Fill Out Your Crf Ifta Form

The CRF IFTA form is an essential tool for motor carriers operating in multiple jurisdictions across the United States, particularly for those based in Georgia. It serves as a registration application for the International Fuel Tax Agreement (IFTA), which simplifies the reporting and payment of fuel taxes for vehicles that travel across state lines. This form requires detailed information about your business, such as your legal business name, location address, and federal employer identification number. Additionally, you must specify your business structure, whether it be a corporation, partnership, or sole proprietorship. The form also asks for information regarding your vehicles, including the number of diesel, gasoline, and other fuel-type vehicles you plan to register. Furthermore, the IFTA form ensures that motor carriers declare their operating jurisdictions, indicating where they will maintain bulk storage of fuel. Another critical aspect involves ownership details, demanding transparency about all related businesses and individuals. Completing this form accurately is vital, as any inconsistencies or missing information could delay processing and impact your ability to operate legally across state lines. Finally, the declaration statement at the end of the form underscores your commitment to comply with state regulations regarding reporting and tax obligations, reinforcing the importance of maintaining accurate records as you travel and conduct business. Each element of the CRF IFTA form plays a crucial role in ensuring that motor carriers adhere to regulatory requirements and can operate smoothly across different jurisdictions.

Crf Ifta Example

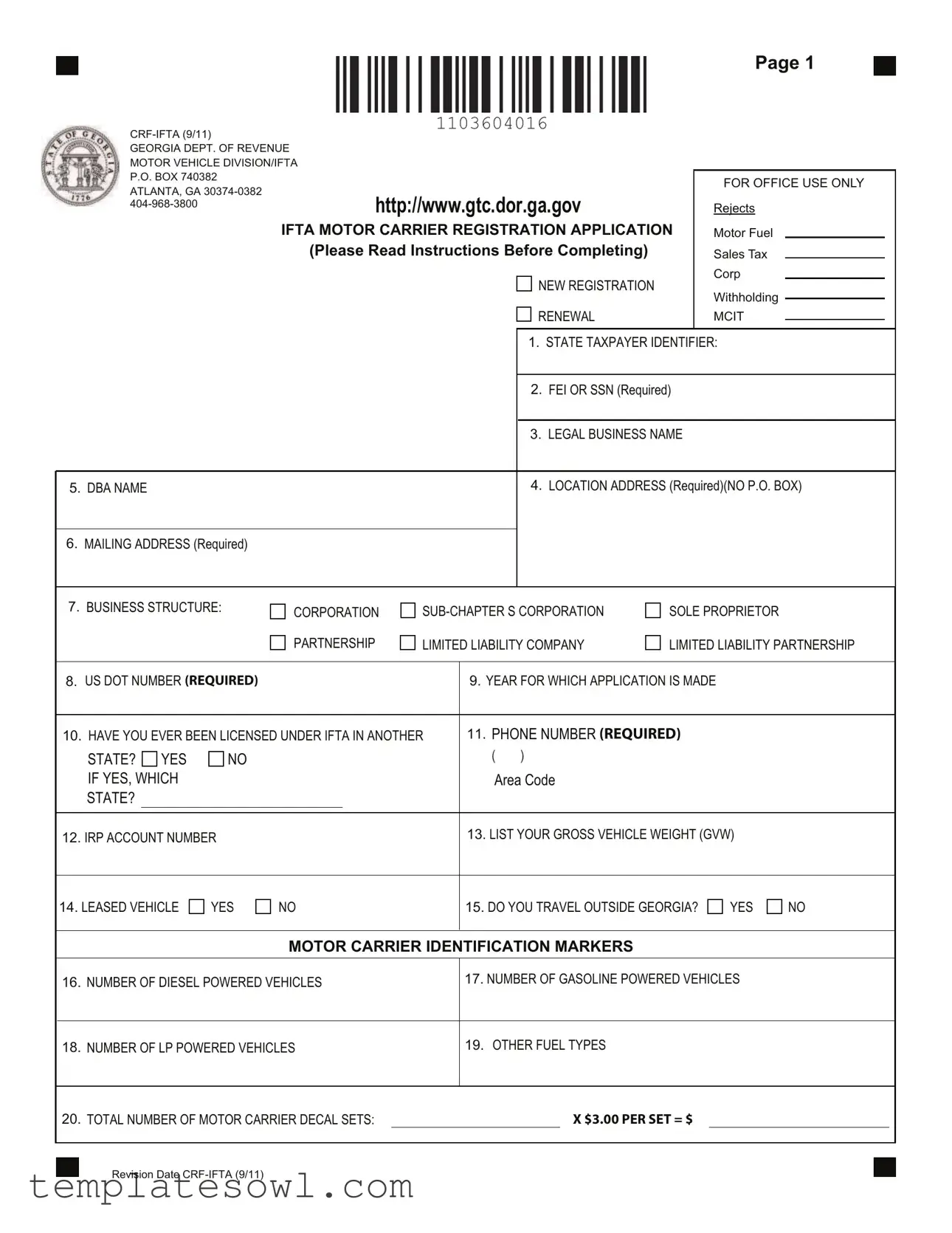

Page 1

GEORGIA DEPT. OF REVENUE

MOTOR VEHICLE DIVISION/IFTA

P.O. BOX 740382 ATLANTA, GA

|

|

FOR OFFICE USE ONLY |

||

http://www.gtc.dor.ga.gov |

Rejects |

|||

IFTA MOTOR CARRIER REGISTRATION APPLICATION |

Motor Fuel |

|

|

|

(Please Read Instructions Before Completing) |

Sales Tax |

|

|

|

|

||||

|

NEW REGISTRATION |

Corp |

|

|

|

Withholding |

|

|

|

|

RENEWAL |

|

|

|

|

|

|||

|

MCIT |

|

|

|

|

|

|||

|

|

|

|

|

1.STATE TAXPAYER IDENTIFIER:

2.FEI OR SSN (Required)

3.LEGAL BUSINESS NAME

5.DBA NAME

4.LOCATION ADDRESS (Required)(NO P.O. BOX)

6.MAILING ADDRESS (Required)

7.BUSINESS STRUCTURE:

CORPORATION

PARTNERSHIP

LIMITED LIABILITY COMPANY

SOLE PROPRIETOR

LIMITED LIABILITY PARTNERSHIP

8. |

US DOT NUMBER (REQUIRED) |

|

|

|

9. YEAR FOR WHICH APPLICATION IS MADE |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

10. HAVE YOU EVER BEEN LICENSED UNDER IFTA IN ANOTHER |

11. PHONE NUMBER (REQUIRED) |

|

|

|

||||||||

|

|

STATE? YES |

NO |

|

|

|

( ) |

|

|

|

|

|

|

|

|

IF YES, WHICH |

|

|

|

|

Area Code |

|

|

|

|||

|

|

STATE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. IRP ACCOUNT NUMBER |

|

|

|

13. LIST YOUR GROSS VEHICLE WEIGHT (GVW) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

|

14. LEASED VEHICLE |

YES |

NO |

15. DO YOU TRAVEL OUTSIDE GEORGIA? |

YES |

NO |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOTOR CARRIER IDENTIFICATION MARKERS |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

NUMBER OF DIESEL POWERED VEHICLES |

17. NUMBER OF GASOLINE POWERED VEHICLES |

|

|

|||||||||

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||||

18. |

NUMBER OF LP POWERED VEHICLES |

19. OTHER FUEL TYPES |

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||

20. |

TOTAL NUMBER OF MOTOR CARRIER DECAL SETS: |

|

|

X $3.00 PER SET = $ |

|

|

|

|

|||||

Revision Date

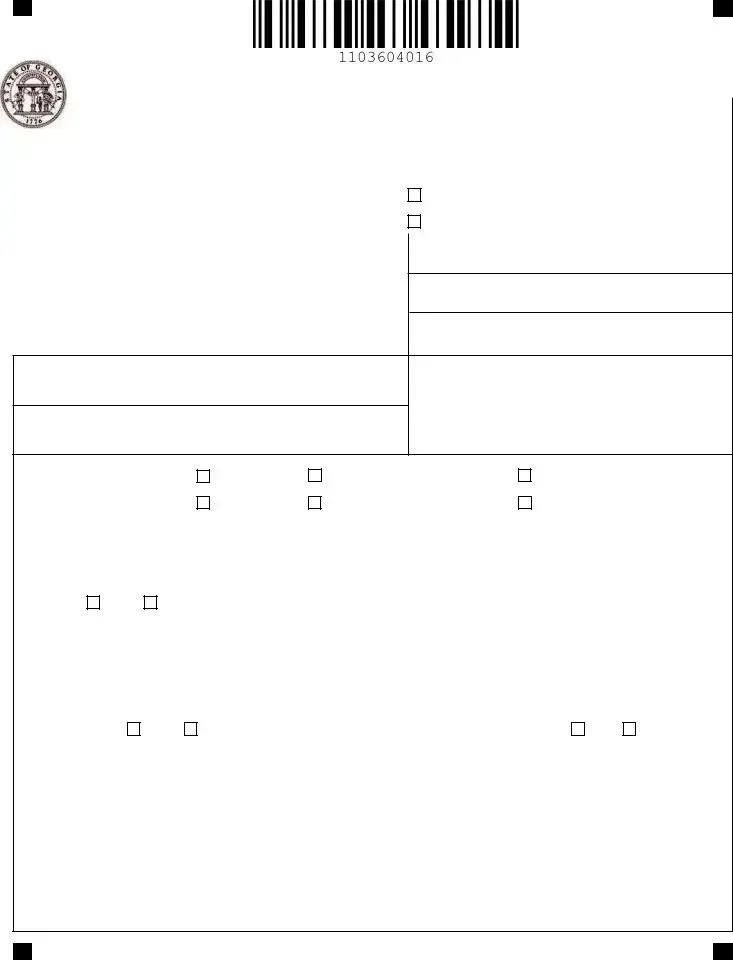

Page 2

GEORGIA DEPTARTMENT OF REVENUE MOTOR VEHICLE DIVISION/IFTA

P.O. BOX 740382 ATLANTA, GA

2 1.OPERATING JURISDICTIONS

Complete the schedule below by placing an “X” next to the jurisdictions in which you plan to maintain bulk storage of fuel.

AK |

Alaska |

AL |

Alabama |

AR |

Arkansas |

AZ |

Arizona |

CA |

California |

CO |

Colorado |

CT |

Connect icut |

DC |

District of Columbia |

DE |

Delaware |

FL |

Florida |

GA |

Georgia |

IA |

Iowa |

ID |

Idaho |

IL |

Illinois |

IN |

Indiana |

KS |

Kansas |

KY |

Kentucky |

LA |

Louisiana |

MA |

Massachusetts |

MD |

Maryland |

ME |

Maine |

MI |

Michigan |

MN |

Minnesota |

MO |

Missouri |

MS |

Mississippi |

MT |

Montana |

NC |

North Carolina |

ND |

North Dakota |

NE |

Nebraska |

NH |

New Hampshire |

N J |

New Jersey |

NM |

New Mexico |

NV |

Nevada |

NY |

New York |

OH |

Ohio |

OK |

Oklahoma |

OR |

Oregon |

PA |

Pennsylva nia |

RI |

Rhode Island |

SC |

South Carolina |

SD |

South Dakota |

TN |

Tennessee |

TX |

Texas |

UT |

Utah |

VA |

Virginia |

VT |

Vermont |

WA |

Washington |

WI |

Wisconsin |

WV |

West Virginia |

WY |

Wyoming |

CANADIAN PROVINCES

NS |

Nova Scotia |

NT |

N W Territory |

ON |

Ontario |

AB |

Alberta |

BC |

Bri tish Columbia |

NF |

New Foundland and Labrador |

MB |

M anitoba |

NB |

New Brunswick |

PE |

Prince Edward Island |

PQ |

Quebec |

SK |

Saskatchewan |

YT |

Yukon Territory |

|

|

|

|

|

OWNERSHIP/RELATIONSHIP SECTION |

|

|

|

|

||

|

|

|

(This section MUST be completed for your application to be accepted) (Continued on page 3) |

||||||||

|

|

|

|

|

|

|

|

|

|||

22. |

CHECK ALL THAT APPLY |

|

|

|

GEORGIA IFTA EFFECTIVE DATE : / / |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

Parent Company |

|

Manager |

|

|

Related Business |

|

|

|

|

|

|

|

|

|||||

|

|

|

Partner |

|

Officer |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

BUSINESS NAME |

|

|

|

|

|

|

STI or LICENSE NO. |

||

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

GA. SALES TAX NO. |

|

|

|

GA. WITHHOLDING TAX NO. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

LAST NAME |

|

FIRST |

|

M.I. |

TITLE |

|

|

SOC SEC NO. |

|

|

|

|

|

|

|

|

|

|

|

|

(Required) |

D

ADDRESS

E

CITY |

STATE |

ZIP |

COUNTY |

COU NTR Y |

PHONE |

()

Revision Date

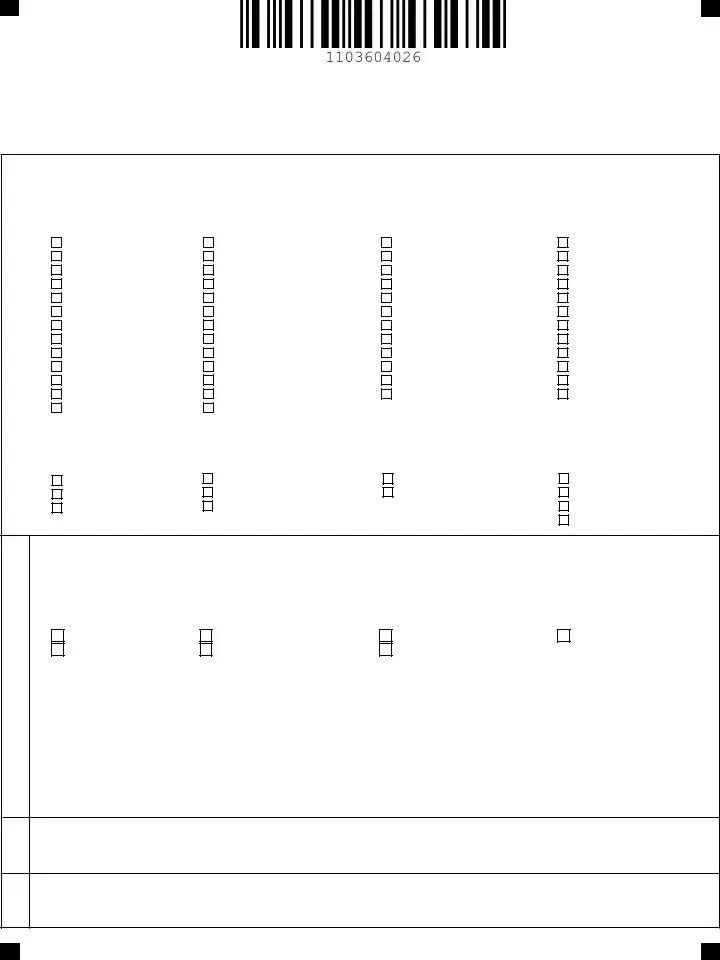

Page 3

GEORGIA DEPARTMENT OF REVENUE MOTOR VEHICLE DIVISION/IFTA P.O. BOX 740382

ATLANTA, GA

|

|

|

|

|

|

OWNERSHIP/RELATIONSHIP SECTION |

|

|

|

|

|

|||

|

|

|

|

(This section MUST be completed for your application to be accepted) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

23. |

CHECK ALL THAT APPLY |

|

|

|

|

|

GEORGIA IFTA EFFECTIVE DATE : |

|

/ |

/ |

||||

|

|

|

Owner |

|

|

Parent Company |

|

|

Manager |

|

Related Business |

|||

|

|

|

|

|

|

|

|

|||||||

|

|

|

Partner |

|

|

Officer |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

BUSINESS NAME |

|

|

|

|

|

|

|

STI or LICENSE NO. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

GA. SALES TAX NO. |

|

|

|

|

|

GA. WITHHOLDING TAX NO. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C |

|

LAST NAME |

|

|

FIRST |

|

|

M.I. |

TITLE |

|

SOC SEC NO. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

(Required) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

CITY |

|

|

STATE |

ZIP |

|

COUNTY |

COU NTR Y |

|

PHONE |

|

||

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECLARATION STATEMENT

The applicant agrees to comply with reporting payment, record keeping and license display requirements as specified in the Georgia IFTA Procedures Manual. The applicant authorizes the State of Georgia to withhold any refund of tax over- payment, if deliquent taxes are due to any member IFTA jurisdiction. Failure to comply with these provisions shall be grounds for revocation or suspension of the license in all member jurisdictions.

The applicant, certifies with his signature that to the best of his/her knowledge, the information is true, accurate and com- plete and any falsification subjects him/her to the offense of making a written false statement to a government official.

Print Name:

Signature |

Title |

Date |

(Must be signed by owner, partner, or authorized officer of corporation - Stamped signature not acceptable)

Revision Date

STATE OF GEORGIA

DEPARTMENT OF REVENUE

INSTRUCTIONS FOR THE COMPLETION OF THE MOTOR CARRIER APPLICATION

All vehicles that operate in two or more jurisdictions and meet the following criteria, must complete the IFTA Motor Carrier Registration Application.

Vehicles are used, designed or maintained for transportation of persons or property and having two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,197 kilograms; or having three or more axles regardless of kilograms gross vehicle or registered gross vehicle weight must be licensed and have identification markers before operation in Georgia. For exceptions please refer to GA. Code

Type or print In Ink- DO NOT USE PENCIL

INSTRUCTIONS FOR COMPLETING THE APPLICATION:

Line 1. Enter your Georgia State Taxpayer Identifier. (If you do not have one, leave blank)

Line 2. Enter your Federal Employer Identification Number or Social Security number. Failure to provide this information will cause the application to be returned.

Line 3. Enter the name under your business which is legally registered with the Secretary of State. If your business is not registered with the Secretary of State, enter the name under which your business owns property or incurs debts. If the business is a partnership, the legal name would be in the partnership name. If the legal name is a sole proprietorship, the legal name would be in the individual name.

Line 4. Enter the physical location of the business (cannot be a P O Box). Failure to provide this information will cause the application to be returned.

Line 5. Enter the “doing business as” name (DBA).

Line 6. Enter the address to which your IFTA correspondence should be mailed. Line 7. Check type of company.

Line 8. Enter your US DOT number. You can obtain a DOT number online at: www.safersys.org or you can contact The Federal Motor Carrier Safety Administration at (800)

Line 9. Enter the year to which the license and decal(s) applies.

Line 10. Check whether you have been previously IFTA registered in another state. If yes, list the state. If you have been registered in more than one state, list the last state.

Line 11. Enter the phone number at which you or your representative can be contacted. Failure to provide this information will cause the application to be returned. Make sure you include your area code.

Line 12. Enter your Georgia International Registration Plan (IRP) account number. Bus company or leasing company enter N/A. If you need an account number, you may contact the IRP

office at

Line 14. Check “Yes” or “No” to indicate if the vehicle is leased.

Line 15. Check “Yes” or “No” to indicate if you travel outside of Georgia.

Motor Carrier Identification Markers Section:

Line 16. Enter the number of diesel powered vehicles you are registering. Line 17. Enter the number of gasoline powered vehicles you are registering. Line 18. Enter the number of LP powered vehicles you are registering.

Line 19. Enter the number of other fuel type powered vehicles you are registering.

Line 20. Enter the total number of motor carrier decal sets for which you are applying and the total cost of the sets.

Line 21. OperatingJurisdictions Section: Place an “X” in each State or Canadian Province which you plan to maintain bulk storage fuel.

Line 22. & 23. Ownership/Relationship Section: Georgia IFTA Effective Date- Enter the date you first plan to do business as an interstate carrier using the Georgia IFTA decal.

The Department of Revenue requires the following information on all related individuals or businesses to determine the ownership of the applying business. This section must be completed for your application to be accepted. Complete one Section for each related business or individual, check the relationships that apply, and enter the effective date of that relationship. For all applications provide information for the following:

A. Owner- The owner of the business, complete lines C, D and E.

B.

D. LLC- If the business is a Manager Member complete lines A through E for each manager member. E. Partner Company - If the business is a subsidiary branch or division or another business,

complete lines A through E.

INSTRUCTIONS FOR SIGNING:

The Declaration Statement must be signed by the owner, a partner or authorized officer of the corporation before the registration can be accepted.

INSTRUCTIONS FOR PAYMENT:

Send a money order or certified funds payable to the Georgia Revenue Collection Account for the total amount. Georgia law stipulates that taxes and fees be paid in lawful money of U.S. funds and be free on any expense to Georgia.

IMPORTANT NOTICE:

Your motor carrier license will not be issued, if there are any outstanding liabilities against your account, or if you do not return the registration form with a proper signature on the Declaration Statement.

INSTRUCTIONS FOR MAILING AND REQUESTING INFORMATION:

The taxpayer should retain a copy of this application for his files and for inspection by the Revenue Commissioner or his agents. Mail the original to the address shown below. Call

DECLARATION STATEMENT:

The applicant agrees to comply with reporting payments record keeping and license requirements as specified in the Georgia IFTA Procedures Manual. The applicant authorizes the State of Georgia to withhold any refund or tax payment, if delinquent taxes are due any IFTA jurisdiction member. Failure to comply with these provisions shall be grounds for Revocation or Suspension of the license in all member jurisdictions.

Applicant certifies with his signature that to the best of his knowledge, the information is true, accurate and complete and any falsification subjects him to the offense of making a written false statement to a government official.

P.O. Box 740382

Atlanta, Ga.

THE PROCESSING OF THIS APPLICATION WILL BE DELAYED IF NOT PROPERLY COMPLETED AND SIGNED.

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Body | The form is governed by the Georgia Department of Revenue. |

| Application Purpose | This form registers motor carriers for the International Fuel Tax Agreement (IFTA) in Georgia. |

| Required Information | Applicants must provide their legal business name, Federal Employer Identification Number (FEIN) or Social Security Number, and the business location address. |

| Eligibility Criteria | Vehicles designed for transporting persons or property must have a gross vehicle weight over 26,000 pounds or have three or more axles to qualify. |

| Application Fees | A fee of $3.00 per set of motor carrier decals is required. |

| Contact Information | The Department can be contacted at 404-968-3800 for inquiries related to the application. |

| Signature Requirement | The form must be signed by an authorized individual, and stamped signatures are not accepted. |

| Processing Time | Incomplete forms may delay processing. All required fields must be filled accurately for timely approval. |

Guidelines on Utilizing Crf Ifta

Filling out the CRF IFTA form is a straightforward process, but it’s essential to provide accurate information to ensure timely approval of your application. Below, you'll find clear steps that guide you through the sections of the form, detailing what you need to include in each part.

- Begin with the first line and enter your Georgia State Taxpayer Identifier. If you don’t have one, leave it blank.

- Next, provide your Federal Employer Identification Number (FEI) or Social Security Number (SSN). This information is required.

- Enter the legal business name as registered with the Secretary of State.

- Input your physical business address. Make sure this is not a P.O. Box.

- Enter your "Doing Business As" (DBA) name, if applicable.

- Fill in the mailing address where your IFTA correspondence should be sent.

- Select the correct business structure by checking the appropriate box.

- Provide your US DOT number. This number can be obtained online or through the Federal Motor Carrier Safety Administration.

- Indicate the year for which you are applying.

- Answer whether you have ever been IFTA registered in another state and, if so, provide the name of that state.

- Supply a phone number where you can be contacted, ensuring to include the area code.

- Fill in your Georgia International Registration Plan (IRP) account number, entering “N/A” if not applicable.

- List your gross vehicle weight.

- Answer whether the vehicle is leased.

- Indicate whether you travel outside of Georgia.

- For the Motor Carrier Identification Markers section, enter the number of diesel, gasoline, LP powered vehicles, and any other fuel type vehicles you are registering.

- Calculate and write down the total number of motor carrier decal sets you are applying for and the associated cost.

- Mark the jurisdictions where you will maintain bulk storage of fuel by placing an “X” next to each applicable area.

- In the ownership section, check any relevant relationships and provide required information for each related individual or entity.

- Sign and date the Declaration Statement confirming that the information provided is true and accurate.

- Prepare your payment in the form of a money order or certified funds, made out to the Georgia Revenue Collection Account.

- Finally, mail the original application to the specified address, retaining a copy for your records.

Completing these steps thoroughly will help facilitate the processing of your IFTA application without unnecessary delays.

What You Should Know About This Form

What is the CRF IFTA form and who needs to complete it?

The CRF IFTA form is an application for motor carrier registration under the International Fuel Tax Agreement (IFTA). It is specifically designed for businesses operating commercial vehicles in multiple jurisdictions. If your vehicles have a gross weight exceeding 26,000 pounds or have three or more axles, you must complete this application. It ensures proper taxation of fuel used by these vehicles across state lines.

What information do I need to provide when completing the form?

Completing the CRF IFTA form requires several key pieces of information. You will need to provide your Georgia State Taxpayer Identifier, Federal Employer Identification Number (FEIN) or Social Security Number, as well as your legal business name and "doing business as" (DBA) name. Additionally, you must fill in your physical and mailing addresses, business structure, and your U.S. DOT number. It’s essential to ensure all information is accurate and complete to avoid delays in processing.

What happens if I have previously been licensed under IFTA in another state?

If you have been licensed under IFTA in another state, you need to indicate this on the form. Be prepared to specify the state where you held the previous registration. This information helps maintain consistent records across jurisdictions and ensures compliance with tax regulations. Failure to provide this detail may lead to complications with your current application.

How do I submit the CRF IFTA form once it is completed?

Once you have accurately completed the CRF IFTA form, you need to submit it to the Georgia Department of Revenue. Make sure to include proper payment in the form of a money order or certified funds. Do not forget to sign the Declaration Statement; your application cannot be processed without it. Send the original application to the address provided on the form, and keep a copy for your records. If you have questions or need assistance, don’t hesitate to call the Department of Revenue.

Common mistakes

Filling out the CRF IFTA form can seem daunting, but avoiding common mistakes can make the process smoother. One frequent error is forgetting to provide a complete location address. It’s essential to enter a physical address and not a P.O. Box. Applications lacking a valid location will be rejected, leading to delays.

Another common misstep involves the Federal Employer Identification Number (FEI) or Social Security Number. If you skip this critical piece of information, the application cannot proceed. All applicants must verify they have included this number to avoid unnecessary back-and-forth with the Georgia Department of Revenue.

Additionally, applicants often overlook the significance of accurately filling out the operating jurisdictions section. Simply placing “X” marks in the wrong states or not indicating all relevant jurisdictions can lead to complications. If fuel is stored in a jurisdiction that is not listed, you may encounter compliance issues down the line.

People also sometimes make errors in identifying their business structure. Whether it’s a sole proprietorship, partnership, or corporation, selecting the incorrect structure will not only invalidate the application but may also create issues with tax responsibilities. Clearly reviewing the options before making a selection is advisable.

Missing crucial contact information, especially the phone number, can pose a challenge. Ensure that you provide a number that allows the state to reach out if there are any questions or concerns about your application. A missing or incorrect number can prolong the approval process.

Finally, applicants may forget to complete the Ownership/Relationship section. This section is mandatory. Failure to provide the necessary details can make your application ineligible. It’s vital to pay attention to this part to ensure that all ownership relationships are properly documented.

Each of these mistakes can cause significant hassle and delay in processing your IFTA application. Careful attention to detail and thoroughness are your best allies in completing the CRF IFTA form correctly.

Documents used along the form

The CRF IFTA form is an important document for motor carriers operating in multiple jurisdictions, ensuring that businesses comply with the International Fuel Tax Agreement. Along with this form, there are several other documents and forms often required for a complete registration process. Below is a list of these essential documents.

- Form 2290 (Heavy Highway Vehicle Use Tax Return): This form must be filed for heavy vehicles that exceed a certain weight, typically 55,000 pounds. It reports and pays the federal heavy vehicle use tax.

- IRP Application: The International Registration Plan application allows motor carriers to register their vehicles for operations in multiple states. It establishes fees based on the miles driven in each jurisdiction.

- USDOT Number Registration: This registration is necessary for commercial vehicles operating in interstate commerce. It tracks the safety records of motor carriers in the U.S.

- Fuel Purchase Receipts: Motor carriers must keep records of fuel purchases across jurisdictions. These receipts are essential for accurate reporting on the IFTA return.

- IFTA Quarterly Tax Return: This document summarizes fuel usage and taxes owed for each jurisdiction on a quarterly basis. It ensures compliance with IFTA tax reporting requirements.

- Authorized Representative Form: If someone other than the owner is managing the IFTA account or filing documents, this form provides their authorization to act on behalf of the business.

- Proof of Insurance: Motor carriers need to provide evidence of active liability insurance coverage as required by state laws and regulations.

- Tax Exemption Certificates: If applicable, these certificates allow for tax exemptions on fuel purchases under certain circumstances, which must be documented for compliance.

- Financial Statements: Some states may require financial documentation to assess the business’s ability to pay any potential liabilities related to IFTA or IRP fees.

- Authority Certificate: This certificate issues proof of authority to operate as a carrier. It's necessary for businesses entering the truck transportation industry.

Understanding the CRF IFTA form's context alongside these related documents is essential for ensuring compliance and smooth operation as a motor carrier. Keeping all necessary paperwork readily accessible can prevent unnecessary delays and complications during the registration and reporting processes.

Similar forms

- IFTA Quarterly Fuel Tax Report: Similar to the CRF IFTA form, this report summarizes the fuel usage and mileage across jurisdictions for a specific quarter. Both documents aim to facilitate compliance with fuel tax obligations for interstate carriers.

- IRP Application: The International Registration Plan (IRP) application also serves carriers operating in multiple jurisdictions. Like the CRF IFTA form, it requires detailed information about the business structure and types of vehicles operated.

- Motor Carrier Permit Application: This permit application requires data about vehicle specifications and routes intended for operation. It shares similarities with the CRF IFTA form in its intent to authorize operations across state lines.

- Unified Carrier Registration (UCR) Form: Similar in purpose, the UCR form collects information from trucking companies to ensure proper registration and fee payment. Both documents aim to streamline the regulatory processes across states.

- Fuel Purchase Receipts: These documents serve as proof of fuel purchases and are essential for tax reporting, similar to the CRF IFTA as they facilitate transparency and compliance with state fuel tax requirements.

- Federal Motor Carrier Safety Administration (FMCSA) Registration: Registration with the FMCSA involves disclosing extensive business information. Like the CRF IFTA form, it focuses on compliance with federal regulations for interstate transport.

- Environmental Protection Agency (EPA) Fuel Emissions Report: This report is required for compliance with environmental regulations and involves providing fuel usage data. It aligns closely with the CRF IFTA form in its need for accurate reporting of fuel-related metrics.

Dos and Don'ts

When filling out the CRF IFTA form, consider the following dos and don'ts:

- Do: Use blue or black ink to fill out the form. Avoid using pencil.

- Do: Provide accurate information. Double-check your entries before submitting.

- Do: Include all necessary identification numbers, such as your US DOT number and Georgia State Taxpayer Identifier.

- Do: Sign the declaration statement yourself. Stamped signatures are not accepted.

- Don't: Forget to check the box for any operating jurisdictions where you will maintain fuel storage.

- Don't: Leave required fields blank. Incomplete applications may be returned.

- Don't: Use a P.O. Box for your physical location address. Only a street address is acceptable.

- Don't: Wait until the last minute to submit your application. Late submissions can cause delays.

Misconceptions

Misconceptions about the CRF IFTA form can lead to confusion and errors in the filing process. Here are some common misunderstandings:

- Misconception 1: All motor vehicles need to complete the IFTA form.

- Misconception 2: You can submit the application with a P.O. Box address.

- Misconception 3: You can use a pencil to fill out the form.

- Misconception 4: Only corporations need to provide a FEI or SSN.

- Misconception 5: You can submit the application without signing the Declaration Statement.

- Misconception 6: You don’t need to report if you have previously registered in another state.

- Misconception 7: All sections of the form are optional.

- Misconception 8: Payment can be made by personal checks.

- Misconception 9: If there are errors, you can simply cross them out.

Not every vehicle requires this form. Only those used for transportation over state lines and meeting specific weight criteria must file.

The application requires a physical location address. A P.O. Box is not acceptable for this purpose.

The form must be completed in ink; using a pencil can lead to rejection of the application.

All applicants, regardless of business structure, must provide either a Federal Employer Identification Number or a Social Security number.

A signature from the owner, authorized officer, or partner is crucial for the application to be accepted.

If you’ve registered in another state, it’s essential to disclose that information on the application.

Several sections, especially the Ownership/Relationship Section, must be fully completed for the application to be processed.

The Georgia Department of Revenue only accepts money orders or certified funds for payment.

Corrections should not be made directly on the form. If you need to correct an error, it’s best to start with a new form to avoid complications.

Key takeaways

Filling out and using the CRF IFTA form requires attention to detail and a clear understanding of the requirements. Here are some key takeaways to help you navigate the process:

- Understand the Purpose: The CRF IFTA form is primarily for motor carriers operating in multiple jurisdictions, ensuring compliance with fuel tax regulations.

- Required Information: Be prepared to provide your Georgia State Taxpayer Identifier and your Federal Employer Identification Number or Social Security number. Omitting these will delay your application.

- Accurate Legal Name: Enter the legal business name as registered with the Secretary of State. Ensure this is correct to avoid issues during processing.

- Physical Address Needed: Your location address cannot be a P.O. Box. It must be the actual physical location of your business.

- Business Structure Matters: Indicate your business structure correctly, whether it’s a corporation, partnership, or sole proprietorship.

- DOT Number Requirement: Make sure to include your U.S. DOT number. This can be obtained through official federal channels if you don’t already have one.

- Report All Vehicles: Provide accurate counts of your diesel, gasoline, and other fuel types. Ensure you list the total number of vehicles for proper decal issuance.

- Operating Jurisdictions: Clearly mark all jurisdictions where you will maintain fuel storage. This is critical for license compliance.

- Signature is Essential: The declaration statement at the end of the form must be signed by an authorized individual. Stamped signatures will not be accepted.

- Payment Instructions: Payments for fees must be made in certified funds or money orders. Ensure these are made payable to the correct account to avoid processing delays.

By keeping these points in mind, you can complete the CRF IFTA form accurately and efficiently, helping to ensure your compliance with the necessary regulations.

Browse Other Templates

Chapter 12 Test - The integration of cumulative knowledge prepares students for advanced studies.

Workers Comp Exemption Tn - Sign and date the form; failure to do so will result in rejection.