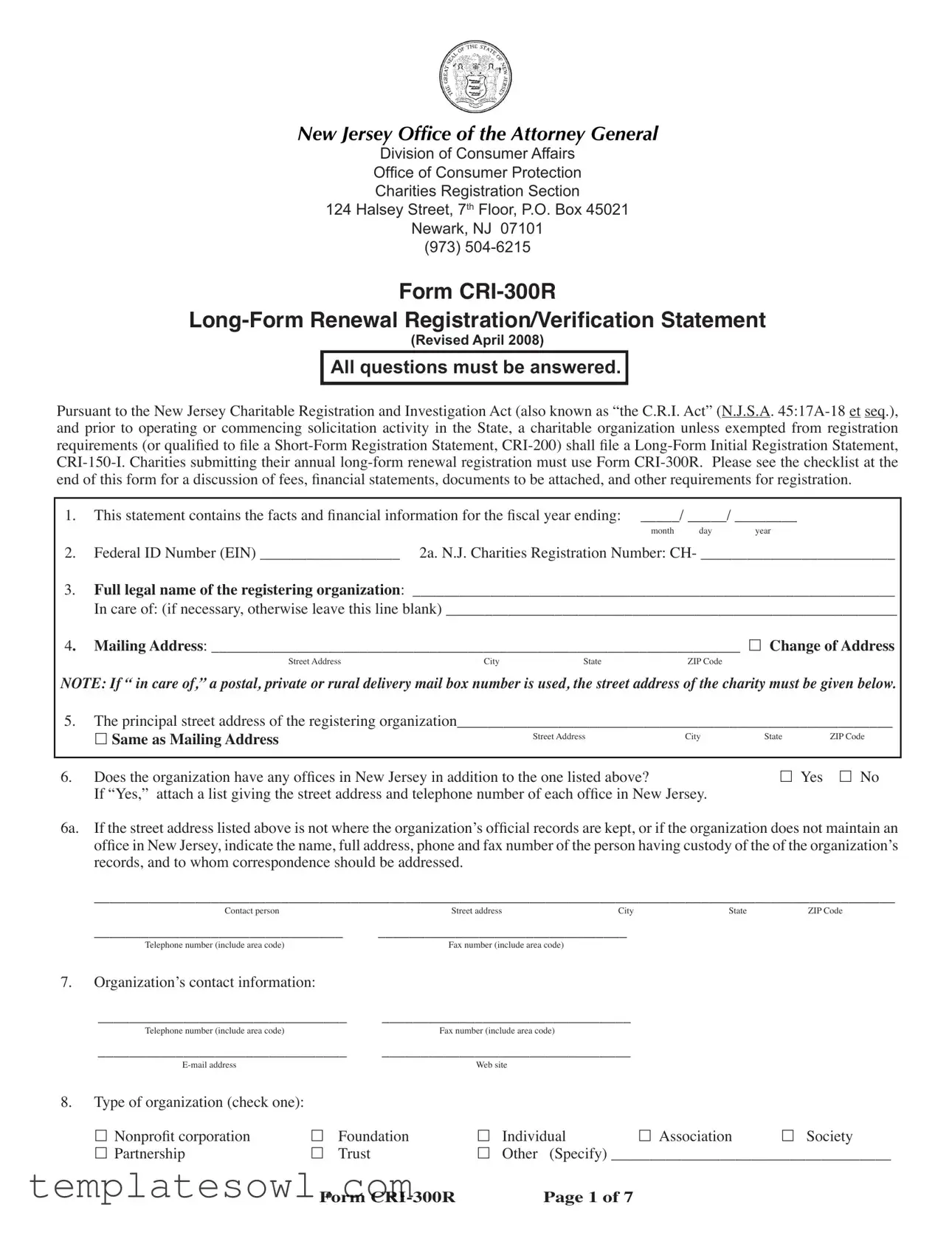

Fill Out Your Cri 300R Form

The CRI-300R form plays a crucial role for charitable organizations operating in New Jersey. This Long-Form Renewal Registration and Verification Statement is essential for those seeking to continue their solicitation activities within the state. Charities are required to submit this form annually, ensuring that they maintain compliance with the New Jersey Charitable Registration and Investigation Act. The form gathers key information, including the charity's legal name, mailing address, and federal ID number, along with financial details such as receipts, expenses, and the sources of their contributions. It also inquires about the organization's purpose, governance structure, and any dependencies or affiliations with other entities. Charities must provide clarity on whether they engage in fundraising activities under other names and whether they have undergone any legal challenges or changes in their tax-exempt status. Lastly, the CRI-300R emphasizes transparency by requesting details about the organization’s operations, funding sources, and compliance history, ensuring that the public can trust the charitable entities in New Jersey. Familiarizing oneself with this form can assist organizations in navigating the complexities of charitable registration and in maintaining their good standing within the community.

Cri 300R Example

New Jersey Office of the Attorney General

DIVISION OF CONSUMER AFFAIRS

Ofice of Consumer Protection

Charities Registration Section

124 Halsey Street, 7th Floor, P.O. Box 45021

Newark, NJ 07101

(973)

FORM

(Revised April 2008)

All questions must be answered.

Pursuant to the New Jersey Charitable Registration and Investigation Act (also known as “the C.R.I. Act” (N.J.S.A.

and prior to operating or commencing solicitation activity in the State, a charitable organization unless exempted from registration requirements (or qualiied to ile a

1.This statement contains the facts and inancial information for the iscal year ending: _____/ _____/ ________

month day year

2. Federal ID Number (EIN) __________________ 2a. N.J. Charities Registration Number: CH- _________________________

3.Full legal name of the registering organization: ______________________________________________________________

In care of: (if necessary, otherwise leave this line blank) __________________________________________________________

4. Mailing Address: ____________________________________________________________________ £ Change of Address

Street Address |

City |

State |

ZIP Code |

NOTE: If “ in care of,” a postal, private or rural delivery mail box number is used, the street address of the charity must be given below.

5.The principal street address of the registering organization________________________________________________________

|

£ Same as Mailing Address |

Street Address |

City |

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Does the organization have any ofices in New Jersey in addition to the one listed above? |

|

£ Yes |

£ No |

|

|

If “Yes,” attach a list giving the street address and telephone number of each ofice in New Jersey. |

|

|

||

6a. |

If the street address listed above is not where the organization’s oficial records are kept, or if the organization does not maintain an |

||||

|

ofice in New Jersey, indicate the name, full address, phone and fax number of the person having custody of the of the organization’s |

||||

records, and to whom correspondence should be addressed.

_______________________________________________________________________________________________________

Contact person |

Street address |

City |

State |

ZIP Code |

________________________________ |

________________________________ |

|

|

|

Telephone number (include area code) |

Fax number (include area code) |

|

|

|

7. Organization’s contact information: |

|

________________________________ |

________________________________ |

Telephone number (include area code) |

Fax number (include area code) |

________________________________ |

________________________________ |

Web site |

8.Type of organization (check one):

£ Nonproit corporation |

£ |

Foundation |

£ |

Individual |

£ Association |

£ Society |

£ Partnership |

£ |

Trust |

£ |

Other (Specify) ____________________________________ |

||

Form |

Page 1 of 7 |

9. |

Where and when was the organization legally established? |

Date: ____________________ State: _____________________ |

||

|

As required by the C.R.I. Act (N.J.S.A. |

|||

|

instrument of organization (that is, the organization’s charter, articles of incorporation or organization, agreement of association, |

|||

|

instrument of trust, or constitution) only if the document has been issued or amended during the iscal year being reported. |

|||

10. |

Does the organization solicit funds under any name or names other than as indicated on line 3 of this form? |

Yes |

No |

|

|

If “Yes,” indicate all of the other names used: _________________________________________________________________ |

|||

11. |

Does the organization intend to solicit contributions from the general public? |

Yes |

No |

|

12. |

Is the organization authorized by any other state or jurisdiction to solicit contributions? |

Yes |

No |

|

|

If “Yes,” please provide a list of those states or jurisdictions, below or on a separate sheet of paper. |

|

|

|

|

_______________________________________________________________________________________________________ |

|||

|

_______________________________________________________________________________________________________ |

|||

13. |

Does the organization have afiliates which share the contributions or other revenue it raised in New Jersey? |

Yes |

No |

|

|

If “Yes,” provide a separate listing of those afiliates indicating the name, street address and telephone number for each one. |

|||

14.What is the charitable purpose or purposes for which the organization was formed? If necessary, attach a separate statement to this registration.

|

_______________________________________________________________________________________________________ |

||

|

_______________________________________________________________________________________________________ |

||

|

_______________________________________________________________________________________________________ |

||

|

_______________________________________________________________________________________________________ |

||

14a. |

What are the speciic programs and charitable purposes for which contributions are used? For each program, state whether it |

||

|

already exists or is planned. Only major program categories need be listed. If necessary, attach a separate statement to this |

||

|

registration. |

|

|

|

_______________________________________________________________________________________________________ |

||

|

_______________________________________________________________________________________________________ |

||

15. |

Does the organization use an independent paid |

Yes |

No |

|

If “Yes,” please attach to this registration a list of paid |

||

|

number, fax number, registration number in New Jersey, and a contact person’s name. |

|

|

15a. Does the independent paid

Yes |

No |

If “Yes,” please describe the situation. |

|

_______________________________________________________________________________________________________ |

|

_______________________________________________________________________________________________________ |

|

16. Has the organization permitted a charitable sales promotion to be conducted on its behalf by a commercial |

||

iscal |

Yes |

No |

If “Yes,” please explain: ___________________________________________________________________________________ |

||

_______________________________________________________________________________________________________ |

||

17. Has the Internal Revenue Service (I.R.S.) determined that the organization is tax exempt under code 501(c)(3)? |

Yes |

No |

a. If “No,” has an application been iled which is still pending? If so, please attach a copy of the |

|

|

I.R.S. 1023 form iled. |

Yes |

No |

b. Has a tax exemption been granted under another I.R.S. code? |

Yes |

No |

If “Yes,” advise which one: ____________________________ |

|

|

c. Has an I.R.S. tax exemption been refused, changed or revoked? |

Yes |

No |

If an exemption has been refused, changed or revoked, attach to this registration a copy of the I.R.S. determination letter of notiication and provide a detailed explanation of the circumstances on a separate sheet of paper.

Form |

Page 2 of 7 |

18. Has the organization ever had its authority to conduct charitable activities denied, suspended, or revoked in any jurisdiction or has the

organization ever entered into any voluntary agreement of discontinuance with any governmental entity?

Yes

Yes

No

No

If “Yes,” attach to this registration a copy of the denial, suspension, revocation or voluntary agreement of discontinuance. If the

document does not explain the reasons for the denial, suspension or revocation, attach to this registration an explanation on a separate sheet of paper.

19.Has the organization voluntarily entered into an assurance of voluntary compliance or similar order or agreement (including, but not limited to, a settlement of an administrative investigation or proceeding, with or without an admission of liability) with any

jurisdiction, state or federal agency or oficer? |

Yes |

No |

If “Yes,” please attach to this registration the relevant document.

20.Has the organization or any of its present oficers, directors, executive personnel or trustees ever been found to have engaged in unlawful practices in the solicitation of contributions or administration of charitable assets or been enjoined from soliciting

contributions, or are such proceedings pending in this or any other jurisdiction? |

Yes |

No |

If “Yes,” attach to this registration photocopies of any and all written documentation (such as a court order, administrative order, judgment, formal notice, written assurance or other document) which show the inal disposition of the matter.

21. Has the organization or any of its present oficers, directors, trustees or principal salaried executive staff employees ever been convicted of any criminal offense committed in connection with the performance of activities regulated under this act or any criminal or civil offense involving untruthfulness or dishonesty or any criminal offense relating adversely to the registrant’s

itness to perform activities regulated by this Act? A plea of |

guilty, non vult, nolo contendere or any similar disposition |

|

of alleged criminal activity shall be deemed a conviction. |

Yes |

No |

22.Has the organization or any of its oficers, directors, trustees or principal salaried executive staff employees been adjudged liable in any administrative or civil action involving theft, fraud, or deceptive business practices? For purposes of this question a judgment of liability in an administrative or civil action shall include, but is not limited to, any inding or admission that the individual engaged

in an unlawful practice in relation to the solicitation of contributions or the administration of charitable assets. |

Yes |

No |

If “Yes,” identify the individual(s) below and attach to this registration a copy of any order, judgment or other documents indicating the inal disposition of the matter.

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

23.Provide the following information for each oficer, director, trustee and the ive

Name |

Business address |

Telephone number |

Title |

Salary |

|

|

(include area code) |

|

|

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Form |

Page 3 of 7 |

Note: If the inancial value of a line item = 0, place a zero in the space provided.

Please report all igures as GROSS, not NET.

Full legal name and street address of the organization

Full legal name:__________________________________________________________________________________________

Fiscal

month day year

Mailing address:

_______________________________________________________________________________________________________

Mailing AddressP.O. Box Number or SuiteCityStateZIP code

Street address of the registering organization: __________________________________________________________________

Street AddressCityStateZIP Code

New Jersey Charities Registration number: CH _______________ |

Telephone number: _________________________ |

|

(include area code) |

Attach to this registration the most recent Internal Revenue Service Form 990 and ScheduleA(990), if the organization has iled those forms. Attach a copy if the organization’s annual inancial report included an audited inancial statement, or if the organization

received gross revenue in excess of $500,000. Note: If the organization received gross revenue of less than $500,000, the inancial reports must be certiied by the organization’s president or other authorized oficer of the organization’s board.

£In lieu of completing the

A. Receipts

Line A1a. Direct Public Support received from the following sources:

(1) |

Direct mail ……………………………………….... |

__________________ |

(2) |

Telephone solicitation…………………………….... |

__________________ |

(3) |

Commercial |

__________________ |

(4) |

Gross receipts from |

__________________ |

(5) |

Canisters, counter cards, door to door etc…………. |

__________________ |

(6) |

Corporations and other businesses…………………. |

__________________ |

(7) |

Foundations and trusts……………………………... |

__________________ |

(8) |

Donated land, buildings, property, equipment and |

|

|

materials……………………………………………. |

__________________ |

(9) |

Legacies and bequests……………………………… |

__________________ |

(10) |

Membership dues solely resulting from |

|

|

solicitations……………………………… |

__________________ |

(11) |

Other support (specify)………………………… |

__________________ |

Line A1b. Total Direct Public Support (add lines A1a(1) through A1a(11) ...… |

__________________ |

|

Line A1c. Indirect Public Support received from the following sources: |

|

|

(1) |

Federated |

__________________ |

(2) |

From an afiliated organization…………………….. |

__________________ |

(3) |

From another |

__________________ |

Line A1d. Total Indirect Public Support (add lines Alc(1) thru A1c(3))… |

__________________ |

|

Line A1e. Total Gross Contributions (add lines A1b and A1d) ………...…… |

__________________ |

|

Form |

Page 4 of 7 |

Line A2. |

Government grants including purchase of service contracts (specify agency) |

||

|

a. |

………………………………………………… |

__________________ |

|

b. |

………………………………………………… |

__________________ |

|

c. |

………………………………………………… |

__________________ |

|

d. |

………………………………………………… |

__________________ |

Line A2e. Total Government Grants (add lines 2a thru 2d)..………………… |

__________________ |

||

Line A3. |

Other Support |

|

|

|

a. Bona ide membership ……………………… |

__________________ |

|

|

b. |

Program service revenue…………………… |

__________________ |

|

c. Professional services rendered by volunteers……… |

__________________ |

|

|

d. |

Miscellaneous income (specify)……………… |

__________________ |

Line A3e. Total Other Support (add the total of lines A3a thru A3d)…..… |

__________________ |

||

Line A4. |

Total Gross Revenue (add lines A1e, A2e and A3e) ………… |

__________________ |

|

B. Expenses

Line B1. |

Program expenses………………………………… |

__________________ |

Line B2. |

Management and general expenses……………… |

__________________ |

Line B3. |

__________________ |

|

Line B4. |

Payments to state/national afiliates (if applicable) |

__________________ |

Line B5. |

Total Expenses (add the totals of line B1 thru B4)…..…… |

__________________ |

C. Excess or Deicit

For the iscal |

__________________ |

|

D. Fund Balance |

|

|

Line D1. |

Net assets or fund balances at beginning of year…………….... |

__________________ |

Line D2. |

Other changes in net assets or fund balances (attach explanation)….. |

__________________ |

Line D3. |

Net assets or fund balances at end of year (Combine line C, D1 and D2) ... |

__________________ |

Please Note: The amount of Gross Contributions ( line A1e on this form) determines the registration fee which must be paid and the form which should be used. July 2006 revisions to the Charities Registration Act now require all charities to pay a registration fee, including charities whose Gross Contributions are less than $10,000. Further information for charity registrants may be found on our Web site: http://www.njconsumeraffairs.gov/ocp/charities.htm.

Form |

Page 5 of 7 |

FORM

Conidential Information

Organization’s Name: _________________________________________________________________________________

N.J. Charities Registration Number: |

CH |

Federal ID Number (EIN) ______________ |

||

Fiscal |

____ / _____ / ____ |

|

||

|

month |

day |

year |

|

24.Are any of the organization’s oficers, directors, trustees or the ive

a. |

each other? |

£ Yes £ No |

b.any oficers, agents or employees of any

organization? |

£ Yes £ No |

c.any chief executive, employee, any other employee of the organization with a direct inancial interest in the transaction, or any partner, proprietor, director, oficer, trustee, or to any shareholder of the organization with more than two (2)

percent interest in any supplier or vendor providing goods or services to the organization? |

£ Yes £ No |

d.If you answered “Yes,” to questions 24a, b, or c, please provide a statement explaining these relationships.

25.Do any of the organization’s oficers, directors, trustees or the ive

or any supplier or vendor providing goods or services to the organization? £ Yes £ No

If “Yes,” please detail these relationships below or on a separate sheet of paper, and provide the name, business address and

telephone number of all interested parties.

We understand that this registration is being issued at the discretion of the Division of Consumer Affairs and agree that employees of the Division may inspect the records in the possession of this organization in order to ascertain compliance with the statute and all pertinent regulations. We also understand that we may be required to provide additional information if requested.

We hereby certify that the above information and the attached inancial schedule(s) and statement(s) are true. We are aware that if any of the above statements are willfully false, we are subject to punishment.

Signature____________________________ Name______________________________ Title ______________ Date ____________

Signature____________________________ Name______________________________ Title ______________ Date ____________

This form must be signed by two (2) authorized oficers of the organization, including the chief inancial oficer.

Note: Form

Form |

Page 6 of 7 |

Renewal registrants who are required to ile the

must submit the following:

(1)A fully completed

(2)All charity registrants in New Jersey must pay a registration fee based on gross contributions. Please visit our Web site at www.njconsumeraffairs.gov for a complete schedule of registration fees due. A check or money order for the registration fee due, made payable to the New Jersey Division of Consumer Affairs, must accompany the registration form. Cash or credit card payments cannot be accepted. Initial registrations must be submitted prior to soliciting in the State of New Jersey. Registrations must be renewed annually, and are due within six months of the iscal

(3)Charity registrants with total gross revenue in excess of $500,000 annually are required to submit a certiied audit (including any management letters) which has been prepared by a certiied public accountant.

(4)Please write the organization’s charities registration number on all checks, forms, and copies of documents submitted.

(5)If the charity was required by the Internal Revenue Service to ile an

(6)Photocopies of any orders, judgments, agreements or other documents which show the inal disposition of any civil or criminal actions brought against the organization or its board members, must be marked with the related question number and the charities registration number.

(7)Only initial registrants must submit photocopies of the organization’s bylaws, the certiicate of incorporation and the I.R.S. determination letter. However, copies of these documents must be resubmitted each time they are amended.

(8)Mail the completed registration, enclosures and any attachments to the:

New Jersey Division of Consumer Affairs

Charities Registration & Investigation Section

P.O. Box 45021

Newark, NJ 07101

Should you have questions regarding charities registration in New Jersey, please visit our Web site at http://www.njconsumeraffairs.gov/ocp/charities.htm where registration information, instructions, forms and a fee schedule may be viewed and/or downloaded. After reading through all of the information on our Web site, if you have further questions, please contact the Charities Registration Section at our hotline number

Form |

Page 7 of 7 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CRI-300R is used for the long-form renewal registration of charitable organizations in New Jersey. |

| Governing Law | This form is governed by the New Jersey Charitable Registration and Investigation Act (N.J.S.A. 45:17A-18 et seq.). |

| Registration Requirement | Charitable organizations, unless exempt, must file this form before operating or soliciting funds in New Jersey. |

| Filing Timeline | The organization must report financial information for the fiscal year ending prior to the filing date. |

| Contact Information | Organizations are required to provide their contact details, including mailing address and telephone number. |

| IRS Tax Exemption | The form includes questions about the organization's tax-exempt status under IRS code 501(c)(3). |

Guidelines on Utilizing Cri 300R

Completing the CRI-300R form is necessary for New Jersey charitable organizations to renew their registration annually. This detailed form requires accurate financial information and a variety of organizational data. Gathering all supporting documents ahead of time will streamline the process and ensure compliance with state regulations.

- Enter the fiscal year ending date in the specified format (month/day/year).

- Provide the Federal ID Number (EIN).

- Input the full legal name of the registering organization.

- If applicable, include the "In care of" address.

- Fill in the mailing address, checking the box for a change of address if relevant.

- Give the principal street address of the organization and mark if it's the same as the mailing address.

- Indicate whether the organization has additional offices in New Jersey, and if so, attach a list.

- Provide contact information for the person holding the organization’s records, if records are not kept at the street address provided.

- List the organization’s contact details including telephone and fax numbers.

- Select the type of organization by checking the appropriate box.

- State the date and location where the organization was legally established. Attach required bylaws if applicable.

- Indicate if the organization solicits funds under any other names.

- Answer whether the organization intends to solicit contributions from the general public.

- State if the organization is authorized by any other state to solicit contributions.

- Indicate if the organization has affiliates sharing contributions and provide their details if applicable.

- Describe the charitable purpose(s) for which the organization was formed.

- List specific programs and their purposes, noting whether they already exist or are planned.

- Determine if an independent paid fund-raiser is used and provide their details if applicable.

- Answer questions regarding IRS tax-exempt status and provide supporting documents if necessary.

- Check if the organization has ever had its charity activities denied or revoked, attaching relevant documentation if applicable.

- Complete inquiries about criminal offense convictions related to organizational activities.

- Provide information about the officers, directors, trustees, and key employees, including their titles and salaries.

- Complete the financial statement section by reporting gross values for receipts and expenses as required.

- Calculate the total gross revenue, total expenses, and net assets at the end of the year.

- Submit a completed registration fee using the amount of gross contributions as determined by line A1e.

Ensure that all necessary documents are attached before submitting the form to avoid delays. Visit the New Jersey Division of Consumer Affairs website for further clarifications on the registration process and fee structure.

What You Should Know About This Form

What is the purpose of the CRI-300R form?

The CRI-300R form is a Long-Form Renewal Registration/Verification Statement that charitable organizations in New Jersey must submit to maintain their registration. This form is governed by the New Jersey Charitable Registration and Investigation Act. It collects essential information about the organization, its activities, and its finances for the fiscal year ending.

Who is required to submit the CRI-300R form?

Any charitable organization operating or intending to solicit contributions in New Jersey must submit this form, unless they qualify for an exemption. Organizations previously registered with the CRI-150 must use the CRI-300R for annual renewals. If the organization qualifies for a Short-Form Registration Statement (CRI-200), it does not need to file this form.

What information is needed to complete the CRI-300R form?

Organizations must provide a variety of information, including their legal name, mailing and principal addresses, federal identification number, registration number with New Jersey, financial details, the nature of fundraising activities, and information about officers and board members. Additionally, the organization may need to attach documents such as bylaws or financial statements as required by the form.

What are the financial reporting requirements for the CRI-300R?

The organization must report its gross revenue and expenses for the fiscal year. If the gross revenue exceeds $500,000, an audited financial statement must be attached. If it is less, financial reports should be certified by an authorized officer of the organization. The form also requires detailed reporting of receipts from various funding sources.

What happens if an organization fails to submit the CRI-300R form?

If an organization does not submit the CRI-300R form, it may face consequences such as suspension or revocation of its registration in New Jersey. This could limit its ability to solicit donations or operate legally within the state.

Are there any fees associated with submitting the CRI-300R form?

Yes, there are registration fees associated with the CRI-300R form. The amount of the fee is determined by the gross contributions reported on the form. As of July 2006, all charitable organizations, regardless of their revenue, are required to pay a registration fee.

Is the CRI-300R form specific to New Jersey?

Yes, the CRI-300R form is specific to New Jersey and is governed by state law. Organizations operating solely outside of New Jersey may have different registration requirements depending on their state’s regulations. It is crucial for organizations soliciting contributions in New Jersey to adhere to this specific requirement.

How can I find additional information about the CRI-300R form?

Additional information about the CRI-300R form and the registration process can be found on the New Jersey Division of Consumer Affairs website. This resource includes guidelines, FAQs, and contact information for assistance with the registration process.

Common mistakes

Completing the Cri 300R form can be a straightforward process if done carefully. However, many organizations encounter obstacles due to common mistakes. One mistake is failing to answer all questions. Each section of the form requires a response, and incomplete forms will be rejected, causing delays in the registration process.

Another frequent error is neglecting to attach required documents. For example, organizations must include their bylaws and the instrument of organization if relevant changes occurred during the fiscal year. Omitting these documents can lead to noncompliance and hinder the registration.

People also often misstate their organization’s legal name or fail to provide accurate addresses. This can create confusion during processing. Ensuring the correct legal name and full mailing address is essential for the organization's identification and for receiving important communications.

Additionally, a lack of clarity in reporting financial information is another common pitfall. Organizations must report gross revenue accurately. Misreporting or providing estimates can result in penalties. Being precise with financial figures, like zero instead of leaving a line blank, helps avoid issues.

Finally, organizations sometimes do not keep track of the necessary signatures for the form. It's critical to have authorized individuals sign the document. A missing signature can delay approval or result in rejection altogether. Attention to detail throughout the form-filling process is crucial for success.

Documents used along the form

The CRI-300R form is essential for charitable organizations operating in New Jersey, as it serves as the Long-Form Renewal Registration. Alongside this form, several other documents may be necessary to ensure compliance and proper registration. Here’s a brief overview of each document commonly filed with the CRI-300R.

- CRI-150-I Form: This is the Long-Form Initial Registration Statement that charitable organizations must submit to register for the first time. It collects foundational information about the charity, including its legal name, purpose, and organizational structure.

- Financial Statements: Charities often need to attach financial statements for the fiscal year, which highlight their revenues and expenses. These documents provide transparency and help regulators assess the charity's financial health.

- IRS Form 990: This form is a required filing for tax-exempt organizations, documenting their financial activities. It consists of detailed information about the organization’s financial status, governance, and compliance with tax laws.

- Bylaws: A copy of the organization’s bylaws must be submitted if they have been amended or issued during the reported fiscal year. Bylaws outline the governance framework and internal rules for the organization.

- List of Affiliates: If the organization has affiliates that share revenues, a detailed list should be provided. This list includes names, addresses, and contact persons for each affiliate, ensuring transparency in operations.

In summary, completing and submitting the CRI-300R form along with these accompanying documents ensures compliance with New Jersey’s charitable registration requirements. This process is crucial for maintaining public trust and fulfilling regulatory obligations.

Similar forms

The CRI-300R form is essential for charitable organizations in New Jersey wishing to renew their registration. It shares similarities with several other documents in the realm of charitable registration and compliance. Here’s a closer look at nine documents that exhibit comparable features:

- CRI-150-I Long-Form Initial Registration Statement: Like the CRI-300R, this form is used by charities to register with the state, though it is specifically for first-time applicants. Both require detailed financial information and the organization’s legal identification.

- CRI-200 Short-Form Registration Statement: This form is used for organizations that meet certain criteria to file a simplified version of the registration. Similar to the CRI-300R, it gathers essential information about the organization but is less complex.

- IRS Form 990: Charitable organizations must file this annual information return with the IRS. Like the CRI-300R, it deals with financial reporting, including income and expenses, allowing for transparency in the organization’s operations.

- IRS Form 1023: This is an application for tax-exempt status. Organizations cite their purpose and financial information, a requirement that resonates with the CRI-300R's need for such details in a state's registration context.

- Annual Financial Reports: These reports provide a comprehensive overview of an organization’s financial activities over the year. They are also required alongside the CRI-300R, ensuring that stakeholders can assess the charity’s financial health.

- State Charitable Solicitation Registration Forms: Many states have their versions of registration forms for charities to solicit donations. These documents often contain similar questions regarding financial practices and accountability as those found in the CRI-300R.

- Consent Agreements with Regulatory Agencies: Charitable organizations sometimes enter into consent agreements regarding compliance issues. These documents share a focus on organizational transparency and accountability, just like the CRI-300R.

- Bylaws and Organizational Documents: Charitable organizations are often required to submit copies of their bylaws and foundational documents during registration. This is also true for the CRI-300R, where recent amendments must be disclosed.

- Audit Reports: Nonprofits that exceed certain revenue thresholds often need to undergo audits. These reports ensure accurate financial reporting and are similar in purpose to the financial transparency required by the CRI-300R.

Understanding these documents and their similarities helps organizations navigate the complex landscape of charity registration and compliance.

Dos and Don'ts

Do's when filling out the CRI-300R form:

- Ensure all questions are answered completely and accurately.

- Attach all required documents as specified in the form instructions.

- Use clear and legible handwriting or type the information where possible.

- Provide up-to-date contact information for the organization.

- Double-check calculations for any financial figures before submission.

Don'ts when filling out the CRI-300R form:

- Do not leave any questions unanswered, as this may delay processing.

- Avoid using abbreviations that could cause confusion, unless specified.

- Do not submit the form without the required attachment of financial statements.

- Avoid providing outdated or incorrect organization details.

- Do not forget to sign and date the form before submission.

Misconceptions

Below is a list of common misconceptions regarding the Cri 300R form, which serves as a long-form renewal registration and verification statement for charitable organizations operating in New Jersey.

- All charities are exempt from using the Cri 300R form. Many believe that smaller or newer charities do not need to complete this form. However, unless exempted by law or eligible to file a Short-Form Registration Statement, most charitable organizations must submit this long-form registration to comply with New Jersey’s regulations.

- The Cri 300R is only for initial registration purposes. In reality, the Cri 300R form is specifically designed for annual renewal. It allows organizations to provide updated information about their operations and financial status.

- Filing the Cri 300R form is optional for all nonprofits. This is false. Organizations must file this form if they intend to solicit contributions in New Jersey. Operating without this registration can lead to significant legal consequences.

- Once filed, the information does not need to be updated. Organizations often think that the information provided is permanent. In fact, any changes in contact details, financial status, or leadership positions must be reported annually.

- Only large organizations have to worry about financial disclosures. Contrary to this belief, even organizations with gross revenue under $10,000 are now required to pay a registration fee and provide some form of financial information as part of the registration process.

- The Cri 300R form is the same as the IRS Form 990. While both forms deal with the financial and operational aspects of charitable organizations, they serve different purposes and regulatory agencies. The Cri 300R is specific to New Jersey state law, whereas the Form 990 is used for federal tax purposes.

- Payment of fees is based solely on past contributions. It is a common misunderstanding that registration fees depend only on previous contributions. The fees are determined based on the gross contributions reported in the current filing period, regardless of past amounts.

- Providing incorrect information on the Cri 300R form is not a serious issue. In fact, misrepresentation or failure to provide accurate information can result in penalties, including suspension of the organization’s ability to solicit funds or even legal action.

- Once registered with the Cri 300R, there are no further obligations. This misconception suggests that filing the form is a one-time task. However, organizations must renew their registration and update their information annually to remain compliant with state regulations.

Understanding these misconceptions can help organizations navigate the complexities of charitable registration requirements more effectively. Compliance with the Cri 300R form ensures a transparent and lawful operation in New Jersey.

Key takeaways

Filling out the CRI 300R form requires attention to detail. Every section must be completed fully. Incomplete forms can lead to delayed processing or rejection of the registration.

The financial section of the form must reflect gross figures. Organizations must report all earnings and expenses accurately. Failure to do so may affect their registration status.

Contact information is crucial. Organizations should provide current details for their principal address, as well as any additional locations in New Jersey. This information ensures that communications reach the correct parties.

Finally, attachments play an essential role in the submission process. Required documents, such as bylaws and financial statements, include specific details from the previous fiscal year. Missing these can stall the registration or renewal process.

Browse Other Templates

What Is Nhis - Providing both permanent and temporary staff distinctions informs regulatory bodies about workforce stability.

Resume How to - Emphasize skills that are most relevant to the desired position.