Portal, available on the SEC web site at https://denebleo.sec.gov/TCRExternal/index.xhtml.

Instructions for Completing Form TCR:

Section A: Information about You

Questions

Last name, first name, and middle initial

Complete address, including city, state and zip code

Telephone number and, if available, an alternate number where you can be reached

Your

Your preferred method of communication; and

Your occupation

For more than two complainants, use additional sheets as necessary to provide the required information for each complainant.

Section B: Information about Your Attorney. Complete this section only if you are represented by an attorney in this matter. You must be represented by an attorney, and this section must be completed, if you are submitting your information anonymously and you want to be considered for the SEC’s whistleblower award program.

Questions

Attorney’s name

Firm name

Complete address, including city, state and zip code

Telephone number and fax number, and

Section C: Tell Us about the Individual and/or Entity You Have a Complaint Against. If your complaint relates to more than two individuals and/or entities, you may attach additional sheets.

Question 1: Choose one of the following that best describes the individual or entity to which your complaint relates:

For Individuals: accountant, analyst, attorney, auditor, broker, compliance officer, employee, executive officer or director, financial planner, fund manager, investment advisor representative, stock promoter, trustee, unknown, or other (specify).

For Entity: bank,

fund), private/closely held company, publicly held company, transfer agent/paying agent/registrar, underwriter, unknown, or other (specify).

Questions

Full name

Complete address, including city, state and zip code

Telephone number,

Internet address, if applicable

Section D: Tell Us about Your Complaint

Question 1: State the date (mm/dd/yyyy) that the alleged conduct began.

Question 2: Choose the option that you believe best describes the nature of your complaint. If you are alleging more than one violation, please list all that you believe may apply. Use additional sheets if necessary.

Theft/misappropriation (advance fee fraud; lost or stolen securities; hacking of account)

Misrepresentation/omission (false/misleading marketing/sales literature; inaccurate, misleading or

Offering fraud (Ponzi/pyramid scheme; other offering fraud)

Registration violations (unregistered securities offering)

Trading (after hours trading; algorithmic trading;

Corporate disclosure/reporting/other issuer matter (audit; corporate governance; conflicts of interest by management; executive compensation; failure to notify shareholders of corporate events; false/misleading financial statements, offering documents, press releases, proxy materials; failure to file reports; financial fraud; Foreign Corrupt Practices Act violations; going private transactions; mergers and acquisitions; restrictive legends,

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Complaint Referral form is designed for individuals to report potential violations of federal securities laws. |

| Governing Entity | The form is governed by the United States Securities and Exchange Commission (SEC). |

| OMB Approval | This form has OMB approval under number 3235-0686, ensuring compliance with federal information requirements. |

| Estimated Time | Individuals should expect to spend approximately 1 hour completing the form. |

| Multiple Complainants | The form accommodates multiple complainants, allowing both individual and entity details to be included. |

| Prior Communications | Complainants are prompted to disclose any prior communication with the SEC regarding the matter. |

| Eligibility Requirements | The form includes specific eligibility questions to determine if the complainant may be disqualified based on their professional background. |

| Confidentiality Concerns | Complainants can identify documents that may reveal their identity and explain their concerns regarding disclosure. |

Guidelines on Utilizing Complaint Referral

Filling out the Complaint Referral form is an essential step in addressing any grievances you may have with an individual or entity regarding potential violations of federal securities laws. After completing the form, you will submit it to the appropriate authorities for review. Here are the steps to accurately fill out the form.

- Begin by entering your personal information in the "Information About You" section. Complete the details for the first complainant including last name, first name, middle initial, address, city, state, ZIP code, country, telephone number, alternate phone number, email address, preferred method of communication, and occupation.

- If there is a second complainant, repeat the above step for "Complainant 2." Fill in all relevant details.

- In the "Attorney’s Information" section, provide information if applicable, including attorney’s name, firm name, address, telephone number, fax number, and email address.

- Proceed to the "Tell Us About the Individual or Entity You Have a Complaint Against" section. Specify whether the organization or individual you are complaining about is an "Individual" or an "Entity." Provide their name, address, phone number, email, and internet address if available.

- If there is a second individual or entity, fill in their information in the same way.

- In the "Tell Us About Your Complaint" section, provide the date of the occurrence, the nature of the complaint, and respond to the questions about prior communications with the SEC and other agencies.

- Answer the questions relating to whether your complaint involves your previous position in the entity and any reporting of violations you may have conducted. Document the date of any actions taken.

- Answer additional questions about supporting materials and how information was acquired. Include details about how your identity could be revealed through the documents you supply.

- If applicable, respond to the eligibility requirements regarding affiliations with government agencies or previous investigations related to your information.

After completing all sections, review your form for accuracy and completeness before submitting it. Be certain to keep copies of any attached documentation or notes that you reference in the form.

What You Should Know About This Form

What is the Complaint Referral form used for?

The Complaint Referral form, officially designated as Form TCR, is utilized to report potential violations of federal securities laws to the United States Securities and Exchange Commission (SEC). Individuals or entities who believe they have witnessed or been subjected to misconduct in the securities industry should complete this form to provide detailed information regarding their complaints. This enables the SEC to assess the allegations and take appropriate action when necessary.

Who can file a complaint using the Complaint Referral form?

Any individual or entity with information about securities law violations can submit a complaint using this form. This includes those directly affected by the alleged misconduct or witnesses to such actions. Legal representatives may also file complaints on behalf of their clients. It's important to provide full and accurate information to enable the SEC to understand and investigate the complaint effectively.

What information is required on the Complaint Referral form?

The form requires several pieces of information, including the complainant's details (name, contact information, occupation), a description of the alleged violator (individual or entity), and details about the nature of the complaint. Complainants must specify any prior communication they had with the SEC regarding the matter and whether they have shared the information with other agencies. Supporting details and documents related to the complaint also need to be provided to facilitate the investigation.

How does the SEC handle complaints submitted through the Complaint Referral form?

Once a complaint is submitted via the Complaint Referral form, it is reviewed by the SEC staff. The information provided is assessed for its relevance and validity. Depending on the circumstances, the SEC may initiate an investigation, provide guidance to the complainant, or possibly refer the matter to another agency if it's outside their jurisdiction. The complainant may not receive updates on the status of the complaint due to confidentiality and regulatory protocols.

Common mistakes

Filling out the Complaint Referral form can be a straightforward process, but many individuals still make common mistakes that can hinder their submission. One pivotal error occurs during the input of personal information. For example, individuals often forget to provide complete names or accurate contact details. Omitting even a single digit from a phone number can lead to confusion and prevent important follow-ups from taking place.

Another frequent oversight is inadequately addressing the nature of the complaint. Individuals sometimes fail to clearly articulate their complaint or provide insufficient details. A vague description of events leaves the reviewing team without enough context to understand the issue, which may delay or even complicate the assessment process.

People also tend to neglect the section that asks whether they have communicated with the SEC about the complaint before. Not indicating prior communications can raise red flags. Moreover, if individuals answered “Yes” but left the name of the SEC staff member blank, this may complicate matters further.

Supporting materials are crucial in substantiating a complaint. However, many submitters do not provide a thorough description of these materials or mention where additional documents can be found. Details about what evidence is available are essential for a comprehensive review. Simply stating "I have supporting documents" without specifics is inadequate.

Furthermore, respondents often miss the eligibility requirements section entirely. Ignoring these questions could lead to misunderstandings about the submission's validity. For instance, failing to answer whether they are a member of certain regulatory bodies may impact the processing of their complaint.

Another error involves improperly identifying sensitive information that may reveal the complainant's identity. This issue is significant because failing to mention documents that could potentially link back to them defeats the purpose of filing confidentially. Individuals must clearly specify any documents that may expose their identity and explain why.

Sometimes, submitters don’t provide their occupation or neglect to fill in the preferred method of communication, which are both helpful in guiding subsequent interactions. Although these may seem like small details, they can greatly enhance communication effectiveness. In adding details, clarity assists the reviewing body in swiftly resolving the matter.

Finally, another common mistake is failing to proofread the entire form for accuracy. Simple spelling or grammatical errors can change the interpretation of the information. Taking a moment to review the complete form ensures all submitted information is correct and conveys the intended message clearly.

Documents used along the form

The filing of a Complaint Referral form often leads to the need for additional documents that substantiate the complaint or provide context. Below is a list of other commonly used forms and documents that may accompany the Complaint Referral form, along with a brief description of each:

- Incident Report: This document details the circumstances surrounding the complaint, including dates, times, and locations of the events in question. It serves as a narrative account that helps the reviewing authority understand the background of the situation.

- Witness Statements: Statements from individuals who witnessed the events related to the complaint. These statements can provide corroborating details that support the complainant's claims.

- Financial Records: This includes bank statements, transaction records, or other financial documents that may be relevant to the alleged violation. Such records can reveal financial misconduct or irregularities.

- Correspondence Logs: A record of all communications related to the complaint. This log can include emails, letters, or messages exchanged between the complainant and relevant parties concerning the matter.

- Prior Complaints: Any historical complaints filed by the same complainant against similar issues. Reviewing these can indicate patterns or repeat violations by the same individual or entity.

- Legal Notices: Documents that inform the parties involved about legal proceedings or actions. This can include notices of potential legal action being taken or prior judgements related to the issue at hand.

- Expert Analysis: Reports or assessments provided by experts that analyze the situation from a technical standpoint. This may include financial analysts or compliance specialists reviewing the actions taken by the respondent.

- Whistleblower Documentation: This includes forms or statements that outline the whistleblower's identity and any protections they may seek under applicable laws. It is crucial for ensuring confidentiality and protection from retaliation.

- Supporting Exhibits: Additional evidence that the complainant might have, such as photographs, recordings, or documents that substantiate the claims made in the Complaint Referral form.

Each of these documents plays a vital role in building a comprehensive case and may be necessary for the proper evaluation of the complaint. When gathering and submitting these materials, ensure that they are accurate and complete to aid in the investigation process.

Similar forms

-

Whistleblower Submission Form: Similar to the Complaint Referral form, a Whistleblower Submission Form allows individuals to report violations of securities laws. Both documents require detailed information about the incident, including the nature of the complaint and any supporting materials. This helps ensure that the relevant authorities can adequately investigate the claims made.

-

Formal Complaint Form: Like the Complaint Referral form, a Formal Complaint Form is designed to present allegations formally. Each requires the complainant to provide personal details and a thorough explanation of the complaint, facilitating a clear understanding of the situation at hand.

-

Incident Report: An Incident Report shares similarities with the Complaint Referral form in that it documents specific events or actions that prompted a concern. Both seek to gather facts and observations for further evaluation, often including the same kind of contextual information to illuminate the complaint’s basis.

-

Consumer Complaint Form: The Consumer Complaint Form functions similarly to the Complaint Referral form by allowing individuals to submit grievances about goods or services. Both forms require personal information and details about the complaint to ensure that the issue can be addressed appropriately by the relevant agencies.

Dos and Don'ts

When completing the Complaint Referral form, it's crucial to follow certain guidelines to ensure your submission is effective and complete. Here’s a summary of what you should and shouldn’t do:

- Do provide accurate and complete personal information.

- Do describe your complaint in detail, including all relevant facts.

- Do include any supporting materials you have or mention where they can be found.

- Do specify if you have communicated with any SEC staff regarding your complaint.

- Do clarify the nature of your complaint and the relevant laws you believe were violated.

- Don't omit any prior actions you've taken, as this can affect your case.

- Don't include vague allegations; ensure that your claims are specific and well-documented.

- Don't rush through the form; take your time to ensure clarity and coherence.

- Don't provide information that could compromise your identity unless necessary.

By adhering to these do’s and don’ts, you can increase the likelihood that your complaint will be taken seriously and addressed promptly.

Misconceptions

There are several misconceptions surrounding the Complaint Referral form that can lead to confusion for potential complainants. It is crucial to clarify these misconceptions to ensure that individuals understand how to effectively submit their complaints. Below is a list of common misunderstandings:

- The form is only for lawyers. Many believe that only attorneys can submit the Complaint Referral form. In reality, individuals can use the form without legal representation.

- You must have concrete evidence to file a complaint. A common belief is that only complaints backed by irrefutable evidence will be accepted. However, the form allows complainants to submit allegations based on reasonable belief, even if not all the evidence is present at the time of submission.

- All complaints will be resolved quickly. Some might think that once they submit their complaints, immediate action will be taken. The SEC processes complaints but responses can take time depending on the complexity of the case.

- Filing a complaint guarantees anonymity. While the SEC often protects the identities of complainants, those who wish to remain anonymous should specifically indicate this on the form, as certain circumstances might necessitate disclosure.

- You can only complain about large corporations. Many assume that the Complaint Referral form is only for major companies. However, individuals can file complaints against both individuals and entities, regardless of their size.

- The SEC only deals with investment-related complaints. People often think that the SEC's jurisdiction is limited to investment issues. Yet, the SEC addresses a wide range of securities law violations that may occur in various contexts.

- There is a fee to file a complaint. Some individuals worry about incurring costs when submitting a complaint. In truth, filing the Complaint Referral form is free of charge.

- You must submit the form in person. It’s a common myth that the form has to be physically delivered to the SEC. In fact, individuals can submit the form electronically, making it more accessible.

- Past complaints will hurt your chances of filing a new one. Many victims fear that previous complaints could negatively affect their new submissions. This is not the case; every complaint is evaluated based on its own merits.

Understanding these misconceptions is vital for individuals considering submitting their complaints. It ensures that they approach the Complaint Referral process with clear expectations and can effectively communicate their concerns to the SEC.

Key takeaways

Complete all required sections of the Complaint Referral form. Your information is vital for the SEC to understand your concerns.

Be honest and thorough in describing your complaint. Details help to clarify the situation and support your case.

Provide supporting materials when possible. These can include documents or correspondence that back up your claims.

Check for any previous communications with the SEC regarding the same matter. This ensures you don’t duplicate efforts and aids in the review process.

Ensure that you meet the eligibility requirements before submitting. This may affect your case's handling and outcome.