Fill Out Your Cr Q1 Form

The Cr Q1 form is an essential document for landlords and property owners operating in New York City, specifically designed for the first quarter of the tax year. Covering the tax period from June 1, 2020, to August 31, 2020, this form is used to report and pay the Commercial Rent Tax due for commercial properties. Completing the Cr Q1 form requires attention to detail, as it captures various information including the business name, address, telephone number, and tax identification numbers. Additionally, it delineates the account type and outlines the tax periods, those being critical to ensure compliance. Property owners must calculate their total base rent and tax liabilities based on rental income, with specific considerations for credits available for small businesses. The form also includes sections for listing premises, calculating deductions and exclusions, and reporting any necessary changes in business mailing addresses. Timely and accurate submission of the Cr Q1 helps confirm that all financial obligations to the city are met, granting peace of mind to property owners while fulfilling civic duties.

Cr Q1 Example

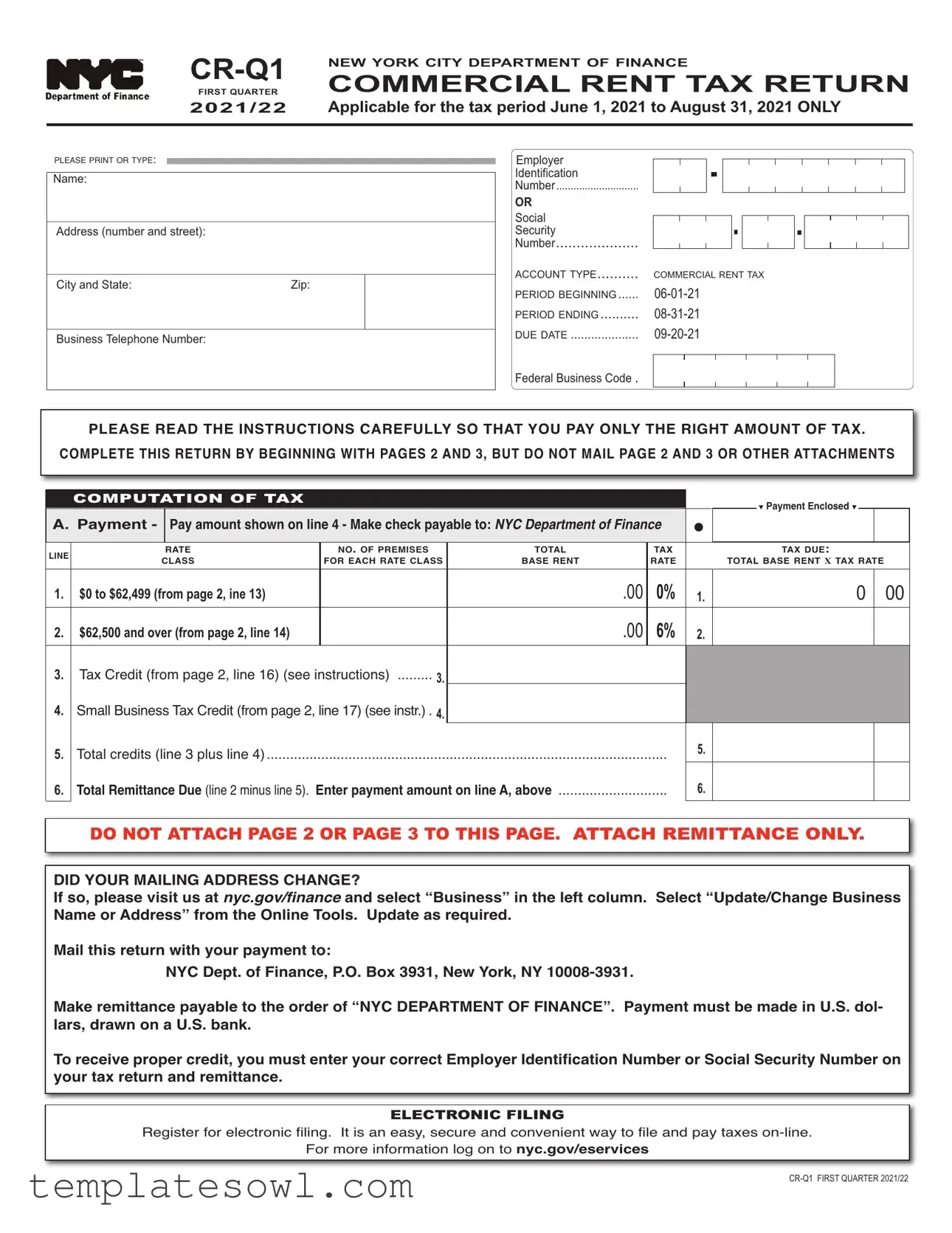

NEW YORK CITY DEPARTMENT OF FINANCE |

||

COMMERCIAL RENT TAX RETURN |

||

FIRST QUARTER |

2021/22 Applicable for the tax period June 1, 2021 to August 31, 2021 ONLY

PLEASE PRINT OR TYPE:

Name:

_________________________________________________________________________________

Address (number and street):

_________________________________________________________________________________

City and State: |

Zip: |

_________________________________________________________________________________ |

|

Business Telephone Number: |

|

Employer

Identification

Number .............................

OR

Social

Security

Number....................

ACCOUNT TYPE |

COMMERCIAL RENT TAX |

PERIOD BEGINNING |

|

PERIOD ENDING |

|

DUE DATE |

Federal Business Code .

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE RIGHT AMOUNT OF TAX.

COMPLETE THIS RETURN BY BEGINNING WITH PAGES 2 AND 3, BUT DO NOT MAIL PAGE 2 AND 3 OR OTHER ATTACHMENTS

|

COMPUTATION OF TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t Payment Enclosed t |

|

|

|

||

A. Payment - |

Pay amount shown on line 4 - Make check payable to: NYC Department of Finance |

l |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

LINE |

|

RATE |

NO. OF PREMISES |

|

TOTAL |

TAX |

|

|

TAX DUE: |

|

||

CLASS |

FOR EACH RATE CLASS |

BASE RENT |

RATE |

|

TOTAL BASE RENT X TAX RATE |

|

||||||

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

$0 to $62,499 (from page 2, ine 13) |

|

|

.00 |

0% |

1. |

0 |

00 |

|

|||

2. |

$62,500 and over (from page 2, line 14) |

|

|

.00 |

6% |

2. |

|

|

|

|

|

|

3. |

.........Tax Credit (from page 2, line 16) (see instructions) |

3. |

|

|

|

|

|

|

|

|

||

4. |

Small Business Tax Credit (from page 2, line 17) (see instr.) . 4. |

|

|

|

|

|

|

|

|

|||

5. |

.......................................................................................................Total credits (line 3 plus line 4) |

|

|

|

|

5. |

|

|

|

|

|

|

6. Total Remittance Due (line 2 minus line 5). Enter payment amount on line A, above ............................

6.

DO NOT ATTACH PAGE 2 OR PAGE 3 TO THIS PAGE. ATTACH REMITTANCE ONLY.

DID YOUR MAILING ADDRESS CHANGE?

If so, please visit us at nyc.gov/finance and select “Business” in the left column. Select “Update/Change Business Name or Address” from the Online Tools. Update as required.

Mail this return with your payment to:

NYC Dept. of Finance, P.O. Box 3931, New York, NY

Make remittance payable to the order of “NYC DEPARTMENT OF FINANCE”. Payment must be made in U.S. dol- lars, drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number or Social Security Number on your tax return and remittance.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file and pay taxes

For more information log on to nyc.gov/eservices

Form |

Page 2 |

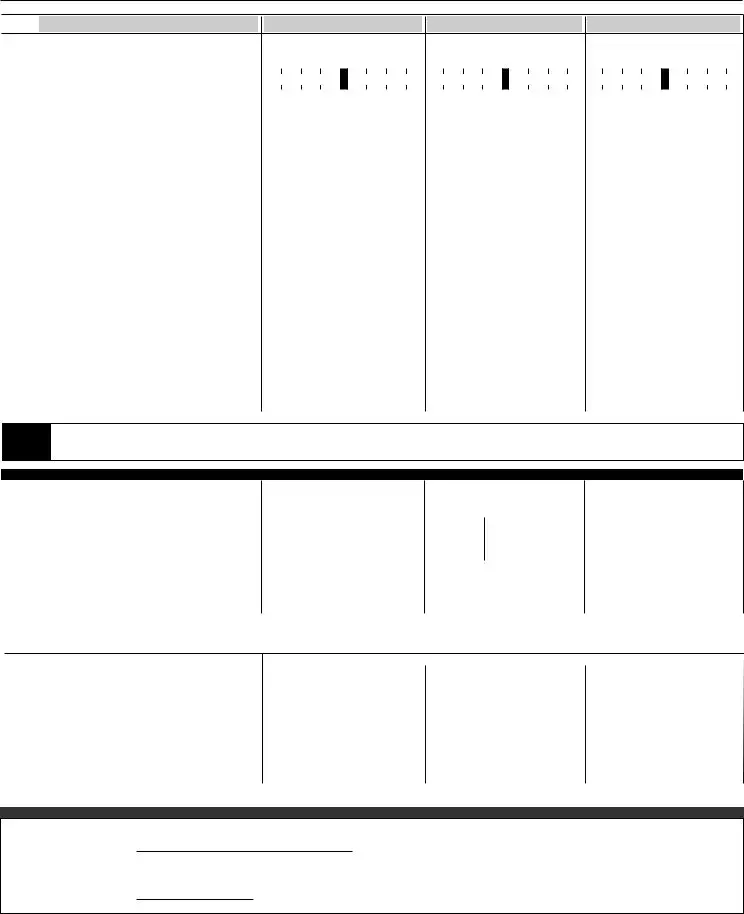

YOU MAY FILE ELECTRONICALLY AT NYC.GOV/ESERVICES. IF YOU ARE FILING ON PAPER, USE THIS PAGE IF YOU HAVE THREE OR LESS PREM- ISES/SUBTENANTS OR MAKE COPIES OF THIS PAGE IF YOU HAVE ADDITIONAL PREMISES/SUBTENANTS. IF YOU CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE CRA.FINANCE SUPPLEMENTAL SPREADSHEET WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

EACH LINE MUST BE ACCURATELY COMPLETED. YOUR DEDUCTION WILL BE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

|

LINE |

DESCRIPTION |

|

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

||||

l |

1a. |

Street Address ................................................................ 1a. |

|

|

|

|

|

|

||

|

1b. |

Zip Code ..........................................................................1b. |

________________________________________________________________________________________ |

|||||||

|

1c/d. Block and Lot Number ...............................................1c/1d. ________________________________________________________________________________________ |

|||||||||

|

|

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

l |

2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

||||||

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

4a1. |

SUBTENANT'S Name if Partnership or Corporation |

4a1. |

________________________________________________________________________________________ |

|

(if more than one subtenant, see instructions) |

l4a2. Employer Identification Number (EIN) for

|

partnerships or corporations |

4a2. |

l EIN ________________________ l EIN ________________________ l EIN _______________________ |

4b1. |

SUBTENANT'S Name if Individual |

4b1. |

________________________________________________________________________________________ |

4b2. |

Social Security Number (SSN) for individuals |

4b2. |

l SSN _______________________ l SSN _______________________ l SSN _______________________ |

4c. |

Rent received from SUBTENANT |

4c. |

|

|

(if more than one subtenant, see instructions) |

___________________________________________________________________________________________________ |

|

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

5b. |

Commercial Revitalization Program |

5b. |

________________________________________________________________________________________ |

|

special reduction (see instructions) |

||

6. |

Total Deductions (add lines 3, 4c, 5a and 5b) |

6. |

________________________________________________________________________________________ |

7.Base Rent Before Rent Reduction (line 2 minus line 6)...7. ________________________________________________________________________________________

8. |

35% Rent Reduction (35% X line 7) |

8. ________________________________________________________________________________________ |

9. |

Base Rent Subject to Tax (line 7 minus line 8) |

9. ________________________________________________________________________________________ |

NOTE

4If the line 7 amount represents rent for less than the full

4If the line 7 amount plus the line 5b amount is $62,499 or less and represents rent for a full

COMPLETE LINES 10 THROUGH 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE

10.Tenants whose rent is not paid on a monthly basis,

|

check box and see instructions. Others complete |

■ |

■ |

■ |

|||||

|

lines 10a through 12 |

10. __________________________________________________________________________________________ |

|||||||

10a. |

Number of Months at Premises during the tax period |

10b. From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

10c. To: |

|

10c. To: |

|

|

10c. To: |

|

11. |

Monthly Base Rent before rent reduction |

_________________________________________________________________________________________________________________ |

|

||||||

|

(line 7 plus line 5b divided by line 10a) |

||||||||

12.Quarterly Base Rent before rent reduction

(line 11 X 3 months) |

12. ________________________________________________________________________________________ |

■If the line 12 amount is $62,499 or less, transfer the line 9 amount (not the line 12 amount) to line 13

■If the line 12 amount is $62,500 or more, transfer the line 9 amount (not the line 12 amount) to line 14

|

|

RATE CLASS |

|

TAX RATE |

|

TRANSFER THE AMOUNTS FROM LINES 13 THROUGH 17 TO THE CORRESPONDING LINES ON PAGE 1 |

13. ($0 - 62,499) |

0% |

13.________________________________________________________________________________________ |

||||

14. ($62,500 or more) |

6% |

14.________________________________________________________________________________________ |

||||

15.Tax Due before credit (line 14 multiplied by 6%).............15.________________________________________________________________________________________

16. |

Tax Credit (see worksheet below) |

................................................. |

16.________________________________________________________________________________________ |

17. |

Small Business Tax Credit |

(from...........................pg. 3, or |

17.________________________________________________________________________________________ |

|

supplemental spreadsheet) (see instructions) |

||

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $62,500, but is less than $75,000. All others enter zero.

Tax Credit Computation Worksheet

■If the line 7 amount represents rent for the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000 minus the sum of lines 7 and 5b) = _____________ = your credit

$12,500

■If the line 7 amount represents rent for less than the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000 minus line 12) = _____________ = your credit

$12,500

Form |

Page 3 |

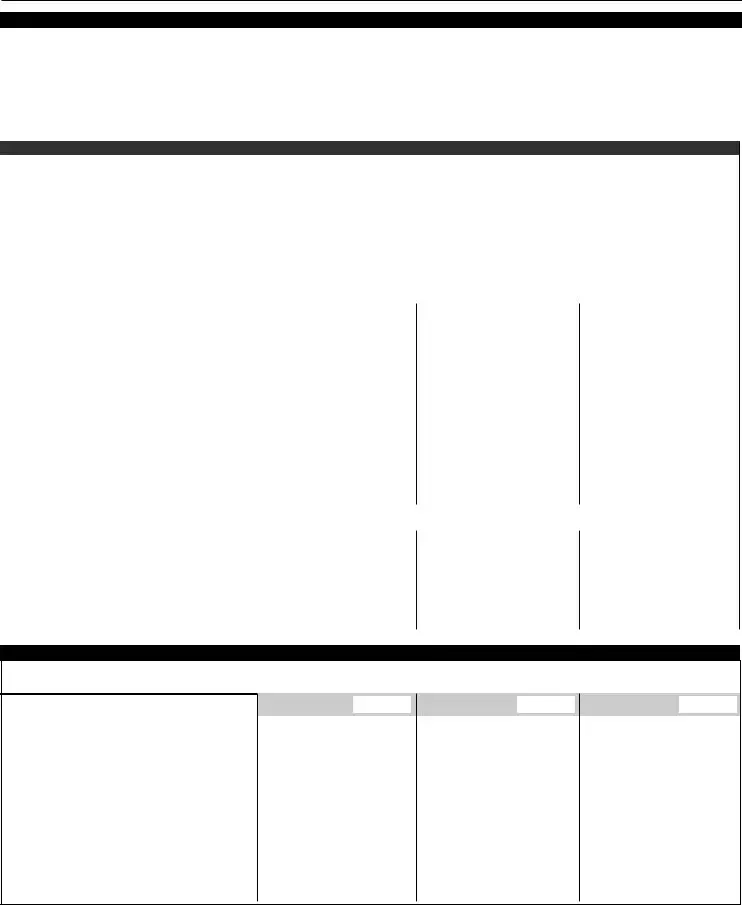

IF YOU ARE FILING ON PAPER, USE THIS PAGE IF YOU HAVE THREE OR LESS PREMISES OR MAKE COPIES IF YOU HAVE ADDITIONAL PREMISES. IF YOU CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE SUPPLEMENTAL SMALL BUSI- NESS TAX CREDIT WORKSHEET WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

SMALL BUSINESS TAX CREDIT WORKSHEET

A. |

Is your "total income" as defined by Ad. Code Section |

■ YES |

■ NO |

|

If your answer to Question A is NO, you are not eligible for this credit. |

|

|

B. |

Is your "Base Rent Before Rent Reduction" (page 2, line 7) for any premises at least $62,500 but less than $137,500? ... |

■ YES |

■ NO |

If the answer to this Question is NO for any of the premises, you are not eligible for this credit for those premises whose Base Rent Before Reduction is either less than $62,500 or equal to or greater than $137,500 and you should not complete this worksheet for those premises.

INCOME FACTOR CALCULATIONS - Complete either lines 1a and 1b OR lines 2a and 2b

1a. |

Enter amount of total income, if total income is $5,000,000 or less (see instructions) |

|

1a. |

______________________________________ |

|||||||

1b. |

Income factor (see instructions) |

|

|

|

|

1b. |

______________________________________ |

||||

2a. Enter amount of total income if total income ...........................................................................................................is more than $5,000,000 |

|

2a. |

|

|

|

|

|||||

|

but less than $10,000,000 (see instructions) |

|

|

|

|

|

______________________________________ |

||||

2b. |

If total income is more than $5,000,000 but less than................................................................................................$10,000,000: |

|

2b. |

|

|

|

|

||||

|

Income Factor is (10,000,000 - line 2a) / 5,000,000 |

|

|

|

|

______________________________________ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

RENT FACTOR CALCULATIONS - Complete either lines 3a and 3b OR lines 4a and 4b |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

3a. Enter amount of base rent, if base |

|

PREMISES |

|

|

PREMISES |

|

|

PREMISES |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

rent from Page....................................................2, line 7 is less |

3a. |

KEEP |

THIS PAGE |

|||||||

|

than $125,000 |

_________________________________________________________________________________________ |

|||||||||

3b. |

Rent factor (see instructions) |

3b. |

_________________________________________________________________________________________ |

||||||||

4a. Enter amount of base rent if base rent |

|

FOR YOUR RECORDS. |

|||||||||

|

(see instructions) |

||||||||||

|

from Page 2, line 7 is at least |

|

|

|

|

|

|

|

|

|

|

|

$125,000 but less than $137,500 |

4a. |

_________________________________________________________________________________________ |

||||||||

|

|

||||||||||

4b. |

If base rent from Page 2, line 7 is at least |

|

DO NOT FILE |

||||||||

|

$125,000 but less than $137,500: |

4b. |

|||||||||

|

Rent Factor is ($137,500 - line 4a) / 12,500 |

_________________________________________________________________________________________ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT CALCULATION |

|

|

|

|

|

|

|

|

|

|

5a. Page 2, line 15 (Tax at 6%) ...............................5a. |

_________________________________________________________________________________________ |

||||||||||

5b. |

Page 2, line 16 (Tax Credit from Tax .......5b. |

|

|

|

|

|

|

|

|

|

|

|

Credit Computation Worksheet on Page 2) |

_________________________________________________________________________________________ |

|||||||||

5c. (line 5a - line 5b) X (line 1b or 2b) X (line 3b or 4b). |

|

|

|

|

|

|

|

|

|

||

|

Enter here and on Page 2, line 17.....................5c. |

_________________________________________________________________________________________ |

|||||||||

WORKSHEET FOR TENANTS WHO PAY RENT FOR A PERIOD OTHER THAN ONE MONTH (SEE INSTRUCTIONS)

To determine the quarterly base rent before rent reduction, divide the rent paid during the tax period by the number of days for which the rent was paid, multiply the result by the number of days in the tax year and divide that result by 4. Enter the result on line 5 here and Page 2, line 12.

1. |

Amount of rent paid for the period |

1. |

2. |

Number of days in the rental period for which |

|

|

rent was paid |

2. |

3. |

Rent per day (divide line 1 by line 2. |

|

|

Round to the nearest whole dollar) |

3. |

4. |

Annualized rent (multiply rent per day, line 3 |

|

|

by 365. In case of a leap year, multiply by 366. |

|

|

Round to the nearest whole dollar) |

4. |

5.Quarterly Base Rent before rent reduction (divide the result on line 4 by 4.

Round to the nearest whole dollar) |

5. |

PREMISES |

PREMISES |

PREMISES |

_____________________________________________________________________________________ |

||

_____________________________________________________________________________________ |

||

_____________________________________________________________________________________ |

||

_____________________________________________________________________________________ |

||

_____________________________________________________________________________________ |

||

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Document Purpose | The CR Q1 form is used to report the first-quarter commercial rent tax for New York City. |

| Tax Period | This form applies specifically to the tax period from June 1, 2020, to August 31, 2020. |

| Filing Deadline | The due date for filing and payment is September 20, 2020. |

| Payment Method | Payments must be made in U.S. dollars, drawn on a U.S. bank, and should be made payable to NYC Department of Finance. |

| Tax Rates | Renters pay 0% tax for base rent up to $62,499 and 6% for rent of $62,500 or more. |

| Eligibility for Tax Credits | Small businesses may qualify for tax credits depending on income and base rent levels as per guidelines. |

| Filing Options | The form can be filed electronically or in paper format, with specific guidelines for premises and subtenants. |

| Instructions Emphasis | Detailed instructions are provided to ensure accuracy and proper completion of the form to avoid disallowed deductions. |

Guidelines on Utilizing Cr Q1

To fill out the CR Q1 form, you need to collect specific information regarding your commercial rent for the specified tax period. This process may seem daunting at first, but breaking it down into clear steps can make it much easier. You'll be providing details about your business, your rent amounts, and any deductions you’re eligible for. Keeping organized documents handy will enable a smoother completion of the form.

- Start with Page 1: Print or type your name, business address, city, state, zip code, telephone number, and your Employer Identification Number (EIN) or Social Security Number (SSN).

- Confirm the Tax Period: Ensure it reflects June 1, 2020, to August 31, 2020, and note the due date of September 20, 2020.

- Determine your Account Type: Identify whether you're filing for the Commercial Rent Tax.

- Go to Page 2: If you have three or fewer premises, fill out the details directly on this page; if more, make copies as needed.

- Complete Line 1: For each premises, enter the street address, zip code, block and lot number.

- Fill in Gross Rent Paid: Report the total gross rent you paid for each premises on Line 2.

- Indicate Rent Applied to Residential Use: Complete Line 3 if your rent includes residential use.

- List Subtenant Information: Provide the name(s) and EIN or SSN for subtenants on Lines 4a and 4b, if applicable.

- Document Other Deductions: Enter any additional deductions on Line 5a and complete Line 5b if relevant.

- Calculate Base Rent Before Rent Reduction: Deduct total deductions from gross rent on Line 7.

- Compute Rent Reduction: Calculate 35% of the base rent on Line 8 and subtract that amount from Line 7 to get the base rent subject to tax on Line 9.

- Line Transfer: If the rent period is three months or less, complete Lines 10-12; otherwise, transfer from Line 9 to either Line 13 or Line 14 based on the total.

- Calculate Tax Due: Multiply the amount on Line 14 by the tax rate and complete Lines 15-17 for credits.

- Payment Section: At the top of Page 1, indicate a payment enclosed (if applicable) by checking the box on Line A.

- Double Check Information: Before mailing, ensure all figures are correct, and that you’re sending to the right address.

Once you have completed the form, mail it along with your payment to the NYC Department of Finance. Ensure that your payment is made out to “NYC Department of Finance” and remember to keep a copy for your records. This completion will help you stay compliant and assist in any necessary follow-ups regarding your commercial rent tax obligations.

What You Should Know About This Form

What is the CR Q1 form?

The CR Q1 form is the First Quarter Commercial Rent Tax Return for New York City. It is used by landlords and property owners to report commercial rent income for a specific tax period, which in this case is from June 1, 2020, to August 31, 2020. This form helps ensure that the appropriate amount of commercial rent tax is calculated and paid to the NYC Department of Finance.

Who needs to file the CR Q1 form?

What information is required to complete the form?

To complete the CR Q1 form, you will need to provide details such as your name, business address, Employer Identification Number (EIN) or Social Security Number (SSN), and the total gross rent paid during the tax period. Additional information about any subtenants, deductions, and tax credits must also be included to ensure the correct calculation of your commercial rent tax.

When is the CR Q1 form due?

The CR Q1 form is due on September 20 of the year corresponding to the tax period. For the 2020-21 period, this means that your filing and any associated payment should be submitted by September 20, 2020. Timely filing helps avoid penalties and interest charges on unpaid taxes.

What happens if I miss the filing deadline?

If you miss the filing deadline for the CR Q1 form, you may incur late fees or penalties from the NYC Department of Finance. It’s vital to file as soon as possible, even if you are late. Doing so minimizes additional penalties and demonstrates your intent to comply with tax obligations.

Can I file the CR Q1 form electronically?

Yes, you can file the CR Q1 form electronically. You can register for electronic filing through the official NYC website. This option offers a secure and convenient way to file your return and make payments online, simplifying the process for you.

What deductions can I claim on the CR Q1 form?

On the CR Q1 form, you can claim deductions for rent that is applied to residential uses and other approved costs. There may be deductions for special programs, like the Commercial Revitalization Program. Ensure you follow the instructions carefully when claiming deductions to prevent disallowed amounts.

Is there a tax credit available for small businesses?

Yes, there is a small business tax credit available for eligible businesses. To qualify, your total income must be less than $10 million, and your base rent must fall within specified ranges. Carefully review the eligibility requirements and complete the necessary worksheets if you believe you qualify for the credit.

Where can I find additional assistance with the CR Q1 form?

For additional assistance, you can visit the NYC Department of Finance website. They provide clear instructions, resources, and FAQs to help you navigate the CR Q1 form and any related questions. Consider reaching out directly to their office if you need personalized assistance.

Common mistakes

Many people encounter challenges when completing the CR Q1 form. One common mistake is not entering the correct Employer Identification Number (EIN) or Social Security Number (SSN). This can lead to delays in processing your return. It's essential to double-check that you provide the correct number in the space provided, as this information directly affects your account.

Another frequent error involves ignoring the instructions regarding premises information. Each line must accurately represent the details of your business’s premises. For instance, listing an incomplete address or omitting the block and lot number can result in processing issues. Be thorough when filling this section out, as accurate location information is crucial.

People sometimes miscalculate the total deductions claimed. The CR Q1 form requires careful addition of all relevant deductions. If the total is inaccurately reported, it can affect the amount of tax due. It’s advisable to use a calculator and double-check your math to ensure all figures are correct before submitting.

Failing to sign the form can also be a significant oversight. When the form is not signed, it may be considered invalid. Remember, submitting an unsigned form could delay your tax processing or lead to penalties.

Finally, many individuals overlook the importance of mailing instructions. It is critical to send the form to the address provided by the NYC Department of Finance. Misaddressing your return can result in significant delays. Follow the mailing guidelines closely to ensure that your return is correctly received and processed on time.

Documents used along the form

The CR Q1 form is an essential document used for reporting the first quarter commercial rent tax in New York City. When submitting this form, you may also need a variety of other forms and documents to ensure complete compliance with tax regulations. Below is a list of documents often used in conjunction with the CR Q1 form, each serving a specific purpose in the tax process.

- Schedule A - Additional Premises: This document should be used if a business has more than three rental properties. It allows for clear and organized reporting of each additional premises for tax calculations.

- Form CR-C - Tenant Certification: Required for tenants to confirm their rental amounts and occupancy. This form prevents discrepancies and ensures that all information reported is accurate.

- Form CR-1 - Commercial Rent Tax Credit Application: This form is necessary for businesses wanting to apply for any available tax credits related to their rental agreements. It outlines eligibility and necessary calculations for potential credits.

- Small Business Tax Credit Worksheet: This supplementary worksheet is used to determine eligibility for small business tax credits. It guides businesses in calculating their total income and base rent, facilitating potential savings.

- Form NYC-1127 - Commercial Rent Tax Abatement Application: Businesses seeking an abatement due to specific criteria must file this form. It details the reasons for abatement and how it complies with NYC tax laws.

- Form SS-4 - Application for Employer Identification Number: New businesses in need of an Employer Identification Number (EIN) must submit this form. The EIN is often required for tax filings and identification purposes.

- Form IT-201 - New York State Resident Income Tax Return: This return is used for reporting personal income for tax liabilities that can be affected by business income. It may impact the overall tax obligations of the business owner.

- Payment Remittance Slip: While submitting the CR Q1 form, a remittance slip should accompany any tax payment. This slip ensures accurate processing of the payment associated with the tax return.

- Electronic Filing Registration Confirmation: For those opting to file electronically, having the confirmation of registration is essential. It serves as proof that the business is registered for online tax filing services.

Understanding the related documents and their purposes can significantly smooth out the process of tax filing. Businesses are encouraged to prepare these documents diligently to avoid delays or complications with the commercial rent tax return.

Similar forms

- IRS Form 1040: Like the Cr Q1 form, the IRS Form 1040 is used to report income for individuals and includes sections for deductions and payments. Both forms require accurate information to calculate owed amounts and possible credits.

- State Tax Form: State tax forms often allow for the reporting of income, deductions, and credits, similar to the Cr Q1 form. Both forms seek to calculate taxes owed based on reported figures and applicable laws.

- Commercial Lease Agreements: These documents outline financial obligations related to space rental, like the Cr Q1 form, which requires similar financial disclosures regarding rent and deductions. Both emphasize accurate reporting of rental agreements and premises information.

- Form 941: This form is used for reporting payroll taxes and employee wages. Like the Cr Q1, it includes specific lines for reporting quantitative data and calculating amounts due to a government entity.

- Sales Tax Return: Sales tax returns are similar to the Cr Q1 form in that they require reporting of gross sales, applicable rates, deductions, and credits, ultimately helping to determine the tax due.

- Property Tax Return: Property tax returns also require property owners to report value and deductions, paralleling how the Cr Q1 form requires commercial property rental data to compute taxes owed.

- IRS Schedule C: This form is for reporting income and expenses from a business, akin to how the Cr Q1 format captures rental income, expenses, and allowable deductions for tax purposes.

- Paycheck Protection Program Forgiveness Application: Businesses use this form to report their qualifying expenses for loan forgiveness. Similar to the Cr Q1, it requires detailed reporting and calculations to determine eligibility and amounts due, fostering transparency in financial dealings.

Dos and Don'ts

When filling out the Cr Q1 form, consider these important do's and don'ts:

- Do: Fill out the form completely and accurately.

- Do: Provide your correct Employer Identification Number or Social Security Number.

- Do: Attach your payment check, which should be payable to NYC Department of Finance.

- Do: Use black or blue ink if you are filling out the form by hand.

- Do: Double-check the due date to avoid late fees or penalties.

- Don't: Forget to sign and date the form before mailing it.

- Don't: Attach page 2 or 3 to your submission; send them only if required separately.

- Don't: Use pencil or light ink; legibility is critical.

- Don't: Ignore the instructions; they contain essential details for completing the form.

- Don't: Submit the form without verifying that all figures are accurate.

Misconceptions

Understanding the CR Q1 form can be challenging due to several common misconceptions. Here are five of those misconceptions, along with clarifications:

- Only Large Businesses Need to File: Many people believe that only businesses making significant amounts of income are required to complete the CR Q1 form. In actuality, all commercial property owners leasing out space need to fulfill this obligation irrespective of their income level.

- You Can Ignore the Deadline: Some individuals think that submitting the form after the deadline is acceptable if they plan to pay later. However, missing the deadline can lead to penalties and interest, so it’s crucial to file on time.

- The Base Rent is the Only Consideration: A misconception exists that the 'Base Rent' is the only figure that matters when calculating tax. However, tenants should also consider deductions for any rent applied to residential use, among other factors that affect the final taxable amount.

- Tax Credits are Automatic: Many assume they automatically receive tax credits without providing necessary documentation. This is not true; taxpayers need to fill out specific worksheets and fulfill eligibility requirements to receive any credits, such as the Small Business Tax Credit.

- You Don’t Need to Keep Records: Some believe that they can file the form without maintaining proper records. This assumption is risky. Accurate records must be kept, as they support the amounts reported and protect against potential audits.

Key takeaways

When preparing to fill out the CR Q1 form, keep in mind the following key takeaways to ensure a smooth and accurate process.

- The form applies only for a specific tax period, spanning from June 1, 2020, to August 31, 2020.

- Your completion of the form should be done using clear print or typing; legibility is crucial.

- Ensure to indicate the correct Employer Identification Number or Social Security Number to guarantee proper credit for your payment.

- Be mindful of the due date, which falls on September 20, 2020; timely submission is essential to avoid penalties.

- Accurate information is vital. Inaccuracies could lead to deductions being disallowed.

- Consider electronic filing as a convenient option; registering online provides a secure way to submit your return and payment.

- Understand the importance of tax credits: if your total base rent lies between certain thresholds, you may be eligible for significant reductions on your taxes.

Browse Other Templates

Bojangles Online Application - Enter the start and end dates for each job.

Weekly Unemployment Benefits Claim,UI Weekly Filing Form,Arizona UI Claim Form,Weekly Benefits Reporting Form,Claimant Weekly Status Report,Arizona Unemployment Insurance Weekly Update,Weekly Work Search Declaration,Unemployment Benefits Weekly Decla - Evidence of job search efforts, such as employer names and contact methods, is necessary.